The sales of high tibial osteotomy (HTO) plates in Canada is projected to grow from USD 19.6 million in 2025 to USD 35.4 million by 2035, exhibiting a 6.1% CAGR throughout the period.

| Attributes | Values |

|---|---|

| Estimated Canada Industry Size (2025) | USD 19.6 million |

| Projected Canada Value (2035) | USD 35.4 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

The Canadian market for high tibial osteotomy plates is growing steadily. Led by an aging population and a government-funded healthcare system that prioritizes joint preservation over early knee replacements, investment in HTO procedures has been increasingly made as a cost-effective alternative.

With provinces like Ontario, British Columbia, and Alberta emphasizing reducing the public health burdens and presenting options to full knee arthroplasty, there is a vast scope for HTO in Canada. Additionally, with the waiting times for orthopedic surgery in Canada more extensive than those of the national benchmarks, there is another factor in favor of this surgical procedure.

Younger patients who are unwilling to wait for full knee replacements are shifting towards joint-preserving procedures like HTO. Participation in recreational sports, especially hockey and skiing, has increased the incidence of knee injuries, thus increasing the demand for HTO plates.

Johnson & Johnson (DePuy Synthes), HankilTech Medical, and Zimmer Biomet are the major participants in the Canadian HTO plate market. With its established network with public health procurement systems in Canada, DePuy Synthes enjoys significant market share across hospitals.

Zimmer Biomet, famous for its knee replacement solutions, is selling the HTO plates as a continuation of care when primary preservation of the knee over earlier replacement is more desirable.

Meanwhile, HankilTech Medical of South Korea, looking to gain momentum in Canada, has sealed strategic deals with regional distributors for providing cost-effective competition to existing players. As the Canadian market continues to favor cost-efficient, durable solutions, these companies are shaping the future of HTO procedures across the country.

Explore FMI!

Book a free demo

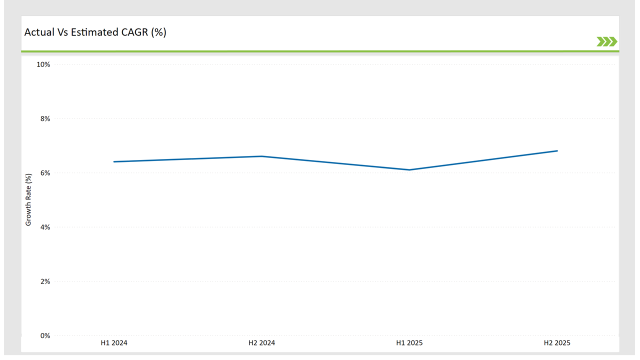

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Canada high tibial osteotomy (HTO) plates market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

High tibial osteotomy (HTO) plates market of the Canada is expected to grow at 6.4% CAGR for the first half of 2023, followed by an upgradation to 6.6% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 6.1% in H1 and is expected to rise to 6.8% in H2.

This pattern presents a decline of -10.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 8.72 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing high tibial osteotomy (HTO) plates market of the Canada, which is primarily affected by regulations, consumer trends, and improvements in high tibial osteotomy (HTO) plates. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Provincial Healthcare Procurement Contracts: DePuy Synthes is using the provincial healthcare procurement contracts to capture its HTO plates more pervasively in the funded hospitals and orthopedic centers. The company is employing patient-specific planning software to improve the accuracy of surgical interventions and is moving hand-in-hand with the nation's trend towards more evidence-based orthopedic care. DePuy Synthes is targeting sports injury clinics, especially in hockey-dominant provinces such as Ontario and Quebec. The company is increasing its stronghold in the academic and high-volume orthopedic centres by providing customized training programs for orthopedic surgeons in partnership with Canadian teaching hospitals for younger athletes to seek joint-preserving procedures. |

| 2024 | Development of Cost-Effective Solutions: HankilTech Medical is penetrating the Canadian market with its cost-effective HTO plate solutions appealing to public hospitals suffering from budget cuts under Canada's single-payer healthcare system. The company is actively forming partnerships with local medical device suppliers for the distribution of products, ensuring greater accessibility across the smaller provinces and rural orthopedic centers. The company is acquiring Health Canada approvals for its advanced titanium HTO plates, making it a value-based alternative to premium brands. It is also focusing on Asian immigrant groups, especially in British Columbia, through partnerships with Korean-Canadian doctors to promote use among surgeons already working with the HankilTech product line. |

| 2024 | Continuum-of-Care Model: Zimmer Biomet is enhancing its continuum-of-care offering in Canada with the addition of HTO plates to its established knee preservation line, addressing patients postponing total knee replacements. The company invests in robotic-assisted and AI-driven surgical planning and aligns with Canada's push on precision-based orthopedic interventions. Zimmer Biomet is also focusing on high-performance sports medicine clinics in provinces such as Alberta and British Columbia, where advanced knee preservation techniques are in demand. The company also gets into private orthopedic clinics that cater to cash-paying patients, thereby ensuring dual-revenue stream strategy beyond Canada's public health system. |

Integration of HTO in Multidisciplinary Healthcare Settings

In Canada, multidisciplinary healthcare teams-consisting of orthopedic surgeons, physiotherapists, and rehabilitation specialists-are increasingly using High Tibial Osteotomy (HTO) as part of a collaborative treatment approach for knee osteoarthritis, especially in younger, active patients.

This integrated care model is becoming more prominent in urban centers such as Toronto, Vancouver, and Montreal, where there is higher adoption of cutting-edge medical practices.

Because HTO is more often recommended to healthy, active individuals who need their joints preserved, surgeons are increasingly working in close collaboration with rehabilitation specialists to deliver the best outcomes for these patients. An increasingly informed understanding of long-term HTO benefits has thereby contributed to the steady increase in demand for HTO plates.

Provinces Are Now Investing More Heavily in Innovative Orthopedic Solutions Within the Health-Care System

Provincial healthcare systems across the country, Ontario, Quebec, and British Columbia, have now started to heavily invest in innovative orthopedic solutions that have the potential to cut wait times for knee replacements while helping to maximize positive patient outcomes.

The wait times for orthopedic surgery in some provinces are a bit of more than six months. So, the government has channeled more resources towards joint-preserving procedures like HTO. This increases its usage and uptake in hospitals, especially in resource-poor areas, where the advanced means of treatment are less reachable.

Some provinces are now covering HTO plates, which is making them more attractive to orthopedic surgeons. This provincial push for innovation is driving greater utilization of HTO plates as more healthcare facilities are equipped to perform the procedure, ensuring wider accessibility for patients seeking alternatives to knee replacement.

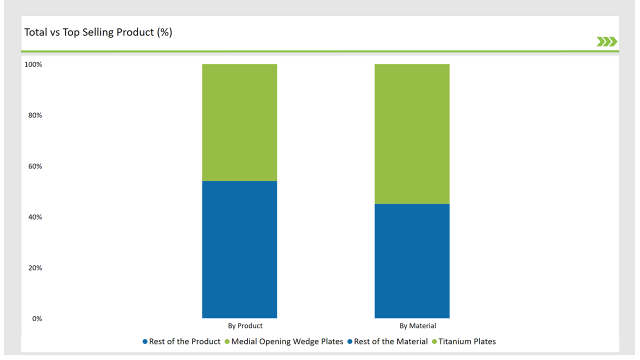

% share of Individual categories by Product Type and Material in 2025

Medial Opening Wedge Plates records significant surge in Canada High Tibial Osteotomy (HTO) Plates, By Product

Medial opening wedge plates are dominant in the industry by product because they offer more accurate alignment and better correction of knee deformities. They are especially preferred in younger, active patients who wish to preserve joint function and delay the necessity for total knee replacement.

In Canada, where sports injuries and active lifestyles are common, medial opening wedge plates are a critical choice for surgeons aiming to maintain a patient's range of motion and knee function.

Moreover, the ability to graft bone in the procedure enables better healing and ensures long-term stability, a key consideration in a system like Canada's, which emphasizes long-term cost-effectiveness in orthopedic treatments.

Titanium plates are more prevalent in the market because they are biocompatible, light in weight, and offer superior mechanical properties compared to stainless steel.

Its corrosion resistance and MRI compatibility are highly valued in the Canadian healthcare setting, where advanced imaging techniques are common. It is especially ideal for younger, active patients requiring durable, long-lasting solutions for joint preservation.

As the public healthcare system in Canada is focused on the outcome of patients and cost-effectiveness, investing in titanium plates is a good value because it reduces long-term complications and improves healing rates, thus aligning with the overall goal of reducing the need for subsequent procedures.

Note: above chart is indicative in nature

The Canada HTO plates market is moderately concentrated, with a few major players dominating the market. Multinational corporations such as Johnson & Johnson (DePuy Synthes), Zimmer Biomet, and Smith & Nephew maintain a strong presence through comprehensive distribution networks and established relationships with Canadian healthcare institutions.

These companies drive the market mainly by offering many types of advanced HTO product features, ranging from patient-specific instrumentation to robotic surgery. Due to their large-scale presence over many years in almost all the large Canadian hospitals and many sports medicine clinics, these competitors enjoy an additional edge in that physician preference comes into play.

Notably, newer regional and minor players such as HankilTech Medical are finding easy grounds by their affordable products with lower price rates. The high level of public funding of the Canadian health system means that even small firms are able to cater to the sparsely populated and poorly funded health delivery environments at much more competitive price points, with all quality and regulatory standards in place.

This segment of the market, therefore, creates higher competition that is compelling bigger players to bring on value-added services like training surgical procedures and post-operative care.

By 2025, the Canada high tibial osteotomy (HTO) plates market is expected to grow at a CAGR of 6.1%.

By 2035, the sales value of the Canada high tibial osteotomy (HTO) plates industry is expected to reach is USD 35.4 million.

Key factors propelling the Canada high tibial osteotomy (HTO) plates market include integration of HTO in multidisciplinary healthcare settings as well as provinces are now investing more heavily in innovative orthopedic solutions within the health-care system.

The key players operating in the global high tibial osteotomy plates market include Johnson & Johnson, Synthex GmbH, Newclip Technics, Arthrex, Intrauma S.p.a., aap Implantate, Aplus Biotechnology, Astrolabe, Changzhou Zener Medtec, Corentec, DTM - Deva Tibbi Malzemeler, Groupe Lépine, HankilTech Medical, I.T.S., Intercus, Jeil Medical Corporation and Others.

In terms of product, the industry is divided into- Medial Opening Wedge Plates, Lateral Closing Wedge Plates, Biplanar Osteotomy Plates, Locking Compression Plates (LCPs), Contoured Plates and Spacer Plates.

In terms of material, the industry is segregated into- medial opening wedge plates, lateral closing wedge plates, biplanar osteotomy plates, locking compression plates (LCPs), contoured plates and spacer plates

In terms of indication, the industry is segregated into- Knee Osteoarthritis, Knee Valgus/Varus Deformities, Sports Injuries and Trauma and Other Indications

In terms of end user, the industry is segregated into- Hospitals, Ambulatory Surgical Centers and Independent Orthopedic Centers

Digital Scale Market Analysis by Product, Age Group, Modality, End User, and Region 2025 to 2035

The Graft Versus Host Disease (GvHD) Treatment Market is segmented by Monoclonal antibodies, mTOR inhibitors, Tyrosine kinase inhibitors and Thalidomide from 2025 to 2035

The Liquid Biopsy Market Is Segmented by Biomarker Type, Sample Type & End User from 2025 to 2035

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

The onychomycosis treatment market is segmented by treatment, disease indication, age group, gender and distribution channel from 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.