Cassava packaging offers a sustainable alternative that is compostable, dissolvable, and non-toxic. That has made it an appealing solution for diverse use cases including retail, food service, agriculture, and personal care. However, growing concerns over the environmental impact of plastics and heightened regulatory approaches to eliminate single-use plastics has contributed to the rise of cassava packaging as a viable alternative.

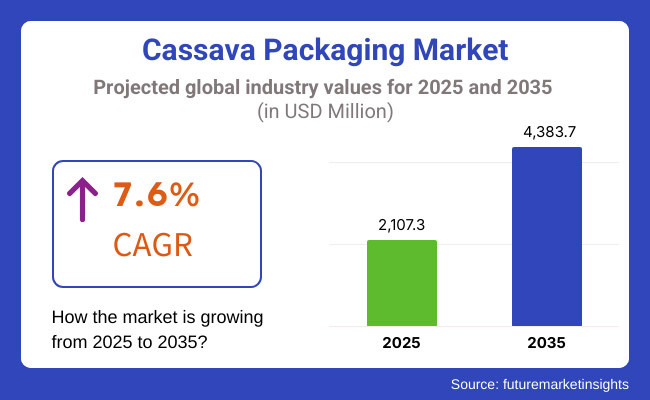

The cassava packaging market is likely to expand rapidly by 2035, as manufacturers focus on scaling production, increasing material strength and enhancing product availability. Cassava packaging Market 2,107.3 Million in 2025. It is expected to reach USD 4,383.7 Million by 2035, at a CAGR of 7.6%. This growth is indicative of rising global demand for sustainable packaging materials and a growing preference for eco-friendly solutions among both consumers and industries.

Explore FMI!

Book a free demo

The North American market for cassava packaging accounts for a sizable share in the global market. Use of cassava-based materials in the USA and Canada has increased for food service, retail packaging, and personal care products. So as more companies commit to minimize their plastic impact, cassava packaging is emerging as a practical, scalable solution in the region.

Supportive role of European Union’s stringent environmental regulations and its greater emphasis on sustainability is supporting the growth of cassava packaging market in Europe. Germany, France, and the United Kingdom are among the leading adoptions of biodegradable packaging, clay based materials are commonly applied in retail, food service, and agricultural sectors. Cassava packaging is gaining traction in response to the region’s commitment to decrease single-use plastics and promote a circular economy.

Asia-Pacific is the fastest growing market for cassava packaging due to heavy availability of cassava crops in the region and increasing environment consciousness among the people. Thailand, Indonesia and the Philippines, among other countries with solid agricultural bases and an increasing demand for sustainable materials, are especially poised to spearhead both the production of and demand for cassava packaging. Asia-Pacific market is projected to exhibit a lucrative growth in the decade owing to rising awareness among consumers and stringent rules imposed by governments regarding plastic usage.

Challenges

High Production Costs, Limited Industrial-Scale Manufacturing, and Performance Constraints

High production costs for the extraction and processing of biopolymers from cassava hinder the growth of cassava packaging market. They are also much more expensive and less scalable than traditional plastic packaging, since cassava-based alternatives require specialized equipment and enzymatic treatment to create.

For one, the market growth is restrained by lack of industrial-grade manufacturing plants for cassava-based packaging, especially in regions that do not grow it in large amounts. Performance limitations is another challenge, cassava-based materials may not be as durable, moisture-resistant, and heat resistant as traditional plastics, necessitating further production of bio-based polymer to strengthen its structure.

Opportunities

Growth in Eco-Friendly Packaging, Government Support for Plastic-Free Policies, and Biodegradable Innovations

Though there are challenges over the coming years, the cassava packaging market is poised with high growth potential due to the growing consumer awareness for sustainable alternatives, global single-use plastic bags, and technological advancements in bio-degradable material. The cassava-based solutions for eco-friendly packaging are gaining ground through various governments' commitments in this area - needing new solutions for food packaging, shopping bags, e-commerce packaging, and disposable containers.

Ongoing R&D for biodegradable film coatings, water resistant biopolymers, and AI optimized packaging design is furthering the strength, shelf life, and versatility of cassava packaging, making it increasingly competitive across diverse industries including food and beverage, healthcare, and retail.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Introduction of plastic bags and composability certification requirements. |

| Consumer Trends | Increasing demand for plastic-free shopping bags, compostable food packaging, and biodegradable mailers. |

| Industry Adoption | Adoption in retail, supermarkets, and food delivery services. |

| Supply Chain and Sourcing | Dependence on cassava-producing regions (Southeast Asia, Africa, Latin America) for raw materials. |

| Market Competition | Dominated by biodegradable plastic firms, specialty packaging manufacturers, and sustainability startups. |

| Market Growth Drivers | Growth fueled by anti-plastic regulations, corporate sustainability commitments, and green consumer behavior. |

| Sustainability and Environmental Impact | Moderate adoption of biodegradable alternatives and plastic-free packaging solutions. |

| Integration of Smart Technologies | Early adoption of compostable packaging films and water-soluble solutions. |

| Advancements in Material Science | Development of moisture-resistant and heat-tolerant cassava-based bioplastics. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on biodegradable packaging, extended producer responsibility (EPR) laws, and circular economy policies. |

| Consumer Trends | Growth in water-soluble packaging, home-compostable solutions, and zero-waste lifestyle products. |

| Industry Adoption | Expansion into e-commerce packaging, healthcare biodegradable packaging, and sustainable logistics. |

| Supply Chain and Sourcing | Shift toward locally sourced starch-based materials and on-site biopolymer production facilities. |

| Market Competition | Entry of AI-driven material engineering firms, plant-based packaging innovators, and smart biodegradable technology companies. |

| Market Growth Drivers | Accelerated by smart packaging innovations, AI-driven waste tracking, and biomaterial customization for different industries. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral production, regenerative material sourcing, and waste-free supply chains. |

| Integration of Smart Technologies | Expansion into AI-powered biodegradation tracking, IoT-enabled composting systems, and smart supply chain monitoring for eco-packaging. |

| Advancements in Material Science | Evolution toward fully compostable, durable, and multi-use cassava packaging solutions for industrial applications. |

The USA cassava packaging market is anticipated to expand at a significant rate, owing to rise in consumer demand towards sustainable & biodegradable alternative of plastic packaging. Government regulations around single-use plastics alongside corporate sustainability initiatives are driving cassava-based packaging into retail, food service and e-commerce. Besides that, biopolymer tech evolution is further improving the durability and performance of cassava packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.7% |

The demand for cassava packaging is on the rise in the UK as both businesses and consumers move towards sustainable alternatives of traditional plastic packaging. Soaring needs for biodegradable packaging options include rigid implementation of environmental policies such as plastic packaging tax and extended producer responsibility (EPR) regulations. Trends such as the increasing movement towards circular economy principles are also aiding market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

The market for cassava packaging is booming across the European Union owing to strict policies against plastic single-use products and for green packaging material. The shift towards compostable and biodegradable packaging solutions in businesses is further driven by the EU’s Green Deal and the circular economy action plan. Moreover, increasing consumer awareness regarding environmental sustainability is driving the demand for cassava-based packaging in the food, beverage, and consumer goods industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.6% |

The Japan cassava packaging market is developing steadily as the country strengthens its commitment to reduce plastic waste and promoting biodegradable alternatives. The market is being aided by bio solution manufacturing innovations and measurable customer demand for sustainable materials in food packaging and retail. The growth of the industry is also being aided by government initiatives that help promote eco-friendly substitutes for petroleum-based plastics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

Biodegradable packaging solutions, which help in reducing the environmental impact, are gaining momentum with businesses and consumers alike in South Korea leading to the growth of cassava packaging market in the region. The adoption is being driven by government policies to eliminate plastic waste and increase the use of sustainable materials in packaging. Growing eco-conscious consumers and sustainable e-commerce packaging solution providers are another factors propelling the market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.7% |

Cassava-based packaging solutions made from natural cassava starch provide eco-friendly, biodegradable, lightweight, and durable options for a variety of applications, including food service, processed foods, and beverage containers. Cassava packaging is gaining momentum across industries as more governments crack down on single-use plastics and consumers are increasingly aware of sustainable packaging solutions. Market and Product Type Published Reports such as Products (Cups & Glasses, Bowls & Trays, Containers & Clamshell - With Lid, Without Lid, Plates - Plane Plate, Partitioned Plate, Cutlery) and Applications - Food (Ready-to-Eat Meals, Processed Food, Fruits & Vegetables, Soup, Others); Beverages (Milk Products, Tea & Coffee, Cold Drinks, Juices).

Containers & Clamshells Lead Market Demand

Food delivery services, restaurants and grocery retailers are increasingly seeking sustainable and compostable alternatives to plastic containers, which will continue to drive growth in the containers & clamshell segment, as the largest segment of the Cassava Packaging Market. Cassava-based containers are highly durable and heat-resistant, providing leak-proof and toxin-free options for takeout meals, meal prep service, and other biodegradable food storage.

Among the sub-segments, with lid is the most salient, as companies are interested in locked, spill-resistant, and trip-proof food packaging products. Restaurants and cafes use cassava containers with lids to package hot meals, salads and takeout orders, so that food stays fresh and sanitary. The without lid segment is expanding in applications like cafeteria-style dining and ready-to-eat meal packaging that require open-top trays and green serving options.

Another category witnessing steady demand is the bowls & trays segment (soups, stews, and fresh food packaging). Heat retention, moisture resistance, and an inherently biodegradable alternative to foam and plastic bowls for QSR (quick-service restaurants) and premium organic food brands, cassava-based bowls deliver.

By Product Type: Plates and Cutlery Gain Popularity in Sustainable Dining

Plates, although they may include plane plates or partitioned plates, are seeing increasing adoption both in the catering and events businesses and in eco-conscious dining establishments. This is due to the growing demand for partitioned plates in the airline catering, hospital and school cafeteria settings where portion control and food separation is required. These plates are made from cassava and offer a lightweight alternative to paper and plastic options, but are 100% compostable.

There’s also cassava-based cutlery gaining popularity as an alternative to plastic spoons, forks and knives. Strong, durable, and heat resistant, these biodegradable utensils are the ideal solution for restaurants, food trucks and takeaway businesses striving to eliminate non-recyclable plastic cutlery..

Ready-to-Eat Meals Drive Food Packaging Demand

Ready-to-eat meals are the largest application of cassava-based packaging, as the demand for muffins, ovens, and fast frozen microwave meals has increased. With on-the-go lifestyles, meal prep and food delivery services on the rise, cassava packaging alternatives offer a sustainable solution to the plastic takeout containers now prevalent with meal prep services.

A healthy growth in the processed food segment is also prevalent, with brands trying to replace plastic packaging with bio-based earth-friendly raw materials. The clean-label and sustainable food production trends are propelling manufacturers to use cassava-based trays and containers for organic snacks, plant-based goods, and frozen foods.

Fruits & vegetables segment - The fruits & vegetables segment is gaining ground as grocery retailers and organic food suppliers are actively looking for biodegradable produce packaging. The containers preserve freshness, breathability and extend shelf life while eliminating plastic waste..

By Applications: Tea & Coffee and Cold Drinks Boost Beverage Packaging Adoption

Cassava-based cups and lids are also in high demand due to the increasing need for sustainable products in the tea & coffee sector, with many sustainable coffee shops and beverage brands searching for alternatives to paper and plastic cups. Demands for eco-friendly products are growing as regulation against traditional, plastic-lined coffee containing vessels increases, and cassava-based bioplastics are becoming popular with environmentally-friendly vapers.

Cassava packaging solutions are also in high demand in the cold drinks field, including smoothies, soft drinks, and plant-based beverages. These cups can be insulated, leak-proof, and compostable making them an appealing option for juice bars, fast-food chains, and beverage brands.

The demand for packaging materials made of cassava is surging owing to the growing trend of eco-friendly, biodegradable, and plastic-free packaging across extension of the market worldwide. Things like AI-powered material engineering, water-soluble cassava-based bioplastics, and sustainable packaging innovations are being studied to improve durability, ensure decomposition efficiency, and increase production scale. Biodegradable packaging manufacturers, sustainable raw material developers, and compostable product suppliers are part of the market whose innovations range from the development of cassava-starch polymers to AI-driven quality control and regulatory-compliant green packaging solutions.

Market Share Analysis by Key Players & Cassava Packaging Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Avani Eco | 18-22% |

| Biogreen Bags | 12-16% |

| EnviGreen Biotech | 10-14% |

| No Plastic International | 8-12% |

| EcoNest Philippines | 5-9% |

| Other Sustainable Packaging Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Avani Eco | Develops AI-optimized cassava-based biodegradable packaging, compostable bioplastics, and water-soluble eco-friendly products. |

| Biogreen Bags | Specializes in sustainable cassava packaging solutions, AI-powered material testing, and high-durability biodegradable packaging. |

| EnviGreen Biotech | Provides non-toxic, plastic-free cassava-based packaging with AI-assisted decomposition monitoring and food-safe applications. |

| No Plastic International | Focuses on cassava resin-based eco-packaging, AI-powered product lifecycle analysis, and scalable biodegradable material production. |

| EcoNest Philippines | Offers compostable cassava packaging for retail, food, and industrial use, integrating AI-driven sustainability assessments. |

Key Market Insights

Avani Eco (18-22%)

Avani Eco is the market leader in cassava packaging, providing biodegradable, compostable, and water-soluble cassava-based packaging solutions. AI-inspired material innovation, sustainable polymer engineering, and food-safe biodegradable substitutes.

Biogreen Bags (12-16%)

Technology adjusts the cassava-plastic packing process to ensure adhesive quality so the product can withstand during the packaging process.

EnviGreen Biotech (10-14%)

EnviGreen offers planet-friendly, plant-based, compostable cassava packing material, maximizing decomposition tracking through AI and continuously upgrading their plastic-free formulation.

No Plastic International (8-12%)

No Plastic International develops cassava-based flexible packaging substitutes while leveraging AI-assisted manufacturing optimization and eco-friendly resin formulation.

EcoNest Philippines (5-9%)

EcoNest produces biodegradable packaging from cassava starch, which are high-performance compostable materials that are AI-improved for quality.

Other Key Players (30-40% Combined)

Several biodegradable packaging firms, compostable material producers, and sustainable product developers contribute to next-generation plastic-free packaging innovations, AI-powered material engineering, and scalable biodegradable production solutions. These include:

The overall market size for cassava packaging market was USD 2107.3 Million in 2025.

Cassava packaging market is expected to reach USD 4383.7 Million in 2035.

The demand for Cassava Bags is expected to rise due to increasing environmental concerns, growing regulations on plastic usage, and rising consumer preference for biodegradable and sustainable packaging solutions.

The top 5 countries which drives the development of cassava packaging market are USA, UK, Europe Union, Japan and South Korea.

Containers & Clamshells and Ready-to-Eat Meals to command significant share over the assessment period.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.