The global market of caramel ingredient has been projected to witness a strong growth rate of 2025 to 2035 based on the increasing demand for confectionery, bakery food, beverages, and dairy food. The demand has been triggered as a result of increased demand for sweet flavor and heavy application of caramel. Growth in the food and beverage industry, premiumization and craft phenomenon, and global foodstuff demand have been the key driving forces for the same.

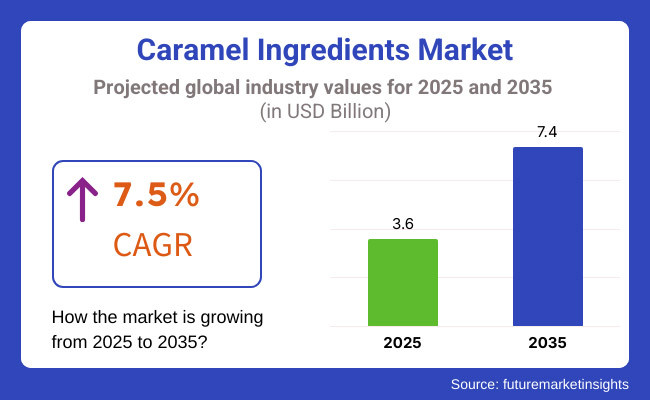

It is expanding at a compounded annual growth rate (CAGR) of 7.5% in 2025 to 2035. Ingredients used in caramels are also gaining popularity even in non-core geographies. Caramels taking up new new flavors, increasing usage of caramels in food having health benefits, and dominating the natural sweetener trend are major drivers driving this market.

Explore FMI!

Book a free demo

The United States and Canada possess a highly developed food and beverage sector, and hence North America is a significant market for caramel ingredients. Caramel flavoring finds its usage in the form of different types of products, including confectionery and bakery food. The enormous demand for superior and artisan-type products in the region has boosted demand for high-quality caramel ingredients substantially.

This is because of heightened demand by consumers for luxury, high-end goods, and the producers have tried to manufacture caramel products to meet such luxury consumer demands in a proper manner, further solidifying the position of caramel even more in North American food culture.

Sustainable food heritage and gargantuan food processing industry in Europe have borne there a persistent demand for caramel products. Its biggest markets are Germany, France, and the United Kingdom, where it is being distributed in confectionery and bakery shops.

Demand has been driving its market expansion, with suppliers going for the production of caramel products to meet the demand. This has necessitated clean-label compliant caramel ingredient formulation as a response to growing demand in the European market for health and health-friendly foods and transparency.

The Asia-Pacific region will be the fastest-growing market for caramel ingredients due to growing urbanization and rising disposable incomes. Consumers in nations such as China, India, and Japan are shifting towards Western-style bakery and confectionery food, including foods with caramel flavor. With growing markets in these countries, there is a demand for caramel in candies and soft drinks.

The increased growth is also calling for business to become product diversified in accommodating the local taste changing. Middle-class growth regionally and contact with global eating trends are instinctive regional drivers of demand for caramel-based food.

Challenges

Health Problem Associated with Consume of Sugar

The market for caramel ingredients is confronted by humongous challenges with elevated health problems coming with consume of sugar. As there has been growing and ongoing concern among individuals about the ill effects of high sugar intake, i.e., diabetes and obesity, individuals are becoming more aware of what they consume.

That is why there has been growing demand for healthy foods, thus spurring companies to innovate such caramel products with lower content of sugar. Flavor and texture control with reduced sugar is a technical challenge of the food industry, which has to find ways of preserving the rich, indulgent taste of caramel without sacrificing consumer health trends. The trend is reshaping the marketplace dynamics.

Opportunities

Growing Demand for Natural and Clean-Label Ingredients

Caramel ingredients are rich with opportunities in the face of the dilemma, particularly with growing demand for natural and clean-label ingredients. There has been a trend among the consumers of the food that does not contain artificial ingredients, additives, and genetically modified foods.

The companies have seen the trend and looked and created caramel ingredients from natural sources as part of the clean-label movement. This food easily makes its way to health-conscious consumers who love having simple and clear labeling of their food. As there is an increase in clean-label, natural caramels trend, caramels ingredients market will also increase, offering companies an opportunity to gain profit from such evolving consumer trends.

Throughout the years 2020 to 2024, caramel ingredients market continued to grow steadily because caramel-flavored food and beverages continued to be required by industries on a consistent basis. New trends in the development of caramel, new introduction of caramel flavors, and its development to be utilized as new products such as plant and functional foods was a top agenda among manufacturers. Change and innovation drivers were some industry drivers such as fluctuating prices of raw materials and health issues brought about by the consumption of sugar.

Planning ahead of the decade 2025 to 2035, the market would shift towards greener and healthier alternatives. The companies would have to invest in R&D for the creation of caramel ingredients with less sugar and organic ingredients.

Application of caramel flavor in healthy foods, such as protein bars and sugar-free candies, will be poised to increase due to increased demand for health indulgence. In addition to this, the awareness of clean-label and alternative sweeteners is also going to decide the future of caramel ingredients' market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Food safety regulators enforced minimal controls on caramel color use, targeting acceptable concentrations of 4-MEI in foods and beverages. |

| Technological Advancements | Producers used conventional thermal treatment processes to make caramel, with minimal flavor and color reproducibility. |

| Industry Adoption | Caramel ingredients experienced widespread applications in traditional confectionery and bakery items, including toffees and chocolates filled with caramel. |

| Supply Chain and Sourcing | Businesses procured caramel ingredients from industrial-scale sugar refineries, with little consideration of sustainability. |

| Market Competition | The market had a combination of long-standing ingredient producers and local suppliers, with minimal product differentiation. |

| Market Growth Drivers | Demand increased as a result of the popularity of rich flavors in desserts and drinks, as seen in the popularity of caramel lattes and frappés. |

| Sustainability and Conservation | Environmental issues prompted early attempts at minimizing the carbon footprint of caramel production, with some producers investigating alternative energy sources. |

| Integration of Smart Monitoring | Low take-up of digital technologies caused inefficiencies in quality control and supply chain management. |

| Advancements in Experiential Marketing | Brands interacted with consumers through classic advertising and retail promotions, providing limited interactive experiences. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Governments will be called upon to introduce stricter labeling protocols, requiring transparent declaration of caramel ingredient content and source to meet consumer demand for transparency and nature-based ingredients. |

| Technological Advancements | The industry will pursue incorporating leading-edge Maillard reaction technology and accurate thermal processing to allow for tailored flavor profiles and ensured coloration in caramel ingredients. |

| Industry Adoption | The product is predicted to broaden to health-oriented snacks, fruit desserts, and functional drinks with the increased consumer demand for wellness and alternative eating. |

| Supply Chain and Sourcing | A trend exists toward using organic and Fair Trade-qualified ingredients in caramel in efforts to support responsible production and the environment. |

| Market Competition | More competition will come from clean-label and artisanal caramel-centered startups that will push the incumbent companies to innovate and diversify portfolios in order to hold share. |

| Market Growth Drivers | Expansion is also projected to be driven by the application of caramel flavoring in new categories such as protein bars and non-dairy ice creams that will attract health-conscious and vegan consumers. |

| Sustainability and Conservation | The industry will embrace comprehensive sustainability initiatives, such as zero-waste production processes and biodegradable packaging of caramel products, since there is growing concern about the environment. |

| Integration of Smart Monitoring | The industry will use IoT-based sensors and blockchain technology to monitor production parameters in real time and traceability of the ingredients utilized to produce caramel for quality testing and supply chain responsibility. |

| Advancements in Experiential Marketing | Firms are also expected to utilize augmented reality (AR) and virtual reality (VR) technology to develop interactive experiences, such as virtual lessons on how caramel is made and interactive stories about product origins, to engage customers. |

The USA caramel ingredients market has been driven by the nation's biggest food processing company and end-consumers' need for sweetness. Caramel-flavored drinks like the Caramel Macchiato in large food stores like Starbucks have also made it popular and, therefore, demand has been established.

Clean-labeling would be the trend most likely to force manufacturers to produce caramel ingredients that have zero artificial ingredients in the future since consumers will use natural ingredients and they are calling for transparency.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

In the United Kingdom, old-fashioned sweets such as sticky toffee pudding have remained favorites for caramel ingredients. The craft market has also created demand for high-end caramel sauces and spreads. Future growth will come from leveraging caramel flavor on gourmet snack foods such as popcorn and crisps in a bid to keep up with changing taste buds among British consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.6% |

The rich and varied food culture of the EU has been underpinning the use of caramel ingredients in other pastries and confectioneries. Promotion of natural additive policy has enhanced innovation using low-processed caramels by companies. Growth in the plant foods sector presents possibilities for plant-based sweet uses and milk replacers uses of caramel, according to the EU agenda of being sustainable.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.2% |

The Japanese sweets market has adopted the caramel tastes, and this is evident in the manufacturing of such sweet foods as the Caramel Almond Pretz by Glico. The combination of Japanese heritage sweets and caramel has led to specialty sweets with a mass consumer appeal. The innovation of high-end confectioneries and gift culture, which is estimated, is also bound to increase demand for high-quality caramels from ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

The highly developed snack food market of South Korea has introduced caramel-flavored flavorings in snacks such as Haitai's Caramel Corn Chips. Demand is created by K-Pop and K-Drama, as well, because the foods are promoted with the media as trends through caramel-flavor content. Demand is likely to be greater with the experimentation of caramel on traditional snacks as well as Western-style snacks for domestic as well as international markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Caramel form ingredients like inclusions, fillings, and toppings, tints, flavorings, and other special shapes are trending for use in premium food applications. The trend is witnessing wider use of high-end caramels in fine dessert applications, gourmet chocolate, and artisan pastries. Each of these formats of caramel is adding textural interest and depth of flavor profile, adding worth to consumer experience in confectionery, bakery, and liquid foods.

Among the top-growing categories, caramel inclusions are taking off in upscale ice cream, breakfast cereal, and chocolate. Food buyers looking for robust experiences are snagging food packed with caramel pieces, flakes, or chips to unleash bursts of buttery sweetness.

Greater use of multi-layered textures throughout confectionery and snack bars has put pressure on the category as manufacturers release caramel inclusions with sea salt, nuts, and even whiskey flavor to be at the forefront of changing tastes.

Toppings and fillings are still the height of caramel ingredient demand, whether that is for sundaes on ice cream or cake or specialty drinks. Increased need for bakery goods with an artisanal appearance has resulted in unexpected demand for fillings that include caramel, especially eclairs, donuts, and croissants. Increased demand for dessert-flavored drinks, like milkshakes and lattes flavored in caramel taste, has also been further complemented on where caramel topping has been found to be utilized for its texture as well as to provide flavor.

Color and flavor variances are also leading the charge in propelling market growth, with manufacturers incorporating varying amounts of caramel to develop distinct product profiles. Light-colored caramel is finding application in light pastry and specialty coffee blends, and darker, more robust caramel types are contributing body to chocolate and confectional coatings. The natural trend has also spurred higher demand for non-GMO and organic caramel, and this is driving cleaner labels and consumer tolerance.

As the market is experiencing aggressive growth, the producers are required to deal with shelf life, sugar level, and ingredient disclosure issues. However, more formulation activity in terms of reduced-sugar caramel solutions, and formulations free from dairy, is counteracting the issues and opening opportunities for the market.

Caramel ingredients are being used with increasing applications in a wide range of foods and drinks including confectionery, ice creams & cakes, bakery, and alcoholic & non-alcoholic beverages. The ingredient provides the optimal sweetness and richness levels, thereby emerging as the first choice of the formulator to deliver a richness food experience.

The confectionery market is the largest application, however, because caramel is an important ingredient in chocolates, chew sweets, and nougats. Large chocolate companies are making other items out of caramel due to the indulgence user base. Caramel-filled pralines and chocolate bars account for more than 60% of the use of the caramel ingredient in the confectionery market, a huge one by market research.

Cake, brownie, and cookie are some bakery items that utilize other uses of caramel in specialty and premium foods as well. Other dessert fusion foods such as cruffins (muffin-croissant) and brookies (brownie-cookie) have also elevated caramel drizzles and fillings to achieve complexity and presentation in the taste profile.

Drinks are also emerging as a profitable niche for caramel ingredients, with alcoholic and non-alcoholic beverages infusing caramel flavor to boost taste experience. Caramel-flavored whiskey, rum, and craft cocktails are particularly fashionable, and high-end caramel syrups and extracts are being demanded. In non-alcoholic categories, caramel is found in flavored coffee syrups, milkshakes, and bubble tea recipes, where its deep, velvety flavor is well-suited to many beverage bases.

Increasing use of caramel in functional and botanical drinks has also fueled market expansion, with businesses testing dairy-free caramels to meet lactose-intolerant and vegan consumers' needs. There is also growing demand for shelf-stable, uniform concentrated caramel flavor systems because of innovation in ready-to-drink (RTD) beverages through channels of distribution.

As caramel is on a large scale of consumption, concerns about artificial ingredients and sugar content are the driving force for clean-label caramel ingredients to emerge. To address consumers' demand for purity and health-fortified indulgence, organic, low-calorie, and natural-colored caramels are now emerging in the market.

Informs of caramel exist in stable form, liquid or powder or granular form each with its specific industry requirements. The market continues to grow on account of flexibility offered by such forms and permitting manufacturers to streamline formulations based on product stability, ease of application, and specific application requirements.

Liquid caramel is the foodservice and industrial market's choice due to its convenience of use in flavoring, drizzling, and glazing. Its broad acceptability in bakery, confectionery, and beverage industries is a testament to its functional role.

Cafe chains continue to launch seasonal caramel drinks, taking advantage of the convenience of liquid caramel to provide consistency across chains. Also, the growing need of the foodservice market for ready-to-use caramel sauces has spurred innovation in naturally sweetened and preservative-free formulations.

Granular or powdered caramel is increasingly finding use in dry mix markets such as instant drinks, protein bars, and snack coatings. Powdered caramel's stability of flavor and ease of solubility have made it a popular choice for RTD drink preparations, powdered cappuccino and latte mixtures, and popcorn and savory snack seasoning mixtures. Its use in these markets is opening up new streams of revenue in the industry.

Reformulated caramel varieties such as encapsulated and crystallized caramel are gaining greater application in functional foods where controlled release and extended flavor stability are required. These findings are especially valuable in chocolate manufacturing, where caramel inclusions must be able to survive temperature fluctuations and retain texture integrity. As confectionery companies strive for multiple textures in experience, reformulated caramel varieties are gaining ground in the premium chocolate market.

In spite of the benefits of both types, challenges related to formulation consistency, moisture sensitivity, and caramelization control still exist. Yet ongoing R&D activities in food science are constantly improving processing methods, guaranteeing improved stability, improved protection of flavor, and clean-label solutions for all types of caramel ingredients.

Green concerns and government policies are defining the caramel ingredients industry, with customers increasingly concerned with sustainable sourcing and healthy formulation of ingredients. Food regulators globally are tightening their controls on caramel color additives, forcing manufacturers to adapt their methods in a bid to remain in sync with changing food safety procedures.

Sustainability is a leading market force today, with caramel ingredients chosen by businesses to be sustainably sourced. Market demand for sustainably sourced palm oil in caramel products, and more demand for non-GMO and organic sources of caramel, has driven wider industry-wide implementation of sustainable sourcing practices. Additionally, green packaging choices for caramel-based products are on the rise, further solidifying the focus on sustainability of the marketplace.

While compliance proves challenging, improved AI-based monitoring of food safety and blockchain-based tracing of ingredients are assisting makers in ensuring transparency and quality control. These shifts are likely to simplify compliance and increase consumer confidence in caramel ingredient formulations.

In the long term, the business of caramel ingredients will keep adapting to changing consumer needs, regulation, and innovation. With premiumization, health-and-wellness formulations, and sustainability being key areas of focus by companies, the function of caramel in the food and beverage sector will keep playing an integral part in enabling further industry growth and development.

Caramel ingredients industry is seeing gigantic growth with skyrocketing demand for intense flavor among confectionery, bakery, and beverage product lines. The industry leaders are shifting their focus towards novel products, applications of natural ingredients, and partnering collaborations in an effort to sustain their competitive leadership.

Higher consumption of clean-label and healthy product lines prompted the suppliers to come up with natural flavor and color alternatives for caramels that matched changing tastes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Incorporated | 15-20% |

| Kerry Group | 12-16% |

| Sensient Technologies Corporation | 10-14% |

| Puratos Group | 8-12% |

| Sethness Caramel Color | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Incorporated | Offers a production line of caramel products such as flavors, colors, and fillings emphasizing sustainably-sourced. |

| Kerry Group | Provides innovative caramel solutions that address bakery and confectionery uses while targeting clean-labeling. |

| Sensient Technologies Corporation | Specialists in natural caramel color and flavor, delivering solutions to the beverage and dairy industry. |

| Puratos Group | Offers caramel toppings and fillings utilized for use in artisan and industrial bakery food items. |

| Sethness Caramel Color | Expert in manufacturing superior caramel color for food and beverage uses. |

Key Company Insights

Cargill Incorporated (15-20%)

Cargill dominates the caramel ingredients space with its versatile portfolio of caramel colors, flavors, and fillings. It is dedicated to sustainable production and sourcing practices since consumers increasingly ask for green products.

Kerry Group (12-16%)

Kerry Group offers innovative solutions for caramel, especially for application in bakery and confectionery. Its clean-label product platform responds to increasing consumer demand for transparency and natural ingredients.

Sensient Technologies Corporation (10-14%)

Sensient has natural caramel colors and flavors capabilities and supplies the beverage and dairy markets. Its focus on natural ingredient procurement is consistent with the clean-label product movement of the industry.

Puratos Group (8-12%)

Puratos produces caramel toppings and fillings for industrial and artisan bakery items. Its focus on quality and innovation assists bakers in meeting changing consumer trends.

Sethness Caramel Color (5-9%)

Sethness is a top manufacturer of premium caramel colors for different food and beverage applications. Their emphasis guarantees stability and consistency in formulation.

Other Key Players (40-50% Combined)

Regional and private players contribute to the caramel ingredients market with niche products and innovations. These are:

The global caramel ingredients market size was estimated at USD 3.6 billion in 2025.

The caramel ingredients market is projected to reach approximately USD 7.4 billion by 2035, indicating continued growth.

The demand for caramel ingredients is expected to be driven by the booming convenience food industry, rising disposable incomes, urbanization, and the versatility of caramel in various food and beverage applications such as bakery items, confectioneries, and beverages.

The top 5 regions contributing to the development of the caramel ingredients market are: o North America o Europe o Asia-Pacific o Latin America o Middle East & Africa

The liquid form segment is expected to command a significant share over the assessment period, owing to its extensive usage in the beverage industry for both alcoholic and non-alcoholic drinks.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.