The global cans market is forecast to generate stead growth opportunities during the period of 2025 to 2035 owing to the burgeoning adoption of sustainable and recyclable packaging solutions across a wide range of industry verticals such as food & beverages, personal care and pharmaceuticals.

Hence, aluminium and steel cans are becoming more popular in the packaging as they are lightweight, low-cost and have a good protective/durable quality. Rising environmental awareness along with government bans on single-use plastics have also spurred the shift to metal cans especially in the beverage industry, where aluminium cans dominate because they have such high recyclability rates and lower carbon footprints.

Smart, convenient packaging: Puncture-and-pour lids, zipper tops and clever copy on labels make the product easier and more convenient for consumers to adopt. Increasing consumption of beverages ranging from energy drinks to soft drinks and alcoholic beverages such as ready-to-drink (RTD) beverages is one of the major driving factor for global market growth while development in technology of aerosol nozzle is fuelling the growth of the market dough.

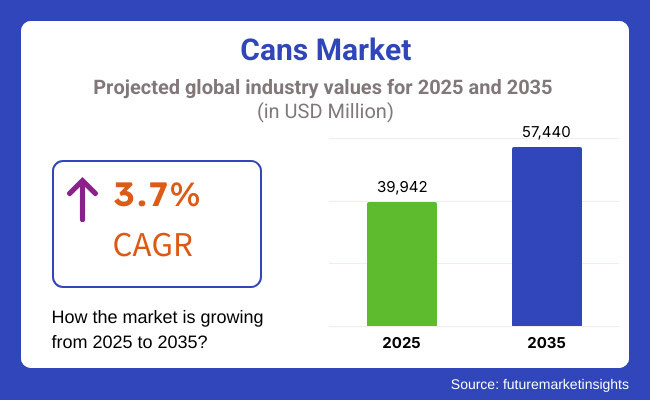

The market is projected to experience CAGR of 3.7% during the period of 2025 to 2035, due to increasing investments to reduce carbon footprints with sustainable packaging solutions, and rising penetration of canned food products in emerging economies, and major improvements in the technology of can production to optimize efficiency and recyclability.

The market is segmented based on material type into aluminium and steel; the aluminium cans are expected to gain higher traction due to lightweight structures and higher recyclability. Whether for carbonated or non-carbonated beverages, aluminium cans are the package of choice -its ability to maintain carbonation and protect from outside elements are key features. Steel tanks are widely used in the food industry for canned fruits and vegetables, soups, and pet feeds because they are more resistant to corrosion and damage.

Furthermore, the increasing adoption of aerosol cans in the personal care segment, including deodorants, shaving creams, and hairsprays, is likely to witness significant developments in propellant technology to deliver better spray pattern and enhanced product dispersion. Based pharmaceutical packaging, particularly for the storage of powdered and aerosolized drugs, have fuelled demand for metal cans.

Moreover, the market is further enhanced by technological advancements, such as increased use of digital printing on cans leading to better branding and product differentiation as well as to the advent of ultra-thin and high-strength can walls, which consume less material while maintaining durability.

Explore FMI!

Book a free demo

Even in terms of cans, North America remains a critical market, where the United States and Canada are the first and second beverage can consumers in the world. The market is driven by the high demand for craft beers, carbonated beverages, and ready-to-drink energy drinks in the region, while regulatory policies that promote sustainability and recycling programs support aluminium can adoption.

Another important factor driving market growth is replacing foods packaged in plastic-based packaging with metal-based packaging, including canned seafood or canned vegetables. Furthermore, advancements in technologies such as lightweight can designs and smart packaging solutions are driving the growth of the region's market.

Rising cans demand and growing usage of eco-friendly recycled packaging materials by different consumer groups in alignment with stringent environmental regulations in Europe act as a major risk to the region's cans industry through 2028. For countries such as Germany, France, and the United Kingdom, metal packaging is gaining ground, with the highest uptake in the beverage and personal care category.

It is not news, anymore, that canned food can be nutritious, organic and even preservative-free, so, as consumers get pickier, manufacturers are following their lead, creating better-quality can linings that protect food without chemical additives. Furthermore, the European Union has integrated ambitious recycling targets for the aluminium sector that has incentivized more aluminium to be recycled contributing to its lower life cycle impacts and a circular economy.

The Asia Pacific considerations over a grow with the most noteworthy CAGR are credited to the developing urbanization, moving discretionary cash flow & depiction of lifestyles in China, India, & Japan market. It has a burgeoning middle class, with disposable incomes and a growing demand for convenience and shelf-stable food and beverage products, which is driving the proliferation of canned products across further brands in the region. Moreover, the growing demand for energy drinks, soft drinks, and canned coffee products including both Japan and South Korea are further driving the demand for aluminium canisters; whereas, the large scale production ability of China and government incentive plans regarding sustainable packaging is benefiting the market in the regional market place. In a new report vessel & aerosol propellant industries global market report 2019 from the firm, which says demand is underpinned by the increasing adoption of canned food and aerosol personal care products in India.

In Latin America, the cans market is increasing and is dominated by Brazil and Mexico where increased consumption of caned beverage and food products has positioned the region as the potential market. The demand for aluminium cans has grown due to the increase in craft beer and RTD cocktails, while government efforts to reduce plastic waste are further pushing manufacturers to adopt the metal packaging solution. Middle East market is driven by growing packaged food and beverages demand and high sustainability focus aiding the market. The adoption of canned products in the region is also booming due to the number of convenience stores and supermarkets.

Challenges

Fluctuating Raw Material Prices and Supply Chain Disruptions

As with any packaging solution, the market for cans is directly impacted by raw material costs. The price volatility of these metals is affected by several factors such as geopolitical tensions, trade barriers and supply chain disruptions. For instance, global aluminium supply has been impacted by things like import tariffs, rising energy costs and restrictions on mining activities, translating into volatility in pricing trends. The volatility impacts can maker’s bottom line, as raw materials account for a large percentage of production costs.

In addition, supply chain disruptions caused the problems with procurement delays, increased shipping fees and logjams have made it difficult for manufacturers to restock levels on a consistent basis. Essentially, the heightened demand for canned foods, canned sodas, anything that is essential during these uncertain times, has been placing strain on what were already strained supply chains, which has created temporary shortages along with increasing production costs.

To meet these challenges, companies must invest in long-term contracts with metal suppliers, pursue some recycling projects to boost secondary aluminium availability and diversify supply chains. As well, manufacturers can rely on new lightweight can technology and material efficiency to decrease costly commodities without sacrificing product quality.

Opportunity

Sustainable packaging is on the rise and consumers demand it more than ever

Cans market is significantly driven by and the strong demand for sustainable packaging factors. Metal containers are gaining popularity in packaging, as consumers and regulators alike increasingly ask for sustainable options, especially as they are reusable and and have less environmental impact than other containers like plastic.Cans hold particular sustainable types of material, one of which is aluminium that is highly recyclable, and can be reused indefinitely without degrading. Metal cans have sustainability proven benefits which align with global sustainability initiatives and the circular economy, placing them central to sustainability in packaging initiatives.

Along with sustainability, the growing consumer demand for canned food and drinks is propelling market growth. The exploding popularity of carbonated beverages has made cans a go-to vessel for a slew of other packaged goods from craft beer and canned seafood to ready-to-eat meals due to their convenience, longevity and durability. That trend combined with the continued rise of the on-the-go consumption trend one prevalent especially in younger demographics has aided canned products' increasing popularity.

Manufacturers are also innovating to make metal cans even more attractive. Advanced-printing technologies, customizable designs and resealable can formats are increasingly being adopted by brands looking to set their products apart from the rest. Moreover, the launch of lightweight and hassle-free-opened cans has enhanced customer convenience, covering up a huge market width in different segments.

The time frame during 2020 and 2024 witnessed an upsurge in demands for the cans market significantly due to the increased acceptance of packaged food and beverages products. Consumers turned to shelf-stable items, increasing purchases of canned food. Sustainability concerns as well drove companies to launch environmental-minded initiatives, like using more recycled aluminium and moving away from plastic packaging. But, the sector was contending with aluminium shortages, increasing production costs, and disruptions in global supply chain.

Furthermore, to their data on the 2025 to 2035 outlook of the market. Changes such as the transition towards carbon-neutral manufacturing, developments in can coating technology, and the incorporation of smart packaging solutions will redefine the industry. Businesses will prioritize increasing recyclability rates and adopting sustainable sourcing practices to align with worldwide environmental objectives. Also, new advancements in can designs such as resealable and lightweight formats will drive consumer appeal in more product categories.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased sustainability regulations on plastic packaging |

| Technological Advancements | Improved can printing and design customization |

| Industry Adoption | Rise in demand for canned beverages and ready-to-eat meals |

| Supply Chain and Sourcing | Challenges in raw material sourcing due to aluminium shortages |

| Market Competition | Growth in competition among beverage and food can manufacturers |

| Market Growth Drivers | Increased consumption of canned beverages and pantry-stable foods |

| Sustainability and Energy Efficiency | Focus on reducing packaging waste and increasing recyclability |

| Integration of Smart Monitoring | Limited use of digital tracking for canned products |

| Advancements in Packaging Materials | Shift towards BPA-free can coatings |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on recycled content in metal cans and carbon footprint reduction initiatives |

| Technological Advancements | Smart packaging integration, including QR codes for traceability and freshness indicators |

| Industry Adoption | Expansion of premium and resealable can formats for enhanced convenience |

| Supply Chain and Sourcing | Greater reliance on recycled aluminium and alternative metal sourcing |

| Market Competition | Entry of new players offering innovative can designs and lightweight packaging solutions |

| Market Growth Drivers | Growth in sustainable packaging demand and consumer preference for recyclable alternatives |

| Sustainability and Energy Efficiency | Widespread adoption of energy-efficient can production and carbon-neutral packaging initiatives |

| Integration of Smart Monitoring | Implementation of block chain-based traceability and interactive packaging for consumer engagement |

| Advancements in Packaging Materials | Development of next-generation eco-friendly coatings and lightweight metal alternatives |

In the United States, steady growth is being witnessed in the can market, fuelled by the growing popularity for sustainable packaging alternatives in food and beverage products. The trend towards aluminium cans, which are infinitely recyclable and offer a more sustainable option than plastic, is growing. Many beverage companies, such as beer and soft drink makers, are developing lightweight and resealable can designs for ease of use as well as lower environmental impact. Factors such as Thermochromic Inks, Smart Packaging, and Digital Printing are also reshaping market dynamics.

In the United States, the demand for aluminium cans is propped up by growing consumption of ready-to-drink (RTD) beverages from energy drinks to flavoured water and even alcoholic seltzers. Additionally, the increased availability of canned food items, most notably in the organic and premium food categories, is further impelling the market growth.

As the consumer awareness about sustainability is increasing, companies are spending on high barrier coatings as well as BPA free linings that help in improving the form safety along with the shelf life of the product. The growth of the USA cans market is being driven further by technological advances in manufacturing efficiency and the presence of major can creating characteristics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The current scenario depicts that the cans market in United Kingdom is growing on a significant scale, primarily driven by the government stringent sustainability regulations and the rising preference for metal packaging in the food and beverage sector. UK's commitment to reducing legacy plastic waste, aluminium and steel cans have come to dominate many of the packaging applications, especially in carbonated soft drinks, craft beer and canned foods. The growth of home consumption trends and the preference for convenient packaging in terms of on-the-go meals and drinks are also propelling demand for canned products.

Food and beverage companies in the UK are also placing more emphasis on environmentally friendly packaging leading to a greater adoption of lightweight aluminium cans with lower carbon footprints. Surge in Demand for Premium and Organic Food Products (especially Plant-Based Meals and Seafood) Driving the Market Growth Also, technologically advanced can designs with easy-open end and resealable closures are improving consumer conveniences and driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The cans market in the European Union is growing in light of additional sustainability efforts and a vigorous regulatory push for recyclable and reusable packages. At the. And European metal packaging is gaining popularity in the beverage field, as well as food packaging, with countries such as Germany, France and Italy championing their use. And EU circular economy policies continue to push manufacturers toward reducing single-use plastics, further boosting aluminium and steel can demand. Export and export to Europe and North America: thus contributing to the significant expansion of the market are: as a result, the development and development of advanced can manufacturing industry in Europe.

There has been a significant increase in the demand for premium quality packaging solutions in the North American cans market, especially in craft beer and energy drinks segments. The possible eco-friendly nature of BPA-free coatings, bolstered printing technologies, and embossing techniques are also aiding the monetary value addition of can packaging. In addition, the trend towards "on-the-go" consumption is fuelling demand for lightweight and resealable beverage cans. Moreover, rising investments made in can manufacturing lines with high speed as well as digital printing innovations are also supporting the growth of the market across the European Union.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

The cans industry in Japan is booming at a stable growth rate driven by a mature packaging sector and a favourable consumer base of convenience foods & beverages. The growing popularity of ready-to-drink (RTD) coffee, tea and even alcoholic beverages like sake and highballs has been driving the growth of aluminium can adoption. Moreover, Japan’s stringent recycling regulations and emphasis on sustainable packaging solutions are supporting the transition to lightweight and wholly recyclable cans. For example, nitrogen-infused cans for coffee and dual-compartments cans for mixed beverages have emerged as innovations in can designs.

Demand from Japan’s food sector is also fuelling consumption of canned products, which are particularly popular in the seafood, soup, and premium ready-to-eat meals categories. With the emergence of compact and travel-friendly packaging solutions, manufacturers can work towards ultra-lightweight aluminium cans that preserve food freshness, decrease transportation expenses, etc. Japan also has made strides in the digital printing and embossing of canned packaging to allow for quality branding, with the designs easily visible on store shelves.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

Growing consumption of canned beverages such as energy drinks, flavoured teas, and craft beers is contributing to South Korea's cans market growth. The rising emphasis on sustainability in the country is pushing the transformation of plastic-to-metal packaging solutions, especially aluminium cans, because they hold high recyclability value. Furthermore, demand for novel can packaging formats is being driven by the growing penetration of international beverage brands and expanding local craft beer segment. Moreover, advanced printing and labelling technologies in South Korea are increasing the product differentiation in the market.

Within the food packaging market in South Korea, there is growth in canned seafood, ready-to-eat meals, and plant-based canned products. As a reaction to urbanization and hectic lifestyles that have caused a growing demand for convenient types of food, manufacturers are offering smaller easy-opening cans for single servings. Additional processing to package in vacuum-sealed cans and nitrogen-infused packaging to extend the shelf life is becoming a trend. The presence of large packaging companies and ongoing R&D in sustainable packaging solutions will bolster cans market in South Korea further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

Due to their own environmental concerns, Styrofoam containers are also no longer allowed, and in the world of cans, the lightweight, durable, and easily recyclable metal (especially aluminium) cans lead. Climate change and consumer demand for more sustainable packaging solutions has made aluminium cans the vessel of choice, with 80% of carbonated soft drinks drunk out of aluminium in 2023 and 78% of energy drinks, 42% of beer and 25% of ready-to-drink coffee and tea. Aluminium cans have superior barrier properties compared to plastic and glass alternatives blocking out light, oxygen and moisture to preserve products and increase shelf life.

Aluminium can demand has also been bolstered by the growth of craft beverages including both premium beer and hard seltzers, as well as functional drinks. Beverage brands have been switching from glass bottles to aluminium cans because they are cheaper to ship, less carbon-intensive to transport, and often more convenient for consumers. Also, aluminium provided even more recycled material than other sources, and aluminium cans are now easily accepted in our recycling streams, with close to 75% of the aluminium ever made still in use.

However, aluminium cans come with challenges, including the dependence on crading raw material prices and concerns about bauxite mining's environmental costs. But the emergence of low-carbon aluminium, along with the incorporation of recycled materials into new cans, are resolving these sustainability issues and paving the way for continued growth in the market.

Steel cans continue to be a key segment of the food packaging market, with receipts for canned vegetables, fruits, soups, meats and pet food. The advantage they give in longer shelf life, superior protection against foreign contamination, and robustness to damage, has made them an essential part of the global food supply chain. Steel cans are much more tamper-resistant than soft plastic pouches, making them ideal for long-term storage without refrigeration.

Aluminium can linings have also improved consumer confidence; today, most steel can linings are BPA-free. There is also a growing demand for steel cans as the food industry’s emphasis on getting rid of preservatives while keeping products safe has ensured that natural food can be kept in better condition, as by using heat sterilization.

But steel cans are also not free from challenges: for instance, the emergence of competing packaging formats such as pouches and the tetra pack, which provide light and flexible packaging options. This however, does little to deter the excellent recyclability which steel cans enjoy and with more investment in sustainable metal packaging, the steel can is here to stay.

Cans continue to find their way to the table top - the biggest user of all, the beverage industry, has never looked back. The growing demand for ready-to-drink products such as soft drinks, sparkling water, functional beverages, and alcoholic beverages also solidified cans' leadership in the space. Cans are popular with consumers because they are portable, come to chill quickly, and hold carbonation and flavour stable for longer periods.

The accelerate growth of this market is seen in alcoholic beverage products such as pre-mixed cocktails, hard seltzers and craft beers being canned for consumers. More brands have been embracing sleek and slim cans to offer product appeal and differentiation. The commercialization of resealable can lids and nitrogen-infused beverage cans has also opened up avenues for premiumisation and consumer experience.

Despite continued competition from plastic and glass bottles in the beverage space, a major sustainability push and regulatory restrictions on single-use plastics have strengthened aluminium can adoption. Growing consumption of organic and plant-based drinks has also boosted demand as manufacturers search for sustainable packaging options.

Food Industry Expands Can Usage Amid Consumer Demand for Shelf-Stable and Preservative-Free Products

Canned foods remain a mainstay in homes around the world today, prized for their long shelf life, ease of use, and low price. The demand for canned vegetables, fruits, soups and protein-rich products such as beans, tuna and chicken has remained steady, especially in regions where food security is a major concern.

One of the major factors that bolsters the demand for steel cans is the growing pet food industry where wet pet food is approximately 95% in metal cans to retain the freshness and integrity of nutrients. The increasing premium pet food market has additionally catalysed the need for superior-quality, sustainably sourced packaging solutions.

One likely reason is that cans still offer better product protection than flexible and lightweight alternatives like stand-up pouches and also meet the industry's recyclability standards as well as enabling long-term food storage without artificial preservatives.

As sustainability becomes a key driver of packaging choices, the cans market is seeing fresh innovation in sustainable materials and formats. Accessing Recycled Content whereas recycled content in aluminium and steel cans is on the rise, companies are looking to circular economy initiatives to reduce carbon footprints.

Smart can technologies such as QR codes, interactive packaging, and augmented reality labels are emerging as one of the key trends to boost consumer engagement and brand storytelling. Also, lightweight can constructions and biodegradable coatings are anticipated to enhance the market attractiveness.

Through challenges like the volatility of raw material prices and competition from alternative packaging solutions, the strong demand for eco-friendly, lightweight, and convenient packaging solutions continue to grow the global cans market at a steady rate.

The food and beverage industry is increasingly adopting eco-friendly and lightweight recyclable packaging solutions, which is an important driver of growth for the global cans market. Moreover, rising consumer preference for packaged beverages including soda, energy drinks, and alcoholic drinks has resulted in market growth.

Besides that, long shelf life less demand for preservatives and convenience are the reasons this food industry still adopts canning packaging for soups, vegetables, fruits, and ready-to-eat meals. Transformational areas include technology advancements in BPA-free coatings and production of high-barrier metal cans for extended shelf life and freshness. Companies focused on brand differentiation too, which needed an increase in investments in digital printing technologies and customized designs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ball Corporation | 22-26% |

| Crown Holdings, Inc. | 18-22% |

| Armagh Group | 14-18% |

| CANPACK Group | 10-14% |

| Silgan Holdings Inc. | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ball Corporation | Leading producer of aluminium beverage cans, focusing on lightweight, recyclable, and innovative can designs for global beverage brands. |

| Crown Holdings, Inc. | Specializes in high-performance metal packaging, including beverage, food, and aerosol cans, with an emphasis on sustainability. |

| Ardagh Group | Provides advanced metal and glass packaging solutions, with a strong presence in both food and beverage can segments. |

| CANPACK Group | Manufactures aluminum beverage cans with customized printing options and environmentally friendly production processes. |

| Silgan Holdings Inc. | Focuses on metal food cans and closures, emphasizing high-barrier coatings and extended shelf-life packaging. |

Key Company Insights

Ball Corporation (22-26%)

A global pioneer in aluminium can manufacturing providing ultra-lightweight and infinitely recyclable can solutions in support of the circular economy.

Crown Holdings, Inc. (18-22%)

Progressing towards metal sustainable packaging portfolio, the firm leverages the advanced sealing technologies as well as lightweight metal materials for food as well as beverages.

Ardagh Group (14-18%)

Respected in metal packaging, producing premium barrier cans to satisfy diverse food and beverage packaging needs.

CANPACK Group (10-14%)

Expanding its Market Share through Investment in Premium Printing and Decoration Technologies. Serving Craft Beverage and Specialty Packaging Markets.

Silgan Holdings Inc. (8-12%)

Provides metal packaging solutions for food and aerosol products, emphasizing product protection and shelf life improvement

Other Key Players (20-30% Combined)

Regional and specialized packaging firms also add to the mix, developing innovations in can manufacturing, material and efficiency improvements, as well as design upgrades. These include:

The overall market size for the Cans Market was USD 39,942 million in 2025.

The Cans Market is expected to reach USD 57,440 million in 2035.

The growing preference for sustainable and recyclable packaging solutions, increasing consumption of ready-to-drink beverages, and the rising demand for durable food storage options fuel the Cans Market during the forecast period. The shift toward lightweight and eco-friendly aluminium cans further accelerates market growth.

The top 5 countries driving the development of the Cans Market are the United States, China, Germany, Japan, and Brazil.

On the basis of application, Aluminium Cans are expected to command a significant share over the forecast period, driven by their high recyclability, lightweight nature, and increasing adoption in the beverage and food packaging industries.

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Kraft Paper Machine - Market Outlook 2025 to 2035

Kraft Paper Bags Market Growth – Demand & Forecast 2025 to 2035

Rotational Molding Machine Market Analysis by Product Type, Application and End Use Through 2035

Case Erectors Market by Automation Type from 2025 to 2035

Container Liner Market Trends, Growth, Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.