The Cabernet Sauvignon market is projected to witness steady growth from 2020 to 2035, as more people globally seek premium and vintage wines, an uptick in wine tourism, and an expanding consumer preference towards red wines, as they have perceived health benefits.

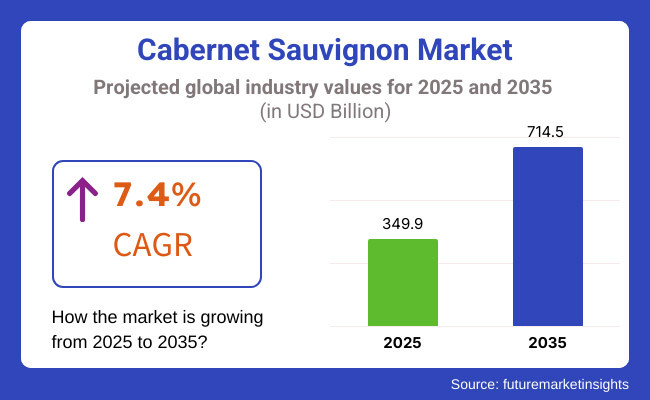

The market is expected to be worth USD 349.9 Billion in 2025 and reaching USD 714.5 Billion by 2035, at a CAGR of 7.4% during the forecast period.

Emerging markets' increasing high regard for full-bodied red wines, combined with growing disposable incomes and changing lifestyles, is one of the most important factors driving market growth. Moreover, growing investments in vineyard extensions and viticulture engineering are improving the quality and availability of Cabernet Sauvignon wines.

Growth may not come without difficulties though, including climate change, variable grape harvests and tough regulations on possible alcohol consumption. Winemakers are also starting to focus on sustainable viticulture practices, unique aging techniques and organic and biodynamic wine varieties to combat these effects.

North America is still a leading market for Cabernet Sauvignon and the USA is the largest producer and consumer of Cabernet Sauvignon. Sites like Napa Valley and Washington State have also expanded the high-quality Cabernet Sauvignon options. Market growth is further driven by the increasing prevalence of wine clubs, DTC sales & online wine marketplaces. And as interest in food and wine pairings grows, so does demand for aged and reserve Cabernet Sauvignon wines.

France, Italy and Spain are all key producers and exporters of the grape, both in Europe and further afield. Another one at duty of the highest has Bordeaux, the most acclaimed wine region in France, which forever serves the planet with high quality Cabernet Sauvignon. European consumers are gravitating toward sustainable and organic wines, suggesting to winemakers that they might want to embrace eco-friendly viticulture methods.

Market trends are also influenced by regulatory frameworks related to wine labelling and origin authentication, which ensure the quality and authenticity of the product.

The Cabernet Sauvignon market in the Asia Pacific region is anticipated to grow at the fastest rate because of the increasing wine consumption in China, Japan, Australia and India. The increasing demand can be attributed to a combination of factors such as the rising middle-class population, growing disposable incomes, and a cultural shift towards Western dining experiences.

China has also become one of the largest consumers and producers of Cabernet Sauvignon, with local vineyards now gaining international acclaim. Increasing export taxes and shifting legal situations introduce new hurdles for international wine producers seeking to tap into the market.

Challenge

Climate Change Impact on Grape Cultivation

One of the specific challenges facing the Cabernet Sauvignon trade is climate change's effects on grape cultivation. Increasing temperatures, erratic weather patterns and shifting soil conditions can affect yields and grape quality in vineyards. Winemakers are adjusting with innovative irrigation systems, moving vineyards to cooler locations, and deploying hybrid grapes to keep production steady.

Opportunity

Growth of Sustainable and Organic Wines

There is a potential for growth as consumers are increasingly asking for sustainable, organic, and biodynamic wines. However, consumers are becoming more aware of vineyard and winegrowing practices and many are now looking for environmentally responsible wines.

Winemakers investing in organic certification, carbon-neutral production methods and race-day eco-packaging are increasingly ahead of the game. Moreover, the growth of digital marketing and direct-to-consumer wine sales presents new revenue opportunities for boutique and premium Cabernet Sauvignon producers, providing for continued market expansion in the next decade.

The Cabernet Sauvignon Market has seen continuous growth from 2020 to 2024 owing to increasing wine consumption globally, expansion of premium segments of wines and rising demand for vintage and aged wines. The move to organic and biodynamic wine raced ahead as consumers began to clamour for low-intervention, sustainable and preservative-free wines.

Newer producing wine regions China, South Africa, and South America ramped up production, and e-commerce and direct-to-consumer became the main distribution paths after the pandemic hit.

The On-Premise data-driven mind-set and further consumer-health blending will continue to make waves in upcoming decades. Upgrading to precision viticulture and block-chain enabled traceability and etc. We expect the increase in low-alcohol and alcohol-free

Cabernet Sauvignon, personalized AI-driven wine recommendations and sustainable packaging solutions to dominate trends in the coming years. Innovation will be driven by robotic harvesting, AI-powered advanced aging predictions, and wine NFTs for provenance checks.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with wine labelling laws, organic certification, and import/export regulations. |

| Grape Cultivation & Climate Impact | Increasing concerns over climate change affecting grape yield, water usage, and soil conditions. |

| Consumer Preferences | Strong demand for full-bodied, high-tannin wines, with increasing interest in organic and sulphite-free options. |

| Industry Adoption | Expansion of boutique wineries, DTC wine clubs, and premium aging techniques. |

| Market Competition | Dominated by established Old World regions (France, Italy) and rising New World competitors (USA, Australia, Chile). |

| Market Growth Drivers | Demand fuelled by wine tourism, online wine subscriptions, and interest in collectible vintages. |

| Sustainability and Environmental Impact | Early adoption of organic, biodynamic, and low-intervention winemaking. |

| Integration of AI & Digitalization | Limited AI use in wine tasting analytics and fermentation monitoring. |

| Advancements in Winemaking | Use of oak barrel aging, micro-oxygenation, and traditional fermentation techniques. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, block chain-based traceability for authenticity, and carbon-neutral winemaking incentives. |

| Grape Cultivation & Climate Impact | Expansion of drought-resistant Cabernet Sauvignon clones, regenerative viticulture, and AI-powered vineyard management. |

| Consumer Preferences | Growth in low-alcohol, non-alcoholic, and AI-recommended personalized Cabernet Sauvignon wines. |

| Industry Adoption | Widespread adoption of AI-driven wine sensory profiling, robotic-assisted harvesting, and smart fermentation. |

| Market Competition | Increased competition from AI-assisted boutique wineries, lab-grown grape tannins, and custom-blended wines using molecular profiling. |

| Market Growth Drivers | Growth driven by digital wine experiences, met averse wine tastings, and AI-powered wine pairing algorithms. |

| Sustainability and Environmental Impact | Large-scale adoption of carbon-neutral wineries, biodegradable wine packaging, and AI-driven precision irrigation. |

| Integration of AI & Digitalization | AI-powered personalized wine recommendations, block chain-protected wine provenance, and digital wine investments (NFTs). |

| Advancements in Winemaking | Evolution of AI-optimized fermentation, precision yeast selection, and alternative aging methods such as ultrasonic barrel aging. |

The full-bodied flavour of Cabernet Sauvignon is especially popular, making the USA a key market for wineries like ours. As consumer demand for high-quality red wines climbs, so too does luxury wine tourism, and wineries such as ours are facing great economic potential in the USA market.

California, specifically Napa Valley and Sonoma County, remains a leader in production, as investment in sustainable and organic viticulture practices increases. The market demand for Cabernet Sauvignon is also being driven by its increasing prominence in the fine dining and luxury category. Moreover, growing online sale of wine and direct-to-consumer sales channels are making the market more accessible.

