The global cancer vaccines market is estimated to reach a valuation of USD 11.29 billion in 2025. It is expected to reach USD 27.95 billion by 2035, reflecting a CAGR of 12% during the forecast period between 2025 and 2035.

In 2024, the global industry for cancer vaccines witnessed significant milestones driven by continued developments in targeted therapies and immunotherapy.

Key players such as Moderna, BioNTech, and Gilead Sciences hastened clinical trials of mRNA-based cancer vaccines for melanoma, lung cancer, and HPV-associated malignancies. Regulatory approvals picked up pace in 2024, with the FDA awarding breakthrough therapy designations to new treatment vaccines.

R&D spending on cancer vaccines also picked up pace, especially in the Asia-Pacific, with governments and biotech companies joining hands to speed up development.

However, factors such as high manufacturing costs, uncertainty in raw material supply chains, and patients' accessibility concerns in low-income economies were setbacks for development.

The industry will continue on a high growth trajectory during the projection period between 2025 and 2035. AI-optimized vaccine development and increased use of neoantigen-based therapies will likely trigger breakthroughs.

Increased application of combination therapies-concomitant use of cancer vaccines together with immune checkpoint inhibitors-can further improve treatment efficacy. Governments will also make reimbursement policies supportive, allowing patients access. As clinical trials advance, new cancer vaccines against pancreatic and colorectal cancer can be anticipated to enter the industry, further fueling industry potential.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 11.29 billion |

| Industry Value (2035F) | USD 27.95 billion |

| CAGR (2025 to 2035) | 12% |

Explore FMI!

Book a free demo

The cancer vaccine industry has been undertaking a robust growth path, supported by developments in mRNA technology, growing regulatory approvals, and growing investment in immunotherapy.

Biopharmaceutical companies and pharma companies will be the gainer as the need for combination and customized treatment increases, while the traditional companies that offer chemotherapy will face strain as the vaccine-based treatments pick up pace. Sustained innovation, partnership collaborations, and improved patient access will be the drivers to maintain this pace till 2035.

Accelerate Investment in mRNA and Neoantigen-Based Vaccines

Pharmas and biotechs must allocate R&D priorities to mRNA and neoantigen-based cancer vaccines, using AI-based drug discovery to maximize accuracy and effectiveness. Strategic investment and collaboration with academia can accelerate innovation and approval.

Increase Industry Access With Pricing & Reimbursement Strategies

To capitalize on growing demand, firms will be required to partner with healthcare regulators and payers to develop models of pricing that will increase patient affordability and access. Penetration in emerging industries through cost-effective models of distribution will be paramount to long-term revenue growth.

Cement Strategic Alliances & M&A to Gain Competitive Edge

Companies need to invest in early-stage innovative biotech start-ups and form strategic partnerships with leading oncology centers to propel clinical development. Partnerships with CDMOs will facilitate enhanced manufacturing capacity and effective global distribution.

| Risk | Probability-Impact |

|---|---|

| Regulatory & Approval Delays | High Probability-High Impact |

| High Manufacturing & R&D Costs | Medium Probability-High Impact |

| Industry Access & Reimbursement Barriers | Medium Probability-Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Advanced Clinical Trials & Approvals | Fast-track key Phase 2/3 trials and engage with regulators for accelerated approvals |

| Optimize Pricing & Reimbursement | Collaborate with insurers and policymakers to establish favorable reimbursement frameworks. |

| Scale Manufacturing & Distribution | Strengthen partnerships with CDMOs and enhance global supply chain resilience. |

To remain at the forefront, the company will have to double down on neoantigen and mRNA vaccine development, speeding up clinical trials and regulatory fast-tracking where possible. An aggressive industry access strategy, including region-by-region pricing and payer negotiations, will be critical to driving adoption and commercial success.

Adding in manufacturing capacity through CDMO partnerships will also decrease supply chain risk and facilitate global scalability. This remark emphasizes the importance of aligning R&D investments with early-stage oncology breakthroughs while developing go-to-market strength in parallel to achieve early-mover advantage in high-growth geographies.

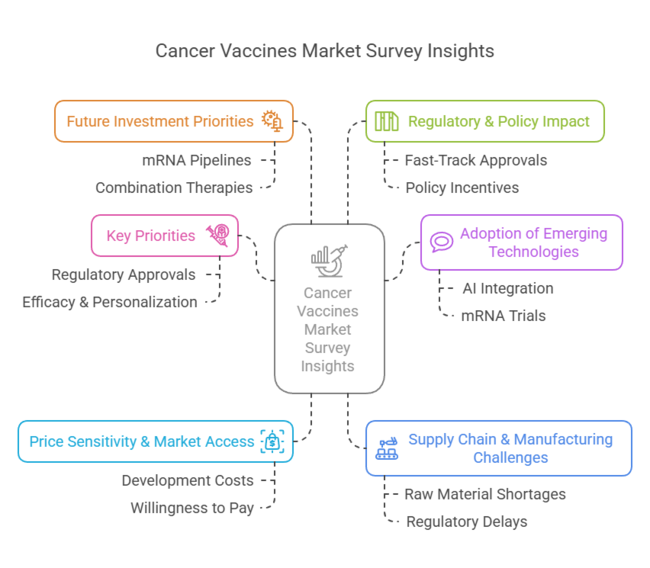

Surveyed Q4,2025, n=500 stakeholder participants across pharmaceutical companies, biotech firms, regulators, healthcare providers, and investors in the USA, Europe, China, and India.

Regional Variance

High Variance in Adoption Rates

ROI Perspectives

74% of USA pharma executives viewed AI-driven R&D as worth the investment, while only 33% of Indian stakeholders prioritized it due to cost concerns.

86% cited high development costs (mRNA vaccines averaging USD 2 billion per candidate) as a major hurdle.

Willingness to Pay Premium for Innovation

52% of global stakeholders called for innovative financing models, including risk-sharing agreements and pay-for-performance models.

70% of pharmaceutical executives prioritized expanding mRNA and neoantigen-based vaccine pipelines.

High Consensus: Regulatory acceleration, affordability, and technology-driven innovation are critical to industry growth.

Key Variances:

Strategic Insight: A localized approach is necessary-premium pricing in the West, cost-effective scaling in Asia, and diversified production strategies to ensure global industry penetration.

| Country/Region | Policies, Regulations, & Mandatory Certifications |

|---|---|

| United States |

|

| European Union |

|

| China |

|

| India |

|

| Japan |

|

| South Korea |

|

The USA has strong government support, an advanced biotech ecosystem, and a robust regulatory framework that help speed vaccine approvals. The FDA’s Breakthrough Therapy and Fast-Track Designation programs also create opportunities for quicker entry into the industry for innovative cancer vaccines, particularly based on mRNA and neoantigen-targeted therapies.

The surging investments by pharmaceutical behemoths such as Moderna, BioNTech, and Merck incepting personalized cancer vaccines are accelerating the industry too. There are also several world-class cancer research institutions, such as MD Anderson and Memorial Sloan Kettering, which guarantee continuous innovation. However, high development costs and reimbursement challenges are still major issues that overcome with innovative pricing models and collaboration with insurance.

FMI opines that the United States cancer vaccines sales will grow at nearly 13.5% CAGR through 2025 to 2035.

The United Kingdom has been leading precision medicine and immuno-oncology, and the NHS has been supporting vaccine-based cancer treatments with biotech firms. Largely in line with other global fast-track approval farms, the UK’s Medicines and Healthcare Products Regulatory Agency (MHRA) will make it easier for companies to commercialize breakthrough therapies.

Industry expansion is also driven by big players such as AstraZeneca investing heavily in mRNA-based cancer vaccine trials. The UK also receives government-provided R&D funding, like the Biomedical Catalyst program. Yet, adjustments to regulations due to Brexit, as well as uncertainties about working on cross-border clinical trials, create challenges.

FMI opines that the United Kingdom cancer vaccines sales will grow at nearly 11.8% CAGR through 2025 to 2035.

France has an excellent public healthcare system, government-funded R&D, and a friendly regulatory environment. France is already at the forefront of research into cancer immunotherapies, with organisations like Institute Pasteur and INSERM working to develop new vaccine candidates. As early detection of cancer and immuno-oncology therapies are emphasized in the Cancer Plan 2021 to 2030, the French National Cancer Institute (INCa) makes vaccine-based treatments a priority among its research topics.

Moreover, France’s CNAM (National Health Insurance Fund) ensures broad accessibility of new cancer vaccines. Nevertheless, limitations in pricing and stringent reimbursement policies can slow the process of commercialization, and thus, public-private partnerships will be key in entering the industry.

FMI opines that the France cancer vaccine sales will grow at nearly 11.9% CAGR through 2025 to 2035.

Due to the strong presence of the biotechnology industry, high healthcare expenditure, and possession of the leadership position in mRNA-based vaccine development, Germany is expected to grow rapidly. It is where BioNTech, one of the pioneers in research into cancer vaccines, is based and where the company still pours money into personalized vaccines.

It has fast-tracked approval routes for cancer immunotherapies with Germany’s vaccine regulator, the Paul-Ehrlich Institute (PEI), to make a speedier route to industry. Meanwhile, the German Cancer Research Center (DKFZ), along with big pharma company CureVac, are increasing their clinical trials, thus propelling the industry growth.

High R&D costs and stringent pricing negotiations with statutory health insurance providers, however, might serve as hurdles to widespread adoption.

FMI opines that the Germany cancer vaccine sales will grow at nearly 12.2% CAGR through 2025 to 2035.

Italy’s cancer vaccines industry is leading to growing investments in personalized cancer vaccines. The Italian Medicines Agency (AIFA) accelerated regulatory processes to enable quicker patient access to innovative medicines; however, tough drug prices and reimbursement negotiations continue to be the main obstacle. The European Institute of Oncology is among the academic institutions driving a surge of clinical trials in Italy.

FMI opines that Italy's cancer vaccine sales will grow at nearly 11.5% CAGR through 2025 to 2035.

In South Korea, the South Korean digital health industry is anticipated to be driven by government-backed investments in biotech, rising cancer incidence, and a strong digital health infrastructure. Minister of Food and Drug Safety (MFDS) accelerate approval of oncology vaccines, especially mRNA and cell-based therapies. Samsung Biologics and SK Bioscience are investing in advanced manufacturing capabilities as well as local production scalability.

Furthermore, South Korea’s National Health Insurance Service (NHIS) is broadening coverage for immunotherapy-based treatments. Nonetheless, abundant development costs, along with regulatory delays for foreign biopharma firms, may limit industry growth. Global partnerships strengthened, and acceleration of clinical trials driven by technology will be key growth drivers.

FMI opines that the South Korean cancer vaccines sales will grow at nearly 12.5% CAGR through 2025 to 2035.

Japan, despite a strong oncology research landscape, is below the global average on account of the relatively slow adoption of fast-track regulatory processes. There are strict approval requirements set up by the Pharmaceuticals and Medical Devices Agency (PMDA), which usually extend the time until commercialization. However, the National Cancer Center in Japan is putting efforts into developing next-generation cancer vaccines, especially neoantigen-based and peptide-based vaccines.

Munyang Mun and the government’s Moonshot R&D Program are also driving innovation in precision oncology. Nevertheless, limitations in price, slow entry for foreign players in the industry, and continued reliance on classic cancer therapies may once again act as hurdles for quickly integrating vaccines into new therapeutic paradigms. More local R&D collaborations and modernization of regulations will aid industry growth.

FMI opines that the Japan cancer vaccines sales will grow at nearly 10.8% CAGR through 2025 to 2035.

China is expected to grow at a higher CAGR than the global industry, driven by huge investments in biotech, government push for domestic vaccine production and increasing cancer burden. The NMPA is pursuing expedited approvals for new cancer vaccines, especially ones created in China.

The country’s cancer vaccine industry is leading the charge toward personalised and cell-based cancer vaccines, where companies such as BeiGene and Sinopharm are at the forefront. Also, China’s Five-Year Health Plan calls for biopharmaceutical self-sufficiency and a dependence on domestic production rather than Western production. However, international firms could face industry entry challenges due to IP protection, regulatory inconsistency, and trust in novel therapies.

FMI opines that the China cancer vaccines sales will grow at nearly 14.0% CAGR through 2025 to 2035.

Australia and New Zealand's growth are driven by government grants targeting cancer research, a large cancer patient pool propelled by the developed healthcare system. The FDA and EMA have implemented accelerated regulatory pathways in Australia, and the Therapeutic Goods Administration (TGA) plan to follow suit to get to the industry faster.

The Medical Research Future Fund (MRFF) is also funding vaccines, especially in partnership with multinational pharmaceutical companies. New Zealand’s Pharmac agency emphasizes cost-effective solutions, and pricing is the dominant factor for industry penetration.

However, the small industry size and high cost of advanced therapies may restrict commercial potential. However, robust involvement in clinical trials and the early use of breakthrough therapies make this region a beacon of growth potential.

FMI opines that the United States cancer vaccines sales will grow at nearly 12% CAGR through 2025 to 2035.

The cancer vaccine industry is changing with the development of recombinant, whole-cell, viral vector & DNA, and antigen/adjuvant-based cancer vaccines. Recombinant cancer vaccines are sought after with specificity to target tumor-specific antigens, driving their estimated CAGR of 7.5%.

Whole-cell cancer vaccines, having been under clinical trials for decades, are expected to face moderate growth as scientists optimize their immunogenicity, bringing them to a CAGR of 6.2%. Viral vector & DNA cancer vaccines are under the spotlight due to their ability to induce robust immune responses, driving their growth at 7.8% CAGR.

Antigen/adjuvant vaccines are turning into a major focus area with scalable solutions and lesser side effects, bringing in an estimated CAGR of 6.5%. The combination of these technologies is building a dynamic landscape for cancer vaccine development as biotech companies and pharmaceutical companies develop new delivery modes and improved immunogenic responses to deliver better patient outcomes.

Preventive and therapeutic cancer vaccines are changing treatment paradigms in oncology. Preventive vaccines are by far the largest segment of the vaccine industry, with the cervical cancer vaccine segment expected to grow at a remarkably stable compound annual growth rate CAGR of 6.2% as a result of extensive immunisation initiatives and well-established industry uptake. Therapeutic vaccines, in contrast, are transforming the cancer landscape by using the immune system to seek out and destroy tumors after diagnosis.

The therapeutic segment is anticipated to grow at a CAGR of 7.5% due to continuously growing clinical advancements in both neoantigen-based therapies and combinations of checkpoint inhibitors.

Therapeutic cancer vaccines are an integral part of the future of immuno-oncology with increasing demand for customized treatment approaches and greater investments in precision oncology driving growth. A trend emerging is the expanding acceptance among oncologists and global healthcare providers of combination approaches incorporating cancer vaccines into immunomodulators.

Leading the way are the prostate and cervical cancer vaccines, as research into other cancer types continues to diversify. Other products in this section include the prostate cancer vaccine, Sipuleucel-T and atezolizumab; these are believed to escalate significant advancements, especially in dendritic cell-based immunotherapies, which place this section at a CAGR of approximately 7.2% in the upcoming future. The rising aging population and rising prevalence are key features expected to boost demand for prostate cancer immunization.

Cervical cancer vaccines continue to be the most broadly utilized, thanks to organized public health and preventive care programs, but their growth is expected to level off at 6.5% CAGR as HPV vaccinations become part of routine care around the world.

Lung, breast and colorectal cancers, among others, constitute a very hopeful area for cancer vaccines. Studies on personalized vaccine therapies for these neoplasms are spurring innovation, and this industry segment is expected to grow at 7.8% CAGR, exceeding that of traditional cancer vaccine use cases. The growth of clinical trials and regulatory approvals in emerging industries will influence this category even more in the coming decade.

The cancer vaccines market is moderately consolidated, with leading pharmaceutical and biopharmaceutical companies powering growth through innovation, strategic mergers and acquisitions, and global expansion.

Companies are striving by developing mRNA, neoantigen- as well as viral vector-based vaccines, collaborating on clinical trials as well AS investing in AI-driven drug discovery. Price continues to be a determining factor, and firms have to draw a balance between affordability and profitability to achieve penetration in the industry.

In 2024, BioNTech purchased China’s Biotheus for USD 950 million to bolster its immunotherapy pipeline. GSK strengthened its oncology pipeline with its acquisition of IDRx for USD 1.15 billion, which focuses on gastrointestinal malignancies.

Bayer entered an exclusive global licensing agreement with Puhe Bio Pharma for an oral cancer drug. Vir Biotechnology inked a deal with Sanofi that gives it exclusive rights to multiple T-cell engagers to bolster its oncology pipeline.

AbbVie made large acquisitions, such as Tentarix Biotherapeutics and Landos Biopharma, further cementing its growing concentration on immuno-oncology. These actions illustrate a trend of strategic investments in breakthrough therapies, partnerships for new therapies regional industry expansions to meet a growing demand. With regulations fast-tracking leading to swifter approvals, competition is likely to heat up as companies race to industry next-generation cancer vaccines.

Market Share Analysis

They help the immune system prevent or treat cancer by targeting specific cancer cells.

They train the immune system to recognize and destroy cancerous cells more effectively.

Vaccines exist for cervical and prostate cancer, with ongoing trials for other types.

Availability depends on regulatory approvals, healthcare infrastructure, and production capacity.

Advancements in mRNA, viral vector, and personalized vaccines are improving treatment outcomes.

Recombinant Cancer Vaccines, Whole-cell Cancer Vaccines, Viral Vector & DNA Cancer Vaccines and Antigen/Adjuvant Cancer Vaccines

Preventive Vaccine and Therapeutic Vaccine

Prostate Cancer, Cervical Cancer and Other Applications

North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East and Africa

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.