Global caramelized sugar market is set to grow easily from 2025 to 2035 under the leadership of increasing consumer need for natural products and extensive usage of caramelized sugars in foods and beverages. As per the trend where disliking of artificial additives has been increasing, need for low-processing and clean-label ingredients has increased manifold and caramelized sugars have emerged as a key food ingredient.

Market demand for sweeter, full-strength flavor in high-value food and specialty food causes additional market growth.Caramelized sugars are a basic component of food manufacturing, flavor enhancers, nature colors, and sweeteners.

Caramelized sugars are naturally present in bakery foods and confectioner foods, where caramelized sugars bring intense toast sweetness to bakery foods, cake, pastry food, and confectioner-flavored chocolate-type confections. Caramelized sugars are also dairy in the sense that they use these in the manufacture of caramel-flavored milk beverages,yogurts,and ice cream.

Use as world foods flavorings, barbecue sauce, and glazes is also contributing to the attainment of appearance and depth. While food manufacturers fight on sensory characteristics and demands for premium, all-natural ingredients increase, the demand for caramelized sugars will expand exponentially with ongoing product innovation and clean-labeling leading to expansion.

Explore FMI!

Book a free demo

North America is the largest market for caramelized sugars because of widespread food processing consumption and leading food and beverages companies. United States alone witnessed demand for caramelized sugars owing to widespread use in bakery food and confectionery. Demand has been generated owing to the clean-label and natural trend, where individuals look for products with no addition of any artificial ingredients.

Europe is an important market for caramelized sugars, with the giants of consumption being UK, Germany, and France. The continent boasts a long history of confectionery and bakery products, thereby creating the need for caramelized sugars. Organic and natural products also contribute their fair share in driving consumer development in demand for clean labels, thus fueling growth in the market.

Asia-Pacific will witness the highest growth in the market for caramelized sugars throughout the forecast period. The growth in demand for caramelized sugars has been witnessed owing to the growth in disposable incomes, food and beverage innovation, and urbanization of foods.

The size of the traditional sweets foods and desserts market in India and China is primarily comprised of the use of caramelized sugars. This consequently contributes to the size high growth in the market.

Challenges

Raw Material Price Uncertainty

The caramelised sugars industry is faced with some acute challenges caused by price uncertainty of large raw materials such as sugar and glucose syrup. Price volatility is caused by market forces such as supply chain disruption, weather, and policy decisions regarding altering the production cost and profitability.

Stevia, monk fruit, and erythritol are some alternative sources of sweeteners. With the firms seeking lower-cost and healthier substitutes to satisfy consumption trends by consumers, demand for caramelized sugar will be impacted. Competition will force industry players to embrace high-road buying practices, cost-reduction measures, and product innovation to allow them to make them distinctive from other substitute sweeteners.

Opportunities

Growing Demand for Clean Label and Natural Foods

In spite of the limitations that it has, the market for caramelized sugars has future potential with increasing consumer demands for clean-label and natural food products.

Manufacturers are calling for naturally caramelized sugars to be used for such trends with rising numbers of health-conscious consumers looking for food products containing zero added artificial additives. This is most clearly seen within specialty dairy, bakery, and beverage foods as natural caramelization develops flavor but no artificial colors or preservatives.

Organic and non-GMO food trends move this market along further as well. By putting focus on innovation, transparency, and sustainability, manufacturers can draw on increasing consumer demand for naturally processed sweetener solutions.

From 2020 to 2024, the market of caramelized sugar developed healthily because consumers were increasingly demanding foods and drinks with flavor. Innovation in products was prioritized by the companies by introducing new taste and composition in order to respond to differentiated consumers' demand. All these in spite of, raw material price volatility and rivalry among confectioneries were forces driving the forces in the market.

During the next decade, 2025 to 2035, the market will grow more sustainably and inclusively. The manufacturers would need to invest in clean-label product supply and sustainable raw material procurement. The new world offers immense growth opportunities with increasing disposable income and urbanization fueling consumption of processed food and convenience foods.

Product innovation and diversification, new formulation and new flavors, will be the major strategy for the manufacturers to capture market shares.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Governments introduced basic food safety regulations impacting caramelized sugar production. |

| Technological Advancements | Manufacturers adopted traditional caramelization techniques. |

| Industry Adoption | Caramelized sugars found applications primarily in bakery and confectionery sectors. |

| Supply Chain and Sourcing | Relied on conventional sugar sources with minimal emphasis on sustainability. |

| Market Competition | Dominated by regional players with limited global presence. |

| Market Growth Drivers | Demand driven by traditional sweet flavor profiles. |

| Sustainability and Conservation | Limited initiatives towards environmental sustainability in production. |

| Integration of Smart Monitoring | Minimal adoption of digital monitoring in manufacturing processes. |

| Advancements in Experiential Marketing | Traditional marketing approaches with limited consumer engagement. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Anticipate stricter labeling laws emphasizing natural ingredients and reduced sugar content. |

| Technological Advancements | Expect integration of advanced technologies like controlled Maillard reaction processes for consistent flavor and color. |

| Industry Adoption | Projected expansion into beverages, dairy, and savory products due to flavor diversification. |

| Supply Chain and Sourcing | Shift towards sustainable sourcing practices and fair-trade certifications for raw materials. |

| Market Competition | Forecasted entry of multinational corporations investing in product innovation and global distribution. |

| Market Growth Drivers | Increasing consumer preference for unique caramel flavors in health-conscious and gourmet products. |

| Sustainability and Conservation | Implementation of eco-friendly production methods and reduced carbon footprint strategies. |

| Integration of Smart Monitoring | Widespread use of IoT and AI for real-time quality control and supply chain optimization. |

| Advancements in Experiential Marketing | Growth of interactive marketing campaigns, including virtual tasting experiences and culinary workshops. |

United States caramelized sugars market flourishes because of an existing food processing industry as well as bakery and confectionary food requirements. Mega companies are launching their premium products like ice creams, snack bars, and specialty foods containing caramelized sugars.

The trend is moving towards the use of natural products in the clean-label phenomenon where the companies reacted to the phenomenon by creating organic and non-GMO caramelized sugar foods. The trend signals shoppers' need for more health and better transparency and offers greater opportunities for growth. Good trends can hope to sustain the optimism that the market could embrace more premium, sustainably produced caramelized sugars going mainstream.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

Multicultural European food culture has enjoyed consistent demand for caramelized sugars, which has been mostly used in bakery and dessert applications. France and Germany, among others, utilize caramelized sugars in specialty foods to add robust flavor to pastry and confectionery.

Furthermore, as increasingly more Europeans seek health-fitness, they call for lower-sugar or functional equivalents. The indulgence with a twist of health and conscious consumption trend will propel the market toward newer, healthier caramelized sugar foods with less sugar, fortification by way of functional ingredients, or products appropriate for increasingly health-conscious lifestyles.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The Japanese sweets industry has shifted to the incorporation of caramelized sugars, particularly in traditional sweets and contemporary desserts. The combination of Western and Japanese cuisines has also brought new food items such as caramelized sugar-enhanced mochi and other sweets. As Japan's food industry remains on the rising trend, premiumization is a trend where companies are producing upscale caramelized sugars in premium food.

Furthermore, the nutritional requirement for healthy snacks has generated interest in using caramelized sugars in low-calorie, functional, or fortified foods by indulgence-seeking consumers who are seeking indulgent but healthier foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

Indian food diversity has welcomed caramelized sugars in traditional sweets and also found its way into the growing bakery and packaged food sectors. Middle-class expansion and urbanization are triggering demand for packaged foods and convenience foods, and this is creating incredible opportunities for caramelized sugars.

As consumers are becoming health-aware and demanding products that concentrate on natural and lower-sugar content, the market is heading in that direction. There is also vast scope for expansion of caramelized sugars to reach such wellness products as organic or non-GMO, riding India's changing consuming market fueled by wellness.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.8% |

The monopoly of the sugar cane sector keeps Brazil firmly in its grip and thus there has been firm turf established in the market for caramelized sugars, particularly the confectionery and soft drinks businesses. Caramel sugars are also used in huge amounts in the manufacture of most conventional candies, and they continue to be in demand.

With more health-conscious consumers in Brazil, the market is turning towards organic and sustainably produced foods. This will trigger demand for caramel sugars that are manufactured using sustainable and eco-friendly processes. Organic caramelized sugar products will have greater market access and attract domestic and foreign health-conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.3% |

The market of caramelized sugar is divided into syrup, powder, and liquid, all serving industry-specific applications. Caramelized sugar syrup controls the soft drink industry and is a necessity in soft drinks, energy drinks, and specialty coffee beverages. Large coffee giants such as Starbucks and Dunkin' use the application of caramelized sugar syrup in an effort to introduce richness and sweetness into lattes, macchiatos, and frappés.

Caramel sugar powder is more sought after to be included in dry mixture food products such as instant cake mix, powdered drinks, and pre-cooked meal packets. With increasing demand for home baking, specialty food companies such as King Arthur Baking and Bob's Red Mill offer pre-blended caramel sugar powders to avid home bakers.

Liquid caramelized sugar, employed extensively in the meat-processing sector, is one of the primary glazes and flavorings employed in barbecue sauces, marinades, and pre-packaged meat products. Liquid caramelized sugars find their application in adding color and taste to pre-packaged grilled meat by Tyson Foods and Smithfield, among other large food manufacturers.

The food industry and bakery and confectionery are still the most prominent end-use applications of caramelized sugars, incorporating the sugar to create texture, color, and flavor. Mondelez International and large bakeries employ caramelized sugars in pastry-filled caramels, chocolate bars, and artisan breads.

Food manufacturers incorporate caramelize sugars into yogurts, milk flavoring, and ice cream to provide depth and sweetness in balance. Caramelize sugars are used by food companies like Häagen-Dazs and Danone for producing complex caramel-flavored milk drinks and ice creams.

In the food category of meat and meat preparation foods, caramelized sugars are a food component that is used in pre-cooked meats, cured and sausage meats that caramelize and season. In barbecue glazes and in meat rubs, for instance, caramelized sugars are used to add umami flavor by McCormick & Company.

Drinks like cola, flavored sparkling water, and malt beverages typically use naturally caramelized sugars not just as a sweetener, but also as a flavor stabilizer. Market leaders Colossus drink giants Coca-Cola and PepsiCo guarantee the flavor of caramel-flavored drinks.

Savory foods, such as ethnic foods and ready-to-eat food, use caramelize sugars to counteract the smoky sweetness. Pre-packaged Asian dishes and condiment businesses, like Kikkoman and Lee Kum Kee, utilize caramelized sugar to sweeten soy sauce, teriyaki sauce, and other fermented foods.

Baby foods make use of caramelized sugars to a lesser extent to provide natural flavor introduction in their food products and function within safety parameter limits. Gerber and Earth's Best Organic are some of the products which make use of teething crackers and infant cereals wherein controlled amounts of caramelized sugar are added as a flavor palatability ingredient.

Even pet food is experiencing the brush of caramelized sugars in gourmet products, namely in dog and cat treats. Blue Buffalo and Hill's Science Diet incorporate caramelized sugars into kibbles and soft chews to provide scent and flavor without resorting to artificial additives.

Caramelized sugars distribution market is both B2B and B2C, and mass food production is dominated by direct selling while retail selling is growing in popularity among consumers.

Direct selling is a typical distribution route for milk producers, bread producers, food processors, and beverage companies. Tate & Lyle, Cargill, and Kerry Group, among others, place bulk B2B orders with typical quantities of high-quality caramelized sugars for use in the mass market. The firms also manufacture customized solutions, for example, private formulations of caramelized sugar for local flavorings in Asia-Pacific, Europe, and North America.

B2C indirect promotion, especially in store-based retailing, has exposed consumers to greater exposure to caramelized sugar products. Retail outlets like supermarkets and hypermarkets like Walmart, Tesco, and Carrefour provide shelf placement of products according to caramelized sugar products in their bakery, confectionery, and beverage sections.

Supermarkets and convenience stores offer convenience access of caramelized sugar products for ease of consumption. Corner stores and gas stations offer foodstuffs flavored with caramelized sugars, i.e., canned iced coffee beverages, caramel popcorn, and energy bars.

Specialty food retailers offer health-aware consumers organic and artisanal caramelized sugars. Whole Foods Market and Trader Joe's offer consumers non-GMO, fair-trade-certified caramelized sugars who purchase only natural ingredient-based products.

Other consumer-staple forms such as gourmet shops and local bakeries sell freshly produced caramelized sugar items such as high-end dessert toppings, pastry-carameled, and hand-toffees.

Store chains such as Walmart Marketplace, Amazon, and specialty food webstores sell bulk and consumer-packaged caramelized sugars. Personalization is provided in the form of online stores with businesses selling different levels of caramelization, flavor-profile, and organic caramelized sugars to meet personal cooking requirements.

Subscription shipping is gaining traction with companies such as Misfits Market and Thrive Market shipping responsibly sourced, responsibly produced caramelized sugars directly to consumers' doorsteps.

Although web shopping brings the marketplace to the consumer, delivery costs and product shelf life are concerns. Intelligent vacuum-packaging and temperature-controlled shipping eliminate concerns and maintain the product's freshness for shipping.

Green caramelization technology is at the forefront of caramelized sugar businesses in the future with firms adopting effective energy production systems and green raw materials. Carbon-neutral production by Ingredion and enzymatic launches by DSM are pointing towards a future with reduced environmental footprints.

Emerging products like gut health functional caramel syrups and plant-based dairy enriched with caramelized sugar replicate upcoming trends. Natural sweetener trend and low-glycemic trend also influence R&D investment in low-glycemic caramelized sugar food.

Regulatory issues and changing raw material costs exist, yet precision caramelization technologies and AI-optimized ingredients' innovation will propel the market growth.

The caramelized sugar market is changing at a very rapid pace as a result of higher demand for novel and innovative flavors in foods and beverages. Since customers nowadays demand more innovative and diversified flavor profiles, the use of caramelized sugars is increasing day by day since they possess sweet, rich, and intensive flavor profiles. This also becomes apparent in the rapidly expanding food sector where such sugars are utilized for improving taste and texture of food and beverages in confectionery, bakery, sauces, and beverages.

Moreover, growth in natural and clean-label applications has also influenced where companies are forced to place more priority on caramelized sugars. Facility in molding and bending of caramels, and facility for the caramelized sugars to be well adapted for an enormous range of uses, is also contributing to expansion in size of the global marketplace.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill | 20-25% |

| Ingredion Incorporated | 15-20% |

| Kerry Group | 10-15% |

| Sethness-Roquette | 8-12% |

| Nigay | 5-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill | Produces a wide range of caramelized sugar products used in bakery, confectionery, and beverage industries. |

| Ingredion Incorporated | Offers caramelized sugar solutions focusing on clean-label and non-GMO formulations for various food applications. |

| Kerry Group | Provides specialty caramelized sugar ingredients enhancing flavor and color in dairy and dessert products. |

| Sethness-Roquette | Specializes in caramel colors and burnt sugar products for the food and beverage sector. |

| Nigay | Focuses on crafting caramelized sugar products tailored for sauces, spirits, and confectionery items. |

Key Company Insights

Cargill (20-25%)

Cargill has emerged as the market leader in the caramelised sugars industry with its very wide product range with solutions to far-reaching applications ranging from bakery foods to confectionery and soft drinks. With being innovative and of better quality, Cargill has been well positioned within the market.

Ingredion Incorporated (15-20%)

Ingredion offers clean-label and non-GMO caramelized sugar solutions that address consumers' desire for natural ingredients. Its solutions are applied widely throughout food categories for taste and appearance.

Kerry Group (10-15%)

Kerry Group provides specialist caramelized sugar ingredients that contribute to flavor and color, especially in dairy and dessert foods. Through their texture and taste innovation, they have been a consistent supplier in a specific category.

Sethness-Roquette (8-12%)

Sethness-Roquette also makes burnt sugars specialties and caramel colors and supplies the food and beverage market with market-leading ingredients in consistency and safety to industrial standards.

Nigay (5-10%)

Nigay manufactures caramelised sugars to be utilized as a sauce, spirits, or for confectionery applications and supplies tailor-made solutions with private-label flavor and color requirements.

Other Key Players (20-30% Combined)

A limited number of local and private organizations move into the caramelized sugars sector with diversified services and products.They are:

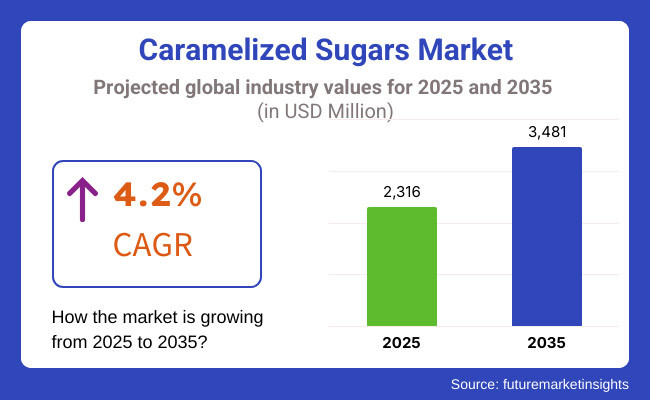

The overall market size for caramelized sugars was USD 2,316 Million in 2025.

The caramelized sugars market is expected to reach USD 3,481 Million in 2035.

The demand for the caramelized sugars market will be driven by increasing consumer preference for unique flavors in food and beverages, rising applications in confectionery and bakery products, the shift towards clean-label and natural ingredients, and innovations in organic and non-GMO caramelized sugar variants. Additionally, the growing focus on premiumization in food products and health-conscious consumption will further fuel the market growth.

The top 5 countries driving the development of the caramelized sugars market are the USA, Germany, Japan, India, and Brazil.

Organic and non-GMO caramelized sugars are expected to command significant share over the assessment period.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.