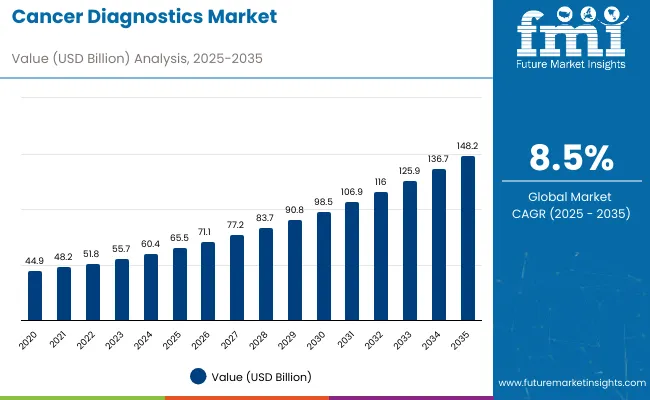

The cancer diagnostics market is estimated to be valued at USD 65.5 billion in 2025 and is projected to reach USD 148.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 65.5 billion |

| Projected Value (2035F) | USD 148.2 billion |

| CAGR (2025 to 2035) | 8.5% |

The market is expected to add an absolute dollar opportunity of USD 82.7 billion during this period. This reflects a 2.3 times growth at a compound annual growth rate of 8.5%. The market evolution is expected to be shaped by the rising emphasis on early cancer detection, technological advancements in multi-cancer early detection (MCED) tests, growing adoption of liquid biopsies, and increasing integration of artificial intelligence in diagnostic imaging, particularly where precision oncology and personalized medicine are prioritized.

By 2030, the market is likely to reach approximately USD 98.5 billion, accounting for USD 33.0 billion in incremental value over the first half of the decade. The remaining USD 49.7 billion is expected during the second half, suggesting a moderately accelerated growth pattern. Product innovation in nanotechnology-driven diagnostic tools, next-generation sequencing (NGS), and point-of-care molecular diagnostics is gaining significant traction.

Companies such as F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., and Abbott Laboratories are advancing their competitive positions through investment in liquid biopsy development, molecular diagnostic partnerships, and global healthcare infrastructure expansion. Rising cancer prevalence, improved awareness about early detection, and government-supported screening programs are supporting expansion into molecular diagnostics, immunohistochemistry, and advanced imaging applications. Market performance will remain anchored in diagnostic accuracy, regulatory compliance, and technological innovation benchmarks.

The market holds a significant share across its parent markets. Within the global healthcare diagnostics market, it accounts for approximately 18.4% due to its critical role in disease detection and monitoring. In the molecular diagnostics segment, it commands a 22.8% share, supported by increasing adoption of precision medicine and personalized therapy approaches. It contributes nearly 15.6% to the medical imaging market and 12.3% to the laboratory testing services segment. In oncology care systems, cancer diagnostics hold around 28.7% share, driven by early detection initiatives and treatment monitoring requirements. Across the point-of-care diagnostics market, its share is close to 9.2%, owing to its position as a key component in decentralized healthcare delivery.

The market is being driven by rising demand for early cancer detection, liquid biopsy technologies, and artificial intelligence integration. Advanced diagnostic technologies using next-generation sequencing (NGS), multi-cancer early detection (MCED) tests, and nanotechnology-driven platforms have enhanced diagnostic accuracy, personalized treatment selection, and minimally invasive testing capabilities, making modern cancer diagnostics essential alternatives to traditional tissue-based methods. Manufacturers are introducing specialized solutions, including circulating tumor DNA (ctDNA) analysis and molecular profiling systems tailored for different cancer types, expanding their role beyond basic detection to comprehensive tumor characterization and treatment monitoring. Strategic collaborations between diagnostic companies and healthcare providers have accelerated innovation in precision oncology applications and market penetration.

Cancer diagnostics’ unique ability to provide accurate, early detection, high sensitivity, and rapid results across multiple healthcare settings is driving its adoption. Its functional capabilities make it indispensable in the identification of various cancers, including breast, lung, colorectal, and hematologic malignancies, where timely diagnosis, precision, and treatment monitoring are critical.

Growing focus on precision oncology, artificial intelligence integration, and minimally invasive testing methods is further propelling adoption, particularly in oncology centers, hospital laboratories, and point-of-care settings. Rising healthcare expenditure, technological advancements in genomics, and increasing investment in cancer research are also enhancing diagnostic capabilities and market penetration.

As multi-cancer early detection tests and AI-powered imaging analysis accelerate across healthcare applications, the market outlook remains highly favorable. With healthcare providers and patients prioritizing early detection, personalized treatment, and improved survival rates, cancer diagnostics are well-positioned to expand across various clinical, research, and point-of-care applications.

The market is segmented by end-user, indication, test type, and region. By end-user, the market is categorized into hospitals associated labs, independent diagnostics laboratories, diagnostics imaging centers, and cancer research institutes, and others. By indication, the market includes breast cancer, lung cancer, colorectal cancer, melanoma, blood cancer, prostate cancer, ovarian cancer, stomach cancer, liver cancer and others. By test type, the market is segmented into tumor biomarker tests, biopsy, liquid biopsy, in situ hybridization, and immunohistochemistry. Regionally, the market spans across North America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Latin America, and the Middle East & Africa.

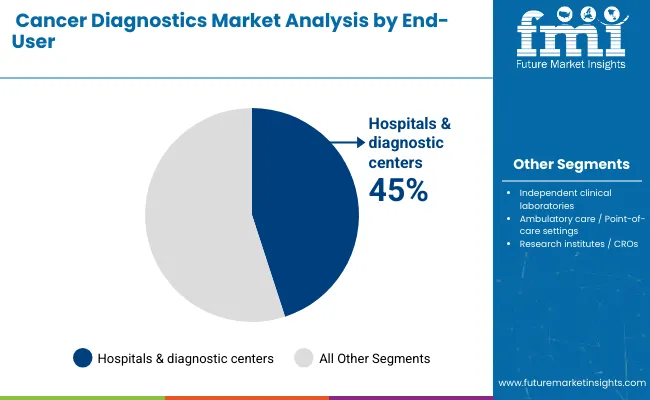

Hospitals & diagnostic centers remain the core end-user segment with 45% of the market share in 2025, as they represent the primary providers of comprehensive cancer diagnostic services across developed and emerging markets. The segment's dominance is driven by integrated healthcare infrastructure, availability of sophisticated diagnostic equipment, and multidisciplinary expertise that enables seamless collaboration between oncologists, pathologists, and radiologists.

Hospital-associated laboratories benefit from comprehensive diagnostic capabilities, advanced imaging systems, and molecular testing platforms, making them the preferred choice for complex cancer diagnosis and treatment monitoring. This makes hospitals & diagnostic centers indispensable in contemporary cancer care delivery and precision oncology implementation.

Ongoing technological advancements and the growing emphasis on early detection programs and personalized treatment approaches are key trends driving the sustained relevance of hospitals & diagnostic centers in the cancer diagnostics market.

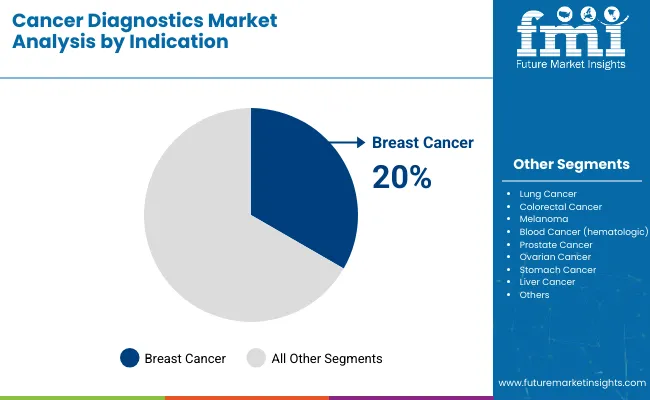

The breast cancer segment holds a dominant position with 20% of the market share in the indication category, owing to its high global prevalence, established screening programs, and comprehensive diagnostic infrastructure across healthcare systems. Breast cancer diagnostics encompass mammography, ultrasound, MRI, biopsy procedures, and molecular testing that are widely implemented across hospitals, diagnostic centers, and specialized breast care facilities due to their proven effectiveness in early detection and treatment monitoring.

They enable healthcare providers and oncologists to achieve superior early detection rates while maintaining excellent patient outcomes through comprehensive screening protocols and advanced imaging technologies. As demand for population-based screening programs and personalized treatment approaches grows, the breast cancer segment continues to maintain preference in preventive healthcare and precision oncology applications.

Healthcare systems are investing in advanced mammography systems, digital breast tomosynthesis, and genetic testing platforms to maintain diagnostic leadership, improve detection accuracy, and enhance patient care outcomes. The segment is positioned to remain dominant as global healthcare initiatives prioritize women's health screening and early intervention strategies.

In 2024, global cancer diagnostics adoption grew by 7.8% year-on-year, with Asia-Pacific taking a 35% share. Applications include early detection screening, treatment monitoring, and precision medicine. Manufacturers are introducing liquid biopsy technologies and AI-powered imaging systems that deliver superior diagnostic accuracy and personalized treatment selection. Multi-cancer early detection formulations now support comprehensive screening positioning. Regulatory approvals and clinical validation studies support healthcare provider confidence. Technology providers increasingly supply ready-to-use diagnostic platforms with integrated data analytics to reduce implementation complexity.

Multi-Cancer Early Detection Innovation Accelerates Cancer Diagnostics Market Demand

Healthcare providers and oncologists are choosing multi-cancer early detection (MCED) tests to achieve superior screening efficiency, enhance early intervention capabilities, and meet growing demands for comprehensive, minimally invasive cancer screening solutions. In clinical applications, MCED tests deliver the detection of multiple cancer types from a single blood sample. Tests equipped with advanced genomics and proteomics technologies maintain high sensitivity throughout various cancer stages and tumor types. In healthcare systems, integrated MCED platforms help reduce screening costs while improving detection rates by up to 40%. MCED applications are now being deployed for population screening and high-risk patient monitoring, increasing adoption in sectors demanding comprehensive cancer surveillance.

Regulatory Complexity, High Costs and Technical Challenges Limit Growth

Market expansion is constrained by complex regulatory pathways, high development costs, and technical validation requirements. Advanced diagnostic systems can cost 50-70% more than conventional methods, depending on technology complexity and validation requirements, impacting adoption in cost-sensitive healthcare settings. Regulatory approval processes require comprehensive clinical validation, adding 2-5 years to product development timelines. Specialized technical expertise and infrastructure requirements extend implementation costs by 30-40% compared to traditional diagnostic methods. Limited availability of trained personnel for advanced molecular diagnostics restricts scalable deployment, especially in emerging markets. These constraints make advanced diagnostic adoption challenging in resource-limited settings despite growing clinical advantages and detection capabilities.

