The casino hotel market is expected to grow immensely in 2025 to 2035 as a result of rising customer demand for integrated entertainment centers, the development of new tourist resorts, and higher disposable incomes.

Integrated entertainment centers such as gaming and entertainment centers in the complex and luxury rooms have transformed casino hotels into a recreation hub and business travelers. The casino property phenomenon with luxury suites, quality dining, and live shows is also gaining momentum overseas.

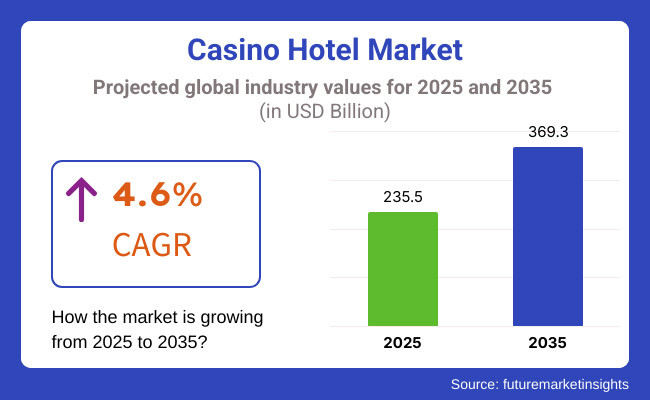

The casino hotel market was approximately USD 235.5 Billion in 2025. The market would be USD 369.3 Billion in 2035 at a compound annual growth rate (CAGR) of 4.6%. This is because of increased demand for upscale gaming centers and development of casino resorts to new geographies. Enhancement in gaming technology, simplicity with cashless payments, and enhanced customer services are also promoting increased market growth.

Explore FMI!

Book a free demo

North America paces casino hotel-supported territories with well-settled gaming hubs such as Las Vegas and Atlantic City. Casino hotels flank its skyline with upgraded rooms, international cuisine, and crowded gaming floors. The American market is generously blessed with open policies and uninterrupted inflow of domestic as well as overseas visitors. New entrants entering markets with debut gaming licenses will also be able to fund the market growth.

Europe is best positioned in the luxury casino hotel industry with premium locations such as Monte Carlo, London, and the French Riviera that embrace high-net-worth travelers who seek discreet gaming and stays. Most of Europe's locations are full of history and culture with premium casino hotels that are nestled in nature's arms.

Destination concentration on providing a combination of old-style gaming environment and new amenities ensures stability of demand among upscale visitors. Demand for major events held within casino hotels also promotes repeat visits.

The Asia-Pacific region will experience the industry's highest growth in casino hotels. Macau, Singapore, and the Philippines' integrated resort clusters continue to welcome tens of millions of foreign visitors annually. Demand for luxury gaming malls is being fueled by China's expanding middle class and Japan and South Korea's outward-bound tourism growth.

New casino hotels are being established in some of these countries in the region as gambling legislation there is also being opened up. It is being fueled by a strong tourism sector and rising disposable incomes.

Regulatory Compliance & High Operational Expense

Regulatory requirements for Casino Hotel are also stringent, resulting in high operational costs for the manufacturers and treat customers with new and innovative offerings. The laws surrounding issuing a correct and suitable responsible gambling policy, anti-money laundering and licensing laws that the government imposes on casinos to comply with exponentially raises burdens on administration.

It is also capital and labour-intensive, as you are maintaining a casino hotel: secure, gaming technology, entertainment, and different hospitality lines, all of which will incur high fixed costs. The profitability of the gambling industry is faced with risks such as market fluctuations, economic downturns and competition from online gambling platforms.

Pursuing these strategies is costly, resulting in casino hotels spending more on advanced security solutions, digital compliance, and diversified revenue streams in the form of integrated resorts, entertainment infrastructure, and exclusive VIP packages.

Luxury gaming and integrated resort experiences expansion

New developments, entertainment tourism, and the upcoming demand for luxurious gaming experiences integrated resorts are great signs for the Casino Hotel Market. HNWIs and experience-seekers desire higher-end gaming products, coupled with premium entertainment, dining and wellness offerings. Moreover, AI technology is being utilized in customer service, personalized gaming experiences, and data-driven marketing strategies, helping to promote customer engagement.

Resort-Casinos: As for the property level, gaming properties investing in smart gaming floors, AI-powered guest services, and exclusive lifestyle experiences will be the ones to beat as markets move toward immersive resort-style casino experiences. Sustainable practices like energy-efficient gaming operations and eco-friendly casino hotels are becoming differentiators in the transitional landscape of hospitality and gaming as well.

During the period from 2020 to 2024, the Casino Hotel Market has grown owing to factors such as increased tourism, legalization of gaming in the emerging market, and advancements in digital gaming technologies. Properties added high-end retail, entertainment venues and wellness offerings to deepen their appeal to more demographics.

Nonetheless, regulatory hurdles, skyrocketing operational costs and the rapid emergence of online gambling platforms proved to be a thorn in the flesh. Casino hotels, on the other hand, are angling for an upgrade of their security systems, turning to contactless payment solutions, and employing AI-driven marketing strategies to keep customers engaged.

But between 2025 and 2035, the market can look very different thanks to block chain for secure transactions, AI-driven gaming personalization, and hybrid physical-digital casino environments. The rise of smart casinos, using real-time analytics to enhance customer experiences and drive operational improvements, will revolutionize the industry.

Global trends, including green gaming resorts and carbon-neutral hospitality function, may also influence the way forward for the sector. The latest Casino Hotel Market will Transit Photography and Audio Fashion and Audio Attractions - Companies offering AI Embedded Guest Engagement, Immersive Entertainment Experiences, and Compliance-Lean Digital Security

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with anti-money laundering laws and with gaming regulations |

| Technological Advancements | Growth in contactless gaming, mobile apps, and digital payments |

| Industry Adoption | Increased integration of entertainment, shopping, and dining experiences |

| Supply Chain and Sourcing | Dependence on traditional casino hardware and gaming software providers |

| Market Competition | Dominance of established casino hotels and resort operators |

| Market Growth Drivers | Booming tourism demand, the legalization of gaming, and the expansion of luxury resorts |

| Sustainability and Energy Efficiency | Initial adoption of energy-efficient gaming operations |

| Integration of Smart Monitoring | Limited real-time tracking of guest behaviour and gaming patterns |

| Advancements in Casino Hospitality | Traditional gaming resorts with entertainment and dining |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Growth of AI-assisted compliance monitoring and responsible gaming of tools, block-chain transactions |

| Technological Advancements | Full-scale implementation of AI-powered gaming floors, VR-enhanced gambling, and immersive smart casinos. |

| Industry Adoption | Expansion into AI-curated experiences, luxury VIP gaming lounges, and hybrid online-offline gaming models. |

| Supply Chain and Sourcing | Shift toward AI-driven data analytics, cloud-based gaming operations, and smart casino management platforms. |

| Market Competition | Growth of tech-driven gaming companies offering personalized digital gambling experiences and smart resort integrations. |

| Market Growth Drivers | More investment in immersive gaming, AI-led ROS and sustainability-led casino operations |

| Sustainability and Energy Efficiency | Large-scale transition to carbon-neutral casino hotels, AI-managed energy optimization, and green-certified gaming resorts. |

| Integration of Smart Monitoring | AI-driven guest analytics, real-time gaming optimization, and cloud-based casino security management. |

| Advancements in Casino Hospitality | Evolution of experience-driven casino hotels featuring AI-powered personalization, immersive AR/VR gaming, and smart luxury accommodations. |

The proliferation of casino hotels across the United States is driven by Las Vegas and Atlantic City maintaining strong influences, an expanding domestic and international tourism landscape, and luxury casino resorts receiving augmented investments. Regulated gaming by individual states continues to cultivate new opportunities as casinos debut in Florida, New York, and tribal territories.

Concurrently, the ascent of digital diversions, sports wagering, and extravagant entertainment within casino hotels attract a more inclusive customer pool. Furthermore, themed complexes, celebrity chef restaurants, and e-sports gaming hubs enhance experiences for guests. Anticipation of ongoing growth in hospitality and gaming suggests the American casino hotel market will steadily broaden its scope.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The prevalence of casino hotels across the United Kingdom stems from an assortment of variables. Demand for opulent gaming spectacles from affluent patrons and global travellers flocking to storied establishments such as The Ritz Club and the lavish floors of The Hippodrome's had consistently increased in London. Furthermore, the regulatory framework instituted by the UK Gambling Commission calls for responsible playing and digitized payment options inside casino facilities to better integrate evolving technologies.

Emerging as an additional engine of market growth is the competitive realm of e-sports betting and customized VIP gaming experiences tailored for top spenders. With deep-pocketed investors relentlessly injecting capital into ultra-luxurious integrated resorts centered on casino entertainment and lodging, the sector is primed for steady expansion in the coming years supported by these motivating conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The casino hotel industry across the European Union has grown steadily yet steadily driven by booming tourism numbers, proliferating luxury lodging options, and increasing legalization of gambling in certain countries. Key markets like vibrant France, robust Germany, and diverse Spain have seen development in integrated resorts that seamlessly combine casinos and destination gaming attractions.

Furthermore, the EU's focus on sustainable travel and digital transformation has compelled casino hotels to wholeheartedly embrace artificial intelligence-driven customer profiling, blockchain-based betting platforms allowing trust less transactions, and immersive virtual experiences transporting visitors to new worlds in varied ways.

In addition, the joyous and unexpected resurgence of international travel after the unsettling pandemic has considerably enhanced demand for integrated resort stays in idyllic Mediterranean destinations among many visitors. With ongoing sizable investments in tourism infrastructure and top-tier gaming offerings that are not uniform, the casino hotel sector across the European Union is anticipated to progressively develop though some obstacles both big and small remain.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The legalization of integrated resorts in Japan sparked widespread transformation in the casino hotel sector due to swelling domestic and international tourism working together with substantial backing for premier gambling havens. Osaka and Yokohama's inaugural licensed casino complexes, planned to debut in coming years, could each attract millions of annual site visitors.

The national government's strategic focus on cultivating the travel industry through high-end amusement complexes, cultural exhibits, and exclusive gaming offerings is fueling market growth. What's more, cutting-edge digital technologies and cashless payment solutions are progressively improving the overall casino hotel experience for patrons. Furthermore, avant-garde designs for integrated resorts incorporate natural surroundings with architecture and amalgamate amenities to appeal to a variety of interests beyond gaming alone.

With unwavering support from officials and huge investments poured into integrated resorts, analysts forecast that the Japanese casino hotel market will undergo significant expansion in the foreseeable future. Opulent facilities combined with a diversity of attractions may draw throngs of new customers into the budding industry, transforming the economic and cultural landscape of urban centers in the process.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The burgeoning South Korean casino market has been driven by escalating inbound tourism in recent years, as well as expanding investments in high-end integrated resorts backed by government incentives. Renowned gaming hubs like Jeju Island and Paradise City in Incheon continue attracting gamblers especially from neighbouring China and Japan with some traveling long distances and booking expensive accommodations to experience the integrated resorts' many attractions.

While traditional casino gambling remains a popular activity, entertainment-focused resorts with luxury shopping, periodic elaborate live performances featuring famous acts, cultural exhibitions, and fine dining restaurants have broadened the industry's appeal far beyond pure wagering for both local and international visitors.

Concurrently, the thriving online gaming and e-sports betting sectors in South Korea which sees billions gambled annually serve to complement brick-and-mortar casino properties whose prestigious integrated resort complexes continue investing in state-of-the-art amenities, live entertainment, and innovative technologies.

As the nation sustains major investments in pioneering smart tourism initiatives and immersive digital gaming experiences through 5G and beyond, the South Korean casino sector employing thousands is forecasted to maintain a steady growth trajectory in the coming years through leveraging new technologies, non-gambling attractions, and marketing to engage both traditional and more casual demographics while establishing itself as a leader in integrated resorts in Northeast Asia.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Global travellers are continuously becoming more interested in luxury gaming experiences, entertainment-driven vacations, and premium hospitality services, which retain an equitable share of the casino hotel market for the slots and poker segments. These congregational casino games are vital in appealing to high-stakers, casual gamers, and tourists from abroad, ensuring that casino hotels have high revenues and brand loyalty.

As one of the most profitable gaming categories worldwide, slot machines can skim high-volume player traffic, automated betting systems and progressive jackpot winnings. In contrast with existing table games, slots need very limited skill, and appeal to a wide range of casual players, overseas tourists and non-gaming visitors.

Demand for electronic and digital slot machines, with high-definition graphics, immersive sound effects and themed gaming experiences, has propelled adoption of advanced slot technologies as casino hotels pay increasing attention to creating engaging gaming environments. Studies show slot machines account for as much as 70% of total gaming revenue in large casino hotels, making for robust profit and steady cash flow.

Slots are receiving even greater demand as the high-stakes slot tournament are becoming increasingly popular, with multimillion dollar prize pools and exclusive VIP gaming areas. AI-driven slot machine analytics, which incorporate personalized suggestions and immediate player monitoring, have also spurred up adoption, allowing for improved involvement and customer retention.

The introduction of themed slot experiences, with movie, sports and pop culture-based game designs has hyper-optimized growth in the market, with the selection appealing to a wider variety of casino demographics. Launch of cashless slot machine payments, powered by mobile app integration and cryptocurrency betting is another contributing factor of the market growth, while providing enhanced convenience and digital transformation of casino hotels, thus further driving the growth of the market.

While slot machines provide excellent stratas of steady cash flow, reachability, and generational player participation, the segment is not without its challenges-notably the growing regulatory pressures, skill-based gaming market shifts, and competitive onslaught of digital optioning.

Nonetheless, advancements in AI-driven tailored gaming, VR slot experiences, and next-gen progressive jackpot technology are also enhancing engagement, profitability, and player retention, with all signs pointing to continued market growth for the slots segment in casino hotels.

Poker has firmly established itself in the market, and in particular among high-rollers, pro-gamers and among competitive gamers as casino hotels continue breaching world class poker rooms, tournaments and private VIP gaming lounges. Unlike slots, poker is skills-oriented, luring seasoned players interested in high-stakes competition and elite gaming amenities.

The increasing appeal of high-limit poker competitions, which include nine-figure prize pools and international, broadcast coverage has sparked a parasitic growth of elite poker hubs, with hotel casinos leveraging the expanding popularity of vacation-based competitive gaming.

Research suggests that both professional poker players and high-rollers of gambling establishments (high-stakes gamblers) account for significant gains to overall profitability from a casino hotel, indicating a strong demand for poker rooms among existing competitors in the market.

The booming demand for luxury poker suites, including private gaming rooms, dedicated dealer services and VIP player amenities, has further intensified market demand and led to increased penetration among affluent players and celebrity clientele. The feature of AI-driven poker analytics providing opponents behaviour solvent, behavioural tendencies and tailored strategy tips has accelerated adoption even more as players can enjoy improving their session trends hands-on.

We have seen the rise of hybrid forms of poker, with live dealer poker being provided alongside digital betting interfaces, allowing new market growth and broader access to these casual and first-time players. The establishment of block chain-backed poker rooms that allow individuals to bet using digital tips over transparent betting environments has strengthened market expansion and provided greater protection and financial mobility for casino hotel poker games.

It has elements such as attracting high-value game customers, increasing global gaming tourism, and enhancing casino brand prestige, but the poker segment faces regulatory compliance burdens, lack of mass-market accessibility, and competition from different online poker platforms.

Nonetheless, new innovations in AI-led skills boosting and live game streaming for remote showmen, as well as interactive digital poker tables, are increasing engagement, accessibility and competitive gaming tourism, making certain that poker in casino hotels could have no choice but to prosper.

These represent two huge market drivers as casino hotels continue to address gender-specific preferences and travel motivations by offering gendered luxury accommodations, entertainment experiences and premium gaming environments.

Casino hotel operators benefit from a strong and economically-able male traveller segment, one that seeks high-stakes gaming, luxurious and exclusive experiences, and hospitality driven by entertainment. In contrast to those leisure-focused travellers, male casino customers tend to be more focused on high-limit gaming, sports betting and club premium.

Ultra-premium accommodations in the gaming industry are on the rise as the popularity of high-roller suites, complete with private poker rooms, exclusive slot tournaments, and VIP concierge services, grow in demand and luxury casino hotels cater more to high-spending male patrons. Studies have shown that male travellers represent more than 65% of the total global casino gaming revenue; therefore, it ensures high levels of engagement with high-limit betting experiences.

The development of sports betting lounges, which include live video streams, VIP seating, and interactive bet slips, has bolstered market demand, guaranteeing higher adoption rates among male sports fans and betters. The introduction of AI-based VIP player tracking capabilities with customized game play and automated loyalty program has also fuelled adoption by enhancing engagement and retaining customers.

Luxury formats, such as private concerts, sessions with celebrities and entertainment in clubs, have fuelled market growth, helping to attract more male high net worth casino travellers. While premium guest engagement, VIP loyalty programs, and high-value revenue generation are the key advantages of this market, the male traveller segment continues to suffer from changing gaming trends, competition from online sports betting, and moving restrictions towards high-limit gaming.

But new developments in AI sports betting analytics, live sports prediction AI, and block chain-based high-stakes betting are enhancing engagement, security and betting options to drive continued growth for male casino hotel travellers.

Female travellers, in particular, have already achieved solid market penetration, with female guests being prominent in luxury resort stays, wellness getaways, and entertainment-focused casino experiences, as women increasingly desire high-end hospitality, luxury shopping options, and social gaming settings. Unlike conventional male gamers, who may visit hotels primarily for gaming, female casino patrons are more likely to seek out spa services, shopping districts, fine dining and live entertainment over high-limit gaming.

With women increasingly seeking respite in gaming resort environments, the increasing demand for luxury casino spa resorts with holistic wellness experiences, five-star spa treatments and bespoke beauty packages is driven by adoption of wellness-oriented casino accommodations. Research has shown that more than 60% of female casino patrons are looking for a destination resort experience, beyond simple gambling (ensuring vertical integration; similar to luxury properties).

This has strengthened market demands for a wider range of much deserved features designed specifically for female gamers that encourages greater uptake of social gaming formats, such as casual gaming lounges, themed slot machines and interactive digital casino games. AI-powered shopping concierge services that provide personalized luxury retail experiences and bespoke fashion styling have also driven adoption and increased engagement among higher-spending female travellers.

While the female traveller segment offers significant benefits in terms of revenue and guest appeal for luxury hospitality, specifically gaining engagement from the female traveller seeking luxury hospitality in destinations, the casinos still need to establish a specific gaming offering to attract female clientele and to nurture that same market into a female-specific gaming space.

However, fresh innovations such as AI-powered luxury travel recommendations, digital concierge shopping platforms and immersive casino wellness retreats are enhancing engagement, exclusivity, and premium experience offerings, paving the way for continued growth for its female casino hotel travellers.

Increasing demand for lavish gaming expeditions, comprehensive diversion towns, and upscale accommodation amenities is principally stimulating development in the casino resort industry. These innovative advancements comprise AI-guided client investigation, all-enveloping playing environments utilizing cutting edge innovation, as well as devotion prizes programs uniquely intended for the most selective and lavish customer base.

Potential new individuals to the business sector involve worldwide betting administrators, extravagance convenience brands known worldwide, and incorporated resort designers, every one of whom adds to propelments in keen gambling club administration frameworks, computerized instalment frameworks giving clients another dimension of accommodation, and man-made consciousness based customized benefit contributions individually altered to every solitary client.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| MGM Resorts International | 18-22% |

| Las Vegas Sands Corporation | 15-20% |

| Caesars Entertainment, Inc. | 12-16% |

| Wynn Resorts, Limited | 8-12% |

| Melco Resorts & Entertainment | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| MGM Resorts International | Develops integrated casino resorts with AI-driven guest services, luxury accommodations, and smart gaming solutions. |

| Las Vegas Sands Corporation | Specializes in premium casino resorts with high-end retail, entertainment, and AI-powered gaming security. |

| Caesars Entertainment, Inc. | Operates world-class casino hotels, incorporating digital payment systems and AI-driven loyalty programs. |

| Wynn Resorts, Limited | Provides ultra-luxury casino resorts with exclusive gaming experiences, private suites, and personalized concierge services. |

| Melco Resorts & Entertainment | Offers high-end casino resorts in Macau and Asia, integrating AI-enhanced security and digital gaming innovations. |

Key Company Insights

MGM Resorts International (18-22%)

MGM Resorts International, a leader in the casino hotel market, presents a new generation of AI-powered gaming, joined with a luxury hospitality and integrated resort experience.

Las Vegas Sands Corporation (15-20%)

Las Vegas Sands focuses on luxury casino hotel resorts, with AI benefits for guest personalization and smart gaming analytics.

Caesars Entertainment, Inc. (12-16%)

Large-scale casino operations, Optimize digital payments, AI-driven customer engagement and loyalty rewards.

Wynn Resorts, Limited (8-12%)

Wynn creates ultra-premium casino hotels, forming a synergy between gaming with exclusive VIP services and smart hospitality technology.

Melco Resorts & Entertainment (5-9%)

Melco develops and operates luxury gaming and integrated entertainment resorts with state-of-the-art AI-driven security and contactless guest experience services.

Other Key Players (35-45% Combined)

A collection of casino and hospitability groups supplement next-gen gaming experiences, AI-integrated casino security, and overall entertainment based solutions. These include:

The overall market size for Casino Hotel Market was USD 235.5 Billion in 2025.

The Casino Hotel Market is expected to reach USD 369.3 Billion in 2035.

The demand for the casino hotel market will grow due to increasing global tourism, rising disposable incomes, expanding gaming entertainment options, growing popularity of integrated resorts, and advancements in hospitality services, driving the appeal of luxury gaming and leisure experiences.

The top 5 countries which drives the development of Casino Hotel Market are USA, UK, Europe Union, Japan and South Korea.

Slots and Poker Drive Market to command significant share over the assessment period.

Evaluating Social Media and Destination Market Share & Provider Insights

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Competitive Overview of Animal Theme Parks Market Share

Key Players & Market Share in the Spa Resort Industry

Market Leaders & Share in the Winter Adventures Tourism Industry

Analyzing Surrogacy Tourism Market Share & Industry Leaders

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.