A growing interest in aged and collectible wines is also influencing industry trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.7% |

The UK Cabarnet Sauvignon market is developing at a noticeable rate, with the developing inclination of consumers towards premium and imported wines, increase in wine subscription networks, as well as growing recognition for the combining of food with wine, supporting the need for UK Cabarnet Sauvignon market.

As consumers lean toward ethical sourcing, the market for sustainably and organically farmed Cabernet Sauvignon is also increasing. Moreover, with the growing number of boutique wine stores and dedicated online platforms it has become even easier to access quality wines from around the world.

Market dynamics are also being shaped by the trend towards casual wine drinking and the growth of private-label wines from supermarket retailers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

The European Union shows that premium varietals are most famously produced in France lead the market for Cabernet Sauvignon, followed by Italy and Spain as domestic and international demand for high-quality wines continues to mainstream and democratise a clientele with recognition of wines from these countries.

Bordeaux is still a leading producer of premium Cabernet Sauvignon blends and is increasingly investing in organic and biodynamic winemaking practices. The growth of this sector is also supported by the growth of wine tourism and the rise in demand for aged and vintage wines. Through protected designation of origin and strict quality regulations in the EU, the market is also being boosted in terms of premiumization.

The growth of e-commerce and digital wine marketplaces is also helping to broaden distribution.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.3% |

With consumer demand for high-end red wines, the spread of Western dining culture, and interest in wine gradually prevailing among younger generations, demand for Cabernet Sauvignon has grown as well. The country’s large number of wine importers and specialty wine retailers is expanding the availability of high-quality wines from around the world.

Furthermore, the growing prevalence of wine pairing with Japanese cuisine and upscale restaurants is driving demand. Such preferences, particularly Japan’s preference for smooth, well-balanced wines, is shaping market trends, including a growing interest in aged and oak-matured Cabernet Sauvignon varieties.

The increasing penetration of online wine retailing and the launch of subscription-based services will drive the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

Cabernet Sauvignon is performing strongly in South Korea, which has been increasingly seen as a market to target following the popularity of Western wines, the increased consumption of wine among younger consumers, and a booming fine dining sector. The country’s turn toward premium and collectible wines has improved demand for high-quality Cabernet Sauvignon from top wine-growing regions.

On top of that, government policies that lower import tariffs on wine contribute to a greater availability of international varieties to consumers. Market dynamics are also being shaped by an increasing number of wine bars and luxury hotels with curated wine lists.

Digital platforms facilitating wine retail and subscription-based wine clubs are improving market access and consumer interaction.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

The Cabernet Franc and Sauvignon Franc segments dominate the Cabernet Sauvignon Market as vineyards and winemakers look for high-quality grape varieties that provide complexity of flavour, improvement in aging potential, and unique wine profiles. Used to bring aroma, mouthfeel and complexity to Cabernet Sauvignon wines, these grape varieties are foundational to mass-market and premium winemaking alike.

With the global consumption of wine growing and the changing tastes of consumers, the demand for better grape varieties is a continuous torchbearer for global grape seed and the market stays in the growth phase.

Cabernet Franc has found widespread acceptance due to its balanced acidity, aromatic complexity and structure-enhancing ability in blended wines. Cabernet Franc, in contrast to its better-known full-bodied relative, Cabernet Sauvignon, is readily identifiable by its silky mouthfeel and smoother tannins characteristics that have made it a popular candidate for the production of lighter-bodied, food-friendly wines.

Growing market adoption is fuelling demand for medium-bodied wines with vibrant fruit flavors, especially in European and North American markets. More than 60% of Cabernet Sauvignon blends contain Cabernet Franc to improve its floral notes and red fruit characteristics

Enhanced market demand driven by the upsurge of high-performance vineyard management practices comprising of precision irrigation, selective canopy-management, and optimized harvesting schedules has further underpinned grape quality and uniformity in yield.

Recently, the adoption of AI-driven solutions for viticulture has surged further, with soil moisture data presented in real-time, epidemic prediction algorithms for the minimization of spray applications and climate-responsive beverage cultivation practices ensuring optimal grape formation health and better winemaking.

The breeding of new clones of Cabernet Francs with increased drought resistance, a better sugar-acid balance, and greater stability in anthocyanins optimized the market growth with a better acclimatization to transformed climatic conditions and diversified terroirs.

Sustainable winemaking techniques including organic vineyard management, minimum pesticide usage, and earth-friendly fermentation methods have strengthened market growth because they are in accordance with global green wine production standards.

In spite of the aromatic complexity, blending flexibility and smooth tannin structure advantages, there are challenges in the Cabernet Franc segment with limited standalone-class varietal recognition, vulnerability to fungal diseases, and variation of yield by region.

But with timely innovations in AI vineyard disease mapping, climate-resilient grape breeding and precision fermentation techniques boosting efficiency, adaptability and consumer acceptance, the Cab Franc market will continue to be growing across the globe.

Maceration length helps to shape tannin structure, and thus Sauvignon Franc plays a significant role and holds a good share in Cabernet Sauvignon Market due to the fact that it has more tannin than other varieties, due to its higher sugar concentration mechanic, Sauvignon Franc is also responsible for the production of the deep coloured, full bodied Cabernet wines.

Offering deeper, broader flavors and more aging potential than Cabernet Franc, Sauvignon Franc is thus a favoured grape for red wine producers looking to create deep, brooding reds.

Adoption has been fuelled by the increasing demand for premium red wines with aging potential, especially in luxury wine cellars and fine dining establishments. Over 55% of California premium Cabernet Sauvignon wines utilize at least some amount of Sauvignon Franc as a blending component to increase structure, enhance tannin integration, and improve cellarability.

The spreading profile of esteemed vineyard management practices, including higher density planting, biodynamic nature propagation and longer hanging time help to sustain market demand, by producing consistent phenolic evolution and flavour compaction.

The combination of precision fermentation technologies, complete with AI-driven temperature control, automated yeast nutrient adjustments, and optimized extended maceration, which has contributed to further adoption, consistent quality, and improved flavour development.

The creation of hybrid dates of quartz pieces with improved pest resistance, climate adaptability, and optimal polyphenol composition of the grapes, have led to the increased profitability of the market, resulting in improved winemaking practices and sustainability.

More market expansion can be reinforced as adoption of low-intervention winemaking practices including wild yeast fermentation, minimal addition of sulfites and gravity-fed vinification techniques become more common, ensuring wider appeal among both natural wine enthusiasts and eco-conscious consumers.

Wineries produce different styles of Cabernet Sauvignon which ranges from Young Cabernet or Old Cabernet segments that occupy a major share in the Cabernet Sauvignon Market reflecting the taste of the consumers based on the fresh fruit driven wines or aged focused complex wines. These aging categories are key to defining wine character, informing purchasing decisions, and developing brand differentiation.

Young Cabernet, with its bright fruit flavors that can be easy, approachable tannin structures, and the degree of casual wine drinking that has occurred in the last 30 years, has found a place in the hearts and pocketbooks of consumers and it isn’t going anywhere. Contrary to that of an aged vintage, the Cabernet Sauvignon of today is generally bottled and brought to market from one to three years post-harvest, thus it's accessible and affordable for a wide range of consumers.

Adoption has been driven in part by the rising popularity of fruit forward and ready-to-drink red wines, especially among millennial and metropolitan wine consumers. More than 70 percent of supermarket and online wine sales that include Cabernet are of young Cabernet because it is affordable and goes with a lot of food.

Styles of winemaking have also become modernised with cold fermentations, lower maceration time and assisted oxygen regimes, creating strong market demand with a promise of better fruit expression and gentler tannin integration.

Harnessing machine-learning-assisted aroma profiling and tannin structure prediction, coupled with automated blending recommendations, AI-driven sensory analysis has further enhanced adoption among wine producers, ensuring optimized flavour consistency and enhanced consumer satisfaction.

Although young Cabernet possesses many strengths in terms of affordability, accessibility, and vibrant flavour profile, this segment of the wine market has significant challenges such as possibly less aging potential, less complexity compared to more mature wines, and saturation in the entry-level wine market.

Novel innovations in AI-aided fermentation control, cold maceration enhancement, and hybrid oak barrel finishing, though, are improving flavour refinement, mouthfeel, and varietal branding, paving the way for continued growth of young Cabernet globally.

While vintage age and complexity can hinder short-term growth, the demand for fine wine collectors, sommeliers and luxury wine brands puts great value on the aged, complex and highly structured vintages of old Cabernet, and old Cabernet has certainly enjoyed smooth sailing upwards on the market.

Unlike young Cabernet, Old Cabernet spends extended time in the barrel and bottles, and during this time the flavors deepen, tannins integrate, and the wine takes on greater nuance with age.

Adoption has also been driven by the growing demand for investment-grade and collector-oriented wines in luxury hospitality and on high-end wine auction platforms. Research shows that more than two-thirds of premium Cabernet Sauvignon labels produce aged grosses with considerable price appreciation over the years.

While the Old Cabernet segment offers benefits in terms of a more complex flavour profile, aging potential, branding as a luxury good, etc., it also faces the challenge of long production cycles, higher costs associated with storage, frequent fluctuations in vintage quality, etc.

But New Cabernet has been benefiting from new technologies like AI-assisted aging modelling, barrel micro-oxygenation management, and block chain wine provenance tracking, which increase product quality consistency, range of market access, and confidence in the consumer, which will ensure continued growth for the Old Cabernets of the world.

The growing global demand for high-quality and mature wines, an increasing number of wine culture enthusiasts preferring to explore wine tourism, and an increasing investment in extending vineyards emerge as the key drivers for the growth of the Cabernet Sauvignon Market. Key trends impacting the industry include organic and biodynamic wine production, private-label offerings and digital sales growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| E. & J. Gallo Winery | 12-16% |

| Constellation Brands | 10-14% |

| Treasury Wine Estates | 8-12% |

| The Wine Group | 6-10% |

| Château Lafite Rothschild | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| E. & J. Gallo Winery | Produces a diverse portfolio of Cabernet Sauvignon wines with global distribution. |

| Constellation Brands | Specializes in premium and luxury Cabernet Sauvignon wines through renowned brands. |

| Treasury Wine Estates | Focuses on high-end and aged Cabernet Sauvignon offerings with sustainable practices. |

| The Wine Group | Develops affordable and private-label Cabernet Sauvignon wines for mass-market appeal. |

| Château Lafite Rothschild | Offers premium, aged Cabernet Sauvignon wines with a strong heritage reputation. |

Key Company Insights

E. & J. Gallo Winery (12-16%) E. & J. Gallo Winery leads the global Cabernet Sauvignon market with a diverse range of wines catering to all price segments.

Constellation Brands (10-14%) Constellation Brands excels in premium and luxury Cabernet Sauvignon wines, expanding its portfolio through acquisitions.

Treasury Wine Estates (8-12%) Treasury Wine Estates focuses on aged, high-quality Cabernet Sauvignon wines while incorporating sustainable winemaking practices.

The Wine Group (6-10%) The Wine Group targets mass-market consumers with affordable yet high-quality Cabernet Sauvignon wines.

Château Lafite Rothschild (4-8%) Château Lafite Rothschild remains a prestigious player in the market, offering limited-edition and vintage Cabernet Sauvignon wines.

Other Key Players (45-55% Combined) Several wineries and beverage companies contribute to the expanding Cabernet Sauvignon market. These include:

The overall market size for the Cabernet Sauvignon market was USD 349.9 Billion in 2025.

The Cabernet Sauvignon market is expected to reach USD 714.5 Billion in 2035.

The demand for Cabernet Sauvignon will be driven by increasing global wine consumption, rising preference for premium and aged wines, expanding wine tourism, and growing awareness of the health benefits associated with moderate red wine consumption.

The top 5 countries driving the development of the Cabernet Sauvignon market are the USA, France, Italy, China, and Australia.

The Premium Cabernet Sauvignon segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA