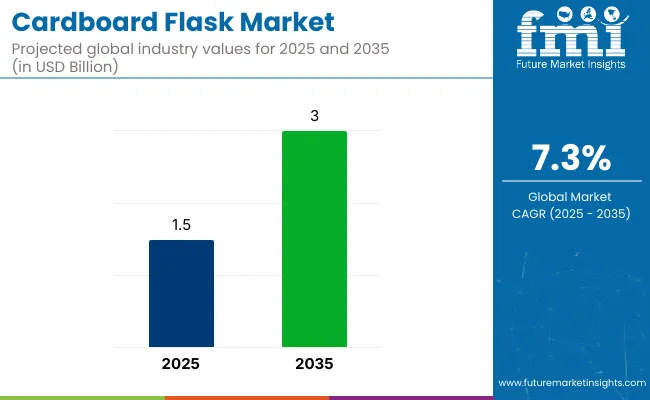

The global cardboard flask market is projected to grow from USD 1.5 billion in 2025 to USD 3.0 billion by 2035, registering a CAGR of 7.3% during the forecast period. Sales in 2024 were recorded at USD 1.4 billion. This growth is primarily attributed to rising environmental concerns, stringent regulations on single-use plastics, and growing demand for sustainable packaging solutions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.5 billion |

| Projected Market Size in 2035 | USD 3.0 billion |

| CAGR (2025 to 2035) | 7.3% |

Cardboard flasks, developed using recyclable and biodegradable fiber-based materials, serve as eco-friendly alternatives to plastic and glass. Their lightweight nature, customizable structure, and cost-efficiency make them ideal for packaging liquids in food, beverage, and personal care industries.

The cardboard flask market is witnessing rapid innovation, driven by the demand for sustainable, plastic-free packaging solutions. Recent developments include the use of moisture-barrier linings that enhance durability and extend shelf life while maintaining full recyclability.

Plant-based adhesives have replaced synthetic glues, making the flasks more environmentally friendly, while 3D-printed custom forms are enabling brands to design distinctive, ergonomic packaging suited to their identity and product type.

These innovations ensure that cardboard flasks meet both functional and aesthetic requirements, making them viable alternatives for liquids such as alcoholic beverages, personal care products, and even household cleaners. Additionally, smart packaging features like QR code-enabled traceability are being piloted by niche brands, allowing consumers to access detailed product information, verify authenticity, and engage with the brand story, thereby enhancing transparency and customer trust.

Looking ahead, the Asia-Pacific region is expected to lead market growth due to a combination of stringent plastic usage restrictions, rising consumer eco-awareness, and government-led sustainability initiatives. Countries like India and China are actively promoting biodegradable packaging through regulation and public awareness campaigns, creating fertile ground for cardboard flask adoption.

In response, manufacturers are prioritizing cost-efficient, scalable solutions and entering partnerships with regulatory and environmental bodies to fast-track approvals and encourage market-wide shifts. These collaborative efforts are not only fostering innovation but also building the infrastructure necessary to support mass adoption.

As production technologies advance and economies of scale improve, cardboard flasks are positioned to transition from niche novelty to mainstream sustainable packaging across multiple industries.

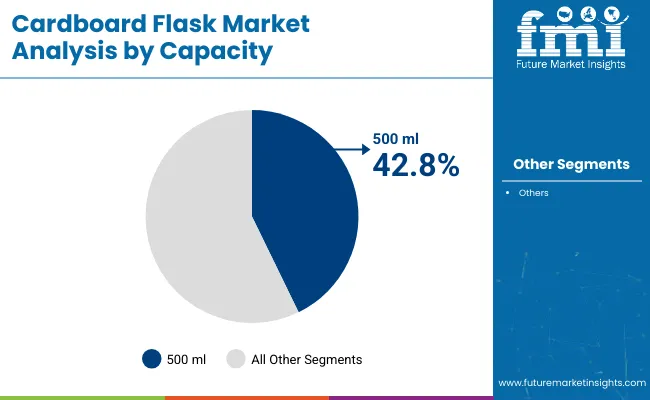

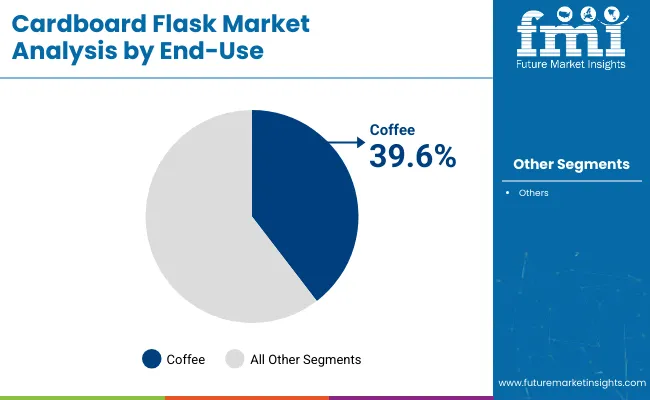

The market has been segmented based on capacity, product type, end use, and region. Capacity options such as 250 ml, 500 ml, 750 ml, and 1000 ml have been specified to cater to varying portion requirements across beverage service environments. Product types have been divided into printed and non-printed variants to support branding needs and plain packaging preferences.

End-use categories such as tea, coffee, soups, and other beverages have been included where cardboard flasks are used for portable, eco-friendly liquid containment. Regional segmentation has been structured across North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA) to address material trends, demand shifts, and regulatory standards.

The 500 ml capacity segment is expected to hold the largest share of 42.8% in the cardboard flask market in 2025, as its use has been driven by balanced volume, ease of handling, and suitability for single-serve formats. This size has been widely adopted for takeaway beverages, quick-service applications, and vending distribution.

Handling comfort, thermal retention, and branding space have been optimized for consumer and commercial use. Operational efficiency during filling and stacking has been supported through standardized 500 ml flask designs.

Compatibility with automated filling lines and tamper-evident sealing systems has been integrated for high-volume beverage packaging. Labeling and graphic customization have been facilitated by consistent surface geometry. Space-saving storage and consumer preference for mid-sized portions have reinforced its dominance. Market share has been maintained due to its widespread application across both hot and cold drink categories.

The coffee end-use segment is projected to account for 39.6% of the cardboard flask market in 2025, as its leadership has been driven by increasing out-of-home consumption, café chains, and mobile service formats. Cardboard flasks have been implemented for espresso, filter, and specialty blends requiring thermal insulation and spill prevention.

Consistent portioning and ergonomic grip have been achieved for use in kiosks, drive-thrus, and office vending solutions. Filling speed, stackability, and secure sealing have supported deployment across large-scale beverage networks.

Standardized flask sizes and lid compatibility have streamlined supply logistics for franchise and event catering channels. Branding and heat-handling performance have enabled their use in premium coffee offerings and fast-moving breakfast menus. Consumer familiarity with disposable formats has reinforced segment uptake in regional and international markets. Dominance has been supported by year-round coffee consumption and demand for portable packaging.

Durability and Performance Limitations

Durability and performance limitations as compared to conventional glass and plastic flasks would also make it a critical factor that needs to be addressed before large-scale consumption. Flasks made of cardboard must also be designed to resist moisture and maintain the integrity of the structure under varying temperatures of liquids, including both hot and cold, without the bottle degrading.

Moreover, concerns about leakage, degradation of material, change in resistance to pressure, and long-term usability hold consumers, retailers, and businesses from adopting the food packaging.

However, to meet these challenges, manufacturers need a significant investment in high-performing barrier coatings, structural reinforcement, innovative waterproofing, multilayer bio-polymer protection, and smart packaging solutions that support durability whilst also reaching sustainable goals and remaining competitive in the market.

Regulatory Compliance and Sustainability Standards

Adopting sustainability standards and increasingly strict environmental regulations can make compliance challenging for the Cardboard flask market, driving sales and production costs.

Governments and industry bodies demand biodegradable, compostable, and recyclable materials that must comply with food safety, material sourcing, and carbon footprint reduction requirements; therefore, design flexibility is often sacrificed.

Moreover, discrepancies between global rules on recycling infrastructure, disposal policies, landfill practices, and Extended Producer Responsibility (EPR) frameworks generate inconsistencies in the management of new-product waste and end-of-life treatment.

To align with increasingly stringent sustainability standards and circular economy directives, organizations need to innovate materials for sustainability, embed plant-based coatings, obtain sustainability certifications, implement AI-powered compliance monitoring technologies, and partner with waste management experts to establish a circular recycling infrastructure.

Growing Demand for Sustainable Packaging Solutions

Growing awareness of plastic pollution, increasing regulatory bans on single-use plastics, and global initiatives to reduce environmental. Cardboard flask are looking up for alternatives to fill in their needs of biodegradable, compostable, and recyclable packaging materials in areas such as beverage, food and personal care end-use industries.

Sustainable packaging companies will have considerable room for growth. Brands investing in these solutions for plant-based coating, water-resistant bio-materials, AI machine learning for sustainability analytics, wax alternative for brand-specific customizing, refillable packaging, lightweight structural design, will dominate more significant chunks of the burgeoning green packaging space and sideline the rest as newcomers in this industry.

Expansion into Diverse Beverage and Consumer Markets

The subtle versatility of cardboard flasks is driving expansion into diverse consumer segments, including fermented drinks, sparkling soft refreshments, dairy products, plant-based beverages, and ready-to-drink (RTD) coffee and tea markets.

Furthermore, the demand for lightweight, portable, and travel-friendly, yet maintainable packaging is growing in outdoor, athletic, experiential travel, and on-the-go usage markets, enhancing the chances of adoption. Groundbreaking innovations in barrier advances, resealable closures, extended shelf-life options, antimicrobial inner coatings, and tamper-evident components will further enhance marketplace penetration and appeal to environmentally aware customers.

Associations that focus on customization, premiumization, AI-driven inventory management, digital marketing campaigns, and innovative packaging developments will strengthen their position in the evolving sustainable drink packaging market, driving revenue growth and consumer engagement.

Looking ahead to 2025 through 2035, the market is expected to witness breakthroughs in smart packaging, degradable coatings, AI-driven quality control, and adaptive material integrity technologies, leading to enhanced product sustainability.

Wider acceptance of plant-derived polymers, fully compostable flask designs, carbon-neutral manufacturing procedures, intelligent packaging tracking, and next-generation bio-barrier solutions will redefine sector standards and marketplace expectations.

Additionally, the integration of digital tracking systems, QR-coded recycling initiatives, refillable packaging models, on-demand customization, and next-generation sustainable material combinations will drive invention, enhance brand competitiveness, and boost consumer engagement.

Companies that prioritize research and development, embrace digital transformation, implement blockchain traceability, and align with global regulatory compliance will emerge as sector pioneers in the expanding cardboard flask marketplace.

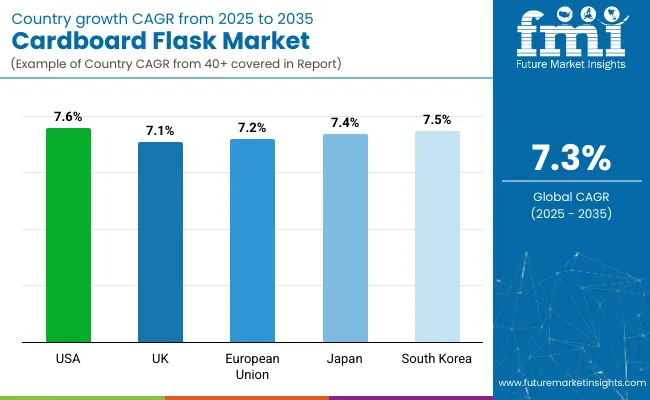

Several factors have bolstered the dominance of the United States in the cardboard flask market. Chief among these is the surging demand for sustainable and biodegradable packaging options, as well as the swelling adoption of such flasks within the beverage and foodservice sectors.

Furthermore, the booming expansion of e-commerce logistics has propagated requirement for these containers. Simultaneously, the persistent presence of premier packaging manufacturers alongside technological breakthroughs in recycled cardboard continues cultivating market progression.

The growing preference of consumers for eco-friendly, lightweight yet durable cardboard flasks aligns with innovations in moisture-resistant coatings and leak-proof designs, further fueling market growth. In addition, the incorporation of mechanization into flask fabrication, as well as sustainable printing remedies and extended shelf-life packaging, improves merchandise appeal across various industries.

Companies likewise focus on formulating cost-effective, fully recyclable cardboard flasks to meet the evolving sustainability objectives. The intensifying emphasis on reducing single-use plastics, while advocating for circular economic practices, also propels market growth within the United States.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The United Kingdom marketplace presents a robust demand for cardboard thermoses, driven by stringent federal laws aimed at reducing synthetic waste, increasing demand for eco-friendly beverage packaging, and evolving consumer preferences for recyclable alternatives. Government initiatives and company commitments to sustainability additionally contribute to the requirement.

Regulations supporting environmental packaging answers, coupled with innovations in biodegradable coatings and resilient cardboard fabrics, enhance marketplace increase. Moreover, breakthroughs in moisture-resistant, compostable, and heat-sealable cardboard thermoses are gaining momentum.

Corporations also invest in customizable, lightweight designs for various drink categories, including fruit juices, dairy, and alcohol. Consumers increasingly migrate toward plant-based, recyclable, and home-compostable packaging, further boosting expansion within the UK. In addition, the increase of eco-friendly manufacturers and e-commerce platforms that endorse plastic-free packaging accelerates adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

Germany, France, and Italy are undisputed leaders in the European cardboard flask market. They greatly benefit from stringent rules limiting single-use plastics, a public focused on eco-friendly packaging, and advanced recycling programs.

The European Union has placed a high priority on creating a circular economy through groundbreaking policies and strategic investments in compostable and biodegradable materials. This fosters the blazing growth seen across the region.

Additionally, the rise of moisture-resistant, food-grade cardboard flasks, combined with intelligent packaging that monitors temperature and freshness, is spurring new innovations. Demand is further fueled by the swelling sustainable beverage packaging movement, zero-waste grocery concepts taking hold, and eco-friendly event packaging solutions growing in popularity.

Range expansion of renewable fiber sources and optimized lightweight cardboard flask logistics also contributes to the market flourishing throughout the EU. Furthermore, new eco-labeling regulations and initiatives reducing carbon footprints are accelerating the transition to sustainable cardboard packaging alternatives.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.2% |

Japan’s rapidly developing cardboard flask marketplace has exploded as a consequence of the nation’s robust emphasis on environmental sustainability, call for ingenious packaging applied sciences, and government-led waste discount projects. The expanding choice for recyclable and biodegradable drinks packaging is gas the boom.

The USA's focus on technological improvements, coupled with the combination of water-resistant and warmth-sealed cardboard flasks, is fueling innovation. Furthermore, strict government laws on plastic trash control and emerging customer awareness approximately eco-friendly options are encouraging agencies to increase excessive-pleasant, food-secure packaging.

The emerging call for sustainable beverage containers, compostable comfort packaging made from seaweed, and bio-coatings is additional accelerating marketplace growth in Japan’s packaging industry. Moreover, the trend towards minimalist and purposeful packaging designs that reduce material usage supports the adoption of sustainable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

South Korea has certainly emerged as a pivotal locale for cardboard flasks, propelled by exacting waste management regulations, a surging adoption of eco-friendly packaging solutions across the sustenance and drink industries, and an escalating demand for lightweight, environmentally friendly options.

Robust administrative rules that powerfully advocate lessening plastic consumption when combined with the progressively far-reaching embracement of degradable and compostable stuffs are serving to broaden the market terrain.

Furthermore, the nation's focus on improving packaging functionality through sophisticated barrier coatings derived from plants, recyclable adhesives, and laminates is optimizing competitiveness.

The government's policies encouraging the utilization of sustainable materials and stricter guidelines on waste handling have been instrumental in transforming the nation into a forerunner in this sphere. Manufacturers have risen to the occasion and are devising innovative solutions that utilize biodegradable, recycled substances to pack both commonplace refreshments and exclusive products.

The burgeoning demand for sustainable carryout containers, molded fiber drinks packaging, and stackable cardboard flask solutions also fuels market uptake. Companies are investing in clever, biodegradable flasks with digital tracking and freshness indicators to enhance food safety.

The rise of green consumer preferences and sustainable dining trends in South Korea is further driving requirements for recyclable and compostable packaging remedies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

The cardboard flask industry has seen tremendous expansion in recent decades owing to the urgent necessity for sustainable packaging options across the food and beverage sectors. Both customers and corporations have increasingly embraced eco-friendly choices to ubiquitous plastic containers, spurring widespread adoption of cardboard-founded flasks.

Makers have redoubled their efforts towards creating designs that are both creative and resilient, as well as recyclable, to appeal to environmentally aware buyers. Emerging patterns permeating the sector include featherweight yet hardy flask architecture, biodegradable external coatings, and optimized thermal protection to accommodate diverse liquid requirements.

Companies have invested significant assets in research and development aimed at enhancing material strength and cost-effectiveness while upholding their commitments to sustainability. In the meanwhile, some manufacturers are exploring hybrid cardboard-plastic materials and new production techniques to meet demanding performance benchmarks and expand into new markets.

Alternative routes being investigated consist of material science breakthroughs, multi-material composites, and closed-loop manufacturing systems destined to lessen environmental impacts throughout the product lifecycle.

The overall market size for Cardboard flask market was USD 1.5 billion in 2025.

The Cardboard flask market expected to reach USD 3.0 billion in 2035.

A variety of factors fuel the cardboard flask marketplace, such as increasing consumer choice for sustainable options and growing focus on biodegradable alternatives within food and drink sectors. Simultaneously, heightened public recognition of plastics reduction legislation complements innovative solutions in recyclable, leak-proof containers. While demand rises within food and beverage domains, specialized manufacturers deliver advanced packaging satisfying environmental regulations alongside performance needs through thoughtful cardboard innovations.

The top 5 countries which drives the development of Cardboard flask market are USA, UK, Europe Union, Japan and South Korea.

Multi-color and single-color printed flasks growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Cardboard Trays Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Cardboard Crates Manufacturers

Cardboard Filler Market Trends – Size, Demand & Forecast 2024-2034

Cardboard Tubs Market

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Breaking Down Market Share in Composite Cardboard Tube Packaging

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Demand for Corrugated Cardboard Cutting Machine in USA Size and Share Forecast Outlook 2025 to 2035

Pocket Flask Market

Spinner Flask Market Size and Share Forecast Outlook 2025 to 2035

Metal Thermos Flask Market Trends & Forecast 2024-2034

Disposable Tea Flask Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA