The cannabis packaging equipment market is projected to progress at a steady pace from 2025 to 2035 through the legalisation of cannabis with respect to medical and recreational use in many countries. As the cannabis market continues to grow, the need for top-notch, compliant packaging solutions is increasing, which, in turn, drives demand for automated, efficient packaging machinery.

Tighter rules on the safety and labelling of cannabis products, as well as the need for child-proof packaging, are also driving investments in specialized machinery used for packaging products.

Manufacturers are to adopt advanced packaging technologies to improve efficiency, product integrity, and shelf-life management, with increasing consumer demand for cannabis-based products such as oils, edibles, and pre-rolls. With modern day more and more machine processes are made to fulfil industrial standards like automated filling, sealing, labelling system and tamper evident packaging types.

Moreover, sustainability initiatives are prompting the emergence of environmentally-conscious packaging systems, propelling the need for compostable and reusable packaging supplies suitable for automated equipment.

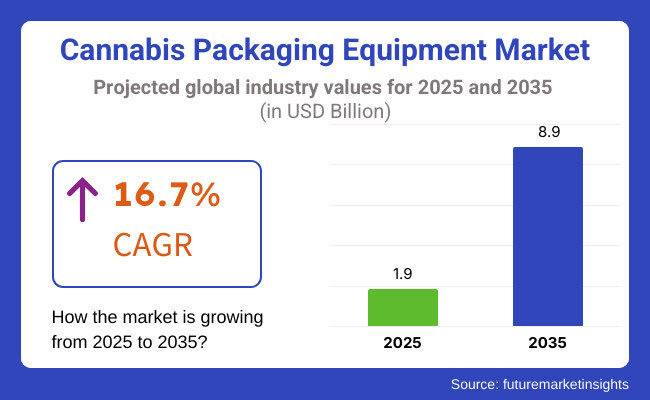

The 2035 to 2035 CAGR growth rate of 16.7% is driven by the increasing adoption of packaging automation for enhanced speed, consistency, and compliance in the cannabis industry . The demand for eco-friendly products and packaging is expected to fuel growth in smart packaging solutions and modular machinery tailored for flexibility and scalability.

Explore FMI!

Book a free demo

Due to the already well-established legal cannabis industry in the United States and Canada, the region holds the major market share of cannabis packaging equipment market. The growing need for pre-packaged cannabis products and edibles, along with strict packaging regulations, is propelling investments in automated packaging machinery. The compliance requirement for child-resistant and tamper-proof packaging still being the top priority, thus putting an emphasis on advanced labelling and sealing technology. Sustainability trends are also making companies to look for compostable and recyclable cannabis packaging solutions that comply with regulatory guidelines.

The cannabis packaging equipment market in Europe is booming with new countries decriminalising medical cannabis. Germany is the most experienced in purchasing cannabis-based products, followed closely by the UK and the Netherlands, which is why there is a demand for high-precision packaging solutions. Strict pharmaceutical-grade packaging requirements in the region are driving investments in sterile, airtight and hermetically sealed packaging equipment. Moreover, the EU's sustainability programs are also prompting the cannabis industry to transition to biodegradable packaging materials.

Countries like Thailand and Australia that are progressively legalizing medical cannabis make the Asia-Pacific a budding market for cannabis packaging equipment. Despite a complicated regulatory environment, however, the region is seeing growing investment in cannabis cultivation and processing, creating a growing demand for automated packaging solutions. Rapidly increasing pharmaceutical and nutraceutical industries also helping driving the advanced packaging technologies used for cannabis-based products.

In Latin America especially in the emerging markets of Brazil, Mexico and Colombia medical cannabis is increasingly accepted, and legal frameworks are developing. The cannabis packaging industry in that region is reaping the benefits of amplified production and exports, which rely on fast and compliant packaging systems. In the Middle East, the market is still nascent, but increasing conversations around legalizing medical cannabis could pave the way for investments in packaging automation in the future.

Challenge

Regulatory Uncertainty and Compliance Costs

Another key challenge in the cannabis packaging equipment market is the dynamic regulatory environment. Laws around cannabis vary from place to place, with some countries and states legalizing its medical and recreational use, while others have strict restrictions. These inconsistencies in things like child-resistant packaging requirements, label mandates, and sustainability guidelines make things complex for equipment manufacturers as well as cannabis businesses.

Adhering to a constantly evolving regulatory framework adds to the operational costs of cannabis packaging firms. Businesses are regularly required to replace equipment and infrastructure to meet new standards that come into play, which drives up capital expenditure. Also, failing to comply with regulations can lead to costly fines or product recalls, both of which affect profitability.

To meet this challenge, cannabis packaging equipment manufacturers need to remain on top of regulatory updates and create flexible, modular solutions. Investing in research and development to develop packaging systems complying with several regional requirements will keep businesses on the right side of compliance without continuous expensive upgrades. The best practices include working closely with industry associations and regulatory bodies to future-proof their model and processes.

Opportunity

Growing Demand for Sustainable and Automated Packaging Solutions

As cannabis is increasingly legalized across the globe, the need for efficient cannabis packaging that is automatic and sustainable is on the rise. As a fast-growing industry, the cannabis companies are investing in the packaging capital for better productivity, lesser labour costs, and promoting standardization of products. Cannabis packaging equipment filling, labelling and sealing systems, for example are automated, so they speed up production, increase accuracy and reduce human error.

Cannabis packaging sustainability too has been identified as a significant concern. Consumers and regulators alike are increasingly demanding the use of eco-friendly solutions like biodegradable packaging, recyclable products, and reduced plastic usage. But, for the sake of sustainability, cannabis companies are spending on packaging equipment that is more conducive to sustainable initiatives such as automated machinery made to support compostable materials or packaging lines designed to prevent waste.

Businesses that utilize clean, green, customizable packaging solutions and save money on energy costs for consumers will have a leg up. Smart packaging and tamper-evident packaging, biodegradable materials, and other solutions will help propel the transformation of cannabis packaging equipment.

From 2020 to 2024, the cannabis packaging equipment market flourished thanks to growing legalization and investment realized in automation. Cannabis manufacturers were looking to improve their overall operational efficiencies by adopting high-speed filling, labelling and sealing machines. The billions of products packaged in child-resistant and tamper-proof packaging across a series of markets created demand for such equipment. [But] hurdles including regulatory uncertainty, high capital costs and restrictions on cross-border trade curbed the expansion of some businesses.

Once regulatory frameworks settle down, manufacturers will be able to design equipment that meets global cannabis packaging specifications without having to build infrastructure according to every unique jurisdiction. Incorporating AI-powered packaging solutions for quality control, weight measurement, and real-time tracking will improve efficiency. Furthermore, organizations will shift towards eco-friendly packaging solutions, incorporating compostable materials and minimizing packaging waste.

Innovations in modular packaging systems will allow cannabis businesses to easily change between different packaging formats. The growing adoption of smart packaging, which utilizes QR codes to enable authentication and traceability will propel innovation in cannabis packaging equipment.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Region specific regulations being dynamic with changing compliance challenges |

| Technological Advancements | Equipment Start-Up Filling, Labelling and Sealing Machines |

| Industry Adoption | Expansion of automation in large scale cannabis production facilities |

| Supply Chain and Sourcing | Cost constraints restrict them to only a few sustainable packaging options |

| Market Competition | Presence of specialized cannabis packaging equipment manufacturers |

| Market Growth Drivers | Growing legalization and consumer interest in cannabis goods |

| Sustainability and Energy Efficiency | Premium cannabis products including everything from apparel to edibles are early adopters of sustainable materials |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Compliance-ready equipment & harmonization of worldwide cannabis packaging Standards |

| Technological Advancements | Incorporation of AI-based quality control, real-time tracking, and innovative packaging solutions |

| Industry Adoption | Ubiquitous modular and flexible packaging systems for more product types |

| Supply Chain and Sourcing | Regarding cannabis packaging solutions, moving towards biodegradable, recyclable and environmentally friendly options |

| Market Competition | Entry of mainstream packaging equipment companies and increased investment in R&D |

| Market Growth Drivers | Increasing sustainable and automated packaging solutions to comply with regulatory demands and consumer requirements |

| Sustainability and Energy Efficiency | Widespread adoption of sustainable packaging solutions and practices that promote a circular economy, such as minimizing plastic consumption |

As the legal cannabis movement continues to grow, alongside increasingly stringent packaging regulations, we've come to the conclusion that our data will help drive the development of the USA cannabis packaging equipment market. As more states legalize both medical and recreational cannabis, the need for sophisticated, compliant and efficient packaging solutions is climbing. Innovations in child-resistant, tamper-proof, and sustainable packaging are forcing manufacturers to spend on automated packaging machinery.

Additionally, the rise of cannabis-infused drinks, edibles, and vapes, is driving this need for specialized packaging equipment. Development of the market is coupled with the presence of large cannabis companies and packaging technology companies in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.2% |

While cannabis is largely illegal within the UK, the medical cannabis sector is increasingly dominating the market, increasing the demand for compliant packaging equipment. As more patients gain access to cannabis-based medicines, pharmaceutical-grade packaging solutions are starting to become more prevalent.

The regulatory framework in the UK government imposes strict labelling, child-proofing, and tamper-evident packaging requirements, thus posing an opportunity for cannabis packaging equipment. Moreover, increasing consumption

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.9% |

Cannabis packaging equipment has recorded healthy growth over the past decade and this translucency is pushed by the growing leisure and medical cannabis market in countries like Germany, France, and The Netherlands, thus country is evolving as a key market for revenue generation for cannabis packaging equipment.

Demand for automated, compliant packaging solutions is being driven by strict EU regulations on pharmaceutical packaging standards. Companies are investing in new filling, sealing and labelling machinery to support the explosion in cannabis-derived wellness and pharmaceutical products. Additionally, the increase in cannabis related research and development in Europe is driving innovation in packaging technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 16.5% |

Stringent cannabis regulations make the Japanese cannabis packaging equipment market relatively small. But this nation has a rising appetite for CBD-linked health and wellness products and specific packaging needs. With Japan slowly gaining traction towards medical cannabis applications, pharmaceutical grade packaging equipment is expected to have gradual yet steady growth. Japanese Market: Niche opportunities for high precision, tamper proof packaging solutions for cannabis-derived products

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.7% |

Cannabis-based medicines have limited acceptance in South Korea, where a much regulated cannabis market exists. The growing sale of institutions for CBD-infused products is fuelling the demand for high-quality packaging solutions. Tempering with this demand, however, is strict government regulations with respect to product safety, labelling and compliance, which are providing a lucrative opportunity for automated packaging equipment manufacturers. Further, the country’s advanced technology in packaging machinery has contributed to the emergence of precision cannabis packaging solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 15.2% |

The cannabis packaging equipment market is booming, driven by growing legalization, escalating demand for cannabis products among consumers, the need for packaging operations to be more efficient, and new marijuana companies entering the cannabis market. Two main forces act on the world market, automation and sustainability, companies strive for quick and accurate solutions while complying with local regulations and environmental interests. Cannabis-specific equipment provides everything that conventional packaging machines don’t: precise dosing, child-resistant and tamper-evident features, and compliance with industry-specific packaging mandates.

The automation of packaging equipment in this sector has surfaced as the fastest-growing segment in the overall market, due to the need for higher production speeds, lower labour costs, and uniform packaging. Automated solutions promote packaging across a portfolio of cannabis products dried flower, pre-rolls, edibles, tinctures, and concentrates unlike manual systems.

The growing use of robotic packaging systems, which can automatically weigh, fill, seal, and label products, has catalysed market demand, providing high throughput and reduced risk of human error in cannabis processing plants. One out of three new hires made by cultivators is an automation specialist, new studies show.

The presence of integrated cannabis packaging lines equipped with multi-functional machines capable of handling multiple packaging formats has strengthened the market adoption of the integrated solutions which allows enhanced flexibility and scalability for the manufacturers.

Additionally, with AI-guided cannabis packaging solutions made up of real-time quality assurance, weight confirmation, and automatic defect identification, the efficiency has reached even higher levels with no waste, least contamination, and enhanced product standardization.

The modular cannabis packaging systems which can cover different or similar configurations for various product types or packing materials has also assisted in market growth, ensuring flexibility for start-ups and large-scale producers alike.

While presenting advantages such as improved efficiency, compliance, and scalability, the use of automated packaging equipment is limited by large capital investments and regulatory complexities, along with the requirement of specialized technical expertise. Apart from these, development of smart packaging integration, IoT-enabled tracking processes, cloud-based packaging line analytics is improving cost-effectiveness, operational visibility and market penetration that is restricting the growth of automated cannabis packaging market on other scales.

An increase in demand for sustainable packaging equipment has become one of the key factors fuelling growth in the cannabis packaging equipment market, as regulatory bodies and consumers try to prevent a repeat of the proliferation of companies that took advantage of a lack of sustainable options and resorted to toxic packaging solutions. Say goodbye to plastic-based packaging with innovative cannabis packaging equipment that uses biodegradable, recyclable, and compostable materials to minimize the impact to the environment while complying with safety regulations.

Corporate social responsibility is on priority for the cannabis brands and this is the leading market growth factor as the demand for upfront cannabis packaging such as glass jar, hemp based bioplastics and recyclable pouches for premium cannabis brands are increasing. More than 60% of cannabis consumers wanted Eco-Friendly Packaging, which will have laser focus on Sustainable Packaging Equipment.

Emerging technologies for making highly compostable cannabis packaging such as plant-based films, water-soluble pouches, and compostable labels have also encouraged market adoption of lower carbon-footprint and more efficient waste-management systems.

Similarly, reducing energy consumption is adopted by energy-efficient cannabis packaging machinery by using low-emission heating methods, reducing material wastage, and includes smart energy management systems in a holistic approach towards long-term cost benefits and meeting regulatory authority needs.

The expansion of specific market factors aligned with circular economy programs and waste diversion/right to repair policy have made their way into closed-loop cannabis packaging solutions, including reusable container packaging systems that generate their own refill cannabis product dispensers.

Sustainable packaging equipment: Sustainable packaging equipment offers advantages in environmental sustainability, brand differentiation, and regulatory compliance while its disadvantages include higher material costs, limited availability of biodegradable substitutes, and technological limits in the manufacturing processes However, these issues can be overcome as the sustainable cannabis packaging equipment is expected to continue with its growth across the globe as possible innovations in nanotechnology-based sustainable packaging, block chain-supported environmental certification tracking, and AI-based material optimization, which can help reduce the material cost while at the same time enhance the product health and scalability.

As of today, data-based analysts drive on the cannabis packaging equipment market at large due to the growing legalization of cannabis for medical and recreational use and the demand for regulatory compliance, automated, tamper-proof, and child-proof packaging; the key driving factors for the cannabis packaging market.

An instance of a machine with multiple packaging forms is the all-purpose filler and sealing machines while prominent transformation areas comprise precision filling & sealing machines, sustainable packaging, and high-speed automated labelling or wrapping systems. Businesses are focusing on compliant-driven solutions that also drive improvements in efficiency while adhering to changing industry standards.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Paxiom Group | 18-22% |

| Canapa Solutions | 15-19% |

| Aesus Packaging Systems | 12-16% |

| CoolJarz by Earthwise Packaging | 8-12% |

| WeighPack Systems Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Paxiom Group | Develops automated cannabis packaging solutions, including pre-roll filling, weighing, and bagging machines. |

| Canapa Solutions | Specializes in precision-based filling, sealing, and labeling equipment for cannabis and hemp products. |

| Aesus Packaging Systems | Provides high-speed labelling and capping machines designed for compliance with cannabis regulations. |

| CoolJarz by Earthwise Packaging | Focuses on sustainable cannabis packaging solutions with child-resistant and tamper-proof features. |

| WeighPack Systems Inc. | Offers fully automated pre-roll packaging, jar filling, and pouch-sealing machines. |

Key Company Insights

Paxiom Group (18-22%)

A top manufacturer of high-speed automated solutions for cannabis packaging including pre-roll, edible and concentrate packaging.

Canapa Solutions (15-19%)

Expert in precision packaging equipment, assuring accuracy in dosage, sealing, and labeling of cannabis and CBD products.

Aesus Packaging Systems (12-16%)

Develops cannabis labelling, capping, and wrapping equipment that is designed with efficiencies and scalability in mind while remaining regulatory compliant.

CoolJarz by Earthwise Packaging (8-12%)

Copes with sustainable cannabis packing solutions including green and child-proof cannabis packages.

WeighPack Systems Inc. (5-9%)

Provides automated packaging solutions such as high speed pre roll filling and bulk weighing and sealing systems for the cannabis industry.

Other Key Players (30-40% Combined)

All these companies cater in the cannabis packaging equipment market by providing personalized, high-efficiency packaging solution. These include:

The Cannabis Packaging Equipment Market was valued at approximately USD 1.9 billion in 2025.

The market is projected to reach USD 8.9 billion by 2035, growing at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035.

The demand for Cannabis Packaging Equipment Market is expected to be driven by the rapid legalization of cannabis products, increasing demand for child-resistant and tamper-evident packaging, the shift towards automation for efficiency and compliance, and the rising adoption of sustainable and biodegradable packaging solutions.

The top 5 countries contributing to the Cannabis Packaging Equipment Market are the United States, Canada, Germany, the Netherlands, and Australia.

The Automation and Sustainability segment is expected to lead the Cannabis Packaging Equipment market, driven by increasing regulatory requirements, growing investment in automated packaging solutions, and the push for eco-friendly materials in cannabis product packaging.

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Neoprene Coffee Sleeves Market Growth - Demand & Forecast 2025 to 2035

Mailer Boxes Market Growth – Demand & Forecast 2025 to 2035

Metal Aerosol Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.