Presence of various factors, such as the rising incidence of cannabis use disorder, increasing consumption of cannabis and advancements in the treatment methodologies are likely to accentuate the growth of the cannabis use disorder treatment market from 2025 to 2035. With several nations legalizing cannabi for medical and/or recreational purposes, the available population of cannabis use disorder (CUD) is growing leading to increased demand for therapeutic targets.

The increasing scientific evidence of the deleterious effects of overconsumption of cannabis over time (e.g., cognitive impairment, mental health disorders, unwanted symptoms when it is stopped) also prompts health care systems to respond with targeted treatments for the condition.

The increasing accessibility of pharmacological and behavioural treatment options in particular is a major market driver. Although cognitive behavioural therapy (CBT) is the most widely utilized method, ongoing studies involving pharmacotherapies (N-acetyl cysteine, cannabidiol (CBD), and other medications) are being conducted to increase treatment effectiveness. Digital therapeutics and telemedicine platforms are becoming increasingly valuable for expanding patient access to counselling and intervention programs.

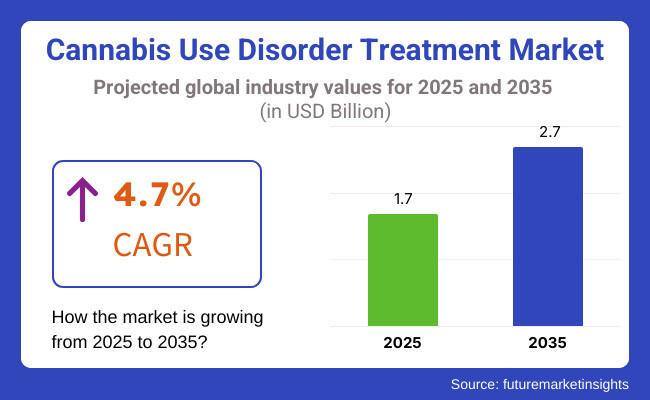

The expected 4.7% CAGR from 2025 to 2035 indicates a rising trend in cannabis addiction treatment generalisedIndice, both research-specific and healthcare-focused. Integration of Mental Health Services with Addiction Treatment Programs to Augment Patient Outcomes and Drive Market Expansion.

Explore FMI!

Book a free demo

The cannabis use disorder treatment market is dominated by North America, owing to the enormous usage of cannabis in the countries such as the USA and Canada. Recent legalization measures along with increased use and dependency has resulted in a rise in cannabis dependency cases stimulating government initiatives and funding for addiction treatment programs. Market growth is driven by increased availability of mental health services, coupled with continued clinical trials for new pharmacological therapeutics. The region also has the telemedicine infrastructure to better meet patients where they are with therapy and counselling services.

In Europe, the cannabis use disorder treatment market is developing at a stable pace, mainly attributed to growing utilization of medicinal cannabis and the increasing recognition of cannabis addiction as a matter of public health. Germany, France and the UK are countries investing funds in rehabilitation centres and integration into national health systems for cannabis addiction treatment. Strict controlled substance regulations in the region also paved the way for structured treatment frameworks to target CUD more effectively.

Cannabis Addiction Awareness in Asia-Pacific Although cannabis is classified as an illegal substance worldwide, awareness of the potential for cannabis addiction is growing in Asia-Pacific, which remains in the early stages of developing targeted treatment programs. Countries like Thailand and Australia, where medical cannabis is permitted, are finally looking to provide treatment for those dependent on cannabis. This market is expected to grow through the expansion of mental health initiatives and the implementation of digital health solutions. However, treatment development is still limited in many Asian countries, due to the continued strict regulation of cannabis.

As medical cannabis programs spread in nations such as Brazil, Mexico, and Colombia, Latin America is slowly accumulating more instances of cannabis use disorder. While governments are moving to establish addiction treatment policies, specialized cannabis rehab is still not easily accessible. Cannabis addiction treatment is not a well-recognised market in the Middle East where cannabis consumption is largely prohibited and such discussions on mental health reform could also shape future development.

Challenge

Limited Awareness and Underdiagnosis

One major problem hindering the cannabis use disorder (CUD) treatment market growth is lack of awareness and underdiagnosis. As cannabis is increasingly legalized for medical and recreational use, many people and healthcare professionals say dependence and addiction to cannabis are not as serious as with other substances. The perception that cannabis is a “safe” drug compared to opioids or alcohol results in an underestimation of problematic use. Consequently, a considerable number of individuals who fulfil the clinical diagnostic criteria for CUD remain untreated, leading to a lacuna in diagnosis and intervention.

Somewhat, there is no standardized treatment protocol or FDA-approved medications for CUD. Treatment approaches all centre around behavioural therapies, which can be effective but are long-term commitments that are not always accessible. Stigma around addiction treatment also prevents people from seeking professional, scalable help, limiting the market’s growth potential in the best cases.

Things to changing this includes a better public education around cannabis dependence, improved screening tools or health providers, and investment in research for targeted pharmacological treatment. Behavioural health professionals with CUD awareness integrated into their mental health programs and substance use disorder screeners may allow people who needed help to be identified sooner in their addiction cycle.

Opportunity

Expanding Research and Therapeutic Innovations

As cannabis use increases worldwide, researchers and pharmaceutical companies are paying attention to the growing need for effective CUD treatments. Exploratory clinical trials for new pharmacological treatment for CUD, including FAAH inhibitors and CB1 receptor modulators, are expanding. However, growing understanding of the biological mechanisms contributing to cannabis dependence via advances in the fields of neuroscience and addiction medicine provide an opportunity now to give targeted interventions.

Moreover, digital health solutions like telemedicine counselling, mobile therapy applications, and AI-powered behavioural intervention are expanding the range of treatments. Personalized treatment plans and ongoing patient engagement are facilitated by virtual cognitive behavioural therapy (CBT) and digital monitoring solutions.

Increasing acknowledgement of cannabis dependence as a real medical condition is going hand-in-hand with improved insurance coverage for treatment. Investments in research will drive the market for CUD treatment, opening up new avenues for healthcare providers, pharmaceutical companies, and mental health organizations.

From 2020 to 2024, the Cannabis Use Disorder Treatment Market was still in its infancy, with a very limited pharmacological treatment and a strong emphasis on behavioural programs, including behavioural therapy (CBT) and motivational enhancement therapy (MET). With the rise in cannabis legalization, there was an alarming paradox in increasing regular cannabis consumption alongside a decreasing number of people recognizing the risks of cannabis dependency. Treatment was mainly offered via rehabs, out-patient mental health services, clinics, and support groups but was not always possible, especially in areas with few addiction treatment centres.

The market will be undergoing some major trends from 2025 to 2035 which are driven by increasing clinical research, the emergence of pharmacological interventions, and increased integration into the healthcare system. Neuroscience will advance, permitting the approval of specific medications targeting CUD by relieving withdrawal and cravings. Global Expansion of Digital Health Platforms, Mobile-based Therapy, & Remote Counselling Services would be Standard across Care.

Furthermore, government authorities and health enterprises also anticipated more fund support for the research of cannabis addiction to develop better early diagnosis and intervention system. Public awareness campaigns will help reduce the stigma attached to CUD treatment, motivating more people to get professional assistance. Access to CUD treatment will be facilitated by the integration of CUD therapy into the general healthcare system, such as the inclusion of CUD treatment as part of primary care or mental health clinics.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Limited recognition of CUD as a serious medical condition |

| Therapeutic Advancements | Behavioural therapies as primary treatment approach |

| Industry Adoption | Limited availability of specialized CUD treatment centres |

| Supply Chain and Sourcing | Few pharmaceutical companies investing in CUD-specific drugs |

| Market Competition | Small-scale competition among behavioural therapy providers |

| Market Growth Drivers | Rising cannabis use but low recognition of CUD risks |

| Digital Health Integration | Limited use of technology in treatment |

| Public Awareness and Accessibility | Stigma and lack of education limiting treatment-seeking behaviour |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expanded regulatory support, insurance coverage, and funding for CUD treatment research |

| Therapeutic Advancements | Development of FDA-approved medications for cannabis addiction |

| Industry Adoption | Integration of CUD treatment into general mental health and addiction recovery programs |

| Supply Chain and Sourcing | Increased investment in targeted medications and alternative treatment methods |

| Market Competition | Entry of major pharmaceutical firms and digital health platforms offering CUD interventions |

| Market Growth Drivers | Increased awareness, research funding, and expansion of evidence-based treatments |

| Digital Health Integration | Widespread adoption of telemedicine, mobile therapy apps, and digital intervention programs |

| Public Awareness and Accessibility | Normalization of CUD treatment, public awareness campaigns, and early intervention programs |

Due to increasing legalization and consumption, the USA holds the largest market share for cannabis use disorder (CUD) treatment, 3 as a result of rising cases of cannabis dependency. The National Institute on Drug Abuse (NIDA) and other health agencies are underwriting widespread studies on treatments, ranging from behavioural therapy to pharmacotherapy to cognitive interventions. Increasing awareness about cannabis addiction and availability of rehabilitation programs are influencing market growth. Finally, in addition, insurance providers are covering substance use disorder treatments, making professional care more attainable and increasing the adoption of treatment solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

Cannabis use disorder treatment in the UK is getting increasing attention given the rise of cannabis-related health problems, especially among younger cohorts. The National Health Service (NHS) and private rehab facilities have increased mental health and addiction treatment offerings. Cognitive-behavioural therapy (CBT) and contingency management programs are widely used. Pharmaceutical research into drug-assisted approaches for cannabis addiction is becoming increasingly desirable, resulting in new potential market expansion opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

In countries such as Germany, France, and the Netherlands, there is a consistent growth of demand for services and treatments for Co-occurring Substance Use Disorders, or CUD. Even though medical cannabis is sanctioned in a number of EU countries, cannabis dependency has been considered a state problem, and governments have sponsored rehabilitation measures.

Market growth is driven by investments in mental health care infrastructure and a well-established presence of addiction treatment centres. Furthermore, pharmaceutical companies are seeking drug therapies to ease cannabis withdrawal and prevent relapse.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

Japan's cannabis laws which, are some of the most stringent in the world, leading to a comparatively low prevalence of cannabis use disorder. With the growing international conversation about cannabis policies, Japanese mental health facilities are now slowly initiating awareness programs concerning cannabis dependence. Neuropharmacological studies are being conducted to find ways to treat substance abuse without risk of addiction, potentially paving the way for future growth opportunities in this niche market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

With CUD treatments being nicotine and caffeine products, South Korea's strict anti-cannabis policies limit their potential market. However, with a growing global exposure, there is an increasing demand for mental health services to treat cannabis dependence amongst travellers who have experienced cannabis use overseas. Korean Research Institutions are also starting to explore Cannabis-related disorders, especially among youth going through mental health disorders and rehab plans, which is slowly but surely growing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The cannabis use disorder (CUD) treatment market is growing, with rising rates of cannabis use, dependence, and legalization efforts necessitating medical intervention. Though cannabis does provide benefits for therapeutic purposes, long-term or excessive use of it can lead to relation issues and withdrawal symptoms, which require specialized treatment options. Cannabis addiction treatment market trends at the compound annual growth rate (CAGR) of 12% to 14%. Neurobiological and psychological triggers of cannabis addiction are greatly affected by pharmaceutical and behavioural therapy solutions. CUD therapies, rather than general substance use treatments, work to modulate cannabinoid receptor activity, behavioural reinforcement, and cognitive control mechanisms to facilitate the recovery process.

The segment of pharmaceutical treatments for CUD has witnessed an exponential growth in the treatment market, providing targeted management of withdrawal symptoms, agripainment of cravings, and prevention of reclamation. Pharmaceutical treatments break this bind via neurochemical modulation; to stabilize long-term abstinence, pharmacotherapies correct dysregulation of the endocannabinoid system.

The initial cash outlay, patient compliance, and retrieval of symptoms are dimensions of the long-term care and point of care that are addressed by the increasing acceptance of upstarts like N-acetyl cysteine (NAC), gabapentin, and antidepressants for the treatment of cannabis withdrawal and, thus, is expected to take the heights of the demand in the market. Research shows that more than half of the people treated for cannabis dependence have experienced improved outcomes when they used adjunct pharmaceutical therapy, creating healthy demand for this segment.

The research around cannabinoid-based medication is witnessing significant expansion, primarily focusing on CBD and FAAH inhibitors, which are expected to fuel market growth by providing non-intoxicating medications with potential neuroprotective effect.

Few developments that further consolidated adoption like integration of precision medicine approaches in CUD pharmacotherapy, with include personalized treatment plans based on genetic markers, neuroimaging data, and metabolic profiling, to ensure improved patient outcomes and reduced side effects.

This has also prevented withdrawal discomfort with the development of long-acting formulations such as the extended-release, transdermal patch formulations and therefore has optimized market growth.

Potential benefits are a focus on symptom relief through the use of scientifically backed medications, new approaches in medicine, re-classifications, and FDA approval, however, there are challenges, such as few FDA-approved medications available and side effects of newly developed drugs as well as the Ongoing Issues with Marijuana Treatment. But recent advances in cannabinoid receptor modulation, AI-assisted drug development, and clinical trial expansions are improving treatment efficacy, agency approvals, and market share, solidifying the worldwide CUD pharmaceutical treatment industries' continuing expansion.

In cannabis use disorder treatment, psychological treatments help to address habitual cannabis use, emotional triggers to usage, and relapse prevention strategies and with such behavioural therapy solutions are becoming an integral part of cannabis use disorder treatment. In contrast to pharmacological treatments, behavioural therapies provide non-invasive, individualized strategies for sustainable recovery by teaching cognitive restructuring and coping strategies.

As demand for cognitive-behavioural therapy (CBT), contingency management (CM), and motivational enhancement therapy (MET) for cannabis dependence increases, the market can expect even greater levels of penetration among young adults and long-distance cannabis users. Research has shown that over 60% of CUD treatment programs offer behavioural therapies, which will ensure a continuous demand for this segment.

However, the introduction of digital mental health platforms, including teletherapy, AI-based behavioural coaching, and virtual support groups, has facilitated market growth by making it easier for CUD patients to access behavioural interventions.

The adoption of CUD recovery programs has been further augmented by the introduction of MBRP, stress management training and trauma-informed therapy to treatment secondary’s to advance a more sustainable approach to psychological health treatment.

The emergence of hybrid treatment models, integrating behavioural therapy with medication-assisted treatment, has further facilitated market expansion, enabling comprehensive recovery frameworks that promote treatment efficacy and prolonged sobriety.

While having benefits in psychological support, coping skills, and prevention of relapse, the behavioural therapy module is also troubled by stigma related to pursuing treatment, making specialized therapists available, and varied success rates across patient demographics. Recently developed tools such as AI-based tracking of mental health states and physiological factors, digital cognitive behavioural therapy platforms, and neurofeedback therapy are work with us in engaging patients, improving accessibility, and promoting adherence as we grow globally transforming behavioural therapy solutions for the treatment of cannabis use disorder.

Legalization has led to an increase in cannabis usage; this, however, comes with an increased risk of dependency leading to the CUD treatment market. Potential areas of transformation include pharmacological therapies, behavioural interventions, and digital health applications for the management of addiction.Organizations increasingly identify a need for FDA-approved medications, CBT-based digital platforms, and rehab programs to deal with withdrawal symptoms and recovery.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Indivior PLC | 18-22% |

| Zynerba Pharmaceuticals | 15-19% |

| Pfizer Inc. | 12-16% |

| GW Pharmaceuticals (Jazz Pharmaceuticals) | 8-12% |

| Adial Pharmaceuticals | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Indivior PLC | Develops medication-assisted treatments (MAT) targeting cannabis dependence and withdrawal management. |

| Zynerba Pharmaceuticals | Specializes in transdermal cannabinoid-based therapies for neurological and psychiatric disorders, including CUD. |

| Pfizer Inc. | Conducts research on neuropsychiatric treatments and pharmacotherapies for substance use disorders, including cannabis addiction. |

| GW Pharmaceuticals (Jazz Pharmaceuticals) | Focuses on cannabinoid-based prescription medications for neurological and addiction-related treatments. |

| Adial Pharmaceuticals | Develops investigational drugs targeting endocannabinoid system modulation for cannabis addiction treatment. |

Key Company Insights

Indivior PLC (18-22%)

A leader in addiction treatment, developing innovative medication-assisted therapies aimed at reducing cannabis dependency and withdrawal symptoms.

Zynerba Pharmaceuticals (15-19%)

Focuses on cannabinoid-based transdermal therapies meant for psychiatric and neurological conditions, CUD included.

Pfizer Inc. (12-16%)

Area of interest: Neuropsychiatric treatments, with interest in the use of pharmacotherapy for substance use disorders, including cannabis dependence.

GW Pharmaceuticals (Jazz Pharmaceuticals) (8 - 12%)

Front-runners for cannabinoid-based prescription medicines root to treat addiction diseases.

Adial Pharmaceuticals (5-9%)

Built on data collected through interviews and literature searches, with the aim of elucidating potential novel drug candidates acting on cannabinoid receptor pathways to combat cannabis use disorder.

Other Key Players (30-40% Combined)

Treating Cannabis Use Disorder Companies The cannabis use disorder treatment market is growing through the development of different innovative therapies and intervention programs, driven by several companies and research organizations. These include:

The Cannabis Use Disorder Treatment Market was valued at approximately USD 1.7 billion in 2025.

The market is projected to reach USD 2.7 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2035.

The demand for Cannabis Use Disorder Treatment Market is expected to be driven by increasing awareness of cannabis dependency, rising cases of problematic cannabis use, expanding research on pharmacological treatments, and growing availability of behavioural therapies to support long-term recovery.

The top 5 countries contributing to the Cannabis Use Disorder Treatment Market are the United States, Canada, Germany, the United Kingdom, and Australia.

The Pharmaceutical and Behavioural Therapies segment is expected to lead the Cannabis Use Disorder Treatment market, driven by increasing clinical trials for medication-assisted treatments, expansion of cognitive behavioural therapy programs, and growing government initiatives to address cannabis addiction

The Intraoperative Radiation Therapy Systems Market Is Segmented by Disease Indication and End User from 2025 To 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.