Wedding is a wonder moreover the Caribbean destination wedding industry is rising to be a huge affair The Caribbean destination wedding market is believed to be prosper from 2025 to 2035. Thus how it is possible that everything functions simply great the response is in the extravagant coastlines, sublime lodgings and also selective comprehensive wedding event bundles of Caribbean destination wedding event market that powers an enormous development of portion. Little wonder, then, that the Caribbean is one of the world’s leading wedding destinations.

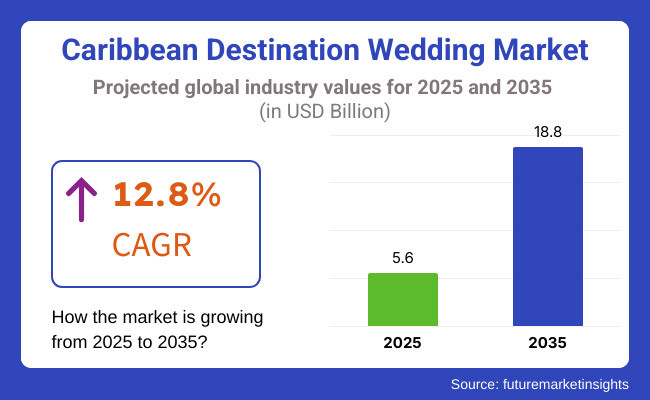

Additionally, the report from Fortieth cites that the global protein hydrolysates market is forecasted to reach USD 18.8 Billion in 2035, up from USD 5.6 Billion in 2023, at a CAGR of 12.8% during the anticipated period. As the trend continues to skew smaller and more experiential, we anticipate consistent strong demand for wedding bookings across the Caribbean.

At the ultimately, combining towards all the attraction of the lovely island the Caribbean as well as the gradually coming up luxury wedding services provided in the region towards the global destination wedding demand, it could be said that the Caribbean bridal marketing are growing faster down the coming period.

Explore FMI!

Book a free demo

Best Caribbean Wedding Locations with Beach Properties, Private island venues and Customized All-inclusive wedding packages. The colourful culture, beautiful architecture and stunning coastal venues make the capital city, Nassau, the perfect setting for traditional and modern wedding ceremonies alike. Exuma, by contrast, with its aquamarine seas and unsuspecting beaches, breeds a much closer-to-home feel, ideal for the couple who wants a private, exclusive escape. The Bahamas, being close to the US and having a big international airport and relaxed wedding/legal regulations, is a popular destination for couples from this part of the world, but also for people from all over.

Jamaica draws couples in with its colorful culture, stunning scenery, and dozens of luxury wedding resorts in Montego Bay, Negril, and Ocho Rios. Blending both the old-world charm and modern-day elegance, the country has much to offer as wedding venues, from Beaches to Gardens. From its warm welcoming hospitality, to its skilled local wedding planners, to its wealth of cultural experiences, Jamaica is still a great destination for the memorable romantic wedding experience.

The Dominican Republic, with its cheap all-inclusive wedding packages and stunning locations, including Punta Cana and La Romana, continues to be a popular option for couples seeking a budget wedding without compromising on a stunning location. And a wide variety of venues - from beachfront resorts to original colonial spaces - enables couples to design a wedding that reflects each couple’s unique vision. And with relaxed marriage requirements and year-round tropical weather, the Dominican Republic is a popular destination-wedding destination. Wedding couples and their guests can experience seamless and memorable wedding moments courtesy of professional planners and high-end hospitality providers.

Known for its culture of affection, Saint Lucia offers lush, tropical landscapes, volcanic beaches and luxurious resorts. Holidaymakers are whisked away to island hospitality surrounded by breathtaking scenery and five star facilities and services. The Pitons and Pigeon Island National Park are classic wedding locations, popular with luxury wedding goers seeking a distinct and beautiful ceremony. Owing to their warm temps throughout the year, stunning views of the sunset and a combination of adventure and relaxation, Saint Lucia is still a top choice for destination weddings in the Caribbean region.

Barbados boasts unspoiled beaches, chic wedding venues and an interesting mix of British and Caribbean influences. Whether it’s a colonial-style plantation or a luxury beachfront property, there are a variety of wedding venues on the island to betide every taste and budget. The ideal service providers, rich tropical climate, and unique cultural experiences (local music, cuisine or customs) that the Indonesian wedding tourism industry already has to offer in a massive scale. A seamless wedding planning process with experienced professionals to create customized ceremonies. Incredible sunsets, open arms, and world-class hospitality mean that Barbados continues to be one of the most memorable wedding destinations in the world.

Challenge

High Costs and Logistical Complexities

The Caribbean Destination Wedding Market faces unique challenges around high cost, complex logistics, and varying regulations between different island nations. Couples looking to hold a destination wedding in the Caribbean face a number of different legal requirements, residency rules and venue restrictions that can make the planning process complicated.

Weather and Seasonal Constraints

Hurricanes and other unpredictable weather conditions are common in the Caribbean, which can lead to interrupted wedding plans and increased cancellations..

Opportunity

Growth in Luxury and Themed Destination Weddings

An increased desire to celebrate in alignment with values - be it downsizing, enjoying the outdoors or eco-consciousness - is also increasing demand for sustainable venues, locally sourced catering and nature-inspired wedding themes. Avenues that offer sustainable options, such as carbon-neutral ceremonies, eco-friendly resorts, and ethical wedding planning will become more competitive in the market.

Increase in Sustainable and Eco-Friendly Weddings

The growing preference for eco-conscious weddings is driving demand for sustainable venues, locally sourced catering, and nature-inspired themes. Resorts and planners that integrate green practices, carbon-neutral ceremonies, and ethical wedding planning will gain a competitive edge in the market.

Steady growth was observed in the Caribbean Destination Wedding Market between 2020 and 2024 due to increasing demand for unique beach ceremonies along with other personalised wedding offerings. International couples have descended on leading destinations such as Jamaica, the Bahamas, the Dominican Republic and Saint Lucia, drawn by gorgeous backdrops and luxe wedding offerings. But erratic weather, regulatory challenges and differing expenses could trip up couples and planners. Businesses quickly responded with flexible wedding packages, off-season discounts and digital planning solutions to streamline the process.

As we move into the next decade of 2025 to 2035 we will witness market evolution with new processes, immersive guest experiences & sustainable destination weddings. Technology-driven planning Platforms, AI-assisted Coordination, and block-chain-based contract management will change the face of the industry. Finally, sustainable events, multicultural weddings and post-wedding getaways will impact what people choose. How the Caribbean Destination Wedding Market has evolved through digital solutions, sustainable initiatives and seamless travel organisation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Marriage laws, residency requirements, and venue regulations |

| Wedding Tourism Growth | Growth in beachfront weddings, private island ceremonies and resort-based events |

| Industry Adoption | The rise of boutique wedding planning, designed guest experiences and vendor collaboratio |

| Supply Chain and Sourcing | Reliance on owners traditional event providers, florists, and caterers |

| Market Competition | Luxury wedding planners, destination management companies, and resort-based wedding services |

| Market Growth Drivers | The pandemic has heightened demand for exclusive venues, personalized experiences, and convenient guest travel |

| Sustainability and Energy Efficiency | Somewhere in between, we focused on sustainable wedding favors and low waste wedding décor |

| Integration of Digital Planning | Restrained use of e-vites, online guest management, and virtual venue hunting |

| Advancements in Wedding Experiences | Traditional wedding formats as well as cultural destination ceremonies |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined wedding licensing, international coordination services, and flexible destination wedding policies |

| Wedding Tourism Growth | Expansion into eco-conscious weddings, intimate elopements, and luxury micro-weddings |

| Industry Adoption | Rise of AI-driven wedding planning platforms, virtual reality venue scouting, and hybrid wedding formats |

| Supply Chain and Sourcing | Shift toward sustainable catering, locally sourced materials, and eco-friendly wedding essentials |

| Market Competition | Growth of independent wedding stylists, digital wedding consultation services, and AI-enhanced event planning platforms |

| Market Growth Drivers | Increased investment in sustainable wedding trends, immersive guest experiences, and destination wedding packages |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral venues, zero-waste wedding initiatives, and sustainable floral arrangements |

| Integration of Digital Planning | Expansion of smart wedding assistants, AI-driven planning tools, and blockchain-authenticated wedding contracts |

| Advancements in Wedding Experiences | Evolution of interactive wedding experiences, immersive multi-day wedding celebrations, and themed destination weddings |

Western European countries serve as a central hub for educational tourism during announcing international educational reforms. The UK, Germany and France dominate when it comes to high-quality higher education, short-term academic exchange schemes and summer schools. Language immersion programs in cities such as London, Paris and Berlin are also increasingly in demand, particularly for learning English, French and German.

| Region | CAGR (2025 to 2035) |

|---|---|

| Western Europe | 13.6% |

The Northern part of Europe is one of those regions that is becoming an increasingly multidisciplinary destination for educational tourism, particularly in countries such as Sweden, Denmark, Finland, and Norway, which are famous for their innovative educational systems, sustainability programs, and high-quality vocational training. Finland’s world-class schooling system and Denmark’s renowned business education entice students in search of alternative models of education. Programs abroad in green technology, engineering and design have also gained popularity.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northern Europe | 13.2% |

With a wealth of cultural heritage and high academic standard, Southern Europe is becoming an important player in educational tourism. Italy and Spain have emerged as popular frontiers for students of history, art, architecture, and culinary arts, with cities like Rome, Florence, Barcelona, and Madrid featuring specialized course offerings. Moreover, Greece is becoming a top destination for study in classical studies and philosophy, attracting foreign students.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southern Europe | 12.9% |

Eastern European countries such as Poland, Hungary and the Czech Republic offer what are considered affordable and quality education options, and with that comes the rising popularity of educational tourism. Medical and technical education, in particular, has a lot of strength, and Poland and Hungary have become top destinations for international students pursuing a career in medicine. Others are study-abroad programs for disciplines like history, economics and political science in places like Prague and Warsaw.

| Region | CAGR (2025 to 2035) |

|---|---|

| Eastern Europe | 12.6% |

Central and Eastern Europe are diversifying to become one of the most sought-after spots for educational tourism with Switzerland, Austria, and Germany leading the pack. Switzerland’s leading hospitality management schools draw students from around the world, and Austria’s universities provide solid academics in their arts, business, and engineering programs. Germany is still one of the leaders in STEM (technological) education, with a rising demand from international students regarding technical and vocational training.

| Region | CAGR (2025 to 2035) |

|---|---|

| Central Europe | 13.1% |

The Baltic region (Estonia, Latvia, and Lithuania) is becoming an interesting emerging educational tourism market focusing on digital education, startup ecosystems, and multilingual education. In fact, Estonia is well-known for its innovative e-learning platforms and information technology programs. Their own degrees (medical and business) are particularly popular with students studying in the EU because they are inexpensive and recognized by EU countries.

| Region | CAGR (2025 to 2035) |

|---|---|

| Baltic Region | 12.3% |

Beach Weddings Dominate the Caribbean Destination Wedding Market Due to Their Scenic Appeal the current Beach Wedding capture is other capturing this market. Beach weddings, unsurprisingly - the Caribbean market for destination weddings is focused on gorgeous coastal scenery, glamorous hotels and a year-round balmy climate Couples planning beach weddings are increasingly flocking to popular destination hotspots like Jamaica, the Bahamas and the Dominican Republic, where they can secure stunning ocean views and customizable wedding packages. These unions are the perfect blend of romance and convenience, with resorts providing a full suite of services, from flower arrangements and beachside receptions to honeymoon suites. Meanwhile, the growing demand of green weddings is forcing resorts to design ecologically sustainable amenities, with little or no carbon footprints at all. The increasing popularity of micro-weddings when couples plan small, intimate ceremonies that include only immediate family and friends has also driven interest in beach weddings. Many couples also incorporate local Caribbean traditions live steel drum bands, tropical floral decor, etc. to inject a little bit of culture.

Kudos to professional wedding coordinators, smooth legal processes and breathtaking coastal landscape, the Caribbean is the world leader in beach weddings. That is why an increasing number of couples are planning a particularly charming wedding in the sand with the gentle breeze of the ocean, and beach weddings combine luxury, affordability, and nature for a beautiful stress free day.

The Island Wedding segment is one of the largest growing segments of our Island as couples searching for personal private venues on their special day. The Caribbean evokes island getaways, with popular luxury destinations such as Turks and Caicos, St. Lucia and the British Virgin Islands, to name a few. Styled around its stunning scenery, customisable experiences, and basics of luxury, these destinations are still a go-to for destination weddings. The spike in private ceremonies, held on islands distant from the crowds, has helped fuel a boom in boutique resorts and villas that offer wedding services tailored to clients on private islands.

In the Caribbean destination wedding market, Wedding Planning represents the greatest share of services as couples rely heavily on professional coordinators especially for logistics, legal requirements and vendors. Vendors across the region provide fully inclusive, day-of packages; they will make the venue, the guests, and the cultural décor details - whatever is needed to keep the whole experience running smoothly. Therefore, many of these weddings are unique and can sometimes be very complex which can definitely increase the demand for those professional planning services for those couples to experience a stress-free and memorable day.

Venues that provide stunning places for ceremonies and reception in most cases. Whether regarded as beachfront resorts and overwater pavilions or historic estates and private islands, the figures for demand for unique wedding venues remain on the ascent. Couples want venues that are dramatic, beautiful and private.

Luxury resorts, heritage sites and private estates are among the popular choices for those seeking fairytale-style atmospherics. Couples have also gravitated to themed weddings, such as castle weddings and vineyard weddings, for tailored experiences that highlight their cultural backgrounds as well as their likings.

The growing trend of eco-conscious weddings has also made couples take even closer looks at venues they choose to hire, many of whom choose to host their ceremonies at sustainable resorts and venues. All of which can make venue choice central to wedding planning.

The Caribbean destination wedding market is witnessing significant growth, fueled by increasing demand for luxurious, all-inclusive wedding packages, stunning beachside venues, and unique cultural experiences. Key destinations such as the Dominican Republic, Jamaica, the Bahamas, and Saint Lucia attract couples seeking a memorable and picturesque wedding experience.

Market Share Analysis by Key Players & Destination Wedding Planners

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Sandals Resorts | 20-25% |

| Palace Resorts | 15-20% |

| DestinationWeddings.com | 10-15% |

| Hard Rock Hotels | 8-12% |

| AMResorts | 5-10% |

| Other Operators & Planners | 30-40% |

Key Company Wedding Offerings

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Sandals Resorts | All-inclusive wedding packages, luxury beachfront venues, and personalized wedding concierge services. |

| Palace Resorts | Customized wedding experiences, elegant resorts, and comprehensive event planning. |

| DestinationWeddings.com | Online wedding planning services, venue selection assistance, and tailored Caribbean wedding packages. |

| Hard Rock Hotels | Rock-themed destination weddings, celebrity-inspired wedding setups, and all-inclusive resort packages. |

| AMResorts | Boutique and high-end wedding experiences, romantic beachfront ceremonies, and honeymoon packages. |

Sandals Resorts (20-25%)

Sandals Resorts is the leader in the Caribbean destination wedding market and provides couples exclusive, all-inclusive wedding experiences at some of the most beautiful beachfront front in the region.

Palace Resorts (15-20%)

Palace Resorts is known for its upscale wedding packages, including one-of-a-kind decor themes, customizable menus, and premium event services.

DestinationWeddings.com (10-15%)

This wedding planner that is based online helps couples find their ideal Caribbean wedding venues and provides customized packages and travel.

Hard Rock Hotels (8-12%)

Hard Rock Hotels - The ultimate destination wedding experience for music lovers, Hard Rock Hotels offer modern elegance with striking rock decor and entertainment, including live bands.

AMResorts (5-10%)

AMResorts specializes in upscale, boutique-style wedding experiences, perfect for couples seeking intimate ceremonies.

Other Key Players (30-40% Combined)

Innovations in personalized wedding planning, AI-driven venue selection, and experiential wedding travel are being introduced by multiple resorts, event planning agencies, and hospitality brands. These include:

The overall market size for Caribbean destination wedding market was USD 5.6 Billion in 2025.

The Caribbean destination wedding market is expected to reach USD 18.8 Billion in 2035.

The growing preference for eco-conscious weddings is driving demand for sustainable venues fuels Caribbean destination wedding Market during the forecast period.

The top 5 countries which drives the development of Caribbean destination wedding Market are Bahamas, Jamaica, Dominican Republic, Saint Lucia and Barbados.

On the basis of wedding type, beach wedding to command significant share over the forecast period.

Evaluating Social Media and Destination Market Share & Provider Insights

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Competitive Overview of Animal Theme Parks Market Share

Key Players & Market Share in the Spa Resort Industry

Market Leaders & Share in the Winter Adventures Tourism Industry

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.