Canned legumes will witness strong growth in sales between 2025 to 2035, as demand for convenient ready-to-eat food options across consumers rises due to the rising popularity of plant-based diets. In addition, the growing knowledge regarding the nutritive profile of pulses, which includes high level of protein, fiber and essential nutrients is also driving the higher demand for these pulses, thereby resulting in the growth of the market. As consumers make healthier eating decisions, canned legumes are becoming a household staple due to longevity and convenience.

Factors influencing market growth include growth in the global food industry and a rise in adoption of vegetarian and vegan lifestyles. Moreover, growing preference for canned legumes among food service providers, such as restaurants and catering vendors is further projected to drive the adoption of legumes in market. Sustainability concerns, as well as preferences for organic and non-GMO products, are also driving product innovation in the sector.

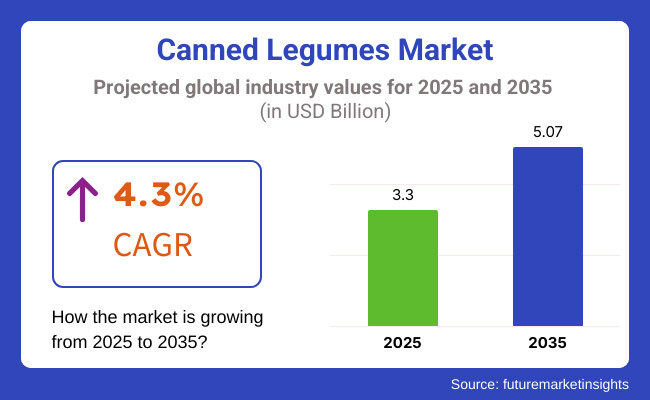

Investments in sustainable packaging and product diversification shall be the level-up for the market, set to span a whopping 4.3% CAGR from 2025 to 2035. New launches like a new flavour line-up, lower-sodium options and greater varieties for organic consumers are likely to heighten the existing consumer interest, too.

Explore FMI!

Book a free demo

The United States and Canada continue to lead in consumption of canned legumes, and North America remains a prominent market for legume canned goods. Demand for canned beans, lentils, and chickpeas is driven by the region's inclination towards healthy eating and plant-based diets. Canned legumes are also stocking all levels of supermarkets and online retail channels for shelf stability, while the rise of quick-service restaurants menuing legumes is also spurring growth. Sustainability initiatives, driving recyclable and BPA-free packaging, are also affecting product development.

In Europe, strong growth in the canned legumes class is also being driven by the Mediterranean diet, which gives legumes a central place in the diet, along with rising consumer preference for plant-based proteins. Germany, France and Italy, for example, have well-established canned-bean, lentil and pea markets, including growing markets for organic and low-sodium varieties. Regional dietary patterns are changing, and food manufacturers are responding by developing premium and gourmet canned legumes.

The Asia-Pacific region is projected to show the highest demand growth for canned legumes, as urbanization rises, eating trends change, and household incomes climb. In countries such as China, India, and Japan, there is increasing adoption of canned legumes as people lead busy lifestyles and offer convenience. Market expansion is also propelled by increasingly pervasive Western-style diets alongside developing retail and e-commerce channel networks. Local and regional actors are also concentrating their efforts on providing canned varieties of traditional legume-based meals.

Beans have an important place in the culture of Latin America, and reflecting that, it is a major market for canned legume products. Demand for ready-to-eat legume foods is on the rise in countries like Brazil, Mexico, and Argentina, mainly in heavy urbanized cities. Legumes are a staple ingredient in many traditional cuisines in the Middle East, which is experiencing increased demand for canned varieties alongside the growth of modern retail and disposable income. Natural or preservative-free products are trending in both markets due to this.

Challenges

Supply Chain Disruptions and Price Volatility

The fluctuation in raw material supply chains is one of the key challenges in the canned legumes market, affecting production costs and pricing for manufacturers. Chickpeas, black beans, lentils and kidney beans depend heavily on seasonal farming cycles, weather patterns and international agriculture. Shifting factors like drought, floods and changing patterns of climate are leading to decreasing yields, affecting supply and prices for manufacturers.

On top of that, geopolitical tensions, trade restrictions and transportation bottlenecks could disrupt procuring from major producers such as India, Canada and Argentina. The cost of producing food packaging materials, labour and transportation, for instance has also risen, adding another source of volatility to prices. Those challenges make it difficult for manufacturers to maintain pricing and margins if they continue supplying consumers.

Companies should implement diversified sourcing strategies and invest in contract farming and advanced supply chain management solutions to mitigate these challenges. Strategies to mitigate risks and ensure a steady supply: Collaborate with local farmers to adopt practices such as precision agriculture; and explore other sources of these legumes.

Opportunity

Increasing Demand of Plant-Based and Convenience Foods

Growing consumer trends for plant-based diets coupled with convenience of food is leading the demand for canned legumes. Legumes are staples of vegetarian and vegan diets, as health-centric consumers pursue protein-packed meat substitutes. All of these factors coupled with increasing awareness of the health benefits of legumes (being among the highest fiber foods and heart-healthy and blood-sugar regulators) have contributed to their mainstreaming.

Urbanization and hectic lifestyles have also driven a rising need for ready-to-eat and easy-to-cook meal options. Canned legumes are a nutritious, shelf-stable option, requiring little to no preparation which has made them a popular choice among working professionals, students and families, too.

In response, canned manufacturers are providing organic, low-sodium, and preservative-free canned legume options to satisfy health-conscious shoppers. As environmental worries grow, so do innovations in packaging, like BPA-free cans and (more) recyclable materials. Patients and third parties alike in the developed world are actively seeking to invest in prevention, and there is substantial room for the population in emerging markets to become health conscious.

The canned legumes market witnessed an upward trajectory in demand from 2020 to 2024, driven by the growing awareness around plant-based and healthy diets, and increase in demand for non-perishable protein-rich food products. However, humans do not eat legumes only for diversification, the above-mentioned health and fitness trend contributed to their popularity as a healthy replacement for animal protein. In turn, manufacturers have been rolling out organic and clean-label, lower-preservative and artificial-additive food products.

Also trending was a move toward sustainable packaging, with brands introducing eco-friendly cans and pouches designed to eliminate as much plastic as possible. But supply chain bottlenecks and pricing volatility were problems for manufacturers, leading to sporadic shortages and price increases.

The transformative decade ahead the decade figure of 2025- 2035 presents a consistent health, sustainability, and convenience trend that promises a radically different marketplace. Functional foods will dominate, meaning there will be an increased demand for fortified legumes featuring extras such as probiotics, omega-3s and plant-based proteins. Expect sustainability sourcing and regenerative agriculture to become the industry standard as brands shift toward carbon-natural production methods through ethical partnerships.

Food processing innovations will lead to improvements in the texture, taste and shelf life of canned legumes without compromising nutritional value. These measures will be supplemented by AI-based supply chain management and block chain technology for traceability, which will enhance transparency and efficiency in the sector. Private-label brands and e-commerce channels are also predicted to gain market share, offering consumers more options in canned legume products that are designed with dietary concerns and tastes in mind.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter food safety regulations, labelling requirements for preservatives |

| Technological Advancements | Growth of BPA-free can packaging, improved preservation techniques |

| Industry Adoption | Increased focus on organic and non-GMO canned legumes |

| Supply Chain and Sourcing | Dependence on key producers like India and Canada for raw materials |

| Market Competition | Established brands and private-label products competing for market share |

| Market Growth Drivers | Growing consumer interest in plant-based diets and protein alternatives |

| Sustainability and Packaging | Shift towards recyclable cans and reduced plastic packaging |

| Retail and Distribution | Dominance of supermarkets and grocery stores for canned legume sales |

| Product Innovation | Introduction of low-sodium, organic, and preservative-free options |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of sustainability and organic certification regulations |

| Technological Advancements | Smart packaging with freshness indicators, biodegradable packaging solutions |

| Industry Adoption | Widespread adoption of regenerative farming and carbon-neutral production |

| Supply Chain and Sourcing | Diversified sourcing strategies, increased use of contract farming and local suppliers |

| Market Competition | Expansion of plant-based food brands, entry of direct-to-consumer (DTC) brands |

| Market Growth Drivers | Functional and fortified canned legumes, rising adoption of flexitarian diets |

| Sustainability and Packaging | Large-scale adoption of biodegradable, compostable, and refillable packaging |

| Retail and Distribution | Surge in online grocery sales, direct-to-consumer models, and meal kit integrations |

| Product Innovation | Development of fermented and probiotic-enhanced canned legumes |

United States Canned Legumes Market Key Drivers the United States canned legumes market is expected to be driven by a rising consumer demand for known-exactly health-conscious convenient and ready-to-eat food products that are in compliance with plant-based diet preferences. Investments are also making in sustainable and BPA-free packaging, led by the growing demand for organic, non-GMO, and preservative-free canned legumes. Leading ones in the USA are looking to extend their portfolios with value-added legumes like seasoned, low-sodium and pre-cooked versions. Moreover, steady expansion of the market is also complemented by increase in private-label brands and expansion of distribution channels (such as e-commerce).

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

The legume canning industry in the UK has enjoyed buoyant demand thanks to the growing interest in vegan and flexitarian diets. The trend to eat more plant-proteins and busy lifestyles are leading to increased consumption of canned beans, chick peas and lentils. Government initiatives encouraging healthy eating and sustainable food choices are also fuelling market growth. Moreover, the UK retailers and supermarkets are diversifying their portfolio of canned legumes to cater to the consumer preferences for organic and ethically sourced food products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The demand for plant-based and ready-to-eat products in major European markets like Germany, France, and Italy is driving the canned legumes industry in the European Union. The recognition of their numerous health advantages, such as high protein and fibre content, has contributed to their growing popularity.

In addition, health consciousness and a focus on reducing meat consumption and adopting plant-based diets have driven growth. The market is further backed by the presence of strong domestic brands and the private-label expansion initiatives taken by the supermarket chains. Industry trends like less plastic packaging and environmentally safe can linings are also improving the sector’s future.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

Japan's canned legumes industry is steadily advancing, primarily due to the greater acceptance of Western eating patterns. Soybeans are commonly consumed in fermented or fresh form, but recent trends in fast moving consumer goods (especially among urban consumers with small households and no domestic need for bean production) are showing more interest in convenient canned products. Additionally, the demand for legumes is increasing and the offer of ready-to-eat legume-oriented food from supermarkets and convenience stores is expanding. Innovations in packaging and preservation techniques to maintain texture and flavour are contributing to these sales as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Canned legumes in South Korea are becoming ever more popular, thanks to rising health awareness and the westening diet. Legumes are finding their way into modern Korean cuisine with canned chickpeas and lentils gaining popularity with younger consumers. Also, the growing vegan and vegetarian community is working in favour of the market as well as the development of high-protein, ready-to-cook legume meals by local and foreign brands. Moreover, continued innovations in the technology behind canning as well as government efforts to promote plant-based food diets are also likely to sustain growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Health aware consumers and food service operators increasingly favour shelf-stable, protein packed and ready-to-use legumes, which is why canned legumes dominate the share of retail and food service segments. Processed legumes have become a staple food in modern life because they add vegetable nutrition to the diet, support vegetarian and vegan diets, and provide flexibility for what type of food to cook in different cuisines.

Over the period from 2023 to 2033, the eye-vertical growth of the canned legumes market will be attributed to the retail sector, which contributes one of the most demanding attributes for canned legumes due to the changing needs of consumers towards easy to prepare, high-protein and high-fiber food options. Unlike dry legumes they need no soaking and long cooking time, that's why canned legumes are becoming a favourite for busy householders, students, and health freaks.

The segment has particularly benefited from the growing demand for canned lentils, chickpeas, black beans, kidney beans, and peas in supermarkets, hypermarkets, online grocery stores, and specialty health stores. According to studies, more than 65% of people living in urban areas choose canned legumes are more convenient, last longer and can be easily used in daily cooking and meals.

Organic and non-GMO canned legumes development with preservative-free formulations, BPA-free packaging, and low sodium varieties further enhance market demand and broader appeal to healthy consumers.

The proliferation of private-label canned legumes from supermarket and e-commerce chains has also helped drive adoption, giving consumers budget-friendly and high-quality options to branded goods. Moreover, arising promotional demand along with another recipe-oriented marketing strategy has strengthened this segment performance in retail market

However, while retail has the advantages of being the most accessible and usually the most affordable with the greatest convenient, it does compete on price for raw legumes as the price can change depending on available supply, and the environmental impact from adding packaging. But, new innovations - in sustainable packaging materials, farming practices, and premium processed canned legumes (e.g., pre-seasoned and ready-to-eat versions) - are enhancing the competitive landscape and engaging consumers to maintain channel growth.

The foodservice segment has secured excellent market adoption, especially among QSRs, casual dining restaurants, institutional kitchens, and catering services. Unlike their fresh counterparts that need so much more time to process, canned legumes offer a convenient, affordable and consistent option to foodservice that allows for streamlined meal prepping and portion control.

The segment has been driven by growing use of canned legumes in salads, soups, curries, burritos, hummus and plant-based protein dishes, along with restaurants and institutional buyers looking for dependable, high-quality legume sources that can produce in large scale for meals for thousands. More than 55% of foodservice operations serve canned legumes because they save time spent cooking and are readily available any time of year.

The expansion of bulk packaging options for canned legumes such as large foodservice-friendly cans, aseptic pouches, and recyclable packaging, has bolstered market demand, which translates into enhanced cost efficiency and less food waste.

The emergence of plant-based dining trends with earthy meat alternatives leveraging legumes as the foremost protein source has also accelerated adoption ensuring hearty growth for canned legumes in vegan or vegetarian foodservice offerings.

Development of sustainable sourcing initiatives, such as legumes which are fair-trade certified, and related environmentally friendly farming methods and reduced-carbon-footprint methods of processing have further boosted market growth, with better aligning with global responsible foods production standards.

Though the foodservice segment is more cost effective, offers a wider range of product options and bulk purchasing, the segment must contend with volatile wholesale pricing, the need for storage of cumbersome large-scale canned items, and changing consumer habits toward using fresh ingredients. Conversely, new innovations extending shelf-life processes, contemporary packaging solutions and gourmet canned legumes are enhancing operational efficiency, quality and flux, ensuring sustained market proliferation of F&B oriented in canned legume applications globally.

Increasing consumer preference for convenience foods with a high-protein and plant-based profile is anticipated to drive the growth of the canned legumes market. The key transformation areas vegan canned legumes and legumes without preservatives, sustainable packaging and extensive range of products for vegan and gluten-free diets. To lure health-minded consumers, companies are honing in on clean-label ingredients, longer shelf-life technologies and eco-friendly canning processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Conagra Brands, Inc. | 18-22% |

| The Kraft Heinz Company | 15-19% |

| Del Monte Foods, Inc. | 12-16% |

| General Mills (Green Giant) | 8-12% |

| Goya Foods, Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Conagra Brands, Inc. | Produces a wide variety of canned legumes under brands like Van Camp’s, with a focus on long shelf life and natural ingredients. |

| The Kraft Heinz Company | Offers organic and low-sodium canned beans under the Heinz brand, targeting health-conscious consumers. |

| Del Monte Foods, Inc. | Specializes in premium, non-GMO, and preservative-free canned legumes for retail and foodservice sectors. |

| General Mills (Green Giant) | Provides high-quality canned legumes with BPA-free packaging and plant-based nutrition benefits. |

| Goya Foods, Inc. | Focuses on Hispanic and global cuisine, offering an extensive variety of canned beans and legumes. |

Key Company Insights

Conagra Brands, Inc. (18-22%)

A market leader producing different varieties of canned legumes, focusing on convenience, cheapness, and shelf-stability.

The Kraft Heinz Company (15-19%)

Leading the organic and premium canned beans space, with a focus on clean-label and reduced-sodium products.

Del Monte Foods, Inc. (12-16%)

Focuses on canned legumes in high-quality with sustainable packaging for natural and organic consumers.

General Mills (Green Giant) (8-12%)

acquires plant-based legumes produced for the health conscious consumer.

Goya Foods, Inc. (5-9%)

Industry Analysis: A key supplier in the ethnic food segment, with an extensive range of canned beans & legumes flavours that are authentic.

Other Key Players (30-40% Combined)

A number of regional and specialty brands are available canned legumes in organic, preservative free as well as globally inspired flavours. These include:

The Canned Legumes Market was valued at approximately USD 3.3 billion in 2025

The market is projected to reach USD 5.07 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.3% from 2025 to 2035.

The demand for Canned Legumes Market is expected to be driven by increasing consumer preference for convenient and ready-to-eat food products, growing awareness of plant-based protein sources, rising demand from the foodservice industry, and expanding retail distribution channels offering diverse canned legume varieties.

The top 5 countries contributing to the Canned Legumes Market are the United States, Canada, Germany, the United Kingdom, and Australia.

The Retail and Foodservice Segments are expected to lead the Canned Legumes market, driven by the rising popularity of plant-based diets, increasing use of canned legumes in restaurant and fast-food chains, and growing demand for long-shelf-life pantry staples among consumers.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.