The worldwide canned tuna business is moderately concentrated with domestic processors, green niche players, and international seafood players vying for market share. International industry giants like Thai Union Group, Bumble Bee Foods, and Starkist Co. dominate 45% market share by virtue of their well-established supply chain, extensive distribution channel, and brand name in B2B as well as B2C markets.

Local selling and buying mid-tiers and regionals such as Ocean Brands, Dongwon Industries, and Chicken of the Sea hold 35%. Niche and sustainable majors such as Wild Planet Foods, Maruha Nichiro Corporation, Genova Seafood, and Crown Prince hold 20% with green and premium-conscious consumers.

The market is moderately concentrated as the top five players own about 55% market share. Here, product innovation, sustainability, and private label partnerships are crucial drivers.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share (%) | 45% |

| Key Companies | Thai Union Group, Bumble Bee Foods, Starkist Co. |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share (%) | 35% |

| Key Companies | Chicken of the Sea, Dongwon Industries, Ocean Brands |

| Market Structure | Sustainable & Niche Brands |

|---|---|

| Industry Share (%) | 20% |

| Key Companies | Genova Seafood, Crown Prince, Wild Planet Foods, Maruha Nichiro Corporation |

The global canned tuna markets are relatively consolidated, with strong seafood processors controlling the markets as sustainable brands and private labels make consumers have more choices.

Light Canned Tuna (50%) leads the market due to price sensitivity and wide usage in meals on a day-to-day basis. Thai Union and Starkist Co. have dominance in this category by mass-market distribution within retail stores and bulk sale to foodservice systems. Canned White Tuna (30%) is targeted for health- and value-sensitive customers, for whom Bumble Bee Foods and Genova Seafood are category leaders. Specialty Canned Tuna (20%), flavored and infused, is growing more popular among gourmet food consumers and health-conscious buyers alike, with Wild Planet Foods and Crown Prince offerings at upscale, green levels.

Chunks (40%) are the most liked because of flexibility in meal preparation and ease, provided predominantly by Bumble Bee, Starkist, and Chicken of the Sea. Solid tuna (30%) is a high-volume category within premium and protein-rich meal use, with dominance by Genova and Crown Prince. Flakes (20%) are favored within salads and fillings for sandwiches, while the Others (10%) category accounts for spread products and ready-to-eat meals of tuna, a new development in convenience food.

B2C (75%) is the highest share, supermarkets (40%) being the core retail channel for mass and premium canned tuna products. Convenience stores (15%) lead impulse and small-pack business, with online retail (10%) expanding led by direct consumer sales and online partnerships. B2B/HoReCa (25%) is solid, with bulk producers serving restaurants, hotels, and catering companies, especially in sushi and fast-food businesses.

2024 saw tremendous action from regional as well as global players in the Canned Tuna market.

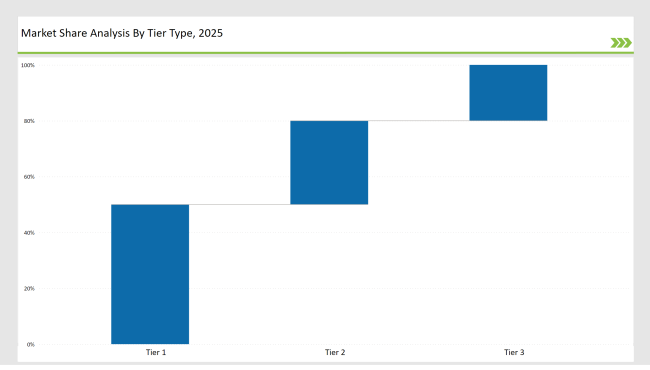

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Thai Union Group, Bumble Bee Foods, Starkist Co. |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Chicken of the Sea, Dongwon Industries, Ocean Brands |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Genova Seafood, Crown Prince, Wild Planet Foods, Maruha Nichiro Corporation |

| Brand | Key Focus |

|---|---|

| Thai Union Group | Strengthened sustainability and traceability programs for 100% responsibly sourced tuna. |

| Bumble Bee Foods | Expanded on-the-go protein-rich tuna pouches, targeting fitness-conscious consumers. |

| Starkist Co. | Launched ready-to-eat flavored tuna meal bowls to cater to busy professionals and students. |

| Chicken of the Sea | Introduced blockchain-based sourcing verification to enhance consumer trust and food safety. |

| Dongwon Industries | Expanded flavored gourmet tuna selections, focusing on Korean and international cuisine. |

| Ocean Brands | Invested in private label partnerships, strengthening its presence in supermarkets and foodservice. |

| Genova Seafood | Developed premium olive oil-packed canned tuna, targeting Mediterranean and gourmet food lovers. |

| Crown Prince | Introduced BPA-free and fully recyclable tuna packaging, aligning with eco-conscious trends. |

| Wild Planet Foods | Focused on pole-and-line caught tuna and expanded organic canned seafood offerings. |

| Maruha Nichiro Corporation | Increased processing capacity in Southeast Asia, ensuring a steady and reliable tuna supply. |

High-quality olive oil-filled, smoked, and aged tuna will become popular, particularly in Europe and North America, where high-end seafood consumers are ready to pay premium prices for excellence. Genova Seafood and Crown Prince brands are spearheading this trend by providing artisanal and specialty-packaged tuna.

Demand for portable tuna pouches, meal bowls, and single-serve snack packs will increase, serving busy and health-aware consumers. Bumble Bee Foods and Starkist Co. already are growing protein-fortified tuna snacks for lifestyle and fitness consumers.

Regulatory bodies and consumers will encourage 100% traceable, MSC-certified, pole-and-line caught tuna, ensuring that sustainability becomes an industry standard requirement. Thai Union Group and Wild Planet Foods will lead this change.

Brands will expand online grocery and direct sales platforms, providing personalized subscription-based canned tuna deliveries. Ocean Brands and Maruha Nichiro Corporation are setting themselves up for digital and online grocery retail expansion.

Smart-label QR tracking, next-generation resealable cans, and BPA-free pouches will be the wave of the canned seafood market. Chicken of the Sea and Dongwon Industries are emphasizing biodegradable and recyclable packaging to address growing sustainability demands.

Top companies include Thai Union Group, Bumble Bee Foods, Starkist Co., Chicken of the Sea, and Dongwon Industries, dominating both B2B and B2C segments.

The industry is shifting towards sustainable fishing, premium product innovation, and convenience-driven packaging formats.

Consumers are embracing bold flavors, regional spices, and ready-to-eat seasoned tuna, driving growth in infused and gourmet-style products.

Brands are committing to pole-and-line fishing, blockchain tracking, and eco-friendly packaging, meeting stricter environmental regulations and consumer demands.

Manufacturers are developing resealable cans, BPA-free materials, and smart-label QR tracking to enhance freshness and sustainability.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.