The Canada axillary hyperhidrosis industry is on course for steady growth, rising from USD 65.4 million in 2025 to USD 120.5 million by 2035, marking a 6.3% CAGR.

| Attributes | Values |

|---|---|

| Estimated Canada Industry Size in 2025 | USD 65.4 million |

| Projected Canada Value in 2035 | USD 120.5 million |

| Value-based CAGR from 2025 to 2035 | 6.3% |

In the Canada market, the demand for axillary hyperhidrosis is growing. Patients have become increasingly conscious about the ailment and also are getting adequate advanced treatments for this condition. There are approximately 3% patients with hyperhidrosis in the Canada population. Also, with increased education among patients, more healthcare providers are coming forward and eliminating the stigma around the ailment.

The key market players are Allergan plc. (AbbVie), who lead with Botox injections as the first-line treatment for severe underarm sweating. The product has high efficacy and has been approved by Health Canada, making it the favorite among dermatologists. Similarly, Journey Medical Corporation (Dermira, Inc.) offers Qbrexza, a topical treatment that is becoming popular among Canadians who are opting for non-invasive solutions.

Another aspect, the OTC segment, includes companies such as Riemann A/S, part of the Orkla, and their product, Perspirex, which also benefit significantly from this increase in demand due to accessible, discreet treatments. Retail pharmacy chains, including Shoppers Drug Mart, play an essential role in promoting distribution through robust healthcare infrastructure.

The Canadian government subsidizes a part of the healthcare-related costs, thus making it affordable in some clinical procedures. This also facilitates higher adoption. Urban areas generally have higher treatment usage rates, since cities like Toronto and Vancouver would have better clinics and pharmacies easily accessible.

Explore FMI!

Book a free demo

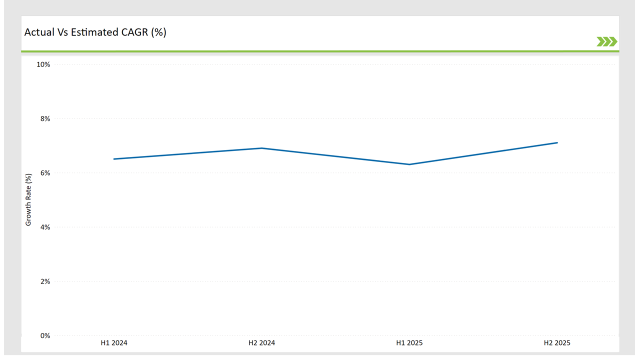

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the Canada axillary hyperhidrosis treatment market. This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Axillary hyperhidrosis treatment market of the Canada is expected to grow at 6.5% CAGR for the first half of 2023, followed by an upgradation to 6.9% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 6.3% in H1 and is expected to rise to 7.1% in H2. This pattern presents a decline of -20.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 24.0 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing axillary hyperhidrosis market of the Canada, which is primarily affected by regulations, consumer trends, and improvements in axillary hyperhidrosis treatment. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Physician Education Programs: Allergan is concentrating on using its lead product Botox through increased physician education programs and insurance partnership-led market penetration. Its approach involves focused marketing initiatives to highlight the therapeutic value of Botox for hyperhidrosis and clinical studies to develop new indications, thereby sustaining its leadership position in the clinical treatment market. |

| 2024 | Expansion in Distribution Network: Riemann instead focuses on its products with long-lasting, prescribable by dermatologists antiperspirants such as Perspirex. The company's growth strategy focuses on expansion through pharmacy and retail distribution networks while marketing adjustments are made for health-focused consumers. This means Riemann invests in research to enhance formulating potency and extending its international reach to strengthen its position in the OTC hyperhidrosis market. |

| 2024 | Investment in Marketing: GlaxoSmithKline drives getting success with its established portfolio of consumer health products like Drysol, targeting hyperhidrosis patients. It focuses on increasing brand trust through clinical endorsements and engaging consumers via digital platforms. GSK also invests in localized marketing strategies and retail partnerships to strengthen accessibility, particularly in high-demand urban markets. |

Provincial Healthcare Insurance for Clinical Treatments

Whereas in Canada, many of the provincial healthcare systems have agreed that Botox treatments for hyperhidrosis do fall under certain cases, which allow more clinical options to be accessible to patients, particularly those suffering from severe axillary hyperhidrosis.

The cases of Ontario and British Columbia have developed Botox services within the public health insurance system, reducing the financial burden for patients and making the specialist treatments more appealing. As public awareness of these treatments increases and more provinces adopt similar policies, the market for clinical hyperhidrosis solutions is set to grow rapidly.

Increasing Role of Dermatology and Specialized Clinics

There is rapid growth of dermatology clinics in major cities like Toronto and Vancouver, creating a strong engine of growth for this market in Canada. Such dermatology clinics typically provide specialized axillary hyperhidrosis treatments, such as Botox or Qbrexza, which are only available in select treatment centers.

Having more dermatologists and increased confidence among patients that specialized clinics deliver better care boosts more Canadians to take up professional treatment for the condition. Others also use digital health tools such as online consultations to treat patients from urban and rural settings, thus making it easier for patients in those settings to gain treatments and thus expanding the market.

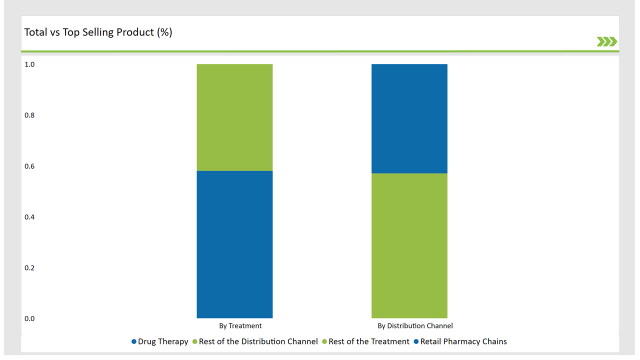

% share of Individual categories by Treatment and Distribution Channel in 2025

Drugged therapy holds a higher usage rate in the USA because of the usage of FDA-approved solutions, such as Botox and Qbrexza, primarily for their proven efficacy and increasing patient trust. Aggressive marketing by the companies along with high awareness among dermatologists ensure these treatments become must-recommend for more patients. Additionally, insurance coverage reduces the cost of out-of-pocket expenditure for these treatments.

The largest portion of retail pharmacy chains dominate in the Canada, offering access to the highest number of locations. Chains like CVS and Walgreens actively stock products for hyperhidrosis and employ strategic shelf placement and promotional campaigns. These retail pharmacy chains provide convenience, reputation, and loyalty programs to encourage customers looking for affordable solutions to their excessive sweating.

In the country, due to established efficacy, drug therapies like Botox and Qbrexza dominate among prescribing physicians due to their support from the provincial healthcare plans. In the case of Botox, in the provinces of Ontario and others, medical treatment is covered under insurance, thus making treatment less costly for such a patient with hyperhidrosis. The availability of such clinical treatments as well as physician endorsements and growing trust in minimally invasive solutions makes drug therapy the preferred option for many Canadians with excessive underarm sweating.

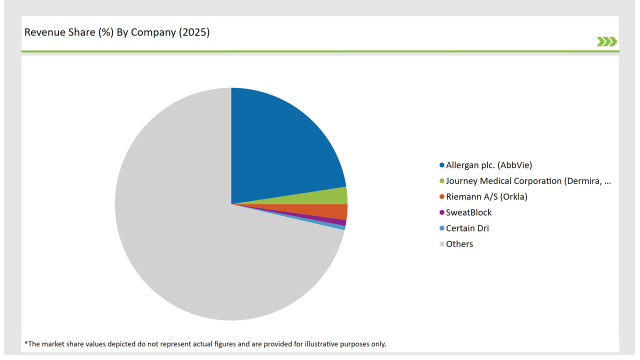

2025 Market share of Canada Axillary Hyperhidrosis Treatment suppliers

Note: above chart is indicative in nature

Retail pharmacy chains in Canada, like Shoppers Drug Mart, are crucial to the dispensation of over-the-counter treatments, including Perspirex and Certain Dri. Such chains are held in trust by Canadian consumers as providers of high-quality products and are widespread throughout urban and rural areas, thus making them available to a vast demographic. Pharmacies also give expert advice and personalized recommendations to increase the confidence of consumers, and therefore, demand for over-the-counter treatments in hyperhidrosis is increased.

By 2035, the Canada axillary hyperhidrosis treatment market is expected to grow at a CAGR of 6.3%.

By 2035, the sales value of the Canada axillary hyperhidrosis treatment industry is expected to reach Canada is USD 120.5 million.

Key factors propelling the Canada axillary hyperhidrosis treatment market include provincial healthcare insurance for clinical treatments and others.

Prominent players in the Canada axillary hyperhidrosis treatment manufacturing include Allergan plc. (AbbVie), Journey Medical Corporation (Dermira, Inc.), Riemann A/S (Orkla), SweatBlock, Certain Dri. among others These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

In terms of treatment, the industry is divided into- drug therapy, botulinum toxins, and medicated wipes.

In terms of end user, the industry is segregated into- hospitals, general physician’s clinics, retail pharmacy chains and online sales

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Suture Anchor Devices Market Is Segmented by Product Type, Material Type, Tying and End User from 2025 to 2035

Home Infusion Therapy Devices Market - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.