The global canned pasta market is expected to register steady growth in the next ten years (2025 to 2035) as demand for convenient meals continue to rise. With a long shelf life, easy-to-prepare meals, and low cost, consumer demand for canned pasta products continues to grow.

While urbanization, shift in food and eating habits and busy lifestyles of working professionals and students is augmenting the market growth. Market growth is further supported by the increasing acceptance of non-perishable foods in emergency kitchens, armies & food aid programs.

Canned pasta market is also being shaped by product innovations as manufacturers develop organic, gluten-free, and high-protein variants to appeal to health-conscious consumers. The spread of interest in preservative-free and clean-label foods has ushered engineered-food products made from natural ingredients and in a low-sodium format. Growing international cuisines, particularly Italian flavors, are additionally expanding product varieties, appealing to a wider customer base.

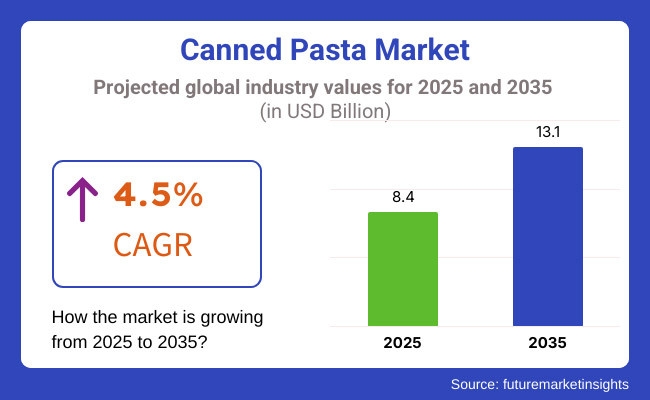

The market is projected to expand at a CAGR of 4.5% between 2025 and 2035, aided by factors such as rising retail penetration, advancements in food processing technologies, and increasing penetration of online grocery shopping. Moreover, environmentally friendly packaging and renewable sourcing practices have also contributed to the expansion of the market as customers grow increasingly aware of environmental concerns.

Explore FMI!

Book a free demo

North America is one of the key markets for canned pasta, with the highest consumption of canned pasta in the US followed by Canada. Demand Is Further Driven By The Popularity Of Convenient Meal Solutions, Especially Among Students And Working Professionals.

Canned pasta is a staple of food assistance program and as part of many emergency preparedness kits, adding to the stability of the market. Manufacturers are looking to reformulate products, providing reduced-sodium and organic-type products for health-conscious consumers.

Europe is already a strong market for canned pasta (especially the UK, Germany, and Italy, where pasta is a staple). Consumers are looking for high-quality ingredients and authentic tastes, and the popularity of premium and gourmet canned pasta varieties is growing.

Packaging Influences Trends in sustainability are driving the cats toward recyclable cans and eco-conscious materials. There’s also a growing focus on food safety and clean-label products there, which is prompting brands to limit artificial preservatives and additives, too.

Canned pasta market is anticipated to grow at the fastest pace in the Asia-Pacific region on account of increasing urbanization and growing disposable income coupled with surge in demand for convenience based meal options. Higher consumption of canned pasta is being observed in countries including China, Japan, and Australia, especially among younger consumers and working class populations.

These global forces come at a time when e-commerce buying is expanding; online grocery sites, notably, are helping push canned pasta into new territory. Moreover, rising demand for fusion flavors and localized variants of pasta is also driving demand across regions.

The canned pasta market in Latin America is booming, with Brazil, Mexico and Argentina leading consumption. The price and shelf stability of canned pasta lends it to being a popular option in lower-income households.

The Middle East, on the other hand, is witnessing an increased demand thanks to the increasing expatriate population as well as the growing prevalence of westernized dietary habits. As governments launched initiatives to improve food security and stockpile non-perishable products in response to the pandemic, the market is being propelled in the region also.

Challenges

Consumer Demand for Fresh and Healthier Alternatives

The major challenge faced in the canned pasta market is increasing consumer preference for fresh and minimally processed food. With increasing awareness of nutrition and transparency of the restaurant industry ingredients, a growing number of consumers are abandoning canned and overly processed meals for freshly made or frozen pasta alternatives.

With concerns around preservatives, artificial additives, and heavily processed foods, health-conscious shoppers started seeking more nutritious and convenient meal solutions than canned pasta products.

Furthermore, the impression that canned pasta simply does not compete in terms of taste and texture with fresh pasta dishes has tempered its appeal, particularly among younger consumers and urban populations accustomed to fresh meal alternatives. The increasing availability of other meal delivery services and quick-cook pasta alternatives only adds to the competition facing canned pasta manufacturers.

But with these problems in mind, brands can move forward by reshaping their cereals into versions containing whole wheat pasta, lower sodium sauces and natural preservatives, for a more wholesome offering.

Highlighting nutritional benefits of different offers and adding value strategies such as plant-based or high-protein pasta alternatives can also tap into a wider audience. Promote the idea of canned pasta as a time-efficient, healthy meal alternative for people with busy lifestyles, such as working parents, hurried college students, and office employees.

Opportunity

Rising Demand for Convenience and Long Shelf Life

With the pace of life and work, there is limited time to prepare food, that is why canned pasta is such a fast meal. Demand remains strong among households with children, value-sensitive consumers and people on the lookout for affordable, ready-to-eat meals.

The trend of survival preparedness along with stockpiling food during emergencies has also contributed to the growth of the canned pasta market. Consumers are relying more and more on non-perishable (food that can last a long time!) nutritious food items, making canned pasta a must-have in every home. This has been especially noticeable in areas vulnerable to economic turmoil, natural disasters, or unpredictable food supply chains.

Moreover, product innovation also opens up some potentials for manufacturers to slightly broaden their portfolio. Create gourmet canned pasta offerings with premium, chef-driven ingredients, globally inspired flavors or restaurant-quality sauces to appeal to new customer segments.

Health- and diet-specific options are another avenue to consider launching organic, gluten-free, and plant-based canned pasta can attract conscientious shoppers who desire low-effort meals that align with their dietary restrictions.

During 2020 to 2024, the canned pasta market witnessed consistent demand owing to its low price, extended shelf-life and on-the-go convenience. Uncertain times drove consumers to canned meals, stocking up on shelf-stable food for emergencies or everyday use. Cheap meal solutions became one of the sales pitches, especially among lower-income families and college students.

But as consumers became increasingly health-conscious, brands overhauled their canned pasta options, cutting sodium, using organic ingredients and removing preservatives. Big manufacturers launched new product lines featuring plant-based proteins, whole-grain pasta and clean-label sauces to address changing eating trends. Another aspect was e-commerce and online grocery platforms that expanded the reach of canned pasta, making it more accessible to digitally savvy customers.

Consumer demand for organic and clean-label canned pasta products will continue to grow due to the increasing rate of healthy meal options. To meet sustainability goals, companies will focus more on recyclable cans and BPA-free linings for eco-friendly packaging.

International flavor expansion is also expected to influence the market for canned pasta due to consumers craving variety and globally inspired cuisine. Regional variations like Italian leans into gourmet sauces, Mediterranean-style pasta and Asian-inspired noodle dishes are prepped to take off.

Additionally, the growing interest in functional foods, including pasta meals enriched with protein and high-fiber products, will expand product portfolios within the canned pasta segment.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter labeling requirements for sodium and additives in canned foods |

| Technological Advancements | Development of preservative-free canned pasta options |

| Industry Adoption | Introduction of organic and gluten-free canned pasta products |

| Supply Chain and Sourcing | Focus on locally sourced wheat and tomato-based sauces |

| Market Competition | Presence of traditional canned pasta brands alongside private-label options |

| Market Growth Drivers | Demand for convenient, ready-to-eat meals |

| Sustainability and Packaging | Shift towards recyclable aluminum cans and BPA-free linings |

| Retail and Distribution | Growth of online grocery shopping and direct-to-consumer (DTC) sales |

| Product Innovation | Introduction of plant-based pasta meals and gourmet sauces |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of clean-label certifications and transparency in ingredient sourcing |

| Technological Advancements | Enhanced packaging with BPA-free linings and sustainable, recyclable materials |

| Industry Adoption | Widespread adoption of high-protein, plant-based, and functional pasta varieties |

| Supply Chain and Sourcing | Increased reliance on regenerative agriculture and sustainable farming practices |

| Market Competition | Growth of premium and gourmet canned pasta brands catering to niche consumers |

| Market Growth Drivers | Expansion of international flavors, high-protein pasta meals, and healthy formulations |

| Sustainability and Packaging | Development of biodegradable packaging solutions and sustainable supply chains |

| Retail and Distribution | Increased presence in specialty food stores, health markets, and digital platforms |

| Product Innovation | Expansion of high-fiber, nutrient-enriched, and global fusion pasta varieties |

USA Canned Pasta Market is already growing steadily owing to rising demand for convenient ready to eat meals. Growth drivers include busy lifestyles and the increasing trend towards long-shelf-life food products. Canned pasta is also a popular choice with budget-conscious consumers, they are usually significantly less expensive than their fresh and frozen counterparts.

Food banks and emergency relief organizations add to steady demand, too. In response, brands are introducing low-sodium, whole-grain and organic canned pasta alternatives that are in line with healthier dietary trends that are becoming more important to consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

Canned pasta is a staple product in countries like the UK, primarily for students, working professionals, and homework individuals providing a quick meal solution. The retail presence is quite strong in the market, through supermarkets, which provide branded products, as well as private-label products in affordable pricing.

But manufacturers are facing increasing pressure from consumers concerned about preservatives and processed foods, and they are responding with healthier versions, including reduced-sugar and gluten-free canned pasta. Efforts to make packaging recyclable or to use BPA-free linings are also affecting consumer purchases.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

However, Germany, Italy, and France are the biggest players in the EU canned pasta market, as convenience and affordability remain key drivers of sales. Fresh and dried pasta are still kings, but canned pasta attracts those who are younger as well as consumers looking for easy-to-prepare meals.

According to Fortune Business Insights, the market is witnessing rising demand for premium products like canned pasta made with premium sauces, organic ingredients and protein-enriched formulations. Sustainability is a focus, too, with brands transitioning to environmentally friendly packaging. And e-commerce growth is also driving sales, with consumers opting more frequently for bulk-head purchases and subscription-based deliveries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan’s canned pasta market is relatively small but expanding, driven by demand for convenience foods and supplies for disaster preparedness. Young consumers and expats are increasingly opting for Western-style canned pasta, the tomato-based or creamy sauce kind.

Manufacturers are also getting creative by incorporating local flavors like miso and soy-based sauces. And consumer preference for smaller portion sizes and premium ingredients is affecting product development, with brands offering a variety of healthier options that include whole wheat pasta and fewer artificial preservatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The canned pasta market in the South Korean market is growing amid increasing interest in international dishes and demand for fast meals. The convenience factor driving sales, in addition to the growing popularity of Western food in South Korean households.

Canned pasta is typically marketed as an inexpensive substitute for fresh pasta, catering to students and one-person households. Moreover, the increase of online grocery stores is enabling more access to imported and specialty canned pasta products for consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

The leading market segments in the canned pasta market: Retail & Foodservice, Supported by Increasing Demand for Ready Meals and Shelf-Stable Products: The canned pasta market is primarily comprised of two segments: retail and foodservice.

Canned pasta has become popular among households, restaurants and institutional food services because of its low cost, extend shelf life and low preparation time. The market demand is indirectly reinforced by functions such as fast meal preparation, emergency food storage or inexpensive bulk meal preparation.

The retail channel accounts for a significant share of the canned pasta market due to consumers seeking ready-to-eat and quick-to-cook pasta meals. Unlike fresh pasta, which needs to be refrigerated and cooked before eating, canned pasta offers a heat-and-serve solution that resonates with busy households, college students and value-minded shoppers.

Since manner have change to proper and easy to cook meals, particularly in moist conditions, have accentuated the market for canned baked course variations like pasta spaghetti, raviolis and macaroni in tomato-based choices, cheese and meat-based variations.

Studies indicate more than 65% of consumers choose canned pasta because of convenience, particularly in regions where fresh ingredients are unavailable or home cooking is simply a time crime.

Moreover, the launch of healthier variants of canned pasta like low-sodium, gluten-free, and organic varieties are also augmenting the demand in the market, especially among health-conscious consumers. It includes insights on the trends to watch for in mature markets in terms of premium products offering niche flavors, natural ingredients, and formulations free from preservatives.

The rise of e-commerce and direct-to-consumer grocery delivery has helped drive adoption as well, allowing consumers to buy more varieties of canned pasta products online. Market dynamics: Other mixed use private equity drivers anticipated to enhance the development of the market are the rising notoriety of subscription based supper packs and crisis food supply packs, to engage a more extensive buyer base that guarantee sharper market demand.

While it has the advantage of being affordable and easy to use, the retail segment is not without challenges arising from consumer perceptions of preservatives, sodium levels and the notion of processed food. But as clean-label formulas, plant-based ingredients, and BPA-free containers continue to come through, they could further build consumer trust and broaden the canned pasta retail space.

The foodservice segment has seen significant market penetration and is highly adopted in sectors such as quick service restaurants (QSRs), school cafeterias, hospitals, military food programs and catering. Fresh pasta involves cooking, timing and temperature control, while canned pasta provides a preprepared, nocalorie, heat-serve menu solution that takes the mess, the mystery and the time out of pulling together a large-scale foodservice operation.

Tinned pasta’s rising presence in cafeteria meals, catered buffets, and institutional dining menus has propelled the growth of the segment since businesses and organizations want to serve reliable, low-cost, and time-saving food options. Researchers report that more than 55% of institutional food providers use canned pasta in their menus because of its long shelf life, portion consistency, and decreased preparation time.

The growing adoption of bulk packaging solutions for foodservice (such as cans and resealable pouches) has enhanced the market demand, as it adds to the operational efficiency and minimizes food wastage.

The growth of government-backed meal assistance programs food aid distribution and school meal programs has additionally fueled adoption, providing confidence in continued demand from public sector programs. And more invested money went into reformulated canned pasta with better taste, texture, and nutritional quality, making it more appealing for foodservice operators.

Though the tomatoes in the foodservice segment benefit from bulk purchasing, storage savings, and cost control, it also has less favorable factors at play, here again with changing consumer mindsets toward made-to-order meals, regulations designed to cut back on processed goods, and competition from frozen pasta.

But continuous innovations with flavor retention, plant-based pasta variants, and eco-friendly packaging solutions are driving acceptance and ensuring consistent growth for foodservice-based canned pasta formulations globally.

Rising enjoyment for easy-to-prepare and eat meal alternatives, especially among working individuals and households contributes to the growth of this market. Important transformation areas are clean-label ingredients, organic and preservative-free formulations, and sustainable packaging. Focusing on how they are expanding lines with healthier products, gluten- and plant-based products, and flavor profiles perspectives to engage health-conscious consumers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The Kraft Heinz Company | 20-25% |

| Conagra Brands, Inc. | 15-19% |

| Campbell Soup Company | 12-16% |

| Nestlé S.A. | 8-12% |

| Premier Foods | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Kraft Heinz Company | Make Chef Boyardee canned pasta in traditional and newer healthier varieties, including whole grain and reduced-sodium options. |

| Conagra Brands, Inc. | Sells Spaghettis and other canned pasta products that appeal to both kids and adults who want easy-to-prepare, tasty meals. |

| Campbell Soup Company | Under different brands, it is increasing its presence with premium and organic canned pasta meals. |

| Nestlé S.A. | Expanding its presence with premium and organic canned pasta meals under various brands. |

| Premier Foods | Provides canned pasta options under brands like Batchelors, focusing on UK and European markets. |

Key Company Insights

The Kraft Heinz Company (20-25%)

Market leader with household names like Heinz and Chef Boyardee, with numerous canned pasta options for every consumer.

Conagra Brands, Inc. (15-19%)

A huge player with a strong ready-to-eat pasta portfolio, that is recently investing in healthier and premium ingredient formulations.

Campbell Soup Company (12-16%)

Best known for SpaghettiOs, the company specializes in kid-friendly canned pasta dishes with better nutritional profiles.

Nestlé S.A. (8-12%)

Exploring international expansion by offering quality and organic canned pasta foods to meet health-conscious consumers

Premier Foods (5-9%)

In the UK market, as an affordable yet healthy canned pasta solution.

Other Key Players (30-40% Combined)

Some include many regional and niche brands offering specialty products, organic formulations, and flavor innovations for the canned pasta market. These include:

The Canned Pasta Market was valued at approximately USD 8.4 billion in 2025.

The market is projected to reach USD 13.1 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035.

The demand for Canned Pasta Market is expected to be driven by increasing consumer preference for convenient and ready-to-eat meals, rising demand from the foodservice industry, expanding retail distribution, and the growing popularity of shelf-stable pasta products in institutional catering and quick-service restaurants.

The top 5 countries contributing to the Canned Pasta Market are the United States, Canada, Germany, the United Kingdom, and Italy.

The Foodservice Segment is expected to lead the Canned Pasta market, driven by rising demand for cost-effective meal solutions, increasing incorporation of canned pasta in institutional catering, and the expansion of ready-to-eat pasta options in restaurants and cafeterias.

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.