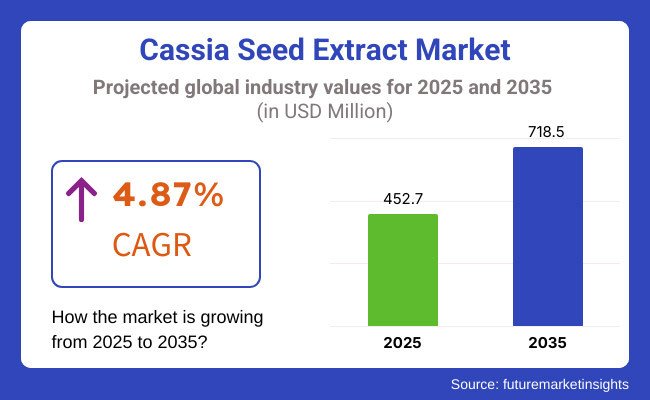

The global cassia seed extract market is set to register USD 452.7 million in 2025. The industry is poised to expand at 4.87% CAGR from 2025 to 2035, reaching USD 718.5 million by 2035.

The global market is being significantly driven by growing global demand for natural products such as herbal medicine and traditional medicines. Owing to their detoxifying property, antioxidant properties, and eye support abilities, these extracts, which can be obtained from the seeds of Cassia tora or Cassia obtusifolia, are extensively used in the pharmaceuticals, nutraceuticals, functional foods, and cosmetics industry. Owing to these factors, industry leaders have been spending in new extraction technologies to develop innovative products.

Rapid growth in herbal and plant-derived extracts among pharmaceutical, nutraceutical, and functional food industries is driving the overall growth of the industry. Cassia seed extract, known for promoting digestive health, vision, and weight, is gaining traction with health-conscious consumers too.

Several companies are developing standardized extracts enriched with bioactives to control and regulate the consistency and efficacy of herbal medicines. With a growing focus on clean-label and organic-certified ingredients, brands are developing cassia seed-based herbal supplements, teas, and natural laxatives.

The growing demand for natural ingredients is also impacting product development. Customers looking for caffeine-free and detox drinks are turning more and more toward cassia seed tea, which is becoming increasingly popular in Asian and Western markets. This trend is leading companies to expand their product offerings, adding cassia seed extract to weight-reducing formulations, anti-inflammatory solutions, and skin care solutions.

One of the key drivers is the inclusion of traditional medicine within modern health systems. Cassia seed extract, which has found invaluable applications in Traditional Chinese Medicine (TCM) and Ayurveda, has now been scientifically validated and has led to its growing footprint in global nutraceutical markets.

Explore FMI!

Book a free demo

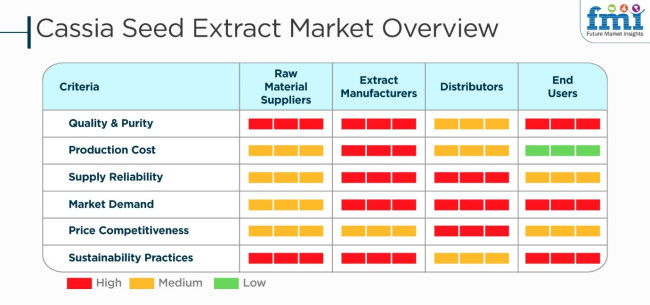

The cassia seed extract industry has several stakeholders who have different priorities, such as raw material suppliers, extract manufacturers, distributors, and end users. Raw material suppliers are concerned about quality, purity, and sustainability in order to provide high-grade cassia seeds for extraction. Extract manufacturers are concerned with the cost of production, reliability of supply, and purity to ensure consistency in the pharmaceuticals, dietary supplements, and cosmetics.

Distributors stress industry demand and price competitiveness, with a streamlined supply chain ensuring adequate consumer supply. The end users, be they pharmaceutical firms or nutraceutical firms, appreciate quality, sustainability, and cost to respond to growing needs for natural wellness supplements. For raw material providers, sustainable provision is their major concern, but for extract producers, process innovation is their aim.

Industry expansion is fueled by the increasing consumption of herbal health products for stomach health, weight, and eyesight. With the growing knowledge of plant wellness products, high-quality standards and a sound distribution network are imperative to fuel industry expansion.

The following table gives a comparative analysis of the change in CAGR over half a year for the base year (2024) and the current year (2025) for the global industry. The analysis demonstrates important changes in performance and reflects revenue realization trends, hence giving the stakeholders an improved perspective on the growth trend throughout the year.

The first half of the year, or H1, is from January to June. The second half, H2, is from July to December. During the first half (H1) of the period 2025 to 2035, the industry is expected to grow at a CAGR of 5.0%, and then at a marginally higher rate of 5.1% during the second half (H2) of the decade 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 4.8% |

| 2024 to 2034 (H2) | 5.0% |

| 2025 to 2035 (H1) | 4.9% |

| 2025 to 2035 (H2) | 5.1% |

Entering the next period, H1 2025 to H2 2035, the CAGR is anticipated to rise to 5.2% during the first half and stay constant at 5.0% for the second half. Within the first half (H1), the industry saw a rise of 30 BPS, whereas in the second half (H2), it saw a fall of 20 BPS.

Growing Demand for Caffeine-Free Herbal Beverages

Consumers are increasingly seeking caffeine-free alternatives to traditional teas and coffees, driving the demand for cassia seed extract in herbal beverages. Traditionally used in Asian herbal teas for their digestive and detoxifying properties, cassia seed extract is now being incorporated into global functional beverage formulations.

Health-conscious consumers prefer natural herbal drinks that offer wellness benefits without stimulants, making cassia seed extract a key ingredient in detox teas and sleep-supporting blends. Manufacturers are introducing cassia-infused herbal infusions, cold brews, and functional tea blends to cater to this growing demand. Brands are also focusing on organic and premium variants with clean-label certifications to appeal to conscious consumers.

The industry is witnessing product innovations such as ready-to-drink herbal beverages and blendable extracts, ensuring wider adoption in mainstream retail and specialty wellness stores.

Rising Popularity of Traditional Chinese Medicine (TCM) and Ayurveda in Western Markets

The global resurgence of traditional medicine systems is creating new opportunities for the product in the nutraceutical and herbal supplement industries. With an increasing preference for natural and preventive healthcare solutions, consumers in North America and Europe are turning to Traditional Chinese Medicine (TCM) and Ayurveda for wellness support.

The product, long valued in TCM for its vision-supporting and anti-inflammatory benefits, is now being incorporated into Western herbal formulations. Nutraceutical brands are launching cassia seed-based capsules, powders, and liquid extracts targeted at eye health, digestion, and metabolic support.

Manufacturers are emphasizing clinical validation and standardized formulations to meet regulatory standards and increase credibility in international markets. This trend is driving collaborations between Asian herbal extract suppliers and global nutraceutical companies, expanding the product’s accessibility beyond traditional medicinal use.

Expansion of The product in Natural Laxatives and Gut Health Products

With digestive wellness becoming a top health priority, the product is gaining traction as a natural laxative and gut health ingredient. Increasing concerns over synthetic laxative side effects and long-term dependency have led to a consumer shift toward plant-based alternatives. The product, known for its mild laxative effects and gut-soothing properties, is being incorporated into herbal formulations for constipation relief and bowel regulation.

Manufacturers are integrating the extract into fiber supplements, digestive teas, and probiotic-enhancing blends to offer holistic gut health solutions. The expansion of prebiotic and digestive wellness product lines by nutraceutical companies is further boosting demand for cassia-based ingredients. Brands are also leveraging clean-label and organic certifications to attract consumers who prefer chemical-free, plant-based digestive remedies.

Increased Adoption of The product in Natural Eye Health Supplements

The growing awareness of eye health, particularly with increased screen time and digital exposure, has fueled demand for natural vision-supporting supplements. The product, traditionally used to relieve eye strain and improve vision, is now being incorporated into herbal eye health formulations. With rising cases of digital eye strain and concerns over age-related macular degeneration, consumers are actively seeking plant-based eye supplements.

