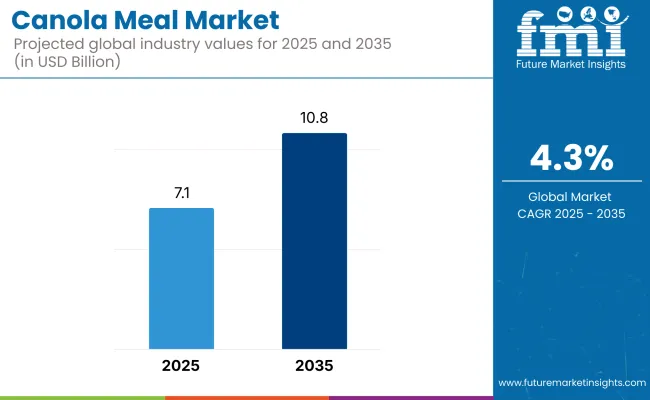

The global canola meal market is set to witness USD 7.07 billion in 2025. The industry is projected to grow at 4.3% CAGR during the study period, reaching USD 10.77 billion by 2035.

The industry is witnessing substantial growth on account of some of the key factors driving demand for plant-based, high-protein by-product of canola oil extraction. The principal cause behind the growth in demand is the global increase in demand for plant-based protein sources, especially for the animal feed industry.

Canola meal is a rich, nutritious feedstuff that contains high amounts of protein and fiber and is therefore a perfect choice for ruminants, poultry, and aquaculture feed. With the population rising globally, the demand for animal products like meat, eggs, and milk has also risen, hence fuelling the demand for effective and environmentally friendly animal feeding solutions.

Also, the increasing trend towards sustainable agriculture and environmentally friendly practices is helping to fuel the demand for the product use. Canola meal is a green alternative to other protein meals like soybean meal, as it has a lower carbon footprint and uses less land and water to grow. This makes it a popular option for farmers and producers looking to address consumer calls for sustainability in the food and agriculture industries.

Another reason is its application in nutrition, especially in plant-based food items. With increasing number of consumers opting for vegetarian, vegan, or flexitarian diets, there has been a growing demand for plant-based protein sources such as canola meal.

In total, the industry is growing as a result of its crucial position in animal feed, its sustainability advantages, and increasing consumer demand for plant-based nutrition. All these put together are aiding in driving demand for the product globally.

In the animal feed industry, demand for low-cost, high-protein feed ingredients is a driving force. Producers are more and more searching for ingredients that can provide nutritional quality while being environmentally friendly. Therefore, the product has become more popular because it contains high protein and has a lower environmental footprint than other feed ingredients such as soybean meal.

Also, the movement towards organic and sustainable farming has inclined consumers and businesses to buy feed that aligns with these philosophies. Buying choices are further supported by the capability to enhance animal growth or production rates, minimize costs, and enhance feed efficiency, making the product a popular choice in most livestock, poultry, and aquaculture uses.

In food and nutrition, there is a trend towards plant-based diets based on health, environmental, and animal welfare concerns. Consumers are increasingly looking for plant-based protein sources, and this trend has increased demand for foods such as canola meal in protein bars, supplements, and functional food ingredients.

Buying guidelines in this segment are based on protein quality, nutritional composition (e.g., amino acid profile), and the functionality of the ingredient in a range of food applications. In addition, the trend toward clean-label foods and natural, minimally processed ingredients is a driving influence, leading to a sense of encouragement to utilize the product in foods meeting these criteria.

Generally, buying factors among various end-use segments focus on the nutritional value of the product, sustainability, affordability, and versatility in satisfying consumer and industry needs. The industry is riding on these changing trends and has emerged as a key player in various industries.

From 2020 to 2024, the industry has experienced dramatic changes fueled by evolving consumer tastes, sustainability issues, and innovation in agricultural production. The growth in worldwide demand for plant-based protein sources, combined with the growing emphasis on animal feed efficiency and sustainability, has been a key driver of product demand across industries.

The animal feed sector, specifically, saw a significant move towards plant-based substitutes for conventional animal feed, with the product becoming increasingly popular because of its high protein content and lower environmental footprint relative to other feed alternatives such as soybean and corn meal.

Looking forward to the 2025 to 2035 time frame, some of the most important trends that will define the canola meal space include the continued growth in plant-based diets and the growing trend towards sustainable agriculture.

With more and more consumers adopting plant-based diets for health and environmental purposes, demand for alternative protein sources such as canola meal will continue to increase. The product's high protein content along with a positive environmental history renders it a valued commodity in human nutrition and animal feed use.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 Industry Shifts | 2025 to 2035 Industry Shifts |

|---|---|

| Rising demand for plant-based diets and healthy food consumption. Greater use of plant-based proteins such as canola meal in functional foods, protein bars, and supplements. | Greater trend towards personalized nutrition, with consumers seeking customized plant-based and sustainable diets. The product will be a major feature in personalized nutritional products. |

| Increased emphasis on sustainable and environmentally friendly farming methods, with a demand for ingredients such as canola meal because of its reduced environmental footprint compared to other feed ingredients. | Sustainability is a high priority, with increasingly stringent standards. Advances in sustainable agriculture and crop optimization will further make the product more efficient in terms of resources. |

| Increased usage of plant-based, affordable, and environmentally friendly feed alternatives. The product became a favored choice over soybean meal because of its high protein value and low ecological impact. | Increased expansion in the use of plant-based animal feed. Technological innovation will further make the product more efficient at promoting animal development and lower the dependency on conventional feed resources. |

| Increased demand for clean-label and plant-based products. Canola meal increasingly being used in protein supplements and functional foods, particularly in vegan and vegetarian diets. | Product’s contribution to benefits related to health such as muscle recovery and weight management will increase. |

The industry, although witnessing tremendous growth, also witnesses a variety of risks that might affect its long-term stability and growth. One of the main risks is global warming. Canola farming is extremely weather-dependent, and erratic weather patterns, including droughts, floods, and temperature variability, can significantly influence crop production.

A drop in canola output as a result of poor weather conditions may result in a shortage of the product, increasing prices and lowering its availability, which would adversely affect industries that use it for animal feed and human consumption.

The other significant risk is volatile commodity prices. Canola meal is a by-product of the production of canola oil, so its availability and pricing are directly linked to the canola oil industry.

Any notable canola oil price fluctuations, initiated by changes in international supply and demand or trade embargoes, directly affect the price and accessibility of the product. Such price fluctuation could undermine the supply chain, particularly for industries such as animal feed and plant foods, which are dependent on consistent pricing.

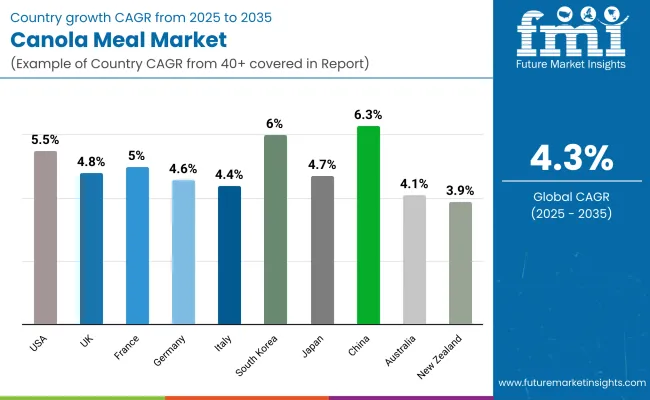

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| UK | 4.8% |

| France | 5.0% |

| Germany | 4.6% |

| Italy | 4.4% |

| South Korea | 6.0% |

| Japan | 4.7% |

| China | 6.3% |

| Australia | 4.1% |

| New Zealand | 3.9% |

The USA is poised to witness a steady rise in the industry on account of growing demand for plant-based and sustainable protein sources, particularly in animal feed. With the continued trend of plant-based diets and growing demand for functional and alternative protein ingredients in human nutrition, American consumers are looking for cleaner, environmentally friendly protein sources.

The agricultural and biofuel industries in the USA are also expected to drive further industry expansion, aided by technological advancements in farming practices.

The UK industry is predicted to experience modest growth due to the nation's growing demand for sustainable and traceable ingredients used in animal feed as well as plant-based foodstuffs.

The UK consumers are becoming increasingly concerned with clean-label and sustainable products, and this is expected to positively contribute to the growing adoption of the product. In addition, the growing interest in animal welfare and environmentally friendly agriculture will also propel the adoption of plant-based protein substitutes such as canola meal.

In France, the industry is also expected to develop at a moderate rate, led by an increased emphasis on healthy diets and sustainable ingredient sourcing. French consumers continue to value sustainability and clean labels, making the product a desirable option in both human nutrition and animal feed applications. Further, growing interest in plant-based diets will drive demand for plant protein sources, further enhancing industry growth.

Germany's industry will grow steadily because of the country's high focus on food security and sustainability. Being a major contributor to the European agricultural industry, Germany's demand for sustainable, protein-rich animal feed ingredients will propel growth.

German consumers are also increasingly health-oriented, and that will drive the wider use of the product as part of plant-based food and supplement solutions. Sustainability is a major driver for German companies to look for alternative, sustainable protein sources.

In Italy, the industry would grow steadily on the back of the prevailing health and wellness trend. With more Italian consumers choosing organic and sustainable food, both animal feed and human nutrition use of plant-based proteins is forecast to increase in the future. The increasing awareness of clean labels in Italy coupled with its superior agricultural innovation is likely to keep the industry ahead during this phase.

South Korea is also projected to have one of the highest growth rates in the industry. South Korea's high interest in health and well-being, as well as growing demand for functional food and supplements, will fuel the industry. South Korea's heightened awareness of sustainability and demand for plant-based diets will further boost uptake of the product as a sustainable, protein-packed ingredient for both animal feed and human consumption.

Japan's industry is poised to rise at a moderate rate, influenced by the aging population and consumer interest in health and vitality. Japan's consumers are increasingly interested in vegetable-based protein sources, which is forecast to support demand for the product in both human nutrition and animal feed. Furthermore, Japan's interest in clean, sustainable products is complementary to the development of the product, further supporting its industry growth.

China's canola meal market will be at its peak in terms of growth, propelled by the country's rising middle class and growing health awareness. The rising interest in protein-rich foods and animal feed will also continue to drive the industry, with consumers looking for substitutes for meat and dairy products.

China's promotion of sustainable agriculture and environmental protection will further raise the interest in green ingredients such as canola meal, which is in line with government direction and consumer sentiment.

Australia's industry is also projected to develop at a more sluggish pace, but progressively, as spurred by the need for sustainable and quality protein offerings. The industry in Australia attaches particular importance to green agriculture and food production through sustainability, and that will boost continued uptake of the product by both the animal feed sector and human diets.

The expansion in the industry will be contained, though, by the high usage of alternative sources of proteins and slower adoption changes in industry attitudes.

New Zealand's canola meal market is predicted to develop at a moderate rate. The nation's consumers increasingly demand sustainability and natural ingredients, creating the product as a good option for both plant-based food items and animal feed.

In spite of the smaller market and competitive stress from other plant-based proteins, growth will be somewhat constrained. In spite of this fact, the growing demand for clean-label and traceable ingredients will continue to add to the market's gradual growth.

The product is more widely used in large farms compared to small farms, primarily due to the scale of operations and the economic benefits associated with its use. Large farms, particularly those involved in livestock production, rely on cost-effective and efficient feed options to meet the nutritional needs of large numbers of animals.

The product is a high-protein, plant-based by-product of canola oil extraction, and it serves as a valuable ingredient in animal feed, especially for cattle, poultry, and swine.

For large-scale farms, the economic efficiency of using the product is a key factor. The protein content in this meal is comparable to soybean meal, but it often comes at a lower price, making it an attractive alternative in feed formulations. Additionally, large farms can benefit from buying the product in bulk, which further reduces costs and ensures a steady supply for the animals.

Moreover, large farms typically have access to better infrastructure and technology, enabling them to store and handle the product more effectively. The ability to scale up production and invest in efficient feed systems also makes it easier for large farms to integrate the product into their operations.

The sustainability aspect of the product also aligns well with larger farms, especially those focusing on improving their environmental footprint by using plant-based proteins over animal-derived ones.

The primary sales channel for the product is normally direct selling, particularly when referring to the large-scale purchasers like livestock farmers, feed mills, and agricultural cooperatives. Direct selling is preferred since it enables bulk buying and long-term agreements that are economically beneficial for both the purchaser and the seller.

Large farms, feed mills, and processors usually buy the product in large volumes, which is more economical in terms of logistics, price, and dependability when done directly.

Direct sales also allow suppliers to develop long-term connections with buyers, guaranteeing a stable supply chain for such a critical ingredient in animal feed. Moreover, direct sales enable more aggressive pricing because intermediaries are being bypassed, and tailored solutions to the needs of the buyer, like formulated solutions for a particular type of livestock, can be provided.

For agro stores, though they are a significant sales channel for smaller volumes of the product, they tend to be more geared to the needs of smaller farms, home gardeners, or local producers. Agro stores may prove to be a viable distribution channel for buyers interested in the product purchase in small quantities or for producers that require constant access to the product without committing to bulk buys.

Nevertheless, large-scale feed operations prefer less agro stores because they are in limited supply and tend to have higher retail prices than direct sales channels. Agro stores would also possibly carry less frequent product supplies, which becomes a problem when bigger farms have a continuous uninterrupted supply need to feed animals.

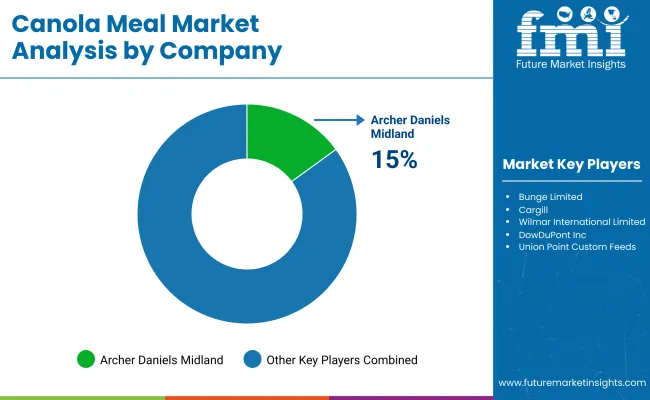

The market is dominated by a combination of large multinationals and niche players, each promoting unique products customized to respond to the escalating demand for high-protein animal feed. The growth in the market is driven by the surge in the demand for quality, sustainable feed products for livestock, coupled with the accelerating demand for plant-based protein sources within the agricultural industry.

Market leaders such as Archer Daniels Midland, Bunge Limited, and Cargill operate in the market, using their large networks of supply chains and research operations to provide products that address livestock nutrition. These multinationals are keen on offering affordable, bulk quantities of products to meet the increasing demand for protein-rich feed solutions.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Archer Daniels Midland | 15-20% |

| Bunge Limited | 12-18% |

| Cargill | 18-22% |

| Wilmar International Limited | 8-12% |

| DowDuPont Inc. | 6-9% |

| Union Point Custom Feeds | 4-7% |

| Pacific Coast Canola | 5-8% |

| Resaca Sun Feeds | 3-6% |

| Sunora Foods | 4-6% |

| Richardson International | 6-10% |

| Company Name | Key Offerings & Activities |

|---|---|

| Archer Daniels Midland | Supplies premium products for animal feed with priority on bulk volumes and competitive price. |

| Bunge Limited | Supplies scalable, plant-based protein alternatives to animal feed, with major thrust on scalability. |

| Cargill | Supplies products to animals and poultry, with priorities placed on cost reduction and sustainable production. |

| Wilmar International Limited | Supplies plant-based proteins such as canola meal in response to expanding demand within the feed industry. |

| DowDuPont Inc. | Offers solutions in the form of canola meal, customized to boost the nutritional value of animal feeds. |

| Union Point Custom Feeds | Specializes in high-grade canola meal for premium animal feed products with a focus on local and sustainable sourcing. |

| Pacific Coast Canola | Provides clean-label products, serving both livestock feed and plant-based protein requirements. |

| Resaca Sun Feeds | Serves the agricultural and livestock industries by providing customized meal formulations for maximum animal well-being. |

| Sunora Foods | Offers sustainable plant-based protein products, such as canola meal, for animal nutrition and feeding. |

| Richardson International | Offers a wide range of high-quality product offerings with attention to both animal feed and agricultural sustainability. |

The industry is being propelled by a growing need for high-protein animal feed ingredients, with industry leaders such as Archer Daniels Midland, Bunge, and Cargill taking the lead in supply and innovation. These firms are concentrating on offering affordable and sustainable canola meal products to large-scale animal operations. They are also catering to mounting environmental concerns over animal feed production, with a focus on sustainable sourcing practices.

While this is happening, niche companies such as Pacific Coast Canola, Resaca Sun Feeds, and Sunora Foods are making inroads in the market by providing high-quality, clean-label products. The companies emphasize sustainability and provide more localized or specialized solutions that attract consumers and farms seeking more customized or premium feed solutions.

Growth in the market is predicted to be defined by product development, sustainability, and cost-effectiveness, so that product becomes a central component in current livestock feeding.

In terms of animal type, the industry is classified into beef cattle feed, dairy cattle feed, swine feed, and poultry feed.

With respect to farm type, the industry is divided into large farm and small farm.

Based on sales channel, the market is classified into direct sales and agro sales.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is slated to reach USD 7.07 billion in 2025.

The industry is predicted to reach a size of USD 10.77 billion by 2035.

Key companies include Archer Daniels Midland, Bunge Limited, Cargill, Wilmar International Limited, DowDuPont Inc., Union Point Custom Feeds, Pacific Coast Canola, Resaca Sun Feeds, Sunora Foods, and Richardson International.

China, slated to grow at 6.3% CAGR during the forecast period, is poised for the fastest growth.

Direct sales are widely preferred.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canola Lecithin Market Analysis by Form, Available Grades, Functionality, End Use, and Region through 2025 to 2035

Canola Proteins Market

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Leaders & Share in the Fish Meal Industry

Ready Meals Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Krill Meal Market Analysis - Size, Growth, and Forecast 2025 to 2035

Competitive Overview of Ready Meals Packaging Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA