Global cast stretch film market is anticipated to witness stable growth on account of increasing demand for cast stretch films for packaging, logistics, and consumer goods across the globe. Cast stretch films are made on a continuous extrusion unit, yielding clearer films with uniform thickness and lower production cost than blown films.

This is a highly recommended material to use to protect and secure palletized items in transport and during storage due to their excellent load holding ability, puncture resistance and grip around products. As the importance of supply chain efficiency grows, there is a greater need for sustainable packaging solutions, which is driving manufacturers to develop recyclable, down gauged films. These breakthroughs, along with consistent growth in the cast stretch film market through 2035 chapter will provide significant upward leverage to the expanding e-commerce & global trade respectively.

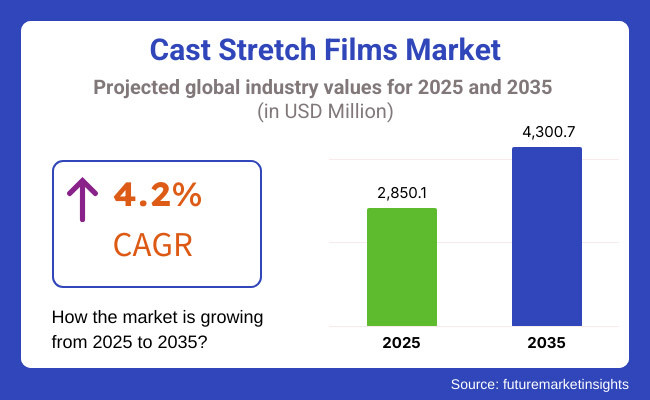

The cast stretch film market was estimated at approximately USD 2,850.1 Million in 2025. It is anticipated to grow with a healthy growth rate of more than 4.2% over the forecast period of 2025 to 2035 and reach around USD 4300.7 Million by 2035. The demand for affordable, high-performance films and the growing use of sustainable materials have contributed to this growth.

Explore FMI!

Book a free demo

North America is another prominent market for cast stretch films due to the presence of a well-established packaging industry and growing importance of efficient logistics operations. In the United States specifically, stable demand has continued to emerge from industries like food and beverage, retail and pharmaceuticals, where consistent quality and usability of film is critical. The region's emphasis on sustainability has also driven innovation and adoption of eco-friendly materials, resulting in increased interest in recyclable films.

Europe, known for its robust environmental regulations and sustainability, is another significant market. Germany, France, and the United Kingdom are leading the way in the development and use of downgauged cast stretch films that will reduce material consumption without sacrificing functionality. In addition, more efforts on circular economy practices and investments in recycling infrastructure in the region further boost market growth. Moreover, European countries are also aiding the market growth with significant logistics and manufacturing segments which in turn further bolsters the demand for stretch films on account of their high quality.

Asia-Pacific is the fastest-growing region in terms of cast stretch films, driven by rapid industrialization, a booming e-commerce market, and an expanding manufacturing base. Demand for cost-effective and reliable packaging materials is surging in countries including; India, Japan, Italy, and China. Increasing logistics and warehousing industries across the region and growing emphasis on improving supply chain efficiency have contributed to driving demand for cast stretch films. Local manufacturers are also adopting advanced production technologies to cater to both local and export demand, making Asia-Pacific a key contributor to the growth of the global market.

High Raw Material Costs, Recycling Complexities, and Competition from Alternative Packaging

The cast stretch film market is confronting an upsurge of challenges, but the most important reason behind this would be the irregularity in the costs of the raw materials used in the production of cast films. If the material is difficult to process, such as multi-layered plastic films and additives for durability and cling properties, the recycling process will be adversely affected. The governments across the globe are implementing stringent regulations on the disposal of plastic waste and extended producer responsibility (EPR) measures, which are encouraging the manufacturers to come up with recyclable and biodegradable alternatives. Furthermore, the increasing competition from alternative packaging solutions, such as paper-based wraps, shrink films, and bio-based stretch films, is expected to impact the market, as companies are pursuing eco-friendly and sustainable packaging materials.

