Carbon black market revenue is estimated at USD 14.50 billion in 2025 and expected to reach USD 23.17 billion by 2035, expanding at a 4.8 % CAGR. The United States remains the most lucrative national market in 2025, buoyed by a huge replacement-tire base and early EV-battery investments, while China is set to be the fastest-growing country through 2035 as tire, plastics, and lithium-ion cell capacity scale in tandem with its “dual-carbon” roadmap.

Across the value chain, tightening emission caps, volatile oil-feedstock prices, and OEM pressure for lower rolling-resistance tires are reshaping the carbon black market. Producers are prioritising ultra-clean furnace technology, acetylene-black lines for battery cathodes, and recovered carbon black (rCB) ventures to lock in circular supply.

High capital costs and inconsistent rCB quality still restrain smaller entrants, spurring alliances between tire majors, pyrolysis start-ups, and petrochemical refiners. Key trends steering the market include AI-enabled dispersion control, bio-oil feed blends that trim CO₂ up to 20 %, and blockchain batch tracing for ESG audits.

Looking ahead, the carbon black market will pivot from bulk reinforcement toward high-purity, low-footprint chemistries. Edge-connected reactors will tune particle morphology in real time, matching tread wear indices and battery-grade conductivity specs while slashing off-grade scrap.

By 2030, recovered-carbon blends are expected to win mainstream OE tire approval, and scope-3-linked “carbon black-as-a-service” contracts will emerge as automakers outsource embedded-carbon reduction. Suppliers embedding CCUS modules, ISO 14067 reporting, and drop-in rCB masterbatches are poised to capture outsized share through 2035.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.50 billion |

| Industry Value (2035F) | USD 23.17 billion |

| CAGR (2025 to 2035) | 4.8% |

Acetylene black is enjoying a breakout run because its ultra-high conductivity (<5 Ω·cm) and low metal ash (<20 ppm) meet the purity bar for EV cathodes, super-capacitors, and 5G antenna pastes. New reactors in Jiangsu, Ulsan, and Texas are being tuned for particle diameters below 35 nm, which slash internal resistance in lithium-ion batteries by ~12 %.

Meanwhile, recovered carbon black (rCB) is moving from pilot scale to commercial tonnage. Michelin, Bridgestone, and Continental each signed multi-year offtake MOUs in 2024, pulling rCB into mainstream passenger-tire tread at 10-15 phr loadings.

The big unlock is de-ashing & de-volat purification: plasma torches and super-critical steam now cut PAH levels by 85 %, letting rCB clear REACH toxicology gates. Expect rCB capacity to top 1 Mt by 2030, lifting its CAGR to roughly 7 %, well above furnace black’s ~4 %.

While standard-grade furnace black continues to dominate traditional applications-particularly in tires, where it remains the go-to filler for tread and sidewalls-its growth is plateauing due to commoditization and pricing pressure.

Specialty-grade carbon blacks, on the other hand, are emerging as margin-rich champions, commanding 3-5 times higher profits by solving high-performance challenges such as UV shielding, color fastness, thermal runaway prevention, and electromagnetic compatibility (EMC) in advanced materials.

Two high-growth segments stand out: First, super-jetness blacks (L* < 2.0 on 2-µm films) have seen a surge in demand from automotive OEM paint shops in the US and Germany, where clear-over-base systems require deep black finishes. Second, high-BET conductive blacks (>110 m²/g) are critical in achieving sub-10⁶ Ω/sq resistivity in TPU and PA films, allowing lightweighting in foldable-phone hinges and radar domes.

These specialty applications-especially in additive manufacturing powders and printable antennas-are driving a projected 5.8% CAGR in specialty-grade volumes, outpacing the ~3% growth expected for standard grades.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Specialty-Grade Carbon Black | 5.8% |

Tires continue to account for over 50% of global carbon black consumption, but the product mix is evolving. As EVs demand low rolling resistance to extend driving range, OEMs are adjusting tread formulations-moving from N220/N330 to blends like N550 and silica with coupling agents-slowing volume growth but improving per-kilogram value.

Non-tire rubber applications such as hoses, belts, and gaskets are expanding with industrial capex; peroxide-cured EPDM hoses filled with low-ash N774 are even entering hydrogen service.

Inks and coatings show the highest value CAGR (5.6%), driven by low-PAH food packaging inks, anti-static floor coatings for semiconductor fabs, and high-jetness blacks in luxury auto trim. Plastics are growing at roughly 5.0% CAGR as masterbatch use expands into UV-resistant drip irrigation pipes, HDPE geomembranes, and fiber-optic conduits-applications where high surface-area grades deliver durability in harsh environments.

Though the battery sector represents a small volume share today, it’s scaling fast; each 100 GWh of Li-ion cell output demands ~2,400 tons of conductive carbon black, setting the stage for double-digit growth in energy storage applications.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Inks & Coatings | 5.6% |

Future Market Insights conducted a survey of almost all the key stakeholders of the carbon black industry, including manufacturers, suppliers, and end-users. The survey highlights that supply chain resilience is a top priority, with 68% of respondents emphasizing the need to diversify raw material sources to reduce disruptions. The majority of stakeholders highlighted the importance of local production in reducing dependence on vulnerable global supply chains.

Sustainability also ranked very high, as over 72% of participants named the rising demand for low-carbon and recycled carbon black. Manufacturers are being forced to invest in sustainable practices due to regulatory compliance as well as corporate sustainability initiatives, and several rCB-based projects are being trialed by companies. Respondents in the automotive sector also expressed a desire for sustainable alternatives to tire production.

Technological advances should also steer the industry's future; for example, 78% of respondents chose innovation in the uses of specialty carbon black as one of the main growth drivers. The electric vehicle and advancements in conductive topcoats are driving the industry towards high-performance products. Digitalization and AI-based quality control processes are being more frequently adopted to drive efficiency and consistency in product output.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | Under the Clean Air Act, the Environmental Protection Agency (EPA) imposes air quality standards that carbon black producers must comply with, as they have strict emissions standards. Under TSCA, manufacturers must report the use of chemicals. Certifications: ISO 14001 (Environmental Management), REACH (in case of EU export). |

| United Kingdom | The UK REACH system is similar to EU norms but has its own compliance structure. More stringent carbon footprint regulation and sustainable production incentives. Accreditations: UKCA (product safety), ISO 9001 (quality management), ISO 14001. |

| France | The French Environmental Code enforces strict controls on emissions during industrial production. Additional regulations such as Extended Producer Responsibility (EPR) ensure sustainable waste management practices. Certifications: REACH, ISO 45001 (Occupational Health & Safety), NF Certificate for industrial products |

| Germany | The Bundes-Immissionsschutzgesetz (BImSchG) regulates air pollution, representing limits for industrial emissions. The government also promotes circular economy measures, for example, recycling obligations. The government has obtained certifications such as REACH, Eco-Label Blue Angel for eco-friendly products, and ISO 50001 for Energy Management. |

| Italy | The Italian Ministry of Ecological Transition enforces EU environmental laws and provides specific incentives for the adoption of low-carbon production techniques. Certifications: REACH, Ecolabel EU (for eco-friendly products), ISO 14064 (GHG Emissions Reporting) |

| South Korea | It is subject to the Korean Chemicals Control Act and the Clean Air Conservation Act and includes reporting and emission reduction. The country has tax incentives for companies that make the switch to sustainable production processes. Certifications: K-REACH, ISO 14001, Korean Eco-Label. |

| Japan | Both the Air Pollution Control Act and the Chemical Substances Control Law impose strict regulations on industrial emissions and chemicals in general. Green Procurement Policies in Japan-Japan encourages environmentally sustainable manufacturing as well. Certifications: JIS, ISO 14001, Eco Mark (eco-friendly). |

| China | The new Environmental Protection Law establishes emissions cuts and carbon-trading regimes for heavy polluters. Manufacturers of black carbon need increased licensing. Certification: CCC (China Compulsory Certificate), ISO 14001, China Green Label. |

| Australia & New Zealand | Manufacturers are required under the National Greenhouse and Energy Reporting (NGER) Act to report carbon emissions. Both countries advocate the principles of the circular economy through waste reduction policies. ISO 14001, GECA (Good Environmental Choice Australia), and Environmental Choice NZ certifications. |

| India | The Central Pollution Control Board (CPCB) regulates and enforces emission standards for industrial units. The government incentivizes a carbon credit program for companies that adopt environmentally friendly practices. ISO 9001, BIS (Bureau of Indian Standards), GreenPro Certification. |

The sector in the USA is growing steadily at a CAGR of 4.5%. The strict EPA emissions regulations in the country have been a driving force for manufacturers to move towards cleaner and greener production methods, an expanding focus on recovered carbon black (rCB). Additionally, the growth of electric vehicle (EV) outputs is driving the demand for specialty carbon black for batteries and conductive applications.

Government incentives for sustainable manufacturing and upward integration in advanced material science also help enable innovation across the country and provide a steady growth trajectory through 2035. The product demand in the United States accounted for a share of 76% of the industry in North America.

Strict carbon neutrality goals and adherence to UK REACH regulations governing imports and domestic production significantly impact the UK carbon black industry. The automotive industry, particularly the tire industry, is still the main driver of demand. But high energy prices and the country’s adoption of circular economy measures are driving manufacturers to transition to recovered and bio-based carbon black.

Government policies supporting low-emission production are encouraging companies to adopt greener methods. In addition, the growing use of specialty carbon black in coatings and polymers is driving the industry's growth. The Carbon Black Industry in the UK is growing steadily at a CAGR of 4.2%.

Similarly, the French carbon black industry has been oriented toward sustainability due to the French Environmental Code and the EU Green Deal. It is growing steadily at a CAGR of 4.0%. The main consumers are the automotive and aerospace industries, primarily for manufacturing high-performance tires and rubber components.

As emission regulations mount, countries have invested heavily in carbon capture and carbon capture and utilization (CCU) initiatives, while recovered carbon black (rCB) is gaining broader adoption in the manufacturing sector. Moreover, the government’s focus on supply chain localization is boosting domestic production and limiting import dependency, ensuring steady growth until 2035.

As Europe’s largest automotive base, Germany is also a lucrative opportunity for the carbon black industry. The country's automotive sector, high-performance tire production, industrial rubber, and specialty applications are driving steady demand. The Bundes-Immissionsschutzgesetz (BImSchG) Act has strict limits on emissions, which has made companies invest in environmentally friendly ways to make things, like using renewable materials and low-carbon processing methods.

Investment in EV production and battery technology is increasing, which is accelerating growth even more. Germany is investing in industrial automation for specialty carbon black applications (coatings, polymers, 3D printing materials), for innovation in material science and to drive long-term growth. The Carbon Black Industry in Germany is growing rapidly at a CAGR of 4.6%.

Italy’s carbon black industry is witnessing increased demand from the automotive, construction, and footwear sectors. Manufacturers are incentivized to adopt greener alternatives under the Italian government’s National Ecological Transition Plan, which emphasizes sustainable manufacturing.

Investment in low-carbon production technologies is being catalyzed by the Eco-label EU certification and other sustainability mandates. The demand for conductive carbon black in electronics and coatings is also growing, and in this case, Italy’s growing share of high-tech industries will work to an advantage. The carbon black industry in Italy is growing significantly at a CAGR of 4.1%.

South Korea’s leading role in automobile and semiconductor production determines its carbon black industry. Strict regulations on emissions and processes imposed by the Korean Chemicals Control Act and the Clean Air Conservation Act are pressuring producers to move toward eco-friendly manufacturing solutions. Specifically, the country is investing heavily in recovered carbon black (rCB) technologies and in high-performance specialty carbon black for batteries and electronic components.

Government incentives in South Korea target sustainable supply chain development, encouraging investment in recovered carbon black (rCB) and eco-friendly manufacturing processes. This enhance production efficiency and drive long-term industry expansion.

Government incentives in South Korea target sustainable supply chain development, which additionally underpins long-term industry prospects. The Carbon Black Industry in South Korea is expected to grow significantly at a CAGR of 4.8%.

The carbon black industry is growing at a steady pace in Japan at a CAGR of 4.3%, led by its automotive, electronics, and high-performance coatings sectors. Based on the Chemical Substances Control Law and Air Pollution Control Act, companies are encouraged to reduce carbon emissions and invest in sustainable alternatives. Similarly, Japan’s Green Procurement policies are further promoting a transition from conventional to bio-based and recovered carbon black by manufacturers.

The industry continues to see strong growth due to the latest in semiconductor manufacturing and battery technology, which require high-purity specialty carbon black. The growing usage of lightweight materials in automotive production is fueling the demand for advanced black carbon formulations.

China is the largest producer and consumer of carbon black, driven by strong demand from automotive, tire, and industrial rubber sectors. The new Environmental Protection Law and targets for carbon neutrality by 2060 are changing the makeup of the industry, driving investment in clean production technologies and circular economy programs.

It is also a leading producer of electric vehicles, creating demand for high-performance carbon black in batteries and conductive applications. The industry will likely continue to expand at the fastest pace in the world, spurred by the Chinese government’s insistence on lowering carbon emissions and funding green technology. The carbon black industry is growing rapidly in China at a CAGR of 5.2%.

The carbon black industry size in Australia and New Zealand is expected to grow but is relatively small as per industries such as construction, mining, and automotive. The National Greenhouse and Energy Reporting (NGER) Act mandates the reporting of emissions, prompting manufacturers to transition to low-carbon production technologies.

The adoption of recovered carbon black (rCB) and bio-based alternatives is increasing, with government grants and sustainability programs supporting the development of such materials. Although imports still dominate the industry, the domestic production capacity is expected to increase, fostering self-sufficiency in the region. EV adoption and infrastructure development projects will also help drive industry growth through 2035 with a CAGR of 4.0%.

Strong demand for carbon black in tire manufacturing, automotive, and construction sectors is driving growth in India’s industry at a CAGR of 5.0%. The Central Pollution Control Board (CPCB) has issued some very strict emission norms that made the manufacturers invest in cleaner ways of producing goods. The rCB and sustainable alternatives industries are getting more and more attention as a result of the constant demand for recovered carbon black, waste reduction, and energy-efficient technologies.

The Make in India initiative is also pushing for growth in domestic production so that reliance on imports can be reduced. India’s EV adoption and infrastructure boom are also a growth driver for specialty carbon black, making India a high-growth industry until 2035.

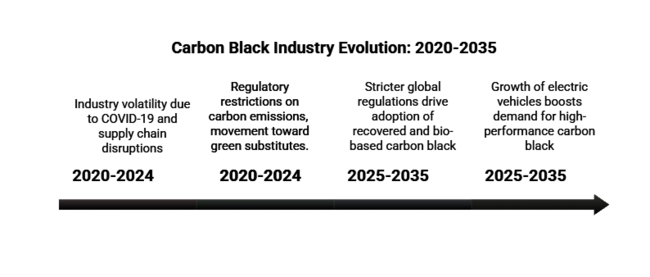

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced volatility due to the COVID-19 pandemic, supply chain disruptions, and fluctuations in raw material prices. | The industry is anticipated to stabilize with effective supply chain diversification and growth in investments into sustainable production technologies. |

| Regulatory restrictions on carbon emissions caused early headaches for manufacturers, encouraging them to move toward green substitutes. | Stricter global regulations will drive the adoption of recovered and bio-based carbon black, supporting sustainability initiatives. |

| Sustained demand in the automotive sector, particularly tire manufacturing, gave impetus to industry recovery post-pandemic. | The growth of electric vehicles (EVs) and autonomous mobility will drive demand for high-performance carbon black in batteries and lightweight materials. |

| Specialty black carbon developments for coatings, inks, and plastics were observed to have a consistent uptake. | Specialty-grade carbon black will see strong growth, led by demand for conductive materials in electronics and high-performance coatings. |

| China, India, and the USA have historically dominated the industry due to high tire and industrial rubber production. | While Asia-Pacific will remain dominant, Europe and North America are expected to adopt sustainable and specialty carbon black at a faster pace. |

| The focus was on recovered carbon black (rCB), but its large-scale implementation faced challenges. | Regulatory pushes and technological developments will hasten the commercialization and widespread adoption of RCB. |

The carbon black industry relies heavily on macroeconomic elements like industrial growth, automotive production patterns, government policies, and environmental objectives. Economic growth in emerging economies such as China, India, and Southeast Asia has led to increasing demand for industrial rubber, tires, and high-performance products, supporting steady industry growth. Manufacturing operations are expected to recover during the Post-Pandemic Recovery Phase (2021 to 2024) and sustain growth within the 2025 to 2035 period.

There has been an increase in inflation and volatility in the prices of oil and raw materials; however, the advancements in recovered and bio-based carbon black are offsetting any price volatility. Supply chain diversification and smart regional investments are also mitigating geographically specific dependencies for production. The sustainability momentum and carbon-neutral manufacturing are reshaping the industry, and governments are imposing stricter emissions regulations.

The expanding use of electric vehicles, battery technologies, and conductive materials is broadening new avenues for growth, particularly for specialty carbon black. Despite the economic uncertainty, strong industrial demand and sustainability-driven innovations will drive long-term growth in the industry.

This report provides a detailed overview of leading companies operating in the global carbon black industry, including their company background, earnings, revenue, product applications, specifications, and more. Top 2 players, like Cabot Corporation and Birla Carbon, focus on better grades, higher-cost specialty grades, and sustainability, whereas the remainder of the players, like Orion Engineered Carbons and PCBL, focus on low-cost manufacturers and local industry penetration.

Companies are investing in rCB technology, specialty conductive grades for EV batteries, and green manufacturing processes. Moreover, expansion across high-growth industries such as Asia-Pacific and Latin America, as well as joint ventures and acquisitions, are major strategies to increase industry presence and strengthen the supply chain.

Cabot Corporation

Industry Share: ~20-25%

As a global leader in specialty chemicals and advanced materials, Cabot Corporation stays ahead with a focus on sustainable and high-performance materials. Using its highly integrated R&D resources, the company works in North America, Europe, and Asia.

Orion Engineered Carbons

Industry Share: ~15-20%

Orion Engineered Carbons is expanding its presence in emerging economies, particularly in Asia and South America, through progressive product offerings and strategic collaborations.

Birla Carbon

Industry Share: ~15-18%

One of the key players in the carbon black industry, Birla Carbon, is part of the Aditya Birla Group. The company has been focused on sustainability, with investments in environmentally friendly production technologies and circular economy projects.

Mitsubishi Chemical Corporation

Industry Share: ~10-12%

Major players like Mitsubishi Chemical Corporation consolidate the Asia carbon black industry. Its investment in technology upgrades and advanced materials is growing to diversify its portfolio and tap into strong demand for high-performance carbon black.

Tokai Carbon Co., Ltd.

Industry Share: ~8-10%

Tokai Carbon (Japan) is one of the major manufacturers in the black carbon segment, specializing in specialty carbon blacks for promoted applications. The firm has been expanding its production capacity to cater to the demand from automotive and industrial end industries.

Phillips Carbon Black Limited (PCBL)

Industry Share: ~5-7%

PCBL, one of the largest carbon black producers in India, has been focusing on capacity expansion and sustainability initiatives. PCBL has been investing in greener technologies to help reduce its carbon footprint and meet regulatory requirements.

China Synthetic Rubber Corporation (CSRC)

Industry Share: ~5-7%

CSRC is one of the industry leaders in China's carbon black industry and focuses mainly on the domestic industry. Thus, the research and development of high-performance black carbon products for various industrial applications has been a major investment for the company.

Specialty carbon black presents a significant growth opportunity, particularly in battery technology and conductive materials. Investors would do well to invest first in high-purity conductive carbon black used in lithium-ion batteries and supercapacitors, as the two types of electrical devices grow in tandem with electric vehicles (EVs) and energy storage devices that are exploding in growth.

This strategy will facilitate rapid industry penetration and long-term contracts with EV manufacturers and battery producers through joint ventures. In addition, R&D progress in nanostructured carbon black would allow companies to become core suppliers to next-gen energy storage tech.

Regulatory pressure, especially in Europe and North America, is driving tire makers to incorporate sustainable carbon black. In particular, stakeholders must focus on increasing the capacity for rCB production, adopting the rCB material, and incorporating rCB into product lines. Investing in pyrolysis and closed-loop recycling technologies is key to gaining a competitive advantage and meeting sustainability demands.

Geographically, rapidly growing industries like India and Southeast Asia can unlock significant potential revenue. These economies are industrializing quickly and producing more tires. To enhance industry presence, businesses should establish country-specific plants or joint ventures and leverage government incentives for sustainable manufacturing.

Segment-wise, in the segments of coatings and plastics, increasing regulatory scrutiny on carbon footprints is creating demand for high-performance, low-emission carbon black. Innovating low-VOC (volatile organic compound) and high-dispersion black carbon variants will help the industry share increments in packaging, automotive coatings, and conductive polymers.

Collaborating strategically with coating formulators and polymer manufacturers can render tailored product solutions and long-term supply contracts.

The industry is segmented into furnace black, channel black, thermal black, acetylene black, and others.

It is bifurcated into standard grade and specialty grade.

It is fragmented into tire, non-tire rubber, inks & coatings, plastics and others.

The market is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East & Africa (MEA).

Carbon black is applied to tires, industrial rubber, plastics, coatings, inks, and battery electrodes.

Firms are investing in recovered and bio-sourced materials to respond to stricter environmental regulations.

The carbon black industry is developing most in the automotive, electronics, and construction sectors.

It increases battery conductivity, improves tire life, and is applicable in light polymer parts.

Tighter emissions rules are encouraging manufacturers to implement cleaner production and circular economy (CE) processes.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black for Packaging Market Growth & Trends 2025 to 2035

Specialty Carbon Black Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA