Based on data up to October 2023, it predicts gradual growth in the canned meat market from 2025 to 2035, with the increased demand for long-shelf-life sources of protein, flexible food consumption, and the recent growth in ready-to-eat meal consumption fuelling this trend.

The growth of urbanization rate and changing lifestyle of people results in increase in demand for the canned meat products among other products such as beef, chicken, pork and seafood in the retail and food service industry. Pros: Inexpensive, easy to tuck away and need little or no pre-treatment, they are one option for consumers seeking protein-dense, convenient meal solutions.

The growing international food supply chain and updates food preservation techniques also make canned meat products attractive. Manufacturers are prioritising product innovation as they try to target health-conscious consumers, such as a shift towards organic, low-sodium and preservative free options. Moreover, the growth of the market is driven by increasing demand for canned meat as a sanitary ingredient for emergency food supplies, military rations, and outdoor adventure-related activities.

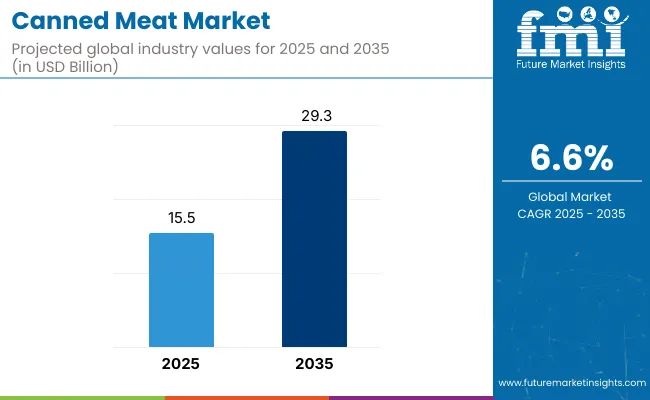

The market is projected to expand at a 6.6% CAGR from 2025 to 2035, as production capabilities are expanded and distribution networks are strengthened, leading to greater consumption in developing countries. New flavours of premium canned meats, eco-friendly packaging and variety entice a broader audience.

Rapid demand for convenient and protein-rich meals is a key driver for the North America canned meat market. Big markets are the United States and Canada, where consumers look for shelf-stable protein sources for home as well as for trips (fishing, camping, hiking, etc.).

Market growth is also supported by the increasing demand for ready-to-eat meals and emergency food kits. Health-conscious consumers are turning to low-sodium, nitrate-free, and organic canned meat products, driving manufacturers to create cleaner-label items.

Shifting dietary habits along with hectic lifestyles and rising disposable income are the most significant factors driving the demand for canned meat in the Europe region. There are especially well-established markets for canned meat products, like stews, pâtés and preserved sausages in Germany, the UK and France.

Rising trends towards sustainability and stricter regulations for food safety are driving manufacturers to opt for sustainable packaging and natural preservation methods. The increasing popularity of plant-based substitutes is also inspiring some companies to introduce hybrid meat products that contain both animal protein and plant-based ingredients.

The canned meat market in the Asia-Pacific is forecasted to experience healthy growth owing to rising urbanization the growing middle class and shifting food preferences. Japan and South Korea generate high demand for canned seafood and processed meat products, while rising consumption of canned chicken and pork products in some Southeast Asian nations, such as Thailand and Indonesia, is being seen.

Manufacturers are expanding their portfolios due to the region's significant concentration on convenience foods and long-lasting pantry items. Furthermore, adoption of e-commerce is enabling canned meat to be more available across customer segment.

There is a well-established canned meat market throughout Latin America, notably in Brazil, Argentina, and Mexico, where consumers have a strong affinity for canned beef and poultry-based products. Canned meat is a staple ingredient in classic dishes that the people are returning to, which drives sustained demand.

Due to climatic conditions, long-shelf-life food products are especially popular in the Middle East, where canned meat sales are also growing. Market growth is attributed to the expansion of retail channels and rising disposable incomes in both regions, and consumer interest in premium, halal-certified canned meat options.

