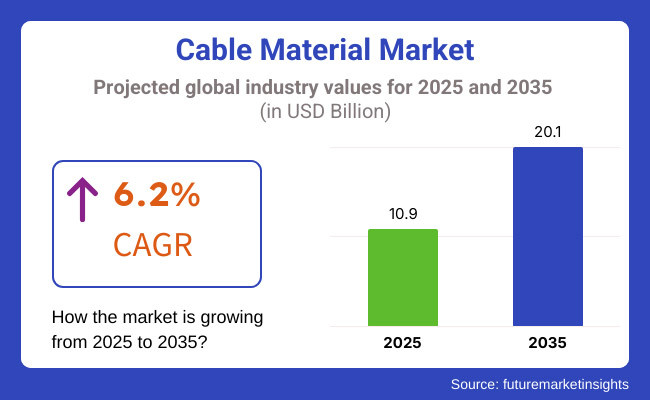

The cable material market is anticipated to register a steady growth rate during the forecast period 2025 to 2035, primarily driven by demand for advanced electrical infrastructure, followed by rapid expansion of telecom networks and growing adoption of renewable energy projects. Market is estimated at USD 10.9 Billion in 2025 and is projected to at USD 20.1 Billion by 2035, over the forecast period CAGR of 6.2%.

Increasing investment in power transmission and distribution networks to accommodate urbanization and industrialization is one of the primary factors that fuel market growth. Moreover, the growing deployment of high-speed internet, 5G networks, and fibre optic cables is propelling the need for high-performance cable materials. But rising raw material prices, supply chain issues, and sustainability concerns around plastic-based insulation might be obstacles.

Explore FMI!

Book a free demo

The North America cable materials market account for considerable revenue share due to major infrastructure investments in smart grid, data centers & renewable energy in the region. Demand for high performance and heat resistant cable material is increasing in the construction and telecommunications sectors in the United States and Canada.

Also, government support programs designed to facilitate the adoption of EVs and charging infrastructure are driving the demand for advanced cabling solutions.

Europe is still a significant market, where Germany, the UK, and or France spend billions on renewable energy grids and expand 5G networks. The regulations of the region are forcing a shift to alternatively-based metals and eco-friendly and low-smoke, halogen-free cable materials. Furthermore, increasing investment in offshore wind farms and electric vehicle infrastructure is driving the demand for high durability cable materials.

The Asia-Pacific region is expected to grow the fastest in terms of the cable material market due to rapid rise in industrialization, urbanization, and digital evolution around nations such as China, Japan, India, and South Korea. The growing number of smart cities, high-speed railway networks, and 5G connectivity is expected to drive the demand for advanced cabling materials.

Further government initiatives promoting green energy and electrification projects are also iterating repletion of market growth. However, challenges like regulatory inconsistencies and price volatility of raw materials may affect manufacturers in the region.

Challenge

Raw Material Price Volatility and Environmental Concerns

Fluctuations in the prices of raw materials such as copper, aluminium, and polymers used in insulation are among the main restrain able factor propelling the growth of the cable material market. Supply chain disruptions and geopolitical uncertainties can affect material availability and increase related production costs.

To add to that, increasing plastic waste and environmental impact issues have also resulted in stricter regulations on synthetic insulation materials, prompting manufacturers towards examining biodegradable or recyclable options.

Opportunity

Growth of Sustainable and High-Performance Cable Materials

The growing trend for sustainable and high-performance cable materials offers major growth prospect. Manufacturers are investing in bio-based, and recyclable insulation materials to lessen the ecological damage. Cable durability, efficiency, and fire resistance are being enhanced as well also advances in computer systems, nanotechnology, and composite materials.

The increasing penetration of electric vehicles, renewable energy projects, and smart grid technologies will drive the demand for next-generation cable materials, ultimately paving the way for long-term market growth over the next 10 years.

The period from 2020 to 2024 saw the Cable Material Market grow gradually owing to the increasing demand for high-performance cables for application in telecoms, automotive, energy, and industry. With demand for 5G equipment, electric vehicles (EVs), and renewable energy infrastructure on the rise, demand for advanced insulation, high-conductivity, and fire-resistant cable materials also increased.

Copper and aluminium were the most common conductor materials, and the most common insulation materials were polyethylene, polyvinyl chloride (PVC) and cross-linked polyethylene (XLPE). However, factors such as raw material cost, adverse effect on the environment due to plastic-based insulation and supply chain disruption,, contributed to the volatility in this market.

In the 2025 to 2035 timeframe, the market will develop more sustainable, lightweight, and AI-optimized cable materials. Bio-based polymers, superconducting materials and self-healing insulation are innovations that will push efficiency and sustainability.

Cable producers will continue to harness advanced data-driven technologies with innovations in carbon-neutral cable production, AI-enabled predictive maintenance, and smart integrated cables equipped with advanced sensors to accelerate inevitable transformation of the industry.

Further, the cable performance and durability will be revolutionized by the inclusion of nanomaterial-enhanced conductors, graphene-based wiring, and biodegradable insulation coatings.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with RoHS, REACH, and fire safety regulations for cable materials. |

| Material Innovation | Use of copper, aluminium, PVC, PE, and XLPE for conductors and insulation. |

| Industry Adoption | High demand from telecommunications, power distribution, and EV sectors. |

| Sustainability & Eco-Friendly Materials | Early-stage research into recyclable insulation materials and lead-free cable production. |

| Market Competition | Dominated by traditional cable manufacturers and polymer suppliers. |

| Market Growth Drivers | Growth fuelled by 5G deployment, EV expansion, and renewable energy grid integration. |

| Sustainability and Environmental Impact | Initial shift toward low-halogen, flame-retardant cable materials. |

| Integration of AI & Smart Technologies | Limited AI use in cable performance monitoring and fault detection. |

| Advancements in Manufacturing | Use of extrusion, cross-linking, and standard polymer processing for insulation. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, recyclability requirements, and carbon-neutral cable material standards. |

| Material Innovation | Transition to graphene-based conductors, superconducting materials, bio-based and self-healing insulation. |

| Industry Adoption | Expansion into AI-driven smart cables, autonomous vehicle wiring, and high-voltage superconducting grid cables. |

| Sustainability & Eco-Friendly Materials | Large-scale adoption of biodegradable cable insulation, carbon-neutral production, and closed-loop recycling systems. |

| Market Competition | Increased competition from nanomaterial start-ups, AI-powered predictive maintenance firms, and eco-friendly cable innovators. |

| Market Growth Drivers | Expansion driven by AI-optimized cable performance, self-repairing insulation, and high-efficiency transmission technologies. |

| Sustainability and Environmental Impact | Full-scale adoption of zero-waste cable production, sustainable polymer insulation, and energy-efficient conductors. |

| Integration of AI & Smart Technologies | AI-driven real-time predictive analytics, self-monitoring cables, and automated energy loss reduction systems. |

| Advancements in Manufacturing | Evolution of 3D-printed conductive materials, Nano coating-based insulation, and superconducting wire manufacturing. |

Factors such as rising demand for high-performance cables in telecommunications, power transmission, and industrial applications have made the USA the major market for cable materials.

The expanding market is driven by rapid 5G networks expansion, increasing renewable energy infrastructure deployment, and advancements in electric vehicle (EV) production. The increasing investments in smart grid technology and data centers are also a factor driving the demand for durable and efficient cable materials.

Factors such as the establishment of major cable manufacturers and the development of sustainable, recyclable insulation materials also contribute to driving industry trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

As digital native business in the cable material landscape, is benefitting from investments in digital infrastructure, uptick in renewable in power generation and increase in need for high-speed connectivity. Driving the market is the transition to fibre-optic networks and the electrification of transportation systems.

Moreover, stringent environmental regulations are bringing the huge gradually negotiations to renewable and halogen-free link materials. Advancements in cable technologies with superior monstrous durability and efficiency are also bolstering requirements for offshore wind farms and smart city projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

Wire Material Market in the European Union is headed by Germany, France, and Italy owing to their solid industrial infrastructure, increasing power grid modernization projects, and the shift towards electric mobility. Rotterdam, The Netherlands. The EU’s strict sustainability rules are spurring the adoption of halogen-free low-smoke, recyclable cable materials.

Also, high-voltage direct current transmission systems and the growing demand for lightweight materials in aerospace and automotive wiring applications are pushing innovation further. The region’s emphasis on energy efficiency and digital connectivity is also driving market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.1% |

The increase in investments that Japan is making in the field of high-speed telecommunications infrastructure, growing demand for advanced automotive wiring solutions, increasing renewable energy deployment, is driving the cable material market in Japan. Demand for high-durability and flexible cable materials is also being fuelled by the country’s leadership in robotics and industrial automation.

Moreover, Japan's emphasis on disaster-resilient power grid infrastructure is generating growth in the adoption of premium insulation and fireproofing materials in cable production. Emerging technologies include electric vehicles and ultra-high-speed fibre-optic technology, which are also affecting turn in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The fast-paced progress in the field of 5G technology, semiconductor manufacturing, and smart cities are positioning South Korea as a growing market for cable materials. The growth of the cable insulation material market is driven by the growing demand for lightweight, high-performance cable insulation materials in consumer electronics and automotive applications.

Government investments in green energy projects, such as solar and offshore wind energy, are also driving demand for specialized power transmission cables. The market dynamics are also being shaped through the expansion of electric vehicle charging infrastructure and next-generation data centers.

With growing concerns for eco-friendly and flame-retardant cable materials, the industry is anticipated to develop sustainable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

The Cable Material Market is substantially Controlled by XLPE and PVC Segment, as industries acknowledge the need for robust, economical, and effective wiring insulation for power and data transmission applications. These materials can significantly enhance cable longevity, electrical performance and safety, making them crucial to a number of industrial and commercial sectors.

XLPE and PVC cable materials continue to be in high demand as the world infrastructure for power transmission and telecommunications expands.

XLPE has been widely used because of its excellent dielectric performance, high thermodynamic antipathy and good mechanical property. XLPE is preferred over traditional medium-voltage insulation materials due to its superior performance in high-voltage applications, making it the insulation of choice for power transmission and distribution networks.

Additionally, increasing need for efficient and durable cable insulation solutions, especially in power grids, renewables installations, and underground cabling is further driving the adoption of these points in cable insulation market. More than 60% of high-voltage power cables are XLPE, which can withstand extreme temperatures and resist electrical stress, according to studies.

Growing utilization of high-performance XLPE formulations with superior cross-linking density, greater thermal stability, and ultraviolet resistant coatings has further driven the market, ensuring enhanced durability and reliability in extreme environmental conditions.

Predominantly, it has led to better alignment of demand and supply cycle, enabling development of AI-driven material engineering solutions with predictive stress test, automated defect detection, molecular structure optimization, etc., which has further increased adoption delivering high performance consistency and lower maintenance cost.

The evolution of next generation XLPE insulation with halogen-free flame-retardant characteristics, enhanced recyclability, and bio-based polymer alternatives has optimized market growth, offering better compliance with environmental and safety regulations.

Low emission production processes, energy efficient cross linking methods, operated by closed loop material recycling initiatives are some examples of sustainable XLPE manufacturing techniques which has further strengthened market growth to ensure compliance with global green energy policies and environmental standards.

Although XLPE material have benefits that include electrical properties, better thermal resistance, and longevity than alternative polymers, the manufacturing is complicated, and the production costs are higher than other products, also they are not recycle manly.

Nevertheless, recent advancements in AI-integrated material refinement, sustainable polymer supplements, and green cross-linking processes are enhancing the sustainability, cost-effectiveness, and industrial integration of XLPE cable components and thus, promoting sustained business progress of XLPE cable supplies across the globe.

Polyvinyl chloride (PVC) is projected to maintain a major leader in the Cable Material Market up to October 2023 due to their low cost, easy processing methods, durability, and flexibility of various types of cables like Electrical and Communication cables.

Whereas specialist high-performance materials excel in particular applications, PVC, often paired with other less-headline-grabbing materials, affordably provides a good compromise of insulation and flexibility, and this makes it a go-to in low- to medium-voltage cable designs.

Growing adoption of flame-retardant cable insulation solution in commercial and residential wiring to meet the rising demand for durable cable insulation solutions is expected to escalate market growth. Such low-cost, flexible and easy to install wiring makes PVC by far the leading wire for households and commercial buildings with over 70% of households and building wiring being made of PVC.

Emergence of advanced formulation of PVC with better resistance to weather, use of non-toxic plasticizers and use of UV-resistant stabilizers has propelled the market growth by ensuring better performance and longevity in indoor and outdoor applications.

The adoption has been further accelerated by the advent of AI-augmented material processing techniques, including in-line extrusion monitoring and automated defect detection and precision compounding.

Analysis of insulation often includes roof specifications, where high-performance LSZH, PVC insulation, offering low toxic irritant gas emissions, high fire performance, and environmentally friendly additive compositions, reconciling market development with strict safety and environmental consideration supported by standards in industrial and commercial civil infrastructure projects.

Increasing adoption of PVC recycling programs, which are oriented around circular economies, incorporating advanced separation technologies, energy-efficient reprocessing methods, and closed-loop systems of material recovery in the market, allows for large-scale cable production to be focused on sustainability, thus generating steady sales growth in this sector.

These factors have contributed to the continued growth of this segment as it offers easy processing, low-cost solutions and good fire resistance. However, the PVC segment is subjected to some challenges owing to environmental concerns regarding plasticizers, potential release of hazardous by products, and regulatory restrictions imposed on halogenated materials.

On the other hand, new innovations in AI-powered material safety assessments, biodegradable plasticizer alternatives, and next-generation PVC stabilization additives have improved compliance, performance and sustainability, and ensured that the PVC cable material market continues to grow around the globe.

Due to the adoption of high-performance power transmission, and advanced connectivity solutions by industries, share of Electrical and Telecom/Datacom Cable segments in the Cable Material Market is considerably higher. All these categories will define technology development, end-use efficiency, and communication infrastructure, among other things, for the foreseeable future.

Due to the increasing demand for power transmission infrastructure which is efficient and durable, the electrical cable market has seen good market adoption. Because electrical cables need high-voltage insulation materials better methods of preventing heat transfers for improved thermal resistance and dielectric strength they're different from communication cables.

The growing need for high-performance electrical cables, particularly in renewable energy installations, smart grids, and industrial power distribution, has driven adoption. Over 75% of all power transmission asset upgrades include more advanced metal compounds for increasing lifetime service time and performance.

The deployment of high-voltage and extra-high-voltage (EHV) electrical cable technologies with superior insulating thickening, moisture-resistant powder, and electrical shielding layers has reinforced the market demand ensuring enhanced safety and reduced energy losses.

While the offering has numerous advantages around high-voltage performance, durability, and insulation strength, the electrical cable segment is hampered by material cost fluctuations, complex installation requirements, and concerns for aging infrastructure. Nonetheless, new technologies such as AI-enabled electrical diagnostics, high-performance composite insulation, and self-healing cable polymers promise to enhance efficiency, reliability, and safety, enabling further growth in the global electrical cables market.

There has been a firm market growth with regard to the telecom/Datacom cable market on account of the promotion of high-speed internet, 5G and fibre optic communication networks across enterprises and governments. While electrical cables need to deal with the potential of short circuits, telecom use signals through their cables, which requires advanced shielding, and the highest possible efficiency for data transmission, which means that high-performance materials are of the essence in our modern digital infrastructure.

Increased adoption is the rising demand for fibre-optic networks, cloud computing, and smart city access solutions. With about 70% of telecom infrastructure investment in high-performance cable materials for quality data transmission and network reliability, studies suggest that the demand for high-performance cable materials is expected to grow.

While fibre-optic cables provide advantages in terms of high-speed communication, low signal loss, and network scalability, the telecom/Datacom cable segment faces challenges, including installation and logistics complexity, high material costs, and regulatory compliance requirements.

Nonetheless, new technologies for AI-based network diagnostics, advanced polymer protection, and ultra-flexible fibre-optic cable materials are increasing performance, decreasing cost and enabling more resilient infrastructure, which will continue to support global growth for telecom/Datacom cables.

Increasing demand for high-performance cables in power transmission, telecommunications, and industrial applications drive the growth of the cable material market. The market is steadily growing as renewable energy projects, smart grids, and 5G infrastructure continue to expand. Large production practices are covering mainly in-region developments, advancements for fire-resistant materials, sustainability, and usage of high-strength lightweight cable materials.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Prysmian Group | 12-16% |

| Nexans | 10-14% |

| Sumitomo Electric Industries | 8-12% |

| LS Cable & System | 6-10% |

| Southwire Company, LLC | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Prysmian Group | Develops advanced cable materials for high-voltage, fibre optic, and renewable energy applications. |

| Nexans | Specializes in fire-resistant and sustainable cable materials for power transmission and telecom industries. |

| Sumitomo Electric Industries | Focuses on high-performance insulation and conductive materials for energy and automotive sectors. |

| LS Cable & System | Manufactures lightweight and high-durability cable materials for industrial and infrastructure projects. |

| Southwire Company, LLC | Produces energy-efficient cable materials with an emphasis on recyclability and sustainability. |

Key Company Insights

Prysmian Group (12-16%) Prysmian Group leads in high-performance cable material innovation, focusing on durability, efficiency, and sustainability.

Nexans (10-14%) Nexans specializes in fire-resistant and eco-friendly cable materials, catering to the power, telecom, and industrial sectors.

Sumitomo Electric Industries (8-12%) Sumitomo Electric Industries excels in high-strength, conductive, and insulation materials for diverse applications, including automotive and energy.

LS Cable & System (6-10%) LS Cable & System focuses on high-durability and lightweight cable materials to support smart grid and infrastructure expansion.

Southwire Company, LLC (4-8%) Southwire Company emphasizes energy-efficient and sustainable cable material solutions, targeting renewable energy and utility markets.

Other Key Players (45-55% Combined) Several global and regional manufacturers contribute to the expanding cable material market. These include:

The overall market size for the Cable Material market was USD 10.9 Billion in 2025.

The Cable Material market is expected to reach USD 20.1 Billion in 2035.

The demand for cable materials will be driven by increasing investments in telecommunications infrastructure, rising adoption of renewable energy projects, expanding electric vehicle (EV) production, and growing demand for high-performance cables in industrial and commercial applications.

The top 5 countries driving the development of the Cable Material market are the USA, China, Germany, Japan, and India.

The Electrical Cable Material segment is expected to command a significant share over the assessment period.

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.