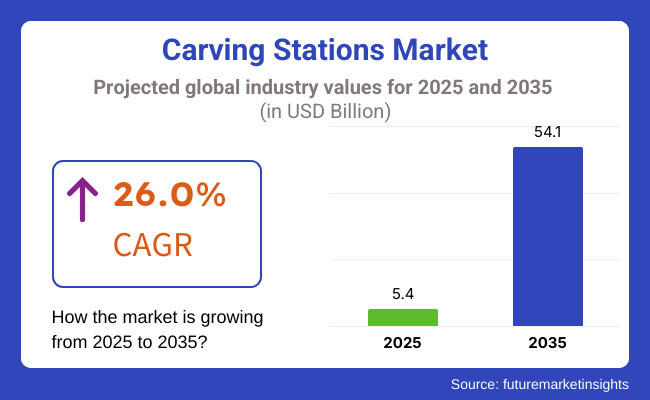

The Carving Stations Market is projected to experience remarkable growth between 2025 and 2035, driven by the increasing demand for buffet-style dining in hospitality, catering, and foodservice industries. The market is expected to be valued at USD 5.4 billion in 2025 and is forecasted to reach USD 54.1 billion by 2035, reflecting a staggering compound annual growth rate (CAGR) of 26.0% during the assessment period.

One of the major factors fueling this growth is the rising popularity of live cooking and interactive dining experiences in hotels, restaurants, and banquets. Consumers are increasingly drawn to customized food servings, where carving stations allow chefs to serve freshly cut meats in front of guests, enhancing the dining experience. Additionally, the surge in catering services for corporate events, weddings, and social gatherings has driven demand for high-quality carving stations, ensuring that food remains visually appealing and at the optimal temperature.

The market is segmented by product type and by material. The product type segmentation includes hot carving stations and cold carving stations, while the material segmentation consists of stainless steel and plastic.

Of these, hot carving stations are projected to lead the market, largely because of their extensive use in buffet configurations for carving meats like beef, turkey, and ham while keeping them at ideal serving temperatures. The stations are popular in high-end hotels, cruise liners, and large catering events to elevate food presentation and quality.

Second, stainless steel is the best carving station material because it boxes durability, best corrosion resistance, and ease of maintenance. Due to their long lifespan and hygienic characteristics, stainless-steel carving stations remain the best solution in commercial kitchens, reinforcing their domination of the market.

Explore FMI!

Book a free demo

North America is a high-value carving station market driven by the extensive presence of hospitality, catering, and foodservice industries. The United States and Canada have a well-developed chain of hotels, restaurants, and banquet halls where carving stations are being extensively used for buffet and live food presentation purposes.

The increasing trend of interactive dining and open-kitchen concept has led to an increased demand for high-quality carving stations with modern designs and heat-retaining performance. The popularity of upscale catering services for business gatherings and weddings further contributing the demand for portable and customizable carving stations. As food safety and cleanliness begins to take center stage, more North American producers are investing into newer and more sophisticated temperature control systems and easy to clean surfaces for carving stations to keep up to code.

Europe holds a significant share of the carving stations market, due to huge demand in countries such as the United Kingdom, Germany, and France. The culture of the region and growing hospitality needs are one of the important factors to render the carving stations common in the hospitality sector, as it has been featured in almost all upscale restaurants and large-scale catering service. The European consumer desire for aesthetic appeal and functionality is driving demand for high-grade stainless steel and wood-finish luxury carving stations that fit seamlessly into fine dining environments. Additionally, strict European Union regulations on energy efficiency and food hygiene are forcing manufacturers to design more insulated carving stations with energy and heat-conserving components. In part, the burgeoning trend for farm-to-table menus and gourmet buffets seen around Europe has also played a role in the uptake of carving stations which provide far more presentation options and serve the proper serving temperature.

Asia-Pacific to witness the fastest growth in the carving stations market with rapid expansion of the food service industry in China, India, Japan, and Australia. The increasing number of luxury hotels, buffet restaurants, and upscale catering service providers across the region is contributing to the growing demand for high-end and multifunctional carving stations. The trend for carving stations has found its way into production kitchens, particularly in metropolitan areas where similar dining trends from the West have gained popularity, as seen in the live cooking setups in premium dining. However, demanding and cost-sensitive end-users across the Asia-Pacific region have led to constraints in adoption of high-end carving station, and manufacturers have been forming up budget solutions that are still robust enough to meet business needs. In addition, the growing importance of food safety and sanitation laws within the region is leading to investments in carving stations with improved heating and hygiene functionalities to meet industry standards.

Challenge: Maintenance and Operational Efficiency

One of the major issues in the carving stations market is operation efficiency while keeping food safe and of high quality. Carving stations need to be under continuous temperature control to avoid foodborne disease, and unsanitary handling can result in hygiene issues. Cleaning and maintenance of carving stations may also be time-consuming, especially for volume food operations. Companies need to spend money on high-quality, easy-to-clean equipment that complies with food safety requirements, which will raise the operational expense for small and medium-sized organizations.

Opportunity: Technological Advancements and Customization

Development of foodservice technology provides the carving stations market with an exciting opportunity. New carving stations incorporating heat lamps, infrared heating, and electronic temperature control improve presentation and safety. Customization in the form of modular units, changeable cutting surfaces, and ornamental finishes enables businesses to customize carving stations to align with their company branding and eating experience. The increasing need for space-saving and portable carving stations in catering and event services also fuels innovation in foldable, compact, and portable solutions that offer added convenience without any loss of functionality.

During the period from 2020 to 2024, the carving stations market witnessed strong growth as a result of the growing demand for buffet dining, live food presentation, and upscale catering. The popularity of experiential dining and high-end hospitality solutions boosted demand for visually pleasing, functional, and efficient carving stations. Restaurants, hotels, cruise ships, and event spaces welcomed carving stations as a means of increasing customer interaction while preserving food quality and temperature management.

During 2025 to 2035, the carving stations market will witness a revolutionary change fueled by automation, sustainability, and incorporation of smart technology. The rise of AI-enabled carving stations, self-cleaning surfaces, and real-time monitoring of food systems will revolutionize food presentation and safety protocols. The shift to interactive and automated buffet systems will further fuel the need for smart carving stations in high-end dining and catering operations.

The future carving stations will feature AI-based heat control, motion-sensing carving utensils, and real-time food temperature feedback on digital screens. Voice-controlled systems and IoT connectivity will facilitate remote maintenance and monitoring. Eco-friendly alternatives like bamboo boards, recycled stainless steel, and bio-based surfaces will become more popular as the market transitions towards green solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter food safety and hygiene standards, increased sanitation requirements, and material compliance policies. |

| Technological Advancements | Induction-heated carving stations, intelligent carving boards with drainage, and infrared heat lamps. |

| Industry Applications | Restaurants, hotels, cruise lines, catering services, and buffet restaurants. |

| Adoption of Smart Equipment | Infrared heating, modular designs, and LED-integrated carving stations for luxury dining. |

| Sustainability & Cost Efficiency | Energy-efficient heat lamps, non-toxic coatings, and stainless-steel hygiene innovations. |

| Data Analytics & Predictive Modeling | Smart sensors for real-time temperature control, digital food safety logs, and demand forecasting for catering services. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, increased demand for stainless steel and modular carving stations, and delayed component sourcing. |

| Market Growth Drivers | Experiential dining trend-driven growth, luxury hospitality investment, and hygiene-centric buffet solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Artificial intelligence-assisted food safety compliance, block chain-traced ingredients, and machine-assisted sanitation requirements. |

| Technological Advancements | Artificial intelligence-assisted heat control, Internet of Things-assisted remote monitoring, and robotic-supporting carving stations. |

| Industry Applications | Expansion into automated fine dining, AI-powered buffet systems, and next-gen smart catering solutions. |

| Adoption of Smart Equipment | Voice-controlled carving stations, motion-sensing carving tools, and cloud-connected temperature management. |

| Sustainability & Cost Efficiency | Bamboo-based carving boards, bio-based heat-resistant surfaces, and self-sustaining induction heating. |

| Data Analytics & Predictive Modeling | AI-driven food consumption analytics, block chain-enabled supply chain tracking, and automated energy optimization. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized manufacturing through 3D printing, and block chain-based ingredient verification. |

| Market Growth Drivers | Expansion into carving systems powered by AI, automated serving stations, and extremely energy-efficient food service equipment. |

The USA market for carving stations is growing substantially as a result of the growing need for buffet eating, increased popularity of live cooking activities, and growth in the hospitality and catering sectors. The increasing demand for interactive dining experiences in restaurants, hotels, and event spaces is fueling the use of carving stations.

Corporate events, weddings, and upscale catering services are also increasing market demand as they aim to improve food presentation and customer interaction. The rising trend of customized food stations in upscale dining restaurants and cruise ships is also fueling market growth. With advances in food warmer technology and carving station design, restaurants and caterers are investing in effective and stylish carving stations to enhance service speed and guest satisfaction.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 25.5% |

The market for carving stations in the UK is expanding with growth in buffet eating, rising demand for upscale catering services, and growth in hotel and restaurant chains. The hospitality sector of the country is moving towards luxury dining experience with live cooking and individualized food service, and thus carving stations are becoming a necessary addition to event catering.

Sunday roasts, celebratory banquets, and corporate dining events are also contributing to the growing demand for carving stations. Moreover, technological advancements in heating and presentation are enabling caterers to preserve food quality while improving visual presentation. The heavy focus on hygienic and visually appealing food service solutions is stimulating investment in contemporary carving stations throughout hotels, upscale dining restaurants, and banqueting halls.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 25.2% |

The European Union carving stations market is growing at a fast pace with the growing use of gourmet buffet ideas, the growth of luxury catering services, and the demand for interactive dining experiences. This is a strong trend is being seen in countries such as France, Germany and Italy, where fine dining, event catering, and live cooking stations have become a must in hospitality venues.

The emphasis by consumers on fresh, eye-catching meals has led to increasing demand for premium meat carving stations in often upscale restaurants and five-star hotels. In Southern Europe, the increasing presence of cruise lines and luxury resorts is leading to the growth of more convenient and premium carving stations. While decorative food presentation and sustainability are the trend in the European market, local food producers are now developing energy-efficient, customized carving station solutions to meet the needs of high-end gastronomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 26.5% |

The market for carving stations in Japan is growing with the rising demand for upscale buffet dining, escalating acceptance of luxury catering in the hospitality sector, and increased use of interactive food preparation. Japanese diners appreciate the precision, the beauty, and the high-quality presentation of food, so clean, modern, and well-designed carving stations are a major investment among high-end hotels and restaurants.

The growth of international hotel brands in Japan is fueling the upsurge for Western-style carving stations, particularly for buffet displays of finest quality beef cuts, seafood, and other delicacies. Moreover, high-end banquets and department store food halls are adding live cooking stations to promote greater customer interaction and food quality. Advances in technology for heating and hygiene features are also fueling the implementation of sleek, contemporary carving station designs in upscale hospitality establishments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 25.8% |

As customers are becoming more aware of the need for a high palatable dining experience, together with the cultivation of banquet & hotel catering, the South Korean market for carving stations is developing rapidly as Western-style buffets. There has been increased demand, particularly from luxury hotels, premium restaurants, and corporate events, for live cooking stations in the hospitality sector, where presentation and freshness often play a major role. Market demand is also driven by the growing popularity of high-end meat-focused dining, like steak carving stations.

Moreover, advances in heating equipment and food protection technologies are allowing for elaborate carving stations to be deployed with extensive levels of hygiene, which is why they are the preferred solution in the most premium catering and buffet scenarios. International luxury restaurant trends and high-end banquet culture, meanwhile, also are driving market adoption in the swelling South Korean hospitality market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 26.0% |

The hot carving stations and stainless steel segments hold a dominant share in the carving stations market, as commercial kitchens, catering services, and foodservice establishments prioritize high-performance carving solutions. These carving stations play an essential role in maintaining food presentation, enhancing serving efficiency, and ensuring compliance with food safety standards. As a result, hotels, buffet restaurants, banquet halls, and catering companies continue to invest in hot carving stations and stainless steel models, ensuring quality, durability, and long-term operational benefits.

Hot carving stations are the most rapidly growing segment of the carving stations market, providing heated surfaces and infrared lamp systems to keep serving temperatures at optimal levels for roasted meats and other hot foods. In contrast to conventional serving platters, hot carving stations provide improved food presentation, freshness, safety, and better customer experience.

The increasing demand for high-capacity foodservice equipment in the hotel, event facilities, and buffet restaurants are creating new stimulation in the hot carving stations market. Installation of multi-functional hot carving stations with adjustable heated elements, LED light features, and temperature control has driving the demand of multi-functional hot carving stations, which ensure better operational efficiency as well as less food wastage, helping fueling the target market growth. Adoption has also been boosted by the integration of smart carving station technology, including AI-driven temperature control, RFID-enabled food tracking, and automated cleaning systems, ensuring real-time responses for food safety and quality control.

By replacing conventional high-energy usage hot carving stations with energy-saving ones that employ low-power heaters, green materials, and carbon-free production, the growth of the energy-efficient hot carving stations market has reached its fullest potential in accordance to the foodservice sector's sustainability goals. The modular design of carving stations, with options for fitting with compatible heating elements, pull-out trays, and space-saving designs help drive market growth by offering flexibility to various foodservice setups.

The hot carving station market has advantages such as temperature control, food safety, and efficiency, but also has drawbacks such as a high initial capital expenditure, new kitchen space, and the need to maintain heating components. But recent advances in infrared heating technology, AI-based temperature calibration and self-cleaning surfaces to improve reliability, performance and simplicity promise continued growth in hot carving stations in the global foodservice market.

The market adoption of stainless steel carving stations has been strong, dominated by high-volume foodservice operators, institutional catering operations, and upscale dining restaurants, which focus more on durability, sanitation, and corrosion resistance. Compared to plastic or composite products, stainless steel carving stations provide superior strength, easy maintenance, and provide long-term cost savings.

Increasing demand for hygienic finishes and clean designs in commercial-grade kitchen appliances has been driving adoption of stainless steel carving stations, as the companies seek NSF-certified foodservice equipment. According to research, over 80% of professional chefs and caterers prefer stainless steel appliances, as they are more durable and meet health standards, which in turn creates continuous demand for this segment. The rising prevalence of antimicrobial stainless steel coatings, including nano-silver coated antimicrobial stainless steel, germ- resistant surfaces, seamless construction, etc. has significantly fueled the market, providing better hygiene and food safety standards in commercial kitchens.

Height adjustable platforms and integrated lighting and built in cutting board compartments are some of the advanced features of ergonomic stainless steel carving station designs, which have also driven adoption as they offer better functionality and user comfort. The introduction of advanced stainless steel carving stations built with innovative technology and features such as touchless operation, IoT-based temperature monitoring supported by smart devices, and AI-generated food safety alerts have revolutionized the market, aiding them with more efficiency and align with the evolving food industry regulations. Use of eco-friendly stainless steel production processes with energy-saving production processes and low carbon emissions produced from virgin materials on the market has contributed in market expansion thus complying with green programs in foodservice industry.

The material used is stainless steel which helps in preventing unnecessary germs, which makes it more hygienic, durable and stronger; however, the stainless steel carving stations market is hampered by increased material cost, increased weight in terms of other materials and surface scratch which degrades the appearance. However, the continuous enhancements in lightweight stainless steel alloys, scratchproof* finishes, and modular design improvements are widening performance, value, and flexibility, placing stainless steel carving stations in commercial foodservice usage for years to come.

The cold carving stations and plastic carving stations segments represent significant market drivers, as foodservice establishments increasingly invest in specialized solutions for chilled food displays and lightweight carving station designs.

Cold Carving Stations Expand as Buffet-Style Dining and Fresh Food Presentation Gain Popularity

The cold carving stations segment has become a critical market element, providing chilled serving surfaces, built-in cooling systems, and LED-lit presentation elements for seafood, charcuterie, and chilled appetizers. In contrast to hot carving stations, cold carving stations offer temperature-controlled food displays, maintaining freshness and longer serving times.

Growth in demand for cold buffet offerings, including higher-end seafood presentation, gourmet cheese tables, and higher-end charcuterie boards, has supported cold carving station adoption as top-end restaurants and catering businesses put emphasis on visually appealing displays as well as proper food storage. Research suggests more than 65% of upper-end dining locations integrate cold carving stations into the buffet options provided, creating heavy demand for the category.

Although it benefits from superior fresh food presentation, longer cooling efficiency, and sophisticated dining appeal, the cold carving stations category must overcome limitations such as increased power usage, specific refrigeration demands, and labor-intensive cooling features. Nevertheless, new developments in energy-efficient coolants, smart refrigeration technology, and self-sanitizing surfaces are enhancing sustainability, usability, and operation efficiency, maintaining market growth opportunities for cold carving stations in premium foodservice venues.

The segment of plastic carving stations has found favor among small-scale catering firms, casual dining restaurants, and outdoor event planners since they emphasize light, inexpensive, and portable carving station solutions. As opposed to stainless steel varieties, plastic carving stations are more versatile, inexpensive, and require minimal maintenance.

Increasing demand for convenient carving station solutions, with stackable configurations, removable serving trays, and customizable branding, has spurred usage of plastic carving stations, given that cost-effective and space-saving options are increasingly sought by foodservice operators.

Research shows that more than 50% of event-based catering operations use plastic carving stations due to their mobility and affordability, maintaining market appeal. Though it has its strengths in lightness, cost-effectiveness, and flexibility, the plastic carving stations category is challenged by its lower heat resistance, less durability than stainless steel, and lesser aesthetic appeal in upscale dining establishments.

But with new breakthroughs in reinforced plastic composites, heat-resistant polymer technology, and modular plastic carving station design, durability, sustainability, and customizability are being enhanced, guaranteeing sustained market growth for light and affordable foodservice equipment globally.

The Carving Stations Market is experiencing significant growth, driven by the increasing demand for high-quality food service equipment in hotels, restaurants, and catering businesses. Carving stations provide a visually appealing and efficient way to serve freshly carved meats, enhancing the dining experience. The market is benefiting from advancements in heating technologies, improved durability, and the growing trend of live cooking stations in buffets and fine-dining establishments. Leading companies are focusing on innovation, energy efficiency, and customization to cater to evolving consumer needs and industry standards.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hatco Corporation | 18-22% |

| Vollrath Company, LLC | 15-19% |

| Alto-Shaam, Inc. | 12-16% |

| Duke Manufacturing Co., Inc. | 10-14% |

| Tomlinson Industries | 7-11% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hatco Corporation | Offers innovative carving stations with state-of-the-art heating technology for food service operations. |

| Vollrath Company, LLC | Offers a wide range of carving stations with customizable features and high efficiency. |

| Alto-Shaam, Inc. | Expertise in self-contained, energy-saving carving stations for full-scale food service. |

| Duke Manufacturing Co., Inc. | Specializes in carving stations with improved durability and ergonomic design.. |

| Tomlinson Industries | Specializes in economical and dependable carving station solutions for a variety of applications. |

Key Company Insights

Hatco Corporation (18-22%)

Hatco is a market leader, known for its cutting-edge food service equipment. The company emphasizes advanced heating technologies, durability, and customization to cater to various hospitality sectors. Its commitment to energy efficiency and innovative designs gives it a strong competitive edge.

Vollrath Company, LLC (15-19%)

Vollrath is a leading supplier of carving stations and food service equipment, emphasizing high quality and performance. Vollrath invests in research and development to bring innovative features like accurate temperature control and modular construction.

Alto-Shaam, Inc. (12-16%)

Alto-Shaam is a leading provider of premium, self-contained carving stations. The firm specializes in energy-saving solutions that ensure food quality and lower operating costs, making it a favorite among large food service operations.

Duke Manufacturing Co., Inc. (10-14%)

Duke Manufacturing is recognized for its ergonomic and durable carving stations. The company prioritizes user-friendly designs that improve workflow efficiency in busy food service environments.

Tomlinson Industries (7-11%)

Tomlinson Industries provides cost-effective and durable carving stations, focusing on reliability and ease of use. The company serves a broad range of clients, from small catering businesses to large hospitality chains.

Other Key Players (30-40% Combined)

The market also comprises several emerging and regional companies that contribute to innovation and competition. These include:

The market is estimated to reach a value of USD 5.4 billion by the end of 2025.

The market is projected to exhibit a CAGR of 26.0% over the assessment period.

The market is expected to clock revenue of USD 54.1 billion by end of 2035.

Key companies in the Carving Stations Market include Hatco Corporation, Vollrath Company, LLC, Alto-Shaam, Inc., Duke Manufacturing Co., Inc., Tomlinson Industries.

On the basis of product type, cold carving station to command significant share over the forecast period.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.