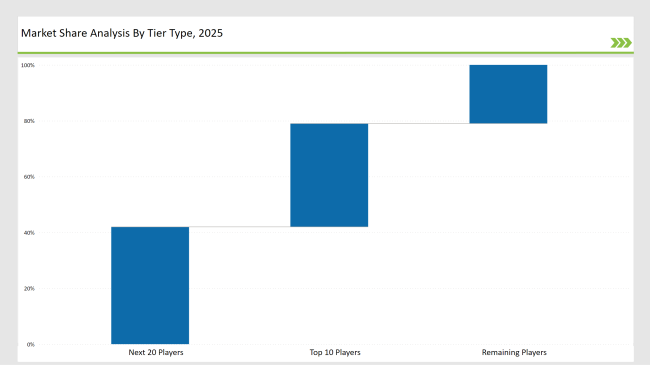

The global carton bottle market is highly competitive, with players categorized into Tier 1, Tier 2, and Tier 3 according to market presence and strategic positioning. Tier 1 players account for 37% of the market, mainly Tetra Pak, SIG Combibloc, and Elopak, and dominate the space by using cutting-edge packaging technology, strong sustainability initiatives, and extensive distribution networks to meet increasing demand for environmentally friendly liquid packaging.

Tier 2 players, including Nippon Paper Industries, Greatview Aseptic, and BillerudKorsnäs, account for around 42% of the market. They are focusing on cost-effective, customizable carton bottle solutions tailored for dairy, juice, and plant-based beverages. These players strengthen their market presence by developing bio-based packaging materials and expanding regional manufacturing capabilities.

Tier 3 players are regional manufacturers and niche startups. They hold 21% of the market, which is highly specialized in unique carton bottle innovations, lightweight packaging, and sustainable material integration. Their agility enables them to respond quickly to changing consumer preferences and environmental regulations.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Tetra Pak, SIG Combibloc, Elopak) | 22% |

| Rest of Top 5 (Nippon Paper Industries, Greatview Aseptic) | 10% |

| Next 5 of Top 10 (BillerudKorsnäs, Uflex, Adam Pack, Stora Enso, Evergreen Packaging) | 8% |

The carton bottle market serves industries such as:

Vendors offer specialized products to meet evolving industry needs:

Manufacturers integrate automation, AI-driven quality control, and material innovation to enhance efficiency while sustainability remains a key driver for growth in the carton bottle market.

This section identifies key innovators and growth drivers for the carton bottle market in 2025. Companies launched high-performance recyclable carton bottles to gain market share and reduce environmental impact. Manufacturers invested in AI-driven quality control to improve efficiency. Firms expanded production capacity as demand for sustainable liquid packaging increased. Businesses developed smart labeling technologies to enhance traceability and branding.

Year on Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Tetra Pak, SIG Combibloc, Elopak |

| Tier 2 | Nippon Paper Industries, Greatview Aseptic, BillerudKorsnäs |

| Tier 3 | Uflex, Adam Pack, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Tetra Pak | In January 2024, launched high-recyclability carton bottles. |

| SIG Combibloc | In March 2024, introduced AI-powered quality control for carton production. |

| Elopak | In June 2024, expanded production capacity for bio-based carton solutions. |

| Nippon Paper Industries | In February 2024, developed high-barrier coated carton bottles. |

| Greatview Aseptic | In July 2024, launched plant-based polymer carton bottles. |

| BillerudKorsnäs | In April 2024, focused on durable bio-based carton bottles. |

| Uflex | In August 2024, expanded sustainable carton bottle production in Asia. |

The industry transforms by AI-enabled production monitoring, green materials and bespoke barrier functionalities. Manufacturers find processes that deliver optimal energy-efficient performances with reduction of emissions to environment.

Investment into bio-based coatings and single material carton bottles increases because the recyclable aspects improve them. Engineers try for lightweight strong carton bottle packages for high convenience to end customers. Enhanced digital branding potential enhances ecofriendly packaging. It would further necessitate investments for newer carton bottle technologies.

Tetra Pak, SIG Combibloc, Elopak, Nippon Paper Industries, and Greatview Aseptic lead the market.

Tier-1 players collectively hold about 37% of the global market.

AI-based quality control, sustainable materials, and high-barrier solutions drive innovation.

Tier-3 companies contribute around 21% of the global market.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.