Growth in E-commerce Packaging, Sustainable Stretch Films, and Smart Logistics Solutions

However, the cast stretch film market is poised for significant growth, fueled by increasing demand from logistics, warehousing, and e-commerce industries. As global trade and online shopping are booming, the demand for pallet wrapping, and reliable transport packaging, is growing. New market segments are being created due to improvements in sustainable stretch films including bio-based, oxo-degradable, and post-consumer recycled (PCR) plastics. Particularly, the incorporation of AI-powered logistics and automated pallet wrapping systems is enabling better efficiency in packaging, minimizing waste and improving sustainable initiatives.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with plastic waste reduction mandates and extended producer responsibility (EPR) policies. |

| Consumer Trends | Increasing demand for secure and cost-effective stretch films for industrial packaging. |

| Industry Adoption | High usage in logistics, food packaging, and warehouse storage solutions. |

| Supply Chain and Sourcing | Dependence on polyethylene resins, with moderate recycling integration. |

| Market Competition | Dominated by large-scale plastic manufacturers and industrial packaging firms. |

| Market Growth Drivers | Growth fueled by e-commerce, warehouse automation, and global trade expansion. |

| Sustainability and Environmental Impact | Moderate adoption of recyclable and down gauged stretch films. |

| Integration of Smart Technologies | Early adoption of automated stretch wrapping machines and pallet load optimization. |

| Advancements in Material Science | Development of high-performance cast stretch films with increased puncture resistance. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global bans on non-recyclable plastics, mandatory biodegradable alternatives, and carbon-neutral production policies. |

| Consumer Trends | Growth in biodegradable and high-strength recycled stretch films for sustainable logistics. |

| Industry Adoption | Widespread adoption of lightweight, bio-based, and AI-optimized stretch film solutions. |

| Supply Chain and Sourcing | Shift toward closed-loop supply chains, recycled PE stretch films, and bio-polymer alternatives. |

| Market Competition | Entry of sustainable packaging startups, AI-driven logistics firms, and biodegradable film innovators. |

| Market Growth Drivers | Accelerated by smart packaging solutions, AI-powered supply chain optimization, and next-gen stretch film materials. |

| Sustainability and Environmental Impact | Large-scale transition to zero-plastic waste logistics, biodegradable stretch films, and carbon-neutral manufacturing. |

| Integration of Smart Technologies | Expansion into AI-driven stretch film dispensing, IoT-enabled logistics tracking, and predictive maintenance for packaging systems. |

| Advancements in Material Science | Evolution toward self-healing, moisture-resistant, and fully biodegradable cast stretch films. |

The cast stretch film market in the USA is segmented into 2 major segments which are end-use industry and region. The adoption of high performance cast stretch films is driven by the growth of e-commerce and need for securing pallet wrapping. Also, recyclable and biodegradable films are being innovated since there are growing concerns over environmental issues which is further expected to spur growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The cast stretch film market in the countries of the United Kingdom as a result of increasing retail & logistics industries. Laminated film within the cast stretch films layer may cause less damage to pallets, trays, and boxes, too, while providing the high level of clarity that many companies are seeking. Additionally, sustainability efforts that encourage recycled materials adoption as well as eco-conscious packaging options are also aiding to the growth of market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

Demand from food, beverage and industrial sectors is creating growth opportunities across the European Union cast stretch film market. Regulatory frameworks regarding packaging waste management and targets related to sustainability in terms of plastic are prompting the manufacturer to produce recyclable cast stretch film and bio-based cast stretch film. Moreover, innovations in multilayer film technologies are improving product performance and durability also propelling the market deployment.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan cast stretch film market is experiencing steady growth, driven by the nation's embrace of cutting-edge packaging solutions and environmental considerations. The growth in this space remains a challenge but the need for wound-tight, puncture-resistant films especially for industrial and food applications is fueling innovation. Moreover, the rising penetration of high-performance cast stretch films due to increasing automation in logistics and warehousing is also driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korean cast stretch film market based on application, end use industry is segmented into food and beverage, consumer goods, pharmaceuticals, and other industries. Demand is largely driven by the growing e-commerce and retail sectors, coupled with innovations in film extrusion technology. Moreover, governmental policies encouraging the use of sustainable packaging materials are fostering the utilization of recyclable stretch films.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

LLDPE and LDPE Materials, Along with 31-50 Micron and 51-70 Micron Thicknesses, Drive Market Growth as Demand for High-Performance Packaging Expands

The Cast Stretch Film Market is experiencing steady growth as businesses across logistics, food & beverage, pharmaceuticals, and industrial sectors prioritize cost-effective, high-strength, and flexible packaging solutions. Cast stretch films provide superior transparency, stretchability, and tear resistance, making them a preferred choice for securing pallet loads, protecting shipments, and ensuring product stability. The market is segmented by Material Type (Polyethylene (PE), Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), Polypropylene (PP), Polyamide (PA), Others) and Thickness (Up to 30 micron, 31-50 micron, 51-70 micron, Above 70 micron).

LLDPE cast stretch films have a significant market share, given their excellent flexibility, remarkable elongation potential, and peak puncture resistance. These films are widely used as pallet wrapping, warehousing and industrial packaging to provide load stability and product safety during shipment. Factors such as the increasing need for lightweight, sustainable, and recyclable packaging also lend support to the utilization of LLDPE-based cast stretch films in logistics, retail, and manufacturing sectors.

LDPE (Low-Density Polyethylene) cast stretch films and shrink film barriers held a prominent share in the market depending upon the application of manual wrapping and consumer product packaging. LDPE films offer decent moisture barrier properties, transparency, and sealability, so these films are suitable for food-grade applications and perishable products packaging. The demand for biodegradable and compostable LDPE stretch films is rising due to growing trend of green packaging solution and the rising food and beverage sector.

The 31-50 micron segment accounts for the largest share in the cast stretch film market, as it offers the best combination of strength, durability and stretch ability. These films are commonly found in pallet wrapping, warehouse storage, and industrial shipments, offering high load containment, while minimizing material usage. A medium-thickness stretch film is preferred in e-commerce, logistics, and distribution centers due to the need for high tensile strength and puncture resistance.

Also, the heavy-duty packaging and others segment is witnessing significant growth in the 51-70 micron range. These thicker films offer better load retention, puncture resistance, and durability than their lighter counterparts; ideal for materials, heavy machinery wrap, and high-value products shipments within construction/industrial operations. The adoption of multi-layer and reinforced 51-70 micron cast stretch films is expected to increase in response to the growing demand for high-performance films for industrial and commercial applications.

The cast stretch film market is expanding due to increasing demand for efficient load stability, cost-effective packaging solutions, and high-performance film durability. Companies are focusing on AI-driven film extrusion optimization, advanced resin formulations, and sustainable stretch film alternatives to enhance clarity, elasticity, and puncture resistance. The market includes flexible packaging manufacturers, industrial film producers, and logistics packaging suppliers, each contributing to technological advancements in stretch film extrusion, AI-powered quality control, and eco-friendly stretch wrap solutions.

Market Share Analysis by Key Players & Cast Stretch Film Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Berry Global Inc. | 18-22% |

| Mondi Group | 12-16% |

| Amcor plc | 10-14% |

| AEP Industries Inc. (A Berry Global Company) | 8-12% |

| Coveris Holdings S.A. | 5-9% |

| Other Packaging Film Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Berry Global Inc. | Develops high-performance cast stretch films with AI-optimized extrusion, enhanced load containment, and sustainable resin integration. |

| Mondi Group | Specializes in biodegradable and high-clarity stretch films with AI-powered thickness control and cost-effective roll production. |

| Amcor plc | Provides multi-layer cast stretch film solutions for industrial packaging, AI-assisted tension optimization, and ultra-thin film innovation. |

| AEP Industries Inc. (Berry Global) | Focuses on machine-grade and hand-grade stretch films, AI-driven elasticity enhancement, and reduced plastic consumption formulations. |

| Coveris Holdings S.A. | Offers low-gauge, high-yield cast stretch films with AI-driven film consistency and recyclable material composition. |

Key Market Insights

Berry Global Inc. (18-22%)

Berry Global is a prominent manufacturer in the cast stretch film market, and offers cutting-edge film extrusion technology, artificial intelligence-powered performance optimization for stretch film, and sustainable production solutions.

Mondi Group (12-16%)

Specializing in sustainable cast stretch films with enhanced resin efficiency through AI, high-clarity, and thin packaging ensures cost-effective pallet wrapping.

Amcor plc (10-14%)

Amcor manufactures industrial and food grade cast stretch films that maximize AI-driven load stability, puncture resistance and high-performance stretch ratios.

AEP Industries Inc. (8-12%)

AEP specializes in flexible cast stretch films with applications for AI-assisted gauge reduction, load efficiency improvements and lightweight film innovation.

Coveris Holdings S.A. (5-9%)

Coveris architects multilayer stretch films, with reliable yield performance, AI-powered quality control, and sustainable raw material sourcing.

Other Key Players (30-40% Combined)

Several industrial packaging film manufacturers, resin suppliers, and logistics packaging companies contribute to next-generation cast stretch film innovations, AI-powered extrusion control, and eco-friendly film solutions. These include:

The overall market size for cast stretch film market was USD 2107.3 Million in 2025.

Cast stretch film market is expected to reach USD 4383.7 Million in 2035.

The demand for cast stretch film is expected to rise due to increasing demand for efficient packaging solutions, growing e-commerce and logistics sectors, and rising preference for cost-effective and high-clarity stretch films.

The top 5 countries which drives the development of cast stretch film market are USA, UK, Europe Union, Japan and South Korea.

Containers & Clamshells and Ready-to-Eat Meals to command significant share over the assessment period.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.