The cartilage repair market is projected to exhibit considerable growth, rising from a valuation of USD 1.6 billion in 2025 to USD 3 billion by 2035. This market is expected to progress at a CAGR of 6.5% during the forecast period from 2025 to 2035. The growth of the market can be attributed to the increasing prevalence of sports injuries, osteoarthritis, and degenerative joint diseases, along with a growing elderly population worldwide.

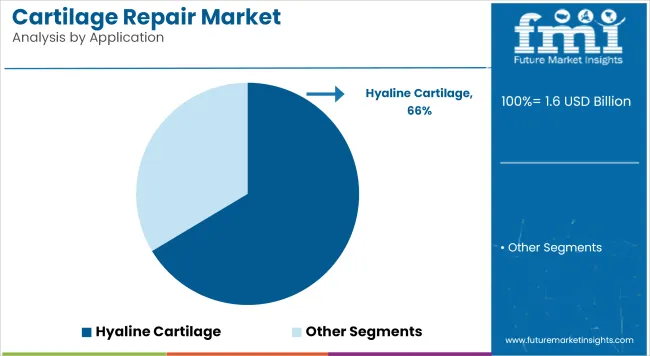

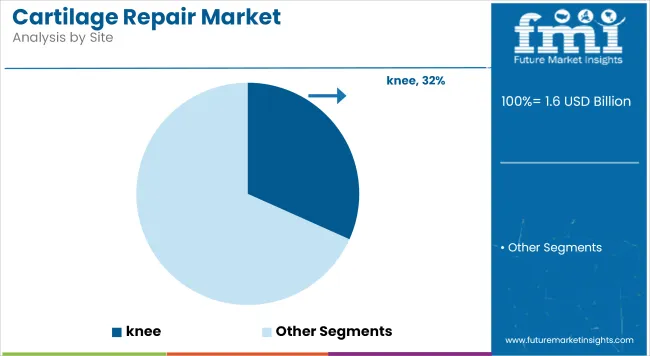

The hyaline cartilage application segment is anticipated to account for a dominant market share of 66.4% in 2025, reflecting the widespread use of this cartilage type in various orthopedic procedures. Additionally, the knee site segment will lead with a projected market share of 31.7% in 2025, driven by the high incidence of knee joint injuries and degenerative conditions necessitating repair solutions.

The adoption of innovative treatment options such as autologous chondrocyte implantation (ACI), matrix-induced autologous chondrocyte implantation (MACI), and osteochondral autograft transplantation is supporting the market's expansion. Increasing preference for minimally invasive and regenerative techniques is further boosting the demand for advanced cartilage repair products

. Hospitals remain the largest end-users owing to their comprehensive surgical capabilities, availability of skilled orthopedic professionals, and advanced imaging and diagnostic technologies that facilitate precise treatment planning and execution.

A notable development influencing market dynamics occurred in August 2024. According to an official press release published by Vericel Corporation on August 26, 2024, the USA Food and Drug Administration approved a supplemental Biologics License Application expanding MACI (autologous cultured chondrocytes on porcine collagen membrane) to include arthroscopic delivery (MACI Arthro) for repairing knee cartilage defects up to 4 cm².

Vericel further confirmed in its Q3 2024 financial results that MACI Arthro became commercially available during the third quarter of 2024, offering a less invasive and more efficient treatment option for patients. This regulatory milestone is expected to improve patient outcomes and broaden the applicability of cartilage repair procedures, marking a critical step forward in regenerative orthopedics.

The competitive landscape of the cartilage repair market is witnessing active product development, technological upgrades, and strategic partnerships among leading players such as Vericel Corporation, Zimmer Biomet, Smith & Nephew, and Stryker. The industry's future growth will be influenced by the increasing investments in R&D, favorable reimbursement policies across developed regions, and a surge in demand for personalized and regenerative medicine approaches.

Attributes Table

| Attribute | Details |

|---|---|

| Market Size (2025E) | USD 1.6 billion |

| Market Size (2035F) | USD 3 billion |

| CAGR (2025 to 2035) | 6.5% |

The global Cartilage Repair market's compound annual growth rate (CAGR) for the first half of 2025 and 2035 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 7.3%, followed by a slightly lower growth rate of 7.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 7.3% (2024 to 2034) |

| H2 | 7.0% (2024 to 2034) |

| H1 | 6.5% (2025 to 2035) |

| H2 | 6.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.5% in the first half and remain relatively moderate at 6.1% in the second half. In the first half (H1) the industry witnessed a decrease of 80 BPS while in the second half (H2), the industry witnessed a decrease of 90 BPS.

