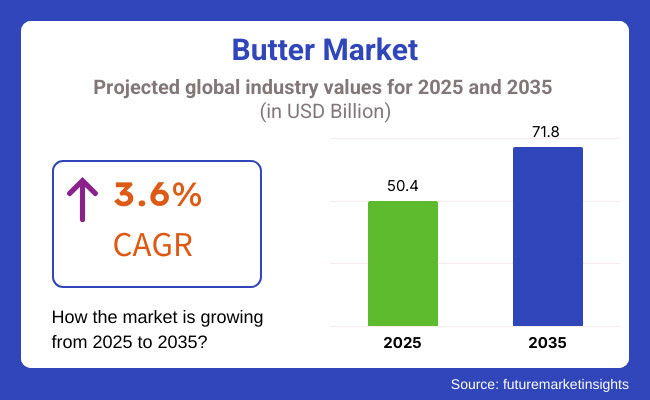

The global butter market is anticipated to grow at a healthy CAGR of around 3.6% during the forecast period from 2025 to 2035. The market is expected to be valued at USD 50.4 Billion in 2025 and projected to reach USD 71.8 Billion by 2035, at a CAGR of 3.6% during the forecast period.

One of the most important factors propelling market growth is an increase in consumption of butter as a primary product used domestically, as well as in bakeries and restaurants across the globe. The trend toward home cooking and artisanal baking and the growth of high-fat diets like keto and paleo are also helping to boost butter sales.

But the relatively high cost of butter, the increasing restrictions on saturated fat as a health concern, and the emergence of plant-based butter alternatives that are gaining appeal all present could also make things difficult. In response, manufacturers are increasingly developing organic, grass-fed, and low-fat butter options and exploring flavoured and functional butter products.

Explore FMI!

Book a free demo

North America, especially the United States and Canada, is a prominent butter market and seen an increase in butter consumption as well. Growing health conscious population and expansion of foodservice sector is making the demand for organic, grass-fed and flavoured butter which is further fuelling the butter product demand.

The increasing demand for dairy-based food trends continues to contribute to market growth. But competition from margarine and plant-based butter alternatives is a challenge, driving dairy producers toward premium and specialty butter products.

There is very significant market for butter in Europe, which is a major producer and consumer countries are France, Germany, and the UK. Another market driving force behind market growth comes from the region's robust dairy industry as well as historical cooking practices that utilize a large amount of butter.

European consumers are speaking with their wallets, demanding organic and pasture-raised butter, part of a larger trend toward clean-label and sustainable dairy products, Davidson said. Moreover, the imposition of government regulations pertaining to dairy farming and carbon releases is proliferating generations.

The butter market in the Asia-Pacific region is projected to grow at the highest rate, mainly due to rising disposable incomes, urbanization and increasing Western dietary influences in China, India and Japan. Demand for snacks and convenience food products flavoured with butter to drive market growth; Expanding bakery and confectionery sectors also cell butter market growth Challenges such as the fluctuation in dairy production costs and the difference in regulations among different countries are barriers to entry for overseas brands.

Manufacturers are leveraging the rising demand by launching regionally adapted butter varieties and expanding retail distribution networks.

Challenge

Health Concerns and Competition from Plant-Based Alternatives

The increasingly saturated for the butter market, and many health debate about saturated fats has resulted in some consumers gravitating toward low-fat dairy products, as well as butter replacements that are plant-based. As more people adopt vegan and dairy-free diets, competition from margarine and from non-dairy spreads also made from coconut, almond and olive oils has increased. In response, butter manufacturers are emphasizing improved formulations like grass-fed and unsalted butter and touting dairy fats' health benefits.

Opportunity

Growth in Specialty and Functional Butter Products

High growth opportunities and demand is accompanied by a growing consumer preference for organic and flavoured butter as well as functional butter high-protein or probiotic-fortified, for example. Moreover, the incorporation of butter in premium and artisanal food items is propelling the market growth. High-quality butter is also in demand within the foodservice industry, which comprises bakeries, confectioneries, and fine-dining restaurants.

With a growing consumer trend towards authenticity and natural ingredients, the market for innovative and premium butter products is expected to continue on an upward growth trajectory in the coming decade.

The Butter Market has grown at a steady pace during 2020 to 2024, as a result of augmented consumer traction for natural dairy items, increased home baking trends, resurgence of high-fat diets like keto and paleo. Consumers looking for less-processed, hormone-free and non-GMO products pushed demand for organic, grass-fed and artisanal butter varieties.

And vegan and dairy-free people helped push up plant-based and lactose-free butter replacements. Yet dairy price fluctuations, the effects of climate change on milk production, and the limits put in place by regulators on dairy farming all challenged the stability of the market.

From 2025 to 2035, the dairy market will witness radical transformations with the crop of sustainable dairy innovations, AI-driven butter formulation, and personalized nutrition. Driving market expansion will be the rise of precision fermentation, bioengineered dairy fats, and carbon-neutral dairy farming.

Butters are likely to see more functionality like anti-inflammatory Omega fatty acids, probiotics and fortification to attract changing health trends. Browse all categories of the website and explore the latest trends in the food industry, such as block chain-enabled supply chain transparency, AI-powered consumer preference analytics, and zero-waste butter production techniques.

The pace of this evolution will accelerate further with the wide endorsement of lab-grown dairy fats, climate-resilient dairy farming practices, and digital dairy commerce platforms.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with dairy safety standards, organic certification, and geographical indication (GI) protections. |

| Material Innovation | Use of traditional cow’s milk, grass-fed butter, and plant-based dairy alternatives. |

| Industry Adoption | Growth in organic, flavoured, and premium butters, along with plant-based dairy substitutes. |

| Sustainability & Ethical Dairy | Rising demand for grass-fed, hormone-free, and humane dairy farming practices. |

| Market Competition | Dominated by dairy cooperatives, artisanal butter brands, and plant-based dairy start-ups. |

| Market Growth Drivers | Demand fuelled by clean-label trends, high-fat diet popularity, and rising home banking activities. |

| Sustainability and Environmental Impact | Initial steps toward organic dairy certification and reduced methane emissions. |

| Integration of AI & Digitalization | Limited AI use in butter production and consumer trend analysis. |

| Advancements in Manufacturing | Traditional churning, cultured butter production, and small-batch artisanal processes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, carbon footprint labelling, and precision-fermented dairy approvals. |

| Material Innovation | Expansion into lab-grown dairy fats, bioengineered milk lipids, and next-gen plant-based butters. |

| Industry Adoption | Widespread adoption of functional butters, AI-optimized fat compositions, and personalized nutrition-based dairy alternatives. |

| Sustainability & Ethical Dairy | Large-scale adoption of carbon-neutral butter production, water-efficient dairy farming, and zero-waste packaging solutions. |

| Market Competition | Increased competition from biotech-driven dairy firms, AI-powered food customization companies, and climate-smart dairy innovators. |

| Market Growth Drivers | Growth driven by functional nutrition, AI-driven flavour profiling, and block chain-backed ethical dairy sourcing. |

| Sustainability and Environmental Impact | Large-scale implementation of methane capture technologies, regenerative dairy farming, and circular economy dairy processing. |

| Integration of AI & Digitalization | AI-driven personalized butter recommendations, smart dairy farming analytics, and automated butterfat optimization. |

| Advancements in Manufacturing | Evolution of 3D-printed dairy fats, precision fermentation-based butter, and AI-driven automated butter churning systems. |

The USA market share of butter remains solid, spurred by growing consumer demand for natural dairy products, a surge in home baking26 and stronger demand for premium and organic butter varieties. Market growth is also being driven by the rising foodservice industry and the growing use of butter in processed foods.

The growing popularity of high-fat, low-carb diets like keto and paleo are also driving up demand for grass-fed and artisanal butter. Supportive factors also include the existence of major dairy producers and technological advancements pertaining to butter processing and packaging. Consumer preferences are also being shaped by the growing move toward clean-label and hormone-free dairy products.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The UK butter market has been growing steadily, driven by increasing consumer preference for high-quality dairy products, growth in home cooking, and rising demand for organic and grass-fed butter. Factors such as the rise of premium and artisanal butter brands and the rising adoption of sustainable dairy farming practices are shaping the market.

Also driving innovation in dairy-free butter products is the growing popularity of plant-based alternatives. The increasing health-aware demographics are also supplementing the need for low-fat and functional potency butter forms, fortified with probiotics and vitamins. Significant growth in e-commerce and direct-to-consumer dairy brands is also making it easier to access both the market and consumer demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.3% |

Germany, France, and Italy dominate the butter market in the European Union, owing to extensive dairy production capabilities, high per capita butter consumption, and increasing demand for premium dairy products. Strict EU quality standards and sustainability regulations are pushing more organic and pasture-raised butter into production.

Moreover, increasing popularity of gourmet and specialty, flavoured and cultured, butters is driving the growth of the market. The positive trend of home baking and the development of food processing industry are equally boosting the butter consumption. Future market trends are being influenced by the region’s emphasis on sustainable dairy farming and greenhouse gas reduction.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.5% |

Demand for premium quality dairy products, increased interest in Western-style bakery products and growing premium butter product range are contributing to steady growth in the Japanese butter market. A growing taste for artisanal and organic butter is being driven by the country’s appetite for local, small-batch dairy products.

Furthermore, surging home-cooking and baking trends and increasing request for functional dairy products are driving the growth of the market. Vigorous food safety criteria and an emphasis on quality and transparency in origination in Japan also play critical roles in consumer purchasing choices. An influx of plant-based and lactose free mock butter options is also diversifying the market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

South Korea is becoming a booming butter market with rising demand for Western-style cuisine, elevated home baking, and growing interest in premium dairy products. An increase in café culture and the foodservice industry in the country is driving an increase in demand for premium butter varieties, such as both organic and grass-fed.

Moreover, the increasing number of health-conscious consumers is also leading to adoption of butter with added health benefits like lower-fat or vitamin plus versions. The growth of online grocery platforms and specialty food retailers also improves the access to premium and imported butter products, which will further propel the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

The Butter Market by product type includes The Cultured and Salted Butter segments are expected to hold a large share in the butter market as they offer premium range dairy offerings coupled with good functional versatility and approach. These butters are the main ingredient for flavour enhancement, food storage, and texture improvement in food preparations. As health-conscious consumers, chefs and food industry professionals experiment with gourmet butter varieties, demand is rising for premium cultured and salted varieties across various food applications.

The availability of cultured butter has been so widespread, and its rich, tangy flavour, probiotic benefits, and consumer shift toward traditionally crafted dairy products has made it a staple in many households. Cultured butter, on the other hand, is made from cream that has been fermented with bacterial cultures, adding complexity of flavour and making it easier to digest.

Market adoption has, in part, been driven by an increasing demand for artisanal and naturally fermented dairy products, especially in gourmet cooking, as well as premium baked goods. According to studies, around 60% of people who eat butter choose cultured butter as it is more delicious, easily digestible, and has better shelf stability.

Growing high-quality formulations for cultured butter, including formulations boasting organic sourced dairy, extended fermentation methods, and naturally ripened textures has reinforced the growth of the market in order to meet the wider health oriented, as well as culinary preferences.

The adoption has been further enhanced with the implementation of smart dairy processing technologies featuring AI-based fermentation tracking, and automated microbial culture optimization, along with real-time butter fat composition analysis.

The Next-generation cultured butter solutions are generally designed with probiotic-enhanced dairy cultures, reduced-lactose formulations, and extended aging processes which drives optimal market growth and have led to a broader application in functional dairy products and specialty food market.

Pasture-raised sourcing, eco-friendly packaging innovations, and solar-powered butter churning systems, among others, have paved for robust uptake of sustainable cultured butter production par with the implementation of sustainability initiatives worldwide in dairy farming.

Although it has notable advantages in terms of superior flavour, gut-health benefits and premium product positioning, the cultured butter category is also challenged by higher production costs, longer fermentation timelines and limited awareness among everyday consumers. But, new developments in the fields of AI-driven dairy culture efficiency optimization, engineered low-fat cultured butter options, and innovative dairy fermentation applications for climate-smart production models are bringing production efficiency, price range, and market reach up, ensuring that cultured butter continues to carve a space on grocery store shelves across the globe.

Salted butter shares a significant portion of the Butter market due to its ability to enhance taste, improve shelf life and a significant ingredient in cooking and baking. Salted butter is different from unsalted varieties as it has sodium added to it, which acts as a natural preservative and flavour enhancer, and is therefore a popular type however in packaged foods and in culinary applications that are professional.

Growing demand coupled with the versatility of flavour-enhancing dairy ingredients for home cooking and commercial food production has driven adoption. Studies show that more than 70% of households as well as professional chefs use salted butter in their recipes to add the best flavour.

The increased consumption of gourmet and artisanal salted butter varieties, such as those that are flavoured with sea salt, come from high-quality grass-fed dairy, and contain herb-sealed formulations has increased the market demand, providing better consumer engagement and product differentiation in the field.

Adoption has been further accelerated by the integration of smart butter production technologies, including AI-based salt concentration control, low-temperature churning techniques, and automated butter texturization analysis, optimizing product consistency and improving customer satisfaction.

The recent innovations with such compositions including reduced-sodium hybrid salted butter, Himalayan salt-enriched, and omega-3 fortified formulations have further streamlined the high market expansion and widened the lucrative reach via health-conscious and specialty food consumption.

The availability of eco-friendly salted butter processing methods, such as zero-waste dairy use, carbon-neutral manufacturing processes, and recyclable butter packaging solutions is further contributing to the market growth while complying with green food production standards.

The salted butter segment plays an important role, thanks to its advantages of flavour enhancement, extended shelf life, and versatile cooking applications, it is subjected to higher consumption compared to unsalted butter, consumers are often prone to high sodium intake, and readily available plant-based butter could pose a stringent threat to the salted butter owing to evolving health regulations.

However, new innovations in the field of AI-powered sodium reduction, mineral-rich butter fortification, and advanced dairy lipid processing help improve health attributes, sustainability and consumer quality, and this will make sure salted butter will keep expanding in the world.

There are two main segments in the Butter Market based on Processing and they hold large portions in the Dairy Market, namely processed and unprocessed butter as dairy manufactures meet the varying consumer demands for convenience, texture consistency, and minimally processed dairy. Butter processing categories are essential for market trends, improving the quality of butter, and enhancing versatility for application.

Processed butter has achieved robust market penetration, owing to its long shelf life, uniformity in texture, and greater resilience as a food ingredient. Processed butter avoids the variability and inconsistency that raw and unprocessed butter can introduce, through careful churning, emulsification, and pasteurization ensuring a uniform composite as per industry standards.

Adoption has been supported by the growing demand for commercially viable solutions for butter substitutes with particularly strong activity in the areas of packaged foods, confectionery, and large-scale baking operations.

Growing demand for advanced butter processing techniques, characterized by precision churning, controlled temperature stabilization, and enzymatic modification, has strengthened the market demand for these products, enhancing usability and performance in food manufacturing.

The processed butter segment is anticipated to grow at a higher variable growth rate though challenged by loss of nutrients, incorporation of artificial ingredients and scrutiny of processing methods used in the food industry.

But there are new innovations in AI-driven dairy process controls, cold-processing butter skills, and functional butter fortification that can simultaneously preserve nutrition, transparency and transparency, and consumer confidence to help processed butter continue its ascent around the world.

Unprocessed butter remains a fast-growing market as consumers and health-focused food brands demand natural, minimally processed, and traditional forms of dairy. Unprocessed butter is preferred by organic dairy consumers and specialty food markets because it preserves its original texture, flavour profile, and nutritional value, unlike processed alternatives.

Adoption has been fuelled by increasing demand for farm-to-table dairy options, especially in artisan cheese-making, organic meal preparations and home baking. According to studies, more than 60% of health-conscious consumers choose unprocessed butter for the purity, better taste and absence unless industrial additives.

Beaten by shorter shelf life, inconsistent texture, and limited reach through mainstream retail channels, unprocessed butter has several competitors, despite its advantages in minimal processing, clean-label positioning and nutritional integrity.

The good news is the next wave of breakthroughs in AI-enhanced dairy traceability, controlled-environment maturation techniques, and next-gen natural preservation approaches are boosting product stability, scalability in distribution, and market accessibility securing global growth for unprocessed butter in the future.

The rising consumption for natural dairy products, growing application in bakery and confectionery, and increasing popularity of premium and organic butter types are also known to drive the Butter Market. Due to developments in dairy processing and plant-based substitutes, the market is thriving. Some of the key trends influencing the industry are sustainable sourcing, non-dairy butter innovations and fortified butter products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amul | 12-16% |

| Land O'Lakes | 10-14% |

| Arla Foods | 8-12% |

| Fonterra | 6-10% |

| Lactalis Group | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amul | Produces traditional dairy butter with a focus on organic and sustainable sourcing. |

| Land O'Lakes | Specializes in premium and flavoured butter options for retail and foodservice industries. |

| Arla Foods | Offers high-quality, grass-fed butter with fortified nutritional benefits. |

| Fonterra | Focuses on export-oriented butter production with innovative dairy formulations. |

| Lactalis Group | Develops a wide range of butter products, including organic and functional dairy spreads. |

Key Company Insights

Amul (12-16%) Amul dominates the butter market with its strong presence in dairy-based products, offering organic and sustainably sourced butter options.

Land O'Lakes (10-14%) Land O'Lakes leads in premium and specialty butter segments, catering to both retail consumers and foodservice providers.

Arla Foods (8-12%) Arla Foods expands its market reach with grass-fed and fortified butter, addressing the demand for healthier dairy products.

Fonterra (6-10%) Fonterra strengthens its market position with large-scale butter exports and innovations in dairy ingredient solutions.

Lactalis Group (4-8%) Lactalis diversifies its butter portfolio with organic and functional spreads, meeting evolving consumer preferences.

Other Key Players (45-55% Combined) Several dairy manufacturers and specialty food producers contribute to the expanding butter market. These include:

The overall market size for the butter market was USD 50.4 Billion in 2025.

The butter market is expected to reach USD 71.8 Billion in 2035.

The demand for butter will be driven by increasing consumption of bakery and confectionery products, rising demand for organic and grass-fed butter, expanding foodservice industry, and growing preference for high-fat dairy products in ketogenic and low-carb diets.

The top 5 countries driving the development of the butter market are the USA, China, Germany, France, and India.

The Salted butter segment is expected to command a significant share over the assessment period.

Licorice Root Market Analysis by Product form, End use, and Region Through 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Latin America Omega-3 Market Analysis by Product Type, Source, Form, Application, Distribution Channel, and Country through 2035

Comprehensive Analysis of Europe Omega-3 Concentrates Market by Source Type, Concentration Level, Application, and Category through 2035

USA Nucleotide Premixes Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Microbial Seed Treatment Market by Microbe Type, Crop Type, Functionality, and Form through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.