The cardiovascular diagnostics industry is valued at USD 6.5 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 5.1% and reach USD 10.69 billion by 2035.

In 2024, the global cardiovascular diagnostics or cardiac testing industry observed immense traction due to advancements in non-invasive testing technologies, primarily in echocardiography and cardiac MRI.

Extensive deployment of AI-assisted imaging within North America and Western Europe played a giant role in diagnostic accuracy, which consequently resulted in hastened intervention procedures.

FMI analysis showed that increased payments in Japan and Germany also helped hospitals and clinics use more advanced heart tests. Private sector R&D partnerships flourished, especially in wearable cardiac monitoring technology that tracks arrhythmias and indicators of early heart failure.

Regulatory agencies also cleared several next-generation biomarkers, which improved the accuracy of ischemia and myocardial infarction diagnosis.

Stepping into 2025, FMI considers the industry poised for stable growth, as the growth will be driven by the increasing global burden of cardiac diseases, increased investment in AI-powered diagnostic systems, and dissemination of tele-cardiology platforms.

The developing economies are expected to advance their diagnostic infrastructures, and the developed economies will further evolve early detection mechanisms. Over the next decade, FMI research demonstrated that precision medicine will continue to overlap with cardiac testing to form personalised screening channels.

By 2035, the field is expected to evolve into a patient-centred, data-driven paradigm focusing on early risk stratification and less invasive treatments.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.5 Billion |

| Industry Value (2035F) | USD 10.69 Billion |

| CAGR (2025 to 2035) | 5.1% |

Explore FMI!

Book a free demo

The cardiovascular diagnostic industry is in a steady growth trajectory, supported by rising worldwide incidence of cardiovascular disease and more rapid uptake of AI-driven diagnostic technologies.

FMI analysis found that new technologies for detecting diseases early and less invasive tests are changing how doctors work, speeding up treatment and leading to better results.

Companies investing in digital diagnostics, telecardiology, and precision imaging are likely to gain significantly, while incumbent companies lagging in innovation may lose industry share.

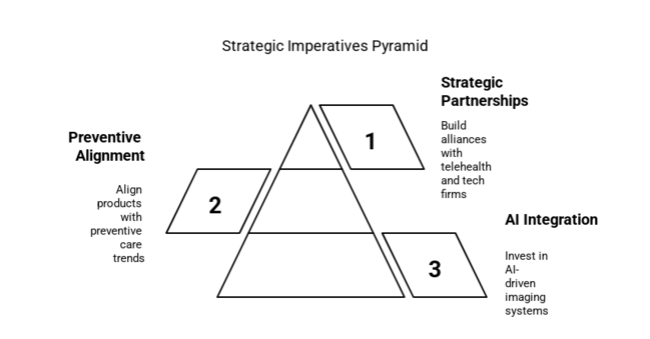

Step up AI integration in diagnostics

Executives will need to invest in AI-driven imaging systems and automated ECG interpretation to improve the speed and accuracy of diagnoses, especially in busy clinical settings.

Endorse offers to align with preventive cardiology trends

FMI thinks that aligning product pipelines to match the world's transition to preventive care-i.e., remote patient monitoring, more forward biomarkers for screening diseases, and diagnostics at home-will be integral to keeping a company industry relevant.

Build strategic partnerships through the care continuum

Firms must build stronger R&D alliances and distribution channels with telehealth companies, wearable tech vendors, and hospitals to support widespread deployment and a diversified long-term pipeline.

| Risk | Probability-Impact |

|---|---|

| Regulatory Delays in AI Tool Approvals | Medium-High |

| Data Privacy Concerns in Remote Monitoring Platforms | High-Medium |

| Supply Chain Disruptions for Diagnostic Equipment Components | Medium-High |

1-Year Executive Watch-list

| Priority | Immediate Action |

|---|---|

| AI-Driven Cardiac Imaging | Run feasibility on integrating machine learning algorithms in diagnostic suites |

| Remote Patient Monitoring | Initiate OEM feedback loop on wearable sensor integration and data interoperability |

| Global Distribution Expansion | Launch after industry channel partner incentive pilot in high-growth APAC and LATAM regions |

To stay ahead, companies need to reorient the cardiac testing strategy to scalable, AI-enabled platforms and proactive patient engagement models. This type of intelligence marks a shift from one-time tests to ongoing, preventive monitoring, which requires initial spending on remote devices, efforts to get AI approved by regulators, and partnerships with tech-focused manufacturers.

FMI analysis concluded that organisations adopting this transformation will achieve clinical mindshare and realise recurring revenue streams through service-based diagnostic ecosystems. The coming 12 months must prioritise aligning capital investment with the long-term digital transformation of healthcare.

Regional Insights

Diverging Perceptions of Return on Investment (ROI)

Cloud-Enabled Systems: Chosen by 66% across the world due to flexibility in decentralised care models.

Manufacturers

Future Investment Priorities

High Consensus: Geography-extended stakeholders converge on diagnostic reliability, AI integration, and cost savings as factors that will decide next-generation competitiveness.

Divergences of note

Strategic Insights: Companies will have to devise product portfolios-focusing on AI and velocity in the USA, regulatory strength and green tech in Europe, and lightweight, price-sensitive innovation in Asia-to realise maximum growth potential.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | FDA regulation via 510(k) or PMA is required for cardiovascular diagnostic devices. The FDA Digital Health Software Precertification Program is streamlining AI-based tool clearance, albeit data privacy under HIPAA continues to be a compliance challenge. |

| United Kingdom | Devices need to meet UKCA marking rules post- Brexit. The MHRA requires clinical performance data and cybersecurity preparedness for diagnostic software platforms. AI tools are required to comply with the UK Government's Code of Conduct for Data-Driven Health Tech. |

| France | The EU MDR regime and ANSM are responsible for regulation. All devices have to be CE marked. France's digital reimbursement system (For fait Innovation) subsidises the adoption of innovative cardiac testing, but only after they are stringently tested. |

| Germany | MDR requires CE certification, as well as further examination by BfArM. Germany's DiGA scheme provides expedited reimbursement for digital diagnostics that have proven clinical benefit and GDPR data protection compliance. |

| Italy | CE marking is obligatory under EU MDR. AIFA and the Ministry of Health evaluate diagnostic innovations, with increased focus on telecardiology. Public procurement is sluggish, but plans in the country are aiding digitisation in cardiology. |

| South Korea | Governed by the Ministry of Food and Drug Safety (MFDS). The devices need to get KGMP certification. The government encourages AI and digital health technologies, with sandboxes regulating entry for remote diagnosis and wearable-based solutions. |

| Japan | The MHLW and PMDA regulate the industry, requiring approval from SHONIN or Ninsho. Japan requires GVP and QMS compliance with stringent post- industry surveillance. Diagnostics based on AI are subjected to further checks for algorithm transparency and safety. |

| China | Approval by NMPA is necessary, along with CFDA registration. China requires local clinical trials for cardiovascular devices in general. The government is encouraging AI medical device innovation but has strict cybersecurity law adherence and data localisation requirements. |

| Australia-NZ | TGA requires ARTG registration and Essential Principles compliance in Australia. New Zealand follows Med safe requirements. Both nations are encouraging digital diagnostics, with Australia actively considering AI-specific medical device regulations. |

| India | The industry is regulated by CDSCO, with an import licence or manufacturing licence under the Medical Devices Rules, 2017. Cardiac testing was categorised as notified medical devices in 2020. Regulatory clarification on AI-based diagnostics is still unfolding. |

The United States industry for cardiovascular diagnostics is projected to grow at a CAGR of 5.6% during the period from 2025 to 2035. Reimbursement incentives, leadership in AI adoption, and highly developed healthcare infrastructure in the country fuel aggressive industry growth.

Major institutions are proactively embedding AI-augmented ECG, CT, and MRI platforms, backed by the FDA's Digital Health Software Precertification Program. Hospitals are making investments in interoperable diagnostics that are based on HIPAA-compliant data platforms.

Strong R&D ecosystems, high patient volumes, and mandates for preventive screening also promote early diagnosis and high throughput. The FMI analysis found the USA industry to be one of the most innovation-led in the world.

In the United Kingdom, the cardiovascular diagnostics industry is projected to grow at a CAGR of 5.0% during the period 2025 to 2035. Post-Brexit, the shift to UKCA-marked medical devices has added complexity, but national health institutions remain focused on digital cardiology.

The long-term plan of the NHS supports early detection and AI-based diagnostics, with funding schemes encouraging the modernisation of cardiac units. Frameworks for cybersecurity, data governance, and AI transparency align procurement.

FMI believes that public-private partnerships and national strategies for lowering cardiovascular mortality will steadily increase demand, particularly for cloud-based imaging tools and mobile diagnostics.

From 2025 to 2035, projections indicate a CAGR of 5.3% for the cardiovascular diagnostics industry in France. France has accelerated efforts to digitise cardiology departments with robust state-supported healthcare infrastructure and is increasing demand for AI-driven imaging. The ANSM, in accordance with EU MDR, imposes strict assessment requirements and CE certification as an absolute entry requirement.

Reimbursement through Forfait Innovation accelerates adoption of novel tools, provided they demonstrate measurable outcomes. FMI analysis found France’s growing ageing population, regulatory clarity, and emphasis on chronic disease management are strong growth enablers in this sector.

From 2025 to 2035, projections indicate a CAGR of 5.5% for the cardiovascular diagnostics industry in Germany. Germany is at the forefront of digital health integration in the European bloc, driven by the DiGA fast-track program and its established hospital network.

Cardiologists enjoy government-subsidised upgrades to diagnostics, provided they ensure clinical value and comply with GDPR data protection regulations. Demand is particularly high for AI-facilitated echocardiography and handheld diagnostics, which facilitate a more precise diagnosis in the outpatient department.

FMI believes that Germany's regulatory restraint balanced by digital advancement positions it among Europe's most investable cardiovascular diagnostic ecosystems.

Estimates indicate that the cardiovascular diagnostics industry in Italy will grow at a CAGR of 4.8% from 2025 to 2035. Although the Italian industry is quite fragmented, hospital modernisation programs run by national authorities are improving diagnostic penetration. Devices with CE certifications are obligatory, and government grants increasingly favour cloud-based platforms in public cardiology facilities.

FMI research discovered that Italy's increasing burden of chronic diseases and ageing population is driving investments in scalable AI-based solutions, particularly in city-based tertiary care centres. Nevertheless, longer procurement cycles and regional inconsistencies in digital health preparedness could temper growth compared to Western European counterparts.

From 2025 to 2035, projections indicate a CAGR of 5.4% for the cardiovascular diagnostics industry in South Korea. The country's high-density urban agglomerations and age factor have spurred the demand for remote diagnostics and cardiac devices compatible with wearables. MFDS provides regulatory sandboxes for nascent AI development, making way for local players as well as global contestants.

Seoul and Busan hospitals are at the forefront of adopting AI-integrated echocardiograms and intelligent ECG systems. FMI believes that South Korea's government-initiated digital health strategy, 5G networks, and partnerships for medical AI with technology titans present high-impact commercial prospects.

In Japan, the cardiovascular diagnostics industry is projected to grow at a CAGR of 4.6% during 2025 to 2035.

The rapid adoption of new technologies is moderated by cost controls and conservative hospital expenditures, even though Japan maintains excellent healthcare standards. SHONIN certification remains stringent, especially for AI-based diagnostics, and retraining limitations among clinicians limit rapid digitalisation.

Demand for portable and space-saving cardiac testing, though, is increasing in urban and elderly rural populations. FMI research indicated that the use of new technology will speed up after 2027 as payment options become clearer and public-private test programs prove that AI tools can help with heart screening and management.

The cardiovascular diagnostics industry in China is projected to grow at a CAGR of 5.8% during the period from 2025 to 2035. Proactive investments in AI-driven diagnostics and intelligent hospital equipment are underway, as cardiovascular disease remains the nation's leading cause of death.

NMPA approval and domestic clinical validation are required, although the regulatory simplification introduced recently is favourable for local innovation.

Urban hospitals implement cloud-integrated diagnostic equipment, whereas community clinics use more mobile ECG and ultrasound machines.

FMI believes national digital health initiatives, an ageing population, and reforms in public health will push China into the forefront of growth industries globally.

For the Australian-New Zealand industry, the cardiovascular diagnostic industry is set to grow by a CAGR of 5.2% between 2025 and 2035. Both TGA and Medsafe provide stable regulatory regimes, allowing regular industry entry through cutting-edge diagnostics.

The National Health Reform Agreement of Australia drives public hospitals toward embracing AI-augmented cardiac instruments for preventive healthcare and outreach to rural locations.

Remote patient monitoring, especially among underserved populations and indigenous communities, has witnessed government-initiated pilots spreading across states.

FMI analysis indicated that the widespread use of telehealth and the emphasis on portable diagnostic tools will keep boosting growth, but the complicated reimbursement process in New Zealand might slow down early business success.

The projections indicate a CAGR of 6.1% for the cardiovascular diagnostics industry in India from 2025 to 2035. The urbanisation of the country and the increasing incidence of heart disease are driving investments in cost-effective, scalable diagnostic equipment. The CDSCO requires licensing under the Medical Devices Rules, with greater emphasis on software and AI compliance.

Public and private healthcare programs like Ayushman Bharat are increasing diagnostic coverage in tier-2 and tier-3 cities. FMI believes that India's young med-tech ecosystem, government-supported digital health mission, and increasing health insurance coverage make it a high-growth frontier for cardiac testing.

Between 2025 and 2035, Implantable Loop Recorders (ILRs) will be the most profitable product segment, driven by increasing incidence of unexplained syncope, increased need for continuous monitoring of the heart, and incorporation of remote telemetry systems.

The ILR segment is anticipated to record a CAGR of about 6.9% between 2025 and 2035, higher than the general industry growth rate of 5.1%. These subcutaneous models provide diagnostic coverage for years, and their convenience is best suited for those with infrequent arrhythmic bursts and cryptogenic conditions.

Analysis by FMI identified a growing preference for ILRs compared to conventional Holter and event monitoring because they offer better diagnostic yields and compliance with patients.

Simultaneously, AI analytics are now able to send real-time alarmsand monitor patients using cloud technologies in both rural and urban health systems.

Between 2025 and 2035, High-Sensitivity CRP (hs-CRP) Kits will be the most profitable point-of-care testing segment because cardiovascular inflammation becomes a central diagnostic criterion in worldwide risk guidelines.

With continued advancement of smartphone-integrated and microfluidic devices, this application is expected to grow at a CAGR of 6.5% between 2025 and 2035. hs-CRP is increasingly being used on a routine basis in measuring subclinical atherosclerosis and directing statin therapy, especially among individuals who have normal lipid levels but elevated inflammation markers.

FMI believes clinical guidelines promoting aggressive screening and the move toward decentralised diagnostics will spur adoption of hs-CRP kits across emergency environments and outpatient clinics.

Cardiac Catheterisation Labs are poised to be the most profitable end-user segment during 2025 to 2035, given their pivotal role in procedural cardiology and advanced imaging diagnostics.

The Cardiac Catheterisation Lab segment is expected to register a CAGR of around 6.7% during the period from 2025 to 2035. With structural heart interventions, electrophysiology studies, and coronary angiographies increasingly dependent on intravascular diagnostics and haemodynamic monitoring, cath labs are evolving into precision centres for diagnosis as well as treatment.

FMI research has detected more spending on cardiac facilities, higher use of hybrid cath labs, and tighter integration of AI into real-time decision-making, all driving both the volume and complexity of procedures.

In the cardiac testing industry, leading players are competing on a combination of pricing agility, innovation-driven product differentiation, and strategic partnerships.

FMI research found that important companies are putting a lot of money into AI-based diagnostic tools, remote monitoring systems, and wearable ECG technologiesto improve diagnostic accuracy and enhance user accessibility.

Partnerships between telehealth providers and hospital networks are increasing access and adoption rates. At the same time, regional expansion-particularly into Asia and Latin America-is facilitating revenue diversification.

Price-sensitive industries are fuelling demand for portable, cost-effective devices. To remain ahead, top companies are also expanding R&D pipelines and obtaining regulatory clearances to accelerate next-generation cardiac testing.

Industry Share Analysis

Roche Diagnostics

Abbott Laboratories

Siemens Healthineers

Thermo Fisher Scientific

Danaher Corporation (Beckman Coulter)

BioMérieux

Other Players (Quidel Ortho, Singulex, etc.)

Key Developments in 2024

Roche Diagnostics introduced the cobas® t 711 troponin T assay in early 2024, advancing cardiac risk assessment with better sensitivity. The assay gained FDA clearance, further solidifying Roche's position as a leader in high-sensitivity cardiac biomarkers.

Abbott Laboratories extended its Alinity® hs-troponin-I assay to growing industries, such as India and Brazil, during Q1 2024. The expansion further secured Abbott's position in regions with increasing cardiovascular disease burdens.

Siemens Healthineers acquired Healthineers AG's last shareholding in Rapid Diagnostics in February 2024 to enhance its POC cardiac testing portfolio. The USD 1.2 billion transaction was aimed at speeding up decentralised diagnostics.

Thermo Fisher Scientific collaborated with Cleveland Clinic in April 2024 to establish next-generation cardiac biomarkers. The partnership centres on predictive algorithms for heart failure via Thermo Fisher's BRAHMS™ platform.

QuidelOrtho experienced a regulatory delay when the FDA sent a warning letter in March 2024 regarding manufacturing deficiencies in its Sofia® troponin assay. The firm is trying to resolve compliance issues affecting short-term sales.

BioMérieux obtained CE marking for VIDAS® Kube® automated immunoassay system in January 2024, simplifying cardiac testing in laboratories in Europe. The system incorporates AI-based analytics for quicker results.

The sales are being fuelled by increased prevalence of cardiovascular disease, improvements in non-invasive technologies, and increased need for early diagnosis.

The industry will grow gradually with rising uptake of AI-driven tools, home diagnostics, and growth in cardiac care infrastructure.

Major players are Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, Koninklijke Philips N.V., GE Healthcare and Wayra, Siemens Healthineers, Lepu Medical, Midmark Corp, Roche Ltd, Randox Laboratories Ltd., Robonik India, Diasorin, Elabscience Biotechnology, Danaher Corporation (Beckman Coulter), BioMérieux, and Thermo Fisher Scientific.

Implantable Loop Recorders are anticipated to dominate, backed by continuous monitoring and greater diagnostic yield.

It is anticipated to be around USD 10.69 billion by 2035.

The industry is segmented into electrocardiogram (ECG) system, resting ECG systems, cardiopulmonary stress testing systems, holter monitoring devices, event monitoring devices, implantable loop recorder (ILR), others.

The industry is segmented into analyzers, lipoprotein test kits, angiotensin test kits, fibrinogen test kits, serum uric acid test kits, high-sensitivity CRP (hs-CRP) kits.

The industry is segmented into hospitals, ambulatory surgical centers, specialty clinics, cardiac catheterization labs, diagnostic imaging centers.

The industry is studied across North America, Latin America, East Asia, South Asia & Pacific, Europe, Central Asia, Middle East and Africa.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.