The cartilage repair market is anticipated to witness significant investments across hyaline cartilage application and knee site segments. These segments are leading revenue contributors in 2025, driven by the surging prevalence of joint-related ailments, technological advancements in regenerative therapies, and increasing awareness about early intervention strategies.

Hyaline cartilage remains the foremost focus in cartilage repair procedures, commanding a robust value share of 66.4% in 2025. This cartilage type is critical as it covers the articulating surfaces of bones in synovial joints, ensuring smooth motion and effective shock absorption during activities. Unfortunately, hyaline cartilage demonstrates poor intrinsic healing capabilities due to its avascular nature.

As a result, damage or degeneration often leads to debilitating joint disorders such as osteoarthritis, especially in weight-bearing joints like knees and hips. The segment’s growth is further propelled by widespread adoption of advanced treatment approaches, including autologous chondrocyte implantation, matrix-induced autologous chondrocyte implantation (MACI), and mesenchymal stem cell therapies, all aimed at regenerating hyaline tissue. Moreover, innovations in biomaterials and scaffolds, along with government initiatives promoting joint health awareness, are expected to enhance treatment accessibility and efficacy.

Consequently, the hyaline cartilage segment will remain a high-priority area for manufacturers, researchers, and healthcare providers addressing the increasing global burden of cartilage injuries and joint degeneration.

The knee segment is poised to lead the cartilage repair market by site, accounting for a significant 31.7% value share in 2025. This dominance arises from the knee joint’s susceptibility to frequent injuries, high mechanical stress, and degenerative diseases such as osteoarthritis, particularly among the aging and active sports populations.

Technological advancements in minimally invasive surgical techniques, like microfracture, osteochondral autograft transplantation, and autologous chondrocyte implantation, have been primarily centered on knee cartilage repair. These procedures offer improved clinical outcomes by restoring joint mobility and delaying or preventing total knee arthroplasty.

The rising global incidence of sports-related knee injuries, along with obesity-driven joint stress, intensifies demand for effective knee cartilage restoration solutions. Additionally, awareness initiatives emphasizing the importance of early treatment for knee cartilage damage are encouraging patients to seek timely medical intervention.

Industry players are also expanding their product portfolios with novel scaffolds, growth factors, and cell-based therapies tailored for knee cartilage repair. As these solutions gain wider acceptance across hospitals, specialty clinics, and ambulatory surgical centers, the knee segment will solidify its position as the most lucrative site for investment in the cartilage repair market.

Rising Incidence of Joint Disorders Driving the Market Growth

The rising incidence of disorders of the joints is gradually becoming a significant concern worldwide. Osteoarthritis, often abbreviated as OA, are degenerative joint diseases characterized by wearing down of the cartilage and bones at the ends of a joint. OA, therefore, is the most common form of arthritis that affects millions of people in the world, especially older adults.

For instance, according to the World Health Organization (WHO) there are around 528 million people worldwide currently living with osteoarthritis.

Another major driving force behind growth is increased participation in high-impact sports and physical activities. While indulging in physical activities the chances of cartilage or joint injuries are increased. Therefore, injuries during sports, such as torn cartilage in knees or shoulders, are becoming very common and will increase demand for their effective treatment solution.

Excess weight increases pressure in the joints, mainly in the lower part of the body, and increases the breakdown of cartilage in the joints, hence precipitating cartilage damage in the joints at an earlier age. Sedentary lifestyles also become prevalent, whereby lack of movement makes muscles and joints weak, hence vulnerable to damage.

Growing Adoption of Minimally Invasive Procedures is Driving the Industry Growth

The growing use of minimally invasive surgical procedures are among the major driving factors for the cartilage repair industry. Some examples of these minimally invasive procedures include techniques such as arthroscopy, microfracture, and minimally invasive autologous chondrocyte implantation and offers several advantage over traditional open surgical method.

The most attractive feature for them is substantially reduced recovery time. In most cases, patients treated with minimally invasive techniques would be informed to expect less pain after the procedure, shorter hospitalization, and an earlier return to normal activity.

Furthermore, all these techniques normally require much smaller incisions, which automatically means less trauma to the surrounding tissues. Moreover, healthcare providers are also coming forward to adopt minimally invasive approaches as they require less resource intensity and often tend to be less resource-intensive and more efficient, hence saving cost to the hospital and patients.

The wide adoption in these techniques is also supported by increasing the availability of advanced surgical tools and imaging technologies. Due to increasing awareness in patients and a desire to seek treatments associated with faster recovery and less pain, the minimally invasive procedure has been increased significantly.

Technological Advancement Creates Further Growth Opportunity for Cartilage Repair

There has been few advancement in treatment of damaged cartilage. Newer technologies have been developed for treatment of cartilage such as 3D bioprinting, gene therapy, and the advanced application of stem cells.

For example, state-of-the-art 3D bioprinting will enable making implants of custom design that would suit the anatomy of a patient, hence ensuring better integration and success rates for the patients who undergo such procedures. Another such technological advancement is gene therapy, which can be used to promote cartilage regeneration from within by modifying a patient's gene.

It might eventually eliminate the necessity of extensive procedures by simply enabling the body to repair the tissues more naturally. The technological advances both improve the potential and outcomes of the repair of the cartilage procedures as well as continue to explore the broader spectrum of available treatment.

As these technologies become more available and advanced, government will promote and offer reimbursement for the same, making advanced cartilage repair more readily available to the public. This ongoing innovation represents a significant opportunity for growth in the market as it meets the increasing demand for better and more personalized care.

High cost of Cartilage Repair may Restrict Market Growth

The high price of cartilage repair may act as a major restraining factor for the expansion of this industry. Such high price can make it inaccessible for numerous facilities such as smaller hospitals and clinics.

In a majority of cartilage repair cases highly expensive surgical intervention is required such as autologous chondrocyte implantation or osteochondral allograft transplantation. Most costs are incurred when advanced biomaterials, especially the use of hyaluronic acid and collagen scaffolds, are implemented. These techniques are not universally reimbursed and are out of reach for many, especially in the developing regions, thus compounding the cost of such treatment.

The adoption of economical and easy-to-maintain alternatives by patients is anticipated to pose a significant challenge for the cartilage repair industry. Despite several advantages, factors such as product recalls could lower the brand image of that particular manufacturer and impede growth of this industry.

In addition, other factors such as lack of availability of skilled professional, supply chain disruption, and other can also be factors which can act as an anchor to the industry’s growth.

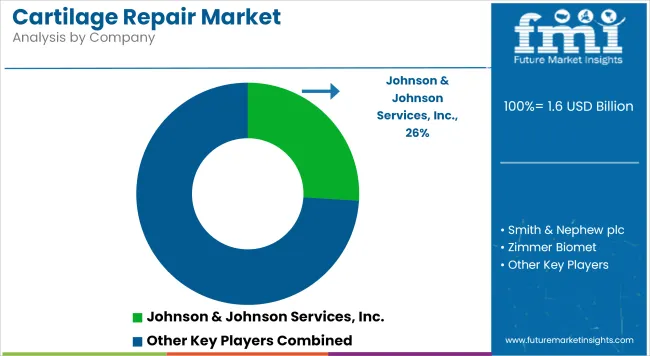

Tier 1 companies are the industry leaders with a revenue of more than USD 100 million, or 59.5% of the global industry. These companies stand out for having a large product portfolio and a high production capacity.

These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. These companies frequently get involved in strategies such as acquisition and product launches. Prominent companies within tier 1 include Johnson & Johnson Services, Inc., Smith & Nephew plc, Zimmer Biomet, CONMED Corporation and Stryker

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 26.6% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Arthrex, Inc., Anika Therapeutics, Inc. and B. Braun SE

Compared to Tiers 1 and 2, Tier 3 companies offer Cartilage Repairs, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. The companies such as Collagen Solutions (US) LLC, Vericel Corporation Inc., and others falls under tier 3 category. They specialize in specific products and cater to niche markets, adding diversity to the industry.

The market analysis for Cartilage Repairs in various nations is covered in the section below. An analysis of important nations in North America, Asia Pacific, Europe, and other regions of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 81.6%. By 2035, India is expected to experience a CAGR of 7.7% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.1% |

| Germany | 2.1% |

| France | 3.5% |

| UK | 2.5% |

| China | 6.8% |

| India | 7.7% |

| South Korea | 5.4% |

Germany’s Cartilage Repair market is poised to exhibit a CAGR of 2.1% between 2025 and 2035. The Germany holds highest market share in European market.

In Germany, there are many old people especially those who have reached 65 years of age. As people ages, the immune system became weak and chances of cartilage damage also increases. Again, the rising cases of joint-related diseases, such as osteoarthritis, further demand cartilage repair solutions. Besides this, the properly developed healthcare structure in this country and a strong focus on research and development work further support the growth.

Germany is home to the large number of leaders in medical technology companies and research institutions which are also involved in developing advanced techniques in cartilage repair through regenerative medicine and tissue engineering.

High expenditure on health alongside comprehensive insurance coverage secures better access to such advanced treatments. Growing awareness among the patients as well as healthcare providers about the long-term benefits of early intervention in joint disorders would also expand demand.

North America, spearheaded by the United States currently holds around 2.1% share of the global Cartilage Repair industry.

The United States is considered the most dominant market for cartilage repair across North America. Demand for cartilage repairs is increasing resulting from growth in the healthcare sector in the United States.

With the increase in healthcare spending, the country is investing more on technologically advance healthcare products to enhance care and patient outcomes. Additionally, the rising elderly population and rising burden of osteoarthritis is fueling healthcare needs including cartilage repair products.

Due to presence of large number of global leading biotech and pharma companies there is a continuous research and development in the cartilage repair sector in this country. In addition, the United States has a strong focus on minimally invasive procedures as it offers lesser recovery time and reduces overall healthcare costs.

Growing patient awareness and demand for effective, long-term solutions to joint problems further boost industry growth. As these trends continue, the cartilage repair market in the United States is expected to expand significantly.

In terms of industrial growth and infrastructure development, China is anticipated to be a strong contender, most importantly in the year 2023 the country is projected to show a CAGR of 6.8% between 2025 and 2035.

With the fast-growing number of cases diagnosed with osteoarthritis in China, it will therefore further boost the market for cartilage repair. With the increasing number of OA cases, innovative cartilage repair solutions and new treatments, like tissue engineering or surgical interventions, are much in demand. The more this burden of OA grows, the investments in research and development are likely to grow for effective treatments that will further boost the Chinese cartilage repair industry.

China is also turning into a central site for biotechnology and regenerative medicine research, allowing innovative and cost-effective treatment options to emerge. Furthermore, the rise in disposable incomes and increased health awareness of the population will boost demand for effective treatments and firmly establish China as a key growth market for cartilage repair in the upcoming years.

The cartilage repair industry faces a high competition as there are large number of cartilage repair manufacturers. These manufacturers are focused on constantly innovating and improving their product portfolio.

Prominent producers of Cartilage Repairs are concentrating on growing internationally in order to increase their revenue and increase the size of their sales footprint in developing nations through the acquisition of regional small players. Manufacturers utilize various key strategies such as agreements, product launches, research sponsorship, and strategic collaborations to boost product sales and establish their market presence.

Recent Industry Developments in Cartilage Repair Market

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.6 billion |

| Projected Market Size (2035) | USD 3 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand procedures for volume |

| Applications Analyzed (Segment 1) | Hyaline Cartilage, Fibrocartilage |

| Sites Analyzed (Segment 2) | Knee, Hip, Ankle & Foot, Others |

| End Users Analyzed (Segment 3) | Hospitals, Clinics, Ambulatory Surgery Centers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Argentina, South Africa, United Arab Emirates, Saudi Arabia |

| Key Players influencing the Cartilage Repair Market | Johnson & Johnson Services, Inc., Smith & Nephew plc, Zimmer Biomet, CONMED Corporation, Stryker, Collagen Solutions (US) LLC, Arthrex, Inc., Anika Therapeutics, Inc., B. Braun SE, Vericel Corporation |

| Additional Attributes | Dollar sales, share, demand for minimally invasive cartilage restoration, emergence of cell-based therapy techniques, orthopedic care advancements, focus on knee & ankle repairs, reimbursement pattern analysis, hospital outpatient trends |

In terms of application, the industry is divided into hyaline cartilage and fibrocartilage.

In terms of application, the industry is segregated into nee, hip, ankle & foot and others

In terms of distribution channel, the industry is divided into hospitals, clinics and ambulatory surgery centers

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global Cartilage Repair industry is projected to witness CAGR of 6.5% between 2025 and 2035.

The global Cartilage Repair industry stood at USD 1.6 billion in 2025.

The global Cartilage Repair industry is anticipated to reach USD 3 billion by 2035 end.

China is expected to show a CAGR of 6.8% in the assessment period.

The key players operating in the global Cartilage Repair industry Johnson & Johnson Services, Inc., Smith & Nephew plc, Zimmer Biomet, CONMED Corporation, Stryker, Collagen Solutions (US) LLC, Arthrex, Inc., Anika Therapeutics, Inc., B. Braun SE and Vericel Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Cell Free Cartilage Repair Market Analysis – Size, Share & Forecast 2024-2034

Artificial Cartilage Implant Market

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Nerve Repair Market Growth - Trends, Demand & Innovations 2025 to 2035

Hernia Repair Devices Market Insights - Trends & Forecast 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Rib Fracture Repair Systems Market Size and Share Forecast Outlook 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Freight Railcar Repair Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA