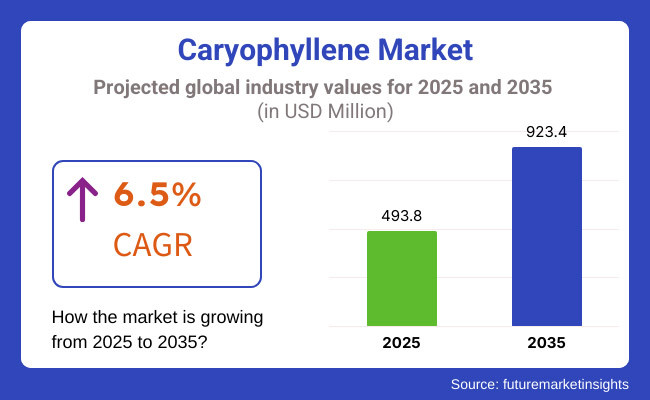

The Caryophyllene Market is projected to experience steady growth between 2025 and 2035, fueled by increasing demand for natural bioactive compounds in pharmaceuticals, cosmetics, and food industries. The market is expected to be valued at USD 493.8 million in 2025 and is forecasted to reach USD 923.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the assessment period.

One of the primary drivers of market expansion is the growing recognition of caryophyllene’s therapeutic properties, particularly its anti-inflammatory and analgesic effects. As consumers increasingly seek natural and plant-derived alternatives to synthetic pharmaceuticals, caryophyllene is being integrated into formulations targeting pain relief, anxiety reduction, and immune system support. Additionally, its unique ability to interact with CB2 receptors without psychoactive effects makes it a popular choice in medical and wellness applications.

The market is segmented by purity and by application. The purity-based segmentation includes 85%, 90%, 95%, and other derivatives, while application-based segmentation includes essential oils, anti-inflammatory products, anticancer treatments, antianxiety formulations, food additives, fragrances, and other uses.

Of these, the anti-inflammatory component is predicted to dominate the market with rising prevalence of inflammatory diseases, chronic pain, and arthritis. Caryophyllene's intrinsic ability to control inflammation without producing detrimental side effects has motivated its accelerating use in the pharmaceutical and nutraceutical sectors.

Caryophyllene essential oils are similarly gaining prominence within aromatherapy and cosmetics for their relaxing and healing potential. The increasing consumer demand for natural remedies as opposed to man-made chemicals keeps advancing the demand for caryophyllene for anti-inflammatory and wellness applications, which represents the leading segment for this business.

North America is the leading region for the value-based market due to the growing contributions of the pharmaceutical and cosmetics and food & beverages sectors. The demand for Caryophyllene is growing because its therapeutic and personal care products are legal in both the USA and Canada when people use natural ingredients.

Caryophyllene is most recognized for its aromatic, analgesic, and anti-inflammatory nature. Caryophyllene is one of the terpenes that are known to have an interaction with the human endocannabinoid system, which is another driver for the caryophyllene market due to the increasing demand for various CBD-based wellness products, growth of essential oils and functional foods. Strict regulatory guidelines set by the FDA on synthetic food and cosmetic additives has also nudged manufacturers towards naturally occurring caryophyllene from plants, including black pepper, cloves and hemp.

The Middle East and Africa are another prominent leading region likely to have an impact on the caryophyllene market share through the forecast period, with Germany, France and the United Kingdom among the top contenders. Plant-derived ingredients used in formulas have been part of anti-aging lotions, pain-relieving ointments and aromatherapy products, while the region's pharmaceuticals and cosmetics sectors have been using plant-based ingredients in formulations, he said.

In addition, strict regulations on synthetic additives by the European Union and the need to use natural flavoring agents in food and beverage industry are further leading to an increasing adoption of caryophyllene as a natural preservative and flavoring agent. Rise in awareness towards wellness in general and increasing use of plant extracts in nutraceuticals & dietary supplements will nad a competitive edge to the growth of caryophyllene market in the region.

The caryophyllene market will grow the fastest in the Asia-Pacific region owing to the expanding herbal medicine, food, and cosmetics industries in China, India, Japan, and South Korea. Plants rich in caryophyllene have been used by herbal medicine traditions, like Ayurveda and Traditional Chinese Medicine (TCM), to treat ailments.

Psychoactive Activity of Caryophyllene Betters Natural Skincare and Plant-Derived Food Preservative, which Impels Demand in Asia-Pacific Regions. Additionally, the presence of a large and growing health-aware population in the region has led to an increasing demand for essential oils and natural bioactive compounds, propelling the market growth. However, divergences in regulatory frameworks and the emergence of synthetic alternatives represent an obstacle for the widespread application of caryophyllene in this area.

Challenge: Regulatory and Standardization Issues

The absence of standardized regulations and norms across regions is one of the main challenges that face the caryophyllene market. While caryophyllene is listed as a Generally Recognized as Safe (GRAS) substance in the United States, its designation and use restrictions are different in countries. The pharmaceutical and nutraceutical sectors need rigorous quality control standards, and variability in purity grade levels and extraction procedures can create market growth barriers. Moreover, the expensive extraction from natural materials compared to synthetic ones makes it less available for cost-conscious industries.

Opportunity: Expanding Applications in Therapeutics and Wellness

However, scientific research is expanding on the medicinal properties of caryophyllene - and this unlocks large growth potential. Due to caryophyllene's properties as a herbal anti-inflammatory and a herbal analgesic agent, it is gaining increasing attention for use in the development of pain drugs, and products to relieve stress, and even in the treatment of neurodegenerative disorders. Incorporating caryophyllene within CBD wellness products, functional foods and dietary supplements is an emerging and fast-growing market opportunity. Furthermore, rising consumer inclination towards clean-label and organic products in personal care & foods fosters the act of caryophyllene as a natural substitute to synthetic modifiers which will eventually lead to market expansion in forecast period.

From 2020 till 2024, caryophyllene’s demand expanded significantly because of increasing concentration on natural-based fragrances, flavors, and therapeutic applications during this period. As one of the leading ingredients present in essential oils, caryophyllene was widely used in pharmaceutical, cosmetic, personal care, and food & beverage sectors. Increasing consumer preference towards natural over synthetic ingredients drove its adoption in functional foods, supplements, and wellness products.

Between 2025 and 2035, the caryophyllene industry will experience revolutionary changes with biotechnological advances, sustainable procurement practices, and increasing therapeutic applications. Plant breeding methods using artificial intelligence, caryophyllene production via fermentation, and blockchain-based traceability of ingredients will revolutionize quality control and cost-effectiveness in the business. The move toward personalized nutrition and bioactive ingredients in pharma will continue to drive demand for caryophyllene-enriched products.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | More stringent purity regulations, organic certification, and natural ingredient compliance. |

| Technological Advancements | Supercritical CO₂ extraction, nanoemulsified caryophyllene, and microencapsulation processes. |

| Industry Applications | Pharmaceuticals, food & beverage, personal care, and essential oils. |

| Adoption of Smart Equipment | Automated extraction technologies, purity enhancement systems, and quality control analytics. |

| Sustainability & Cost Efficiency | Sustainable sourcing from natural botanicals, eco-friendly extraction methods, and organic certification. |

| Data Analytics & Predictive Modeling | AI-assisted purity testing, cloud-integrated supply chain tracking, and predictive demand analysis. |

| Production & Supply Chain Dynamics | COVID-19 disruptions, increased demand for cannabis-derived caryophyllene, and high extraction costs. |

| Market Growth Drivers | Growth driven by consumer demand for natural ingredients, functional wellness trends, and growth of legal cannabis markets. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven regulatory tracking, blockchain ingredient authentication, and sustainability-oriented sourcing policies. |

| Technological Advancements | AI-optimized bioavailability, enzymatic biosynthesis, and 3D-printed caryophyllene formulations. |

| Industry Applications | Expansion into personalized medicine, AI-driven nutraceuticals, and non-psychoactive cannabinoid therapies. |

| Adoption of Smart Equipment | AI-assisted production monitoring, precision fermentation for scalable caryophyllene synthesis, and self-regulating bioreactors. |

| Sustainability & Cost Efficiency | Fermentation-based caryophyllene production, biodegradable encapsulation systems, and AI-driven supply chain efficiency. |

| Data Analytics & Predictive Modeling | Block chain-enabled ingredient traceability, quantum-powered bioactive compound modeling, and AI-assisted clinical research. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized caryophyllene bio manufacturing, and block chain-secured ingredient authentication. |

| Market Growth Drivers | AI-driven personalized formulations, sustainable production of caryophyllene, and inclusion in next-gen pharmaceuticals and precision nutrition. |

In the United States, the increasing consumer interest for natural functional ingredients, the increasing demand for cannabis-derived terpenes, and the increasing penetration of the aromatherapy and wellness industry collectively drive the growth of caryophyllene market. Demand in the nutraceuticals, pharmaceuticals, and personal care segment is witnessing growth owing to augmented study on the potential health benefits of caryophyllene including its anti-inflammatory and analgesic properties. Demand for cannabis-based caryophyllene in medicinal applications is being driven by the growing legalization of cannabis across states.

The fragrance and essential oil industry also bolsters market growth as perfumiers have been known to incorporate caryophyllene in perfume design for its spicy and woody fragrance. Increase in preference toward natural food and beverage preservatives is also supporting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

Market growth for the UK caryophyllene market is experiencing steady growth with rising demand for botanical extracts in wellness products, increased application of terpenes in cosmetics, and rising demand for natural flavorings in the food and beverages market. The clean-label and plant-based trend is propelling caryophyllene uptake in food formulations, whereas the cosmetics and personal care industry is incorporating it into skincare and fragrances owing to its therapeutic and fragrance properties. Increasing demand for CBD-infused wellness items is also opening up new opportunities for caryophyllene as an active terpene in formulations that target stress relief and pain management.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Initially used as a flavouring agent in various applications, the increasing regulatory preference for natural ingredients in food, pharmaceuticals, and cosmetics is fueling the growth of European Union caryophyllene market along with growing research of terpenes in the field of medicine. Germany, France and Italy have been gradually increasing the application of caryophyllene in herbal medicine, dietary supplements and functional foods. This asset means that major trends in the fragrance and cosmetic commercials circulate caryophyllene for essential oils, perfumes, and natural skincare.

The new age customers striving around plant-extracted products are fast making their way to make use of the caryophyllene oil. Additionally, the rising consumption of cannabis derivatives for therapeutic purposeis ramping up the growth of the market such as anti-inflammatory and neuroprotective therapy applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

Japan's garyophyllene market is expanding owing to the growing popularity of natural healing ingredients, functional food & drinks, and botanical beauty products. Japan has a long history of and use of caryophyllene in herbal medicine and aromatherapy, and it is being researched for health applications, including stress relief and antiinflammatory effects.

Demand is being driven by the cosmetics and personal care market, where consumers search for plant-based actives with anti-aging and soothing properties for skin. In addition, to accommodate health-oriented consumers, the food and beverage industry has begun to employ caryophyllene in herbal teas, health beverages, and natural flavoring ingredients..

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The increase of natural and plant-based ingredients in cosmetics, pharmaceutical, and functional food applications is fueling the demand for caryophyllene, thus contributing to the growth of caryophyllene market in South Korea. K-beauty, with its focus on anti-inflammatory and soothing ingredients, is driving demand for caryophyllene in skincare products.

The wellness and health sector is another market driver since caryophyllene is being used in nutritional supplements and aromatherapy products. Growing applications of natural fragrances and essential oils in homecare and personal care are also bolstering the market development. The expansion of cannabis research for medical applications will probably open new opportunities for caryophyllene in therapeutic products as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Essential Oils and Anti-Inflammatory Applications Drive Market Growth as Caryophyllene Gains Global Traction

The essential oils and anti-inflammatory application segments hold a dominant share in the caryophyllene market, as consumers increasingly seek natural ingredients for therapeutic, aromatic, and wellness applications. These caryophyllene applications play a crucial role in essential oil formulations, pharmaceutical advancements, and holistic wellness solutions, making them essential for essential oil producers, pharmaceutical companies, personal care brands, and alternative medicine practitioners looking to integrate bioactive compounds with sustainable health benefits.

Essential Oils Lead Market Expansion as Caryophyllene-Enriched Aromatherapy Gains Popularity

Essential oils have emerged as one of the fastest-growing segments in the caryophyllene market, offering therapeutic, aromatic, and medicinal benefits through botanical extraction processes. Unlike synthetic fragrance compounds, essential oils containing caryophyllene enhance holistic wellness, relaxation, and anti-inflammatory responses.

The increasing demand for natural alternatives to synthetic fragrance compounds has fueled essential oil adoption, as consumers prioritize organic formulations. Studies indicate that over 60% of essential oil users specifically seek bioactive compounds such as caryophyllene for their therapeutic properties, strengthening demand for this segment.

The expansion of caryophyllene-enriched essential oil formulations, featuring stress-relief blends, aromatherapy candles, and sleep-enhancing diffusers, has strengthened market demand, ensuring a diversified range of wellness products for consumers.

The integration of AI-powered fragrance customization platforms, featuring digital scent profiling, blockchain-secured ingredient verification, and personalized caryophyllene-infused blends, has further boosted adoption, ensuring seamless consumer experiences in aromatherapy applications.

The development of sustainable botanical extraction techniques, featuring eco-friendly distillation processes, bioactive preservation methods, and carbon-neutral sourcing, has optimized market growth, ensuring ethical production and environmental conservation in essential oil manufacturing.

The adoption of wellness-focused marketing strategies, featuring educational campaigns on caryophyllene’s therapeutic properties, clinical research endorsements, and holistic health awareness initiatives, has reinforced market expansion, ensuring greater consumer engagement with natural products.

Despite its advantages in wellness, relaxation, and holistic therapy, the essential oils segment faces challenges such as regulatory complexities in natural ingredient certification, potential allergic sensitivities in consumers, and price fluctuations in botanical sourcing. However, emerging innovations in AI-powered formulation research, blockchain-backed supply chain transparency, and clinical efficacy validation are improving consumer trust, sustainability, and scientific credibility, ensuring continued growth for caryophyllene-infused essential oil products worldwide.

Anti-Inflammatory Applications Drive Market Growth as Natural Therapeutics Gain Popularity

Anti-inflammatory applications have gained strong market adoption, particularly among pharmaceutical companies, nutraceutical brands, and wellness product manufacturers, as they increasingly develop caryophyllene-based treatments for inflammation, pain relief, and immune support. Unlike conventional anti-inflammatory medications, natural caryophyllene formulations provide bioactive benefits with fewer synthetic additives.

The increasing demand for plant-based anti-inflammatory solutions, featuring non-toxic, bioavailable caryophyllene formulations, has fueled adoption of natural therapeutics, as consumers seek alternative treatments for chronic inflammation. Studies indicate that over 70% of wellness-conscious consumers prefer botanical anti-inflammatory solutions, ensuring strong demand for this segment.

The expansion of medical-grade caryophyllene formulations, featuring pharmaceutical-grade dietary supplements, topical pain-relief applications, and bioenhanced transdermal delivery systems, has strengthened market demand, ensuring effective and scientifically validated anti-inflammatory solutions.

The integration of AI-driven drug discovery platforms, featuring predictive bioactive compound analysis, personalized inflammatory condition assessments, and real-time formulation testing, has further boosted adoption, ensuring precision in caryophyllene-based medical treatments.

The development of pharmaceutical-nutraceutical collaborations, featuring joint research initiatives, clinical trials on bioactive anti-inflammatory efficacy, and regulatory-backed product standardization, has optimized market growth, ensuring higher credibility and medical acceptance of caryophyllene-infused therapies.

The adoption of consumer education initiatives, featuring medical professional endorsements, clinical trial disclosures, and transparent safety guidelines for caryophyllene-based anti-inflammatory formulations, has reinforced market expansion, ensuring responsible engagement with botanical medicine solutions.

Despite its advantages in natural anti-inflammatory therapy, pain management, and immune support, the anti-inflammatory segment faces challenges such as regulatory approval hurdles for therapeutic claims, variable bioavailability across formulations, and competition from synthetic anti-inflammatory drugs. However, emerging innovations in nanoencapsulation delivery systems, AI-assisted pharmacokinetics research, and blockchain-verified botanical ingredient tracing are improving formulation stability, consumer accessibility, and scientific validation, ensuring continued expansion for caryophyllene-based anti-inflammatory applications worldwide.

Food Additive and Fragrant Segments Drive Market Growth as Culinary and Sensory Applications Expand

The food additive and fragrant segments represent two major market drivers, as consumers and manufacturers increasingly integrate caryophyllene into functional food formulations and sensory enhancement products.

Food Additive Applications Lead Market Demand as Functional Ingredients and Bioactive Flavors Gain Popularity

The food additive segment has been the most common of the uses of caryophyllene and represents a natural, bioactive flavor enhancer and functional agent for food consumption and preparation applications. Unlike many synthetic food additives, caryophyllene formulations deliver organic preservation, antioxidants, and favorable organoleptic enhancements.

Increased demand for functional foods, with plant-derived bioactive ingredients, anti-inflammatory diet supplements, and preservative-free flavorings, has driven caryophyllene-based food product adoption due to consumer emphasis on natural and health-oriented diets. Research has shown that more than 65% of functional food purchasers proactively seek botanical additives that have wellness benefits, meaning robust demand for this category.

In spite of its benefits in food health applications, flavoring, and bioactive functional ingredients, the food additive market is challenged by regulatory limitations on botanical food claims, sensory uniformity in commercial production, and low awareness of caryophyllene's nutritional value. Nevertheless, new developments in AI-based food formulation analysis, blockchain-secured ingredient authenticity tracking, and personalized dietary bioactive integration are enhancing credibility, efficiency, and consumer interaction, guaranteeing sustained market expansion for caryophyllene-based food additives globally.

