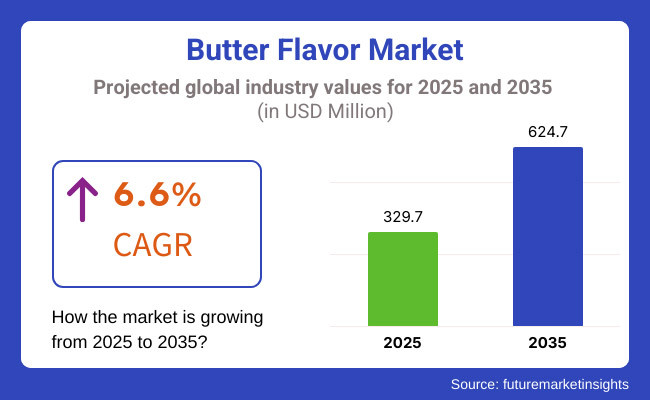

Growth forecast for the butter flavor market between 2025 to 2035, which can be attributed to rising use of natural and artificial butter flavors, especially in food and beverage applications. The market is anticipated at USD 329.7 Million in 2025 and is projected to reach USD 624.7 Million by 2035, registering a CAGR of 6.6% over the assessed timeframe.

One of the significant elements driving the growth of the market is the increasing interest of the consumers towards luxurious and creamy flavors in processed food, snacks, bakery products, and RTE products. The growing trend along with the change in consumer preferences such as plant-based and dairy-free butter flavoring solutions will affect the market economically thus fuelling by giving rise to innovations in the market.

Nonetheless, regulatory hurdles concerning the use of artificial flavoring agents, as well as food safety standards, could challenge the growth of the market. To alleviate these concerns, manufacturers are emphasizing clean-label, non-GMO, and organic butter flavor formulations to better align with changing consumer preferences.

Explore FMI!

Book a free demo

The main sales of butter flavor are based in North America, and the USA and Canada have a higher demand for bakery, confectionery, and dairy alternatives with butter flavor. Market growth is aided by the expanding popularity of the plant-based diets and the introduction of vegan-friendly butter flavorings, as companies work to develop formulations using natural extracts.

Furthermore, growing consumer inclination towards microwave popcorn, snack foods and gourmet cooking applications continues to catalyse the sales of butter flavoring solutions in the region.

Europe continues to be a significant market for butter flavor, especially in Germany, France, and the UK, where butter-based bakery and confectionery products are highly common. The European Food Safety Authority (EFSA) is working with its food safety and labelling regulations in the region which is making natural and organic butter flavors production potential.

Moreover, consumers increasingly seeking premium quality in their culinary endeavours is contributing to the demand for quality flavored butter solutions catering to top-tier food applications.

Asia-Pacific is projected to be the fastest growing region in the butter flavor market, owing to changing dietary patterns, increasing urbanization, and rising disposable income. The demand for butter-flavored bakery, snack, and convenience food products is increasing in countries such as China, Japan, and India.

Market growth is also being further powered by the expansion of the Quick Service Restaurants and growing popularity of Western-style confectionery items. On the other hand, mainstream practices and tastes may still diverge across the region, challenging efforts to unify product formulations.

Challenge

Regulatory Compliance and Health Concerns

Global demand for butter flavor faces regulatory and trade-related issues as the standards for artificial flavoring agents set by the governments of various regions are widely different and impact its production compliance. Its presence in certain artificial butter-flavorings has led to concerns about respiratory health risks, resulting in tighter regulation in many areas.

Growing consumer demand for naturally derived ingredients are also driving manufacturers to reformulate their products to include clean-label and organic substitutes.

Opportunity

Growth of Plant-Based and Clean-Label Butter Flavors

The increasing trend towards plant based and dairy-free butter alternatives opens up a huge opportunity for expansion. To compete with other vegan and lactose-intolerant segments, manufacturers are working on the development of flavors of non-dairy butter from coconut, almond, and soy-based ingredients.

Furthermore, the implementation of modern extraction methods to improve the genuineness and complexity of natural butter flavors is on an upward trend. The market for butter flavoring solutions that are clean-label is also associated with the movement of clean-label food that influences buying behaviour and is expected to gain significant momentum in the next 10 years.

The butter flavor market recorded substantial output growth from 2020 to 2024, as consumers were inclined towards natural and plant-based butter flavors, increasing application in processed food, and its adoption in the bakery industry, dairy, and snacks. The increasing trend of clean-label and organic ingredients as well as growing preference for vegan, lactose-free butter alternatives accelerated market innovation.

Natural butter flavors produced through fermentation and enzymatic processes began to emerge as health-conscious consumers looked for non-GMO options. But manufacturers faced challenges from high raw material costs, regulatory constraints over artificial flavoring, and supply disruptions.

By 2025 to 2035, the market would evolve further, keeping in mind AI-optimized flavour formulation, bioengineered butter flavours, sustainable plant-based alternatives and others. Precision fermentation, enzymatic butter flavor synthesis, and fat-mimicking technology will improve authenticity while serving dietary restrictions.

Block chain-based supply chain transparency, AI-powered consumer taste analytics, and low-carbon footprint butter alternatives will reshape the market landscape. Healthier formulations in both the baked goods and snacks segments will see growth of nutritional butter flavors with probiotics and omega-3 fortified butters, which will serve the functional playground among food developer trends towards health.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and clean-label regulations, focus on reducing artificial ingredients. |

| Material Innovation | Use of dairy-based butter flavors, synthetic flavoring agents, and plant-derived alternatives. |

| Industry Adoption | Increased use in snacks, baked goods, dairy alternatives, and ready-to-eat meals. |

| Clean-Label & Plant-Based Trends | Rising demand for organic, natural, and vegan butter flavoring solutions. |

| Market Competition | Dominated by flavor houses, dairy processing companies, and plant-based food start-ups. |

| Market Growth Drivers | Growth fuelled by health-conscious consumers, lactose-free diets, and demand for rich buttery flavors in plant-based foods. |

| Sustainability and Environmental Impact | Initial shift toward palm oil-free butter flavors and reduced carbon footprint in dairy sourcing. |

| Integration of AI & Sensory Analytics | Limited AI use in flavor profiling and sensory data collection. |

| Advancements in Manufacturing | Use of chemical synthesis, extraction from dairy sources, and enzymatic processing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global standards on artificial and synthetic flavors, increased demand for traceable, sustainably sourced butter flavors. |

| Material Innovation | Transition to fermentation-derived, AI-optimized, and bioengineered butter flavors for enhanced authenticity. |

| Industry Adoption | Expansion into functional foods, personalized nutrition, and AI-driven taste-matching solutions. |

| Clean-Label & Plant-Based Trends | Large-scale adoption of zero-waste, allergen-free, and carbon-neutral butter alternatives. |

| Market Competition | Increased competition from biotech-driven flavor engineering firms, AI-assisted taste prediction platforms, and sustainable ingredient manufacturers. |

| Market Growth Drivers | Expansion driven by AI-powered flavor enhancement, functional food trends, and personalized dietary formulations. |

| Sustainability and Environmental Impact | Adoption of fermented butter flavors with near-zero emissions, upcycled food waste applications, and fully transparent supply chains. |

| Integration of AI & Sensory Analytics | AI-driven predictive taste modelling, real-time consumer preference analysis, and bio-synthesized butter flavoring compounds. |

| Advancements in Manufacturing | Evolution of 3D-printed butter flavor compounds, bioengineered fat-mimicking molecules, and lipid-optimized mouthfeel enhancers. |

The USA is a key marketplace for butter flavor, owing to the gain in consumer proposing natural and artificial butter flavoring for bakery, confectionery & ready-to-eat food products. The growing movement for plant-based substitutes includes new developments in vegan and plant-based butter flavors as well. Further, the expansion of fast-food and convenience food sectors is contributing to the consumption of butter flavoring in processed and packaged products.

The market is spurred by the presence of leading flavor manufacturers and the ongoing advancements in encapsulation technologies that seek to improve flavor stability. Rising demand for clean-label and organic flavoring options is also dictating market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

The UK butter-flavor industry is registering uninterrupted growth, fuelled by rising demand for innovative food products, spurting consumption of baked goods & dairy substitutes, and soaring preference for nature-derived flavorings. Increased consumer awareness about health is increasingly driving the demand for low-fat and non-dairy butter flavoring in a wide range of food applications.

Furthermore, increasing the plant-based food market is motivating manufacturers to advance development for butter flavor solutions for vegan and lactose-intolerant clients. Rising use of butter flavors in gourmet snacks and artisanal baked products are also aiding market growth. With a growing world of e-commerce and direct-to-consumer sales channels, specialty butter flavor products are increasingly accessible.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

The butter flavour market in the European Union is dominated by Germany, France, and Italy, driven by a robust bakery and confectionery sector as well as a growing trend of preference for naturally-derived and clean label flavouring agents. A catering module is being implemented with the growing demand for organic and sustainably sourced ingredients driving manufacturers to produce non-GMO and natural butter flavors.

Moreover, some other factors such as increasing food processing industries and the demand for premium and gourmet products are expected to boost the market growth. New fat-reduction technologies and non-dairy butter flavor concepts are driving market trends. Growing preference for convenience food and flavored dairy items also has been driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.5% |

Butter flavor market in Japan is expected to be steadily growing, owing to increasing demand for high-quality flavoring agents in end use like bakery, confectionery and processed food. This huge demand for all foods in China is pushing for the adoption of butter flavors both in traditional and western-style foods because of the citizens’ taste for premium, umami flavors.

Moreover, the growing popularity of lactose-free and plant-based alternatives is leading to advancements in the formulation of non-dairy butter flavor. Japan’s strict food safety regulations and preference for natural and minimally processed ingredients are also influencing market dynamics. In addition, the growing ready cuisine and rising consumer inclination for flavor-enhanced snacks are other factors fuelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

Increasing demand for bakery and dairy-flavored food products, along with growing popularity of Western food, is making South Korea an important market for butter flavour, as is the growing food processing sector in the country. The demand for high-quality butter flavors is being fuelled by the country’s fast-developing snack and confectionery industries.

Moreover, the rising inclination of the consumers towards plant-based and health-conscious substitutes is boosting the innovation of non-dairy butter flavors. Market growth is also being propelled by the growth of specialty cafes and premium baked goods. Butter flavoring is marketed through e-commerce and retail in many regions, providing consumers with a means of access to these products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

As food manufacturers make the rising trend of versatile, high-quality, and long-lasting butter substitutes, the majority of the share of Butter Flavor market is attributed to Liquid and Powder Forms segments.

This functional utilization is essential to improve taste, increase shelf stability, and also keep production affordable for various food products such as baked goods, dairy products, snacks, and processed foods. Liquid and powdered butter flavors are in high demand for their natural and indulgent flavors, especially as more and more applications come into play.

Liquid butter flavor is widely accepted because of its advanced, concentrated flavor, easy blending and due to higher solubility. Liquid butter flavor dissolves completely into a wet ingredient mix, whereas powdered forms may clump and leave flecks in the product; therefore, this format works particularly well in sauces, confectionery and dairy applications.

Market adoption has been driven by the rising demand for high-quality butter substitutes, especially in ready-to-eat meals, bakery fillings, and premium dairy products. In contrast, the significant flavor and aroma retention ability with the ease in providing flavor uniformity within the formulation make liquid butter flavor an ingredient of preference for more than 65% food manufacturers.

Market demand is driven by the introduction of innovative high-performance liquid butter flavor formulations which include natural and organic ingredients, low-fat, and allergen-free substances providing higher penetration in the health-conscious consumer segment.

It is the combination of smart flavoring technologies, characterized by AI-driven taste profiling, enzyme-based flavor enhancement, and automated blending systems, which helped spur adoption even further, guaranteeing optimized production efficiency and high product customization.

Next-generation liquid butter flavor solutions include non-GMO ingredients, heat stable compounds, and extended shelf-life capabilities to advance market growth, including a broader range of compatibility with various food processing.

Market expansion has been consolidated by the integration of bio-based fermentation, solvent-free extraction processes, and environmentally responsible packaging innovations, in turn guaranteeing adherence to global food sustainability objectives through sustainable liquid butter flavor production techniques.

Liquid butter flavor provides the benefits of replacing the real taste with higher solubility and ease of application, but its ability to be oxidized and expensive transportation costs have restricted the growth of the market and short stability compared to powdered ones. Nonetheless, novel developments in AI-boosted preservation methods, plant-based lipid stabilizing, and advanced encapsulation technologies are improving longevity, cost-effective scaling, and product consistency, promising continued growth for liquid butter flavor on a global scale.

The powdered butter flavor segment maintains a leading share of the overall Butter Flavor market owing to its long shelf life, simplicity of handling, and wide compatibility with dry food formulations. Powdered butter flavor requires less storage space, is more stable than liquid alternatives, and can be used in baked goods, dry mixes and instant foods, making them less variable.

Adoption has been fuelled by rising demand for dry and pre-mixed seasoning solutions, especially across the convenience foods, powdered soups and snack coatings segment. More than 60% of the packaged food manufacturers use powdered butter flavor because it helps preserve the flavor, aroma and texture during longer shelf life.

The increase in spray dried & freeze dried flavored powdered butters with enhanced heat stability, fine particle dispersion, and enhanced solubility have boosted the market demand, thus providing for better usability in large scale food manufacturing.

The addition of intelligent processing technologies, which utilize AI-powered moisture content regulation, microencapsulation techniques, and novel lipid oxidation prevention systems to improve flavor retention while minimizing waste in bulk manufacturing, has also contributed to increased adoption.

Market growth has been furthered by the development of fat-reduced hybrid powdered butter flavor compositions, plant-based butter analogs and fortified nutrient-infused variants, leading to wider adoption in health-oriented food products.

This is further attributed to the introduction and widespread adoption of sustainable powdered butter flavour manufacturing practices, wherein solar-powered drying systems, carbon-neutral ingredient sourcing, and biodegradable packaging materials to ensure compliance with environmentally sound food production initiatives are the focus across the value chain.

While powdered butter flavor offers cost efficiency, long shelf life, and compatibility with dry ingredients, factors such as flavor loss during processing at high temperatures, low instant solubility, and clumping of ingredients in humid conditions pose challenges to the powdered butter flavor segment.

In addition, advances in artificial intelligence techniques and microencapsulation of flavors, next-generation spray-drying processes and moisture-stable/powder-stable encapsulation technologies are overcoming previous challenges in terms of reliability, efficiency and user satisfaction, meaning that powdered butter flavor remains set for their ever-increasing global uptake.

Butter Flavor Natural and Organic segments account for significant share in the Barcode market as consumers increasingly seek clean-label, NON-GMO and minimally processed flavoring solutions. These butter flavor categories are important for providing market transparency, maintaining trends and known dietary preferences.

Drive for Natural Butter Flavor in Market- According to our market analysis, Natural Butter Flavor Type is the promising option among all butter flavors available in the market as it is compliant with clean label certifications; appealing to health-conscious consumers and delivering authentic butter taste and mouth feel without using any synthetic derivatives. Natural butter flavor, in contrast to artificial flavors, is sourced through dairy fermentation, enzyme modification, or plant lipid extraction, allowing for limited chemical processing.

This is driving adoption as consumer appetite for transparency and minimally processed food ingredients particularly in organic dairy products, plant-based snacks and clean-label baking formulations continues to rise. Researchers have found that more than 70% of food brands that focus on natural product positioning incorporate natural butter flavors into their formulations since they are consumer-preferred and tend to be less heavily regulated.

Emergence of next-gen natural butter flavor derivation technologies, through enzyme-driven lipid transformation, bio-fermentation, and sustainable feedstock fermentation, has propped up the interest in this market with guarantees of enhanced authenticity and lowered dependence on synthetic flavoring constituents Which in turn profit the serve of natural butter flavor industry

While the natural butter flavor segment has certain advantages in terms of consumer trust, regulatory compliance, and authentic taste delivery, it encounters challenges such as higher production costs, supply chain limitations, and variable raw material availability.

Yet, emerging innovations in AI-powered flavour extraction, bioengineered plant-based lipid fermentation and sustainable dairy-waste valorisation are enhancing affordability, production scalability and industry adoption to sustain natural butter flavour expansion worldwide.

Strong market growth of organic butter flavor is expected to continue as consumers and food brands prioritize USDA certified organic, non-GMO, and sustainably sourced flavoring solutions. Organic butter flavor replaces conventional natural flavors and must comply with stringent processing standards, falling in line with certified organic agriculture.

Adoption has been driven by the growing demand for premium, organic dairy and bakery products, especially those focused on health and plant-based foods. According to studies, more than 60% of high-end organic food brands use organic butter flavor to ensure brand positioning and consumer expectations for authenticity and sustainability.

However, even with these benefits of organic certification, premium positioning, and sustainability-oriented processing, the organic butter flavor category is not without its challenges, including limited ingredient sourcing, elevated retail price points, and greater regulatory complexity from market to market.

But recent developments in AI-assisted organic ingredient supply chain optimization, regenerative dairy-sourced organic lipid extraction, and climate-adaptive organic crop management are enhancing scalability, affordability, and global accessibility, paving the way for greater penetration of organic butter flavor around the world.

Some of the leading constraints in the Butter Flavor Market include increasing consumer demand for natural and artificial butter flavors in conjunction with rising applications in the food and beverage industry as well as advancements in flavor formulation technologies. The market continues to grow steadily due to rising interest in clean-label ingredients and plant-based alternatives.

Sustainably sourced, non-dairy butter flavor innovations, flavor stability in processed foods, and other notable findings comprise key trends shaping a rapidly evolving industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan | 12-16% |

| Firmenich | 10-14% |

| International Flavors & Fragrances (IFF) | 8-12% |

| Symrise AG | 6-10% |

| Sensient Technologies | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Givaudan | Develops high-performance butter flavors with natural and synthetic options for various food applications. |

| Firmenich | Specializes in clean-label butter flavor solutions, including plant-based and dairy-free alternatives. |

| International Flavors & Fragrances (IFF) | Offers advanced butter flavor formulations with enhanced stability and taste. |

| Symrise AG | Focuses on sustainable and natural butter flavor ingredients catering to evolving consumer preferences. |

| Sensient Technologies | Provides high-quality, customized butter flavor solutions for bakery, confectionery, and snack industries. |

Key Company Insights

Givaudan (12-16%) Givaudan is a global leader in the butter flavor market, offering a diverse range of natural and synthetic solutions tailored for food manufacturers.

Firmenich (10-14%) Firmenich focuses on clean-label and plant-based butter flavors, aligning with the growing consumer demand for dairy alternatives.

International Flavors & Fragrances (IFF) (8-12%) IFF enhances its market presence by providing highly stable and customizable butter flavor solutions for various applications.

Symrise AG (6-10%) Symrise integrates sustainability in its butter flavor production, emphasizing natural ingredients and advanced formulation techniques.

Sensient Technologies (4-8%) Sensient specializes in innovative butter flavor solutions, catering to bakery, snack, and processed food manufacturers worldwide.

Other Key Players (45-55% Combined) Several flavor manufacturers and suppliers contribute to the expanding butter flavor market. These include:

The overall market size for the Butter Flavor market was USD 329.7 Million in 2025.

The Butter Flavor market is expected to reach USD 624.7 Million in 2035.

The demand for butter flavor will be driven by increasing consumer preference for natural and plant-based flavoring solutions, rising applications in bakery, confectionery, and ready-to-eat foods, and growing demand for clean-label and organic food products.

The top 5 countries driving the development of the Butter Flavor market are the USA, China, Germany, France, and India.

The Natural Butter Flavor segment is expected to command a significant share over the assessment period.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.