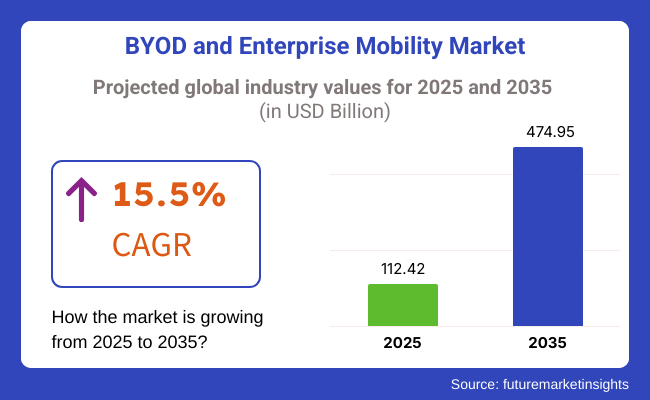

The bring your own device (BYOD) and enterprise mobility market is predicted to grow significantly in 2025 to 2035 with increasing deployment of remote working policies, cloud-based enterprise solutions, and artificial intelligence-powered mobile security. The industry worth USD 112.42 billion in 2025 is estimated to grow up to USD 474.95 billion in 2035 with a CAGR of 15.5% during the forecast period.

With increasing businesses requiring office responsiveness, real-time collaboration, and secure mobile access to corporate assets, they are investing heavily in enterprise mobility management (EMM), mobile device management (MDM), and artificial intelligence-powered endpoint security. Zero-trust architecture, 5G, and blockchain technology-based mobile authentication are also driving demand for scalable, secure, and efficient BYOD solutions.

With larger enterprises embracing hybrid work patterns, there is a greater demand for robust mobile security models and unified device management solutions. Businesses are embracing AI-powered threat detection, biometric authentication, and cloud-native EMM platforms to protect business data and enhance productivity.

With larger enterprises embracing hybrid work patterns, there is a greater demand for robust mobile security models and unified device management solutions. Businesses are embracing AI-powered threat detection, biometric authentication, and cloud-native EMM platforms to protect business data and enhance productivity.

Explore FMI!

Book a free demo

The BYOD and enterprise mobility market is going through a lot of growth as the trend of mobile-first strategies among businesses and institutions is quite the talk of the town these days. Big players are working on the lines of tight security, mobile device management (MDM), and the integration of the new network with the existing IT structure to enable remote work while making sure that data remains secure.

The focus of small and medium-sized enterprises (SMEs) is on smart and cheap mobility options that are achievable according to their work efficiency without massive IT investment. Healthcare is one of the industries that attaches considerable importance to the regulations for HIPAA and others, including providing safe mobile access to patients' data and medical records only.

Government bodies are in need of very secure and supervised mobility solutions for public service access and data safety. Retail and e-commerce industries are utilizing the enterprise mobility for omnichannel customer experiences, making it possible to integrate mobile POS systems and workforce mobility solutions.

The selection criteria differ by industry, with security, compliance, cost-effectiveness, and scalability being top priorities. The industry is undergoing immense transformation as a result of the invention of cloud computing, 5G, and AI-powered enterprise mobility solutions, that are making industries adopt such technologies more readily.

| Company | Contract Value (USD Million) |

|---|---|

| Microsoft Corporation | Approximately USD 120 - USD 130 |

| VMware (Workspace ONE) | Approximately USD 100 - USD 110 |

| Cisco Systems (Meraki & Duo Security) | Approximately USD 90 - USD 100 |

| BlackBerry Limited | Approximately USD 80 - USD 90 |

Between 2020 and 2024, the industry grew as companies were making employees to work remotely. There were digital collaborations, and cloud security solutions coming up. Adoption of hybrid workplaces drove demand for mobile device management (MDM), endpoint protection, and zero-trust architecture.

Businesses began implementing AI-based cybersecurity, encrypted virtual private networks (VPNs), and multi-factor authentication (MFA) to protect business data on personal devices. Yet, issues like data privacy risks, compliance exposures, and more sophisticated cyber-attacks compelled organizations to further develop mobility strategies with tighter access controls and policy enforcement.

Enterprise mobility in 2025 to 2035 will be influenced by AI-driven security automation, 6G connectivity, and decentralized identity management. AI-driven threat detection will offer real-time protection from cyber threats, while blockchain-based authentication will advance user privacy.

Edge computing will streamline mobile workflows, facilitating smooth remote collaboration with minimal latency. Biometric security systems and AI-based device monitoring will be enhanced as organizations strive to block individuals attempting to access without authorizations. The arrival of autonomous mobile workspaces and smart integration with intelligent wearables will also reposition enterprise mobility, providing an infrastructure for the workplace that is secure and fast.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter regulations made it important for businesses to have data encryption, better control on access, and endpoint security in BYOD environments. | AI-driven, zero-trust enterprise mobility solutions ensure real-time compliance enforcement, decentralized identity management, and AI-powered anomaly detection for secure mobile workforces. |

| AI-driven security offerings enhanced real-time threat protection, adaptive access governance, and dynamic policy enforcement for mobile devices. | AI-native, self-adaptive enterprise mobility platforms automatically track device activity, forecast security threats, and apply AI-powered dynamic access controls for future-proof secure mobility. |

| The transition to remote and hybrid workplaces drove demand for cloud-enabled enterprise mobility solutions that provide secure remote access and collaboration. | AI-enhanced, decentralized enterprise mobility ecosystems provide ultra-fast, real-time cloud synchronization, AI-driven productivity optimization, and seamless multi-device continuity for hybrid workforces. |

| 5G-enabled enterprise mobility solutions improved connectivity, reduced latency, and enabled seamless real-time data access across mobile devices. | AI-powered, 6G-integrated enterprise mobility platforms deliver ultra-low latency cloud computing, AI-driven edge processing, and real-time predictive analytics for frictionless mobile operations. |

| Organizations deployed endpoint detection and response (EDR), AI-based mobile device management (MDM), and zero-trust security architectures for BYOD policies. | AI-native, self-healing BYOD security architectures automatically identify device vulnerabilities, impose blockchain-enhanced authentication, safeguard against tampering, and provide real-time endpoint security. |

| AI-based virtual assistants enhanced corporate mobility by facilitating hands-free task completion, voice-based authentication, and workflow automation. | AI-based, real-time voice AI and forecasting enterprise assistants deliver dynamic workflow suggestions, adaptive scheduling, and context-aware automation for next-generation mobile productivity. |

| AI-based security systems scanned mobile endpoints in real time, identifying phishing attacks, unauthorized access, and malware threats. | AI-based, quantum-secured enterprise mobility ecosystems automatically neutralize cyber threats, forecast security breaches, and implement real-time AI-based risk mitigation policies. |

| Firms streamlined enterprise mobility infrastructures for reduced energy usage and green digital workplace programs. | Carbon-aware, AI-based BYOD solutions utilize intelligent energy distribution, dynamic workload balancing, and AI-optimized cloud management for environmentally friendly enterprise mobility. |

| Businesses investigated blockchain-secured authentication for mobile devices, providing tamper-proof access control and secure identity management. | Decentralized, AI-enabled enterprise mobility platforms provide trustless authentication, AI-based compliance automation, and secure, self-sovereign digital identity management for mobile workers. |

| AI-driven analytics maximized workforce mobility, forecasted device performance, and IT support for remote workers in auto-mode. | AI-born, self-optimizing enterprise mobility platforms utilize real-time sentiment analytics, AI-based adaptive workload allocation, and predictive employee engagement forecasts for smart workforce management. |

The industry is associated with significant risks such as security threats, compliance issues, operational challenges, and employee privacy issues.

Among these is one of the greatest risks, which is data security and cyber threats. Some individual devices can lack the industrial-strength firewalls, encryption, or antivirus that enterprise devices have, leaving them open to malware, hacking, and phishing attacks. If compromised, such devices can serve as an entry point for cyber crooks into corporate networks and access confidential information.

The risks that arise from regulatory compliance are also challenges, for example finance, healthcare, and government sectors that must follow strict data protection laws. It is challenging to ensure that individual gadgets support GDPR, HIPAA, or CCPA and such a situation may put businesses at risk of legal penalties or data breaches.

The existence of different types of devices among employees is another challenge to the IT management. IT teams are required to address aspects such as software compatibility, update security, and network access in relation to various operating systems and hardware. The absence of effective Mobile Device Management (MDM) solutions puts the business model at risk of poor performance and high IT support expenses.

Furthermore, handling the worries of employee privacy is mandatory. A number of employees tend to keep a distance from the idea of the company monitoring their private devices. A wrong implementation of BYOD can lead to job discontent, opposition to usage, and decreased productivity among workers.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.8% |

| China | 11.4% |

| Germany | 9.9% |

| Japan | 10.2% |

| India | 11.8% |

| Australia | 10.3% |

The USA industry is expanding with organizations deploying AI-based mobile security solutions, remote working culture, and cloud-based applications. Organizations are adopting BYOD strategies to enhance productivity, enhance mobile device management, and automate business processes.

The deployment of AI-based cybersecurity, cloud-based mobile workspace, and 5G-enabled enterprise mobility is driving the growth of BYOD solutions. In 2024, the American business sector invested over USD 30 billion in mobile workforce management technology. FMI is of the opinion that the USA industry is slated to grow at 10.8% CAGR during the study period.

Growth Factors in The USA

| Key Drivers | Details |

|---|---|

| Growing Remote Work and Mobile Workforce Growth | There is greater adoption of BYOD models because of convenience in the workplace and flexibility in operations. |

| Mobile Security and Endpoint Management | AI innovations with enhanced security, compliance, and efficiency. |

| Higher IT Services, Healthcare, and Financial Sector Adoption | Enterprise mobility solutions are meant for improved availability of information, worker productivity, and collaboration. |

The Chinese industry continues to grow with innovations in mobile device management (MDM), increased levels of adoption of AI-based workplace solutions, and government efforts towards secure enterprise mobility.

The country is experiencing strong demand for cloud-based collaboration solutions, unified endpoint management (UEM), and mobile security solutions. China, in 2024, invested USD 32 billion in enterprise mobility and secure communication platforms. FMI is of the opinion that the Chinese industry is slated to grow at 11.4% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government Support for Secure Enterprise Mobility and AI-Driven MDM | Cloud-based mobile workforces are complemented with cloud-based mobile workforce-friendly policies. |

| AI and IoT Growth in Enterprise Mobile Security | AI-based cybersecurity solutions push endpoint security and compliance. |

| Expanding Demand for Secure and Scalable Mobile Collaboration Solutions | Enterprise mobility solutions improve real-time communication, workflow automation, and IT support. |

The German industry is growing with industrial robustness, increasing demand for secure enterprise mobility solutions and data security GDPR-compliant.

Artificial intelligence-based enterprise mobility management (EMM) solutions are gaining momentum for hybrid workforces, IT compliance, and security. Government bodies and enterprises are adopting secure digital workplace solutions. FMI is of the opinion that the German industry is slated to grow at 9.9% CAGR during the study period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Current Business Need for Secure Mobile Work | Businesses use AI-driven mobility solutions to provide secure remote work and collaboration. |

| Growing AI-Driven Mobile Threat Protection and Endpoint Security | Businesses invest in AI-driven security technology for BYOD programs. |

| Growth of Cloud-Based Enterprise Mobility Solutions | Businesses implement mobile device management and secure remote work applications. |

The Japanese industry is expanding with enterprise cloud connectivity solutions, workplace automation through AI, and mobile security solutions. BYOD solutions are being adopted by enterprises for digital transformation, workforce productivity monitoring in real-time, and mobile workforce security.

Security analytics through AI and endpoint management for mobile endpoints are leading the adoption. FMI is of the opinion that the Japanese industry is slated to grow at 10.2% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI Integration in Mobile Security and Secure Workplace Automation | Japan is a pioneer in mobile threat defense and AI-powered endpoint security. |

| Hybrid Work Model and Cloud-Driven Enterprise Mobility Expansion | AI-powered BYOD deployments are making their way into day-to-day operations in banking, health, and retail. |

| 5G-Enabled Secure Mobile Workspaces Expansion | The advent of 5G-enabled Secure Mobile Workspaces enhances collaboration and workflow management. |

India's industry is expanding with greater investment in cloud computing, greater adoption of remote workforce solutions, and digitally propagated government-led transformation projects. Initiatives such as 'Digital India' and enterprise IT adoption based on AI are driving mobile enterprise application demand for secure use in IT services, BFSI, and manufacturing industries.

The easy presence of local mobility solution vendors and AI-powered cybersecurity solutions are driving the industry. FMI is of the opinion that the Indian industry is slated to grow at 11.8% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Initiatives for Secure Enterprise Mobility and Digital Workspaces | Policy incentives drive mobile-first workforce strategy, driving adoption. |

| Increased Adoption of AI-Based Cybersecurity and Cloud Mobile Management | Compliant enterprise mobility solutions drive compliance, risk management, and IT governance. |

| Increasing Demand for Cost-Effective, Scalable Mobile Workforce Solutions | AI-based enterprise mobility platforms are gaining traction among large enterprises and startups. |

Australia's industry is growing as organizations are adopting secure mobile workspaces, AI-driven enterprise mobility management, and cloud-based IT security. Banks, hospitals, and government agencies are adopting enterprise mobility solutions for endpoint security, workforce optimization, and data management.

The country's digital transformation efforts and AI-driven cybersecurity efforts are fueling the industry. FMI is of the opinion that the Australian industry is slated to grow at 10.3% CAGR during the study period.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Government Support for Secure Enterprise Mobility and Digital Workforce Automation | Growth in the industry results from policies driving secure remote work. |

| Growing Adoption of AI-Based Mobile Security and Zero-Trust Business Access | Businesses embrace AI-based authentication and mobile endpoint security. |

| Boost in Demand for Cloud-Based Scalable Enterprise Mobility Solutions | Organizations take advantage of AI-based BYOD platforms to safeguard, automate, and analyze mobile data. |

As more businesses rely on mobile networks for communication, collaboration, and remote access to enterprise data, network security becomes an important aspect of enterprise mobility. Due to the increasing frequency of cyber threats, including man-in-the-middle attacks, phishing, and unauthorized access, organizations are adopting advanced network security solutions. Companies are also adopting technologies like Virtual Private Networks (VPNs), Secure Access Service Edge (SASE), and Zero Trust (ZTNA) to ensure complete data protection with continuous connectedness.

The need for network security for enterprise mobility is being recognized, and top providers like Cisco, Palo Alto Networks, and Fortinet come to the front with innovative and assertive techniques. Cisco has SecureX for integrated network security, Palo Alto Networks has Prisma Access for cloud-based mobile security, and Fortinet’s FortiGate firewalls transmit data securely across mobile networks.

With hybrid work models becoming mainstream, AI from security-first data centers is a priority for organizations with a focus on threat detection, end-to-end encryption, and network segmentation. Device security is another important aspect of BYOD and venture portability.

With employees working on their personal devices, securing the endpoint against malware, data breaches, and unauthorized parties' access becomes a task of utmost importance. Solid device security includes the implementation of Endpoint Detection and Response (EDR), Mobile Threat Defense (MTD), and biometric authentication by organizations.

Some heavy-hitters, including BlackBerry, Symantec (now owned by Broadcom), and Microsoft, provide state-of-the-art enterprise device security. CylancePROTECT by BlackBerry incorporates solutions with AI-driven threat prevention, Symantec gives Endpoint Security Complete to protect a device, and Microsoft delivers Defender for Endpoint for real-time threat mitigation. Companies are also using remote wipe features, app containerization, and mobile risk assessments to protect enterprise data held on personal devices.

Mobile Content Management (MCM) is crucial in securely sharing and collaborating content in the enterprise mobility ecosystem. As employees need secure access to corporate documents, emails, and applications, data protection policies and risk management concepts have to be followed.

MCM solutions help in file encryption, digital rights management (DRM), and secure sharing of documents, preventing sensitive information from being accessed by an unauthorized user. The MCM industry is dominated by industry leaders such as IBM, VMware, and Citrix.

IBM’s MaaS360 Content Management gives enterprises the power to control document access, for example, while VMware’s Workspace ONE Content provides seamless file syncing that comes with security controls, and Citrix’s ShareFile allows secure sharing in regulated industries, working with Microsoft Teams.

In a mobile-first workplace, organizations are adopting AI-driven content governance, cloud-based content storage, and compliance-driven content workflows for smooth enterprise data management. Mobile Device Management (MDM) which is one of the three foundational pillars of enterprise mobility is a solution that enables IT teams to monitor, control, and secure devices on their networks.

MDM solutions enable organizations to enforce security policies, configure settings remotely, and handle device inventory. As more enterprise devices based on iOS, Android, and Windows are being adopted, MDM platforms provide devices to be remotely troubleshooted, software updates and app distribution, and geofencing functionalities. Microsoft, IBM, and VMware have extensive solutions that dominate the MDM industry.

The industry has seen exponential growth, driven by the dynamics of remote working, increased adoption rates of cloud computing, and strong demand for mobile security solutions. Organizations are approaching enterprise mobility as a strategy to drive productivity by securing business applications on personal devices and facilitating work collaboration.

While global players such as Microsoft, IBM, VMware, Citrix, and BlackBerry are enhancing their industry positions through advances in mobile device management (MDM), unified endpoint management (UEM), and AI-based security solutions, startups, and niche players are chasing on zero-trust security, encrypted mobile workspaces, and adaptive access control solutions to address changing enterprise needs.

In device security and network performance-improving developments, 5G connectivity, AI-enabled threat detection, and real-time compliance enforcement can be seen. The interplay of strategic factors, such as the integration of enterprise cloud platforms with cybersecurity firms' partnerships and advancements in mobile-first workforce solutions, govern the competitive landscape.

Initiatives like secure and scalable BYOD frameworks are thus being prioritized by businesses, who are subsequently investing in automated security, endpoint intelligence, and policy-driven access management to sustain industry growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Corporation | 20-25% |

| IBM Corporation | 15-20% |

| VMware (Broadcom) | 10-15% |

| Citrix Systems | 8-12% |

| BlackBerry Limited | 5-10% |

| MobileIron (Ivanti) | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Corporation | Enterprise mobility security, Microsoft Endpoint Manager, and AI-driven cloud solutions. |

| IBM Corporation | AI-powered security solutions, mobile device management (MDM), and endpoint protection. |

| VMware (Broadcom) | Workspace ONE platform, cloud-based UEM, and secure mobile application management. |

| Citrix Systems | Secure remote work solutions, virtual desktop infrastructure (VDI), and mobility security. |

| BlackBerry Limited | AI-enhanced enterprise security, secure mobile communications, and zero-trust network access. |

| MobileIron (Ivanti) | Cloud-based endpoint security, zero-trust mobile access, and data protection solutions. |

Key Company Insights

Microsoft Corporation (20-25%)

Microsoft has controlled the industry of BYOD and enterprise mobility mainly through secure endpoint management and cloud-based access solutions integrated with the latest AI-driven security infrastructure.

IBM Corporation (15-20%)

IBM delivers sophisticated artificial intelligence and mobile digital enterprise mobility management solutions across its customers by ensuring secure access and compliance among the mobile workforce.

VMware (Broadcom) (10-15%)

VMware supports mobile device management and security virtualization under the same umbrella. Hence there is a unique offering named the Workspace ONE platform, indeed.

Citrix Systems (8-12%)

Citrix provides its customers with comprehensive remote work and mobility solutions for protected enterprises, exceeding BYOD policies and virtual desktop environments.

BlackBerry Limited (5-10%)

BlackBerry has a complete focus on AI-driven mobile security at its messaging sites and zero-trust access for enterprises with sensitive data.

MobileIron (Ivanti) (4-8%)

MobileIron offers cloud-centric enterprise mobility solutions focused on endpoint security, management of mobile identities, and access to a zero-trust network.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in BYOD and enterprise mobility by integrating AI-powered cybersecurity, cloud-based remote management, and secure mobile collaboration tools. The increasing adoption of hybrid work environments, remote workforce security, and unified endpoint management continue to shape the competitive landscape of the industry.

The industry is projected to reach USD 112.42 billion in 2025.

The industry is expected to witness significant growth, reaching USD 474.95 billion by 2035.

India is expected to experience the fastest growth, with a CAGR of 11.8% from 2025 to 2035.

Interactive Intelligence, Connect First, inContact, Aspect Software Parent Inc., Enghouse Interactive, 8X8, Inc., Genesys, Oracle Corporation, Content Guru, Cisco Systems, Five9, Live Ops, Verizon, Intelecom, Altitude Software, West Interactive, NewVoiceMedia, and Interactive Intelligence Group are the key players in the industry.

Enterprise Mobility Management (EMM) is the most widely used segment in the industry.

By security, the industry is segmented into network security, device security, and identity and access management (IAM).

By software, the industry is segmented into mobile content management and mobile device management (MDM).

By deployment type, the industry is segmented into on-premises and cloud-based.

By end-use, the industry is segmented into government and defense, banking, financial services, and insurance (BFSI), healthcare and life sciences, manufacturing, academia and research, energy and utility, media and entertainment, retail and consumer goods, IT and telecommunication, transportation and logistics, and others.

By organization size, the industry is segmented into small and medium enterprises (SMEs) and large enterprises.

By region, the industry is segmented into North America, Latin America, Asia Pacific, Middle East and Africa, and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.