Growth of market for cacao beans between 2025 to 2035 in The region will be continuously propelled by increasing demand for chocolate products in the world, increasing consumer awareness towards the consumption of organic and fair-trade cacao and increase of usage of cacao in different food and cosmetic industry, which in turn should drive the growth of similar market.

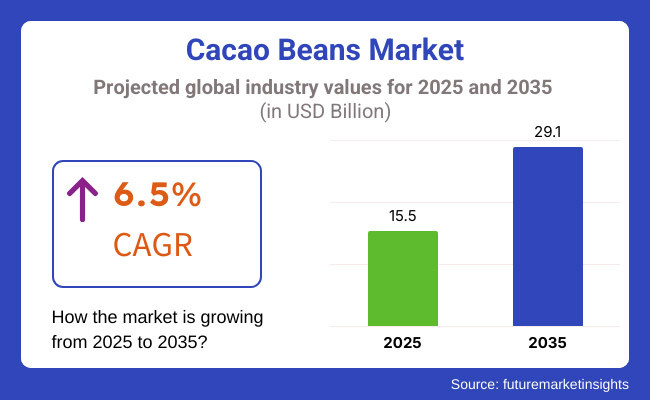

The market is expected to grow at a CAGR of 6.5 % with a market value of USD 15.5 Billion in 2025 and USD 29.1 Billion in 2035. The market growth is primarily driven by increasing demand for premium and artisanal chocolate along with quality cacao beans.

In addition, increasing awareness regarding the health benefits associated with consumption of cacao such as the high levels of antioxidants it contains and potential to support cardiovascular health are leading to a rise in demand for cacao-based health and wellness products. Potential such as climate change, volatile commodity prices as well as ethics around sourcing will also affect market dynamics. The world's most innovative chocolate brands are leading the way in cacao sustainability, supply chain transparency, and organic certification.

Explore FMI!

Book a free demo

North America is a significant market for cacao beans due to high chocolate product demand and increasing consumer preference for organic and ethically sourced cacao. Single-origin and fair-trade cacao beans are gaining traction in the United States and Canada backed by sustainability initiatives undertaken by large chocolate brands. Also, the increasing inclination towards plant-based and functional food markets promote the sale of cacao-based nutritional products.

Europe is also one of the largest consumers of cacao beans, with Switzerland, Belgium, and Germany taking up leading ranks for production and consumption of chocolate. The region’s emphasis on sustainability and fair trade is increasing demand for cacao sourced responsibly. The stricter food safety rules as set by the European Union are also rapidly transforming market dynamics to favour the use of high-quality and organic cacao types. This is for the ever-growing demand for premium and craft chocolate brands; both let the market grow steadily.

The Asia-Pacific region will probably see fast growth in the cacao beans market due to rising consumption of chocolate in China, Japan, and India. Enabling factors such as the increase in respective consumer spending and changes in consumer behaviour which incline Indian's towards international inspired confectionery are fuelling the market growth. And the increase in cacao-based health supplements and cosmetic products popularity is opening up new market opportunities.

Challenge: Climate Change and Sustainability Concerns

Climate change is one of the biggest challenges threatening the cacao beans market impact due to changes in rainfall decreasing cocoa production and increasing the risk of crop diseases. There are also concerns over deforestation and labour exploitation in cacao-growing regions, with some calling for stricter sustainability practices. Combatting these problems will involve investments in climate-resilient agriculture, agroforestry practices and ethical sourcing campaigns.

Opportunity: Growth of Organic and Functional Cacao Products

Highly profitable growth opportunities continue to emerge as demand grows for organic, fair-trade and functional cacao products. There is increasing awareness among consumers about the health benefits of raw cacao, resulting in increased demand for cacao-based superfoods, protein bars, and dietary supplements. In that regard, cacao butter and cacao extracts to a lesser extent are also gaining traction in the beauty and personal care industry for their antioxidant and moisturizing qualities. With wellness and sustainability trends rapidly changing the landscape of consumer preferences, the market for premium cacao beans of the highest quality is poised for unprecedented growth over the next ten years.

Not only due to increase in demand for good quality chocolate chasing through around the world, Cacao Beans Market was high but also due to the development sustainable and natural cocoa farming and the interest of origin and hand-made chocolate. As consumers became more aware of sustainable sourcing, ethical labour practices and diversity of flavor, demand for organic, fair-trade and heirloom cacao varieties grew. This growth rate was also supported by the rise in the number of bean-to-bar chocolate brands, cacao-based items, as well as plant-based and functional foods with cacao added.

Skip forward to 2025 to 2035 when the market moves even more toward eco-friendly, sustainable practices and also AI-led smart farms, cacao strains resistant to climate change, and block chain-empowered traceability. As we shift towards carbon-neutral cacao production, agri-forestry-based plantations and regenerative farming, sustainability will continue to improve. Developments in bioengineered cacao, lab-cultured cocoa fats and alternative fermentation techniques of cacao will allow yields and flavor profiles to arrive more consistently. AI driven market analytics, smart irrigation systems, and gene breeding initiatives to breed disease resistant cacao plants are just some of the initiatives that will disrupt the industry. Novel cacao-augmented functional foods eg, tailored chocolate formulations and the plant-derived synthetic cocoa substitute will expand consumer choice.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fair-trade certifications, organic farming standards, and sustainable cocoa sourcing initiatives. |

| Cacao Farming & Sustainability | Rising demand for organic, shade-grown, and ethically sourced cacao. |

| Consumer Preferences | Growth in single-origin, bean-to-bar, and artisanal chocolate consumption. |

| Industry Adoption | Expansion of premium cacao farming, smallholder cooperative support, and sustainable trade policies. |

| Market Competition | Dominated by traditional chocolate manufacturers, fair-trade cacao brands, and artisanal chocolatiers. |

| Market Growth Drivers | Growth fuelled by ethical sourcing, plant-based chocolate alternatives, and demand for rich flavor profiles. |

| Sustainability and Environmental Impact | Early adoption of deforestation-free sourcing, carbon footprint reduction, and agroforestry integration. |

| Integration of AI & Smart Agriculture | Limited AI use in cacao disease detection and yield forecasting. |

| Advancements in Processing & Manufacturing | Standard fermentation, roasting, and traditional chocolate processing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter deforestation-free cacao regulations, carbon-neutral certification, and AI-driven supply chain transparency. |

| Cacao Farming & Sustainability | Large-scale adoption of regenerative cacao farming, climate-resilient cacao strains, and AI-assisted pest management. |

| Consumer Preferences | Increased demand for personalized chocolate blends, AI-optimized flavor profiling, and functional cacao-infused health foods. |

| Industry Adoption | Widespread integration of block chain-based cacao traceability, carbon-positive cacao plantations, and smart irrigation technology. |

| Market Competition | Increased competition from lab-grown cacao start-ups, AI-driven taste customization firms, and climate-resilient cocoa innovators. |

| Market Growth Drivers | Expansion driven by synthetic cocoa fats, AI-powered cacao breeding, and carbon-conscious chocolate brands. |

| Sustainability and Environmental Impact | Large-scale implementation of AI-driven cacao yield optimization, waste-free cacao processing, and biodegradable packaging. |

| Integration of AI & Smart Agriculture | AI-powered real-time soil analysis, precision cacao breeding, and automated quality assessment for fermentation. |

| Advancements in Processing & Manufacturing | Evolution of lab-grown cacao fats, 3D-printed cocoa-based products, and AI-enhanced fermentation for flavor consistency. |

The USA is one of the most significant markets for cacao beans globally, owing to rising consumer preference for premium and organic chocolate, a better health awareness of cacao and its nourishing elements, and the growing trend of craft chocolate production. This is further driving the growth of the market, particularly as sustainable sourcing practices and Fair Trade-certified cacao are being increasingly adopted.

The scope of application of cacao is also growing in functional foods, dietary supplements, and plant-based beverages. Large chocolate makers and expanding direct-trade investments with cacao-producing nations are helping to define the industry's landscape. There is also a trend towards bean-to-bar chocolate production, which is changing market dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The UK cacao beans market is leveraging growth on the back of rising demand for dark chocolate, growing preference for ethically sourced cacao, and growing popularity of luxury chocolate brands. Growth in organic and Fair Trade chocolate category is further driving the market demand.

Plus, cacao’s health aspects they know the antioxidant benefits as well as mood enhancements and popularity in health and wellness products is rising. Market growth is also further accelerated by the introduction of dairy-free and plant-based chocolate alternatives in UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

The EU's cacao beans industry is being aided by high-quality chocolate production and a rising customer need for premium chocolates. Germany, France, and Belgium have been leading the industry in the region. The EU’s strict policies governing deforestation-free supply chains and ethical labour practices are driving more people to choose cacao beans sourced responsibly.

Meanwhile, the growing interest in single-origin chocolate and bean-to-bar production is creating direct-trade links between European chocolate manufacturers and cacao-producing countries. Market Growth is also driven by growing demand for cacao-based functional foods and superfoods in EU.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.4% |

The market for cacao beans in Japan is growing, aided by rising consumer interest to buy premium and high-cocoa-content chocolates in the region, increasing awareness of the health benefits of cacao, and the demand for unique and exotic flavours of cacao. The nation’s taste for low-sugar and dark chocolate options is influencing market trends.

Moreover, the growing number of specialty chocolate boutiques and increased direct trade relationships with cacao farmers are fuelling demand for premium beans. Japan's confectionery industry is incorporating cacao into innovative products from match-infused chocolates to fermented cacao-based snacks which helps create even more opportunities in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The growing interest towards premium or artisanal chocolates, demand for functional cacao, and an increasing number of boutique chocolate makers make South Korea an important market for cacao beans. And the burgeoning interest in single-origin cacao and ethically sourced beans is driving direct-trade agreements with cacao-producing nations.

Moreover, the growing interest in cacao for beauty and wellness has led to its incorporation into various cosmetic formulations and dietary supplements, promising further growth opportunities. The growing presence of online stores and selective chocolate shops is further increasing consumer access to premium quality cacao-based products, thus contributing to steady market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

The Cacao Beans Market is primarily bifurcated based on bean type segment, where the Forastero and Criollo segment, holds a significant share in the Cacao Beans Market as most of the chocolate manufacturers and specialty food producers are striving for high-quality and high-yield cacao beans for various applications. These bean varieties guide flavor profiles, optimize production efficiency, and target specific consumer segments. As the demand for premium chocolates and organic cacao-based products rises, Forastero and Criollo beans are increasingly adopted across the food and beverage industry worldwide.

They are a very common bean because they were readily adapted to local conditions, had a good flavor, high yield potential, and were disease-resistant. Unlike more delicate cacao varieties, Forastero beans provide consistency and are used for mass chocolate supplies and industrial purposes.

With an increasing demand for low-cost and long-lasting cacao varieties, particularly in the large-scale confectionary manufacturing, it has propelled market adoption. According to some studies, Forastero beans make up 70% of global cacao production thanks to their resilience, productivity, and how easily they can be processed into cocoa powder and cocoa butter.

All of this development, including the introduction of high-performance Forastero bean cultivars with increased genetic resistance, improved post-harvest processing, and more efficient fermentation methods has brought market demand to new heights with greater consistency across chocolate production.

The adoption has been further propelled by AI-powered agro-techs leveraging climate-adaptive cocoa farming, automated pest health monitoring, and real-time soil nutrient assessment that guarantee yield stabilization and cost-effective production.

Particularly significant is the development of second-generation Forastero hybrids with improved flavor complexity and less bitterness, along with improved fat composition to optimise for broader market growth and appeal in premium chocolate and gourmet cocoa chocolate blends.

Alongside organic certification programs, agroforestry integration, and a zero-waste cacao processing model, the adoption of sustainable Forastero farming techniques has forged market expansion and compliance with global sustainability standards and ethical sourcing initiatives.

However, numerous obstacles exist, despite advantageous high yield, disease resistance and processing efficiency characteristics, the Forastero segment struggles with between flavor standardisation issues, a lack of demand from high-end chocolate markets and few being labelled as specialty cacao. Recent innovations in AI-powered fermentation optimization, terroir-specific flavor profiling, and carbon-neutral cacao cultivation are enhancing quality differentiation, sustainability, and industry adoption, positioning the Forastero bean for continued growth across the global market.

On the one hand, Criollo fat beans remain largely responsible for nearly a 60% share of the Cacao Beans Market with their superior complex favors as well as low bitterness and high values in gourmet chocolate production. In contrast, Criollo beans are less pungent and more floral, fruity, and aromatic than Forastero beans, which makes them popular among artisanal chocolatiers and elite confectionery products.

The adoption is fuelled by the increasing demand for premium and single-origin chocolates, especially from luxury confectionery and organic cacao segments. Studies show that Criollo beans account for less than 5% of global cacao production due to lower, but rarer varieties, which are also more sensitive to environmental stress conditions.

The planting of these exclusive Criollo cacao plantations, which include biodynamic farming practices and emphasis on heirloom varieties, along with evolved processing methodologies based on terroir, were reinforced by market demand to support higher value gourmet and craft chocolate.

The use of precision fermentation methods, with AI-assisted microbial selection, controlled temperature processing, and denatured aging for greater complexity, combined with the above, have only served to accelerate their adoption, with optimal flavor development and product differentiation built in.

Hybrid Criollo-Forastero cultivars that exhibit better disease resistance, higher yields, and complexities of aroma have their applications for maximizing market growth where affordability and sustainability drive forms of premium chocolate.

By incorporating ethical labour practices with Creole direct trade sourcing programs and fair-trade partnerships are helping build the market for small-batch fermentation, and making inroads with brands committed to sustainability and consumers looking for a coffee with a story.

However, its typical low yields, disease susceptibility, and high production costs hinder the Criollo segment due to the trade-off between flavor richness, luxury market positioning, and genetic wealth. But emerging innovations in AI-enabled cacao genome mapping, controlled-environment Criollo farming, and block chain-based supply chain transparency will lead to improved needs-based cultivation, quality assurance, and access to market, continuing expansion for Criollo beans around the planet.

food manufacturers, chocolatiers, and beverage producers are incorporating cacao-based ingredients to enhance flavor, texture, and nutritional appeal; hence, the food and beverages and bakery & confectionery segments account for the majority share in the cacao beans market. applications in different segments cop the doomsday and other world exterminators reshaped the cocoa processing machine industry is driven by applications but its trend is extremely adjusted in various segments.

Food and Beverage Sector Expands as Cacao-Based Ingredients Gain Popularity in Functional and Gourmet Products

This segment has witnessed strong market adoption owing to the rise in the application of cacao-based extracts in dairy products, protein bars, plant-based substitutes, and specialty beverages. Modern food and beverage developments targeting cacao are founded on offering both pleasure and health, quite different than applications which rely solely on chocolate.

Adoption is being propelled by growing demand for antioxidant-rich and flavonoid-enhanced cacao ingredients, especially in functional food categories and superfood blends. Studies show that more than 60% health-aware consumers choose cacao-infused snacks, beverages and dietary sports supplements due to their presumed cognitive and cardiovascular advantages.

Moreover, cacao infused beverage innovations including cold-brew cacao, cocoa protein shakes and artisanal cacao tea have expanded their market while fortifying market demand ensuring diversified products in this beverage sector.

And yet, despite its functional food potential, increasing consumer interest, and nutritional value, the food & beverage industry faces challenges like fluctuating cacao prices from supply chain disruptions, and regulatory compliance for health claims. But, novel solutions around AI-enabled cacao content standardization, fermentation optimizations to maintain flavonoids and sustainable fair-trade cacao supply are improving market access for cacao trades, enhancing consumer trust and accelerating industrial adoption that will guarantee the growth of cacao within the worldwide food & beverage ecosystem going forward.

Bakery and confectionery is another consumer application for raw cacao that continues to see solid market growth as premium chocolate brands, pastry chefs, and commercial bakeries seek high-quality cacao ingredients for their various applications. Bakery and confectionery applications demand finely processed cacao with the best texture, melt behaviour, and flavor consistency, unlike general food and beverage uses.

Adoption has been driven by the growing demand for single-origin and craft chocolate ingredients, especially in artisan bakeries and gourmet dessert formulations. Research shows that more than 70% of specialty chocolate offerings use high-quality cacao to develop the best possible mouthfeel, texture, and flavor potency.

Bakery & Confectionery segment has their own set of challenges such as raw material price fluctuation, high competition from alternative ingredient, and sustainability issues despite its advantages in gourmet positioning, enhanced sensory attributes, and strong consumer appeal. But novel innovations like AI-enhanced cacao taste profiling, low-temperature cinching, and waste-free cacao processing are making manufacturing process more efficient, products consistent, and sustainable processing, leading to promising growth for cacao in bakery and confectionery sector across the globe.

The Cacao Beans Market will be fuelled by rising global demand for high-quality chocolate, increasing interest in sustainable and organic cacao farming, and growing applications in confectionery, cosmetics, and beverage industries. Processing technologies have matured, fair-trade initiatives have taken off and the market is growing steadily. Some of the other trends that are shaping the industry today are direct trade sourcing of the beans, bean-to-bar chocolate; and growing investment in agroforestry practices.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Barry Callebaut | 12-16% |

| Cargill, Inc. | 10-14% |

| Olam International | 8-12% |

| ECOM Agroindustrial Corp. | 6-10% |

| Touton S.A. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Barry Callebaut | Develops high-quality cacao bean sourcing programs with sustainability initiatives. |

| Cargill, Inc. | Specializes in direct-trade and fair-trade cacao sourcing for chocolate and food applications. |

| Olam International | Focuses on traceable and certified cacao bean supply chains for premium chocolate manufacturers. |

| ECOM Agroindustrial Corp. | Supplies ethically sourced cacao beans with investment in smallholder farming communities. |

| Touton S.A. | Provides high-quality raw cacao beans with a strong focus on agroforestry and sustainability. |

Key Company Insights

Barry Callebaut (12-16%)

Barry Callebaut leads in sustainable cacao bean sourcing, with a strong presence in bean-to-bar chocolate manufacturing.

Cargill, Inc. (10-14%)

Cargill specializes in direct-trade cacao, focusing on transparency and fair-trade initiatives to support global chocolate production.

Olam International (8-12%)

Olam is a key player in traceable cacao supply chains, providing high-quality beans for premium and artisanal chocolate brands.

ECOM Agroindustrial Corp. (6-10%)

ECOM focuses on ethical cacao sourcing, investing in smallholder farming and sustainability programs.

Touton S.A. (4-8%)

Touton contributes to the market with agroforestry-focused cacao bean production, supporting eco-friendly chocolate manufacturing.

Other Key Players (45-55% Combined)

Several cacao bean suppliers and processing companies contribute to the expanding market. These include:

The overall market size for the Cacao Beans market was USD 15.5 Billion in 2025.

The Cacao Beans market is expected to reach USD 29.1 Billion in 2035.

The demand for cacao beans will be driven by the increasing consumption of chocolate and confectionery products, rising demand for organic and sustainably sourced cacao, expanding applications in cosmetics and pharmaceuticals, and growing consumer preference for premium and artisanal chocolate.

The top 5 countries driving the development of the Cacao Beans market are Ivory Coast, Ghana, Indonesia, Brazil, and Ecuador.

The Forastero Cacao Beans segment is expected to command a significant share over the assessment period.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.