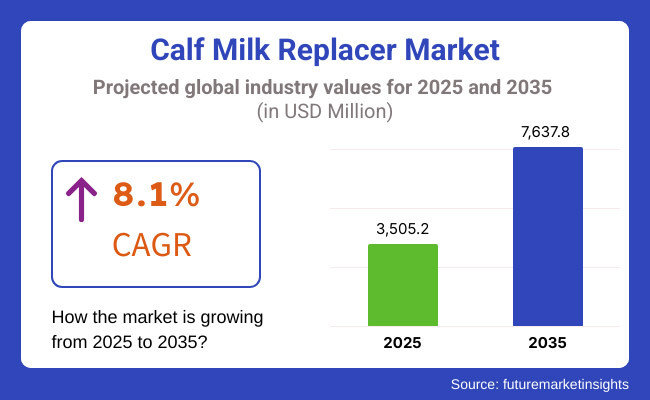

The global calf milk replacer market is projected to grow from USD 3,505.2 million in 2025 to USD 7,637.8 million by 2035, reflecting a CAGR of 8.1%, driven by increasing demand for nutrient-enriched formulations, rising dairy farm productivity, and advancements in animal nutrition solutions.

The worldwide calf milk replacer sector is expected to record substantial progress within the period 2025 to 2035, mainly due to the breakthroughs in nutritional science, the implementation of green farming practices, and the growing request for effective calf-rearing techniques. Calf milk replacers (CMRs) are at the forefront of today's dairy and beef farming, offering to young calves the needed nutrients when the natural milk is either not available or insufficient.

The market for CMR is affected by various factors like the increasing acceptance of early-life nutrition among farmers that leads to the adoption of specialized milk replacers which boosts calf health and productivity and the rise of whole milk prices and the need for cost-efficient feeding solutions. Besides, the growing trend of agriculture that is environmentally friendly is added as CMRs are produced to mitigate their ecological footprint.

At the moment, North America is dominant in the market, due to its long-established dairy sector and the application of modern calf-rearing techniques. Europe is the next in line, as countries there have animal welfare and quality nutrition as priority issues.

The Asia-Pacific area gives the impression of being a flourishing market because of the sharp increase of dairy farms and the subsequent gain of focus on animal health. Latin America and the Middle East & Africa are also seen as factors of the forecasted growth, which is propelled by the increase of livestock sectors and the introduction of better farming practices.

The manufacturers have turned to research and development to create innovative formulations which meet the latest consumer needs. Alongside the launch of instantized powders and liquid concentrates that go hand in hand with automated feeding systems, the industry takes a leap towards technological integration.

Cheap raw materials for the market and the need for farmers to be aware of the advantages of CMRs are some of the main problems but that is not the whole story. Those problems become chances for companies to get on with their value-added services like technical support and training programs. The animal welfare and organic farming practices' increase in trend also introduces spaces for premium, specialized products.

The market is mainly made of key players such as Land O’Lakes, Cargill, Nutreco, and Archer Daniels Midland (ADM) who maintain their positions through wide distribution and diverse product portfolios. They are extending their reach in terms of partnerships and acquisitions focusing on emerging markets and intent to enlarge the customer base. Local operators gain a similar advantage by providing suitable solutions tuned for local farming practices and preferences.

Over the coming years, the calf milk replacer market globally is set to remain in the upward flow based on the expansion of technology, the total shift to organic farms and the consequent demand for high-quality animal protein. Manufacturers who cherish innovation, flexibility, and cooperation with customers are bound to be the ones who will thrive in such a dynamic and creative setting.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H12024 | 7.7% (2024 to 2034) |

| H22024 | 8.3% (2024 to 2034) |

| H12025 | 7.9% (2025 to 2035) |

| H22025 | 8.5% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 7.7% in the first half (H1) of 2024 and then slightly faster at 8.3% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 7.9% in the first half of 2025 and continues to grow at 8.5% in the second half. The industry saw a decline of 35 basis points in the first half (H1 2025) and an increase of 46 basis points in the second half (H2 2025).

Focusing on Early Life Nutrition Precision to Ensure Further Feedlot Growth

Dairy farmers and farmers are increasingly focused on the nutrition strategies being developed to add value to the calf and milk industries by specter health, growth, and future milk yield. Scientific studies show that nutrition during the first month of life mainly determines the lifelong milk yield and reproduction thus creating a market for special milk replacers that have bioactive compounds, amino acids, and probiotics.

The manufacturers being actively involved in this development are presumably forms with other nutritional additives against flatulence and diarrhea from bad gut microbiota. The introduction of prebiotics, nucleotides and bovine colostrum extracts is emerging as a trustable sign of a premium product and thus their demand has surged.

Moreover, the use of tailored formulations for specific breeds of antioxidants, gut health and environmental conditions is also spreading. With the transition of dairy farmers toward better efficiency and sustainability, precision formulated calf milk replacers are emerging as a strategic investment in herd performance.

Transition from Skim Milk to Whey Protein Sources

The price of skim milk powder is undergoing fluctuations due to which calf feeding manufacturers are moving toward whey protein concentrates (WPCs), whey protein isolates (WPIs), and hydrolyzed whey proteins as other protein sources in calf milk replacers.

Cheese production by-products, especially whey, provide an inexpensive and excellent protein source with good digestibility for calves. Whey proteins have a better amino acid profile than skim milk; thus, they contribute more to muscle development and immune system function in young animals.

Furthermore, modern equipment allows companies to process the whey streams better, thereby creating healthier hydrolysates with low levels of allergens and high nutrient absorption rates. The shift also helps the calf milk replacer manufacturers by free lining of the reduced reliance on the unstable dairy fat market and increased supply chain sustainability. Consequently, it is becoming the norm for large dairy farms to use whey based replacers to get the nutritional benefits they want while at the same time reducing costs.

Expansion of Tailored Replacers for Beef over Dairy Calves

The nutritional needs of beef and dairy calves are different and as a result, producers are innovating specie-specific calf milk replacers. Dairy calves need to grow at a uniform pace while beef calves need a high-energy bulking diet to improve weight at the earliest possible time. Thus, beef calf replacers focus on an increased fat level (20-25%) and additional energy-dense ingredients such as MCT oils, starches, and soluble fibers.

Conversely, the dairy calf milk replacers are focused on the gut microbiome, immune system, and copious lactation potential emphasizing the use of functional additives like beta-glucans, probiotics, and yeast extracts. As the market differentiates itself, it is the infancy, neonatal and pre-weaning replacers ranging in growth stages that are also prioritized. The demand for custom formulations which not only suit specific species but the production goals too has risen significantly.

Fat Composition Specification and Use of Alternative Lipid Sources

The utilization of the alternative lipid sources in calf milk replacers is on the rise due to volatile milk fat prices and digestibility issues. Farmers are replacing their fat blends to facilitate weight gain of their livestock using structured triglycerides from palm oil, coconut oil, fish oil, and linseed oil, which directly translates to better energy density and absorption.

The use of palm fats, especially medium-chain triglycerides (MCTs), improves gut development and immune functions. Omega-3 fatty acids which are found in derivatives of fish oil promote a healthy brain and vision development in young calves. Moreover, the encasing of lipid-based technology has improved fat emulsifying power, which in return ensures a better nutrient dispersion and digestibility of liquid products.

The movement toward custom fat profiles is related to the transplant techniques in precision nutrition, which are aimed at promoting calf growth while concurrently stressing out less on metabolic processes. In a climate of disability pressure caused by the drop in efficiency, the adoption of fat formulations is becoming an industry standard.

Automated Calf Feeding Takes Off Liquid Replacer

Dairy farms have unveiled automatic calf feeders as a bugle of the advanced technology that hopes to ease the problems farmers face with the labour shortage. Liquid milk replacers are getting traction as they are characterized by instant solubility, low-foam properties, and stable dispersion of nutrients in the automated systems.

Established manipulations of fluids were not required in the traditional bucket-fed way but the new auto feeding needs the use of replacers with a specific stable viscosity, pH balanced formulations, and a reduced sedimentation rate. In this regard, the manufacturers are introducing pre-mixed liquid concentrates, instantized powder blends and so ensuring precision feeding without clogging or inconsistencies.

Automated calf feeders ensure greater efficiency of labour, calf health monitoring, and tracking feed intake thereby serving as an attractive solution for forward-thinking dairy farmers. The liquid replacers that are in step with the dairy automation are further fuelling the demand run due to shortage of manual labour and are expected to be the growth drivers in the latter half of the decade.

Consolidation to Dairy Sector and Regional Diversification in Manufacturing

A significant change in the dairy industry is the merger of companies which has a direct influence on the production of calf milk replacers and their location. The major dairy companies and feed manufacturers are moving towards a regional solution by creating production units in the main dairy areas like the USA. Midwest, Netherlands and China to cut logistics costs, and ensure supply security.

Furthermore, the local sourcing of ingredients has become a priority to cut down the reliance on imported dairy proteins and fats. This not only provides the manufacturers with an opportunity to adapt their formulations to the locally available ingredients but it also helps in meeting regulatory requirements.

This tactic also resolves the risks that are associated with trade barriers, dairy policy changes, and supply chain interruptions. The consolidation of the dairy sector leads to the agglomeration of the feed, milk production, and processing sectors, this will give rise to regional manufacturing which will redefine the competitive landscape of the calf milk replacer market.

Calf milk replacer market underwent continuous growth between 2020 and 2024 due to the increasing understanding of calf nutrition and the positive effects of milk replacers on calf development. This time was characterized by the evolution of the product formulations that turned into the center of attention with the characteristics of more digestibility and better nutrient profiles which will be able to cover the changing needs of dairy farmers.

Looking a little bit ahead, the market is estimated to keep going up in the years 2025 to 2035 due to the technological innovations and more and more emphasis being put on the production of non-medicated and sustainable products.

It is predicted that companies will give resources for Research and Development, additionally, introducing replacers that have been enriched with probiotics and prebiotics to promote calf health and improve their growth. Furthermore, the utilization of automated feeding systems in the future, besides the probiotic-rich formulations is expected to launch the invention of the liquid and instantized powder formulations being compatible.

The Global Calf Milk Replacer Markef, with Tier 1 companies taking up most of the market, is a market with moderate concentration as much as Tier 1 companies identify them. Tier 1 companies are the ones who have a global presence, who have formulated advanced products, and lastly, who have strong brand equity; the Tier 2 and Tier 3 companies are those who operate the region-specialized and cost-effective manufacturers.

Land O’Lakes, Cargill, Nutreco, ADM, and FrieslandCampina are all examples of Tier 1 players who cover a very large percentage of the market. These companies take advantage of their strong production facilities, their research and development investments, and their premium products offer to the commercial dairy farms around the world.

Their focus issues are mainly on the provision of precision nutrition, on the formulation of compatible automation, and on the drugs that are not included in the products, with the adoption of the industry of functional nutrition for calves. A number of the companies have added specific probiotics, fecal acids, and certain types of fat to their products for better digestion and hysteria. That said, their powerful distribution systems and collaboration with dairy cooperatives make them strong on the market.

Tier 2 posse-ups like, for instance, Nukamel, Volac, Calva Products, Honneur, and Bewital Agri operate at a regional level, specializing in high-performance, breed-specific milk replacers. They are focused on providing the most economical yet high-quality solutions; in particular, they are exploring unexplored dairy markets in Latin America, Asia, and Eastern Europe.

Some medium-sized enterprises are working on developing heat-stable products that are specific to tropical climates, as well as whey-based alternatives to help alleviate cost pressures. Moreover, their knowledge and know-how on adaptation to local conditions give them the upper hand.

In the Tier 3 players grouping of small-organized or unorganized manufacturers we have primarily small manufacturers of bulk, region-specific, and private-label products in price-sensitive markets. They are very essential to the small and medium dairy farms as they provide lower-cost substitutes to their product offerings.

However, their inability to carry out R&D and the fluctuating output limit their capability for global expansion. In spite of the Tier 1s and Tier 2s focusing mainly on product innovations and premiumization, Tier 3 players maintain the provision of the Market-Eco logic which guarantees sectorial accessibility.

The calf milk replacer market is expected to witness varying growth rates across key regions, with the United States growing at a CAGR of 3.3%, New Zealand at 6.3%, and Brazil at 5.5% from 2025 to 2035, driven by increasing demand for high-quality nutrition, advancements in dairy farming, and rising livestock productivity initiatives.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.3% |

| New Zealand | 6.3% |

| Brazil | 5.5% |

In the United States, major players like Land O'Lakes, Inc. and Cargill, Inc. are prioritizing the development of probiotics and prebiotics-enriched calf milk replacers. The basic concept is to facilitate the teaching of gut flora, to increase the power of immunity, and to absorb nutrients more efficaciously in calves.

The positive bacteria and soluble fibers intake, which are the very doors to a balanced intestinal microbiome, may thus diminish the prevalence of constipation and strengthen calves overall. On the other hand, such an approach can be viewed as a movement towards functional nutritional alternatives that offer solutions for health issues in calf rearing, beyond the basic requirement of nutrients, and the proactive health management.

New Zealand's dairy industry, which primarily consists of systems reliant on the use of pasture, has made it easier for Fonterra Co-operative Group as a manufacturer to develop calf milk replacers that would better suit natural grazing. These products' conception involves nutrient enrichment that pastures may lack, while this ensures good, development in young stocks.

One of the central issues is providing such supplements that comply with country's sustainable farming practices, alongside boosting the nutritional value of pasture-fed calves without any significant imported feed components. This practice also facilitates the natural feeding behavior of calves while fulfilling their dietary needs.

In Brazil, companies including Nutron Alimentos (a Cargill subsidiary) are concurring with the problems directly inflicted by the local tropical climate by tackling the problem through the release of heat-stable calf milk replacers. These formulations are made to make sure that once you open it, the product will smell and taste good and will not spoil in very high temperatures, no-off spoilage and can be consistently fed to the calves by users.

The especific processing, together with certain additives, is what passes on the quality to the milk replacers, and allows them to reach possible optimal specific growth rates even in regions where heat can affect the use efficiency of the feed. The positive side of this development is the fact it encourages optimal growth as well as health improvement in calves under the different conditions existing in Brazil.

| Segment | Value Share (2025) |

|---|---|

| Non-Medicated CMR (Product Type) | 60% |

The popularity of the non-medicated calf milk replacer (CMRs) is the result of a positive shift of the people trust in the natural way of adding immunity to calves rather than the use of antibiotics. The formulations include top-grade proteins, all the required vitamins, and added functional components, such as probiotics, prebiotics, essential fatty acids, and immune-boosting colostrum extracts, which will help gain gut health and improve disease resistance.

Environmental lawmakers, the worldwide regulation of antibiotics, and the desire for a greener world are forming a trifecta that is driving the innovations of the likes of Cargill, Nutreco, and Land O' Lakes. They are working with bioactive ingredients, enzyme-activated proteins, and yeast-derived immune enhancers, among other things.

With the introduction of tailored formulations for regional climates, as well as precision nutrition systems for automated feeders, a shift is evident. The transformation indicates the growing needs of dairy and beef farmers for effective, sustainable calf nutrition, reaching early-life resilience, good feed conversion, and long-term benefits without compromising animal health or milk production efficiency.

| Segment | Value Share (2025) |

|---|---|

| Commercial Dairy Farms (End User) | 65% |

The commercial dairy farms are seriously considering antifunctional calf milk replacers (CMRs) which have been precisely formulated in a way that would give an optimal growth rate, and shorter weaning times, and be effective in the whole milk production chain as well.

These operations are generally high structured due to the priority of the performance of the replacers at a high peak of digestible protein, energy-dense fats, and immune-supporting supplementation. Companies such as Land O’Lakes, Nutreco, and Glanbia sought to meet this trend by designing bespoke, breed-specific solutions, including whey protein concentrates for better absorption and structured fat blends for prolonged energy release.

Besides that, they now have a bigger concentration on automation, with the introduction of instantized powders and liquid-ready solutions. With the labor efficiency and cost-cutting still at the forefront, commercial dairy farms continue to push the boundaries of innovation in high-solubility, gut-friendly and performance-enhancing calf milk replacers leading to longer-lasting herds and more profitable dairies.

Key players such as Land O’Lakes, Cargill, and ADM Animal Nutrition have made the calf milk replacer market a competitive environment, with Land O’Lakes and other companies being the major contributors. They are introducing new features such as the formation of highly nutritious, customized products to meet the demands of dairy farmers, tend to their needs, and gain market share.

These strategies include developing non-medicated mixtures that are able to strengthen calf health instead of using antibiotics, which aligns with customers' choices about all-natural items. Besides that, manufacturers are putting money into R&D to counter with the implements of creative techniques like probiotics enriched replacers and precision diets.

An example of this can be seen in the addition of special digestive enhancers, which Land O’Lakes has introduced to its product range of milk replacers. Attention is given to the good quality of protein and the appropriate amount of fat found in Cargill's milk replacers. The aim of these products is to proper grow and keep the young livestock healthy. The moves made are but a testament to the initiative taken to conform to the consumers' trend and thus transcend the competition in the trade.

The global calf milk replacer market is expected to reach USD 7,637.8 million by 2035.

The market is projected to grow at a CAGR of 8.1% during the forecast period.

New Zealand (6.3%), Brazil (5.5%), and the United States (3.3%) are among the key countries experiencing notable market growth.

Medicated CMR, Non-Medicated CMR

Powder CMR, Liquid CMR

Direct Sales/B2B, Retail/B2C

Commercial Dairy Farms, Individual Farmers, Research & Academic Institutions

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

Korea Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Region Through 2035

Japan Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Region Through 2035

Yogurt And Probiotic Drink Market Analysis by Product Type, Source Type, and Region Through 2035

Korea Pectin Market Analysis by Product Type, Application, and Region Through 2035

Korea Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Japan Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.