Companies are developing cassia seed extract-infused formulations in combination with lutein, zeaxanthin, and other carotenoids to enhance eye protection. The expansion of vision-support nutraceuticals is prompting manufacturers to focus on clinically backed formulations, ensuring efficacy and consumer trust. Product innovations such as eye-care herbal teas, vision-boosting capsules, and cassia seed-based functional drinks are gaining traction in both online and offline wellness markets.

In this industry, the use of natural health solutions has been growing rapidly due to increased consumer awareness, while the adoption of herbal extracts in pharmaceutical and nutraceutical products has also been increasing. The product, known for its benefits in digestion, eye health, and weight management, has seen steady growth in herbal supplements and functional food applications.

From 2020 to 2024, the expansion of clean-label products and plant-based medicine propelled industry growth. The demand for herbal teas, gut health supplements, and eye-care formulations incorporating the product increased significantly, driving investments in standardized extract production. Manufacturers focused on organic certifications and innovative formulations to cater to evolving consumer preferences.

Looking ahead to 2025 to 2035, the demand is expected to accelerate as consumers prioritize natural laxatives, vision-support supplements, and herbal detox solutions. Advancements in extraction techniques and clinical research are further strengthening cassia seed extract’s industry position. With increasing regulatory approvals and product diversification, the global industry is set for steady expansion over the next decade.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing use of the product in traditional medicine and herbal supplements for eye care and digestion. | AI-personalized nutraceuticals with the product for vision support, gut health, and metabolic health. |

| Growing application of the product in functional teas and drinks due to its detoxifying and anti-inflammatory nature. | Expansion into adaptogenic beverages, smart hydration drinks, and nootropic formulations for cognitive enhancement. |

| Organic and non-GMO cassia seed extracts gained traction due to growing consumer preference for clean-label botanical ingredients. | Blockchain-based traceability, carbon-neutral sourcing, and sustainable wild harvesting practices will redefine supply chains. |

| The product was widely used in weight management supplements due to its mild laxative and metabolism-boosting effects. | AI-driven formulation of precision weight management solutions using cassia seed bioactives for optimized results. |

| The cosmetic industry utilized the product for anti-aging and skin-brightening formulations. | Encapsulation systems enhance bioavailability, thereby creating high-quality skincare products with extended performance. |

| Compliance costs are raised due to regulations associated with heavy metal poisoning and pesticidal content in herbal extracts. | Artificial intelligence-based quality control, faster contaminant detection, and tougher regulation on the global scene will ensure the purity and safety of the extracts. |

| Limited clinical evidence and validation for pharmaceutical use have restricted its wider use in pharmacy. | Additional biotechnological studies and AI-assisted clinical trials shall fully unlock the diverse therapeutic possibilities of the product. |

The industry is one of the main hazards which depend on weather situations and agricultural changes. Cassia seeds are mostly grown in parts of the world like China and India, which are greatly influenced by the climatological conditions, soil fertility, and precipitation. Severe weather events, such as droughts or too much rain, can cause supply chain disruptions, and hike the costs of raw materials.

Supply chain problems also reflect another significant risk factor, especially for the cases of cross-border trade. Sufficient logistics, storage, and transportation are the key requirements of the product to keep its quality. The delays caused by the geopolitical conflicts, trade embargoes, or disturbances in the shipping routes can bring about the increased costs and product shortages in the world markets.

Issues relating to regulatory compliance, and quality control are the key areas of concern in this context. The uses of the product are in pharmaceuticals, dietary supplements, and functional foods, so it necessitates the full compliance with the internationally recognized safety and quality standards such as FDA (USA), EFSA (Europe), and FSSAI (India). Problems related to contamination, pesticide residues, or non-conformance to labeling rules can lead to product recalls and associated legal penalties.

Growing consumer interest in natural digestive health, weight management, and vision support are fueling the demand for the product for dietary supplements, herbal capsules, and detox teas. Its mild laxative, anti-inflammatory and antioxidant properties have made the extract a go-to for gut health and metabolic health formulations.

Manufacturers including Nature’s Way, NOW Foods, and Swisse are investing in standardized, high-bioactive extracts, and are catering to the growing demand for clean-label, organic, and scientifically validated herbal supplements. In addition, increasing demand for TCM based nutraceuticals across various Western and Asian markets is expected to drive the growth of TCM herbal medicine industry.

As the nutraceutical and herbal product industries have been increasingly digitalized, specialized herbal extract consumers have begun to prefer online platforms as their sales channels. Direct-to-consumer (DTC) brands like Nature’s Way, NOW Foods, and Gaia Herbs have enhanced their online offerings with a wide array of cassia seed extract-based dietary supplements, herbal teas, and detox formulations. Online sales have grown significantly due to rise in influencer-driven marketing campaigns as well as growing popularity of subscription-based supplement services.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.7% |

| India | 7% |

| USA | 5.5% |

| Germany | 5% |

| Japan | 6.9% |

FMI is of the opinion that the USA industry is expected to grow at a CAGR of 5.5% during the study period. Growing demand from health-conscious consumers for natural supplements has been fueling growth, particularly in the digestive health and weight management categories.

The USA industry provides high-quality standards and regulations for consumer acceptance. The clean-label trend and sustainable sourcing are influencing manufacturing processes. Strategic alliances with international suppliers and creative marketing are also driving industry growth.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Health-Conscious Consumers | Growing demand for natural and plant-based health supplements. |

| Regulatory Compliance | Emphasizing compliance with high-quality and safety standards. |

| Clean-Label Trend | Growing demand for products with transparent sourcing and minimal processing. |

| Strategic Partnerships | Collaborations with international suppliers to expand product lines. |

The German industry is slated to witness a CAGR of 5% during the forecast period, states FMI. Organic and clean-label trends have supported the use of the product as a functional food ingredient, beverage, and cosmetic. Germany's tight regulation ensures that product quality and safety are sustained, making the country a tremendous industry for premium herbal products. Growing demand for organic and herbal tea products supports further industry expansion.

Growth Drivers in Germany

| Key Drivers | Descriptions |

|---|---|

| Organic Product Preference | There is a growing demand for clean-label and sustainably procured herbal extracts. |

| Stringent Regulatory Compliance | Continued compliance with EU stringent food safety and quality requirements. |

| Expanded Functional Beverage Segment | Higher intake of the product in healthy and herbal beverages. |

| Sustainability Emphasis | Growing interest in environmentally sustainable methods of extraction and sourcing. |

Japan's industry is expected to witness a CAGR of 6.9% during the study period, cites FMI. The country's emphasis on natural health and traditional medicine has spurred additional use of the product in functional foods and nutraceuticals. Japanese companies are known for product innovation and quality, resulting in new product forms to meet increasing consumer demand. Japan's aging population is also a key driver of demand for digestive and vision care supplements.

Growth Drivers in Japan

| Key Drivers | Description |

|---|---|

| Traditional Medicine Practices | Advancements in products such as Kampo medication and other classical medicine. |

| Product Development | Launching new products for specific disease needs. |

| Aging Population | Boost in the demand for age-specific health disorder-targeted supplements. |

| Quality Compliance | Commitment towards high product performance and manufacturing quality. |

China is the leading producer and consumer of the product. The long tradition of using cassia seed in Traditional Chinese Medicine (TCM) has been the main growth driver. The industry will grow at a CAGR of 6.7% between 2025 and 2035, as per FMI, due to increasing domestic consumption and increasing export opportunities. Chinese manufacturers are enhancing extraction processes and maintaining global quality standards. Policies supported by the government for the herbal sector also increase growth opportunities.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Usage of Traditional Medicine | Increased consumption of cassia seed in Traditional Chinese Medicine. |

| Technological Upgrades | Investments in sophisticated extraction technologies to improve product quality. |

| Government Support | Pension and insurance subsidies for the benefit of herbal vendors. Support herbal industry policies and promotion of traditional medicine. |

| Export Opportunities | Natural health products' global demand increased. |

Increased demand in response to enhanced adoption of Ayurveda and natural health supplements has propelled the industry. Indian companies are making investments in research and development to launch new products that align with conventional wellness regimes.

Government policies supporting herbal firms and the availability of raw materials also increase industry size. Organic and sustainable production sourcing practices are also receiving greater interest from manufacturers. The Indian industry will achieve a 7% CAGR over the study period, according to FMI.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Ayurvedic Tradition | Strong cultural heritage driving the consumption of herbal products. |

| R&D Spending | New applications and new products incorporating cassia seed extract. |

| Government Programs | New programs and policies favoring the herbal sector. |

| Raw Material Availability | Good quality cassia seeds in large quantities for processing. |

The global industry is very competitive because it has been spurred on by the growing demand from consumers for plant-based wellness in functional foods, nutraceuticals, and herbal medicine. Companies are working hard to come up with advanced extraction technologies and value-added formulations and to source more sustainably to be able to position themselves in a growing clean-label and transparency-driven industry.

Further, leading players are expanding global distribution and investing heavily in partnerships and organic, GMP, and halal certification for their products to bolster their industry position. Meanwhile, advances toward solvent-free and supercritical CO₂ extraction continue to enhance product purity and retention of bioactive content, further intensifying competition.

With the emergence of the product in terms of weight management, improving digestive health, and promoting eye care, future businesses or companies that will be more tied up with regulatory compliance, transparency in the supply chain, and personalized health formulations will stand a better chance of surviving competitively. Ethical sourcing and customized solutions will be capitalizing on a consumer trend that increasingly demands high-quality botanical extracts.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Shaanxi Yongyuan Bio-Tech Co., Ltd. | 12-16% |

| Xi'an Green Spring Technology Co., Ltd. | 9-13% |

| Changsha Wanrun Bio-Technology Co., Ltd. | 7-11% |

| Botaniex Biotech Inc. | 6-10% |

| Shaoxing Marina Biotechnology Co., Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Shaanxi Yongyuan Bio-Tech Co., Ltd. | A prominent leader in herbal extracts, it specializes in high-purity extracts for pharmaceutical and nutraceutical applications. |

| Xi'an Green Spring Technology Co., Ltd. | Focuses on innovative plant-derived extracts with extracts that are high in bioavailability for functional food applications. |

| Changsha Wanrun Bio-Technology Co., Ltd. | Natural botanical extracts for the world industry are developed using sustainability and compliance with global organic standards. |

| Botaniex Biotech Inc. | Specializes in high-quality herbal ingredients and advanced extraction methods, making the herbal ingredients more potent and purer than extraction methods. |

| Shaoxing Marina Biotechnology Co., Ltd. | Products are provided for weight loss and digestion solutions and meet the needs of the global herbal supplement markets. |

Key Company Insights

Shaanxi Yongyuan Bio-Tech Co., Ltd. (12-16%)

A top supplier of high-purity herbal extracts that relies on advanced extraction techniques to cater to the pharmaceutical and nutraceutical industries.

Xi'an Green Spring Technology Co., Ltd. (9-13%)

Research-intensive plant extract products ensure high potency and bioavailability for use in functional food applications.

Changsha Wanrun Bio-Technology Co., Ltd. (7-11%)

Very keen on sustainability and organic certifications to meet the increasing demand for clean labels.

Botaniex Biotech Inc. (6-10%)

Value-added botanical ingredient producers ensure higher efficacy and purity of the product through the proprietary extraction process.

Shaoxing Marina Biotechnology Co., Ltd. (5-9%)

Products include cassia seed extracts, promoting several health benefits, such as weight loss and aiding digestion.

Other Key Players (40-50% Combined)

Estimated revenue for 2025 is USD 452.7 million.

The market is projected to reach USD 718.5 million by 2035.

Key companies include Shaanxi Yongyuan Bio-Tech Co., Ltd., Xi'an Green Spring Technology Co., Ltd., Changsha Wanrun Bio-Technology Co., Ltd., Botaniex Biotech Inc., Shaoxing Marina Biotechnology Co., Ltd., NATUREX France Avignon, Teatox Australia Pty Ltd, Nutraonly, Shanghai Herbary Biotechnology Co., Ltd., and Nanjing NutriHerb BioTech Co., Ltd.

India, slated to capture 7% CAGR during the study period, is expected to grow rapidly.

E-commerce is preferred the most.

The industry is segmented into pharmaceutical applications, nutraceutical applications, food & beverages, and other applications.

By distribution channel, the industry is divided into sales via retail and sales via wholesale.

The industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.