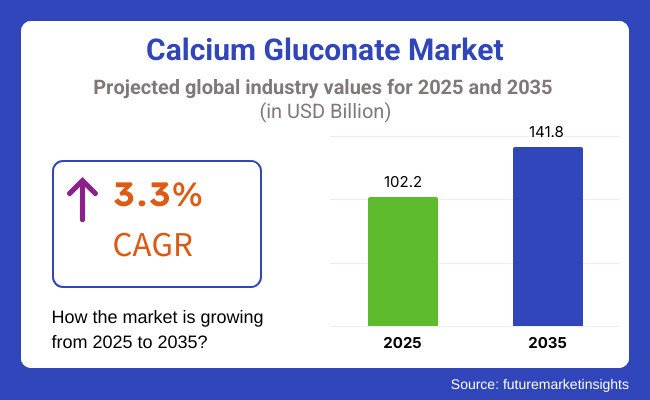

The global calcium gluconate market is set to experience USD 102.2 billion in 2025. The industry is poised to register 3.3% CAGR from 2025 to 2035, reaching USD 141.8 billion by 2035.

The industry growth can be attributed to the growing utilization of the product in pharmaceuticals, dietary supplements, and food fortification. Growing awareness about bone health, the increasing global geriatric population, and the rising trend of calcium deficiencies are major drivers for industry growth. Calcium gluconate is increasingly being used as an essential supplement in different industries as more focus and attention is given to preventive care.

The product is known for treating calcium deficiencies, increasing bone density, and preventing disease states, such as osteoporosis and hypocalcemia, and is commonly used in the pharmaceutical industry, notably in IV products for medicinal treatment of hypocalcemia, cardiac issues, and magnesium toxicity.

It is also one of the important calcium fortifiers in food that can fill the dietary calcium gap in infant and functional foods. Food and beverage manufacturers are including it in dairy foods, fortified beverages, and plant-based products as consumers gravitate toward clean-label and bioavailable sources of calcium.

The increasing demand for dietary supplements is one of the key factors driving the industry growth. The industry is booming, and the product’s demand, especially for bone health supplements, prenatal supplements, and geriatric nutrition, is set to contribute to the growth of the nutraceutical industry.

Furthermore, the rising trend of plant-based and vegan diets has further spurred the demand as the product provides a dairy-free alternative to traditional calcium sources. Furthermore, growing knowledge regarding the benefits of calcium consumption for overall health among consumers further promotes the adoption of fortified food and supplement products.

However, the industry faces some constraints despite accounting for favorable growth numbers. One of the major hurdles it deals with is promoting substitute sources of calcium, such as calcium carbonate and calcium citrate that make similar profits for perhaps far less cash.

Further, excessive calcium consumption has been associated with certain health concerns and has consequently been subject to regulatory scrutiny and consumer hesitation in certain markets. Moreover, the cost of pharmaceutical-grade product and strict regulatory permissions for its utilization in medical applications impede its large-scale utilization.

Emerging industry trends and opportunities include innovation in calcium gluconate products, which maximize bioavailability and absorption. For example, new technology, such as microencapsulation in supplement manufacturing, is helping improve the stability and efficacy of the product in functional foods and drinks.

As the demand for more vegan-friendly and sustainable supplements continues to grow, so do the prospects for plant-derived alternatives to the product. Greater investments are anticipated for research and development, making innovation reports, access, and efficiency for the product relatively better.

Explore FMI!

Book a free demo

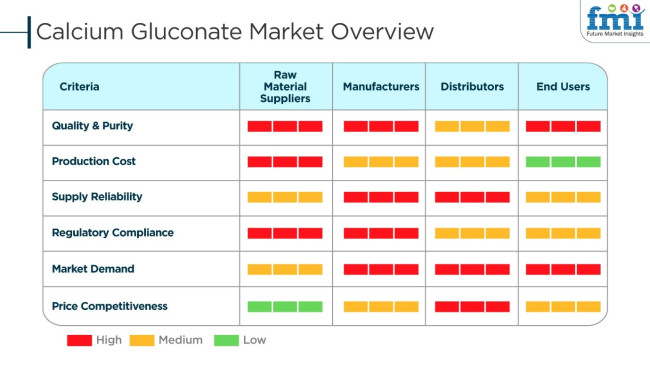

The industry is continuously growing with its diversified uses in pharmaceuticals, food & beverages, and nutraceuticals. Raw material providers emphasize high-quality gluconic acid and calcium carbonate sourcing, maintaining purity and following international safety standards. The manufacturers emphasize formulation efficacy, bioavailability, and medical and dietary supplement regulations.

Distributors focus on streamlined supply chains and low-cost logistics that cater to bulk purchasers and small consumers alike. End-users such as hospitals, pharmaceutical firms, and food manufacturers demand highly absorbent, safe, and certified product for uses in calcium supplementation, treatment of hypocalcemia, and food fortification.

Industry drivers are rising cases of calcium deficiency, expanding geriatric populations, and growing health-conscious eating habits. With rising disease occurrences, demand for fortified food, injectable calcium products, and animal feed supplements will drive manufacturers to invest in new formulations and green manufacturing processes for industry competitiveness.

This analysis highlights key shifts in industry performance, providing stakeholders with a clearer view of the growth trajectory. The first half of the year (H1) spans from January to June, while the second half (H2) includes July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.2% (2024 to 2034) |

| H2 2024 | 3.3% (2024 to 2034) |

| H1 2025 | 3.4% (2025 to 2035) |

| H2 2025 | 3.5% (2025 to 2035) |

The above table presents the expected CAGR for the global calcium gluconate industry over a semi-annual period spanning from 2024 to 2035. In H1 2024, the business is projected to grow at a CAGR of 3.2%, followed by a slight increase to 3.3% in H2 2024. Moving into 2025, the CAGR is expected to rise to 3.4% in H1 and maintain a steady increase to 3.5% in H2.

H1 2025, the industry witnessed an increase of 2 BPS, while in H2 2025, the industry observed a rise of 3 BPS, indicating a consistent upward trend. These variations suggest strong industry stability, driven by sustainable the product production initiatives, increasing demand for the product in pharmaceutical and functional food applications, and advancements in calcium-based medical treatments ensuring long-term productivity.

Increasing Demand for the Product in Pharmaceuticals and Healthcare

The growing need for calcium supplementation in medical treatments is a significant driver of the calcium gluconate market. It is widely used in intravenous therapies for hypocalcemia, cardiac support, and electrolyte balance regulation. The increasing incidence of osteoporosis, bone disorders, and calcium deficiencies, especially among the aging population and postmenopausal women, has led to a surge in prescription-based formulations.

Additionally, hospitals and emergency medical services are increasingly using intravenous calcium gluconate for treating magnesium sulfate toxicity, calcium channel blocker overdoses, and hyperkalemia. With the rising prevalence of chronic diseases and metabolic disorders, the demand for pharmaceutical-grade injections and supplements is expected to grow steadily.

The pharmaceutical industry’s ongoing research in calcium-based drug formulations is also expanding the use of the product in advanced medical applications. As healthcare awareness increases and governments promote preventive healthcare measures, the role of the product in therapeutic treatments will continue to expand, ensuring sustained industry growth over the next decade.

Expanding Applications in Functional Food, Beverages, and Nutraceuticals

The product is increasingly being integrated into functional foods, beverages, and dietary supplements, making it a key component in the nutraceutical industry. With rising consumer awareness about bone health, muscle function, and calcium absorption, food and beverage companies are fortifying products with the product to enhance their nutritional value.

The demand for calcium-fortified dairy products, plant-based milk, breakfast cereals, and protein-enriched beverages has significantly increased, particularly among health-conscious consumers, athletes, and aging individuals. Additionally, the vegan and plant-based nutrition movement has driven demand for non-dairy calcium sources, making the product a preferred fortification ingredient in soy, almond, and oat-based beverages.

In the sports nutrition segment, the product is gaining traction as a muscle recovery and electrolyte replenishment supplement. With more consumers opting for clean-label, functional foods and dietary supplements, the nutraceutical industry is expected to be a major growth avenue for the product.

Rising Use of The product in Agriculture and Animal Feed

The agricultural and animal feed industries are increasingly recognizing the importance of the product as a nutrient supplement for livestock and crop enhancement. Calcium is an essential mineral for plant growth, improving soil fertility, and ensuring higher crop yields. The addition of the product to fertilizers is helping improve plant nutrient uptake, making it a preferred choice for sustainable agriculture practices.

In animal nutrition, the product is widely used to prevent calcium deficiencies in livestock, poultry, and dairy cattle. It plays a crucial role in enhancing bone strength, milk production, and overall animal health, ensuring optimal growth and productivity. The increasing focus on high-quality animal feed formulations is driving demand for the product in livestock farming.

With global agricultural output expanding and sustainable farming initiatives gaining traction, the application of the product in agriculture and animal nutrition is expected to grow significantly, ensuring long-term industry stability.

From 2020 to 2024, the industry grew steadily due to expanding demand in the pharmaceutical, food fortification, and animal feed sectors. Increased awareness of calcium deficiency drove its use in dietary supplements, and food companies used it in fortified foods. The livestock sector also adopted the product as a low-cost nutritional supplement.

Yet, the disruptions in the supply chain due to the pandemic, geopolitical tensions, and volatile raw material prices resulted in price uncertainty and sourcing issues. By 2022, industry stability had increased as manufacturers began implementing sustainable manufacturing practices, bioavailability improvement, and supply chain optimization to address increasing demand.

Between 2025 and 2035, ingredient formulation advancements, biotechnological extraction, and sustainable production will define the industry. AI-based research will speed up the creation of high-absorption products, targeting aging populations and preventive healthcare markets.

Clean-label fortification will be the focus in the food sector, while pharmaceutical uses will grow with advances in injectable and bioactive calcium therapies. Improved global trade policies and digitalized supply chains will increase industry efficiency, driving continued growth.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand in pharmaceutical and nutraceutical industries for treatment of calcium deficiency | Growing applications in functional foods and beverages resulting from increasing consumer interest in bone health |

| Dominant application in injectable and oral calcium supplements | Growing usage in plant-based dairy alternative fortification and sports nutrition |

| North America and Europe as major markets with consistent demand | Aggressive industry growth in Asia-Pacific and Latin America fueled by increasing health consciousness |

| Moderate consumer knowledge of the advantages of the product | Enhanced educational promotions and advertising emphasizing its contribution to general well-being |

| Reliance on traditional sources of calcium for supplement manufacturing | Increased demand for organic and sustainable sources of calcium |

| Supply chain disruptions impacting raw material availability and price | Enhanced supply chain resilience through diversified sourcing and enhanced production efficiency |

| Regulatory emphasis on product safety and pharmaceutical-grade quality | Tighter compliance requirements and greater scrutiny on ingredient transparency and sustainability |

The sector is subject to a number of main promoters and these consist raw of material availability, regulatory compliance, production costs, supply chain disruptions, and industry competition.

The availability of raw materials is quite crucial here because the product mainly comes from calcium carbonate and gluconic acid. The amount of the raw materials which is supplied or their large fluctuation in prices due to political differences, mining rules, agricultural factors can negatively affect the production and therefore the price.

Apart from that, compliance with regulatory requirements is a problem especially in medical, food, and nutraceuticals applications. Various firms such as FDA, EMA, and EFSA which regulate the production of intravenous (IV) solutions use high-quality and safety standards for the product, supplements, and fortified foods. Non-compliance with the regulations is subject to product recalls, court orders, and industry restrictions.

Production expenses encompass energy consumption, labor costs, advanced purification processes, and other profitability drivers. Investment in cost-effective production methods, which should be complemented by high-level product purity and quality, are a must for the manufacturers.

Supply chain disturbances such as logistics delays, transportation costs, and import-export restrictions pose global manufacturers and distributors with a plethora of problems. The risks can be minimized through establishing regional production plants and fostering strong supplier relations.

In recent years, industry competition has been on the rise with a good number of traders selling both synthetic and organic calcium supplements. The industry in the dietary supplement field is hindered by alternative calcium types like calcium citrate and calcium carbonate that are replaced with gluconate. Strengthening a brand and product differentiation are the two basic principles to maintain a strong presence in the industry.

The product, which is pharmaceutical-grade, is widely used as it plays a vital role in treating calcium deficiencies, restoring electrolyte levels, and addressing urgent medical needs. A high-purity, medically recognized compound, it has been used extensively in intravenous (IV) calcium therapy, treatments of calcium channel blocker overdoses, and electrolyte replenishment solutions. With the incidence of osteoporosis, hypocalcaemia, and metabolic bone disorders rising, adoption in hospitals and clinical settings has continued to grow.

Moreover, calcium gluconate intravenous is widely given to dialysis, critical care, and surgical patients, and it is expected to boost the industry during the forecast period. The expansion of calcium gluconate-based injections and oral supplements is driven by the geriatric population and the rising incidence of cardiovascular diseases. Some of the key players operating in the segment include Fresenius Kabi, American Regent, and Hikma Pharmaceuticals, among others.

Powdered calcium gluconate is seeing robust demand due to its high solubility, easy formulation, and rapid absorption. It will comparatively hold a greater share due to the major end-use sector of pharmaceuticals, where this compound is widely used in tablet formulations, IV therapies, or electrolyte supplementation to manage cardiovascular, nervous, and muscular disorders, which include osteoporosis, hypocalcemia, and bone-related disorders among others.

The increasing incidence of calcium nutrient deficiencies, especially in aging populations in North America and Europe, has further secured calcium's place as a favored pharmaceutical excipient.

The principal use of the product is in the pharmaceutical sector, mainly for medical purposes in the treatment of calcium deficiency. The product in its drug form is widely applied in hospitals and clinics, where it is intravenously administered to cure diseases like hypocalcemia, osteoporosis, and muscle cramps due to low calcium levels.

It is regarded as an extremely effective means of rapidly increasing blood calcium levels, and therefore it is imperative in medical and emergency situations. The purity and safety standards needed for pharmaceutical-grade calcium gluconate make it safe to be used effectively and without harm in such situations.

The principal end-application of the product is in the form of a pharmaceutical agent, i.e., in the treatment of calcium deficiency and associated medical conditions. The product is extensively used in hospitals and healthcare institutions, where it is intravenously administered to patients with conditions such as hypocalcemia, osteoporosis, and muscle cramps resulting from calcium deficiencies.

In all these clinical uses, the product acts to immediately reestablish blood levels of calcium for the smooth performance of muscles, nerves, and bones. Its purity and pharmaceutical-grade safety have made pharmaceutical-grade calcium gluconate a therapeutic agent that plays a central role in the healthcare industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.5% |

| Canada | 4.2% |

| India | 5.1% |

| Japan | 3.9% |

The USA is one of the largest markets, underpinned by advances in the pharmaceutical, nutraceutical, and functional foods sectors. Pharmaceutical-grade calcium gluconate demand continues to increase as medical practitioners emphasize its application in intravenous calcium treatment, electrolyte-balancing medication, and treatment of osteoporosis. Doctors increasingly prescribe calcium supplements as the population ages and bone diseases rise.

The USA dietary supplement industry has grown remarkably, with consumer interest in bone health, muscle recovery, and cardiovascular health. The product finds widespread application in fortified milk, plant-based drinks, and protein-fortified foods. Moreover, continuous research and development activities are improving the bioavailability of calcium products to help them get absorbed by the human body more effectively. FMI believes the USA industry will expand at 4.8% CAGR throughout the study period.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| Pharmaceutical Applications | Used in intravenous calcium infusions and electrolyte balance solutions. |

| Growing Nutraceuticals | Growing consumer demand for calcium supplements and functional foods. |

| Aging Population | A large amount of osteoporosis and bone issues trigger consumption. |

| Fortification in Functional Foods | The product is used in plant-based beverages and protein-fortified foods. |

The UK industry continues to grow as demand from the pharmaceutical, diet supplement, and functional food markets remains high. The product is a precious drug ingredient in medicine therapies, especially for calcium deficiency diseases and cardiovascular health. Doctors actively prescribe calcium supplementation, which supports increased product consumption.

Increasing consumption of fortified food in the UK also helped boost the industry. Both dairy and non-dairy food companies introduce the product into their foods to fulfill consumer demands regarding superior nutrition. Governmental initiatives also support food fortification initiatives, improving access to calcium-fortified foodstuffs. As estimated by FMI states that the UK industry will grow at a 4.5% CAGR during the study period.

Growth Drivers in the UK

| Key Drivers | Information |

|---|---|

| Medical Applications | Used in treating calcium deficiency and cardiovascular conditions. |

| Functional Foods Expansion | Fortification of milk and milk substitutes at a higher rate. |

| Government Initiatives | Rules promote food fortification schemes to reach optimal levels of nutrients. |

| Higher Supplement Intake | Consumers turn to dietary supplements with calcium for bone activity. |

The Canadian industry is growing with increased pharmaceutical and functional food demand. Calcium gluconate is widely used in dietary supplements because people prefer bone and muscle function. Moreover, growing awareness for the prevention of osteoporosis has led to wider use of calcium-based products.

The Canadian food sector has accepted calcium gluconate in fortified foods and milk beverages to provide additional nutritional benefits. Bioavailable calcium products are also highlighted in research in the country so that they can gain effective absorption. Environmental conservation through agronomic practices with sustainability also provides adequate raw materials for production at high-quality levels. FMI believes the Canadian industry will reach 4.2% CAGR growth during the forecast period.

Growth Drivers in Canada

| Key Drivers | Information |

|---|---|

| Increased Consumption of Supplements | The product is found to be extensively used in dietary supplements. |

| Fortification of Functional Food | Added to milk and fortified beverages for nutritional enrichment. |

| Research on Bioavailability | Attempts to improve calcium absorption drive innovation. |

| Sustainable Source of Ingredients | Emphasis on eco-friendly processes guarantees a stable supply. |

India's industry is growing fast, with pharmaceutical, nutraceutical, and food applications becoming increasingly popular. The healthcare industry depends on the product for intravenous use, especially in hospitals that deal with calcium deficiency. The dietary supplement industry is also growing, with health-conscious consumers demanding products for bone health and overall well-being.

India's food industry increasingly uses the product in fortified foods, drinks, and supplements. Government policies favoring food fortification programs and sustainable farming still support the supply chain. FMI predicted that India's industry will grow at a 5.1% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Greater Pharmaceutical Applications | Applied in intravenous infusions to correct calcium deficiency. |

| Greater Fortified Foods | Fortification of cereals and drinks increases nutritional content. |

| Government Support | Public health programs promote food fortification programs. |

| Increased Health Awareness | Consumers look for dietary supplements to enhance bone strength. |

The Japanese industry is stable due to the support of demand for pharmaceutical, food, and nutraceutical applications. The pharmaceutical industry uses the product as a medical treatment, and the food industry adds it to functional drinks and dietary supplements. Increased demand for fortified foods has also increased product consumption.

Japan has depended on importing the product, especially from Australia and Canada, to meet industrial demand. Improved processing technology has improved the contents of calcium-enriched products with superior absorption rates. FMI expects Japan's calcium gluconate market to register a 3.9% CAGR over the forecast period.

Growth Drivers in Japan

| Key Drivers | Information |

|---|---|

| Pharmaceutical Application | Applied in medicinal use in calcium balance. |

| Functional Food Growth | Enhanced use in fortified beverages and supplements. |

| Import Dependence | Australia and Canada are major suppliers. |

| Sophisticated Processing Technologies | Innovations maximize foods' calcium bioavailability. |

The calcium gluconate market is moderately consolidated and majorly focused by players on pharmaceutical-grade formulations, nutraceutical applications, and fortifications in foods. Further industry growth is progressive through an increasing demand for bioavailable calcium supplements, IV-grade calcium gluconate, and fortified food and beverage products.

Such companies include BASF SE, Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc, and Roquette Frères, which have all exercised the advanced manufacturing process with strict quality control and well-established distribution channels for a competitive edge. They invest in sustainable calcium sourcing, new formulation techniques, and regulatory compliance to design their products differently.

The entrance of startups and niche manufacturers into the industry brings calcium delivery systems evolving with innovative plant-based alternatives, high-purity pharmaceutical solutions, and much more.

Furthermore, advancements in biotechnology along with mineral absorption enhancement will lead to a charged competitive landscape, thus allowing companies to cater to changing consumer and medical industry needs. Companies with a strong focus on research-driven product development, strategic partnerships, and compliance with worldwide safety standards will retain a strong position in the ever-growing industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| BASF SE | 20-25% |

| Koninklijke DSM N.V. | 15-20% |

| Jungbunzlauer Suisse AG | 10-15% |

| GlaxoSmithKline plc | 8-12% |

| Global Calcium Pvt Ltd | 5-8% |

| Other Players (Combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops high-purity pharmaceutical and food-grade calcium gluconate, emphasizing innovation in bioavailability and sustainability. |

| Koninklijke DSM N.V. | Focuses on nutraceutical formulations with scientifically backed calcium fortification for dietary supplements and functional foods. |

| Jungbunzlauer Suisse AG | Supplies the product for pharmaceutical and food applications, leveraging expertise in organic acid-based solutions. |

| GlaxoSmithKline plc | Provides calcium gluconate-based OTC and prescription supplements with a strong presence in medical and consumer healthcare. |

| Global Calcium Pvt Ltd | Specializes in calcium salts for pharmaceutical, veterinary, and food applications, focusing on global supply chain expansion. |

Key Company Insights

BASF SE: 20-25%

BASF SE is a leader not only in the production of high-purity calcium gluconate but also in molding the footprints of future sustainable and innovative drug and food applications.

Koninklijke DSM N.V.: 15-20%

Enhances its portfolio as a nutraceutical player by supplying clinically substantiated bioavailable calcium formulations.

Jungbunzlauer Suisse AG: 10-15%

Uses its know-how in organic acid-based solutions to supply a high-quality calcium gluconate product for pharmaceutical and food purposes.

GlaxoSmithKline plc: 8-12%

A giant in consumer health care, it offers OTC and prescription-grade calcium gluconate supplements.

Global Calcium Pvt Ltd: 5-8%

Extends its offerings on calcium salts for the pharmaceutical and veterinary industries and also works on improving its global distribution network.

Other Key Players (15-25% Combined)

The industry is slated to reach USD 102.2 billion in 2025.

The industry is predicted to reach USD 141.8 billion by 2035.

India, slated to grow at 5.1% CAGR from 2025 to 2035, is poised to observe fastest growth.

Key companies include BASF SE, Koninklijke DSM N.V., Jungbunzlauer Suisse AG, GlaxoSmithKline plc, Global Calcium Pvt Ltd, Amano Enzyme Inc., Anmol Chemicals, Jost Chemical Co., SRL Pharma, and Nutrichem Co. Ltd.

Pharmaceutical-grade product is being widely used.

By grade, the industry is segmented into pharmaceutical and food.

The industry is segmented by form into powder, gum, and liquid.

The industry is segmented by application into oral liquid, pharmaceutical, tablets, food additive nutraceuticals, and food and beverage.

The industry is segmented by end-use into bulk agent, emulsifier, and thinning agent.

The industry is segmented by region into North America, Latin America, Asia Pacific, the Middle East & Africa, and Europe.

Cheese Analogue Market Insights - Growth & Demand Analysis 2025 to 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.