The Cable Fault Locator is projected to grow significantly over the next several years, with a compound annual growth rate (CAGR) of fashion statements, systemic, and title pages of direct blueprints. The need for efficient fault detection technologies that provide prompt identification while reducing downtime and repair costs is growing as smart grids, underground cable networks, and renewable energy installations continue to grow.

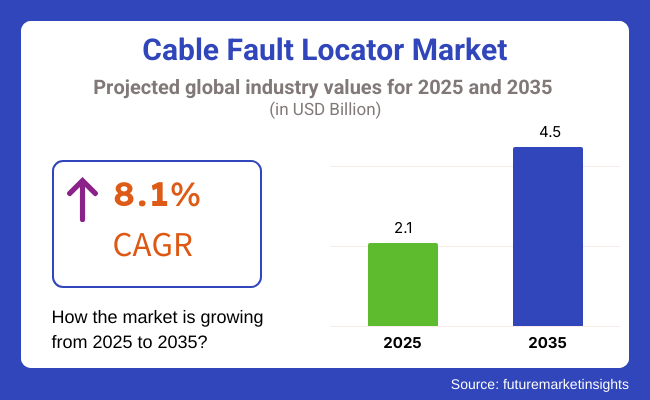

With a compound annual growth rate (CAGR) of 8.1%, year is forecast to reach USD 2.1 billion in 2025 and USD 4.5 billion in revenue by 2035. Along with the increasing challenges of using power distribution automation and laws having strict regulatory standards for electrical safety, the growth is expanding due in large part to the underground cable networks.

Cable fault locators such as time-domain reflectometers (TDR), arc reflection meters, and very low frequency (VLF) testers are integral to locating faults in overhead and underground power cables. As the industry shifts toward real-time monitoring, predictive maintenance, and AI-based diagnostic systems, it is facilitating quicker, more accurate fault detection at reduced operational costs.

Innovations like portable and wireless test equipment, compatibility with IoT-based monitoring systems, and AI-based predictive analytics are expected to increase the reliability of fault detection systems. The demand for advanced cable fault locators is also being propelled by the growing investments in smart grid modernization, fiber-optic cable infrastructure, and industrial automation.

Explore FMI!

Book a free demo

North America will dominate the cable fault locator the growth due to the proper energy infrastructure investments, the adoption of smart grids, and stringent electrical safety regulations. USA and Canada are contributors for high-voltage power transmission, grid automation, and underground cable installation, the USA and Canada are significant contributors.

This increased demand for real-time fault detection systems is defining trends Real-Time Fault Detection System Project is being guided by modern USA government's power grid and protection against interruptions. However, with the ongoing expansion of 5G infrastructure and fiber-optic broadband systems, the requirement for cable fault locators is also growing.

Europe has the largest sector share and also known as the cable fault locator, with countries including Germany, UK, and France leading the way in power transmission. Such growth in the region is primarily due to the increasing focus on underground power cable installations to enhance reliability and ensure safety.

The need for advanced cable fault detection technology is increasing as a result of EU policies that shift energy from fossil fuels to renewable sources. Product innovation and adoption are being further pushed by regulatory policies like the EU's Low Voltage Directive (LVD) and IEC standards for power systems.

The cable fault locator market in the Asia-Pacific region is anticipated to grow rapidly owing to quick urbanization, industrialization, and rising electrical grid infrastructure. Prominent countries in this context are China, India, Japan, and South Korea, with major investments in the smart grid entities, fiber-optic networks, and high-voltage power transmission projects.

Rising investments in grid extension are driving expansion. Innovation in the integration of renewable energy with power systems, government-led initiatives to develop smart cities. Furthermore, the installation of deepwater communication cables and the spread of 5G networks are creating new growth prospects for sophisticated fault-detection technologies.

Challenges

Some of the key challenges in the cable fault locator which are the investment in advanced fault-detecting technologies, which can be expensive throughout the entire process. Implementing sophisticated algorithms and expert knowledge to locate faults is difficult given the complexity of dense networks of underground cables.

"It's another big challenge to be compliant with regulatory. Mandatory safety and performance standards enforced by entities like the IEC, IEEE, and regional power commissions mean more validation and testing for the product. In addition, in developing, lack of awareness and insufficient knowledge in advanced fault location technologies limit acceptance, delaying the penetration of the sector in these geographical areas.

Opportunity

There are still many opportunities for growth , despite these challenges. AI-powered fault detection is being advanced to improve accuracy, reduce downtime, and improve maintenance efficiency. The growing need for smart grid solutions and remote monitoring systems also contributes to the advanced fault detection technologies.

Telecommunications infrastructure becoming more complicated with the expansion of 5G and fiber-optic networks globally is providing new opportunities for cable fault locators. Moreover, the rising focus on sustainability and renewable energy is driving investments in renewable power transmission networks, including offshore wind farms and solar grids. These opportunities are anticipated to propel the growth of the cable fault locator for the next decade as well.

The shifts for cable fault locators grew significantly between 2020 and 2024 due to a number of factors, including urbanization, rising power distribution network investments, and rapidly expanding telecommunication infrastructure. The need for sophisticated fault detection technologies increased as utilities and industries concentrated on lowering downtime and improving grid-wide reliability.

As governments and private players focused on expanding and modernizing infrastructure, especially in the domain of energy transmission, underground power lines and fiber optic networks, it led to increased penetration of precise cable fault locator solutions. As power grids became more complicated and underground cable networks became more common, detecting faults efficiently became necessary.

While traditional TDR and arc reflection methods were widely adopted, a shift over time toward higher-precision techniques (e.g., very low frequency [VLF] testing, frequency-domain reflectometry [FDR], and AI-driven fault diagnostics) was observed. During the past few years, automated fault detection solutions integrated with the global positioning system (GPS) have emerged that allow faster detection and localization of a fault that significantly reduces the maintenance time and operational cost.

Both regulatory bodies and utility commissions sought to tighten standards on both grid reliability and the quality of their power, leading to utility providers investing in advanced diagnostics. In industries like power distribution, telecommunications, oil & gas, and railways, the need to implement a cable fault locator witnessed an upsurge to mitigate potential catastrophic failures and minimize service disruptions.

Nevertheless, over the years, advancements in artificial intelligence (AI), IoT-enabled monitoring, and remote sensing technologies have significantly improved the precision of fault detection and the effectiveness of real-time diagnostics. From 2025 to 2035, AI-powered predictive maintenance, quantum-enhanced sensing technologies, and the integration of smart grid infrastructure will drive transformative changes in the cable fault locator.

The industry is stepping toward the real-time fault monitoring system, automatic fault detection platforms, and self-healing grid technologies. Through AI-based fault diagnostics, accurate real-time information will facilitate timely intervention, resulting in predictive maintenance and proactive grid monitoring. Self-learning fault detection systems: Allowing systems to self-learn using machine learning algorithms will enable a single system installed in a network to become more and more accurate and to adjust to the network conditions.

This quantum-enhanced sensing technology will allow for ultra-precise fault detection that significantly upgrades the fault localization subsequent to faults in underground and submarine cables. For example, new-generation superconducting detectors will improve the sensing of weak electromagnetic emissions from defective cables for pinpointing decades-long faults across vast telecommunication networks.

The advent of a fully autonomous robotic cable inspection system will be a game changer for the industry. Likewise, AI-based robotic fault locators will deploy along subterranean and subsea cable routes to detect faults in real time while streaming data back to cloud-enabled monitoring clouds. These autonomous systems will automate inspections, dramatically cutting down both maintenance costs and machine downtime.

There will be a greater emphasis on sustainability, leading to energy-efficient cable fault locators powered by self-sustaining energy sources. With AI optimizing the functionality of the power transmission grids, energy production loss during the transmission process will be kept to a minimum, thus making the entire energy-generating process efficient while also reducing the electric power carbon footprint. Fault locator systems will be significant components of the IoT infrastructure in smart cities, connecting power distribution networks, smart meters, and real-time monitoring systems.

Market Shifts: A Comparative Analysis (2020 to 2024 Vs. 2025 to 2035)

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven predictive fault monitoring regulations and blockchain-secured fault data governance will shape future compliance standards. |

| Technological Advancements | Quantum-enhanced sensing, AI-powered predictive diagnostics, and autonomous robotic fault locators will redefine the industry. |

| Industry Applications | AI-assisted autonomous cable fault inspection, smart grid-integrated monitoring, and IoT-enabled fault detection will expand industry applications. |

| Adoption of Smart Equipment | AI-powered self-healing grids, robotic fault inspection systems, and real-time remote monitoring platforms will drive next-generation fault detection. |

| Sustainability & Cost Efficiency | Self-powered fault detection systems, sustainable cable insulation monitoring, and AI-driven power grid efficiency strategies will enhance sustainability. |

| Data Analytics & Predictive Modelling | Quantum computing-enhanced predictive maintenance, AI-powered adaptive fault detection, and real-time fault prediction analytics will transform grid resilience. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized fault locator manufacturing, and blockchain-based logistics for diagnostic equipment will improve accessibility. |

| Market Growth Drivers | The rise of AI-driven smart grids, quantum-enhanced fault sensing, and autonomous cable monitoring systems will fuel future expansion. |

The USA Cable Fault Locator is expected to grow at a steady rate, driven by the growing need for efficient power distribution, rising adoption of the smart grid, and aging infrastructure. According to the USA Department of Energy, as the nation's aging grid continues to struggle under the pressure of a growing population and health problems, the demand for advanced fault detection and location solutions is on the rise.

The requirement for periodic fault detection is being emphasized due to aging power transmission and distribution networks. The underground cabling trend in city areas is also generating robust demand for time-domain reflectometry (TDR) and very low-frequency (VLF) testing technologies. Companies such as Megger, Fluke, and HV Diagnostics are expanding their product offerings in the USA by introducing AI-based diagnostics for real-time fault detection.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

Technological advancements in cable fault locators: The growth of the United Kingdom cable fault locator industry can be attributed to increased investments in renewable energy infrastructure, an aging electrical network, and strong regulatory emphasis on minimizing power outages. This has resulted in increasing demand for emergent fault detection solutions as the UK's National Grid pours billions into power transmission underground.

The transition to renewable energy sources, including offshore wind farms, makes efficient fault location in long-distance power cables unavoidable. Cable fault locators with AI and IoT capabilities are enhancing real-time monitoring and proactive maintenance. The rising deployment of fiber optic networks is in turn boosting the demand for the telecom cable fault locator.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

The cable fault locator in the European Union is expanding due to stringent regulations on power reliability, increasing investments in smart grid infrastructure, and growing demand for underground power cabling. The EU’s Horizon Europe Program has allocated €3.2 billion for grid modernization, boosting the adoption of fault detection technologies.

Germany, France, and Italy are leading in underground power transmission expansion, requiring advanced cable fault locator solutions. Additionally, the adoption of IoT-based monitoring and predictive maintenance solutions is driving growth. The increasing deployment of high-voltage direct current (HVDC) transmission lines is also boosting demand for high-precision fault location systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

The Japan Cable Fault Locator Market is growing due to the aging electrical infrastructure, a growing focus on the resilience of the power system, and government initiatives. The need for an advanced fault detection solution is surging with Japan’s Ministry of Economy, Trade, and Industry (METI) designating USD 400 billion for power grid enhancements.

The country’s frequent seismic activity increases the need for high-accuracy underground cable fault locators. The adoption of AI-powered diagnostics in power distribution networks is improving operational efficiency. Furthermore, the expansion of 5G networks is driving demand for telecom cable fault locators.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The South Korea Cable Fault Locator Market is growing at a healthy rate owing to the rapid growth of smart cities, rising deployments of underground cables, and increasing government support towards digital transformation in the energy sector. The South Korean government is investing USD 2.5 million in power infrastructure modernization through its Ministry of Trade, Industry, and Energy (MOTIE), further expanding demand for fault locators.

High-speed rail and metro projects are expanding rapidly, thus leading to increasing demand for effective fault detection in underground power cables. Moreover, AI and IoT are combined upon smart grids to monitor real time and maintain (preventive) well. This segment is also expanding on account of the rising need for fiber optic networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

As utility providers, telecom companies, and industrial operators all have energy being wasted on keeping faulty cables in service, Time Domain Reflectometer (TDR) and Very Low Frequency (VLF) testers knit a large share of the cable fault locator by enabling efficient identification of cable faults and reducing cable fault restoration time to a minimum.

TDR technology plays a significant role in industrial maintenance teams and utility companies such as telecom operators which locates faults in coaxial networks, data transmission lines, and power cables by examining reflected signal pulses. The rising investments in smart grids and high-voltage underground cable networks are fueling the growth of the TDR-based cable fault locators.

In addition, the technology has become more portable with the development of handheld TDR units, enabling technicians to locate faults in cables faster, improving time efficiency for work that would otherwise take longer.

Although TDR testers are commonly used, they also present many challenges, including high initial cost, a need for highly trained operators, and the inability to detect faults in complicated network cable wiring. Nevertheless, the advancements in AI-based signal processing, multi-sensor fault diagnosis, and cloud-based diagnostics are significantly contributing towards the accuracy, automation, and ease of use in this field and thus are ensuring continuous growth across this.

High Voltage Insulation Testing: Keeping Your Cables Fighting Fit with VLF Testers VLF testers are becoming a vital tool for high voltage cable fault location and insulation testing. The growing installation of underground power cables and renewable energy grids is raising the demand for VLF testers as utility companies want suitable and nondestructive diagnostic tools. VLF testing is used by power transmission operators to ensure high-voltage cables in substations, wind farms, and industrial plants are working correctly, minimizing unexpected failures and maintenance costs.

Although VLF testing has become increasingly popular, obstacles like low effectiveness for shorter cables, expensive equipment, and differences in geographic regulations still plague the method. Smart test automation and portable VLF technology with predictive maintenance software are garnering the adoption of these machines, paving the way for rich high demand. Fun Facts Power Transmission and Telecommunications Sectors Drive Growth as Infrastructure Expands

Power transmission and telecommunications are the two major segments driving demand for cable fault locators, with other end-users adopting fault detection technologies to enhance the resilience of networks and rely on service offerings.

This change towards more integration of solar and wind energy has only accelerated the demand for cable fault locators as more solar and wind farms roll out large networks of underground cables that require constant monitoring. These smart grid initiatives also include automated cable fault location systems for grid resilience, operational cost savings, and improved power restoration times.

Although the cable fault locator is an essential part of power transmission, they need to overcome multiple challenges like the volatility in demand of developing regions, high cost of devices, and interoperability with existing infrastructure. Nevertheless, innovations such as AI-based fault analysis, predictive maintenance platforms, and next-generation sensor technology are overcoming these challenges, facilitating growth in the industry.

A key factor contributing to the rapid growth of the cable fault locator is the growing volume of high-speed fiber optic networks instigated by the telecommunication sector. TDR and OTDR technology can be used by service providers to locate a fault in a fibre optic cabling run, and TDR tests enable network performance optimization and loss of signal testing.

Telecom operators increasingly turn to automated fault detection tools to facilitate uninterrupted connectivity as 5G infrastructure is rolled out across the globe in parallel with efforts to improve broadband penetration. OTDR technology in particular enables telecom providers to quickly locate fiber breaks, measure cable attenuation, and assess splice quality, working together to reduce maintenance costs and create a more efficient network.

A recent analysis of the global cable fault locator by a leading analyst firm indicates that ATPs will contribute to the growth through the adoption of cable fault locators, as demand for efficient power distribution, lower downtime in utility networks, and the development of sophisticated and precise cable testing technologies rise. Drawing on major global players and niche companies offering TDR, VLF testing, and portable fault detection solutions.

Such companies are specifically focusing more on AI-based diagnostics, cloud-based system integration, and multi-mode test systems to provide accuracy and reliability when it comes to the detection of underground cable faults. The rollout of smart grids and renewable energy infrastructure, powered further with urban electrification projects and pushes demand higher.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Megger Group | 12-17% |

| Fortive Corporation (Fluke) | 10-14% |

| HV Technologies Inc. | 8-12% |

| BAUR GmbH | 6-10% |

| Sonel S.A. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Megger Group | Develops advanced cable fault location systems using TDR, VLF, and arc reflection methods. |

| Fortive Corporation (Fluke) | Specializes in portable and handheld fault locators with AI-powered diagnostics. |

| HV Technologies Inc. | Manufactures high-voltage testing and diagnostics solutions for underground cable networks. |

| BAUR GmbH | Focuses on precision cable fault location using advanced surge wave generators and diagnostics. |

| Sonel S.A. | Provides cost-effective and field-friendly cable fault detection solutions for utilities and industrial applications. |

Key Company Insights

Megger Group (12-17%)

Megger, a top manufacturer of cable fault location equipment, provides TDR, VLF, and bridge test-based locators. So we invest in automation and cloud-enabled tools for diagnosing underground cable efficiently.

Fortive Corporation (Fluke) (10-14%)

FlukeAI-enabled portable cable fault detection systems The company specializes in ease of use, safety, and real-time remote diagnostics.

HV Technologies Inc. (8-12%)

HV Technologies designs and manufactures high-voltage testing systems catering to the power utilities and industrial applications. His firm provides partial discharge detection products and state-of-the-art fault mapping devices.

BAUR GmbH (6-10%)

BAUR, known for its precision fault location systems, surge wave generators, and very low frequency (VLF) test systems. The company prides itself on speed of fault detection and limited service downtime.

Sonel S.A. (4-8%)

Sonel focuses on budget-friendly, compact cable fault locators with efficient diagnostics for utilities and construction sectors.

Other Key Players (45-55% Combined)

Numerous companies contribute to the cable fault locator, driving innovations in precision testing, real-time analytics, and AI-integrated diagnostics. These include:

This is poised for growth as demand for reliable, fast, and automated fault detection solutions increases across power utilities, telecommunication, and industrial applications.

The global cable fault locator industry is projected to witness a CAGR of 8.1% between 2025 and 2035.

The global cable fault locator industry stood at USD 2.1 billion in 2025.

The growth for Global Cable Fault Locator is expected to reach USD 4.5 billion by the end of 2035.

North America is projected to achieve the largest CAGR during the forecast period.

A few of the major players operating in the global cable fault locator industry are Megger, Fluke Corporation, Hubbell Incorporated, PCE Deutschland GmbH, 3M, Electrocon Systems, BAUR GmbH, High Voltage Inc., Kehui International Ltd., and others.

Gauss Meter Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Supplies Market Growth – Trends & Forecast 2025 to 2035

Trace Oxygen Analyzer Market Growth – Trends & Forecast 2025 to 2035

Soil Field Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Water Activity Instrumentation Market Analysis by Type, Distribution Channel, End Use, and Region Forecast Through 2035

Heat Stress Monitor Market Analysis by Product, Application, Offering, Life Form, Technology, Sensor Type, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.