Challenges

Consumer Perception and Health Concerns

The major hurdles faced by the canned meat market is the negative perception of processed meat products. This is because many consumers link canned meat with high sodium content, artificial preservatives, and a lower nutritional value than equivalent fresh or frozen alternatives.

Furthermore, the growing concern about the use of additives in meat products, like nitrates and phosphates, has left health-conscious individuals increasingly distrustful of traditional meat products.

Another hurdle is changing consumer eating habits. The growing popularity of plant-based and flexitarian diets meant that the number of people cutting back on their meat consumption was on the rise, potentially extending the long-term threat to the canned meat industry. With growing consumer interest in fresh, minimally processed fare, traditional canned meat demand may lag.

Manufacturers should aim to reformulate their products to include cleaner, healthier ingredients to combat these fears. Consumer scepticism can be addressed through the introduction of low-sodium, preservative-free and organic canned meat food options. Transparent labelling, combined with educational initiatives emphasizing the nutritional value of canned meat, including its protein content and longevity, can help ameliorate market attitudes.

Opportunity

Rising Demand for Shelf-Stable Protein Sources

In the face of these issues, the demand for shelf-stable sources of protein is strong, revealing growth potential for the canned meat market. In particular, consumers in cities with a hustle-and-bustle consciousness look for easy, ready-to-eat protein options that require less than easy preparation. In addition, canned meat products provide a quick and affordable protein option for consumers because they have better shelf life and can easily be stored.

Growing concerns of emergency preparedness as well as stockpiling trends further drive the market growth, as consumers are increasingly purchasing canned meat for long-term storage. Such a pattern has applied especially in areas that are more susceptible to natural disasters or economic uncertainties, leaving a sizeable need for dry foods.

In addition, protein based on meat sources is gaining popularity with high-protein and keto diets. To exploit this trend, manufacturers can launch protein-rich canned meat products with clean-label formulations targeting healthy consumers looking for convenient, protein-rich dishes. Canned meats that are premium and gourmet, that derive from sources like grass-fed beef and certified organic chicken, can also introduce a more discerning consumer.

The global canned meat market experienced steady demand between 2020 and 2024 on account of the consumers need longhwensive food options and an affordable protein source. Other traditional canned meat products like spam, corned beef, and canned chicken remain popular, especially in areas with limited fresh meat access, where they are seen more and more as a delicacy that can be prepared at home. But concerns about health issues related to processed foods led to a higher demand for reduced-sodium and preservative-free options.

Sustainability also emerged as a core area of focus, with manufacturers pivoting towards sustainable packaging solutions. Metal cans with recyclable materials gained much-needed traction as companies sought to cut their environmental footprint. You also witnessed a boom in direct-to-consumer (DTC) models, not to mention online grocery shopping, impacting distribution channels for canned meat brands.

In 2025 to 2035, the market is expected to see a shift towards diversification. Fewer meat-based ingredients: Consumers will look for better-quality canned meat options: organic, antibiotic-free and ethically sourced meats. It also will make products more appealing through innovations in packaging, such as vacuum-sealed and resealable containers.

Expect even more focus on sustainability, with companies investing in carbon-neutral production processes and environmentally-friendly sourcing. Consumer will demand traceable supply chains for meat production to verify the source of their meat and its environmental impact, due to rising ethical concerns surrounding meat production.

Furthermore, worldwide food supply issues may drive even higher demand for convenient, shelf-stable and nutrient-dense sources of protein, making canned meat an essential element of emergency food stocks.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter food labelling regulations for processed meats |

| Technological Advancements | Improved canning techniques to enhance shelf life |

| Industry Adoption | Introduction of low-sodium and reduced-preservative canned meat options |

| Supply Chain and Sourcing | Focus on regional meat suppliers to ensure stable raw material supply |

| Market Competition | Presence of traditional brands competing with private-label offerings |

| Market Growth Drivers | Demand for non-perishable protein sources for convenience and emergency use |

| Sustainability and Packaging | Shift towards recyclable metal cans and reduced plastic use |

| Retail and Distribution | Growth of e-commerce platforms and online grocery shopping for canned meat |

| Product Innovation | Development of flavoured and ready-to-eat canned meat varieties |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of clean-label and organic certification requirements |

| Technological Advancements | Development of vacuum-sealed, resealable, and BPA-free packaging |

| Industry Adoption | Widespread availability of antibiotic-free, organic, and ethically sourced canned meat |

| Supply Chain and Sourcing | Expansion of sustainable meat sourcing, including regenerative farming practices |

| Market Competition | Growth of premium and gourmet canned meat brands targeting health-conscious consumers |

| Market Growth Drivers | Increased consumption of high-protein diets, leading to greater demand for premium canned meat |

| Sustainability and Packaging | Adoption of biodegradable packaging and carbon-neutral production practices |

| Retail and Distribution | Expansion of direct-to-consumer (DTC) sales channels and subscription models |

| Product Innovation | Introduction of gourmet, grass-fed, and ethically sourced meat options |

Consumers in the USA are helping the canned meat market grow, as demand for protein sources with long shelf lives, emergency food, and convenience-based meal options continue to rise. The trend of high-protein, keto-oriented, safe ready-to-eat meat product development serves to drive investment activity into product innovation.

Moreover, growing market growth of military and camping food supplies is expected to endure to propel the market growth. Through the premiumization initiative, major brands are promoting organic, preservative-free, and ethically sourced canned meat products towards health-conscious consumers. The growth in need is also due to the increasing penetration of e-commerce and the expansion of private labels by major retailers.

| Country | CAGR (2025 to 2035) |

|---|---|

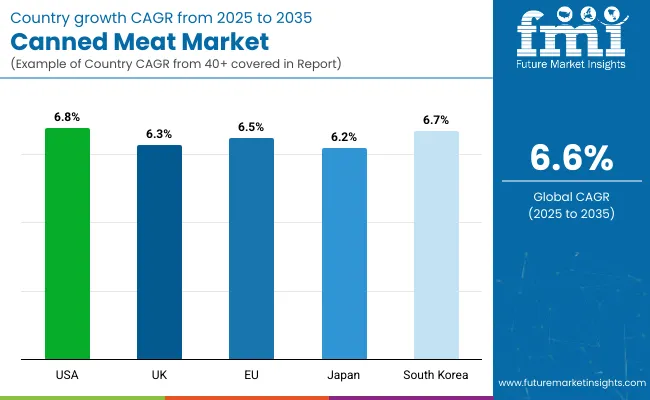

| USA | 6.8% |

The UK canned meat market is seeing steady growth as people look for quick, inexpensive protein sources. Ready-to-eat meal consumption is growing particularly among the busy urban population, driving sales of canned meat products.

But increased health and sustainability sensitivity is pushing brands to provide low-sodium, lower-fat and responsibly sourced kinds. Importantly, Brexit has also caused a reconfiguration of domestic production and supply chains, whereby local sourcing is becoming more critical. The growing private labels by supermarket chains is further stimulating market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

Consumer preference for preserved and protein-rich food options has resulted in Germany, France and Spain holding the largest shares in the EU canned meat industry. Canned products, relatively speaking, are popular, such as canned poultry, beef and pork.

Environmental issues are redefining the industry even more, with manufacturers investing in sustainable packaging and responsibly sourced meat products. They are also looking for organic and antibiotic-free meat products. We are also well positioned to capitalize on the growth of e-commerce channels, the expansion of discount supermarket food chains to provide affordable pricing on canned meat.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.5% |

Japan's canned meat market is booming, driven by a surge in interest in emergency rations, convenience foods and high-protein diets. Canned fish and seafood account for the majority of the overall market historically, but demand for canned chicken and beef products is increasing from Western dietary influences.

Additional driver of consumer interest is the emergence of premium and gourmet canned meat products, such as flavoured canned meat and ready-to-eat canned meat products. Moreover, improving technologies to enhance canning techniques include an improvement in both the taste as well as texture of canned goods, which is encouraging the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

Parts of South Korea's canned meat market are growing steadily, driven by demand for easy-to-store protein sources and urbanisation. Canned luncheon meat, especially SPAM, is very popular with consumers due to the cultural importance in Korean cuisine.

Consumers are also increasingly favouring high-quality, low-sodium and premium canned meat products. Meanwhile, the burgeoning e-commerce sector has been helping sales of canned meat increase online, where brands are introducing new flavours and packaging to appeal to younger consumers. Government action to bolster food security and emergency preparedness also helps to promote market stability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Canned meat is commonly available in the retail and foodservice segments, which have the highest share in this market, as both consumers and businesses demand for convenient, longer shelf life, and protein-rich food products.

The growing prudence towards shelf-stable foods such as canned meat is attributed to their added longevity, versatile storage, and convenience in both home and commercial kitchens. Their wide use for emergency preparedness, outdoor lover, and ready-to-eat meals, are also increasing their market demand.

The retail sector has emerging as a driving force in driving the canned meat market due to growing demand by consumers for convenient, protein-rich meals. Because canned meat products do not need to be refrigerated when unopened (unlike fresh meat), they are popular with consumers, travellers, and emergency food storage. For those same reasons along with their year-round availability consumers are also increasingly choosing canned beef, chicken, pork, and seafood.

The growing demand for high-protein diet and increasing consumer interest in ready to eat and less processed food supported the growth of retail segment. According to studies, more than 60% of consumers buy canned meat because it is convenient, particularly in geographical areas that are limited in fresh meat access or where fresh meat is expensive.

Growing demand in the market has driven the expansion of organic, preservative free and low sodium canned meat products to cater to health conscious consumers. In addition, premium variants with gourmet flavours, high-quality cuts and ethically sourced meats are gaining traction especially in developed markets.

As e-commerce and direct-to-consumer retail models become increasingly popular, adoption has been further magnified: customers can now find more variety of canned meat products sold online. The introduction of subscription-based meal kits and wallet-friendly emergency food packets has also driven market growth, allowing products to remain relevant across broader consumer demographics.

While it has the advantages of price and convenience, the retail segment struggles with consumer perceptions around processing, preservatives and competition from frozen and fresh meat alternatives. Nonetheless, continuing improvements in clean-label formulations, sustainable packaging, and advanced processing methods are boosting consumer confidence and causing greater expansion in the retail market for canned meat.

The foodservice has been widely adopted in the market, especially in QSRs, military rations, schools, hospitals, and catering. Canned meat provides an easy, affordable and long-storage option for mass-meal prepping, as opposed to fresh meat, which has to stay refrigerated and handled carefully. Stream the daily show live as well as on-demand all day with the Free & Premium tier of the The Daily Show app, available on iOS and Android.

The growth of the segment has been driven by the rising use of canned meat in sandwiches, stews, pasta dishes and ready-made meal kits, as companies look for consistent, labour-saving and portion-controlled sources of meat. Research shows that more than half of institutional foodservice operators add canned meat to their menus for its longevity shelf and how easy it is to maintain inventory, as well as its quality consistency.

Bulk packaging solutions for foodservice such as large cans, vacuum-sealed pouches, and resealable containers have also been growing in number, further supporting the market growth by ensuring food remains efficient and waste is reduced.

The increased adoption of military and emergency relief food supply programs has only served to enhance adoption, ensuring that demand will continue from the corner of government and humanitarian organizations. The growing investment in the development of canned meat products using low sodium, texture improvements, and nutritional enhancements also make these products of interest to the foodservice operators.

While it benefits from bulk purchasing, storage efficiency, and cost control, the foodservice segment also faces several challenges, including shifting consumer attitudes toward fresh ingredients, regulatory restrictions on meat processing, and concerns about canned food preservatives.

However, the continual evolution of advanced canning processes and sustainable packaging in addition to a growing acceptance of preservation methods that boost flavour support the market expansion of foodservice-based applications of canned meat globally.

The demand for long-shelf-life protein sources, convenience foods, and emergency food supplies drives the canned meat market. Key areas of transformation include organic and preservative-free canned meats, sustainable packaging and expanded product offerings for high-protein, keto and ready-to-eat meal trends. Businesses are looking towards clean-label ingredients, improved processing methods and innovative packaging solutions to draw in health-conscious consumers.

Market Share Analysis by Company

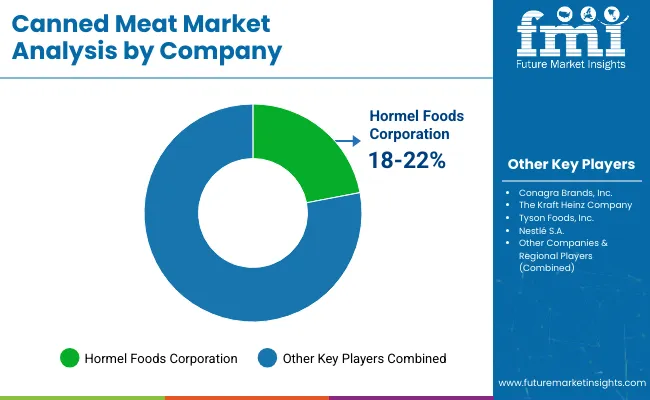

| Company Name | Estimated Market Share (%) |

|---|---|

| Hormel Foods Corporation | 18-22% |

| Conagra Brands, Inc. | 15-19% |

| The Kraft Heinz Company | 12-16% |

| Tyson Foods, Inc. | 8-12% |

| Nestlé S.A. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hormel Foods Corporation | Produces popular canned meat products like SPAM and Dinty Moore, focusing on long-shelf-life and ready-to-eat protein solutions. |

| Conagra Brands, Inc. | Offers a variety of canned meat products under brands like Armour Star, catering to both traditional and premium meat consumers. |

| The Kraft Heinz Company | Provides canned meat options such as potted meat and corned beef under brands like Libby’s, emphasizing affordability and convenience. |

| Tyson Foods, Inc. | Specializes in high-protein, ready-to-eat canned chicken and beef products for meal prep and emergency food storage. |

| Nestlé S.A. | Expands into premium canned meat options, focusing on health-conscious and high-protein meal solutions. |

Key Company Insights

Hormel Foods Corporation (18-22%)

A leading brand of canned meats, with a variety of products, valued for their long shelf-life and convenience of use.

Conagra Brands, Inc. (15-19%)

Competes well in the market with its Armour Star line of canned meat, targeting value and protein per serving.

The Kraft Heinz Company (12-16%)

A line of potted meat and corned beef products, targeting consumers seeking traditional shelf-stable meat solutions.

Tyson Foods, Inc. (8-12%)

Canned foods in so expanding its slot as foods also cater to health concerns and high protein diet

Nestlé S.A. (5-9%)

Develop higher quality, healthier canned meat option.

Other Key Players (30-40% Combined)

A number of regional and specialty brands also serve the canned meat market, providing organic, preservative-free and internationally inspired products. These include:

The Canned Meat Market was valued at approximately USD 15.5 billion in 2025.

The market is projected to reach USD 29.3 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.6% from 2025 to 2035.

The demand for Canned Meat Market is expected to be driven by increasing consumer preference for convenient and long-shelf-life protein sources, rising demand from the foodservice sector, growing popularity of ready-to-eat meals, and expanding retail availability of premium and specialty canned meat products.

The top 5 countries contributing to the Canned Meat Market are the United States, China, Germany, Brazil, and the United Kingdom.

The Retail and Foodservice Segments are expected to lead the Canned Meat market, driven by the increasing consumption of processed meat products, growing demand for protein-rich convenience foods, and expansion of quick-service restaurants incorporating canned meat into their offerings.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canned Fruits Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Canned Tuna Business Landscape.

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Mackerel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Anchovy Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Canned Seafood Market Size, Growth, and Forecast for 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Leading Providers & Market Share in Canned Tuna Industry

Canned Legumes Market Insights – Protein-Packed Convenience Foods 2025 to 2035

Canned Pasta Market Trends - Convenience & Consumer Preferences 2025 to 2035

Canned Mushroom Market Analysis by Nature, Product Type, Form, and End-Use Application Through 2035

Canned Salmon Market Analysis by Source, Species, Form, and Sales Channel Through 2035

Market Share Insights of Canned Food Packaging Providers

Analysis and Growth Projections for Canned Foods Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA