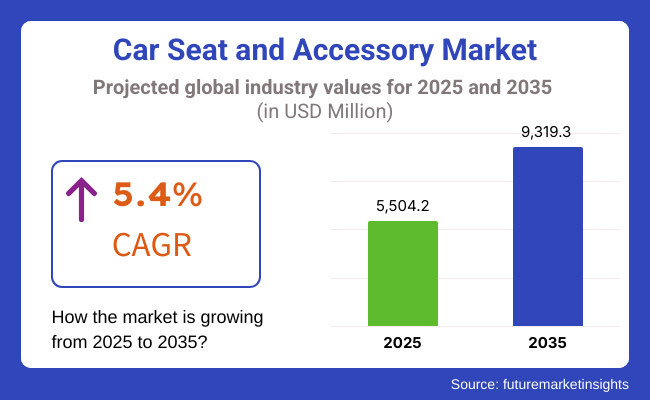

The global car seat and accessory market is poised for substantial expansion, increasing from USD 5,504.2 million in 2025 to USD 9,319.3 million by 2035. The market is expected to grow at a CAGR of 5.4% from 2025 to 2035.

Car seats have gained popularity rapidly because of safety-focused designs and comfort found in many modern vehicles. Market expansion happens swiftly because consumers seek out really efficient travel solutions that are super flexible and safety-smart somehow. Demand spans multiple economic segments, with car seats catering predominantly to families and safety-conscious drivers in urban areas.

Rising interest in smart car features fuels market growth rapidly amidst surging disposable incomes. Modern consumers prioritize functionality with features like adjustable designs, which enhance product appeal pretty significantly nowadays overall. Eco-friendly practices gain traction fast with substantial safety-driven accessory solutions, which are driving market expansion forward really quickly nowadays.

Safety-focused car seats with smart features drive market growth rapidly due to their substantial investment potential. Wealthy buyers perceive fancy accessory technologies as financially savvy moves that boost sales in upscale auto markets rapidly. Eco-friendly products greatly influence purchasing decisions among buyers who somehow prioritize environmental sustainability.

Digital platforms revolutionize the pet car seat market, offering consumers remarkably easy access via online portals to numerous models featuring transparent pricing. Younger folks rapidly drive up online sales, leveraging e-commerce platforms for super convenient purchasing and somewhat detailed product comparisons.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the car seat and accessory industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2025 to 2035) | 4.5% |

| H2 (2025 to 2035) | 6.2% |

| H1 (2025 to 2035) | 6.6% |

| H2 (2025 to 2035) | 4.3% |

The CAGR exhibits a fluctuating trend, initially increasing by 45 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 66 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints. Growth rebounds in H2 (2025 to 2035) with a 43 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

Rising Demand for Compact and Smart Car Seats Drives Market Growth

The global car seat and accessory market is experiencing significant growth rapidly nowadays because of the rising demand for safety-enhancing comfort solutions daily. Modern urban drivers prefer sleek seats that fit snugly into compact vehicles in densely populated city settings. Luxury product consumers lean heavily toward sleek car seats featuring advanced safety systems and superior adjustability.

Manufacturers respond with sleek, multifunctional designs, enhancing convenience beneath remarkably high standards of safety performance somehow. Sustainable seats are gaining popularity and rapidly accelerating market growth due to low environmental impact and reduced material waste. Digital platforms offer augmented reality previews with personalized recommendations that boost buying experiences significantly, driving sales upward rapidly online.

Growing Popularity of Eco-Friendly and Safety-Enhancing Seats Boosts Market Expansion

Sustainability efforts coupled with safety need fuel demand for extremely eco-friendly car seat units daily. Eco-conscious shoppers perceive sustainable seats as savvy financial moves that lower costs beneath sprawling environmental programs. Globally, governments promote safety-certified seats, which significantly influences daily consumer buying habits.

Manufacturers integrate fairly sophisticated materials, low-impact technology, and pretty enhanced safety mechanisms that appeal directly to environmentally conscious consumers. Sophisticated monitoring systems coupled with ergonomic designs somehow become major distinguishing factors. Eco-friendly seats will probably thrust market growth upward fairly rapidly over the next few years.

Rising Focus on Convenience and Flexibility Drives Demand for Car Seats Drivers now prioritize flexibility in seats, driving adoption of super compact designs with ease of use and mobility. Unlike fixed seating, these units offer easy installation mobility and compatibility with multiple vehicle layouts, making them attractive for families.

Innovations like adjustable bases and foldable frames enhance product versatility in multiple ways, catering directly to diverse consumer needs. Family travel trends accelerate market growth rapidly in urban areas as consumers opt for safety-efficient travel solutions daily.

E-Commerce and Digital Platforms Revolutionize the Car Seat Buying Experience

Digital platforms transform the car seat market with seamless access via various online tools and expert reviews readily available everywhere now. Digital stores provide numerous models at fixed prices with flexible payment plans making fancy seats pretty affordable overall nowadays. Virtual product demos boost online shopping with AR-based seat previews and AI-driven personalized recommendations.

Social media significantly impacts consumer behavior through highly targeted digital marketing campaigns and effective influencer partnerships boosting sales online steadily. Doorstep delivery convenience and easy return policies will likely keep fueling e-commerce growth rapidly in car seat market segments overall.

Global car seat and accessory market saw fairly rapid expansion from 2020 to 2024 at annual rate of 4.3% during that timeframe. Market expansion got fueled rapidly by increasing demand for safety-driven solutions rising urbanization and growing adoption of comfort-focused car accessories. Market value soared massively upward reaching USD 5,462.2 million by 2024 fueled largely by consumer interest in ecofriendly convenience.

While the COVID-19 pandemic initially disrupted supply chains, it also accelerated demand for car accessories, as consumers focused on upgrading their vehicles for greater safety. E-commerce platforms played a crucial role in driving sales, with online product demonstrations, customer reviews, and flexible financing options increasing accessibility. Rapidly increasing demand for smart-enabled extremely safe seats significantly boosted market momentum.

Global car seat and accessory market will likely expand rapidly at a CAGR of 5.4% from 2025 reaching USD 9,319. million by 2035. Numerous factors will fuel rapid growth due to significant technological advancements in smart integration and rising disposable incomes. Buyers likely favor seats with safety-efficient features and AI driven tech offering real-time safety tracking.

Sustainability trends play significant role in shaping market demand with manufacturers focusing on eco-friendly materials and safety innovations. Digital platforms will radically alter market landscape enhancing buying experience via augmented reality previews and AI-driven virtual assistants somehow. Family travel trends rising rapidly nowadays imply sizable expansion prospects for car seat market soon.

Tier-1 players dominate the global car seat and accessory market, holding a 35-40% share. These firms capitalize on cutting-edge production methods strong brand recognition and sprawling international networks maintain dominance. They prioritize novelty offering smart-enabled safety-efficient seats with cutting-edge features like AI-driven adjustments and IoT connectivity somehow seamlessly. These brands cater to premium consumers who seek high-performance, durable seats. Notable Tier-1 players include Graco, Britax, Diono, and Evenflo.

Tier-2 companies account for 30-35% of the market and primarily serve mid-range consumers seeking reliable and affordable seating solutions. These firms prioritize efficiency by incorporating safety modes and compact designs in products suited for densely populated city dwellings. They focus heavily on regional market expansion via partnerships with various retailers and numerous e-commerce platforms. Notable Tier-2 players include Chicco, Cybex, Maxi-Cosi, and Safety 1st.

Tier-3 players operate in niche and budget-friendly segments, holding a 15-20% market share. They focus on compact low-cost seats designed specifically for tiny urban vehicles and frugal buyers. These brands fiercely compete on price offering basic models with remarkably simple functionalities amidst decent overall quality levels. Notable Tier-3 players include Cosco, BubbleBum, Harmony, and various private-label brands on online marketplaces.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 4.60 |

| Country | Germany |

|---|---|

| Population (millions) | 84.3 |

| Estimated Per Capita Spending (USD) | 3.75 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 5.90 |

| Country | France |

|---|---|

| Population (millions) | 68.2 |

| Estimated Per Capita Spending (USD) | 7.60 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 67.4 |

| Estimated Per Capita Spending (USD) | 5.50 |

The USA car seat market, valued at USD 1,277.8 million, is driven by high consumer spending on auto accessories, increasing preference for smart and safety-efficient seats, and a strong family and rental market. Urban consumers often favor compact seats with sleek designs but premium buyers prefer app-enabled models featuring safety alerts.

Germany’s car seat market valued at USD 415.5 million benefits greatly from strong sustainable practices and safety habits. Eco-conscious consumers largely drive innovation in recyclable car seats through preference for safety-efficient gear. Compact models gain popularity amidst urban travel trends and space constraints found in many vehicles.

Japan’s car seat market valued at USD 275.7 million thrives heavily on cutting-edge high-tech innovation alongside super compact travel solutions. Many vehicles have small interior spaces so demand remains high for slim profile seats. Japanese consumers favor seats with sleek designs and numerous features that seamlessly blend into modern vehicle spaces quietly.

France’s car seat market valued at USD 208.7 million gets shaped by urbanization rising rapidly amidst growing single-parent households and a huge preference for smart seats. French consumers love ultra-sleek seats beautifully integrated into modern vehicles. Market insiders notice surprisingly robust interest in modular seats and those that fold up neatly inside small cars.

The UK car seat market is valued at USD 299.8 million driven largely by the mounting adoption of smart accessories alongside rental market fluctuations. Demand for safety-efficient plug-and-play seats increases rapidly in densely populated urban areas with smaller vehicles. Consumers prefer remarkably silent seats featuring adaptable designs and flexible safety capabilities to suit various needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

| Canada | 6.5% |

| UK | 5.7% |

| China | 7.2% |

| India | 9.1% |

The USA car seat market will likely experience rapid growth at 4.6% CAGR from 2025 driven by soaring demand for safety-efficient gear. Urbanization fuels demand for tiny vehicles so car seats become super desirable in smaller rentals nowadays.

Consumers prioritize safety efficiency and waste reduction amidst government efforts promoting eco-friendly accessories somehow. Smart tech significantly impacts buying decisions as app-connected safety-tracked seats gain popularity very rapidly online. Strong online retail platforms significantly boost market growth by facilitating consumer comparisons of features and providing easy access nearby.

The UK car seat market will likely expand rapidly at a CAGR of 5.7% over next decade driven by eco-conscious consumers. Manufacturers introduce low-impact accessory models amidst rising concerns regarding waste reduction and safety efficiency requirements.

Rental vehicle increase likewise fuels demand since tenants generally prefer portable accessories that facilitate easy relocation somehow. Younger buyers seek space-saving solutions with modular foldable seats rapidly gaining traction in today's fast-paced lifestyle somehow. E-commerce players offer at-home trials and flexible financing options for buyers through various online platforms nowadays.

India’s car seat market is set to grow at an impressive CAGR of 9.1% from 2025 to 2035, fueled by rapid urbanization, an expanding middle class, and increasing adoption of modern auto accessories. Nuclear families rising alongside disposable incomes drive demand for convenient seating solutions that don’t need dedicated space.

Growing awareness of safety and comfort gizmos fuels emergence of car seats as preferred alternative in urban hubs. E-commerce boom has made these accessories extremely accessible through leading platforms offering enormous discounts under easy EMI options and doorstep services. Global brands eye Indian market introducing super compact seat models suited perfectly for local driving habits daily.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Convertible Car Seats | 5.7% |

The convertible car seat segment leads the car seat market and is projected to grow at a CAGR of 5.7% from 2025 to 2035. This growth is fueled by rising adoption in small households and rental vehicles, where space efficiency is a major priority. The increasing demand for safety-efficient and eco-friendly accessories further propels this segment’s expansion. Consumers prefer compact plug-and-play seats requiring minimal setup so convertible models become a highly sought after option nowadays. Manufacturers integrate smart features like safety connectivity and automatic adjustments making seats more convenient for modern users.

| Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Online Retail | 6.2% |

The online retail segment dominates the sales of car seats and is expected to grow at a CAGR of 6.2% from 2025 to 2035. The convenience of doorstep delivery facilitates easy installation guides and wide product choices thus accelerating online purchases rapidly every day somehow.

Consumers rely heavily on customer reviews and flexible payment options making e-commerce platforms a preferred shopping spot online nowadays. Manufacturers’ shift towards direct-to-consumer sales substantially fortifies this particular sales pathway allowing brands to offer bespoke models alongside comprehensive post-purchase support services. Partnerships between leading brands and e-commerce giants significantly enhance visibility accessibility promoting robust expansion of online sales.

The global car seat and accessory market is highly competitive, with key players such as Graco, Britax, Diono, Evenflo, and Chicco dominating the industry through innovation, safety efficiency, and advanced technology integration. Graco is a leading brand recognized for its quiet operation and cutting-edge safety-efficient seats, particularly its 4Ever technology, which enhances versatility and reduces adjustments. Britax stands out with its smart seat features, including sensor-based safety cycles and app connectivity, catering to tech-savvy consumers looking for convenience.

Apart from these major brands, emerging players like Cosco and BubbleBum are redefining the market with affordable and space-saving solutions, targeting small households and urban drivers. Cosco specializes in compact, portable seats with intuitive controls and quick installation, making them ideal for renters. BubbleBum, on the other hand, focuses on budget-friendly models with inflatable designs, eliminating the need for bulky frames and enhancing portability.

The market is witnessing a strong shift toward safety-efficient and smart-enabled seats, with brands investing in AI-powered safety cycles, comfort optimization, and voice assistant compatibility. Sustainability and eco-friendly initiatives also play a crucial role, as manufacturers develop low-impact seats and introduce recyclable material compatibility to align with growing environmental concerns.

Recent Industry Developments in the Car Seat and Accessory Market

Graco introduced a new AI-powered convertible seat that optimizes safety and comfort based on the child size and travel level. This innovation enhances efficiency and sustainability, catering to the growing demand for smart auto accessories with eco-friendly features.

Britax expanded its range of compact seats by introducing models with app connectivity and safety assistant integration. These seats allow users to monitor safety remotely via a mobile app, improving convenience for consumers in small vehicles and rental homes.

Diono launched a self-adjusting car seat featuring UV protection technology to eliminate wear and odors, ensuring a more reliable fit. This development aligns with rising consumer concerns about safety and health-conscious auto accessories.

The global car seat and accessory industry is projected to witness a CAGR of 5.4% between 2025 and 2035.

The global car seat and accessory industry stood at USD 5,462.2 million in 2024.

The global car seat and accessory industry is anticipated to reach USD 9,319.3 million by 2035 end.

India is set to record the highest CAGR of 9.1% in the assessment period.

The key players operating in the global car seat and accessory industry include Graco, Britax, Diono, Evenflo, and Chicco, among others.

In terms of product type, the industry is divided into convertible car seats, infant car seats, booster seats, seat covers, and others.

The industry is further divided by sales channels that are direct sales, supermarkets & hypermarkets, specialty baby & auto stores, electronics & accessory stores, online retailers, and other sales channels.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.