The worldwide capacitive proximity sensors market will develop magnificently in 2025 to 2035 with the increasing trend of automation, consumer electronics, and IoT. Capacitive proximity sensors identify the existence or nonexistence of an object without physically contacting them depending on whether they can find a capacitive variation or not and therefore are the essential parts of immensely huge fields ranging from smartphones to automation control systems.

There have been various drivers that have resulted in such growth in the market, such as growing use of smart devices, growing use of Industry 4.0, and growing focus on touchless interfaces, particularly due to health and safety needs. Capacitive proximity sensors are among the leaders when it comes to consumer product user interface and manufacturing precision.

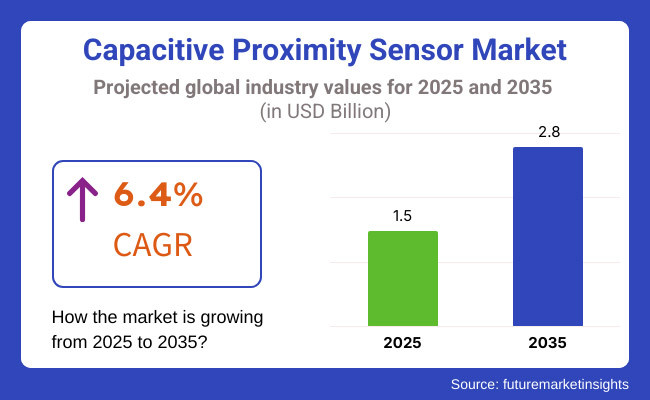

6.4% compound annual growth rate (CAGR) to be achieved between 2025 to 2035 is providing huge business opportunities for the capacitive proximity sensor market manufacturers and developers. Miniaturization of sensors and increased sensitivity will be propelling its applications in industries.

Explore FMI!

Book a free demo

North America is a huge market for capacitive proximity sensors already due to its industrial might and its readiness to adopt newer technologies earlier. The United States grows most quickly because of the greater deployment of the sensors in the automobile sector, primarily for ADAS.

The sensors enhance the car's safety, develop the user experience, and enable a more effortless driving experience. With the car industry focusing on innovation and automation, capacitive proximity sensors play an even more critical role to help car manufacturers be ahead of the curve in terms of safety and performance and cater to autonomous drive development technology.

Europe leads the world in industrial automation and car technology, especially in Germany and France, where smart manufacturing is largely focused. Capacitive proximity sensors are one of the fields that provide precision in the form of applications such as robot arms, assembly lines, and quality control.

With the advantage of delivering more precision and efficiency, the sensors allow the industries to control the demand for high-performance and high-quality products. Industry 4.0, through the adoption of automation, data exchange, and Internet of Things (IoT), also allows for the employment of capacitive proximity sensors within European industry.

Market growth of capacitive proximity sensors will be highest-growth in the Asia-Pacific region due to increased industrialization and explosive growth of consumer electronics. "Make in India" and "Made in China 2025" are driving technology upgradation and local production opportunities.

China, Japan, and South Korea are a few nations where huge demand is being generated for capacitive proximity sensors, particularly in smart phones, domestic appliances, and equipment. Capacitive proximity sensors are sophisticated and inexpensive in goods and are therefore one of the main drivers to change manufacturing and consumer goods industries in the region.

Challenges

Technological Limitations and Competition

Competing technologies like optical sensing and inductive sensing are threatened by capacitive proximity sensing with both having inherent superiority in a given application. Inductive sensors, for example, rule the daytime when metal detection is active and there's an established history of high accuracy at extended ranges from optical sensors.

Moreover, capacitive sensors are not only vulnerable to environmental factors such as temperature, humidity, and electromagnetic interference but the latter one of them will be interfering with their functioning. This places companies in a dilemma to invest in continuous innovation and development in design and material to give hardness and toughness to capacitive sensors to be able to endure conditions.

Opportunities

Integration with New Technologies

Besides challenges, capacitive proximity sensors have excellent future with technologies such as the Internet of Things (IoT), artificial intelligence (AI), and wearables. Due to a growing demand for smart devices, higher sensitivity of sensors, low power consumption, and operation in different environments are needed.

Capacitive sensors could be the future of smart cities, medical treatment, and consumer interactive devices. Converting the sensor technology to these new problems can give rise to new markets and applications and establish capacitive sensors as the norm in new technology.

In the 2020 to 2024 period, capacitive proximity sensor market grew incrementally with rise in application of touchless interfaces and industrial automation in manufacturing. COVID-19 global pandemic also benefited usage of contactless technology in health care and retail industry. Complexity of supply chain and requirement for high accuracy in most applications were the limitations.

Future until 2025 to 2035, capacitive proximity sensors' market will be converging and expanding. Companies will be investing in R&D of less environment-sensitive and more accurate sensors and easier integration into various systems and products.

Joint ventures along with sensor application-based design by the technology vendors and increased availability through e-commerce channels can guarantee maximum reachability and closeness to the customer.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Standards for capacitive proximity sensors for basic safety and performance were set. |

| Technological Advancements | Capacitive proximity sensors experienced sensitivity improvement and reduction in size to allow integration into small products such as smartphones and wearables. |

| Industry Adoption | Consumer electronics and the automotive sector started using capacitive proximity sensors for touchscreens and proximity sensing. |

| Supply Chain and Sourcing | Manufacturers used components from global suppliers, aiming to reduce costs. |

| Market Competition | The market had multiple established companies that provided similar sensor technologies. |

| Market Growth Drivers | Expansion fueled by increased demand for touch devices and automation of manufacturing functions. |

| Sustainability and Conservation | Limited emphasis on the environmental dimension of sensor manufacturing and disposal. |

| Integration of Smart Monitoring | Original use with simple monitoring systems for performance monitoring. |

| Advancements in Experiential Applications | Application in interactive screens and game consoles for improved user experience. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulations will be strengthened by governments to emphasize environmental sustainability and energy efficiency, impacting sensor design and production procedures. |

| Technological Advancements | Expected developments involve the incorporation of artificial intelligence (AI) for predictive maintenance and the creation of flexible sensors for use in wearable technology and smart textiles. |

| Industry Adoption | Broader take-up is forecast across industries such as healthcare for non-invasive patient monitoring and industrial automation for more advanced process control, based on the requirement for accuracy and dependability. |

| Supply Chain and Sourcing | There will be a move towards local sourcing and sustainable materials to counteract supply chain disruption and comply with environmental standards. |

| Market Competition | Greater competition is forecast from new entrants focusing on specialist applications and providing tailored sensor solutions, fueling innovation and diversification. |

| Market Growth Drivers | These include the growth in IoT devices, increased smart home technology, and increased autonomous vehicles, which are forecasted to push market growth. |

| Sustainability and Conservation | Increased focus on green manufacturing methods and recyclable sensor development will be anticipated as part of a global effort to meet sustainability initiatives. |

| Integration of Smart Monitoring | Increased use of advanced IoT platform integration to analyze real-time data and perform remote monitoring will become the norm, making processes more efficient. |

| Advancements in Experiential Applications | Expansion into virtual reality (VR) and augmented reality (AR) applications is expected, with immersive experiences in gaming, training, and education markets. |

The USA capacitive proximity sensor market has been driven by the quicker uptake of smart consumer electronics and high-end automotive technology. Giant tech corporations have leveraged these sensors to improve devices such as smartphones and tablets.

The transformation of the automobile sector into electric and autonomous vehicles has also fueled demand for proximity sensors to be used in collision avoidance and parking assistance. Government rules at the forefront of Industry 4.0 and intelligent manufacturing will drive market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

German heavy duty car penetration has prompted capacitive proximity sensor innovation technology in premium cars with high-end high-tech driver assistance software (ADAS). Industrial robotics and smart factory concepts applied in the nation also prompted sensor technology. Collaboration and coordination activity of research institutions with sensor production companies are pushing the innovation to ability for improved sensors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.2% |

Japan's consumer electronics sector, which has been utilized to manufacture new and high-technology products, has widely used capacitive proximity sensors in smartphones, cameras, and game controllers.

The automotive industry, also, brought about the need for sensors with its emphasis on hybrid and electric cars. Ongoing investments in robotics and automation are also creating potential applications for the use of sensors in manufacturing and healthcare.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

South Korea's technological prowess in the production of semiconductors and consumer electronics has made capacitive proximity sensors economically viable for an extremely wide range of products from smart phones to home appliances. Its technology development in 5G and IoT infrastructure will make such sensors penetrate even faster in the applications of smart home and industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

China's manufacturing supremacy and industrialization at a high pace have fueled the need for capacitive proximity sensors in quality inspection and automation applications. Growing business in consumer electronics and programs such as "Made in China 2025" will drive sensor adoption. Spending on smart city initiatives and IoT infrastructure also provide huge opportunities for growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.6% |

Capacitive proximity sensors belong to touch sensors, motion sensors, position sensors, etc. Capacitive proximity sensors are increasingly finding application in various industries to enhance levels of automation, enable effective sensing of movement, and enable conformity of consumer and manufacturing applications according to safety.

Capacitive proximity sensors go a long way towards improving industrial control systems, man-machine communication, and effortless navigation by self-driving vehicles. Its application is in the form of automotive, industrial, aerospace & defense, marine, and others as demand for advanced non-contact sensing solutions keeps mounting.

Touch sensors rank among the biggest drivers in the capacitive proximity sensor market with widespread application across consumer electronics, industrial control panels, and healthcare products. The need for smartphones, tablets, and smart home appliances has been the major driving force in propelling the growth of this market.

Capacitive touch sensors provide smooth, solid, and highly sensitive user interaction with easy interaction with the device. Their sensitivity to the slightest touch is an intuitive-to-use feature, which is the characteristic feature of contemporary consumer electronics.

Touch sensors find applications in industrial control panels for automation to enhance efficiency of operation with easy-to-use and intuitive interfaces to drive processes and machines. It makes complicated functions easy and reduces human error.

In the medical field, capacitive touch sensors find applications in medical devices like disposable medical devices through touching and hospital bed control panels. Sensors enable effective care of patients through sanitary, precise, and easy interaction with medical devices.

Touch sensors are also used in the automobile industry, primarily for dashboard operations and infotainment systems, as alternatives to mechanical switches. Aside from the beauty of cars, the technology is also operational with benefits such as gesture control and haptic feedback. As digital is becoming more trendy by industries, so is the use of capacitive touch sensors, thereby a leading technology for products and applications today in any industry.

Motion sensors, or better known as capacitive sensors, are gaining even more importance in most applications for most industries. They are a part of the necessary components in order to provide security systems, smart homes, and industrial robots with greater efficiency.

Capacitive motion sensors in particular are one of the most important parts in smart lighting systems to sense presence to control light and energy saving in smart buildings. They are used for gesture recognition and intruder detection and to make life easier and safer.

In manufacturing halls, motion sensors are used to help automate via accurate movement measurement to be followed in real time and utmost assembly line control. Drones and AMRs use capacitive sensors to make choices while moving around complex areas with minimal human handling.

In aerospace uses, capacitive motion sensors are used in aircraft stabilization, UAV flight control, and tactical reconnaissance. As industries are shifting towards being efficient, automated, and safety-conscious, the uses of capacitive motion sensors are expanding at an exponential rate. Their high-precision and real-time data characteristics make them a core component in future robotic automation and security networks, and this is pushing innovation in numerous industries.

Position sensors form a leading proportion of the capacitive proximity sensor market with strict areas of application in industrial automation, automobile, and shipbuilding industries. Position sensors precisely identify the positions of machine components, maximize the efficiency of conveyor belts, and provide accurate positioning in precision manufacturing technologies in industrial automation.

Position sensors play a very critical role in the automotive system, where they monitor steering angles, pedal position, and power adaptive suspension systems for enhanced car performance and security. Position sensors ready for use in the marine environment are also applied in ship stabilization and navigation to enhance on-water operating efficiency and safety.

The aerospace industry also depends on such sensors, using them in flight control to track landing gear position and control surface deflection, steadying aircraft stability during flight. With greater need for automated production and accuracy in engineering, capacitive position sensors are becoming ever more vital to optimizing operations and safety in mission-critical functions.

Their capacity to offer consistent real-time information enhances performance and reliability in a broad spectrum of industries and are therefore a vital component of contemporary technological progress.

Capacitive proximity sensor market prevalent over various end-use applications is very wide, with the industrial and automotive segments driving growth. The industrial usage highly depends upon capacitive sensors to use them for autonomous systems, condition monitoring, and real-time monitoring of process. Factory automation is supported by capacitive sensors from compliance of safety in risky conditions to the identification of an object and tracking of a conveyor belt and further.

The car industry utilizes capacitive proximity sensors in new driver assistance systems (ADAS), keyless entry, and automotive infotainment touchscreens. Capacitive sensors allow gesture control for touch-free travel and management of media systems for increased comfort during driving. Electric vehicles (EVs) employ capacitive sensors for battery management systems and port sensing to charge efficiently for energy consumption.

With smart cars rolling and smart factories operating, capacitive proximity sensors are the answer to obtaining automation and maximizing operational productivity in automotive and industrial sectors.

Aerospace & defense uses are among the highest growth opportunities for capacitive proximity sensors, mainly in avionics, navigation, and tactical systems. Capacitive sensors also give precise position information for aircraft control systems to ensure optimal flight performance and stability. Capacitive sensors are used in military applications for missile guidance systems, radar systems, and unmanned aerial systems to provide better situation awareness and successful targeting.

Moreover, capacitive sensors are providing support to space missions exploration in the areas of space docking system monitoring, robot arm positioning, and planet rover interaction with the planet. With increasing investments being placed on future aerospace missions and defense equipment, capacitive proximity sensors will be of great importance for precise aerospace applications.

The maritime sector increasingly utilizes capacitive proximity sensors for ship navigation, autonomous berthing systems, and underwater target surveillance. The sensors improve sea safety by detecting obstructions and monitoring live ship position. Capacitive sensors are implemented in ballast water treatment systems to deliver environmental compliance as well as maximization of ship stability.

Sub-sea exploration equipment utilizes capacitive sensors for remote-operated vehicle (ROV) applications and seafloor surveys to aid deep ocean science and deep water oil & gas exploration. With digitalization now finally reaching the shipping and shipping-related sectors, capacitive proximity sensors enhance automation and simplify maritime operation. Market Growth Driven by New Applications and Technological Advances

Apart from their conventional uses, capacitive proximity sensors are breaking into new markets in the form of augmented reality (AR), virtual reality (VR), and wearables. Hand tracking for AR/VR headsets is enabled through capacitive sensors because it improves user interface in gaming, simulation training, and virtual conferencing.

Wearable technology such as smartwatches and activity trackers employ capacitive touch sensors for contact application and for biometric sensing to provide ease of use and user-friendly interface. Medical devices also deploy capacitive sensors in contactless patient monitoring systems and electronic skin applications for cutting-edge healthcare diagnostics.

Technology advancement in sensor miniaturization and nanotechnology is also driving market innovation even deeper, allowing ultra-thin flexible capacitive sensors to be made to be applied in the future. As the industry ventures into new fields of human-machine interface and smart automation, capacitive proximity sensors will continue to redefine technology advancement across all industries.

Capacitive proximity sensors' market is expanding exponentially with increased usage of automation across industries, increased utilization of touch devices, and advancements in smart technology.

Capacitive proximity sensors find applications in the automotive, industrial automation, consumer electronics, and medical industries to make products better in terms of efficiency and usage. Such developments such as flexible and transparent sensors are creating new opportunities for application.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Rockwell Automation Inc. | 15 to 20% |

| Omron Corporation | 12-16% |

| Pepperl + Fuchs GmbH | 10-14% |

| Infineon Technologies AG | 8-12% |

| Fargo Controls Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Rockwell Automation Inc. | Provides industrial automation solutions incorporating capacitive proximity sensors for object detection and process control. |

| Omron Corporation | Offers capacitive proximity sensors integrated into factory automation systems, enhancing precision and efficiency. |

| Pepperl + Fuchs GmbH | Specializes in sensor technology, including capacitive proximity sensors for hazardous environments, ensuring safety and reliability. |

| Infineon Technologies AG | Develops semiconductor solutions with capacitive sensing capabilities, enabling touch and proximity detection in consumer electronics. |

| Fargo Controls Inc. | Manufactures capacitive proximity sensors for diverse applications, including level detection and material handling in industrial settings. |

Key Company Insights

Rockwell Automation Inc. (15 to 20%)

Rockwell Automation is at the forefront in applying capacitive proximity sensors in advancing object detection and process control for industrial automation solutions across industries.

Omron Corporation (12-16%)

Omron Corporation employs capacitive proximity sensors in making accuracy and productivity possible for factory automation systems, leading to optimized manufacturing processes.

Pepperl + Fuchs GmbH (10-14%)

Pepperl + Fuchs GmbH is a sensor technology company providing capacitive proximity sensors for hazardous areas with reliability and safety in industrial applications.

Infineon Technologies AG (8-12%)

Infineon Technologies AG produces semiconductor solutions with on-chip capacitive sensing functionality for high-end touch and proximity sensing in consumer electronics.

Fargo Controls Inc. (5-9%)

Fargo Controls Inc. produces capacitive proximity sensors for industrial applications such as level sensing and material handling with enhanced operating efficiency.

Other Key Participants (40-50% of the overall)

Regional participants and independent participants contribute towards proliferating capacitive proximity sensors through the creation of innovative and specialty products. Among the notable independent players are:

The overall market size for the capacitive proximity sensor market was USD 1.5 billion in 2025.

The capacitive proximity sensor market is expected to reach USD 2.8 billion by 2035.

The demand for the capacitive proximity sensor market will be driven by increasing industrial automation, rising adoption of smart technologies in sectors like automotive and consumer electronics, proliferation of IoT devices, advancements in sensor technology, and the growing emphasis on touchless interfaces and user experiences.

The top 5 companies driving the development of the capacitive proximity sensor market are: o Farnell o Panasonic o Siemens o Omron o Honeywell

Industrial Automation is expected to command a significant share over the assessment period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.