The cardiovascular repair & reconstruction devices market will progress substantially, as CVDs are highly prevalent, with complex medical technology evolving and the demand for minimally invasive operation rising.

Cardiovascular repair and reconstruction devices play a vital role in the management of congenital heart defects, valvar heart diseases, aneurysms, and various complex structural heart diseases. Which are used for prosthetic heart valves, vascular grafts, occludes, annuloplasty rings, and tissue patches where they restore cardiac function and improve the healthcare outcome of the patient.

An increase in the aging population globally is one of the essential driving factors behind the expansion of the market as older adults are more prone to being diagnosed with heart diseases, aneurysm, and vascular diseases.

Cardiovascular diseases are widely regarded as the leading cause of death, with millions of new global cases each year, as reported by the World Health Organization (WHO). This consequently results in rising healthcare expenditures, state efforts to diminish CVD, and the demand for innovative cardiovascular medical devices.

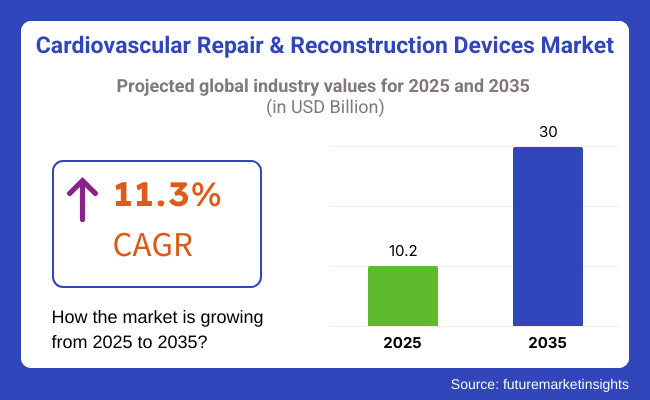

The cardiovascular repair & reconstruction devices market accounted for USD 10.2 billion in the year 2025 and is expected to reach USD 30.0 billion by the year 2035, at a CAGR of 11.3% during the forecast period.

Explore FMI!

Book a free demo

High CVD prevalence along with availability of robust healthcare infrastructure, sophisticated surgical techniques and greater healthcare expenditure supports the greatest market.

As the data mentioned, due to the aging populations, new technology innovations, plus government supportive policies regarding the cardiovascular treatments, it grows steadily.

Strong growth in this region, driven by the healthy increase in cardiovascular disorders within China, India, and Japan, increasing healthcare spending, and growing medical tourism.

Growth driven by better healthcare infrastructure and more adoption of cardiovascular repair devices in Brazil and Mexico.

Emerging markets, benefiting from an increase in cardiac surgeries and rising investments in advanced cardiovascular treatment.

Challenge

High Cost and Regulatory Hurdles in Cardiovascular Repair & Reconstruction Devices

Some of the factors such as high cost of advanced cardiovascular devices and stringent regulatory requirements are hampering the growth of Cardiovascular Repair & Reconstruction Devices Market. Devices that are sometimes seen as new cardiovascular repair solutions: grafts, stents and heart valve repair devices, taking into consideration research, clinical trials and regulatory approvals, such as FDA approvals and CE marking in Europe.

This results in longer approval timelines and higher development costs, which restrict access for healthcare providers and patients from cost-sensitive regions.

Opportunity

Technological Advancements and Growing Adoption of Minimally Invasive Procedures

Minimally invasive cardiovascular surgeries are now being performed at an increasing pace, creating significant opportunities for market growth. The future, however, is looking for brighter - bioresorbable stents, tissue-engineered heart valves and 3D-printed vascular grafts are all pushing the envelope on cardiovascular repair.

Demand for next-generation repair and reconstruction devices is also being propelled by the advent of robotic-assisted surgeries and catheter-based interventions. The cardiac healthcare market is also expanding as emerging economies invest in similar infrastructure.

According to the market research in the period 2020 to 2024, the market also grew due to the rising prevalence of cardiovascular diseases (CVDs) and increasing preference for minimally invasive procedures. COVID-19 had a temporary negative effect on elective cardiovascular procedures but an exponentially positive effect on the implementation of telemedicine and digital health programs for remote follow-up.

Major companies concentrated on bioengineered implants and diversified their portfolio with AI-based imaging methods for precision-based interventions.

In the coming years of 2025 to 2035, the market will experience ground-breaking advancement as Artificial intelligence (AI), Regeneration medicine, and 3D Bio-printing technologies will be employed. Advances in personalized medicine, such as patient-dedicated grafts and AI-enhanced predictive analytics for cardiac care, will propel the next wave of market expansion.

Moreover, there is a premise of biodegradable and drug-eluting implants as a way to reduce complications in the future, improving patient performance.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with standard FDA & CE regulations |

| Cardiovascular Device Innovation | Growth in bioresorbable stents and synthetic grafts |

| Market Growth Drivers | Rising prevalence of CVDs and increased awareness of early intervention |

| Sustainability Trends | Initial focus on reducing device-related complications |

| Surgical & Treatment Advances | Increased adoption of catheter-based interventions |

| Supply Chain & Manufacturing | Dependence on traditional medical device suppliers |

| Market Competition | Presence of leading cardiovascular device manufacturers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Compliance with standard FDA & CE regulations |

| Cardiovascular Device Innovation | Growth in bioresorbable stents and synthetic grafts |

| Market Growth Drivers | Rising prevalence of CVDs and increased awareness of early intervention |

| Sustainability Trends | Initial focus on reducing device-related complications |

| Surgical & Treatment Advances | Increased adoption of catheter-based interventions |

| Supply Chain & Manufacturing | Dependence on traditional medical device suppliers |

| Market Competition | Presence of leading cardiovascular device manufacturers |

The United States cardiovascular repair & reconstruction devices market is anticipated to hold a substantial share of the global market. This market is majorly driven by the increasing Incidence of cardiovascular diseases (cvds) and bettering geriatric population & development in minimally invasive cardiac procedures.

According to the Centers for Disease Control and Prevention (CDC), heart disease is still the number one cause of death in the USA, with more than 800,000 cases of heart-related death each year, thus increasing the demand for advanced cardiovascular repair and reconstruction devices.

Increasing investments in structural heart innovations and robotic-assisted cardiac surgeries that are transforming minimally invasive cardiovascular repairs and their respective hospital stays and recovery time.

Market growth is also being supported by the increasing implementation of tissue-engineered cardiovascular implants and bioabsorbable stents. Medicare and private insurance coverage for heart valve repairs, coronary bypass procedures and aortic aneurysm reconstruction are also expanding access to high-quality cardiovascular repair devices throughout the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.7% |

The UK cardiovascular repair & reconstruction devices market is an essential device for cardiovascular surgery, and the NHS is also increasing its investment in cardiovascular care due to the increasing prevalence of heart diseases in the UK, which is driving the growth of the UK cardiovascular repair & reconstruction devices market, and the development of bioresorbable cardiovascular implants will has a major impact on the UK cardiovascular repair & reconstruction devices market.

Demand for heart valve repair devices, vascular graft and stent graft to proliferate, helped by the British Heart Foundation (BHF) reporting that 7.6 million people in the UK currently live with heart and circulatory diseases.

The UK’s National Health Service (NHS) is increasing investment in cardiac surgeries and regenerative medicine studies for bioengineered cardiac tissues and 3D-printed vascular scaffolds. Heart valve repair interventions, like TAVR - Tran’s catheter aortic valve replacement - are increasingly available, not only lowering surgical risk for seniors.

The rising trend of hybrid operating rooms in well-known UK hospitals also drives the demand for robotic-assisted cardiovascular repairs and catheter-based interventions. In addition, partnerships between UK biotech companies and international medical device companies are expediting the creation of the next generation of cardiac reconstruction devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.6% |

The cardiology repair & reconstruction devices market in the European Union (EU) is characterized by strong growth, driven by an aging demographic, a continuously expanding healthcare expenditure base, as well as regulatory support for innovations in cardiology devices. According to ESC, cardiovascular diseases (CVDs) account for 45% of all deaths in Europe and drive the demand for vascular grafts, annuloplasty rings, and implantable cardiac patches.

Next generation cardiovascular implants, such as tissue engineered heart valves and 3D printed cardiovascular scaffolds are leading to Germany, France and Italy using clinical trials and implementation. Manufacturer shift towards biocompatible and bioresorbable cardiovascular implants are also being expedited with the EU Medical Device Regulation (MDR) with hopes of promoting patient outcomes and lessening downstream complications.

However, the rising number of government-mandated reimbursement schemes for TAVR, coronary bypass and aortic aneurysm repair will enhance patient access to cutting-edge cardiovascular reformation technologies. Cardiac surgery: Regenerative heart tissue and artificial heart valves.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 11.3% |

Japan cardiovascular repair & reconstruction devices market is witnessing growth from the technological advancements in the minimally invasive heart procedures, increasing instances of aging-associated heart diseases, and government-sponsored healthcare innovations.

Biotech industries in Japan have been actively supported by the Japanese Ministry of Health, Labour and Welfare (MHLW) funding of research into the development of artificial heart valves, bioengineered patches, and vascular grafts in order to improve surgical outcomes and decrease the rate of hospitalization.

Demand for cardiovascular implants and heart valve replacement procedures is on the rise, given Japan’s rapidly aging population. Moreover, Japan's lead in robotic-assisted surgeries and AI-based diagnostics is driving the robotic catheter-based cardiovascular repairs market, improving precision and minimizing post-operative complications.

Generating broad interest in the regenerative medicine landscape in Japan, which in turn stimulates the development of stem cell-based cardiovascular repair treatment, laying the groundwork for developing next-generation cardiac regenerative medicine approaches.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.6% |

The market is driven by the increasing prevalence of cardiovascular diseases (CVDs), increasing healthcare investments by the government, and the presence of strong medical technology companies producing cardiac implants. Aiming for advanced minimally invasive cardiac surgeries, the Korean Ministry of Health and Welfare (MOHW) is actively supporting the development of bioresorbable stents, vascular grafts, and artificial heart valves by biotech companies.

Patients now have greater access to high-quality devices for cardiovascular reconstruction with the growing government-backed health insurance coverage expansion for TAVR and percutaneous coronary intervention (PCI). Also, South Korea, being a skilled region in nanomedicine and smart implantable devices, is introducing biodegradable cardiac scaffolds and artificial intelligent-enabled heart monitoring implants.

The move to telemedicine and remote cardiac diagnostics also facilitates the uptake of next-generation cardiovascular repair technologies for personalized heart disease treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.4% |

Cardiovascular repair & reconstruction devices market is dominating by Valve Repair Devices and Vascular Grafts segments: Increasing prevalence of cardiovascular diseases, advancements in minimally invasive procedures, and rising demand for durable implant solutions are driving the Cardiovascular Repair & Reconstruction Devices Market.

Valve Repair Devices Gain Market Prominence with Rising Adoption of TAVR and TMVR

Presence of only valve repair devices segment will spur the market growth owing to increasing focus on minimally invasive solutions by health care providers will continue to spur development in valvar heart diseases. Now, some of these devices are commonly used in hospitals, ambulatory surgical centers and cardiac catheterization labs, making certain that heart valves are being properly restored, and patients are surviving at high rates.

A growing demand from the market to eliminate surgical risks in patients at high risk due to widening acceptance of trans catheter aortic valve replacement (TAVR) i.e. implantation of a catheter-related valve, has led to increased transplant volume. The increasing demand for trans catheter mitral valve repair (TMVR) which is fundamental to minimally invasive anatomic valve therapy is leading the market growth by delivering TMVR and its devices that secures cardiac function.

Robot-assisted valve repair procedure which enables procedure-specific interventions have established deeper market penetration and more importantly ensured optimized procedural outcomes amongst the adopters. Factors such as rising adoption of durable bio prosthetic brain and mechanical valve repair solutions in North America, which are anticipated to provide long-term benefits to patients, have driven the growth of the market.

The vascular grafts segment is projected to witness considerable growth due to the increasing prevalence of peripheral artery disease (pad), aortic aneurysms, and blockages in blood vessels. These grafts are commonly used in coronary artery bypasses, aneurysm repairs, and other vascular reconstructions to create or maintain blood flow and vessel patency.

The peripheral arterial disease (PAD) being one of the mostly occurring cardiovascular disorders has created upsurge demand in the market of peripheral vascular grafts, synthetic and biological grafts. Aortic grafts, especially endovascular aneurysm repair (EVAR), characterized by a strong growth potential due to the stalling of high ao disease progression, and the establishment of minimally invasive approaches, ushering an increased demand for aortic grafts in the market.

Drug eluting vascular grafts with anti-thrombotic coatings have uplifted the market adoption thanks to their ability to prevent post-surgical complication. Cases of biodegradable vascular grafts using tissue-engineered scaffolds have taken a lead in the market, as they offer better biocompatibility and integration and are advanced in the surgical field.

In cardiovascular reconstruction, vascular grafts are applied, and long-term graft patency and infection risks pose significant challenges. However, recent advancements in nanotechnology-based grafts, tissue-engineered scaffolds, and hybrid synthetic-biological graft solutions are favourably impacting graft functionality ensuring superior surgical outcome.

Among the key segments of the cardiovascular repair & reconstruction devices market, the hospitals and independent cardiac catheterization labs together hold a dominating position, as hospitals often have the surgical infrastructure, the specific expertise, and a large patient volume when it comes to undergoing cardiovascular surgery.

Most cardiovascular surgeries, such as valve replacements and vascular graft procedures, are conducted in a hospital environment, and as such, the Hospitals segment continues to be a top contributor. They provide extensive care, advanced equipment, and multidisciplinary teams, resulting in high procedural success and patient recovery.

The rise in adoption of hybrid operating rooms having integrated imaging and robotic-assisted systems is driving the market growth which ensures accuracy in cardiovascular interventions. Government funding for advanced technologies and the growing trend towards hospital-based TAVR and TMVR programs led by specialized cardiac teams have further bolstered market growth, providing access to state-of-the-art treatments.

Moreover, the growth of hospital-associated cardiovascular research centers, including clinical trials and new device testing, has increased this application to the market by enhancing continuous innovation. The market is driven by the increasing utilization of AI-assisted diagnostic tools that help in assessing real-time cardiac function and adopting personalized treatment methods.

Regardless of these advantages, high treatment costs and long hospital stays pose challenges. Like, the expanding availability of government reimbursement applications, value-based healthcare models, as well as medical center partnerships with medical equipment suppliers is drastically enhancing affordability, making certain the current reason for market development remains.

The Independent cardiac catheterization labs segment is experiencing the most significant growth, driven by the desire of patients and healthcare providers for outpatient-based, less-invasive cardiovascular interventions. They have angioplasty, stent placements, valves repairs and vascular interventions labs around the country for lower treatment, early diagnosis and same-day treatment solutions.

The growing trend towards minimally invasive vascular graft implantations (involving catheter-based delivery) has propelled market growth, providing for quicker recovery.

The growing number of AI-enabled electrophysiology lab with real-time hemodynamic monitoring software supporting the adoption of the market to ensure accuracy in cardiovascular assessment. The increasing adoption of robot-assisted catheter-based interventions with improved precision and control has been contributing to the market growth, assuring superior procedural outcomes.

Increasing cardiovascular disease prevalence among people, enhanced demand for minimally invasive procedures, and technological advancements in tissue engineering have than significant growth to the Cardiovascular Repair & Reconstruction Devices Market. Novel bioresorbable stents, artificial heart valves, vascular grafts, as well as cardiac patches is expected to enhance the patient outcome which will serve to propel the market growth. Moreover, the growing geriatric population, along with favourable reimbursement policies and the increasing acceptance of regenerative medicine, are sustaining the market growth.

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 22-26% |

| Edwards Lifesciences Corporation | 18-22% |

| Abbott Laboratories | 14-18% |

| Terumo Corporation | 10-14% |

| Getting AB | 7-11% |

| Others | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Market leader in heart valve repair, vascular grafts, and trans catheter solutions. |

| Edwards Lifesciences Corporation | Specializes in bio prosthetic heart valves, trans catheter mitral and aortic valve replacement (TAVR/TMVR). |

| Abbott Laboratories | Develops stent grafts, percutaneous heart valve repair systems, and occlusion devices. |

| Terumo Corporation | Offers vascular repair solutions, haemostatic products, and coronary stents. |

| Getting AB | Focuses on vascular grafts, hemodynamic monitoring systems, and cardiac surgery solutions. |

Key Market Insights

Medtronic plc (22-26%)

Medtronic dominates the cardiovascular repair and reconstruction segment with its innovative Tran’s catheter heart valves and synthetic vascular grafts. Its strategic acquisitions and R&D investments ensure sustained market leadership.

Edwards Lifesciences Corporation (18-22%)

Edwards Lifesciences is a key player in minimally invasive heart valve repair and replacement. The company's TAVR technology has revolutionized aortic stenosis treatment, making it a preferred choice among surgeons worldwide.

Abbott Laboratories (14-18%)

Abbott focuses on catheter-based cardiovascular therapies, including Mitral Clip™ and Absorb™ bioresorbable stents, which are widely used in structural heart repairs and coronary interventions.

Terumo Corporation (10-14%)

Terumo has a strong presence in vascular intervention and cardiac surgery markets, offering peripheral stents, haemostatic sealants, and artificial vascular grafts.

Getting AB (7-11%)

Getting is known for its innovative vascular graft technology and hemodynamic monitoring solutions, widely used in coronary artery bypass graft (CABG) procedures.

Other Key Players (15-25% Combined)

The overall market size for cardiovascular repair & reconstruction devices market was USD 10.2 billion in 2025.

The cardiovascular repair & reconstruction devices market is expected to reach USD 30.0 billion in 2035.

The growth of the cardiovascular repair & reconstruction devices market will be driven by the rising prevalence of cardiovascular diseases, advancements in minimally invasive surgical procedures, and increasing adoption of bioengineered grafts and prosthetic devices.

The top 5 countries which drives the development of cardiovascular repair & reconstruction devices market are USA, European Union, Japan, South Korea and UK.

Hospitals and cardiac catheterization labs to command significant share over the assessment period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.