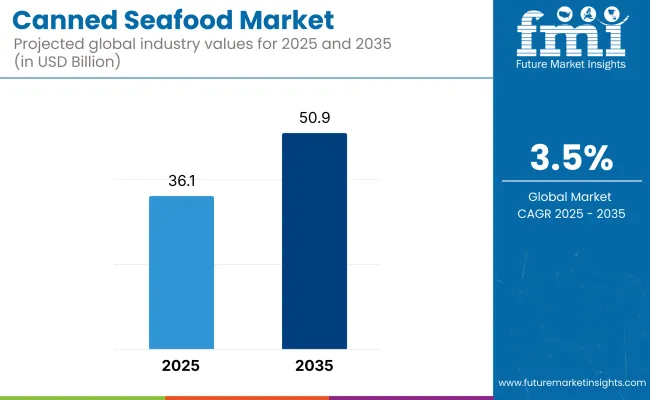

The global canned seafood market is estimated to be worth USD 36.1 billion by 2025 and is projected to reach a value of USD 50.9 billion by 2035, reflecting a CAGR of 3.5% over the assessment period 2025 to 2035.

A detailed evaluation of market dynamics clearly underscores the United States as the most lucrative region, driven by a deeply embedded cultural acceptance of seafood, robust consumer spending, and expansive distribution networks.

Moreover, emerging regions such as Southeast Asia and Latin America are projected to experience rapid growth, primarily due to evolving lifestyles, increasing urbanization, and significant consumer shifts toward convenience foods. Expert analyses consistently highlight these regions as vital to global demand, setting the stage for sustained market expansion over the forthcoming decade.

The ongoing upward trajectory in canned seafood consumption is largely fueled by robust consumer demand for nutritionally dense, shelf-stable products. Increasingly health-conscious populations globally have recognized canned seafood as a highly beneficial dietary option, given its exceptional content of omega-3 fatty acids, lean protein, and essential vitamins

Furthermore, convenience remains a paramount consideration for modern consumers, particularly within busy urban contexts where food preparation time is limited. Hence, canned seafood, providing a reliable, quick, and nutritionally valuable meal solution, continues to gain preference over fresh and frozen alternatives. Industry reports consistently validate these observations, confirming a strong correlation between rising health awareness, convenience-seeking behavior, and growing sales of canned seafood.

Despite promising growth prospects, the market is not without significant hurdles. Concerns related to the environmental sustainability of fishing practices and health apprehensions regarding potential mercury and BPA contamination in canned products may temper consumer enthusiasm. Industry experts assert that heightened regulatory oversight on food safety, labeling accuracy, and environmental compliance will present considerable operational challenges for manufacturers.

Yet, these regulatory frameworks, when navigated strategically, could simultaneously reassure consumers and bolster market credibility. Reports from leading sustainability certification bodies strongly indicate that brands employing transparent sourcing strategies and clear labeling practices substantially enhance consumer trust, thereby overcoming growth constraints effectively.

Looking forward to 2035, the canned seafood market is anticipated to exhibit substantial innovation, driven predominantly by consumer expectations for transparency, sustainability, and novel product offerings. Increased integration of blockchain and digital tracking solutions to ensure traceable and ethically sourced seafood is expected to become standard industry practice, further enhancing consumer confidence.

Moreover, packaging innovations emphasizing recyclability and biodegradability will gain widespread adoption, resonating positively with eco-conscious consumer segments. Consequently, companies adept at aligning their offerings with emerging consumer values of sustainability, nutritional transparency, and ethical sourcing are projected to dominate market share, ensuring their sustained relevance and competitive advantage throughout the forecast period.

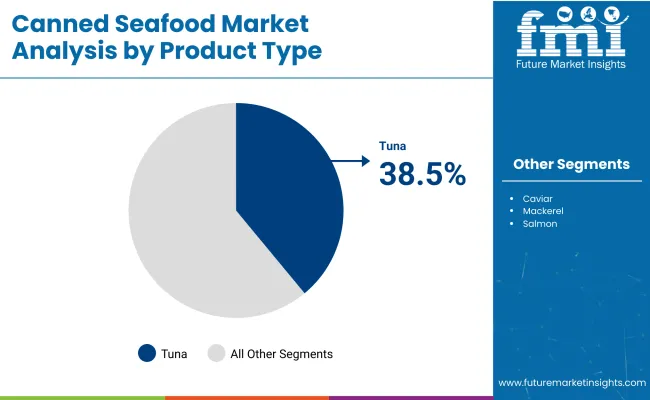

Tuna accounts for 38.5% of the global canned seafood market in 2025, maintaining its position as the dominant product segment. The canned seafood market overall is set to grow at a CAGR of 3.5% between 2025 and 2035.

Tuna’s commanding market presence stems from its perceived versatility, nutrient density, and compatibility with global consumption patterns-especially in urban households and institutional foodservice formats. Its lean protein content, combined with essential omega-3 fatty acids, has ensured sustained consumer appeal in both Western markets and rapidly modernizing economies.

However, this reliance on tuna also exposes the market to structural vulnerabilities. Heightened scrutiny around tuna fishing practices-including bycatch management, illegal fishing, and traceability-has amplified regulatory and reputational risks.

Several regional supply disruptions and growing consumer awareness of environmental sustainability are increasingly pushing processors and brands toward adopting certified sourcing schemes such as MSC (Marine Stewardship Council) and FAD-free tuna.

Looking ahead, the segment’s performance will depend on how well players adapt to traceability technologies and transparency mandates. The growth outlook remains positive, but only for brands willing to invest in responsible sourcing, vertical integration, and data-backed provenance systems. In this light, tuna is no longer just a staple product-it has become a litmus test for ethical leadership in canned seafood.

Southeast Asia is projected to register the fastest growth rate within the global canned seafood market from 2025 to 2035, contributing disproportionately to volume expansion at a forecast CAGR exceeding the global average of 3.5%.

This accelerated growth trajectory is being shaped by rapid urbanization, increasing dual-income households, and the region’s historic familiarity with seafood-based diets. As consumers across countries like Indonesia, Vietnam, and the Philippines pivot toward convenience-focused consumption, canned formats are emerging as accessible alternatives to fresh seafood, particularly in urban and peri-urban retail environments.

Furthermore, regional manufacturers are upgrading their processing capacities to meet both export-grade standards and surging local demand. This dual capability enhances Southeast Asia’s role not just as a consumption center, but also as a production and export hub.

Strategically, Southeast Asia is shifting from a peripheral to a pivotal position within global supply chains. This transition presents a compelling opportunity for global players seeking cost-effective manufacturing, co-packing partnerships, or local brand acquisitions.

However, success in the region hinges on addressing infrastructure gaps, aligning with halal and local regulatory frameworks, and developing culturally resonant product formats. Companies that embed regional agility into their growth playbooks are poised to outperform peers over the forecast horizon.

Challenges

Sustainability Concerns and Overfishing Regulations

Growing concerns about sustainable practices coupled with the negative effects of over-fishing have created considerable pressure on the canned seafood market. Strict fishing quotas, regulatory measures and environmental guidelines have been put in place to control the depletion of marine life. These measures typically constrain supply and add operating expenses for seafood processors and canneries. Moreover, illegal fishing operations and unsustainable fishing methods have made consumers doubtful about the sourcing of seafood, putting more pressure on companies to maintain transparency in their process and adhere to global standards.

Another challenge comes from volatility in raw material prices and supply chain disruptions. Climate change, erratic weather conditions and geopolitical tensions have affected fishery yields worldwide, resulting in volatile pricing and shortages. But canned seafood goods have faced upward price pressures, and to balance profitability with consumer spending power, manufacturers are faced with a challenge.

In order to solve these issues, companies have to invest in sustainable fishing practices, adopt eco-certification (Marine Stewardship Council (MSC), Aquaculture Stewardship Council (ASC)) and enhance traceability in their supply chains. Sustainable aquaculture enhances the potential for scaling up sustainable seafood and alleviates pressure on wild fish stocks by providing a reliable and sustainable source of raw material.

Opportunity

Increasing Consumer Preference for Ready-to-Eat Seafood and Health-Focused Products

Increasing need of convenient, protein-enriched, as well as nutrient dense food products among consumers for the nutritional dietary requirements is propelling the global canned seafood market. Consumers are gravitating to prepared meals as healthful options, and they need to have some nutrients and help busy lifestyles.

And canned seafood products tuna, sardines, salmon and mackerel, among others, all of which have a long shelf life and require very little preparation time, while packing so much protein all can be appealing to people looking to eat healthy.

Furthermore, a growing consumer experience for functional foods and fortified products are expected to drive innovations in the market. To lure a broader spectrum of eaters, manufacturers are debuting canned seafood products that are fortified with omega-3 fatty acids and assorted vitamins and other health-promoting components.

This is partly driven by greater awareness of the Mediterranean diet, which promotes eating seafood, and by the growing demand for high-quality, sustainably harvested canned fish.

Providing organic, low-sodium and preservative-free versions can also appeal to consumers of clean-label foods. Partnerships with health institutions and strong marketing campaigns regarding the health benefits of eating seafood could greatly improve user confidence and drive market growth.

Growth in USA Canned Seafood Market 454 the growth of the USA canned seafood market has been stable; this mainly stems from growing consumer preference for providing convenient and protein-rich food. Some of the most popular canned seafood includes tuna, salmon, sardines and crab meat. Healthier living has meant that sustainably sourced and packaged seafood in BPA-free containers has experienced rising demand.

In turn, companies are responding with panty spam of their own, launching premium canned seafood products, many wild-caught and also organic, to entice health-focused consumers. The rise of online grocery platforms is also propelling market growth and making canned seafood more widely available to consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

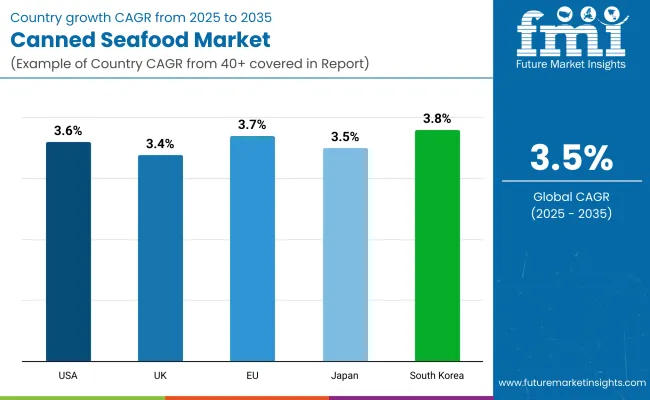

| USA | 3.6% |

In the UK, canned fish continues to be a staple of the pantry, especially among shoppers looking for protein sources at a lower price. Tuna, mackerel and sardines are the leading products here, and emphasis is on sustainability and environmentally friendly sourcing.

Government regulations encouraging responsible fishing have forced brands to get certifications like MSC (Marine Stewardship Council) approval. Rising demand for ready-to-eat seafood salads and high-protein meal solutions also act as growth facilitators, contributing to product innovations as timely introduction of new canned seafood varieties with enhanced herbs, sauces and health-enhancing ingredients stokes the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

The canned fish sector is a strongly established cultural segment for the EU, especially for countries like Spain, Portugal and France where the sector shows constant growth year-on-year. Canned anchovies, sardines and mussels are also widely consumed and used in Mediterranean cuisine, traditional favourites.

At the same time, gourmet canned seafood is on the rise, with artisanal brands made with high-quality, preservative-free seafood packed in olive oil or organic brine. With the European consumer increasingly looking for seafood products coming from certified sustainable fisheries, sustainability continues to be a central theme.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Japan’s canned seafood market continues to grow as demand appears to be on the rise for long-shelf-life seafood products, particularly among busy urban consumers. In addition to the usual tuna and salmon, there are specialties like canned eel, squid, and mention (spicy cod roe).

Japanese producers is focused on exceptional quality, often utilizing traditional ways of preservation to keep flavour and texture of seafood. Growing trends of convenience-based meal kits and on-the-go consumption are also driving demand for ready-to-eat canned seafood.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

In South Korea, canned seafood finds increasing popularity thanks to its cheapness and ease of use. Tuna is the market’s most dominant fish, with flavours like spicy gochujang (red chili paste) tuna and kimchi-flavoured tuna catering to local taste preferences.

Demand for canned salmon and sardines is rising with the growing popularity of Western-style seafood consumption. Moreover, the increase in home cooking trends and food delivery services has supported the use of canned seafood in Korean cuisine, which further helps the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

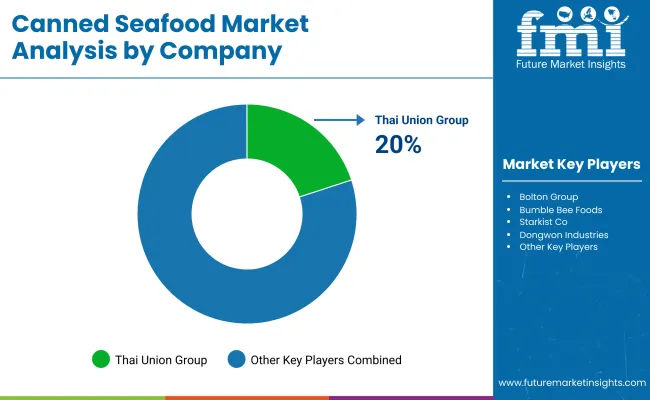

Thai Union Group (20-25%)

November 1, 2021, Marks the 1st Sustainable Hanabi Seafood Partner in the Japan Partnership Programme, a world leader in canning cold seafood fish, such as Polkev fish, focusing on sustainable fishing, eco-friendly packaging and delicious and high-quality tuna, salmon and mackerel.

Bolton Group (15-19%)

A European giant, specializing in premium canned seafood brands focusing on sustainably sourced and high-quality gourmet products.

Bumble Bee Foods (12-16%)

North America: A mid-size player with a big portfolio of high-protein, convenient and sustainable canned seafood products.

Starkist Co. (10-14%)

Specializes in affordable, protein-rich seafood products with growing investment in “healthy” and flavored tuna.

Dongwon Industries (8-12%)

Go-to player in the Asian market and adding to its product line for global audiences looking for premium and innovative canned seafood solutions.

Other Key Players (25-35% Combined)

Multiple regional and specialty brands also comprise the canned seafood market with sustainable, organic and gourmet seafood offerings. These include:

The Canned Seafood Market was valued at approximately USD 36.1 billion in 2025.

The market is projected to reach USD 50.9 billion by 2035, growing at a compound annual growth rate (CAGR) of 3.5% from 2025 to 2035.

The demand for Canned Seafood Market is expected to be driven by increasing consumer preference for convenient and long-shelf-life protein sources, growing health awareness regarding omega-3-rich seafood, rising demand from the foodservice sector, and expanding retail distribution of premium and sustainably sourced canned seafood products.

The top 5 countries contributing to the Canned Seafood Market are the United States, Japan, China, Spain, and Thailand.

The Retail and Foodservice Segments are expected to lead the Canned Seafood market, driven by increasing consumption of ready-to-eat seafood meals, the expansion of sustainable and ethically sourced canned seafood options, and rising demand from restaurants and institutional catering services.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA