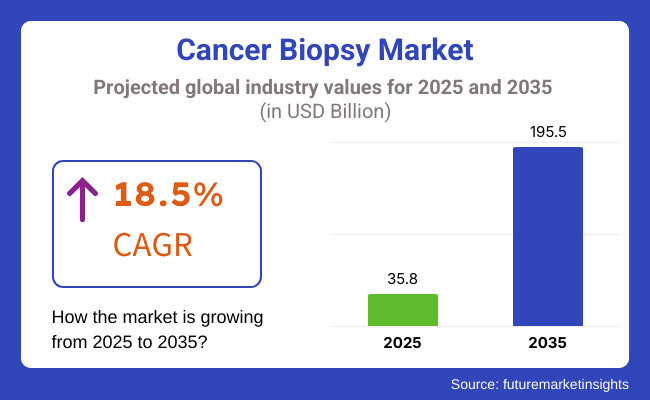

The Cancer Biopsy Market is expected to experience remarkable growth between 2025 and 2035, driven by the rising prevalence of cancer worldwide and advancements in minimally invasive diagnostic techniques. The market is projected to be valued at USD 35.8 billion in 2025 and is anticipated to reach USD 195.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 18.5% over the forecast period.

One of the key factors fueling this growth is the increasing adoption of liquid biopsy techniques, which offer a non-invasive, real-time approach to cancer detection and monitoring. Traditional tissue biopsies are often invasive, time-consuming, and pose risks to patients, whereas liquid biopsies allow for earlier cancer detection, better treatment response monitoring, and improved patient outcomes. Additionally, growing investments in precision oncology, advancements in genomic sequencing technologies, and the demand for personalized medicine have further accelerated the expansion of the cancer biopsy market.

The market is segmented by type and by product type. The type segmentation includes tissue biopsies, liquid biopsies, and other types, while the product type segmentation consists of instruments, kits and consumables, and services.

Liquid biopsies specifically identify the tumor’s genetic code from blood rather than by taking a tissue sample, and will therefore dominate the market as they are being used more frequently for cancer to detect early cancer, detect recurrence, and inform treatment. Because liquid biopsies can be performed using a simple blood draw, they are less invasive, quicker and less expensive than tissue biopsies. Furthermore, advancements in circulating tumor DNA (ctDNA) testing, exosome-based testing, and next-generation sequencing (NGS) have greatly enhanced the accuracy and reliability of liquid biopsies.

However, owing to the growing significance of the early determination and personalized treatment plans by the healthcare professionals and oncologists, the demand for liquid biopsies will exceed the traditional biopsy procedures to become the largest segment of the cancer biopsy market.

Explore FMI!

Book a free demo

The cancer biopsy market in North America is a highly lucrative region, primarily influenced by a booming healthcare sector, rising prevalence of cancer types, and rapid research and development activities. The USA and Canada have developed diagnostic labs and hospitals that are heavily invested in precision oncology and minimally invasive biopsy technologies.

Europe dominates a large share of the cancer biopsy market, with high demand from France, Germany, and the United Kingdom. The continent boasts an effectively regulated system of healthcare, with early cancer detection and personalized medicine as the core focus. European governments highly support research in non-invasive biopsy methods, particularly liquid biopsies and molecular diagnostics, which are being integrated into standard cancer treatment.

Strict medical device approval regulations in the region drive the development of high-accuracy, rugged biopsy technologies. In addition, collaborations among leading research institutions and biotech firms are accelerating commercialization of novel biopsy solutions that are improving diagnostic effectiveness and reducing repeat biopsies.

Asia-Pacific will experience the highest growth in the cancer biopsy market due to growing cancer incidence, upgraded healthcare facilities, and increased awareness towards earlier cancer detection. China, India, Japan, and South Korea are all experiencing huge investments in diagnostic technology and hence are the key drivers of the global biopsy market. Increased uptake of liquid biopsies and the expansion of precision medicine programs are fueling demand in the region. Access to advanced diagnostic centers in rural areas is a challenge, though, and results in disparities in cancer detection rates. Government initiatives to enhance cancer screening initiatives and approval of new biopsy technologies for use will fuel the growth of the market in the next couple of years.

Challenge: Regulatory and Reimbursement Hurdles

Overcoming the onerous regulatory landscape and complicated reimbursement models is one of the major barriers in the cancer biopsy landscape. Prior to gaining regulatory clearances, biopsy technologies, in particular liquid biopsies and molecular diagnostic technologies, require substantial clinical validation. In addition, many advanced biopsy procedures are not cheap, limiting access in some regions and also because insurers and health providers have not adapted to cover the new diagnostic tests. The need for standardization in biopsy procedure and diagnostic accuracy also makes large-scale adoption difficult.

Opportunity: Advancements in Liquid Biopsy and Precision Oncology

The unparalleled opportunity in the cancer biopsy market is the growing adoption of liquid biopsies. Liquid biopsies allow for less invasive and more convenient real-time monitoring of the evolution of a tumor based on a simple blood draw that could supplement conventional tissue biopsies. Emerging technologies such as circulating tumor DNA (ctDNA) analysis and exosome-based diagnostics improve early cancer detection and treatment planning. Additionally, AI-based biopsy interpretation is revolutionizing oncology through improved diagnostic accuracy and precision medicine. As the field of precision medicine continues to accelerate, there will be an army of stakeholders seeking for new tools and effective methods of biopsy, and therefore the demand within this sector is likely to continue to grow.

Between 2020 and 2024, the cancer biopsy market witnessed tremendous growth due to:Increase in the prevalence of multiple types of cancersAvailability of minimally invasive diagnostic techniquesAdoption of liquid biopsy technologiesThe cancer biopsy market is projected to reach over USD 1,721 million by 2024, expanding at a CAGR of over 8.9 , during the 2020 to 2024 period. END The need for timely, accurate, real-time cancer diagnosis thus became critical, a fact recognized as healthcare systems across the globe faced the ongoing and pressing concerns of early cancer detection and personalized treatment modalities, requiring an accurate и timely diagnosis of cancer. While standard tissue biopsies remained the mainstay, liquid biopsies became increasingly popular for their minimally invasive potential to assess circulating tumor DNA (ctDNA) and cancer-associated biomarkers in body fluids.

In particular, rigorous approval protocols for biopsy-based diagnostics were implemented by regulatory agencies including the USA Food and Drug Administration (FDA), European Medicines Agency (EMA), and China’s National Medical Products Administration (NMPA) to ensure the safety and efficacy of these novel technologies. By a similar token, the COVID-19 pandemic precipitated the disruption of oncology diagnostics upon the halt of elective biopsy procedures and backlogs for cancer screening. And this did increase the uptake of liquid biopsias - it enabled remote sample collection and decreased hospital visits.

Between 2025 and 2035, the cancer biopsy market will witness revolutionary changes influenced by AI-powered diagnostics, real-time molecular imaging, and emerging single-cell analysis. Artificial intelligence integration in the interpretation of biopsy will improve precision, minimize human error, and speed up the detection of cancer. Biopsy automation through AI will enable the rapid processing of high-throughput samples, increasing diagnostic efficiency.

The future generation of biopsy technologies will emphasize multi-modal liquid biopsies that can identify cancer in its earliest form by combining ctDNA, exosomes, and epigenetic markers. Nanorobotics and molecular imaging-based real-time in vivo biopsies will facilitate non-invasive tumor profiling, transforming early cancer detection and surveillance. AI-powered predictive biopsy platforms will also enable real-time risk stratification, enabling early intervention and customized treatment plans.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | More stringent FDA and EMA approval procedures for biopsy-based diagnostics, guaranteeing safety and efficacy. |

| Technological Advancements | NGS-based liquid biopsies, AI-assisted pathology, and multi-omics tumor profiling. |

| Industry Applications | Oncology diagnostics, biomarker-driven therapy selection, and cancer staging. |

| Adoption of Smart Equipment | AI-powered pathology tools, high-throughput sequencing, and portable biopsy collection kits. |

| Sustainability & Cost Efficiency | High costs of NGS-based biopsies, reimbursement issues, and issues related to false-positive rates. |

| Data Analytics & Predictive Modeling | Cloud-based biomarker repositories, AI-driven biopsy image analysis, and integration of genetic data. |

| Production & Supply Chain Dynamics | Delayed production of biopsy reagents, COVID-19 supply chain shocks, and elevated use of home-based sample collection. |

| Market Growth Drivers | Growth driven by rising cancer incidence, advancements in liquid biopsy technologies, and personalized oncology treatments. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven biopsy regulation systems, block chain-based compliance monitoring, and worldwide standardization of liquid biopsy guidelines. |

| Technological Advancements | AI-driven autonomous biopsy interpretation, quantum-boosted biomarker discovery, and nanorobotics in vivo biopsy methods. |

| Industry Applications | Expansion into AI-driven risk assessment, real-time molecular imaging, and non-invasive tumor monitoring. |

| Adoption of Smart Equipment | Automated biopsy interpretation, real-time risk stratification, and AI-guided biopsy robotics.. |

| Sustainability & Cost Efficiency | Cost-efficient AI-powered biopsy workflows, decentralized diagnostic labs, and affordable point-of-care biopsy solutions. |

| Data Analytics & Predictive Modeling | Quantum-powered biopsy prediction models, block chain-secured patient data management, and decentralized AI-driven biopsy diagnostics. |

| Production & Supply Chain Dynamics | Decentralized biopsy testing on portable platforms, AI-optimized supply chains, and block chain-based tracking of biopsy data. |

| Market Growth Drivers | AI-driven precision oncology, real-time molecular imaging, and expansion into early cancer detection and predictive diagnostics. |

Market of cancer biopsy shows significant growth in the United States, due to an increased incidence of cancer in the populace, rising requirement for rapid and accurate diagnostic tests and the development in liquid biopsy technology. Market growth is also accelerated by government endorsements to facilitate improved cancer screening programs and access to well-established healthcare infrastructure and oncological studies on large scales.

The growing adoption of minimally invasive biopsy procedures, such as liquid biopsy and fine needle aspiration (FNA), is reducing pain for patients and improving diagnostic accuracy. Additionally, advancements in next-generation sequencing (NGS) and artificial intelligence (AI)-based diagnostics are fueling the potential for the early-stage detection of cancer. Market growth is also being propelled by the significant spending on healthcare and the dominance of large biotechnology and pharmaceutical companies in the US.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 18.2% |

The growth of the UK cancer biopsy market is driven by government-sponsored cancer research initiatives, increasing utilization of personalized medicine, and increasing awareness toward early cancer detection. Several programs under the National Health Service (NHS) for the early diagnosis of cancer have emerged, giving added incentive for the development of advanced biopsy techniques.

Rising application of liquid biopsy in precision oncology is driving the market growth, as this technology allow non-invasive cancer detection with real-time monitoring. In addition, the growing investments in AI-based diagnostic tools are improving the precision and speed of cancer biopsies. The increasing elderly population, along with the high prevalence of cancer, are also driving the growing demand for biopsy procedures.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.9% |

The cancer biopsy global market is expanding aggressively due to high regulatory support, increased spending in cancer research and advancement in molecular diagnostics technology in the European Union region. It is in Germany, France, and Italy where precision oncology and biomarker-directed biopsy methods that are transforming the diagnosis of, and treatment planning for, cancer are leaders. One of the key trends being witnessed in the region is the rising use of liquid biopsy for detection of circulating tumor DNA (ctDNA) and exosome biomarkers.

At the same time, the European Cancer Plan (introduced to help reduce the number of deaths due to cancer) helps drive the founding and usage of new biopsy techniques. By making biopsy technology more accessible and efficient, some factors such as the growing number of top-notch biotech companies and research centers also drive innovation in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 18.8% |

The rapidly growing cancer biopsy market in Japan is mainly driven by the rising ageing population people, increase in the incidence of cancer and the government's strong support for the early diagnosis of cancer. The availability of advanced healthcare facilities and focus on state-of-the-art biotechnology within the country has led to significant development in non-invasive biopsy modalities such as liquid biopsy and fluorescence in situ hybridization (FISH). Japan is investing heavily in AI and robotics to enhance the biopsy and optimise diagnostics as well.

Genomic profiling in the diagnosis of cancer is above all driving demand for biopsy technologies based on NGS. The market is anticipated to grow steadily during the forecast period, due to supportive government initiatives toward national cancer screening programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 18.0% |

South Korea cancer biopsy market has a rapid progression owing to the advancements in diagnostic imaging technology, the increasing number of cancer cases, and the surge in investment in precision medicine. The strong biotechnology landscape in the country is driving the progress of liquid biopsy and molecular diagnostics technologies of cancer detection with less accuracy and affordable when compared you need. Market growth is also powered by government-sponsored programs in South Korea for cancer screening and early detection initiatives. More widespread use of AI-based diagnostic tools in leading hospitals is streamlining and improving biopsy, as well. Hallyu is also helping drive the development of new cancer biopsy technologies, including next-generation sequencing of cancer cells and tracking of tumor growth in real time through the collaboration of South Korean biotechs with international drugmakers..

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 18.4% |

The kits and instruments and consumables segment has the largest share of the cancer biopsy market because health care professionals now more than ever depend on state-of-the-art diagnostic equipment to detect cancer earlier and more precisely. These methods of biopsy help in making informed treatment decisions well in time, maximizing patient outcome, and furthering precision oncology programs. Increasing incidence of cancer, increasing need for minimally invasive diagnostic tests, and advances in biopsy equipment are fueling market growth, and instruments and kits are becoming indispensable for hospitals, diagnostic labs, research centers, and biotech companies looking to increase diagnostic productivity and enhance patient care.

The instruments segment is anticipated to be a major driver of market growth, owing to the increasing use of sophisticated biopsy devices in cancer detection, characterization, and treatment planning. Despite this, traditional biopsy diagnosis of rare and complex diseases is limited by the time taken in sampling lesions, the volume of tissues obtained for histopathological examination, and the subsequent treatment strategies. Rising preference for image-guided biopsy systems, robotic-assisted biopsy devices, and AI-supported diagnostic platforms will continue to create demand for cancer biopsy devices. These benefit factors will boost the market demand for advanced biopsy devices, as research states that over 70% of oncologists & pathologists wish to use advanced biopsy techniques to obtain a more accurate cancer diagnosis. Another factor these are the rising adoption of minimally invasive biopsy devices such endoscopic biopsy devices, fine needle aspiration (FNA) systems and vacuum-assisted biopsy devices, which have decreased patient discomfort and improved institutions success rates that matched the criteria further well to these patients.

With its deep learning algorithms and image analysis capabilities, an AI-based digital pathology platform helps solidify this workflow along with other digital pathology applications like whole-slide image scanners and cloud-based biopsy imaging platforms, increasing diagnostic workflow and enabling faster and more precise cancer diagnosis. The development of biopsy devices equipped with imaging systems, such as MRI or ultrasound, to ensure real-time imaging, has improved the efficiency of sampling by targeting lesions accurately and reducing the need for repeat biopsies.

Moreover, the incorporation of biopsy devices with microfluidic technology and biosensors has further strengthened the growth of the market in recent years with high-throughput sample analysis, enhanced detection of specific biomarkers and improved compatibility with personalized oncology. While excellent for precise diagnosis, procedural efficiency, and improved patient outcomes, the instruments segment faces challenges such as the higher costs of advanced biopsy systems, complicated regulations in medical device approval, and healthcare practitioners training. However, impending technologies such as AI-centric biopsy automation, nanotech-enabled tissue extraction, and NGS-compatible biopsy devices are improving diagnostic precision, procedural effectiveness, and accessibility, stimulating sustainable growth prospects for cancer biopsy devices globally.

High market acceptance has been observed for kits and consumables, particularly in use among clinical labs, diagnostic centers, and research organizations, with cancer biopsy testing acknowledgment as a de facto entity of daily oncology diagnostic procedures, while covering all measures on early diagnostics. Unlike single-use biopsy devices, biopsy kits and consumables enable rapid and rapid sample acquisition, processing, and analysis with standardized diagnostic processes and reproducible results.

The increasing demand for both liquid biopsy-oriented and exosomal (ECs and EVs)-derived biopsy kits for circulating tumor DNA (ctDNA) sequencing, exosomal analysis, and cell-free RNA profiling has significantly increased the demand in the market, ensuring its large scale adoption in precision medicine and early cancer screening programs.

The growth of one-time-use biopsy consumables, including disposable biopsy needles, core biopsy kits, and vacuum-assisted biopsy trays, has also increased procedural safety by lowering risks of cross-contamination and adherence to infection control measures.

Incorporating biopsy kits within automated sample analysis platforms, with real-time PCR (RT-PCR) analysis, NGS-based cancer typing, and multiplex biomarker detection, has further streamlined diagnostic workflows to enable high-throughput cancer screening as well as improve detection sensitivity.

The introduction of microfluidic biopsy kits with lab-on-a-chip technology has maximized cancer biomarker analysis, providing quick and inexpensive detection of oncogenic mutations and therapeutic targets.

The use of environmentally friendly biopsy kits with biodegradable consumables and eco-friendly packaging has supported market growth, aligning with international sustainability objectives and diminishing biomedical waste.

Although its diagnostic efficiency, sensitivity of biomarkers, and optimized oncology workflows are benefits, the kits and consumables market is threatened by variability in sample integrity, regulatory oversight of biomarker validation, and affordability issues for high-throughput biopsy testing. Yet, new developments in AI-based biopsy sample analysis, CRISPR-based detection of cancer biomarkers, and combined multi-omics biopsy kits are enhancing diagnostic precision, scalability, and affordability, and thereby assuring sustained growth in the global market for cancer biopsy kits and consumables.

Services have emerged into prominence with the integration of AI-driven biopsy analysis, liquid biopsy interpretation, and personalized oncology solutions into precision medicine. Differing from traditional pathology services, AI-fueled biopsy analytics maximize sample interpretation, thus maximizing high-throughput cancer screening and enhancing diagnostic efficiency.

Growing demand for AI-based histopathology services, including deep learning-based cancer detection, digital slide analysis, and computer-aided tumor grading, has spurred the adoption of AI-based biopsy interpretation to guarantee increased diagnostic accuracy and scalability. Research shows that more than 75% of pathology labs in developed economies employ AI-based biopsy analytics for cancer diagnosis, solidifying market momentum for this sector.

Though it is gaining an edge with automation, AI-based accuracy, and tailored oncology applications, the services sector is confronting regulatory hurdles in AI-based diagnostics, ethical challenges to automated cancer diagnosis, and data privacy threats in cloud-biopsy analysis. Yet, upcoming innovations in block chain-secured biopsy data management, human-AI hybrid diagnostic models, and federated learning for decentralized biopsy analytics are enhancing transparency, security, and adoption, facilitating further growth for AI-based cancer biopsy services globally.

The Global Cancer Biopsy market is witnessing significant growth due to the increasing prevalence of cancer worldwide. Market growth is propelled by advancements in liquid biopsy, next-generation sequencing (NGS), and molecular diagnostics. Moreover, the growing implementation of personalized medicine and targeted treatments has driven the demand for accurate and early detection of cancer. Major players are focusing on product innovation, strategic partnerships, and expanding their diagnostic portfolio to strengthen their market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Qiagen N.V. | 18-22% |

| Illumina, Inc. | 15-20% |

| ANGLE Plc | 10-14% |

| Becton, Dickinson, and Company | 9-13% |

| Myriad Genetics | 7-11% |

| Hologic, Inc. | 6-10% |

| Biocept, Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Qiagen N.V. | Offers sophisticated molecular diagnostic solutions, including liquid biopsy technologies for the detection of cancer at an early stage. |

| Illumina, Inc. | Expects in next-generation sequencing (NGS) platforms applied to cancer genomic profiling and biopsy analysis. |

| ANGLE Plc | Creates novel liquid biopsy solutions centered on circulating tumor cell (CTC) analysis. |

| Becton, Dickinson, and Company | Provides a broad range of biopsy instruments and diagnostic solutions for oncology uses. |

| Myriad Genetics | Focuses on genetic testing and molecular diagnostics to support precision oncology. |

| Hologic, Inc. | Provides advanced imaging and biopsy solutions, including mammography and tissue biopsy technologies. |

| Biocept, Inc. | Expertise in liquid biopsy assays for cancer biomarker detection and monitoring.. |

Key Company Insights

Qiagen N.V. (18-22%)

As a leader for molecular diagnostics, Qiagen has developed a wide ranging portfolio of liquid biopsy and PCR-based cancer testing solutions. Top Most Things About the Company for Sharing 2 : The Company Focus On Precision Medicine and Strategic Partnership.

Illumina, Inc. (15-20%)

A top firm in the realm of genomic sequencing, Illumina's next-generation sequencing (NGS) technologies have revolutionized the field of cancer diagnostics. The firm is expanding its product presence and collaborations to further drive cancer research and clinical application.

ANGLE Plc (10-14%)

ANGLE is a pioneer in liquid biopsy technologies, specifically in circulating tumor cell (CTC) detection. Its proprietary Parsortix system is making headway in cancer diagnostics and personalized medicine.

Becton, Dickinson, and Company (9-13%)

BD has a wide portfolio of biopsy tools and sample collection solutions for oncology diagnosis. BD is also investing in automation and digital pathology to enhance diagnostic accuracy and productivity.

Myriad Genetics (7-11%)

A pioneer in hereditary cancer testing, Myriad Genetics is dedicated to molecular diagnostics to inform targeted therapy selection. Myriad continues to develop its genomic testing services and partnerships in oncology.

Hologic, Inc. (6-10%)

Hologic provides state-of-the-art biopsy and imaging technologies, including 3D mammography and vacuum-assisted biopsy systems. The company’s emphasis on innovation in breast cancer diagnostics gives it a competitive edge.

Biocept, Inc. (5-9%)

Biocept is a key player in liquid biopsy, offering highly sensitive assays for detecting circulating tumor DNA (ctDNA) and other cancer biomarkers. The company’s expanding portfolio supports precision oncology and non-invasive cancer monitoring.

Other Key Players (30-40% Combined):

The Cancer Biopsy market also includes emerging and regional players contributing to market expansion:

The market is estimated to reach a value of USD 35.8 billion by the end of 2025.

The market is projected to exhibit a CAGR of 18.5% over the assessment period.

The market is expected to clock revenue of USD 195.5 billion by end of 2035.

Key companies in the Cancer Biopsy Market include Qiagen N.V., Illumina, Inc., ANGLE Plc, Becton, Dickinson, and Company, Myriad Genetics.

On the basis of product type, instruments to command significant share over the forecast period.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.