The worldwide ropeways and cable cars market will experience rapid expansion in 2025 to 2035 on the back of increasing tourism, urban mobility needs, and eco-friendly transport modes. Cable cars and ropeways are gaining significance to offer secure, efficient, and scenic modes of transportation over difficult terrain.

Green travel over mountain peak ski resorts and urban cities is being utilized more, because of the manner in which they spread congestion, enhance the penetrability of a region, and provide sustainable mobility.

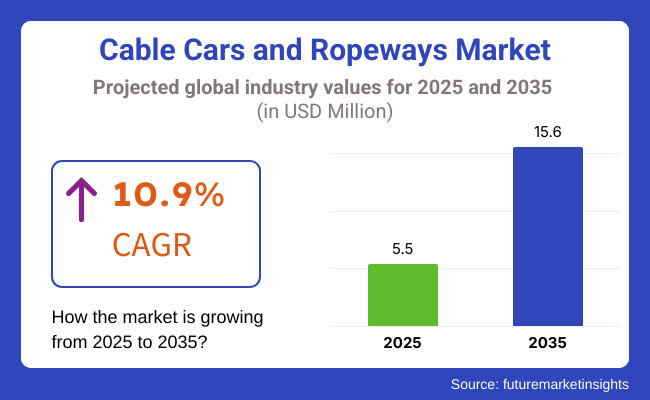

The market size was approximately USD 5.5 Million in 2025 and will increase consistently to USD 15.6 Million by 2035. This is at a 10.9% compound annual growth rate as cable car and ropeway systems gain popularity in tourist structures as well as city transport systems. Energy efficiency, improved safety, and improved comfort for commuters are also pushing the market.

North America is a pioneer ropeways and cable cars market with well-developed ski resorts and growing requirements for adventure travel. Mountain resort regions of the continent, e.g., British Columbia and Colorado, dominate chairlift and gondola demand. New York City and Portland are even considering aerial cable cars as efficient forms of public transit. While cities, trying to contain traffic and lower carbon prints, remain a hub of innovation for ambitious ropeway endeavors in North America.

Europe has the largest market for cableways and ropeways because of its busy alpine tourism industry and long history of relying on cable-based transportation systems. They are Austria, Switzerland, and France, among many other countries that have a prosperous cable car network of winter sports tourists and summer tourists.

Besides ski resorts, cableways are also being integrated by European cities into transportation planning to ensure greater connectivity and reduce dependency on traditional road networks. The quest for sustainability and quality travel experience keeps propelling the growth of this sector.

The Asia-Pacific is also seeing growth at a high rate in the ropeways and cable cars sector due to an increase in tourism in India, Japan, and China. The vast topography of the region with numerous mountains has seen increasing installations of cable cars.

Cable cars are also being introduced as new means of transport by the government and private investors in cities with complex topographies. Increase in the middle-class earnings of the region and investment in infrastructure propel Asia-Pacific as a prominent region of growth for the ropeways and cable car industry.

Infrastructure building costs and regulatory compliance

High infrastructure costs, and stringent regulations, along with concerns regarding environmental impact, are some of the challenges facing this market. Cable car and ropeway systems require significant capital expenditure for specialized engineering, compliance with safety standards, and land acquisition.

Moreover, government approvals require rigorous environmental impact assessments, land use permits, and compliance with local and international safety protocols. This financial and regulatory opposition can be a bottleneck to project development and restrict expansion.

Growth of tourism and solutions for urban mobility

With the rise in tourism and the accompanying surge in demand for urban mobility solutions, businesses must invest in short transportation routes such as cable car and other ropeway infrastructure. Ropeway transport is being adopted in several urban areas as a green solution to congested road networks that improve connectivity in hilly and high-density cities.

Moreover, the growth in mountain tourism, ski resorts, and adventure tourism is the acting the need for cable cars and gondola systems. Smart ticketing, AI-driven monitoring, and zero-emission cable car designs are innovative technologies that are also increasingly improving operational efficiency and passenger convenience.

Subsequently, companies introducing autonomous ropeway systems, hybrid power technologies, and green landscape mobility infrastructure will stand to benefit from the growing demand for sustainable, high-capacity transport solutions.

The Cable Cars and Ropeways Market grew steadily from 2020 to 2024, as a result of increasing spending on tourism infrastructure, urban transport expansion, and developing ski resorts. Various governmental and private sector developers introduced some of these new cable car projects in order to diversify tourism and mitigate mountain as well as urban traffic congestion.

Although the market completed a high number of projects, high project costs and environmental concerns hindered the capacity of projects implemented in the value chain, while disruptions of supply chains of equipment led to maintenance issues. In response to these concerns, companies have been concentrating on developing energy-efficient ropeway systems, lightweight materials, and automated maintenance solutions designed for improved durability and operational efficiency.

The report provides a comprehensive forecast for the period 2025 to 2035, analysing the future of cable car technology, urban integration, and sustainability practices. The implementation of AI driven predictive maintenance, real-time passenger flow optimization and autonomous gondola operation will transform the efficiency of cableway transport. New developments in renewable energy-fed cable cars, such as solar and hybrid-electric propulsion, will also contribute towards sustainability efforts worldwide.

The adoption will be driven further with the integration of ropeways with multi-modal public transport systems and the smart city infrastructure. The evolution of the Cable Cars and Ropeways Market over the next decade will largely be dictated by companies focusing on automation, green energy solutions, and cost-effective installation processes.

Market Shifts A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with tourism and safety regulations for cable car projects |

| Technological Advancements | Growth in energy-efficient ropeway systems and automated operations |

| Industry Adoption | Increased development in ski resorts and tourism-centric ropeways |

| Supply Chain and Sourcing | Dependence on specialized cable car manufacturing hubs |

| Market Competition | Dominance of established ropeway manufacturers |

| Market Growth Drivers | Rising demand for adventure tourism and high-altitude connectivity |

| Sustainability and Energy Efficiency | Initial adoption of low-energy cable car operations |

| Integration of Smart Monitoring | Limited use of digital diagnostics and safety tracking |

| Advancements in Urban Mobility | Use of cable cars mainly in tourism and ski resorts |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven safety monitoring and sustainability-driven transport policies. |

| Technological Advancements | Integration of AI-powered predictive maintenance, autonomous gondolas, and smart ticketing. |

| Industry Adoption | Expansion into urban mobility, public transport integration, and high-altitude cargo transport. |

| Supply Chain and Sourcing | Localization of ropeway production and investment in lightweight, high-durability materials. |

| Market Competition | Growth of innovative start-ups focusing on smart transport solutions and energy-efficient cableway designs. |

| Market Growth Drivers | Increased investment in urban cableway networks, smart mobility, and eco-friendly transport systems. |

| Sustainability and Energy Efficiency | Large-scale deployment of solar-powered, hybrid, and regenerative energy cableway solutions. |

| Integration of Smart Monitoring | AI-driven fault detection, cloud-based system analytics, and automated ropeway control systems. |

| Advancements in Urban Mobility | Widespread integration into urban transport networks, last-mile connectivity, and multimodal transit hubs. |

The United States cable car and ropeway market has steadily expanded, driven by rising financial commitments in tourist frameworks, expanding selection of urban transport links, and developing interest for maintainable development alternatives. Well known traveller goals like Colorado, California, and Utah have extended ski resort facilities, energizing request for cutting edge transport links and lifts.

In metropolitan territories, urban areas like New York and Los Angeles are investigating transport frameworks pulled by ropes as an elective to conventional open transportation. Furthermore, government subsidizing for natural amicable developments and advanced urban communities is encouraging selection of low-outflow transport links.

The ongoing ventures in the enthusiasm for traveller spots and cutting edge transportation frameworks in urban territories imply that the USA market for transport links and lifts is relied upon to develop essentially later on.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.2% |

The United Kingdom has witnessed extraordinary expansion in its aerial lift industry owing to massive investments aiming to promote environmentally sound urban mobility, a striking surge in tourist activities across the nation, and a rising demand for efficient transit in mountainous regions.

The hugely popular Emirates Air Line in London has shown ropeways' potential to serve as a practical and viable urban transport alternative, spurring other ambitious plans in areas including Scotland's scenic and rugged places, Wales, and additional major metropolitan areas.

The booming tourism and leisure sector, particularly in remote Scottish Highlands and the picturesque Lake District, has led to growing needs for innovative cable car and aerial tram installations. In addition, policies championing low-emission modes of travel have fueled investments into cutting-edge electric and solar-powered ropeway systems.

With a heightened focus on eco-friendly tourism and expanded urban ropeway networks, the United Kingdom's cable transport market is primed for steady progression and remarkable growth in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.5% |

The growth of cable car and ropeway networks across the European continent has been driven by both the significant expansion of winter sport tourism in the Alpine region and a mounting focus on establishing smart, low-carbon transportation solutions to link populated areas.

Countries like Austria, Switzerland, France, and Italy have installed countless ski lifts and mountain gondolas over the decades to accommodate the burgeoning numbers of winter sports fans visiting their slopes year after year, yet more recently turned attention to designing high-capacity automated transit systems spanning long distances between cities by sky.

As concerns over climate change spur policymakers to lessen the carbon footprint of travel between European population centers, several visionary projects have been proposed to construct aerial lift infrastructure stretching across borders in Germany, France, and Spain.

What's more, continuous progress in ropeway engineering has yielded increasingly energy-efficient designs with the potential to improve accessibility in both the tourism industry and public transportation through challenging terrain.

Projections indicate demand will surge exponentially for both tourism-centric aerial lift networks and urban ropeways due to evolving preferences among citizens and visitors favoring smart, eco-friendly mobility alternatives, leading analysts to foresee the market value and geographical scope of overhead transit lines significantly expanding and modernizing throughout the European Union in the coming years to accommodate a growing reliance on these sustainable modes of transport.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.8% |

The volcanic islands and towering mountains that comprise Japan's visually striking landscapes have enthralled people seeking respite from congested metropolises for generations. Popular national parks including scenic Hakone with its geologically unique characteristics and Tateyama Kurobe have notably grown their elevated transportation networks, intensifying visitors' diverse experiences-some raising solitary adventurers high above while others carry intimate parties in a relaxed rhythm through lush woodlands past steaming thermal waters.

Towering peaks loom large behind wispy clouds as shorter trails meander through colourful forests and alongside gurgling streams and planted fields. While urban centers such as Tokyo and Osaka look to cable cars to alleviate crowded roadways and lessen pollution from vehicles, Japan is pioneering smart cableway systems for public transit.

Leveraging their leadership in automation and transport technologies, cutting-edge Japanese gondolas and lifts are being powered by artificial intelligence to transport passengers swiftly and efficiently.

Furthermore, focus on eco-friendly transportation coupled with expanding tourism means Japan's ropeways sector is poised for substantial expansion in the coming years. With government support for green infrastructure and public-private partnerships propelling innovation, the outlook is bright for low-carbon, high-tech cable solutions to integrated mobility needs across the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.7% |

The cable car and gondola market of South Korea has steadily advanced due to major investments in tourist sites, urban projects connecting locations, and initiatives by the government endorsing smart mobility options. Places popular with visitors such as Jeju Island and Seoul's Namsan Park have seen their need for aerial systems rise as more travel to take in scenic views from the sky.

Authorities have also studied using cable transport within busy population centers to ease traffic that comes from too many vehicles on crowded streets. Technical enhancements including higher speeds even in poor weather have allowed the industry to broaden its reach across the nation. As infrastructure spending grows and green ways of getting around become more in demand, South Korea's ropeway sector is anticipated to prosper gradually.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.9% |

Tourism and public transportation sectors represent a significant share of the cable cars and ropeways market, as more global cities and tourism hotspots are adopting this efficient, environmentally friendly, and scenic transportation system.

Sustainable skiing and urban tourism: These next-generation aerial mobility systems will become essential for improving urban transport efficiency, alleviating congestion and enabling the sustainable transport of tourists so they reach urban, amusement park or eco-tourism areas and public transport systems.

One of the key factors supporting the cable cars and ropeways market is tourism, which creates scenic transport solutions, high-altitude accessibility, and adventure-based aerial solutions. Cable cars and ropeways are not only traditional ground transportation but offer tourist’s panoramic views and immersive travel experiences, full mobility, and access to various mountainous and coastal tourist destinations.

The increasing popularity of adventure tourism, including cable car rides across mountain-covered terrain, woods, & national parks has also increased the uptake of such high-capacity ropeways as travellers look for unique scenic spots that provide them with a scenic experience. Research points out that more than 60% of adventure travellers prefer destinations with aerial ropeway access, truly promising a higher footfall for the ropeway-based attractions.

The growing proliferation of cable car installations in heritage & cultural sites, which includes historic mountain towns, ancient temples and hilltop fortresses, has further bolstered market demand, paving the way for enhanced uptake of ropeways in cultural & religious tourism.

Adoption has been further enhanced with the application of AI that has helped in automated cable car controls, predictive maintenance with real-time speed adjustments resulting, in turn, in a better safety, efficiency, and operational reliability.

The emergence of sustainable tourism ropeways- propelled growth by solar powered, low emission cable car systems to have better harmony with sustainability based policies across the world. For example, adventuring tourists with hefty expenditure are better catered through the increased adoption of premium scenic cable cars, with glass-floor gondolas, premium seating and climate-controlled cabins.

While it offers tourism benefits for enhancing experiences, improving accessibility, and supporting sustainable travel, the tourism segment does require seasonal demand fluctuations, an upfront capital investment for infrastructure, and potential environmental constraints for regulatory policy.

New technologies-like personalized, AI-powered tourist experiences, smart ticketing integration, and hybrid resort cable car and electric bus transit networks-are making tourism-focused cable cars and ropeways increasingly efficient, lucrative, and operational year-round, so the market for those experiences will still expand.

Public transportation has achieved robust market penetration, especially in high-density urban areas, hilly cities, and island-based municipalities, with governments and city planners increasingly deploying sustainable, congestion-free, high-efficiency aerial transit systems. Cable cars and ropeways provide uninterrupted mobility, reduced emissions, and inexpensive urban transit solutions, thus largely reliable in densely populated areas unlike road-based public transport.

Increasing demand for urban aerial cableways, which provide ropeway-based mass transit in metropolitan environments, has driven the uptake of high-capacity urban gondolas as cities continue to focus on reducing congestion and improving public transport efficiency. Urban cable cars, according to studies, help decrease travel time by more than 40%, promoting a faster and more eco-friendly mode of transport in densely populated areas.

The rise of intermodal urban transport solutions, with cable car stations co-located with metro, bus, and train hubs has bolstered the demand across the market, paving the way for higher adoption in smart city transport planning.

Adoption has been accelerated, too, thanks to the addition of AI-powered urban mobility insights, which includes tracking real time passenger flows and forecasting demand to better optimize aerial public transport services. The easy energy powered cables car USGs has met the market growth rate with global carbon neutrality and greater alignment through development, solar and battery-operated gondolas guarantee zero-emission transport.

Factors like soaring adoption of digital ticketing and fully contactless payment systems, which utilize a mobile-based fare collection system for seamless transit (to assure better accessibility and user convenience), have buoyed the expansion of this market.

Though it has benefits such as decongesting urban roads, reducing emissions, and providing high efficiency mobility, it also suffers from high infrastructure costs and land acquisition hurdles, along with public doubt over long-term viability.

But newer and innovative concepts of AI-based prediction of traffic congestion, modular ropeway expansion in the urban area and new age energy-efficient cable car characteristics have started adding to their viability, cost-effectiveness, and scalability making sure that cable cars and ropeways continue to expand in the space of urban public transportation.

OEM (Original Equipment Manufacturer) and aftermarket sales channels are two of the many market drivers, emphasizing that cable car and ropeway typical users are more inclined toward purchasing high-quality equipment and maintaining it regularly to keep operating with no interruptions for the upcoming period, and upgrading the system to ensure optimal functional delivery and the longest operational period possible.

OEM sales have also become one of the largest channels for the cable car market, with complete cable car solutions, innovative ropeway components, and cutting-edge aerial transit technologies driving a majority of these sales. More importantly, OEMs provide comprise complete solutions for new ropeway projects with seamless system integration, regulatory compliance and operational reliability unlike aftermarket sales.

Growing preference of high-performance OEM ropeways in adventure tourism, including customized designs for extreme weather conditions, has triggered adoption of advanced cable car installations by the enterprises and private operators, which are buying next-generation products that are potential to sustain long durability. Studies show that OEM-installed ropeways last as much as 40% longer than retrofitted systems, providing better return on investment for tourism and public transit operators.

The expansion of OEM smart cable cars, combined with self-diagnostic AI systems and automated emergency braking, have further reinforced the demand in this market, which would ultimately lead to a greater adoption of high-tech aerial transport solutions.

Modular designs of ropeways integrated with expandable cabin capacities combined with multi-ropeway adaptability for such solutions have further provided an impetus for adoption and scalability such that future expansions to the urban transport can be accommodated if needed. This, with the development of energy-efficient OEM solutions, including solar-assisted & kinetic-energy recovery cable cars, has optimally contributed to the growth of the market further ensuring maximum sustainability of aerial transit networks.

These benefits from a systems perspective in terms of reliability, regulatory compliance, and long-term efficiency have not translated into massive OEM (Original Equipment Manufacturer) sales due to high capital outlay, extended lead time on installations, and reliance on government approvals for large-scale projects.

Still, new developments such as, system diagnostics driven by AI, predictive maintenance scheduling technique and energy-efficient defined OEM ropeway solutions are helping improve cost-efficacy, installation speed, and operational scalability, fuelling the market growth for OEM cable cars and ropeways.

The aftermarket segment has seen robust market adoption in aging ropeway systems, tourism-centric cable car operators, and urban public transport networks where operators are progressively diverting budget into regular maintenance schedules, component replacements, and performance upgrades to maximize the lifetime of existing installations.

Unlike the OEM sales, aftermarket solutions are intended to service, retrofit, and upgrade cable cars with equipment that reflects ongoing development for greater safety and regulatory compliance.

Operators are focusing on the operational reliability and safety of the visitors, which is driving the adoption of long-term ropeway service contracts, primarily characterized by the demand for periodic inspection, lubrication, and structural reinforcements, for ski resort and adventure tourism facilities. Research shows that proactive aftermarket maintenance improves system uptime by more than 50 percent, helping to ensure seamless customer experience and profitability of tourism operators.

The climactic demand for data-oriented predictive maintenance systems has been secured by the provision and advancements such as retrofit and modernization services, system diagnostics based on AI and digital performance monitoring. The introduction of automated safety compliance monitoring, with real-time wear detection and AI-driven alerts for the replacement of parts, has increased adoption and improved regulatory compliance and provided assurance of safety.

Smart aftermarket kits with plug-and-play digital upgrades of aging cable car systems have enhanced the growth of the market, making it more accessible to small and medium-sized operators. While aftermarket sales offer an opportunity to increase operational lifetimes, minimize unplanned downtimes, and promote safety, they also have drawbacks in the form of on-and-off demand for maintenance work, expensive upgrades for legacy systems, and finite availability of spare parts for older ropeway infrastructure.

However, newer predictive maintenance artificial intelligence, modular system retrofitting, and block chain-backed safety certification tracking schaffen exciting innovative opportunities that are addressing these pain points in efficiency, cost-effectiveness, and reliability, enabling a continuing expansion of the cable cars and ropeways market.

The rising interest of urban mobility solutions, mountain tourism, and environment-friendly transportation systems is a reason for growing the market for cable cars and ropeways. The reports also mention that the companies are targeting on AI-powered cable car automation, high-speed ropeway technology and sustainable transportation infrastructure to strengthen passenger safety, efficiency and connectivity in the hilly terrains and urban areas.

Global transportation system manufacturers and specialized ropeway solution providers are equally part of the market; each is accelerating innovative transformations with the use of aerial tramway, gondola lift, funicular railway, and chairlift systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Doppelmayr/Garaventa Group | 20-25% |

| Leitner Ropeways (HTI Group) | 15-20% |

| POMA Group (MND Group) | 12-16% |

| Bartholet Maschinenbau AG | 8-12% |

| Nippon Cable Co., Ltd. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Doppelmayr/Garaventa Group | Develops high-speed detachable gondolas, urban cable car solutions, and AI-powered ropeway control systems. |

| Leitner Ropeways (HTI Group) | Specializes in energy-efficient ropeway systems, advanced urban cable transport, and digital monitoring solutions. |

| POMA Group (MND Group) | Manufactures hybrid and solar-powered gondola lifts, ski resort ropeways, and public transport aerial trams. |

| Bartholet Maschinenbau AG | Provides customizable ropeway solutions, AI-driven cable car safety systems, and modern funicular railways. |

| Nippon Cable Co., Ltd. | Offers high-precision ropeways and gondolas for ski resorts, tourism, and urban transportation. |

Key Company Insights

Doppelmayr/Garaventa Group (20-25%)

Doppelmayr dominates the market, providing the latest designs for high speed gondola lifts, your urban transport needs, and AI cableway protection systems.

Leitner Ropeways (HTI Group) (15-20%)

Leitner focuses on environmentally friendly cable car technology, leading in use efficiency and intelligent connection in urban and mountain transportation.

POMA Group (MND Group) (12-16%)

POMA is based out of Canada, and provides energy-efficient aerial tramways combined with hybrid gondola lifts, offering the best type of high-capacity transportation in a sustainable setting.

Bartholet Maschinenbau AG (8-12%)

Bartholet specializes in custom ropeway development, with innovative additions like AI-analytics diagnostics and passenger safety features.

Nippon Cable Co., Ltd. (5-9%)

Gentle to the environment, taking into account for ease of use, and reducing energy usage. Nippon Cable manufactures ski resort and public transport ropeway systems.

Other Key Players (30-40% Combined)

There are numerous transportation and infrastructure companies that are engaging in next-generation cable car innovations, AI-driven automation, and sustainable urban ropeway solutions. These include:

The overall market size for Cable Cars and Ropeways Market was USD 5.5 Million in 2025.

The Cable Cars and Ropeways Market is expected to reach USD 15.6 Million in 2035.

The demand for the cable cars and ropeways market will grow due to increasing tourism activities, rising investments in urban transportation infrastructure, expanding adoption in mountainous and remote areas, and the need for eco-friendly and efficient transit solutions in congested cities.

The top 5 countries which drives the development of Cable Cars and Ropeways Market are USA, UK, Europe Union, Japan and South Korea.

Tourism and Public Transportation Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Industry, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Industry, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Industry, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Industry, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Industry, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Industry, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Industry, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Industry, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Industry, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Industry, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Cable Cleaning Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Cleaning Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Cable Fault Locator Market Size, Share, and Forecast 2025 to 2035

Cable Tray Market from 2024 to 2034

Cable Wrapping Tape Market

Cable Racks Market

Cable Testing Market

Cable Assemblies Market

Cable Carrier Market

Cable Detector Market

Cable Flange Market

Cable Connectors and Adapters Market Analysis by Application, Product, Type and Region: Forecast from 2025 to 2035

LED Cable Market

HVDC Cables Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Brake Cables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA