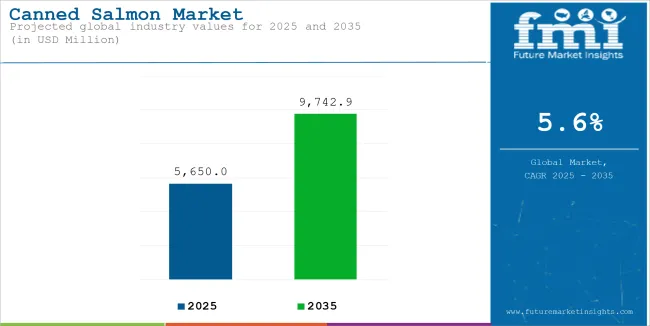

The global Canned Salmon industry is estimated to be worth USD 5,650.0 million by 2025. It is anticipated to reach USD 9,742.9 million by 2035, reflecting a CAGR of 5.6% over the assessment period 2025 to 2035.

Canned salmon is a large-scale operation in the broad seafood industry driven by customer demand for shelf-stable, healthy, convenient food. Canned salmon, in grades such as pink, coho, chum, and sockeye, is highly valued for its protein content and high levels of essential omega-3 fatty acids, vitamins, and minerals.

Its safe shelf life, convenience of preparation, and versatility with various modes of culinary uses make it a favorite among the global consumer. Increasing consumer interest in sustainable sourcing has also become one of the leading drivers in the market, with secondary certifications like the Marine Stewardship Council (MSC) affecting consumer buying decisions.

The economic value of canned salmon as a protein-rich food option when compared to fresh seafood remains constant in terms of sustaining its demand, particularly where access to fresh fish remains unsettled or commercially unfeasible.

The market addresses different target customer segments, including health-oriented believers, career office staff, and bargain shoppers. Secondly, the uptrend in consuming high-protein diets, ketogenic diets, and paleo diets has also increased enthusiasm for canned salmon. Region-wise, North America and Europe continue to be significant markets owing to the high seafood consumption per capita and strong infrastructure for distribution covering retail, internet retailing, and food services channels.

In addition, the ease of consumption of ready-to-eat or quick-cooking products meets the lifestyles of busy consumers today. Supply chain trends also support the growth of the market. Supply and demand pressures, changes in salmon harvesting levels, regulations for fishing, impacts of climate change, and international trade policy all have significant potential to impact market trends.

| Attributes | Description |

|---|---|

| Estimated Global Canned Salmon Industry Size (2025E) | USD 5,650.0 million |

| Projected Global Canned Salmon Industry Value (2035F) | USD 9,742.9 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

Private-label products have become increasingly popular, particularly in developed countries, with the advantage of high-quality products at low prices. Challenges remain, including raw material availability, volatile salmon prices, and environmental issues related to the methods of salmon farming.

Technology growth in aquaculture and greater industry emphasis on traceability and transparency are, however, solving these issues. Overall, the global canned salmon market is expected to record steady growth, led by increasing health consciousness, convenience-led consumer habits, product innovation, and sustainability efforts.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for the global Canned Salmon market. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 4.2% (2024 to 2034) |

| H2 | 5.4% (2024 to 2034) |

| H1 | 4.8% (2025 to 2035) |

| H2 | 5.9% (2025 to 2035) |

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 4.8%, followed by a higher growth rate of 5.9% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase to 4.2% in the first half and remain considerably high at 5.4% in the second half. In the first half (H1), the sector witnessed an increase of 15 BPS, while in the second half (H2), the business witnessed a decrease of 10 BPS.

| Segment | Value Share (2025) |

|---|---|

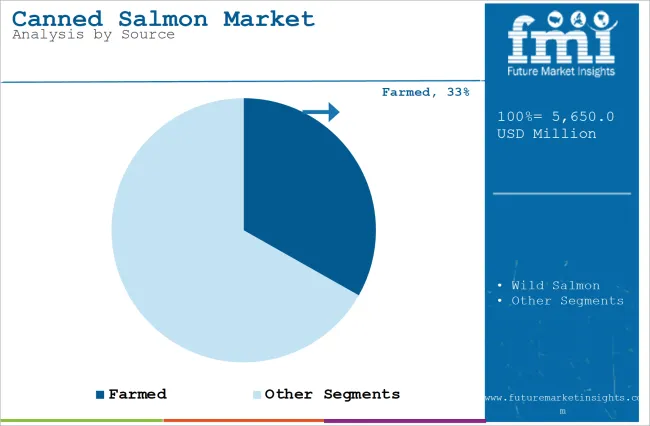

| Farmed Salmon (By Source) | 33.2% |

The farmed salmon industry has become the market leader of canned salmon across the world on the back of stable supply, cost-effectiveness, and improving aquaculture techniques. While the demand for salmon is on the rise all over the globe, farmed salmon has also been the most dependable and sustainable source to support this demand.

As compared to wild-caught salmon, which is normally exposed to capricious fishery yields and seasonal fluctuations, farmed salmon provides a year-round supply, rendering it the best option for producers and retailers. This steady supply allows canned salmon manufacturers to continue production without experiencing the fluctuations usually associated with wild-caught stocks.

Enhanced feeding schemes, breeding schemes, and disease control have reduced the cost and brought farmed salmon within reach and everyone's budget. All this has facilitated the producers to meet the increasing global demand for seafood, particularly in regions where the availability of fresh fish may be limited in short supply, or expensive.

Farm-raised salmon can be raised in controlled environments, which acts as a mitigation for the risks associated with wild fisheries, such as overfishing or climatic fluctuation. Controlled rearing methods yield a reliable, stable source of salmon, thereby ensuring the development of the canned salmon industry.

| Segment | Value Share (2025) |

|---|---|

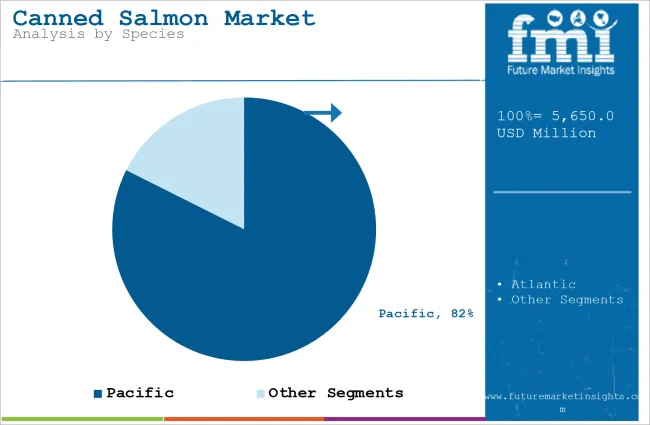

| Pacific Species (By Species) | 82.4% |

The Pacific species division has established a dominant role in the canned salmon industry because of its natural abundance, taste, and capacity to satisfy high consumer demand in various regions. Pacific salmon species such as Sockeye, Chinook, Coho, and Pink Salmon have been a favorite in the seafood market for a long time, and their dominance in the market is a reflection of their extensive availability and desirable nature. Their enhanced taste and quality, in addition to the use of different dishes, have propelled them as the favorite choice of both fresh and canned salmon.

Another primary aspect that keeps the Pacific species prominent is that, naturally, the oceanic distribution is abundant with such species, specifically in nations like the United States, Canada, and Russia. The Pacific Ocean is a rich fishing area, and the consistent harvests from these species are directly transferred to the canned salmon segment as a steady supply.

The reliability of this supply brings a dampening effect on the volatility that is possible due to fishing limits, weather, or volatile harvests that may hit other species or areas. In Pacific salmon, manufacturers can count on constant catch cycles, thus ensuring their capacity to satisfy world demand without serious supply disruptions.

Smart Packaging Integration in Canned Salmon Products

Smart packaging technologies' integration is on the verge of changing the canned salmon market. It exceeds the standard packaging materials through the integration of technologies such as QR codes, NFC (Near Field Communication), or RFID (Radio Frequency Identification) to allow consumers access to product information of value.

For instance, by scanning the QR codes on packaging, consumers can find out where the salmon originated, how it was transported from the ocean to the table, and recipes or cooking instructions. Traceability will also be facilitated by this innovation so that companies can prove their responsibility in sourcing and gain consumer confidence.

Increased consumer awareness and pressure for transparency in sourcing and sustainability are propelling the trend, forcing producers to adopt smart packaging as a means to stand out in a saturated market. Smart packaging is being more and more integrated to enable not only an interesting customer experience but also greater operational efficiency and product quality control. This will necessarily lead to more sophisticated purchasing decisions, consumer loyalty, and stronger demand for higher-quality canned salmon.

Automated Manufacturing and Precision Processing in Canned Salmon

Technological advances in automated manufacturing and precision processing are transforming the production of canned salmon into greater efficiency, consistency, and quality control. Automation has been progressively applied in the fish processing sector, from the earliest stages of salmon harvesting to canning and packaging. Robotics, machine learning, and artificial intelligence are employed to make production automated, remove human faults, and enhance quality checking.

Besides this, precision processing techniques are helping the salmon keep its ideal texture, taste, and nutrient levels without wasting much. For example, precision filleting machines enable fine separation of bone from meat without deforming or damaging it in any way, and uniformity is achieved in every can as well as reduced risks of contamination.

Application of these technologies also creates cost savings for producers, making canned salmon products price competitive without sacrificing high standards. With more automated processing, the firm is able to respond to increasing consumer demand for stable, high-quality products at reduced prices. This trend will thus propel international market growth, with robot production allowing companies to produce more while keeping operating costs at lower levels.

Canned Salmon as a Plant-Based Protein Alternative

A new and exciting trend in the international canned salmon market is positioning canned salmon as a substitute protein option for plant-based consumers. Rather than being marketed traditionally as a seafood item, canned salmon is now being promoted as a sound option for individuals who can be concerned about plant-based proteins from a health standpoint or desire a more environmentally friendly source of animal protein.

Salmon is rich in omega-3 fatty acids naturally, which are essential for brain and heart health, and hence, it is a good choice for those who want to add variety to their protein sources. Vegetarians, flexitarians, and those who want to cut down on meat without losing nutritional value are opting for canned salmon as a lean protein source, healthy fat, and essential micronutrient source.

Manufacturers are perceiving the opportunity to position their products as part of the growing "better-for-you" movement for consumption, with consumers looking for nutrient-dense, lower-impact alternatives to more processed meat options. As the environmental and physiological benefits of fish become more widely recognized, the market for canned salmon as a plant-based protein substitute will expand significantly.

This transition creates new consumer markets and has the potential to increase global demand, particularly as companies learn how to communicate more effectively with a broader, more health-conscious, and ecologically sensitive population.

Global sales increased at a CAGR of 4.2% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on such products will rise at 5.6% CAGR.

The global canned salmon market grew at a high rate between 2020 and 2024 due to various factors. During this period, the demand for healthy, convenient, and shelf-stable food items surged due to the COVID-19 crisis. With health-conscious people searching more and more for protein-rich foods, canned salmon emerged as a popular choice due to its rich content of omega-3 fatty acids and convenience. The requirement for shelf-stable items accelerated because individuals sought to stock up on food items for longer periods, further driving the popularity of canned salmon.

During the period between 2025 and 2035, the world canning industry of salmon will proceed to expand on the strength of changing consuming behavior, innovative technologies, and increasing knowledge regarding the health benefits of consuming salmon. As the world population proceeds to increase and there is an increase in the need for sustainable food, canned salmon will remain a desirable protein source, especially among emerging nations where the consumer desires convenient but nutritious food.

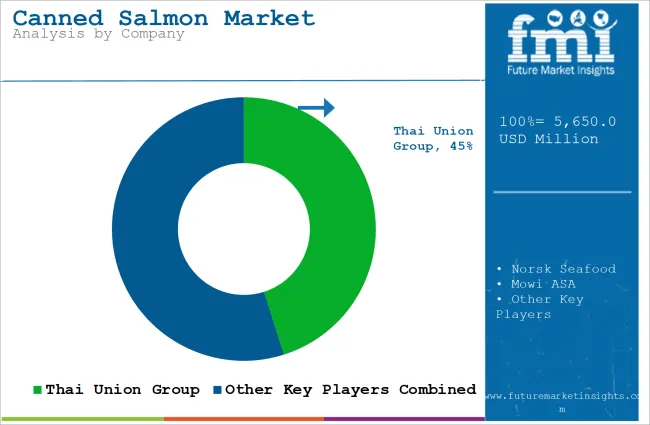

Tier 1 firms in the global ide canned salmon industry are the large, multinational corporations that have a firm hold on the industry in terms of market share and production capacity. They exercise considerable control over the market with their well-established brand names, worldwide distribution networks, and financial strength.

The leading players are some of the biggest seafood firms like Thai Union Group, Marine Harvest (Mowi), and Norsk Group, which have built solid reputations over a period of many decades of business. The market leaders benefit from economies of scale, allowing them to provide competitive prices with uniform product quality for different geographical locations.

Tier 2 enterprises are positioned in the middle of the packaged salmon market, with a strong local presence and the capacity to price, develop, and manufacture competitively. The companies have a smaller geographical footprint than Tier 1 companies, but they have significant local market shares. Companies like Pernod Ricard (Les Salaisons du Sud) and Gulf Pacific Salmon belong to this category, dominating their chosen areas with sound relationships with retailers and distributors.

Tier 3 players in the international market for canned salmon are smaller, typically family or regional businesses specializing in niche segments or product types. They could be very specialized in certain types of canned salmon, like organic or artisanal options, or concentrate on limited geographical areas where big brands' penetration is limited.

The following table shows the estimated growth rates of the top three territories. China and Japan are set to exhibit high consumption, recording CAGRs of 5.1% and 6.2%, respectively, through 2034.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The USA | 5.4% |

| Brazil | 6.5% |

| India | 7.4% |

| Japan | 5.1% |

| China | 6.2% |

China is currently one of the fastest-growing markets for canned salmon because of shifting consumption patterns, increased health consciousness, and increased availability of high-quality marine products. Chinese seafood consumption, particularly for canned fish, has increased in recent years as a result of urbanization and shifting culinary preferences among the country's growing middle class.

Salmon, a nutrient-dense food, also complements the growing trend toward healthy eating among urban residents searching for protein alternatives to traditional meat like pork or beef. Consumption is also being driven by government initiatives encouraging the consumption of fish and seafood as sources of essential fatty acids, or omega-3s, found to be linked to heart disease and brain functioning.

This sudden growth in the Chinese market for canned salmon owes huge infrastructure and distribution-channel investments. Large multinational corporations have accelerated operations in China by tying up with domestic distributors and retail chains. To illustrate, within the last couple of years, firms such as Thai Union and Mowi aggressively entered the Chinese market through the use of custom-designed promotional schemes that highlight the health advantages of canned salmon.

The United Kingdom is swiftly becoming a major participant in the worldwide canned salmon market as customers seek healthier, more diverse protein sources, as well as the growing popularity of online food commerce. As healthy eating gains traction in the United Kingdom, canned salmon has become a more enticing option for people looking for healthy yet convenient alternatives to typical animal items.

Canned salmon, with its high concentration of omega-3 fatty acids, protein, and vitamins, meets the growing need in the United Kingdom for functional foods that promote health. This trend appears most prominently in urban areas, with consumers more disposed to experiment with various diets such as pescatarian diets and flexitarian diets.

Various factors account for the UK's rapid growth in the canned salmon market. First, the nation has a tradition of consuming canned fish products, so the market is more receptive to salmon. In recent years, the trend has been towards premium, health-conscious canned seafood, and salmon, due to its nutritional content, has benefited from this trend. Besides, increased awareness of responsible and ethical seafood sourcing has also led consumers to seek out openly and responsibly sourced products, which has encouraged companies to emphasize the same in their products.

The global canned salmon market is highly competitive, with both established players and new brands. Market players compete on product quality, price, and innovation in packaging and products. Companies are more interested in reacting to shifting consumer preferences, with particular emphasis on flavor profiles, portion sizes, and convenience.

Furthermore, as demand is increasing region by region, especially in emerging markets, competition is intensifying. Suppliers are also putting money into locking up supply chains and distribution systems to meet product availability, and this is further contributing to the dynamic and competitive nature of the market.

For instance

As per Source, the industry has been categorized into Farmed and Wild Salmon.

As per Species, the industry has been categorized into Pacific and Atlantic species.

As per Form, the industry has been categorized into Skinless/Boneless, Chunks, and Fillets.

As per the Distribution Channel, the industry has been categorized into Direct Sales and Indirect Sales.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

The global industry is estimated at a value of USD 5,650.0 million in 2025.

Sales increased at 8.3% CAGR between 2020 and 2024.

Some of the leaders in this industry include Thai Union Group, King Oscar USA, Norsk Seafood, Mowi ASA, Stolt-Nielsen, Marine Harvest, Wegmans Food Markets, Clover Leaf Seafoods, John West, Bumble Bee Foods, Atlantic Sapphire, Chuo Kagaku Co., Ltd., and Crown Prince, among others.

The East Asian territory is projected to hold a revenue share of 19.2% over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.6% from 2025 to 2035.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA