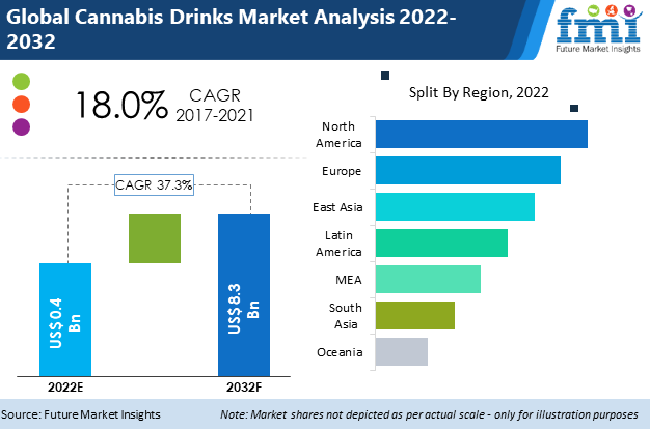

The Cannabis Drinks Market is expected to value USD 0.4 billion in 2022 and is projected to grow at a CAGR of 37.3% during the forecast period of 2022 to 2032, to reach a value of USD 8.3 billion by 2032. The global cannabis drinks demand is projected to grow year-on-year (Y-o-Y) growth of 18.7% in 2022.

Factors that stimulate the market expansion are:

Cannabis beverages take the place of other marijuana-infused foods and drinks that are regarded as harmful.

| Attributes | Key Statistics |

|---|---|

| Market Size Value in 2022 | USD 0.4 Billion |

| Market Forecast Value in 2032 | USD 8.3 Billion |

| Global Growth Rate (2022 to 2032) | ~ 37.3% CAGR |

| Collective Value Share: Top 3 Countries (2021A) | 55.8% |

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

North America, led by the USA, is at the forefront of the cannabis-infused product sector. The region's functional beverage market has an exponential development pattern, and it had the greatest market share for cannabis drinks. Additionally, the presence of several producers is anticipated to support the expansion of the cannabis drinks market in the area during the forecast period.

Manufacturers are introducing cannabis, hemp, and marijuana beverages to the USA market as smoother, healthier substitutes for wine, beer, and spirits. Teas, still and sparkling waters, fruit-flavored items, as well as wine and beer infused with tetrahydrocannabinol are all examples of beverages.

A significant driver of development is the legalization of cannabis for both medicinal and recreational uses. The recreational and medicinal use of marijuana became legal in Canada in 2018. The United States has many territories such as New York, New Jersey, Vermont, and California where it is allowed to add cannabis infusion to meals and drinks. This aspect is anticipated to ratchet up the cannabis drinks market growth for cannabis-infused foods and beverages across North America.

Due to the legalization of low tetrahydrocannabinol and high cannabidiol goods in 13 USA states, there is a significant market for cannabidiol-infused cannabis beverages in the area.

In countries like Germany, France, Italy, and others, the use and consumption of cannabis-related products for therapeutic purposes have been legalized by the government.

The business for cannabis beverages in Europe is expected to increase over the next several years as customers become more socially accepting of them over alcoholic beverages. As a result, it is predicted that throughout the forecast period, the cannabis drinks market would expand significantly in Europe.

According to the Cannabis Trade Association, there were 250,000 cannabidiol consumers in the United Kingdom in 2017 compared to 125,000 in 2016. Due to the existence of marijuana-specific cafés and restaurants, demand is also high in the Netherlands.

The country's expanding cannabis tourism industry is anticipated to significantly increase demand. The legalization of marijuana for medicinal and recreational use is expected to result in a considerable increase in product demand in nations like Australia and Uruguay.

Since 2018, international producers have paid close attention to the development of non-alcoholic beer with tetrahydrocannabinol added. Female millennials dominate the market for non-alcoholic beer.

Calorie-free beverages rather than brownies and cookies are being promoted by manufacturers to the expanding female consumer base. Additionally, major producers of alcohol are making significant investments in the creation of non-alcoholic beverages.

Some international players are creating portfolios of cannabis-infused specialty beverages using molecules. These drinks come in a variety of unique and potent flavors and have a low-calorie count.

On the other hand, some cannabis drink market participants are also selling cannabis drinks with coffee flavors. These drinks include flavors that are reminiscent of coffee and come in a range of tetrahydrocannabinol and cannabidiol concentrations to accommodate different types of cannabis consumers.

Global players are even producing non-alcoholic cocktails that blend cannabis socialization with cocktail culture in a single bottle. These beverages have a wide range of flavors, each with an amazing fusion of herbal, floral, and dry overtones.

For first-time users, these cannabis drinks are great. Some well-known industry businesses develop beverages using carbonated water, fragrant oils, agave juice, and a small amount of Californian cannabis extract. These drinks deliver highly controlled effects that are milder than those of other cannabis-infused beverages. These are available at several dispensaries and could be bought online as well.

Cannabis drinks are expected to gain traction due to strong demand among millennials across the globe. According to the study, 55 million people in the USA in 2017 used cannabis recreationally.

Beer and wine sales dropped 15% in states where cannabis drinks were authorized, according to Georgia State University and the University of Connecticut. On the back of this, the demand for cannabis drinks is projected to surge by 20x over the upcoming decade.

Cannabis drinks demand grew at 18.0% CAGR between 2017 and 2021. Cannabis beverages are gaining immense popularity as a preference for soft drinks is rising. The low sugar content of drinks is one of the factors driving the demand in the market.

Recent research has revolutionized the industry over the period and is further projected to grow at a CAGR of 37.3% during the forecast period (2022 to 2032). In the global cannabis drinks market, the demand for alcoholic cannabis-infused drinks, CBD-infused drinks, and flavored cannabis drinks is expected to rise.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

Cannabis Drinks Sales to Grow in the USA as the Product is Legalized

As per Future Market Insights (FMI), North America is expected to be the fastest-growing and largest market for cannabis drinks. The legalization of marijuana for recreational and medical purposes is expected to fuel the growth in the market.

According to the National Conference of State Legislatures, the District of Columbia, Puerto Rico, Guam, and the United States Virgin Islands have legalized medical cannabis programs for public use, which has resulted in the increased launch of various cannabis drinks.

Cannabis Drinks Sales to Surge in the United Kingdom with New Product Developments

Due to an increase in the consumption of medicinal cannabis, the demand for cannabis drinks in the United Kingdom is expected to rise over the assessment period. The number of CBD consumers in the United Kingdom has increased from 125,000 to 250,000 in 2016 & 2017 respectively, according to the Cannabis Trade Association.

Cannabis-related businesses in the United Kingdom are launching new products to keep up with the expanding trend of wellness beverages. CBD Cloud 9 and Ultra Brewing in Manchester, for example, have released the first CBD Session IPA beer in the United Kingdom, which is produced with cannabis sativa extract.

Alcohol Cannabis Infused

Over the forecast period, the rising consumption of cannabis-infused wellness drinks is expected to favor the growth in the market. The legalization of marijuana for recreational and medical uses is expected to have a significant influence on alcoholic cannabis-infused drinks sales. As a result, an increasing number of alcohol companies are investing in cannabis drinks.

For example, Hi-Fi Hops, a cannabis-based beverage with zero calories and carbs and infused with Cannabidiol (CBD) and Tetrahydrocannabinol, was launched by Lagunitas, Heineken's fast-growing California beer label (THC).

Burgeoning Demand for THC-Infused Drinks Propelling Cannabis Drinks Production

THC emulsifications are being developed by manufacturers of cannabis-infused beverages in order to achieve optimal suspension within liquids and a shorter uptake period. Leading cannabis drinks companies are catering to the growing demand for cannabis-based drinks, fueling the demand in the market.

Key cannabis drinks manufacturers are adopting strategies such as joint ventures, partnerships, mergers, and acquisitions, for innovative product lines. Also, top cannabis drinks brands are focusing on upgraded and modified products with rising demand for new formulations from the food and beverage industry.

For instance,

| Attribute | Details |

|---|---|

| Market Size Value in 2022 | USD 0.4 Billion |

| Market Forecast Value in 2032 | USD 8.3 Billion |

| Global Growth Rate | ~ 37.3% CAGR |

| Forecast Period | 2022 to 2032 |

| Historical Data Available for | 2017 to 2021 |

| Market Analysis | MT for Volume and USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East and Africa |

| Key Countries Covered | United States of America, Canada, Germany, Brazil, Mexico, France, Italy, Spain, United Kingdom, Russia, China, Japan, South Korea, India, Australia, GCC Countries, South Africa, and others |

| Key Market Segments Covered | Product Type, Component, Flavor, Sales Channel, and Regions |

| Key Companies Profiled | Artet; CAN; Phivida Holdings Inc.; The Alkaline Water Company; VCC Brands; Koios Beverage Corporation; Keef Brand; Dixie Brands Inc.; Aphria; Hexo Corp; Canopy Growth; Others |

The cannabis drinks market is estimated to reach sales of nearly USD 0.4 Billion by 2022.

Cannabis drinks market revenue is expected to increase at a CAGR of around 37.3% during the period 2022 to 2032.

Cannabis drinks sales increased a CAGR of around 18.0% over the past half-decade.

The global cannabis drinks market value will be around USD 8.3 Billion in 2032.

Artet, CAN, Phivida Holdings Inc., The Alkaline Water Company, and VCC Brands are a few of the top players driving the market growth.

High product demand from the beverage industry and the legalization of the product in several countries are the factors driving the growth of the cannabis drinks market.

| Market share for 2024 | USD 38,300 million |

|---|---|

| Market Value for 2034 | USD 64,876 million |

| Value-based CAGR (2024 to 2034) | 5.40% |

| Market Value (2023) | USD 70 Million |

|---|---|

| Market Value (2033) | USD 120 Million |

| Market CAGR (2023 to 2033) | 6% |

Explore Functional Beverages Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.