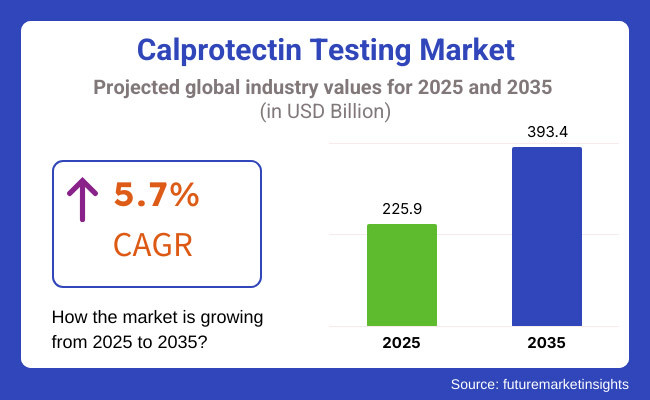

Calprotectin testing market is expected to witness growth between 2025 & 2035 with a growing awareness regarding gastrointestinal disorders, high adoption of diagnostic technologies, and rising prevalence of inflammatory bowel diseases (IBD) such as Crohn’s disease and ulcerative colitis. Markets the market is expected to be worth USD 225.9 Billion in 2025 and USD 393.4 Billion by 2035, with a CAGR of 5.7% in the forecast period.

Calprotectin is a neutrophil cytosol biomarker that is a reasonable surrogate for intestinal inflammation. Its testing is commonly utilized to distinguish both irritable bowel syndrome (IBS) and inflammatory bowel diseases (IBD) while minimizing the requirement for invasive examinations, such as a colonoscopy. Increasing incidence of digestive disorders globally, an aging population and a growing preference for non-invasive diagnostic tools are all fuelling the market.

And on the growing availability of at-home testing kits and point-of-care (POC) solutions, making calprotectin testing more approachable on conditionality of even most destitute-oriented, as well as the unavailability of microbiome content. But, the uncertainty regarding test accuracy, regulatory constraints, and lack of awareness in the developing landscapes might hinder the growth of this market.

Explore FMI!

Book a free demo

The US and Canada continue to be the leading countries in North America for calprotectin testing adoption, which is the largest market for this testing. Rising Cases of Gastrointestinal Disorders, Established Healthcare Infrastructure and Robust Reimbursement Policies to Aid Growth of the Market Inflammatory bowel diseases impact more than 3 million people in the USA with a growing need for dependable diagnostic modalities, including calprotectin tests. Moreover, clinical studies on biomarker-based diagnostic and use of AI in test interpretation to improve diagnostic accuracy and efficiency will continue in the future. Notably, the rise of direct-to-consumer testing and the growth of telemedicine services are also playing an important role in expanding market accessibility. Innovation in the sector is also being driven by increased investment in precision medicine and personalized healthcare.

Germany, the UK, and France have emerged as the leading countries in Europe for advancements in any research and diagnostic assays related to calprotectin testing market. The European market will grow, owing to robust regulations and government support in early disease detection programs. The growing emphasis on alleviating endoscopy burden within healthcare systems has driven the increasing use of calprotectin tests for the non-invasive assessment of inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS).

The growing presence of major diagnostic companies and partnerships between research institutions and hospitals are stimulating innovation in test development. These issues aided the market growth as usage of biomarkers in personalized medicine is garnering traction and performing a personalized medicine augmenting market growth in treatment monitoring and analysis of disease progression including factors like calprotectin. The implementation of artificial intelligence in diagnostic workflows is also gaining ground, enhancing efficiency and minimizing diagnostic errors.

Asia-Pacific is projected to witness the fastest growth in calprotectin testing market, which can be attributed to enhancing healthcare awareness, increasing disposable incomes, and developing diagnostic infrastructure in Asian countries such as China, Japan and India. Changing dietary diets, urbanization, and increasing antibiotics use in the region have led to an increased incidence of GI diseases, supporting the demand for accurate and non-invasive testing solutions. Government Projects Targeting Better Healthcare Access & Early Disease Detection Are Key Factors For Market Growth. Moreover, international diagnostic companies are in a competition to invest in Asia-Pacific to launch their products, as the region has the potential to provide economical, state-of-the-art calprotectin testing solutions.

An increasing number of clinical labs and collaborative research initiatives in respective countries including South Korea and Australia continue to bolster the market outlook. As people in emerging markets desire hospitalisation for better medical facilities a trend that has given rise to medical tourism, particularly in South-East Asia the need for high-end diagnostic tests, such as an assay for calprotectin, is also expected to grow.

Challenge

Test Variability and Regulatory Compliance

The presence of variability in calprotectin test results due to differences in assay techniques and sample handling has hampered the growth of the market. A major concern has been the consistency and accuracy of results obtained by different laboratories across the globe.

Moreover, the complexity and time-consuming nature of regulatory compliance and approvals for emerging diagnostic technologies, particularly in regions with strict healthcare standards, can be a challenge. Solutions to these challenges will be found through progressive work to standardize assays, implement stringent quality control protocols, and adhere to global diagnostic standards.

Opportunity

Expansion of Point-of-Care and Home Testing Solutions

Rising implementation of point-of-care and home-based diagnostic testing is likely to act as a growth promoter. As lateral flow assay technology and portable diagnostic devices evolve, calprotectin tests are becoming increasingly available for patients outside of laboratory settings. Now companies are preparing simple, fast diagnostic kits that allow people to have the own gastrointestinal health checked only at home.

Also, the inclusion of AI with cloud-based platforms for the interpretation of test results is enhancing your diagnostic efficiency. As healthcare moves toward patient-centric models, the trend toward decentralized testing solutions will only increase long-term market growth. Increasing partnerships between diagnostic makers and healthcare providers are also signalling the departure from one-size-fits-all solutions by both parties to which innovations will be adopted by healthcare solutions providers.

Key factors driving the growth of this market includes the increasing prevalence of inflammatory bowel disease (IBD), growing demand for non-invasive diagnostic solutions, and the development of biomarker-based testing for gastrointestinal diseases. Cost-effectiveness and reliability of fecal calprotectin (FC) led to the increasing adoption of FC testing as a standard diagnostic tool for assessing the differential diagnosis of inflammatory bowel disease (IBD) versus irritable bowel syndrome (IBS).

The commercial availability of point-of-care calprotectin tests, fully automated ELISA kits, and lateral flow assays in gastroenterology clinics and diagnostic laboratories raised the prospect of an easier to adopt fecal biomarker. However, hurdles including standardized testing, complications with reimbursement, and lack of awareness among primary care providers hindered widespread use.

Artificial intelligence based diagnosis interpretation, in-home testing & precision medicine approaches to gastrointestinal diseases will be new trends that will evolve the market in the next decade from 2025 to 2035. Wearable biosensors for continuous inflammation monitoring, AI-powered predictive analytics for IBD progression, and smart digital health platforms will become driving forces for improving patient outcomes.

Other advances, such as lab-on-a-chip microfluidic devices, CRISPR-based biomarker detection, and block chain-secured patient data tracking will allow calprotectin testing to be more accurate, accessible, and secure than ever before. Similarly, genomic-based personalized treatment pathways will drive segmentation while gut microbiome analysis and AI-integrated gastroenterology decision support systems will provide layer-chaining on top of the diagnostic landscape.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and CLIA regulations for diagnostic accuracy and clinical validation. |

| Diagnostic Technologies | Widespread use of ELISA-based fecal calprotectin assays, lateral flow tests, and automated lab solutions. |

| Industry Adoption | Growing integration of calprotectin testing in routine gastroenterology diagnostics and IBD monitoring. |

| Point-of-Care (POC) & At-Home Testing | Early adoption of POC calprotectin tests with rapid turnaround times. |

| Market Competition | Dominated by diagnostic kit manufacturers, specialty labs, and hospital-based testing solutions. |

| Market Growth Drivers | Growth fuelled by rising IBD prevalence, demand for early inflammation detection, and non-invasive testing solutions. |

| Sustainability and Environmental Impact | Focus on recyclable test kit packaging and reducing lab-based diagnostic waste. |

| Integration of AI & Digital Health | Limited AI use in calprotectin test interpretation and remote patient monitoring. |

| Advancements in Testing & Automation | Use of traditional ELISA-based lab testing and semi-automated sample processing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven diagnostics regulations, digital health security mandates, and personalized biomarker approval processes. |

| Diagnostic Technologies | Adoption of AI-powered digital calprotectin readers, real-time wearable biosensors, and microfluidic lab-on-a-chip diagnostic devices. |

| Industry Adoption | Expansion into at-home digital testing, AI-assisted clinical decision support, and gut microbiome-based inflammation tracking. |

| Point-of-Care (POC) & At-Home Testing | Widespread use of real-time, AI-assisted at-home calprotectin monitoring kits and telemedicine integration. |

| Market Competition | Increased competition from AI-driven digital health start-ups, gut microbiome analytics firms, and block chain-enabled diagnostic companies. |

| Market Growth Drivers | Expansion driven by AI-powered predictive diagnostics, precision medicine for IBD, and patient-driven digital health ecosystems. |

| Sustainability and Environmental Impact | Adoption of biodegradable testing materials, AI-optimized resource utilization, and block chain-secured data storage for digital diagnostics. |

| Integration of AI & Digital Health | AI-powered IBD progression prediction, gut microbiome-based inflammation analysis, and digital twin modelling for personalized treatment. |

| Advancements in Testing & Automation | Evolution of fully automated, real-time calprotectin testing with AI-driven diagnostic insights and personalized treatment recommendations. |

The United States is by far the largest market of the calprotectin test market across the globe due to the growing number of inflammatory bowel diseases (IBD) such as Crohn’s disease and ulcerative colitis, increasing preference for non-invasive diagnostic techniques, and advancements in biomarkers research.

Market growth is further accelerated by an increasing focus on disease detection in the early stages and personalized medicine. Further, the growth of market is also propelled by increasing presence of leading diagnostic companies and better reimbursement policies for fecal calprotectin testing. New developments, such as the growing uptake of point-of-care testing and the provision of home-based diagnostic kits, are improving accessibility and patient compliance. Thus, the growth of the immunoassay and automation technologies is also contributing to the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

The market for calprotectin testing in the UK is steadily growing with the increasing government initiatives aimed at improving the diagnostics for gastrointestinal diseases, rising adoption of fecal calprotectin testing as a first-line screening tool, and growing awareness among healthcare providers. Both US and Europe, NHS (National Health Service) in UK has implemented fecal calprotectin testing into their standard diagnostic algorithms for the differential diagnosis of IBS and IBD, contributing to the increasing usage of fecal calprotectin in the market.

Moreover, the changing nature of healthcare which includes the advent of telemedicine and home diagnostics is providing a patient access to different calprotectin testing solutions. Market growth is also driven by the increasing number of clinical laboratories and diagnostic service providers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

While Germany, France, and Italy are hold a prominent position in the European Union calprotectin testing market due to their strong healthcare infrastructure, burgeoning research on inflammatory diseases, and government initiatives to promote early disease detection programs. Rising adoption of automated and rapid diagnostic technologies in the hospitals and clinical laboratories are driving the growth in the European market. Moreover, rigorous regulations on diagnostic precision and productivity are increasing the demand for high-sensitivity immunoassays.

Rising public awareness regarding gut health together with the growing burden of gastrointestinal disorders is likely to drive demand for fecal calprotectin testing in the region. Market accessibility is being further improved by the growing transition towards digital health platforms to interpret tests and their results.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.6% |

The Japanese conjugate calprotectin testing market is anticipated to grow owing to the increasing prevalence of gastrointestinal diseases, growing aging population, and rising demand for non-invasive diagnostic solutions. Fecal calprotectin is one of the most commonly used tests in India that are still in the early adoption stage due to its advanced healthcare system and focus on early disease detection.

Moreover, currently available high-throughput testing and automated immunoassay platforms streamline diagnostics. Japan’s initiatives in biomarker-based disease detection are similarly enabling innovation in testing for calprotectin. Soaring the importance of home-based testing solutions and telemedicine platforms are expected to increase market accessibility.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Strong demand for calprotectin testing in South Korea attributed to rising healthcare investments, growing prevalence of inflammatory gastrointestinal disorders, and increasing adoption of point-of-care diagnostic solutions. Market expansion is supported further by the government's emphasis on improving diagnostic capabilities and preventive healthcare measures. Furthermore, coups over the monopolistic lab industry by Korean manufacturers of automies and diagnostic interpretation based on AI are expected to support better calprotectin use in Korea.

Home-based testing kits and digital health platforms are also helping patients obtain access to early disease screening. This is further propelling demand for high-quality calprotectin testing solutions with the expansion of private healthcare providers and diagnostic centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The Calprotectin ELISA and Rapid Testing Kit segments represent the Calprotectin Testing Market both segments have the largest share, as clinicians and diagnostic laboratories are constantly looking for accurate, efficient, and non-invasive solutions to detect inflammatory bowel disease (IBD) and other gastrointestinal disorders. The utilization of these test kits is essential in allowing for the timely management of disease, minimizing the necessity of invasive procedures, and improving patients' outcomes. With an increase in the number of chronic gastrointestinal disorders worldwide, the demand for reliable, high-precision calprotectin testing continually progresses globally.

The growing popularity of calprotectin ELISA test kits account for their comparatively higher accuracy, high sensitivity and quantitative measurement of calprotectin. ELISA-based kits allow for in-depth analysis unlike rapid screening methods, which is what makes them the preferred tool for clinical laboratories and research institutes.

The rising requirement of accurate and reproducible inflammatory marker detection, especially in diagnosis of Crohn’s disease, ulcerative colitis and irritable bowel syndrome (IBS) will supplement market penetration. More than 65% of gastrointestinal diagnostic tests use ELISA-based calprotectin after confirming that it is a reliable test that can detect early-stage inflammation.

The demand for advanced ELISA testing kits equipped with assay needs with high sensitivity, automated plate readers to accommodate improved workflow efficiency, multiplex biomarker for better clinical applicability has augmented the market growth and accuracy for specific detection of diseases.

The availability of AI-based diagnostic analytics, combining real-time data interpretation, automated threshold analysis, and predictive modelling for potential disease progression, also contributed to increasing adoption and helping to accelerate clinical decisions and provide personalized treatment plans.

Shorter incubation periods, increased throughput, and stable reagents are some of the advancements resulting in next-generation ELISA test kits optimizing market growth, leading to improved efficiency, and reduced operational costs in laboratory settings.

The global market has been strengthened by the adoption of sustainable production techniques for ELISA test kits, with growth factors including biodegradable assay components, energy-efficient lab automation, and eco-friendly reagent packaging to comply with global sustainability initiatives in healthcare diagnostics.

While the ELISA test kit segment offers high levels of diagnostic precision, scalability, and allows for quick monitoring of diseases, it is hindered by longer processing times, higher prices against rapid tests, and the requirement of certified laboratory personnel to operate it. Nonetheless, innovations are emerging to aid access, efficiency, and market penetration of calprotectin ELISA test kits, such as AI-powered assay optimization, microfluidic-based ELISA testing, and portable ELISA devices, thereby ensuring that the calprotectin ELISA test kit market continues to grow globally.

The rapid testing kit segment for calprotectin testing continues to capture a large share of the calprotectin testing market, as these calprotectin testing kits offer benefits in terms of ease of use, rapid results, and point of care testing. Compared with ELISA-based methods, rapid tests produce qualitative or semi-quantitative results within minutes note; these tests are suitable for use at primary care clinics, emergency rooms, and for home-based health monitoring.

The adoption has been driven by the growing need for non-invasive and immediate gastrointestinal diagnostics, especially in outpatient settings and remote healthcare services. Approximately 60% of general practitioners and urgent care providers use rapid testing kits in over 60% of patients to differentiate between functional and organic gastrointestinal disorders.

With the availability of improved sensitivity, integrated digital readouts and real time transmission of results, the consumption of such high-accuracy LFA-based calprotectin rapid test kits has been expanded over the period, which is directed towards enhancing the reliability of tests and improved patient compliance over the process.

Smartphone-compatible rapid testing solutions featuring AI-powered image recognition, cloud-based diagnostic reporting, and telemedicine platform convergence, have further driven adoption, providing easier access in remote and underserved regions.

Exponential market growth is expected to be contributed through the development of dual mode accelerated rapid testing kits, allowing for calprotectin testing alongside other inflammatory markers, thus enhancing clinical application in differential diagnosis of gastrointestinal conditions.

Sustainable practices further help to contribute to the existing healthcare environment adapting towards new methodologies including low waste production of the test, recyclable test components and biodegradable sample collection disposables.

The rapid testing kit segment is advantageous due to speed, convenience and applicability at the point of care, yet it has some drawbacks, including relatively lower sensitivity than ELISA, lack of quantitative analysis capabilities, and possible variability in results due to differences in operator accreditations. But new developments in AI-driven rapid test validation, next-gen biosensor technology, and cloud-based standardization of diagnostic results are driving accuracy, reliability, and clinical acceptance, so worldwide expansion for calprotectin rapid testing kit is set to continue.

As healthcare professionals focus on non-invasive and minimally invasive diagnostic approaches, the Stool and Blood Serum/Plasma segments are rapidly occupying a dominant portion of the Calprotectin Testing Marketplace. These types of samples are critical for minimising patient discomfort, allowing for reliable biomarker detection and facilitating laboratory workflows.

Stool sample testing has a strong market adoption because of its stochastic correlation with intestinal inflammation, low sample collection requirement, and higher patient compliance. Moreover, compared to blood-test-based approaches, stool-calprotectin testing can provide localized insight in gut disorders, which is the gold standard for discriminating inflammatory from non-inflammatory bowel disease.

A growing need for timely and accurate detection of IBD, such as in high-risk and paediatric populations, has driven adoption. Research shows that more than three out of four gastroenterologists believe stool calprotectin testing helps appropriately limit unnecessary colonoscopies, and optimize treatment plans.

The increasing adoption of automated stool processing technologies, with improved sample stability, minimized pre-analytical errors, and ability to test multiple samples in batches, has increased the market demand, with improved operational efficiency and diagnostic reliability.

While stool samples have advantages such as non-invasively providing high specificity and having become widely accepted in clinical practice, the stool sample segment has its challenges, including sample consistency variability, requiring proper handling protocols to facilitate sample collection, and reluctance from patients to collect the samples.

Nonetheless, new breakthroughs in the ability of stool sample analysis through AI, the use of portable, home-based stool testing kits and next-generation stabilizing agents are enhancing usability, sample integrity, and diagnostics convenience, leading to further expansion for stool-based calprotectin testing globally.

Market growth for blood serum/plasma testing remains robust as clinicians turn to comprehensive inflammatory marker assessment for both gastrointestinal and systemic disease management. While stool-based calprotectin testing is specific to gastrointestinal inflammation, blood-based calprotectin analysis captures many inflammatory pathways, providing a new and exciting tool for monitoring disease progression and tracking multi-organ inflammation.

With a rise in the demand for multi-biomarker diagnostic panels specifically for monitoring autoimmune disease, adoption has been further accelerated. Strategically, around 65% of systemic inflammatory disease patients are shown to derive clinical use from serum/plasma calprotectin testing when performing wider-angle diagnostic workups.

Although the advantages of systemic inflammation assessment, clinical versatility, and sample processing standardization make blood serum/plasma the most widely used marker of gut inflammation, patient discomfort with venepuncture, the need for laboratory processing, and high variability due to host systems other than the gastrointestinal system complicate the use of blood-based biomarkers. And yet emerging innovations, including AI-powered blood biomarker interpretation, microfluidic-based rapid blood testing and personalized inflammation risk assessment models are enhancing the diagnostic accuracy, accessibility and clinical adoption of such testing ensuring blood-based calprotectin testing continues to proliferate across international boundaries.

The Calprotectin Testing Market is driven by the rising incidences of inflammatory bowel diseases (IBD), the development of non-invasive diagnostic methods, and growing use of calprotectin as a marker for gastrointestinal diseases. The rapid diagnostic kits and laboratory automation are the included innovations boosting the market growth. Trending topics influencing the industry are point-of-care, integration with digital health, and expanding clinical applications towards early disease detection.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BUHLMANN Laboratories AG | 12-16% |

| Thermo Fisher Scientific | 10-14% |

| DiaSorin S.p.A. | 8-12% |

| Biohit Oyj | 6-10% |

| Roche Diagnostics | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| BUHLMANN Laboratories AG | Develops high-performance calprotectin ELISA and rapid test kits for IBD diagnosis. |

| Thermo Fisher Scientific | Specializes in automated calprotectin testing solutions for clinical laboratories. |

| DiaSorin S.p.A. | Offers advanced immunoassay-based calprotectin diagnostic tools for gastrointestinal diseases. |

| Biohit Oyj | Focuses on point-of-care calprotectin tests with enhanced accuracy and rapid results. |

| Roche Diagnostics | Provides integrated calprotectin biomarker analysis within its laboratory testing platforms. |

Key Company Insights

BUHLMANN Laboratories AG (12-16%)

BÜHLMANN leads in calprotectin testing solutions, offering high-sensitivity ELISA and point-of-care testing kits.

Thermo Fisher Scientific (10-14%)

Thermo Fisher specializes in automated calprotectin assays, improving efficiency in laboratory diagnostics.

DiaSorin S.p.A. (8-12%)

DiaSorin enhances its presence in the market with immunoassay-based calprotectin testing solutions for early disease detection.

Biohit Oyj (6-10%)

Biohit focuses on rapid and point-of-care calprotectin tests, making diagnosis more accessible and efficient.

Roche Diagnostics (4-8%)

Roche integrates calprotectin testing into its diagnostic platforms, streamlining analysis for gastrointestinal disorders.

Other Key Players (45-55% Combined)

Several diagnostic companies and biotech firms contribute to the expanding calprotectin testing market.

These include:

The overall market size for the Calprotectin Testing market was USD 225.9 Billion in 2025.

The Calprotectin Testing market is expected to reach USD 393.4 Billion in 2035.

The demand for calprotectin testing will be driven by increasing prevalence of inflammatory bowel diseases (IBD), rising awareness about early disease diagnosis, growing adoption of non-invasive diagnostic methods, and advancements in laboratory automation.

The top 5 countries driving the development of the Calprotectin Testing market are the USA, Germany, China, the UK, and Japan.

The ELISA-Based Calprotectin Testing segment is expected to command a significant share over the assessment period.

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.