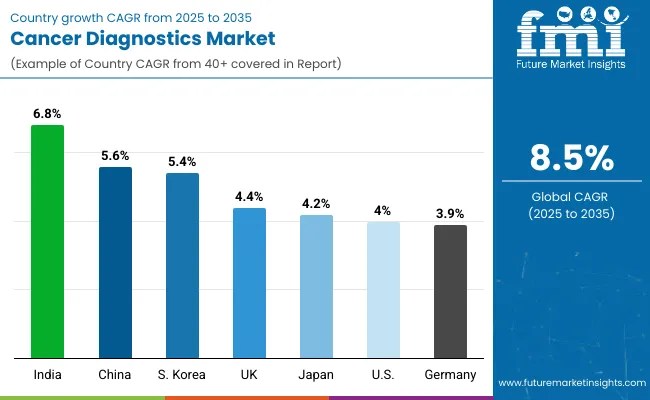

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.8% |

| China | 5.6% |

| South Korea | 5.4% |

| United Kingdom | 4.4% |

| Japan | 4.2% |

| United States | 4.0% |

| Germany | 3.9% |

The cancer diagnostics market shows varied growth trajectories across the top seven countries. India leads with the highest projected CAGR of 6.8% from 2025 to 2035, driven by increasing cancer incidence, improved healthcare infrastructure, and growing awareness about early detection. China follows with a CAGR of 5.6%, supported by government healthcare initiatives and expanding diagnostic capabilities. South Korea shows strong growth at 5.4%, benefiting from advanced healthcare technology adoption and comprehensive screening programs. The UK, with a CAGR of 4.4%, experiences steady expansion supported by NHS screening programs and diagnostic innovation, reflecting regional differences in healthcare development and cancer care infrastructure maturity. Japan demonstrates solid growth at 4.2%, supported by precision medicine initiatives and advanced diagnostic infrastructure. USA and Germany show moderate growth at 4.0% and 3.9% respectively, driven by aging populations and advanced healthcare systems.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from cancer diagnostics in India is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by rising demand for early and accurate cancer detection. Growth is fueled by a massive population base, increasing cancer prevalence, and expanding healthcare infrastructure across major cities, including Delhi, Mumbai, and Bangalore. The market is characterized by strong government support through digitalization initiatives and rising adoption of molecular diagnostic technologies.

Sales of cancer diagnostics in China are expected to grow at a CAGR of 5.6% from 2025 to 2035, driven by government healthcare initiatives and aging population demographics. Growth has been concentrated in urban healthcare infrastructure development and expanding cancer care capabilities in the Beijing, Shanghai, and Guangzhou regions. The market demonstrates robust growth with strong government support for public insurance coverage driving accessibility. Increasing adoption of advanced imaging technologies and molecular diagnostics is improving early detection rates.

The demand for cancer diagnostics in South Korea is projected to expand at a CAGR of 5.4% from 2025 to 2035, driven by advanced healthcare technology adoption and comprehensive national screening programs. Growth is concentrated in metropolitan areas, including Seoul, Busan, and Incheon, where advanced imaging technologies and molecular diagnostics are expanding. The market benefits from strong government support and advanced healthcare infrastructure. Furthermore, rising investments in personalized medicine and biomarker-driven research are strengthening South Korea’s position in the regional cancer diagnostics landscape.

The cancer diagnostics market in the USA is anticipated to expand at a CAGR of 4.0% from 2025 to 2035, driven by rising focus on innovation and precision medicine. Growth is centered on advanced diagnostic technology adoption and personalized medicine applications in major healthcare hubs, with the USA leading global market development in terms of technological advancement and clinical validation. Moreover, strong investments from both government agencies and private sector companies are accelerating innovation and market penetration across oncology diagnostics.

The demand for cancer diagnostics in Germany is expected to grow at a CAGR of 3.9% from 2025 to 2035, meeting European market expectations. Demand is driven by advanced healthcare systems, comprehensive insurance coverage, and strong regulatory frameworks in Berlin, Munich, and Hamburg markets. Germany holds the highest market share in the European market, supported by well-structured healthcare infrastructure and diagnostic center networks. Increasing adoption of digital pathology and AI-assisted imaging is improving diagnostic accuracy and efficiency.

Revenue from cancer diagnostics in Japan is projected to grow at a CAGR of 4.2% from 2025 to 2035, supported by steady demand for advanced imaging technologies and molecular diagnostic systems. Healthcare systems in Tokyo, Osaka, and Yokohama are experiencing expansion in AI-powered diagnostic tools and precision medicine practices. The market demonstrates strong growth with public insurance driving accessibility and adoption. Rising investments in genomic research and biomarker development are strengthening early detection and personalized treatment capabilities.

The cancer diagnostics market in the UK is expected to expand at a CAGR of 4.4% from 2025 to 2035, reflecting steady mature market expansion with a focus on NHS integration. Growth is driven by national screening programs and diagnostic innovation initiatives in the London, Manchester, and Edinburgh regions. The market benefits from established healthcare infrastructure and comprehensive cancer care programs integrated within the NHS framework. Increasing adoption of liquid biopsy and genomic testing is enhancing early detection and treatment personalization.

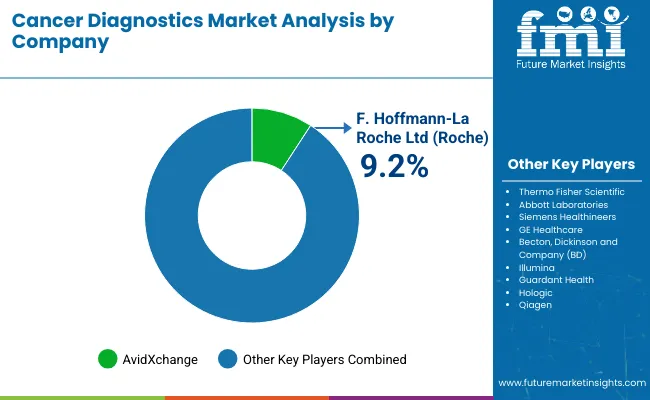

The market is moderately concentrated, featuring a mix of global healthcare companies, specialized diagnostic manufacturers, and technology innovators with varying degrees of technical expertise, research capabilities, and market reach proficiency. F. Hoffmann-La Roche Ltd leads the market with an estimated 9.2% share, primarily driven by its comprehensive oncology diagnostic portfolio and advanced molecular testing platforms.

Thermo Fisher Scientific Inc. maintains a significant market presence with its specialization in molecular diagnostics and genomic analysis solutions, leveraging established relationships with healthcare providers and research institutions. Abbott Laboratories, Siemens Healthineers, and GE Healthcare differentiate through diversified diagnostic portfolios, advanced imaging technologies, and comprehensive clinical support that cater to various oncology, molecular diagnostics, and hospital laboratory applications.

Emerging companies like Guardant Health and Illumina focus on innovative liquid biopsy technologies and next-generation sequencing platforms, addressing growing demand for precision medicine, minimal residual disease monitoring, and personalized treatment selection.

Entry barriers remain moderate to high, driven by challenges in regulatory compliance, clinical validation, and technological innovation across multiple diagnostic categories. Competitiveness increasingly depends on technological differentiation, clinical evidence generation, and strategic partnerships for diverse healthcare and research environments.

| Items | Value |

|---|---|

| Quantitative Units | USD 65.5 Billion |

| End-User | Hospitals associated labs, Independent Diagnostics Laboratories, Diagnostics Imaging Centers, Cancer Research Institutes, and others |

| Test Type | Tumor Biomarker Tests, Biopsy, Liquid Biopsy, Immunohistochemistry, and In Situ Hybridization |

| Indication | Breast Cancer, Lung Cancer, Colorectal Cancer, Melanoma, Blood Cancer, Prostate Cancer, Ovarian Cancer, Stomach Cancer, Liver Cancer, and Others |

| Regions Covered | North America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Latin America, and the Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ Countries |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific, Abbott Laboratories, Siemens Healthineers, GE Healthcare, Becton Dickinson and Company (BD), Illumina, Guardant Health, Hologic, and Qiagen |

| Additional Attributes | Dollar sales by indication and test type, regional demand trends, competitive landscape, healthcare provider preferences for molecular versus traditional diagnostics, integration with precision medicine practices, innovations in liquid biopsy technology and AI-powered analysis for diverse oncology applications |

The global cancer diagnostics market is estimated to be valued at USD 65.5 billion in 2025.

The cancer diagnostics market size is projected to reach USD 148.2 billion by 2035.

The cancer diagnostics market is expected to grow at a CAGR of 8.5% between 2025 and 2035.

The breast cancer segment is projected to lead in the cancer diagnostics market with a 20% market share in 2025.

In terms of end use, the hospitals & diagnostic centers segment is expected to command 45% share in the cancer diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thyroid Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Colorectal Cancer Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

ESR1 Mutated Metastatic Breast Cancer Diagnostics Market - Growth & Forecast 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA