The butter powder market is projected to witness significant growth between 2025 and 2035 ,Market players anticipate an upsurge of the butter powder market between 2025 and 2035, as the demand for shelf-stable dairy products increases, butter powder is being used for more applications in the food processing sector.

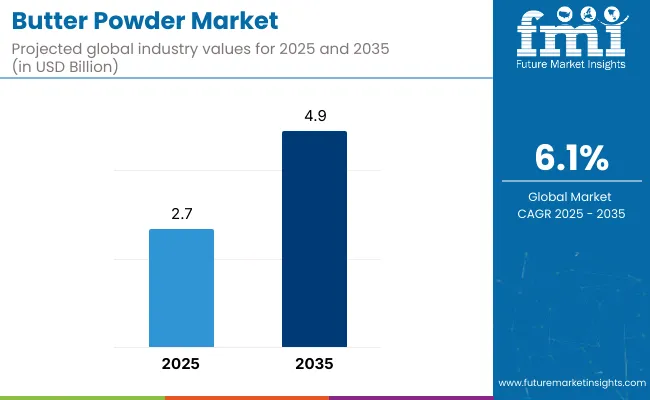

The market is expected to be valued at USD 2.7 Billion in the year 2025, and is projected to reach USD 4.9 Billion by 2035, at a CAGR of 6.1% over the forecast period.

The increasing demand for butter powder as a replacement for traditional butter in bakery, confectionery, and ready-to-eat meal applications is a significant factor driving the market expansion. Growing trend of health-conscious consumers looking for clean-label and natural ingredient-based products also working in favour of organic and non-GMO butter powder formulations.

But, varying prices of dairy and competition from plant-based butter, and limitations in selling dairy-based food and products, may hinder market growth. In response to these challenges, manufacturers are emphasizing sustainable sourcing practices, innovative packaging solutions, and functional butter powder variants with improved nutritional profiles.

In North America, the butter powder market across the USA and Canada are expected to garner significant demand from bakery, processed food and foodservice sectors. Market growth is additionally enhanced by the growing use of long-lasting dairy ingredients for commercial and home application in the region.

The growing consumption of meal kits, protein-based powders, and other instant baking solutions further support demand for butter powder. Modifications in this market are also driven by clean-label and organic dairy complements.

The market for butter powder in Europe continues to be significant, especially in countries such as Germany, France, and the UK, where there is a demand for high-quality dairy ingredients. Strong bakery and confectionery industries in the region consume a high amount of butter powder used in formulations where longer shelf life and consistent flavor are needed.

Moreover, the rising preference of European consumers towards organically produced and natural dairy and dairy products is compelling manufacturers to produce butter powder varieties that are organic and GMO-free.

The butter powder market is expected to witness the fastest growth in the Asia-Pacific region due to rising disposable incomes, increasing urbanization, and growing demand for dairy-based convenience foods. The rising adoption of butter powder in bakery, confectionery and infant nutrition applications is predominantly stretching across China, Japan and India.

The growth of market is also attributed to the expansion of quick-service restaurants (QSRs) and food manufacturing facilities. Different countries have different dairy regulations, and this can be a hurdle for international manufacturers trying to expand into the market.

Challenge

Price Volatility and Competition from Plant-Based Alternatives

The fluctuation of dairy prices, which directly impacts production costs and pricing strategies, is one of the key challenges for the butter powder market. Moreover, the rise of plant-based butter powders, such as coconut and nut-based powders, is steadily creating competition for conventional butter powder manufacturers. This challenge can be addressed with investment in economical production processes and value-added dairy ingredients.

Opportunity

Growth in Functional and Organic Butter Powder Products

Growing demand for functional dairy ingredients is expected to penetrate the market substantially. Manufacturers are aiming on enriching butter powder with additional vitamins and minerals, as well as protein, to fulfil the needs of health-conscious consumers.

Growing demand for organic, non-GMO, and lactose free butter powder is also influencing product development in the segment. Continuous market expansion during the upcoming decade will be driven by further application development in sports nutrition, infant formulae, and meal replacement products.

The Butter Powder Market grew consistently from 2020 to 2024, driven by an increasing demand for shelf-stable dairy alternatives, widespread applications in the food sector, and the rising interest in convenience-based cooking options. Demand for dehydrated butter formulations was driven by the growing popularity of instant baking mixes, meal kits, and plant-based dairy alternatives.

Sports nutrition and functional food markets were also utilizing butter powder as a high-fat, keto-friendly ingredient. Nonetheless, changing dairy pricing, increasingly sustainability-focused policies towards dairy production, and growing regulatory issues surrounding food additives formed obstacles to growth in the market.

A decade down the road we will witness the evolution of the market with AI-operated formulation of ingredients, butter powders derived from precision fermentation, and focused dairy processing methods geared towards sustainability. Carbon neutral dairy farming, biodegradable packaging, and supply chain transparency through block chain will influence consumer choices.

Innovative spray-drying technology, bioengineered dairy fats, along with functional butter powders containing probiotics and omega fatty acids will also appeal to the health-minded consumer. The 3D-printed food application for such specialty items, lab-grown dairy fats and always-digital commerce for custom butter powder formulations will also expand market innovation.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and organic certification for dairy powders. |

| Material Innovation | Use of spray-dried butter powder, whey-based derivatives, and emulsified dairy blends. |

| Industry Adoption | Growth in bakery, confectionery, sports nutrition, and instant food applications. |

| Sustainability & Dairy Innovations | Initial steps toward low-emission dairy production and organic certification. |

| Market Competition | Dominated by dairy cooperatives, specialty food ingredient companies, and plant-based start-ups. |

| Market Growth Drivers | Demand fuelled by rising interest in shelf-stable dairy, clean-label products, and convenience foods. |

| Sustainability and Environmental Impact | Early adoption of recyclable butter powder packaging and organic dairy sourcing. |

| Integration of AI & Digitalization | Limited AI use in flavor enhancement and ingredient sourcing. |

| Advancements in Manufacturing | Standard spray-drying, freeze-drying, and emulsification processes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability policies, carbon footprint labelling, and regulations on lab-grown dairy powders. |

| Material Innovation | Adoption of precision fermentation-derived butter powders, bioengineered lipids, and fat-mimicking plant-based alternatives. |

| Industry Adoption | Expansion into personalized nutrition, AI-optimized butter powder formulations, and hybrid dairy-plant-based powders. |

| Sustainability & Dairy Innovations | Large-scale adoption of carbon-neutral dairy farming, water-efficient butter processing, and upcycled dairy by-products. |

| Market Competition | Increased competition from synthetic dairy firms, AI-driven personalized nutrition brands, and smart food start-ups. |

| Market Growth Drivers | Growth driven by AI-powered ingredient personalization, functional butter powders with added nutrients, and eco-friendly packaging solutions. |

| Sustainability and Environmental Impact | Large-scale implementation of methane-reducing dairy technology, precision fermentation, and sustainable farming. |

| Integration of AI & Digitalization | AI-driven flavor optimization, block chain-enabled supply chain transparency, and 3D-printed butter powder applications. |

| Advancements in Manufacturing | Evolution of lab-grown dairy fat powders, microencapsulated butter powders for enhanced shelf life, and sustainable dehydration techniques. |

With the rising emphasis on value-added dairy products and a strong position in the food processing industry, the USA is anticipated to be one of the largest markets. Market growth is also being driven by increasing popularity of high-protein and functional food products. The growing implementation of butter powder in packaged and ready-to-eat meals is another aspect driving the rising adoption.

Additionally, the major dairy producers in the region and technological advancements in spray-drying to improve the quality of butter powder are helping the market growth. Changes in consumer preferences are further driven by the increasing interest in clean label, organic and non-GMO dairy ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

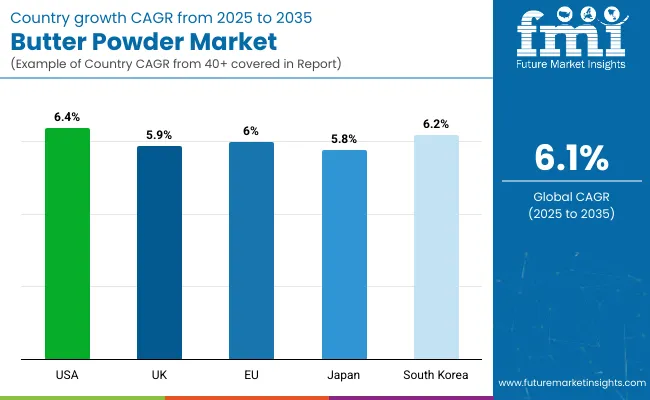

| USA | 6.4% |

The UK butter powder market is expanding at a stable pace, aided by the surging demand for bakery and confectionery products, the growth in the processed food industry, and the growing demand for long shelf-life dairy substitutes.

Innovation and development of new products related to butter powder, growing market for packaged food, and growing trend of home cooking/baking are making butter powder one of the fastest growing consumption dairy products.

Moreover, the growing use of butter powder in foodservice formats, such as sauces, soups, and seasonings, is helping drive the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.9% |

The butter powder market in the European Union is dominated by Germany, France, and Italy with solid dairy production capabilities, high demand for bakery and confectionary food products among consumers, and gaining popularity of butter powder as a food ingredient. Manufacturers are investing in high-quality, additive-free butter powder solutions due to the EU's stringent food quality and safety regulations.

Moreover, the growing health-conscious consumer base is expected to drive the demand for low-fat and functional butter powder variants. This has been key contributor to the butter powder market growth alongside because butter powder is widely used in industrial food production, including snacks, convenience meals, and ready-to-mix products.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.0% |

The growing demand for convenient dairy ingredients, rising interest in Western-style baked food items, and expansion of the processed food industry are driving the Japan butter powder market. Burgeoning export trends coupled with the country's high emphasis on food innovation and dairy processing are proliferating the production of quality butter powder versions.

The emergence of home bakers and growing demand for butter confectioneries are also potential drivers for the market. Japan’s stringent food safety standards and appetite for clean-label dairy products are also influencing industry dynamics. The growing preference for butter powder in instant soups, ready-to-cook meals, and snack food products is propelling the growth of this market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The growing demand for Western-style cuisine owing to the changing food preferences of consumers in the country and the growing bakery and confectionery sector is supporting the demand for butter powder across South Korea. The market is expanding in a region, due to the country’s robust food processing industry along with the growing demand for butter powder in packaged snacks, instant meals, and seasoning mixes.

Trends are also being shaped by the healthy spurred demand for organic and natural butter powder, and innovations in the formulation of dairy ingredients. Convenience features like online shopping, the rise of specialty food stores are also increasing accessibility to premium butter powder products, further ensuring the steady growth of such market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The Butter Powder Market is characterized by a large share of the Dairy-Based and Vegan segments as food manufacturers require quality, shelf stable and versatile butter alternatives for multiple food industry applications. These play a key role in texture enhancement, superior flavor profiles, and processing convenience without compromising on product stability and refrigeration savings.

As plant-based eating continues to gain traction and there are market demands for clean-label ingredients, dairy-based and vegan butter powders are being increasingly adopted in a wide variety of industries.

The dairy-derived butter powder became widely used because of its full flavor, longevity on the shelf, and incorporation in food formulations. Unlike dairy-based butter, the kind that must be stored in the refrigerator and typically has a short shelf-life, dairy-based butter powder provides manufacturers with a lightweight, shelf-stable alternative that keeps the sweet, creamy taste and functionality.

Particularly the baking, confectionery and ready-to-eat meal sectors are the drivers behind high demand for convenient dairy ingredients, which in turn has been an adoption enabler for the market. According to studies, more than 65% of food manufacturers choose dairy-based butter powder because it provides better taste retention, solubility, and shelf life in dry food products.

The growth of high-performance dairy-based butter powder product formulations with stable fat retention, superior reconstitution, and reduced moisture sensitivity has further facilitated market demand to provide standardization and quality for food production.

These include adopting smart dairy processing technologies, as well as using AI-powered fat standardization, enzyme-enhanced dairy lipid preservation, and microencapsulation for retaining lipophilic bioactive components in butter powder.

The introduction of new dairy-based butter powders such as lactose-free, low sodium, or protein-added butter powder variants are likely to be Propelling the market growth.

The rising consumption of dairy-based butter powder, together with sustainable production techniques with carbon-neutral dairy farming, solar-powered spray drying systems, and recyclable packaging solutions, have aided in market growth as it meets alignment with global food sustainability initiatives.

Although it has advantages in flavor authenticity, extended shelf stability, and formulation compatibility, the dairy-based butter powder segment does struggle with fluctuating dairy commodity prices, allergen concerns, and regulatory compliance in clean-label food formulations.

Nonetheless, ongoing innovations through cutting-edge AI-optimized dairy supply chain management processes, precision fermentation techniques to augment lipid synthesis for affordable butter production, and novel processing methods of heat-stable dairy powder for cost-effective and scalable advanced dairy products are driving efficiency and affordability and scalability in the dairy market, ensuring growth for butter powder on a global platform.

The butter powder market is dominated by vegan butter powder segment owing to the demand for allergen-free healthy food formulations and dairy free ingredient innovations focused on sustainability. As dairy-free variants, vegan butter powder is made from plant oils and other alternative fats, appealing to consumers looking for non-dairy and lactose-free butter alternatives.

Consumers, especially those in vegan and flexitarian categories have led to the surge in demand for plant-based food solutions. According to studies, over 60% of plant-based product developers use vegan butter powder to maintain buttery rich flavors whilst meeting the demands of dairy-free and clean-label food processing standards.

Increasing importance of the high-performance vegan butter powder formulation includes non-hydrogenated vegetable oils along with coconut-based emulsifiers and allergen-free stabilizers, thus strengthening the demand from market, attributing a better texture, taste, and functionality of the food application.

The adoption has also been supplemented by smart food processing technologies with AI-led plant lipid profiling, molecular-level fat mimicry techniques and next-gen emulsification methods to guarantee superior mouthfeel and functional performance across plant-based food formulations.

The growth of hybrid vegan butter powder formulation, omega-3 enriched versions, gluten-free and soy-free formulations, and designs from organic coconut also boosted the vegan butter powder market, catering to the growing pool of health-conscious and dietary-restricted consumers.

Market diversification has been realized through the introduction of sustainable vegan butter powder manufacturing processes, including the carbon-neutral sourcing of plant oils, water-efficient spray-drying methods and biodegradable packaging innovations, thus aligning with environmental conscientious food production standards.

Even though the vegan butter powder segment has major advantages such as enabling dairy-free formulation, prolonging shelf life, and taking on allergen-friendly applications, it also faces challenges including matching the identical flavor profiles of dairy butter, creating fats that remain stable in high-heat applications, as well as overcoming a general consumer scepticism about plant-based taste authenticity.

Yet, the ruling consumer preferences for sensory characteristics, functional integrity, and acceptability of the product mean that innovative technology options like AI-guided fat organizations, enzyme-inclusive lipid properties, and advanced fermentation-based butter parallels are helping to align sensory attributes, functional integrity, and market positioning, ensuring sustained growth for vegan butter powder worldwide.

Food brands serving high-cost health-conscious consumers as well as low-price sensitive mass market consumers will witness the dominance of Organic and Conventional segments in Butter Powder Market. These processing categories are essential for establishing food standards, transparency in ingredient sourcing and creating online marketplace access.

The organic butter powder has witnessed an exceptional market uptake owing to its chemical-free, non-GMO, and ethically sourced dairy and plant-based product appeal among consumers. It can be done only as per the organic farming process, to give organic butter powder among the products, based on organic production concept having strict agricultural and process rules for maintaining minimum environmental impact and sustainability.

Adoption has been driven by the growing demand for organic food products, especially in health food retail chain stores, health & specialty food stores, and plant-based formulations. More than 70% of organic food brands now include organic butter powder as it provides them vendor certification at an equal price and consumers have a higher trust in clean-label ingredients.

Demand in the market has also been bolstered by novel next-gen organic butter powder production approaches with enhanced traceability and eco-friendly production processes, as well as regenerative dairy sourcing, and supply chain transparency and carbon-negative food processing systems.

While its organic certification and premium positioning offers advantages with increased appeal to consumers the organic butter powder segment is challenged through increased production costs as well as supply chain limitations and regional differences in dairy and plant oils that are sourced organically.

Even so, ongoing innovations for AI-led organic ingredient procurement, climate-adaptive dairy farming practices, and bioengineered plant-based lipid enrichment hobbling in scalable, cost-effective, and product-accessible formats herald bright prospects for organic butter powder westward and beyond.

Butter powder is also seeing significant growth in the traditional market as food manufacturers and commercial bakeries seek to decimate dairy ingredients that are cost-effective, readily available, and easy to work with. Regular butter powder is industrially manufactured as opposed to organic ones and hence have greater economic feasibility for mass food processing applications.

Growing demand for standardized butter powder formulations, especially in industrial baking, processed food manufacturing and snack food processing, keeps adoption active. Research shows that over 65% of commercial food producers choose reactively conventional butter powder due to its stable price, functional dependability, and even qualification of components.

While its affordability, wide availability, and industrialization leads to a considerable portion of the global unit production for butter powder, this segment of the butter powder market is under pressure from a host of factors: a growing segment of consumers looking for organic, 'clean-label' options that avoid usage of additives along with increasing regulatory scrutiny on mass-market dairy production practices.

What emerging technologies such as AI-driven dairy traceability, sustainable ingredient sourcing or hybrid clean-label butter powder formulations have been working produce improved consumer perception, cost effectiveness, and adherence to regulatory requirements for the perpetual growth of conventional butter powder all over the world.

There also exists a growing need for convenience foods and shelf-stable dairy substitutes which drives the butter powder market. The market is expanding rapidly due to advances in food processing and formulation. Some of the key categories driving the industry are clean-label butter powder, a plant-based alternative, and improved nutritional formulas.

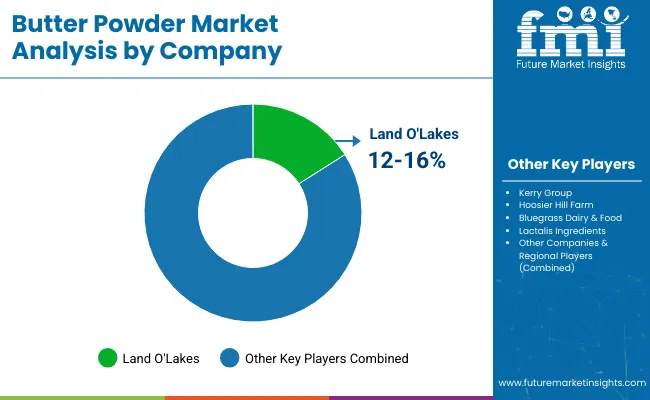

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Land O'Lakes | 12-16% |

| Kerry Group | 10-14% |

| Hoosier Hill Farm | 8-12% |

| Bluegrass Dairy & Food | 6-10% |

| Lactalis Ingredients | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Land O'Lakes | Produces premium-quality butter powder for foodservice and retail applications. |

| Kerry Group | Specializes in dairy ingredient solutions, including functional butter powder formulations. |

| Hoosier Hill Farm | Offers shelf-stable, high-quality butter powder for baking and cooking applications. |

| Bluegrass Dairy & Food | Develops custom butter powder blends tailored for industrial food processing. |

| Lactalis Ingredients | Focuses on clean-label, high-nutrition butter powder formulations for global markets. |

Key Company Insights

Land O'Lakes (12-16%) Land O'Lakes dominates the butter powder market with premium, high-quality formulations catering to both retail and industrial needs.

Kerry Group (10-14%) Kerry Group excels in functional dairy ingredients, offering innovative butter powder solutions for processed food applications.

Hoosier Hill Farm (8-12%) Hoosier Hill Farm provides long-lasting, easy-to-use butter powder tailored for home baking and foodservice markets.

Bluegrass Dairy & Food (6-10%) Bluegrass Dairy & Food specializes in customized butter powder blends designed for industrial food manufacturing.

Lactalis Ingredients (4-8%) Lactalis focuses on clean-label, nutritious butter powder solutions with broad applications in food processing and ready-to-eat meals.

Other Key Players (45-55% Combined) Several dairy producers and food ingredient manufacturers contribute to the expanding butter powder market. These include:

The overall market size for the Butter Powder market was USD 2.7 Billion in 2025.

The Butter Powder market is expected to reach USD 4.9 Billion in 2035.

The demand for butter powder will be driven by its increasing use in bakery and confectionery applications, growing demand for shelf-stable dairy products, rising popularity of convenience foods, and expanding use in foodservice and industrial applications.

The top 5 countries driving the development of the Butter Powder market are the USA, China, Germany, France, and India.

The Dairy based Powder segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Competitive Breakdown of Buttermilk Powder Providers

Butter Coffee Market Size and Share Forecast Outlook 2025 to 2035

Butter Market Insights - Dairy Industry Expansion & Consumer Trends 2025 to 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Butter Flavor Market Trends – Food & Beverage Innovation 2025 to 2035

Analysis and Growth Projections for Butter and Margarine Business

Butter Concentrate Market

Nut Butters Market Insights - Premium Spreads & Consumer Trends 2025 to 2035

Dry Buttermilk Market

Shea Butter Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Aloe Butter Market

Kokum Butter Market Analysis by Application, End Use, and Region through 2035

Vegan Butter Market Insights - Dairy-Free Alternatives & Industry Growth 2025 to 2035

Cocoa Butter Market Analysis by Product Type, Nature, Form, and End Use Through 2035

Peanut Butter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peanut Butter Keto Snacks Market Analysis - Trends & Growth 2025 to 2035

Lactic Butter Market Analysis - Size, Share & Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA