Global caramel food color market will grow enormously in 2025 to 2035 due to increasing demand by consumers for naturally sourced products providing coloring. Caramel color is a first preference coloring product used on food products providing brown color to food and beverages.

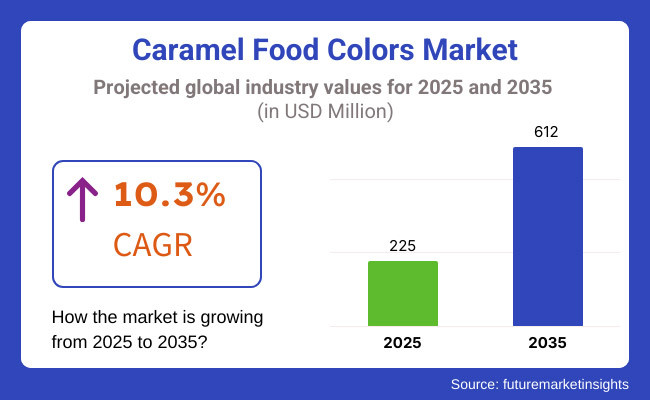

Market value, as per Future Market Insights, is anticipated to reach from USD 225 million in 2025 to approximately USD 612 million in 2035 at a compound annual growth rate of 10.3% over the forecast period. Growing demand for clean-label becomes progressively more so, food and beverage innovation and continuous technological advancement in production activity driving growth predominantly.

Other demands on the customers' part for naturally derived ingredients and open labeling are compelling manufacturers to produce and inherently additive-free caramel color. It's all part of the larger movement toward sustainable, healthy food driving the market forward.

Demand for North American caramel food color is increasing at a slowing rate primarily because more food and beverage processing foods are being consumed. United States is also leading the way with higher consumption of foods and beverages with caramel color like bakery, confectionery, and soft beverages.

Higher utilization of natural and clean-label ingredients has also accelerated market growth with no additive products gaining acceptance among consumers. This shift towards all natural ingredients is part of the wider trend of healthier food consumption and label integrity and is driving North America market growth.

Europe is a big market for caramel food coloring because there is a developed food processing industry and there is demand for specialty and premium food. The main markets are Germany and France, which have extensive applications of caramel color in confectionery and bakery food.

European food additive regulation has fostered the adoption of natural coloring material of caramel by manufacturers due to consumer demand on clean-label food. Natural food preference and legislation are the main drivers, where growth and development can be achieved in Europe's food caramel color market.

Asia-Pacific would be experiencing top growth of market for caramel food colour with its vast urbanization, growing disposable incomes, and health foods and beverages industry. India and China governments are observing an emerging boom for processed foods such as soft drinks, snacking foods, and ready meals in which huge volumes of caramel colour are utilised.

Food items like cakes, pastries, and biscuits, and food products of the confectionery and bakery categories require demand that is also escalating the trend higher. As more and more countries of this continent are increasingly accepting world foods, there will be growing demand for such foods such as caramel color, and thus there will be growing regional market demand as well.

Challenges

Health Challenges and Regulation Compliance

Of the largest threats confronting caramel food coloring business, one is possibly the disease that may result from consumption of certain grades of caramel color, i.e., those that are made with conditions under which ammonia compounds exist.

Such beverages may contain 4-MEI (4-methylimidazole), a potential carcinogen. The European Food Safety Authority (EFSA) and USA Food and Drug Administration (FDA) have established tight tolerances for the presence of 4-MEI in order to protect consumers.

Businesses therefore had no option but to utilize other methods of creating compliant, healthier, customer-centric as well as safer products. They are not simple without compromising the quality of the product and are industry challenges in the next few days.

Opportunities

Clean-Label and Natural Product Demand on the Rise

There is very wide market opportunity for caramel food color as consumers are demanding cleaner, natural food. With consumers being health-conscious and seeking greater transparency on natural products, there is potential for companies to invest more in research and development in creating caramel colors from natural ingredients without additives and chemicals.

Being one of the larger clean-label trends, it leaves room for differentiation on safer and more natural options. The more and more of these kinds of products get sold, the better it's a market opportunity to grow and develop and differentiate in the caramel food colors business.

Demand for caramel food color increased in 2024 and 2020 because of growing convenience and need for processed food. On the other hand, health complications arising as a result of using some of the caramel coloring that had regulatory complications led the companies to develop alternative products to allow them not to consume it but still produce by utilizing natural form for the product.

In 2025 to 2035, the market will be welcoming openness and sustainability. The consumers will be welcoming such type of products with open labeling and natural ingredients. The technology for manufacturing and extraction will be so advanced to produce good quality, natural caramel color. Organic food segment growth also opens up new opportunities for growth as organic origin caramel color will be required.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Governments implemented basic food safety legislation in relation to the use of caramel food colorings, including maximum allowable amounts and labeling. |

| Technological Advancements | Producers employed traditional production techniques for caramel colorings, involving low levels of automation and regular quality control operations. |

| Industry Adoption | Caramel food colorings were utilized predominantly in beverages like colas and some confectionery items, with little diversification across the range of food groups. |

| Supply Chain and Sourcing | Firms bought caramel color ingredients from established suppliers with little attention paid to sustainability or traceability. |

| Market Competition | The market was made up of established players with established customer bases, hence moderate competition and scant innovation. |

| Market Growth Drivers | Demand came as a result of the popularity of carbonated soft drinks and old-fashioned candies, where caramel color is a typical additive. |

| Sustainability and Conservation | Environmental issues were low with scant efforts to reduce the carbon footprint associated with the manufacture of caramel color. |

| Integration of Smart Monitoring | Quality control was done through manual sampling and testing, leading to potential inconsistency and inefficiency in production. |

| Advancements in Experiential Marketing | Marketing activities were traditional, with an emphasis on product quality and basic functionality without triggering consumer experiences. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulatory agencies will be required to put tighter controls on natural and clean-label ingredients that will force companies to implement open-source manufacturing and sourcing practices. |

| Technological Advancements | The industry is likely to use sophisticated technologies like AI-based quality control systems and caramelization automation, improving the consistency of products and lowering production costs. |

| Industry Adoption | An extension of use is expected, as caramel colors are added to meat alternatives from plants, health food, and craft bakery foods in line with increasing consumer demand for variety and attractively presented food. |

| Supply Chain and Sourcing | There is a move toward more sustainable supply, with businesses forming direct connections with sustainable suppliers and investing in traceable supply chains to cater to consumers' needs for responsibly sourced food additives. |

| Market Competition | Increased competition from new players in organic and tailored caramel color products will force traditional players to innovate and expand product lines to retain market share. |

| Market Growth Drivers | The growth is anticipated to be driven by increasing consumer demand for gourmet food, craft beverages, and ethnic food with the assistance of caramel color because of its cosmetic value, as well as a wide-based trend towards natural food ingredients. |

| Sustainability and Conservation | Sustainability is at the forefront with producers embracing green manufacturing habits, minimizing waste, and embracing renewable energy sources to meet global environmental standards and customer requirements for green products. |

| Integration of Smart Monitoring | The implementation of smart monitoring systems, such as IoT-based sensors and real-time data analytics, will most likely automate production processes, secure the consistency of quality, and optimize traceability from raw material sourcing through to end-product delivery. |

| Advancements in Experiential Marketing | Companies would need to enact immersive marketing campaigns, including virtual reality representations of caramelization and factory tours, to educate consumers and develop better relationships with the brand, making the product more desirable and establishing a customer loyalty program. |

The USA caramel color market has been driven by the nation's enormous food and drink market, particularly in confectionery and soft drinks. PepsiCo and Coca-Cola, the all-time giants, have dominated demand for caramel color. Although as much as consumers have embraced the clean-label and natural foods trend, the producers have also been producing naturally derived caramel colors, based on health-driven trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

EU's strong food culture and strict food safety standards have propelled a strong market for caramel food colorings. Caramel color is increasingly finding applications in bakery and confectionery foods in France and Germany.

With natural additives being an issue of concern in the EU, manufacturers have been manufacturing caramel colors without any artificial additives to satisfy the needs of the health-oriented customer segment in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 10.2% |

China's increasing food processing industry and customers' requirement for conventional seasonings such as soy sauce are driving demand for caramel food color. The market is expanding with clients seeking good-tasting, tasty foods. Businesses are concentrating on quality and safety requirements to cater to domestic as well as overseas regulatory demands.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.9% |

India's diverse food culture and growing processed foods sector have also created a demand for the application of caramel food color. Applications include traditional confections and newer snack foods. Growing demand for natural ingredients has also been propelling the market towards the utilization of naturally occurring caramel colors, as in conformity with global clean-labeling trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.8% |

Brazil's fast-moving confectionery and soft drinks sectors have remained a stimulus to demand for caramel food colours. As the increasingly health-aware consumer is seen, greater demand is being generated for naturally sourced colouring agents better positioned to meet continued nutritional issues. The producers then adapt product formulation accordingly.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 9.8% |

Caramel food color types are grouped as plain, caustic sulphite, ammonia, and sulphite ammonia. These product types have found increasingly diverse uses in food and beverages, mostly from beverage formulators, confectionery companies, and RTE meal developers.

As manufacturers have been under rising clean label and natural origin pressures, they have been making their caramel colours with the aim of fulfilling consumer needs for stability, authenticity, and sustainability.

Plain caramel is the leading category of the caramel food colors market through large-scale application in carbonated soft drinks, malted drinks, and milk flavorings. Its pale yellowish-brown color and pleasant taste are being exploited by food processors to attain beauty without overwhelming taste. A number of leading beverage manufacturers, such as Coca-Cola and PepsiCo, are exploiting plain caramel as a leading ingredient in constant and customer-wanted product.

Raw plain caramel has broader applications in bakery applications, including applications in bread, cake, and pastry. Caramel color finds applications in small-sized bakery units as well as in large-scale industrial bakeries for the deposition of dark brown color to fillings and crusts in order to contribute towards acceptability at sight without being unfriendly in the clean label sense.

Higher demand for additional visually acceptable bakery food products due to naturally sourced colors is also driving the segment growth. Caustic Sulphite Caramel Trends in Dairy and Confectionery with Improved Stability

Caustic sulphite caramel is a staple in the dairy market, especially for milk flavor, coffee whiteners, and yogurts. It is used by dairy firms because it is stable under changing pH levels. This makes it the company of choice for dairy companies as they would want even brown color in their products. Other brands such as Nestlé and Danone use caustic sulphite caramel aggressively in a way that they derive more product consistency at the expense of none of the nutrition.

In confectionery, type of caramel is a key component of caramel chocolate coatings, boiled sweets, and toffees. Caramel type is employed in confectionery to yield deep amber and brown shades and provide visual continuity to ranges of products. Distribution of caustic sulphite caramel will be boosted by new gourmet caramel-coated products coming onto the market from high-status confectionery companies.

Dark-brown-colored ammonia caramel is included in the ingredient description of umami flavor-containing savory food products like soy sauce, barbecue sauce, and Worcestershire sauce. All the factory plants of condiments globally like Heinz and Kikkoman incorporate ammonia caramel to impart distinct deep-brown color to their foods of good umami quality.

Meat processing industry also utilizes ammonia caramel to provide visual appearance to ready-to-eat food, smoked food, and processed meat. It is also commonly used in rubs and marinades to yield deep brown color when grilled meat due to the demand for restaurant-quality, premium look in packaged foods by consumers.

Sulphite ammonia caramel is rightfully used in the animal feed and spice industries because it is stable and has good color effect. Instant noodles, spice mixtures, and bouillon cubes use such a form of caramel for maintaining consistency in browning without compromising on flavor. Spice giants worldwide such as McCormick and Knorr use sulphite ammonia caramel in dry seasonings to make products acceptable worldwide in different cuisines.

Sulphite ammonia caramel is employed in the pet food market to standardize kibble and wet food color in an effort to offer pet owners natural-tasting, premium foods. Purina and Pedigree and other regulatory bodies employ caramel coloring in foods for palatability purposes without altering their nutritional values.

The food and beverage industry is the largest user of caramel food colors because of the enormous demand for flavored alcoholic drinks, malt drinks, and carbonated soft drinks. Caramel colors have been depended on by some of the world's leading beverage companies, such as PepsiCo and The Coca-Cola Company, to guarantee the distinctive color of their brand names. The move to producing sodas, specialty teas, and flavored dairy drinks is also opening up new opportunities for caramel color producers.

In beer and spirits, caramel colors are required in whiskey, rum, and dark ale. Distilleries and breweries use caramel color to give their mass-market and premium brands consistent visual appearance. With the emerging market for craft brewing and craft spirits, market demand for improved caramel colors in this segment should rise.

The bakery industry mixes caramel colors into products such as bread, cookies, and pastry to achieve golden-brown coloration and enhanced appearance. Artisan bakeries and industrial bakeries use the use of caramel colors in an effort to have consistent products especially in multigrain and rye bread where color consistency enhances consumer attitude.

Food processing utilizes caramel colors extensively in chocolates, toffees, and nougats to obtain uniform look and increase shelf appeal. With top-end chocolate players experimenting with gradient and layered color schemes, caramel colors have now started being utilized in alternative forms, giving fillip to innovation for the segment.

Caramel colours are increasingly being applied to pasta and rice foods, particularly in pre-cooked or ready-to-eat meal foods. Instant noodle, rice mixes, and microwaveable pasta meal brands utilize caramel color to achieve uniform browning for enhanced perceived quality of taste.

Caramel colors intended for application in ready-to-use soups and dressings also experienced growing demand, as the firms wish to offer products that have a pleasing appearance and flavor. Firms such as Campbell's and Heinz apply caramel color to create the soup bases of a single color so that the products will appear uniform in global presentation.

Pet food manufacturers increasingly use caramel colors to add better appearance for wet and dry pet food. Premiumization of the pet food market, particularly the expansion of grain-free and gourmet products, has fueled the use of caramel colors in the market.

Similarly, the seasonings segment is also positively influenced by caramel colors as manufacturers create global spice blends and dry seasoning products. The increasing usage of natural food colors in the application of spices is in alignment with consumer requirements for clean-label ingredients, driving market growth even further.

The caramel food color business is facing technology innovations like improved extraction processes and more stability options. Due to shifting consumers' preference to clean-label and organic foods, manufacturers are in the process of research and development to produce caramel colors in an environmentally friendly way.

Regulatory reform and transparency labeling also define the market dynamics. Food companies increasingly disclose the production source and processes of caramel colors to enable more informed consumer choice. Meeting global food safety standards remains a prime driver of quality and innovation in the industry.

Foundational barriers such as regulatory constraints and plant-based alternative color issues, the caramel food colors market is still strong. Food manufacturer and brand alliances and developments in formulation innovation are likely to drive subsequent growth and use by different segments of food and beverages.

The international market for caramel food colors is growing exponentially with growing demand for natural and clean-label food ingredients. Since the consumers are becoming more interested in using natural products than synthetics, the application of caramel color has grown manyfold in uses in various foods and beverages like baked foods, beverages, and confectionery. The companies are doing so by investing in new production technologies and expanding their range with natural caramel color substitutes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Incorporated | 18-22% |

| Sensient Technologies Corporation | 15-19% |

| Kerry Group PLC | 12-16% |

| DDW, The Color House | 10-14% |

| Sethness Caramel Color | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill Incorporated | Yields varying grades of caramel color, Class I to Class IV, supporting the varied needs of food and beverages. |

| Sensient Technologies Corporation | Provides natural and synthetic caramel colors with a focus on innovation and customization to address particular client requirements. |

| Kerry Group PLC | Offers clean-label caramel colors from natural origins, highlighting sustainability and traceability. |

| DDW, The Color House | Excels in natural caramel shades with emphasis on stability and performance in food matrices. |

| Sethness Caramel Color | Provides a large range of caramel colors, with reputation for quality and consistency, available to worldwide markets. |

Key Company Facts

Cargill Incorporated (18-22%)

Cargill is leading the market in caramel food colors with its comprehensive range of caramel color offerings from pale to dark shades for applications in food such as beverages, sauces, and bakery foods. Its innovation and sustainability efforts have also further solidified its market position.

Sensient Technologies Corporation (15-19%)

Sensient focuses on producing natural and synthetic caramel color, emphasizing the delivery of tailored solutions that meet the unique needs of their clients. They spend time on research and development in order to provide high-quality and innovative product offerings.

Kerry Group PLC (12-16%)

Kerry Group offers clean-label caramel colors from natural origin as a solution to consumers' growing demands for transparency and sustainability. Their global reach and innovation steam have assisted them in sustaining their robust market footing.

DDW, The Color House (10-14%)

DDW is a leading natural caramel colorings company focusing on product functionality and stability across a broad food application portfolio. Their know-how in coloring solutions has earned them a partner of choice status among food manufacturers around the world.

Sethness Caramel Color (8-12%)

Sethness is world-famous for its wide range of superior quality caramel colours to various markets globally. Its attention to consistency and quality has turned it into a market leader.

Other Major Players (30-40% Total)

There are several regional as well as private players that occupy the caramel food colours market by specialty products as well as new-age solutions. These include:

The overall market size for the caramel food colors market was USD 225 million in 2025.

The caramel food colors market is expected to reach USD 612 million in 2035.

The demand for the caramel food colors market will be driven by the growing consumer preference for natural ingredients and clean-label products, the expanding food and beverage industry, the versatility and compatibility of caramel colors with different food formulations, and the cost-effectiveness and stability of caramel colors under various processing conditions.

The top 5 countries driving the development of the caramel food colors market are the United States, China, India, Brazil, and Germany.

Class III Caramel Color is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Caramelized Sugars Market Trends Growth & Forecast 2025 to 2035

Caramel Market

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA