As the focus is on product safety, leak prevention, and extended shelf life, the cap liner business is undergoing rapid advancement. Increased impetus is given by the growing demand from the food and beverage, pharmaceuticals, and personal care industries, where manufacturers innovate with high-barrier materials, tamper-evident liners, and sustainable sealing solutions. Companies are incorporating advanced induction seal technology, pressure-sensitive liners, and compostable alternatives to suit the changing regulatory standards and environmental concerns.

To enhance efficiency and improve cost, manufacturers are investing in artificial intelligence-based quality management systems, dynamic high-speed die-cutting technology coupled with multi-layered sealing systems. The industry is gradually moving towards recyclable liners, solvent-free adhesives, and antimicrobial coatings to strengthen product protection and sustainability.

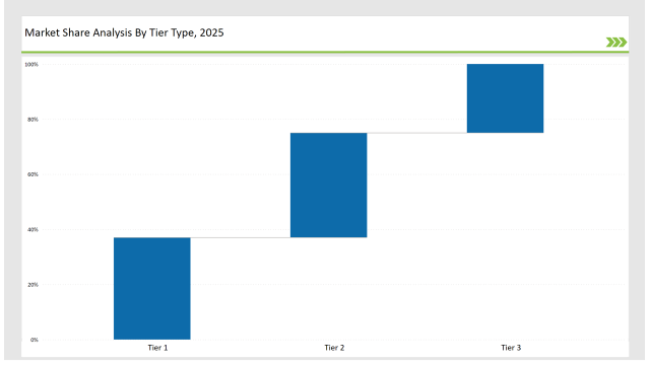

Tier 1 players account for 37% of the market with high-performance liners, excellent material technology, and global distribution capabilities. These are some of the elite companies, including Tekni-Plex, Tri-Seal, and Selig Group.

Tier 2 companies, which include The Cary Company, Enercon Industries, and Pres-On, account for 38% of the market with their cost-effective, customized, and application-specific cap liners for several industries.

Tier 3 comprises regional and niche players providing tamper evident, digitally printed, and biodegradable cap liners that control 25% of the market. These players are more localized in production, which allows for the generation of high-impact graphics, and customized sealing technology.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Tekni-Plex, Tri-Seal, Selig Group) | 17% |

| Rest of Top 5 (The Cary Company, Enercon Industries) | 12% |

| Next 5 of Top 10 (Pres-On, Liner Factory, Bluemay Weston, Protech, Qorpak) | 8% |

Cap liner industry caters to various industries, where product safety, freshness, and tamper-proofing are of utmost concern. Companies are developing high-performance liners that can comply with regulatory acts and meet the expectations of consumers. They are incorporating high-barrier materials to offer protection against contamination and moisture. At the same time, manufacturers are adopting more sustainable, compostable alternatives for lesser plastic waste. Moreover, businesses are also developing smart liner technologies to enable in-field authentication and supply chain tracking.

The producers have further optimized these cap liners by means of intelligent sealing, improved barrier properties, and eco-sustainable materials. They are developing ultra-lightweight liners that really save on material usage while keeping full performance. Companies are also incorporating high-performance adhesives to achieve superior adhesion to diverse packaging substrates. Furthermore, companies are now utilizing advanced thermal resistance coatings that will allow the liner to maintain its integrity under extreme temperature conditions.

Sustainability and intelligent packaging are indeed altering the entire cap liner industry. The focus on reduced environmental impact has led companies to integrate RFID-enabled seals, water-based adhesives, and bio-based liner materials into their packaging. Businesses are now creating ultra-thin liners that consume less material while providing peak performance. They are also diversifying the digital-printing technology for branding and authentication purposes. In addition, companies are optimizing their high-speed production techniques in order to meet the increasing demand for high-performance sealing solutions.

Technology suppliers should focus on automation, sustainable liner materials, and digital authentication features to support the evolving cap liner market. Partnering with food, beverage, and pharmaceutical brands will drive innovation.

Tier-Wise Vendor Classification (2025)

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Tekni-Plex, Tri-Seal, Selig Group |

| Tier 2 | The Cary Company, Enercon Industries, Pres-On |

| Tier 3 | Liner Factory, Bluemay Weston, Protech, Qorpak |

Top manufacturers are innovating cap liner tech with AI-based QC, biobased materials, and smart security features. They are incorporating high-performance coatings for chemical and durability enhancement. Above all incode laser-marked security features in ensuring anti-counterfeiting and authentication.

| Manufacturer | Latest Developments |

|---|---|

| Tekni-Plex | Launched ultra-thin, high-barrier cap liners in March 2024. |

| Tri-Seal | Developed solvent-free, recyclable sealing solutions in April 2024. |

| Selig Group | Expanded induction-seal liner technology in May 2024. |

| The Cary Co. | Released pressure-sensitive liners for reusable packaging in June 2024. |

| Enercon Ind. | Strengthened induction-sealing advancements in July 2024. |

| Pres-On | Introduced custom-printed, eco-friendly foam liners in August 2024. |

| Liner Factory | Pioneered antimicrobial cap liner solutions in September 2024. |

The cap liner market is evolving as companies invest in sustainable materials, smart packaging, and high-speed production innovations. They are developing thinner, high-barrier liners that enhance product integrity while minimizing material use. Additionally, businesses are incorporating RFID and QR-enabled liners for improved traceability and consumer engagement. Manufacturers are also expanding the use of bio-based and solvent-free adhesives to reduce environmental impact.

Manufacturers will continue integrating AI-driven defect detection, sustainable materials, and smart authentication. Companies will refine moisture-resistant and tamper-evident liners to improve product security. Businesses will develop biodegradable sealing solutions to align with circular economy goals. Firms will expand automation in production lines to enhance efficiency. Additionally, companies will adopt blockchain traceability to ensure authenticity in pharmaceutical and food applications.

Leading players include Tekni-Plex, Tri-Seal, Selig Group, The Cary Company, Enercon Industries, Pres-On, and Liner Factory.

The top 3 players collectively control 17% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, smart packaging, high-barrier materials, and automation.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.