The industry of butcher paper will continue to increase steadily from 2025 to 2035 because food packaging, meat processing, and food service markets will increasingly require more demands. Butcher paper, or kraft paper, is commonly utilized for wrapping raw meat, for lining food trays, and as a disposable working surface for food preparation.

It offers strength, breathability, and water resistance, and therefore is the material of choice in butcher shops, grocery stores, barbecue restaurants, and delis.

Among the strongest drivers of market growth are the increasing size of the foodservice market, led by North America and Europe, fueled by increased takeaway food consumption and the rise of barbecue culture. Demand has been driven by the pressure to biodegradable and environmental packaging materials since butcher paper is compostable and environmentally friendly and offers a better option than plastic-packaging materials.

These, and other in-home cooking, grilling, and smoking activities, have driven increasing demand for butcher paper at the consumer level.

There are different types of butchers' papers including white butchers' paper, pink butchers' paper, and peach-treated butchers' paper which are employed for different uses. The pink butchers' paper, in particular, is becoming increasingly popular among barbecuing businesses since it keeps moisture but provides room for the smoke to penetrate in which ads flavour to smoked meat.

The food-grade and FDA-compliant property of butchers' paper has also become increasingly popular among meat packers and food wrap uses.

While it has its constraints, the market is being restricted by raw material price volatility, low penetration in certain markets, and competition from plastics-based products. However, long-term growth will be driven by increasing environmental and government-led initiatives towards green packaging.

Availability of custom-printed butchers' paper for promotional and branding also offers new business opportunities for foodservice operators and manufacturers.

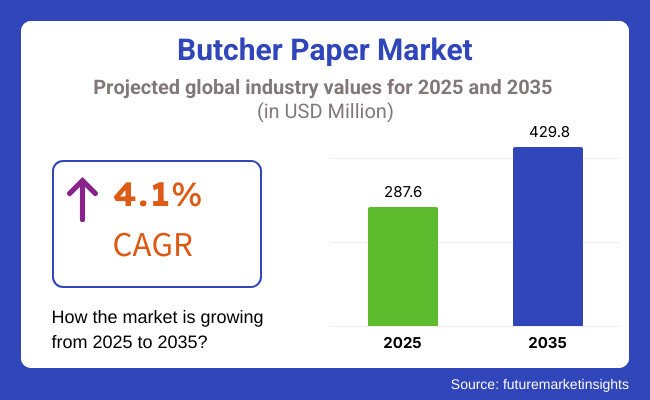

The butcher paper market accounted for USD 287.6 million in the year 2025 and is expected to reach USD 429.8 million by the year 2035, at a CAGR of 4.1% during the forecast period.

Explore FMI!

Book a free demo

Deep penetration of barbeque culture in North America, growing trend towards sustainably packaged food, and consumers' awareness of home smoking of meat and grilling are drivers driving market dominance for butcher paper. Plastic-packaging today is being abandoned in favour of unbleached, compostable butcher paper by both companies and consumers.

Market growth momentum comes not just from the consumer side but also from the side of smokehouses and upscale meat retailers.

The European market keeps expanding steadily with packaging regulation in legislation encouraging biodegradable and eco-friendly packaging material. The UK, France, and Germany are converting to compostable butcher paper to meet EU sustainability requirements. Other butchery and foodservice operations fuel demand as restaurants and supermarkets seek natural chemical-free packaging materials.

Asia-Pacific is the most rapidly expanding region, driven by urbanization, disposable income growth, and increasing development of quick-service restaurants (QSR). China, India, and Japan are experiencing fast-demand growth of green food packaging for fast food and meat. Government efforts in prohibiting plastic waste also drive the trend of using butchers' paper in the region.

Challenge

Environmental Concerns and Competition from Alternative Packaging Solutions

One of the key challenges in the Butcher Paper Market is the growing environmental concerns associated with paper production and disposal. Despite being biodegradable, the manufacturing process of butcher paper involves resource-intensive processes, including deforestation and water consumption.

Additionally, the rising adoption of eco-friendly and reusable packaging materials, such as compostable wraps, waxed cloth, and biodegradable films, is increasing competition for butcher paper.

Opportunity

Growth in Sustainable and Customizable Butcher Paper Solutions

One of the biggest threats to the Butcher Paper Market is mounting environmental pressure with regard to paper manufacturing and disposal. While paper is biodegradable, its manufacturing includes consumptive practices such as deforestation of forest land and water consumption. In addition, consumers are shifting towards green and reusable packaging materials made of compostable wraps, waxed cloth, and biodegradable film to challenge butcher paper.

From 2020 to 2024, the Butcher Paper Market expanded steadily with mounting demand for good quality food-grade paper for wrapping food, packaging meat, and restaurants. Short-run disruption in supply chain caused by the COVID-19 pandemic created increased demand for takeout and safe food packaging solutions, creating sales of butcher paper. Issues of deforestation and plastic-coated paper wastage were the main concerns otherwise.

Forward to 2025 to 2035, the market will experience a boom in growth for green solutions like PFAS-free and chlorine-free butcher paper with more stringent enforcement on green laws. Transition to compostable and recyclable food packaging will force manufacturers to look for the creation of new coatings with higher grease resistance at the cost of low-to-zero environmental trade-off.

In addition, advancements in digital printing and food-safe inks technology will propel growth in custom-printed and branded butcher paper.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with basic food safety regulations |

| Market Growth Drivers | Growth in demand from butcher shops, delis, and food service providers |

| Sustainability Trends | Initial adoption of FSC-certified paper |

| Customization and Branding | Moderate demand for printed and logo-embedded butcher paper |

| Supply Chain Dynamics | Reliance on traditional pulp-based manufacturing |

| Technological Innovations | Limited integration of new coatings and barrier technologies |

| Market Competition | Presence of local and regional suppliers |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability regulations and bans on non-recyclable coatings |

| Market Growth Drivers | Increased demand for compostable and PFAS-free butcher paper |

| Sustainability Trends | Large-scale use of chlorine-free, biodegradable, and eco-friendly coatings |

| Customization and Branding | Increased adoption of custom-branded and digitally printed butcher paper for premium packaging |

| Supply Chain Dynamics | Adoption of alternative fiber sources like bamboo and recycled paper for sustainable production |

| Technological Innovations | Development of non-toxic, food-safe, and biodegradable grease-resistant coatings |

| Market Competition | Expansion of global players offering innovative and eco-friendly butcher paper solutions |

United States demand for butcher paper is rising in steps with an increased consumers' interest in environmental friendly food packing, increasing consumption of meat, and increased barbeque culture. Food institutions such as butchering homes, steakhouses, deli shops, and barbecues restaurants are highly dependent on the use of butcher paper in covering meat, trays lining, and serving foods in an environmental way in rural countryside form.

With increasing interest in plastic waste, a lot of restaurants, supermarkets, and meat processors are turning towards biodegradable and recyclable packaging, which indirectly is inducing demand for unbleached kraft pulp butcher paper. Outdoor barbecue and home grilling lifestyle has also created consumer demand for waxed and pink butcher paper to maintain moisture content and let penetration of smoke in barbecued meat.

In addition, the USA Food and Drug Administration (FDA) and USA Department of Agriculture (USDA) impose rigorous food safety and sanitation requirements, additionally demanding high-quality, food-grade butcher paper use in meat packaging. Online meal kits and specialty butcher shops also drive demand for custom-printed butcher paper as company’s desire improved presentation and promotional benefits.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The UK butcher paper industry is growing continuously with the rising sustainability issues, government policies against plastic usage, and the growing demand for the quality of meat packaging. Due to the UK's Plastic Packaging Tax and efforts to reduce waste, retailers and foodservice businesses are moving towards a growing trend of using compostable and recyclable butcher paper as an alternative to plastic wraps and synthetic food packaging.

The culture of butcher shops still prevails in the UK, where hand cutting of meats, farm-to-table supply chains, and organic foods are trendy. Natural, unbleached butcher paper is being pushed to stay fresh and appear presentable. Growth in takeaway and deli counter segments also drives adoption of butcher paper to wrap sandwiches, cheese, and specialty meats.

Increasing popularity of high-end burger houses and barbecue restaurants in city centers such as London, Manchester, and Birmingham is also fueling sales of grease-resistant foodservice butcher paper in a natural, green manner. Moreover, private-labelling and specialty printing of butcher paper are also becoming more popular amongst high-end meat wholesalers and chain restaurants.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The EU market for butcher paper is witnessing stable growth as a result of environmental regulatory pressures such as the necessity for sustainable packaging of food, growing premium meat markets, and regulatory pressures. EU's Single-Use Plastics Directive and Circular Economy Action Plan are pressurizing retailers, butchers, and food processors to migrate from plastic food wraps to biodegradable packaging alternatives of butcher paper.

These three countries are substantial free-range meat markets for organically branded organic and premium meat products with strong pressure towards the use of good quality food-grade butcher paper. Demand for waxed butcher paper and parchment as over-the-counter agents of choice is being fueled also due to penetrating deeper into delicatessens, high-end cheese boutiques, and high-end artisanal bakeries offering specialty fare.

Northern and Western European grilling and barbecuing culture is growing, further fueling demand for pink and smoked butcher paper, which is commonly used for household barbecuing as well as for BBQ restaurants. In addition, major food package corporations are putting their stakes on grease-resistant coated butcher paper solutions, which are EU sustainability standards compliant and have high-performing packages.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.1% |

The butcher paper market of Japan is rising steadily with increased demand for premium meat packaging, increasing sustainability drives, and enhanced popularity of Western-style BBQ and gourmet meat retailers. The Japanese Ministry of Agriculture, Forestry and Fisheries (MAFF) is promoting green food packaging substitutes, which are fueling more use of recyclable butcher paper in butcher stores, supermarkets, and premium meat suppliers.

While Japan focuses on presentation and looks of food, upscale meat stores are resorting to customized-printed butcher paper to enhance branding and customer experience. Following suit for waxed and pink butcher paper is also the growth of Western-style steakhouses, burger joints, and barbecue restaurants in efforts to improve meat preservation and presentation.

Additionally, there is new anti-bacterial and greaseproof butcher paper coming up that is revolutionizing the market, conforming to Japan's high standards of food sanitation. High-quality food-grade wrapping papers for ensuring freshness in transportation are also becoming more in demand in the exportation of quality Wagyu beef.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

South Korea's butcher paper market is growing with the rise in premium meat consumption, growing demand for food safety, and green packaging demand. The Korean Ministry of Environment has implemented a campaign to encourage biodegradable and recyclable packaging, and thus there has been increased use of food-grade butcher paper in supermarkets, butcher shops, and high-end beef stores.

With Korean barbecue food culture spreading globally, local restaurateurs and consumers alike are calling for specialty, heat-resistant butcher paper more and more. Furthermore, increasing online meat delivery businesses are pushing demand for personalized, brand-marked butcher paper packaging for improved brand identity and food safety.

Investments by South Korea in cutting-edge food packaging technology such as greaseproof and antimicrobial butcher paper also improve product quality and shelf life.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The market for Butcher paper is experiencing smooth growth due to the demand for more eco-friendly food packaging, rising application in the meat processing sector, and rising inclination towards green wrapping products. Out of major segments, Unbleached Butcher Paper and the 66-95 GSM Weight Segment are turning out to be drivers with their versatility, strength, and food-grade status.

The Unbleached Butcher Paper segment has a large market share, as food service establishments and butchers seek more natural, biodegradable, and chemical-free packaging options. Unbleached butcher paper, unlike its bleached version, retains a natural brown appearance, offering a natural appearance but with food safety for contact.

Increased use of unbleached butcher paper as meat wrapping paper with high breathability and water resistance has ensured market growth with the assurance of longer freshness.

The increasing need for sustainable food packaging, 100% compostable and recyclable, has led to market uptake, with lower environmental footprints.

The increased availability of custom printing on unbleached butcher paper, with the ability to brand for food vendors, has elevated market demand, with optimal consumer appeal.

The increasing application of unbleached butcher paper for barbecue and grilling, with excellent heat resistance, has propelled market growth, with high-performance cooking uses.

As consumers and businesses grow greener and move towards green packaging, demand for unbleached butcher paper continues to grow, a market leading category.

66-95 GSM Weight segment dominates a significant portion of the Butcher paper market owing to the reason that it is a resilient but elastic substitute for wrapping meat, seafood, and deli items. It also has enhanced tear resistance and moisture, which is ideal for commercial as well as retail food application.

The increased demand for 66-95 GSM butcher paper in premium meat packaging with improved durability and grease resistance has fueled market growth, offering quality food presentation.

Increased demand for medium-weight butcher paper for convenience in wrapping and handling of deli and fast food packaging has driven market growth, facilitating ease of operations.

Increased multi-layer coatings of 66-95 GSM butcher paper with improved moisture barriers have facilitated market adoption, allowing for extended shelf life for perishable products. The increasing adoption of printed butcher paper for promotions and branding with custom logos and designs has created market demand, facilitating increased customer interaction.

Temporary wrapping is handled by lighter GSM paper, although the 66-95 GSM segment remains most favored due to its strength, flexibility, and food preservation qualities. Continuous improvements in waxed and poly-coated butcher paper varieties are further driving the growth of the segment.

The Butcher paper industry is experiencing stable growth because of the demand for food-safe wrapping materials in the meat sector, barbecue restaurants, and supermarkets. Growing consumer interest in environment-friendly and biodegradable packaging, growth of foodservice markets and retail sales of meat, and increased adoption of unbleached, FDA-approved butcher paper to wrap food are propelling the growth of the market.

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Georgia-Pacific LLC | 20-24% |

| WestRock Company | 16-20% |

| Oji Holdings Corporation | 12-16% |

| International Paper Company | 10-14% |

| Twin Rivers Paper Company | 8-12% |

| Others | 14-18% |

| Company Name | Key Offerings/Activities |

|---|---|

| Georgia-Pacific LLC | Leading producer of FDA-compliant butcher paper for foodservice, retail, and industrial use. |

| WestRock Company | Focuses on sustainable and recyclable butcher paper solutions. |

| Oji Holdings Corporation | Manufactures high-quality unbleached butcher paper for meat and deli applications. |

| International Paper Company | Develops moisture-resistant butcher paper with waxed and untaxed options. |

| Twin Rivers Paper Company | Specializes in lightweight butcher paper with strong grease resistance. |

Key Market Insights

Georgia-Pacific LLC (20-24%)

Georgia-Pacific leads the butcher paper market with a wide range of food-safe paper solutions. Its Kraft butcher paper is widely used in butcher shops, barbecue restaurants, and grocery stores.

WestRock Company (16-20%)

WestRock focuses on sustainability, offering biodegradable and recyclable butcher paper designed to meet environmental regulations.

Oji Holdings Corporation (12-16%)

Oji Holdings specializes in unbleached, eco-friendly butcher paper with strong durability and food-safe properties.

International Paper Company (10-14%)

International Paper Company offers highly durable and moisture-resistant butcher paper, catering to large-scale food processors and meat retailers.

Twin Rivers Paper Company (8-12%)

Twin Rivers Paper Company focuses on lightweight, grease-resistant butcher paper, ideal for delis, supermarkets, and food packaging applications.

Other Key Players (14-18% Combined)

The overall market size for butcher paper market was USD 287.6 million in 2025.

The butcher paper market is expected to reach USD 429.8 million in 2035.

The expansion of the butcher paper market will be driven by the growing demand for sustainable and food-safe packaging solutions, supported by increasing adoption in butcher shops, delis, and food service industries.

The top 5 countries which drives the development of butcher paper market are USA, European Union, Japan, South Korea and UK.

Unbleached butcher paper and 66-95 GSM weight to command significant share over the assessment period.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.