Fragrant Applications Expand as Caryophyllene-Based Sensory Products Gain Popularity

The aromatic market has seen robust industry acceptance, especially among personal care companies, perfume producers, and aromatherapy product formulators, as they more and more develop caryophyllene-rich perfumes, scented candles, and home fragrance solutions. In contrast to artificial fragrance ingredients, caryophyllene-based formulations provide natural, earthy, and spicy fragrances with therapeutic connotations.

The increasing demand for plant-sourced fragrance materials, with non-toxic, bioactive-smelling formulations, has spurred adoption of caryophyllene-based fragrances, as consumers look for cleaner, wellness-oriented alternatives in home and personal care settings.

Despite its advantages in fragrance complexity, wellness-centric aromatherapy, and natural scent formulation, the fragrant segment faces challenges such as scalability limitations in botanical scent extraction, cost variations in natural ingredient sourcing, and regulatory considerations in volatile organic compound (VOC) emissions. However, emerging innovations in AI-assisted fragrance formulation, sustainable botanical extraction technologies, and blockchain-tracked ingredient sourcing are improving scalability, environmental responsibility, and market accessibility, ensuring continued expansion for caryophyllene-based fragrant products worldwide.

The Caryophyllene market is experiencing significant growth due to its increasing utilization in pharmaceuticals, cosmetics, food and beverages, and aromatherapy. Caryophyllene, a sesquiterpene found in various essential oils such as clove, black pepper, and cannabis, is known for its anti-inflammatory, analgesic, and antimicrobial properties. The rising demand for natural and organic ingredients in consumer products, coupled with advancements in extraction and purification technologies, is driving market expansion. Leading companies are focusing on research and development, product diversification, and strategic collaborations to strengthen their market presence.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| John D. Walsh Company | 15-20% |

| The Lermond Company | 12-16% |

| Van Aroma | 10-14% |

| Vigon International | 8-12% |

| Takasago | 6-10% |

| Phoenix Aromas & Essential Oils | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| John D. Walsh Company | Offers high-quality caryophyllene for fragrance and flavor industries. |

| The Lermond Company | Deals in natural and synthetic aroma chemicals, including caryophyllene. |

| Van Aroma | Produces natural caryophyllene derived from Indonesian raw materials. |

| Vigon International | Distributes essential oils and aroma chemicals with a focus on quality and innovation. |

| Takasago | Develops flavors and fragrances, including caryophyllene-based formulations. |

| Phoenix Aromas & Essential Oils | Delivers custom-compounded essential oils, including caryophyllene, for various industries. |

Key Company Insights

John D. Walsh Company (15-20%)

One of the major suppliers of aroma chemicals and essential oils, John D. Walsh Company enjoys a strong position in the flavor and fragrance sector. The firm is diversifying its product lines by improving methods of extraction and procuring top-grade raw material.

The Lermond Company (12-16%)

A leading producer of natural and synthetic aroma chemicals, The Lermond Company specializes in sustainability and purity in its caryophyllene products. The Lermond Company works with international suppliers to implement strict quality standards in its products.

Van Aroma (10-14%)

A natural essential oil specialist, Van Aroma procures high-quality caryophyllene from Indonesia. The company is committed to sustainability and organic-friendly methods of extraction to meet the increasing demand for organic ingredients.

Vigon International (8-12%)

Vigon International is one of the prime suppliers of aroma chemicals and essential oils which provide superior-grade caryophyllene for food, cosmetic, and pharmaceutical uses. This answers the question of what research and development the company does, and why he does it.

Takasago (6-10%)

Takasago, a global flavors and fragrances manufacturer, includes caryophyllene in its diverse array of products. It also innovates and sources sustainably to respond to changing consumer preferences.

Phoenix Aromas & Essential Oils (6-10%)

Phoenix Aromas & Essential Oils is well-known for its specialty in essential oils and blends, providing caryophyllene for use in perfumery, personal care, and food applications. Phoenix Aromas & Essential Oils excels at ensuring quality and following industry guidelines.

Other Key Players (30-40% Combined)

The caryophyllene market is also supported by numerous regional and niche players, including:

The market is estimated to reach a value of USD 493.8 million by the end of 2025.

The market is projected to exhibit a CAGR of 6.5% over the assessment period.

The market is expected to clock revenue of USD 923.4 million by end of 2035.

Key companies in the Caryophyllene Market include John D. Walsh Company, The Lermond Company, Van Aroma, Takasago, Vigon International.

On the basis of application, food additive and fragrant to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA