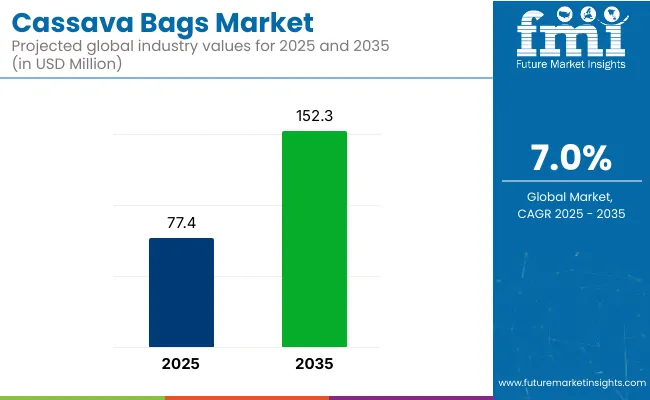

The cassava bags market is projected to grow from USD 77.4 million in 2025 to USD 152.3 million by 2035, registering a CAGR of 7.0% during the forecast period. Sales in 2024 reached USD 72.3 million, indicating sustained momentum in the biodegradable packaging sector. Growth has been driven by rising use in retail, food service, and agriculture, where environmentally friendly bag alternatives are increasingly preferred.

This growth has been driven by rising consumer awareness of plastic pollution, increased adoption of biodegradable alternatives, and supportive government policies targeting single-use plastics. Manufacturing techniques that enhance tensile strength, moisture resistance, and cost-efficiency have also been implemented, enabling scalability. These factors collectively contribute to the promising growth trajectory of the cassava bags market over the next decade.

In May 2023, Cassava Bags Australia wins ‘eco-disruptive’ award. Cassava Bags Australia has come out on top in Bupa’s global eco-disruptive competition. The bags dissolve in hot water in seconds and break down in the earth within months, making them a more environmentally friendly alternative to typical single-use plastic bags. Bruce Rossi, Cassava Bags Australia’s president of purpose, stated, “This win marks a significant milestone in Cassava Bags Australia’s journey and solidifies the company’s position as a leading provider of eco-friendly, biodegradable solutions.”

The collaboration between Bupa and Cassava Bags Australia, according to Rossi, is a critical step towards building a sustainable future and addressing the pressing demand for solutions that save the environment and enhance public health.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 77.4 Million |

| Projected Market Size in 2035 | USD 152.3 Million |

| CAGR (2025 to 2035) | 7.0% |

Manufacturers have emphasized the use of non‑toxic, compostable cassava starch in place of conventional plastics. Production processes have been enhanced to include solar-drying and chemical-free extruding, reducing carbon footprints and water usage.

Quality improvements such as heat‑resistant and water-resistant bag variants have been introduced to meet industry requirements. Certifications such as BPI industrial composability and alignment with circular economy standards have been pursued to strengthen consumer trust. Automation in bag fabrication and printing has ensured consistency and scalability.

Strong growth is expected in the cassava bags market as global plastic bans, environmental policies, and consumer preferences converge.

Leading-edge producers that secure composability certifications and invest in high-capacity, low-emission facilities are poised to gain market advantage. Expansion in Southeast Asian production hubs, supported by local cassava farming, will enable cost-effective supply chains. Partnerships between cassava-bag manufacturers and major retail or food-service brands are anticipated to enhance distribution and drive adoption.

The market is segmented based on type, category, end use, and region. By type, the market includes grip-hole bags, t-shirt bags, and garbage bags. In terms of category, the market is divided into organic and conventional segments.

By end use, the cassava bags market comprises food & beverages, animal feed, pharmaceuticals, personal care & cosmetics, and others. Regionally, the market is analyzed across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA).

Organic cassava bags are projected to hold 59.1% of the market share by 2025, as preference has been steadily shifting toward fully compostable and toxin-free materials. These bags have been produced using starch extracted from organically cultivated cassava roots, free from synthetic chemicals or pesticides.

Regulatory favorability and alignment with compost certification programs have enabled wider retail acceptance, especially in developed regions. End-use industries have opted for organic variants to enhance eco-branding, especially among zero-waste and sustainability-focused consumers. Packaging bans and plastic levies have further accelerated substitution with organic cassava materials.

Unlike conventional bags, organic options have been positioned as marine-degradable and safer for animal and soil health, promoting their use in eco-sensitive regions. Branding with organic compliance logos has been widely adopted to build consumer trust and expand usage in high-volume packaging formats. Shelf-ready and printable organic bags have been successfully integrated into mainstream supply chains.

With governments and brands aligning sustainability mandates with consumer sentiment, demand for organic cassava bags is expected to continue rising. Investment in organic starch sourcing and decentralized bag manufacturing units has been encouraged to meet escalating demand across multiple sectors.

The retail & e-commerce segment is projected to hold 42.7% of the cassava bags market by 2025, driven by widespread bans on plastic carriers and growing pressure to adopt biodegradable substitutes. Brick-and-mortar stores and online retailers have transitioned to cassava-based bags for delivering goods in environmentally friendly packaging.

Lightweight yet durable bag formats have been adopted for garments, groceries, and consumer electronics, supported by print customization options and attractive branding. Retailers have used cassava bags to reinforce sustainable brand values, reduce plastic waste, and comply with local environmental laws. Their ease of disposal and home composability have appealed to a wide consumer base.

E-commerce platforms have integrated cassava bag usage into fulfillment and returns operations, aligning with green logistics targets. Tamper-proof, resalable, and transparent variants have also been introduced to enhance the post-purchase experience.

Co-branded eco-packaging partnerships have contributed to broader retail adoption globally. As consumers increasingly prioritize sustainable packaging in online and offline shopping experiences, retail and e-commerce demand for cassava bags is expected to accelerate. Extended producer responsibility (EPR) frameworks and eco-labelling incentives are forecasted to further entrench cassava bags within this segment.

High Production Costs, Limited Consumer Awareness, and Biodegradability Regulations

High production costs for extraction and processing of cassava-based biopolymers hamper the growth of cassava bags market. Cassava-based alternatives also involve more complex manufacturing processes than regular plastic bags, making them more expensive than conventional plastic, and in some cases also than other bioplastics.

In addition, low consumer awareness of cassava-based biodegradable alternatives and their benefits stymies market adoption.

Another significant challenge is regulatory compliance as governments have imposed stringent biodegradability testing and certifications, cassava bags must comply with certain compostability and eco-friendly disposal standards, and this higher compliance cost places a strain on manufacturers.

Growth in Sustainable Packaging, Government Bans on Plastic, and Biodegradable Innovations

Despite these challenges, with rising consumer demand for sustainable alternatives to plastic, government regulations banning single-use plastics, and advancements in biodegradable materials, the cassava bags market is expected to grow considerably.

Plastic bags and movements toward biodegradable options in many countries are driving demand for cassava-based bags.

Further, active R&D in bio-based polymers is directing to make cassava bags stronger, water-resilient, and cost-effective, competitive for retail, food packaging, and e-commerce industries.

This is also expected to accelerate market adoption owing to the expansion of zero-waste initiatives and circular economy programs.

The USA cassava bags market is expanding, as there is growing concern about the environment, and the government is enforcing the limitations on the usages of single-use plastic bags.

Cassava-based bags become eco-friendly solution for retailers and food service providers to meet the increasing demand for biodegradable and compostable alternatives. In addition, rising customer awareness and corporate sustainability initiatives are supporting the market growth.

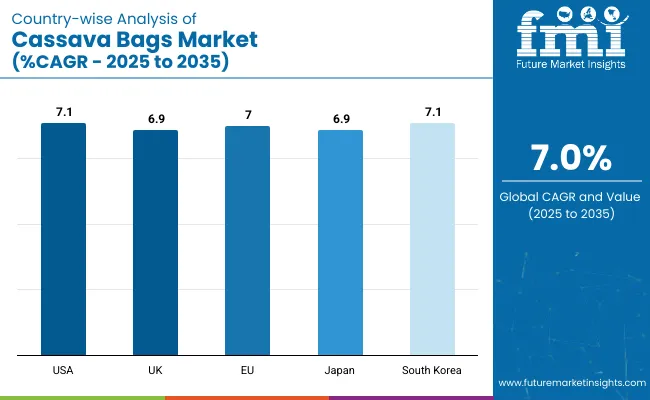

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

In the United Kingdom, the companies and consumers are increasingly seeking sustainable and eco-friendly packaging to reduce plastic waste, which is driving the growth of the cassava bags market.

As a result, the enforcement of plastic bag bans and the introduction of extended producer responsibility (EPR) regulation have further expedited the growth of biodegradable packaging. On the other hand, investment in bio-based materials are coming in to realize a world-class cassava-based bag.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.9% |

The demand for biodegradable alternatives in the packaging industry has prompted the proliferation of the Cassava Bags market across the European Union due to the strict sustainability regulations.

The rising cassava bag adoption in retail, e-commerce, and food packaging industries is driven by EU’s stringent regulations against single-use plastics and incentives towards the development of bio-based products. The market's growth is also being fueled by increasing consumer preference for eco-friendly shopping bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.0% |

Japan cassava bags market is forecast to grow at a robust CAGR in the years to come as the country reinforces its emphasis on sustainable packaging and the mitigation of plastic waste.

Manufacturers are now exploring cassava-based materials as the government promotes biodegradable alternatives to plastic and the country is determined to cut plastic pollution. Moreover, the rising use of green packaging in the retail and food industries is also boosting demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

South Korea is seeing growth for the cassava bags market owing to the increasing awareness on environmental sustainability and government initiatives for the banning of single-use plastics.

Factors such as the significant presence of bio-based material innovation & and increasing consumer preference for biodegradable shopping & packaging solutions propel the market demand. E-commerce and food delivery companies are also using cassava bags to meet their sustainability objectives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

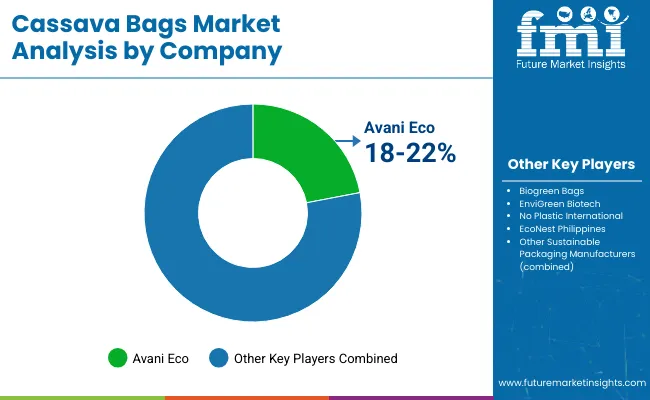

The growth of the cassava bags market can be attributed to the increasing demand for environmentally friendly, biodegradable, and plastic-free alternatives. In the future, companies are customizing AI solutions to drive plastic material optimization, compostable polymer bonding combinations, and sustainable manufacturing of additional plastic product types to help increase bag performance, decomposition speed, and market attractiveness.

It’s providing of technological advances in cassava-based bioplastics, AI-powered monitoring of product quality, and scalable production processes represents the breadth of the market, which includes biodegradable packaging manufacturers, sustainable material providers and eco-conscious product developers.

Other Key Players

Some startups among thousands of biodegradable packaging companies, sustainable product testers, cassava-based polymer makers, and more develop next-generation plastic-free packaging, AI-driven production scaling, and eco-friendly material engineering. These include:

The overall market size for cassava bags market was USD 77.4 Million in 2025.

Cassava bags market is expected to reach USD 152.3 Million in 2035.

The demand for Cassava Bags is expected to rise due to increasing environmental concerns, growing regulations on plastic usage, and rising consumer preference for biodegradable and sustainable packaging solutions.

The top 5 countries which drives the development of cassava bags market are USA, UK, Europe Union, Japan and South Korea.

T-Shirt Bags and Organic Cassava Bags to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cassava Packaging Market Growth - Forecast 2025 to 2035

Cassava Flour Market Trends – Size, Share & Forecast 2025-2035

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Sugar Bags Market

Cotton Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA