From USD 209 million in 2020, the global carbon mold market (2023-2025) is expected to reach USD 929 million, representing an approximate 7.12% expansion rate, from USD 585 million during the evaluation period. Precision manufacturing relies on carbon molds for fabricating a wide range of components, particularly those that are complex and durable.

Increasing uptake of carbon fiber-reinforced composites and innovation in mold manufacturing technologies are driving demand for the market. In addition to these factors, the industry's rapid evolution is also being driven by the rise of automation in manufacturing, increased investment in 3D printing solutions, and a growing emphasis on sustainable and energy-efficient materials.

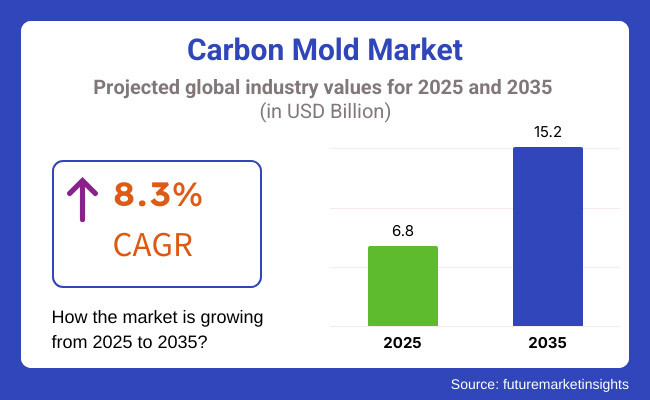

The Carbon mold market was at USD 6.8 billion in 2025. The market is estimated to be USD 8.2 billion in 2020 and is expected to be USD 15.2 billion by 2035, with a compound annual growth rate (CAGR) of 8.3% during the forecast period. The growing demand for lightweight, high-performance materials, advancements in mold-making processes, and increasing investments in carbon composite applications drive the growth of this market.

Other factors, including the rising use of artificial intelligence in mold design, enhanced thermal resistance, and cost-effective production processes, will bolster market growth. Additionally, the market penetration and consumer adoption are further dependent on the development of reusable carbon molds with a longer life.

Explore FMI!

Book a free demo

North America is a leading market for carbon molds owing to a robust aerospace and defense industry, significant investments in advanced manufacturing technologies, and large-scale adoption of carbon composite materials. 2 - Next-generation carbon molding solutions, including automated molds fabrication and AI-powered process optimization, are being advanced to commercialization pace by leaders in United States and Canada.

The rising need for lightweight vehicle parts, regulatory incentives toward fuel-efficient transportation, and increasing industrial robotics applications are propelling market growth. Furthermore, growing demand for high-performance carbon molds in renewable energy and medical device manufacturing continues to drive product development and adoption.

The demand for renewable and high-strength materials, regulatory legislation for lightweight engineering solutions, and advancements in composite molding technologies are expected to drive the European market. Countries, including Germany, France, and the UK, are focusing on specific priorities, such as high-precision and energy-efficient carbon molds for the automotive, wind energy, and aerospace sectors.

The rising concern for carbon neutrality, material recyclability, and research for the next generation of composites is contributing to the market adoption. Further additions, such as applications in electric vehicle manufacturing, high-performance sports gear, and architectural fabrication, are opening up further avenues of opportunity for manufacturers.

The Asia-Pacific region is expected to register the highest revenue growth rate in the Carbon mold market, driven by rapid industrialization, increasing investment in advanced material research, and growing demand for high-strength manufacturing solutions. Chinese, Indian, and Japanese companies are investing billions in carbon mold technology to enhance domestic production in the automotive, electronics, and aerospace sectors.

The rise in electric vehicle production is accelerating regional growth, the spread of 3D printing use cases, the development of industrial automation trends, and the moves the government is making to support advanced manufacturing.

Moreover, growing awareness regarding carbon fiber-reinforced molds used for manufacturing lightweight structural parts is further contributing to propel their demand in the market. The growth of domestic mold manufacturers and alliances with global industry participants is also boosting market growth.

This is mainly owing to growing awareness regarding lightweight materials combined with an increase in demand for high-performance industrial components as well as increasing investments in aerospace and automotive manufacturing, favoring the steady growth observed in the Latin American market.

Brazil and Mexico are major contributors, concentrating on increasing access to inexpensive, high-quality carbon molds for multiple applications. The use of local raw materials, low-cost production processes, and marketing of carbon composite products is also supporting market growth.

Moreover, the increasing number of renewable energy projects, industrial automation, and government incentives to drive advanced manufacturing have further made products more accessible across the region.

The Carbon mold market is slowly entering the MEA region, and various new investments are being made for infrastructure development, renewable energies, and high-end manufacturing solutions. A sector where the UAE and South Africa could bolster product availability and technological improvements.

Establishing organizations and expanding demand for carbon-based tooling solutions are additional factors supporting market growth, along with partnerships between global and regional manufacturers.

Furthermore, government policies that support material innovation, improvements in carbon recycling processes, and consumer demand for durable and lightweight manufacturing components are bolstering long-term industry growth. This is also attributable to an increasing preference for sustainability initiatives, which are augmenting towards high-tech production facilities in the region.

The Carbon mold market is anticipated to perform steady growth during the upcoming decade due to the continuous evolution of composite molding, automation and carbon material processing. Advancements in mold design, precise manufacturing, and sustainable material sourcing are crucial areas for companies seeking to innovate for enhanced functionality, market appeal, and long-term usability.

Moreover, growing demand for lightweight engineering, rapid digital integration across production lines, and other upcoming industrial trends are shaping the future of the industry. Additionally, AI-driven manufacturing analytics, automated molding machines and eco-friendly carbon fiber alternatives are also further optimizing production efficiency and ensuring high-quality worldwide mold fabrication.

Challenge

High Production Costs and Raw Material Constraints

High fibre costs and complicated mold manufacturing processes have increased the overall profitability of the Carbon mold market, which remains a challenge. Carbon molds are precision-engineered, requiring specialized equipment and advanced curing techniques, which leads to higher production costs and longer lead times.

Additionally, cost pressures are intensified by unpredictable prices of raw materials, supply chain disruptions, labor shortages, and a restricted supply of high-quality carbon fibers. With increasing global demand for carbon composites, wider usage leads to more competition for carbon composite inputs and can make those inputs scarce, closing them off to small- and mid-sized manufacturers.

To counter these benefits, producers need to invest in optimized production processes, explore alternative composites made from carbon, implement more automation, and seek partnerships with reliable material suppliers to secure supply chain stability alongside cost reduction.

Regulatory and Environmental Compliance

Stringent environmental regulations around carbon fiber production, energy-intensive manufacturing process, and disposal make it challenging for the Carbon mould markets to remain compliance. The production of carbon molds releases carbon dioxide emissions, creates non-biodegradable waste, and produces toxic by-products; hence, companies need to implement green manufacturing practices.

Moreover, the technical nature of carbon fiber recycling presents a limit of sustainability efforts due to its relative longevity, thermal resistance, and multilayered polymer matrix structure. Environmental regulations, including emissions, workplace safety, and the sourcing of materials, make it even more complicated.

Manufacturers must adopt green production technologies, invest in carbon fiber recycling initiatives, conduct lifecycle analyses, and adhere to global sustainability standards to minimize environmental impact and mitigate the risk of costly regulatory action.

Opportunity

Growing Demand in Aerospace, Automotive, and Industrial Applications

Aerospace, automotive, and industrial manufacturing are key industries where carbon molds will see an increase in demand due to the demand for lightweight, high-performance materials. In particular, carbon moulds enable the production of light and stiff parts with impact strength as well as structured, optimized designs, properties of high relevance for transport vehicles to reduce fuel consumption and e-vehicle battery housings, as well as a new aircraft concept.

Moreover, the increasing applications of electric vehicles, unmanned aerial systems (UAS), and next-gen robotics are further boosting the demand for this carbon composite. Companies that create novel new techniques to enhance the durability of molds; simulation of mold AI process; mold AI simulations; accelerate cycles; and scalable production capabilities will be assisted within the tremendous adoption of carbon molds in the managing sectors of advance manufacturing.

Advancements in 3D Printing and Automated Manufacturing

Production costs, material waste, and labor requirements are all decreasing with the introduction of 3D printing, digital twin modeling, and automated manufacturing, collectively changing the game in the Carbon mold space. On-demand production via additive manufacturing allows faster prototyping, complex geometries for mold designs, as well as the development of lighter, more efficient molds with optimized structural integrity.

AI-based automation also improves consistency, enables predictive maintenance, scales efficiently, and makes production more efficient, allowing for mass customization. Demand for advanced mold-making technology that relies on robotic-assisted mold fabrication, AI-driven material selection, digital twin technology for simulation, and next-gen mold surface treatments will put any such supplier at the forefront of this large-scale boil-up, while also building efficiency, reducing defects, improving uptime, and minimizing downtime output.

According to Future Preparedness, between 2020 and 2024, the Carbon mold market experienced growth driven by increasing demand for lightweight materials in transportation, aerospace, renewable energy, and industrial applications.

Nonetheless, impediments such as high production costs, shortages of raw materials, supply chain disruptions, and regulatory constraints delayed widespread adoption and led to operational inefficiencies.

The company’s counters utilize engineering to develop elegant production methods, advance hybrid carbon composite molds, resin infusion technologies, and reinforce AI-based automation, thereby reducing production times, minimizing material waste, and deferring manufacturing costs while adhering to sustainability specifications.

By the time we reach 2025 to 2035, expect to see advances in sustainable carbon fiber recycling techniques, AI-driven improvements in mold design, and nanoseconds-augmented composite materials for superior performance.

New carbon composites (graphene-infused carbon materials and carbon threads), self-healing and shape-recoverable composites, ultra-high-temperature resistant die molds, and bio-based carbon fibers will enhance the durability, energy efficiency and sustainability of production. Long-term market transformation will also be furthered by the adoption of circular economy models, carbon-neutral manufacturing, blockchain-enabled traceability and real-time AI anticipatory and preventative quality control systems.

Leading companies will be those who have leaped these innovations, have built strong digital manufacturing capabilities, and can adapt to these changing environmental regulations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with emission standards and waste management regulations |

| Technological Advancements | Growth in automation and precision molding |

| Industry Adoption | Increased use in aerospace, automotive, and industrial sectors |

| Supply Chain and Sourcing | Dependence on traditional carbon fiber suppliers |

| Market Competition | Dominance of established carbon composite manufacturers |

| Market Growth Drivers | Rising demand for lightweight, high-performance components |

| Sustainability and Energy Efficiency | Initial focus on reducing waste and optimizing production |

| Integration of Smart Monitoring | Limited use of AI in mold production monitoring |

| Advancements in Material Innovation | Use of traditional carbon fiber composites |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of circular economy models, carbon-neutral production, and recyclable carbon fiber initiatives |

| Technological Advancements | AI-optimized mold design, graphene-enhanced composites, self-healing carbon molds, and real-time defect detection |

| Industry Adoption | Expansion into medical devices, hydrogen storage, renewable energy, and robotics applications |

| Supply Chain and Sourcing | Development of alternative bio-based carbon materials and localized production for supply chain resilience |

| Market Competition | Rise of innovative startups, AI-driven mold fabrication, and sustainable material providers |

| Market Growth Drivers | Integration of smart manufacturing, generative design, AI-driven automation, and energy-efficient production |

| Sustainability and Energy Efficiency | Full-scale adoption of sustainable carbon fiber recycling and zero-waste manufacturing practices |

| Integration of Smart Monitoring | Real-time AI-driven predictive maintenance, digital twin modeling, and blockchain-based supply chain tracking |

| Advancements in Material Innovation | Development of nanomaterial-infused carbon molds, self-healing surfaces, and hybrid composite structures |

On the basis of geography, North America accounted for the largest share of the Carbon mold market owing to increasing applications from aerospace, automotive, and industrial manufacturing cliënten in the region. Market growth is driven by the presence of prominent producers of carbon composites and advances in lightweight, high strength materials.

The other factors supporting market growth are the increasing investments in high-performance carbon fiber molds for machining applications and the growing use of carbon-based tools for automotive prototype tooling. Moreover, the use of automation in mold manufacturing is on the rise, AI-based design optimization is in place and carbon composite recycling processes are making the industry more innovative.

Additionally, companies are focusing on developing high-temperature-resistant carbon molds to meet the growing demand of the aerospace and defense industries. USA market for aluminum extrusion (2020 USD - Billion)) along with manufacturers, partners, new entrants and suppliers) and others influencing the global industry is expected to grow with the increasing application of electric vehicles (EV) and lightweight structural components.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

Carbon Molds Market in UK - Out of all the countries, the UK held the key market for carbon molds globally in 2016, with key growth being driven by increasing investment in aerospace R&D, advanced manufacturing, and the increasing penetration of composite materials in automotive applications. Sustainability and lightweight engineering are also driving demand.

Government policies promoting carbon-neutral manufacturing and advancements in technology such as carbon fibers mold techniques also support market growth. Additionally, developments in high-precision mold design, CNC-machined carbon molds, and hybrid composite manufacturing are also gaining momentum.

The companies are also investing extensive resources in fast prototyping solutions, as well as additive manufacturing, in an effort to streamline their processing and reduce costs. In the UK, Market growth is also propelled by the rising use of carbon molds in wind energy applications and the production of next-generation aircraft components. There are also developments in new materials for high-performance molding applications, resulting from collaborations between research institutes and industry leaders.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.7% |

The European Carbon mold market is dominated by Germany, France, and Italy, due to their robust industrial manufacturing environment, demand for lightweight materials, and investment in sustainable composite solutions.

Stringent policies enforced by the European Union to curb carbon emissions, combined with advanced material application techniques and government initiatives supporting high-performance manufacturing, further propel market growth. Moreover, the use of carbon fiber-reinforced polymer (CFRP) molds, automation of carbon shell production, and high-precision tooling innovations are enhancing product performance.

Moreover, the emergence of electric mobility and sustainable construction materials, as well as the growing application of high-speed rail for the transportation of both passengers and freight, are expected to propel the demand for advanced carbon mold solutions, which in turn will fuel market growth in the future.

The innovation of carbon mold technologies in the EU market is also being driven by the rise of large-scale 3D printing and the development of AI-driven materials. In parallel, the composite industry is being pressured by circular economy initiatives to research recyclable and bio-based alternatives to carbon fiber.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.8% |

The strong focus on precision engineering and high-performance materials, combined with innovations in automated mold production, is contributing to the growth of the Japanese carbon mold market. Market growth is also fueled by the growing demand for lightweight and durable carbon molds in robotics, automotive, and industrial applications.

Innovation is being stimulated by the country's development in technology and AI, which is applied in innovative materials science, nanocomposite reinforcement, and automated mold manufacturing. Additionally, significant government incentives for sustainable and advanced manufacturing methods are motivating companies to create high-grade carbon fiber mold solutions.

Japan’s industrial sector expansion is being further amplified by the growing demand for carbon molds in the production of hybrid and hydrogen fuel cell vehicles. Moreover, the implementation of smart sensors in mold manufacturing for predictive maintenance and real-time quality monitoring is also witnessing considerable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.0% |

The advanced manufacturing landscape in South Korea, coupled with growing adoption of carbon fiber in electrical and automotive applications, in addition to government backing of high-tech industries, has led to the emergence of this market.

The market growth is also highly attributed to strong government regulations that fostered smart manufacturing, as well as the growing application of carbon molds within semiconductor manufacturing and the enclosures of electric vehicle (EV) batteries. Additionally, the country’s focus on increasing production output efficiency through initiatives such as high-speed mold machining, vacuum-assisted carbon fiber molding, and digital twin simulations is enhancing competitiveness.

Market adoption is also driven by increasing need for carbon molds used in electric aviation, renewable energy, and sports equipment among others. Molding of hybrids of various materials and graphene-enhanced carbon composites is expected to ease the cost burden while improving strength.

The implementation of Industry 4.0 technologies for carbon mold production represents a sector-wide transformation, promoting innovation and operational efficiency within South Korea's high-tech materials ecosystem.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.1% |

The rest of the market is captured by dies and carbon fiber molds because of their advantage over strength-to-weight ratio, long-term durability, and higher thermal resistance. Those molds are widely utilized in industries that need lightweight and high-performance components, including aerospace, automotive, and energy industries.

Carbon fiber molds can withstand very high temperatures without deforming, which is why they are often used in precision molding applications that require such properties. Additionally, advancements in carbon fiber production, from automated layup to resin infusion techniques, have enhanced production efficiency and reduced prices, thereby spurring demand.

The carbon mold market is also comprised of Graphite molds, which hold a significant share due to their excellent machinability, heat resistance, and chemical stability. These molds are widely used in electronics and semiconductor manufacturing, an area where thermal conductivity and precision are crucial.

Graphite molds have found revolutionary applications in semiconductor fabrication due to the exponential demand for miniaturized and ultra-high-performance electronic components. Additionally, advancements in graphite treatment processes, including improved surface coatings and oxidation resistance techniques, have increased the longevity and effectiveness of these molds, making them an appealing choice for industrial applications.

In composite molding applications, male molds are essential for processes where the composite needs to be shaped externally. Custom molds like these are often used in both the aerospace and automotive industries to form aerodynamic structures and lightweight components.

Growing applications of fuel efficiency and emission reductions have bolstered the demand for Male Mold to manufacture complex and high-strength composite parts. To enhance the precision and repeatability of male mold production, manufacturers are also investing in CNC machining and additive manufacturing techniques that offer high precision.

However, female molds are extensively used in process applications where internal cavity formation is required. These molds offer excellent detailing and precision, making them ideally suited for developing intricate components associated with the electronics, semiconductor, and energy sectors.

In recent years, industrial manufacturing demands high yield to form molded parts and high micro-beam pressure increases due to female molds from carbon fiber-reinforced plastics (CFRPs), which drives demand for CFRP tooling. Improved female molds in terms of their efficiency and life at high temperatures are being developed through better mold surface treatments as well as vacuum-assisted molding processes.

One of the biggest consumers of carbon molds aerospace & defense will continue to be due to their lightweight and their increasing cellular structure, designed to increase the performance of aircraft and fuel economy. Carbon fiber molds are widely employed to manufacture aircraft fuselages, wing structures, and interior components.

The high demand for advanced aircraft with improved aerodynamics and reduced carbon footprints has also driven the adoption of advanced carbon molds in aviation. Additionally, the adoption of automated molding processes and robotic layup systems has enhanced production efficiency and accuracy, thereby promoting the growth of carbon mold applications in the aerospace and defense sectors.

The large market share of the automotive & transportation industry in the existing market, wherein a higher number of carbon molds manufacturers focused on providing lighter solutions to enhance the operation and efficiency of vehicles, is another crucial factor fueling the growth of carbon molds.

Carbon molds are used extensively in the manufacturing of electric vehicles (EVs), where minimizing weight is key to increasing battery range and minimizing energy use. Growth for carbon resin multi-wave mold technologies have come from the move towards sustainable mobility solutions and the growing market for high-performance composite materials in the vehicle structure.

The mold efficiency and design efficiency have been promoted by the accelerated innovation in the automotive field and the increased popularity of 3D printing and digital twin simulation in mold development.

The carbon mold market is expanding due to the growing demand for lightweight, high-strength, and heat-resistant materials across various sectors, including aerospace, automotive, and electronics.

With changing industry requirements, incorporating advanced carbon composite manufacturing technologies, cost-effective production, and improved durability have become the focus areas for industry players. Some trends include 3D printing with carbon molds (cheap prototypes), new high-temperature-resistant composites, and recyclable carbon fiber molds.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Toray Industries, Inc. | 17-21% |

| Hexcel Corporation | 13-17% |

| SGL Carbon SE | 10-14% |

| Mitsubishi Chemical Carbon Fiber and Composites | 7-11% |

| Nippon Carbon Co., Ltd. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Toray Industries, Inc. | Leading provider of advanced carbon fiber molds for aerospace and high-performance industrial applications. |

| Hexcel Corporation | Specializes in lightweight and high-strength carbon mold solutions for the automotive and defense industries. |

| SGL Carbon SE | Develops high-temperature-resistant carbon molds and composite solutions for various high-tech applications. |

| Mitsubishi Chemical Carbon Fiber and Composites | Focuses on cost-efficient carbon mold manufacturing with enhanced durability and recyclability. |

| Nippon Carbon Co., Ltd. | Innovates in high-purity carbon molds for the semiconductor and electronics industries. |

Key Company Insights

Toray Industries, Inc. (17-21%)

As a global frontrunner in advanced composite technologies for aerospace, automotive, and industrial applications, Toray Industries is present across 300 locations worldwide, providing a host of industry-leading solutions in the Carbon mold space.

Hexcel Corporation (13-17%)

Hexcel is a manufacturer of light, strong carbon fiber molds for aerospace, defense and other industrial applications.

SGL Carbon SE (10-14%)

Only SGL Carbon high-performance carbon materials ensure a precise plan with advanced play of high heat resistance and mechanical stability.

Mitsubishi Chemical Carbon Fiber and Composites (7-11%)

Their carbon molds are most cost-efficient and recyclable, aligning with MITSUBISHI CHEMICAL's recycling method and sustainable society vision for advanced integrated manufacturing.

Nippon Carbon Co., Ltd. (5-9%)

Nippon Carbon specializes in the precision machining of carbon molds, with a strong emphasis on semiconductors, electronics, and high-temperature usage.

Other Key Players (35-45% Combined)

Global and regional players in the carbon mold innovation space focus on efficiency, sustainability, and advanced composites technology. Key players include:

The overall market size for Carbon mold market was USD 6.8 Billion in 2025.

The Carbon mold market expected to reach USD 15.2 Billion in 2035.

Driving factors behind the carbon mold market include increasing usage in aerospace and automotive sectors, rise in lightweight and high-strength materials demand, advancements in manufacturing technologies, growing usage in electronics and energy sectors, and increasing need for affordable and durable molding solutions.

The top 5 countries which drives the development of Carbon mold market are USA, UK, Europe Union, Japan and South Korea.

Aerospace & defense and automotive sectors growth to command significant share over the assessment period.

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.